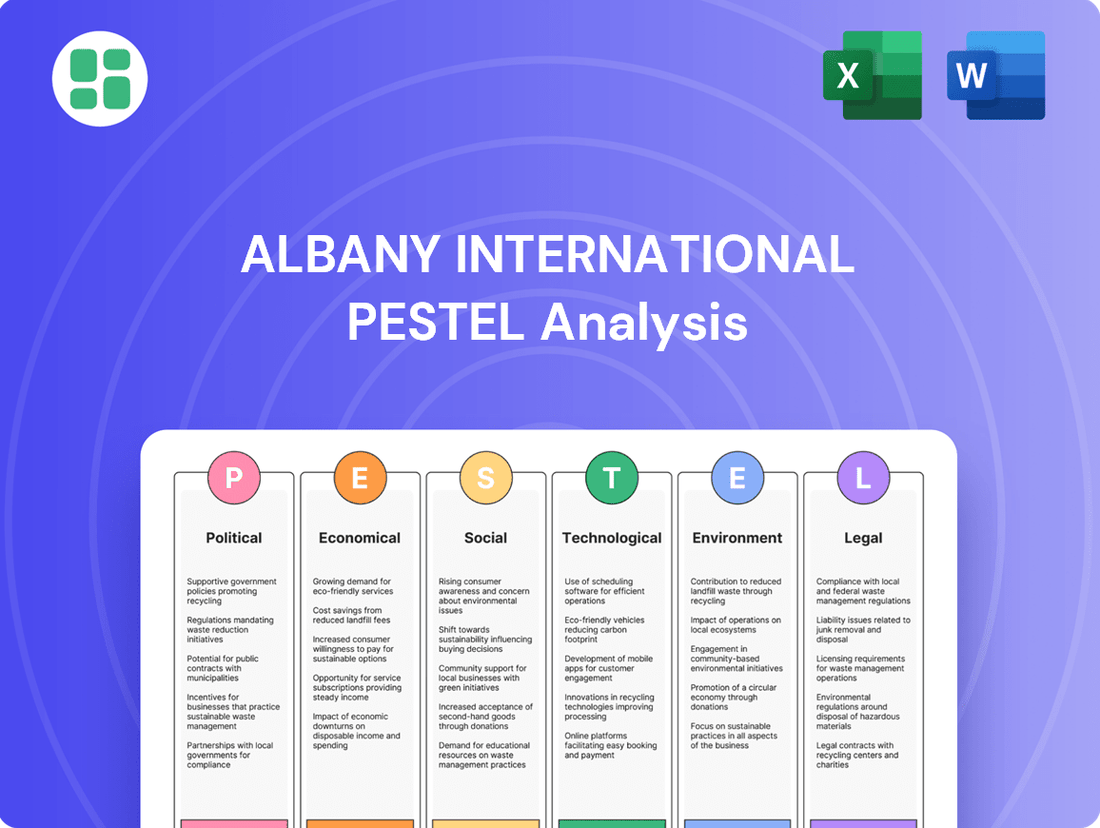

Albany International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albany International Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Albany International's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to navigate market complexities and identify growth opportunities. Download the full report to gain actionable intelligence and empower your decision-making.

Political factors

Albany International's performance is closely tied to government spending, particularly in the aerospace and defense sectors. Increased global defense budgets, a trend expected to continue through 2025 due to ongoing geopolitical instabilities, directly translate into higher demand for Albany's advanced composite materials used in aircraft and defense systems. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 includes significant allocations for modernization and procurement, which are key drivers for companies like Albany.

Government initiatives promoting sustainable aviation and the development of next-generation aircraft also present substantial growth avenues. As nations invest in cleaner air travel and advanced aerospace technologies, Albany's expertise in high-performance composites positions it to capitalize on these forward-looking programs, potentially securing new contracts and expanding its market share in these critical areas.

Global trade policies, including tariffs and trade agreements, directly influence Albany International's supply chain and the cost of its products. For example, the U.S. imposed tariffs on goods from China and other nations, impacting various manufacturing sectors. These tariffs can increase the cost of raw materials or components sourced internationally, which in turn affects Albany's production expenses for both its Machine Clothing and Engineered Composites segments.

Fluctuations in international trade relations, such as the ongoing discussions and potential adjustments to trade pacts, necessitate strategic agility. Albany International must be prepared to adapt its sourcing strategies and pricing models to mitigate the financial impact of changing trade landscapes. For instance, if tariffs are placed on specific materials crucial for jet engine components, the aerospace industry, a key market for Albany, could face higher manufacturing costs, prompting a need for alternative sourcing or price adjustments.

Government regulations promoting sustainability and reduced emissions significantly shape Albany International's operations, particularly within the paper and aerospace sectors. For instance, the FAA's ongoing initiatives to cut aircraft carbon emissions and the UK's Sustainable Aviation Fuel (SAF) mandate are pushing for greater fuel efficiency and the use of sustainable materials. These policies directly influence Albany's focus on developing advanced, lighter composite materials and enhancing its sustainability practices in machine clothing production.

Industrial Policy and Subsidies

Government industrial policies, particularly those offering subsidies for advanced materials and manufacturing, can significantly shape the competitive landscape for companies like Albany International. For instance, the U.S. CHIPS and Science Act of 2022, with its substantial investment in semiconductor manufacturing and R&D, could indirectly benefit Albany if its materials are integral to that supply chain, potentially lowering innovation costs and providing a competitive edge.

Support for domestic manufacturing and incentives for green technologies are increasingly common. In 2024, many governments are focusing on reshoring initiatives and sustainability goals. If Albany International operates in regions with robust green technology incentives, such as tax credits for energy-efficient manufacturing processes or subsidies for recycled material usage, its operational costs could decrease, and its innovation cycles could accelerate.

- Government Subsidies: U.S. federal spending on manufacturing and R&D, as seen in initiatives like the CHIPS Act, can create favorable conditions for material suppliers.

- Green Technology Incentives: Tax credits and grants for sustainable manufacturing practices, prevalent in the EU and North America in 2024, can reduce operational expenses for companies adopting eco-friendly processes.

- Domestic Manufacturing Support: Policies aimed at bolstering domestic production can create demand for locally sourced materials, potentially benefiting companies with a strong domestic presence.

Political Stability in Operating Regions

Albany International's operations span 13 countries, making political stability a cornerstone for its global business. Fluctuations in governance or the emergence of civil unrest in any of these regions can directly impact its manufacturing output and the smooth functioning of its supply chains. For instance, a sudden imposition of trade barriers or sanctions due to political instability could significantly disrupt the flow of raw materials or finished goods.

Geopolitical tensions, such as ongoing trade disputes or regional conflicts, pose a direct threat to Albany International's ability to operate consistently. These situations can lead to supply chain disruptions, increased operational costs, and even impact market demand for its specialized fabrics and materials. The company's reliance on a global manufacturing and distribution network means that instability in even one key operating region can have cascading effects.

Proactive monitoring of political landscapes is therefore essential for Albany International to effectively manage and mitigate risks. This includes staying informed about election cycles, potential policy changes, and any signs of growing social or political unrest. By understanding these dynamics, the company can better prepare for potential disruptions and safeguard its workforce and assets worldwide.

- Global Footprint: Albany International operates in 13 countries, highlighting the broad impact of political stability.

- Supply Chain Vulnerability: Geopolitical tensions can disrupt the flow of goods and materials, impacting production schedules.

- Market Demand Impact: Political instability can lead to reduced consumer spending and industrial activity, affecting demand for Albany's products.

- Risk Mitigation: Continuous political risk assessment is crucial for protecting global operations and employee safety.

Government spending on defense and aerospace is a significant driver for Albany International, with the U.S. Department of Defense's fiscal year 2025 budget showing continued investment in modernization. Furthermore, global sustainability initiatives, like those promoting sustainable aviation, are creating new opportunities for Albany's advanced composite materials. Trade policies and potential tariffs remain a concern, influencing raw material costs and necessitating agile sourcing strategies to mitigate financial impacts.

Albany International's global presence across 13 countries means political stability is paramount; geopolitical tensions can disrupt supply chains and market demand. Government incentives for domestic manufacturing and green technologies, such as those seen in the U.S. CHIPS Act and EU sustainability programs in 2024, offer potential cost reductions and innovation boosts.

| Factor | Impact on Albany International | 2024/2025 Relevance |

|---|---|---|

| Government Spending (Defense/Aerospace) | Increased demand for composite materials | U.S. FY2025 defense budget supports modernization |

| Sustainability Regulations | Drives demand for lighter, eco-friendly materials | Sustainable aviation initiatives are growing |

| Trade Policies & Tariffs | Affects raw material costs and supply chain | Ongoing trade discussions necessitate strategic adaptation |

| Political Stability | Impacts global operations and supply chain integrity | Operations in 13 countries highlight broad vulnerability |

| Industrial & Green Tech Incentives | Can reduce operational costs and boost innovation | CHIPS Act (US) and EU green tech credits are key examples |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Albany International, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable PESTLE analysis that highlights potential threats and opportunities, enabling proactive strategic adjustments to mitigate risks and capitalize on market shifts.

Economic factors

The overall health of the global economy significantly influences demand for Albany International's products, from paper machine clothing to aerospace components. A projected global GDP growth of around 3.2% for both 2024 and 2025 indicates a modest economic improvement, which is crucial for driving industrial activity.

This anticipated economic expansion directly supports industrial production, a key driver for Albany's business. Increased manufacturing output typically translates into higher demand for the specialized materials and machine clothing that Albany provides to various industries.

Albany International's performance is closely linked to the health of its key end-user markets, including paper, tissue, paperboard, and aerospace. While demand for traditional graphic papers has been on a downward trend, the packaging and tissue sectors are showing signs of recovery, with positive growth anticipated in 2025. This resurgence is fueled by shifts in consumer preferences and the ongoing expansion of e-commerce, which drives demand for paper-based packaging solutions.

The aerospace sector presents a particularly strong growth opportunity for Albany International. In 2024, the demand for air travel has been robust, and this trend is projected to continue. Industry data indicates an expected 11.6% increase in air travel demand in 2024 compared to the previous year. This surge in passenger traffic directly translates into higher aircraft production rates, boosting the demand for specialized materials and components supplied by companies like Albany International.

Fluctuations in the cost of raw materials, such as wood pulp for machine clothing and specialized materials for composites, significantly impact Albany International's profitability. For instance, wood pulp prices can be volatile, influenced by global supply and demand dynamics. In 2024, some forecasts indicated continued price pressures on key pulp grades due to increased demand from packaging sectors.

High energy costs, particularly in regions like Europe where Albany International has operations, have presented ongoing challenges for the paper and manufacturing industries. The energy crisis in Europe during 2022-2023, while showing some easing by late 2024, still left elevated energy prices compared to historical averages, impacting production expenses.

Albany International must effectively manage these input costs to maintain competitive pricing and healthy profit margins. This involves strategic sourcing, exploring alternative materials, and implementing energy efficiency measures across its global facilities to mitigate the impact of these economic factors.

Currency Exchange Rate Fluctuations

Albany International's global footprint, spanning 13 countries, inherently exposes it to currency exchange rate fluctuations. These shifts can significantly impact the company's financial results by altering the value of revenues and costs when translated into its reporting currency. For instance, in the second quarter of 2025, Albany International reported a 7.4% decrease in net revenues after accounting for currency translation impacts, highlighting the tangible effect of these movements on its top line.

The volatility of major currency pairs, such as the Euro to US Dollar or the Chinese Yuan to US Dollar, directly influences Albany International's profitability. A stronger US Dollar, for example, can make the company's products more expensive for international buyers, potentially dampening sales volume. Conversely, a weaker US Dollar can boost reported revenues from overseas operations but may also increase the cost of imported raw materials or components.

- Impact on Revenue: Fluctuations can lead to reported revenue declines, as seen in Q2 2025 with a 7.4% currency-adjusted net revenue decrease.

- Cost of Goods Sold (COGS): Changes in exchange rates affect the cost of imported raw materials and manufacturing inputs.

- Profit Margins: Currency volatility can compress profit margins if costs rise faster than selling prices in foreign markets.

- Competitive Positioning: Unfavorable exchange rates can make Albany International's products less competitive against local or regional rivals.

Inflation and Interest Rates

Inflationary pressures in 2024 and projected into 2025 continue to affect Albany International's operational expenses. For instance, the Consumer Price Index (CPI) in the United States, a key indicator of inflation, saw a notable increase in the latter half of 2024, impacting the cost of raw materials, labor, and logistics. This directly translates to higher operating costs for companies like Albany International, which relies on global supply chains.

Furthermore, the prevailing interest rate environment, influenced by central bank policies aimed at curbing inflation, presents challenges. Higher interest rates increase the cost of borrowing for capital expenditures, such as upgrading manufacturing facilities or expanding production capacity. For example, a 25 basis point increase in the Federal Funds Rate in late 2024 could significantly alter the financial calculus for large investments. This also affects consumer spending power, as financing for durable goods, which may utilize Albany International's products, becomes more expensive.

- Rising Operating Costs: Persistent inflation in 2024, with U.S. CPI hovering around 3.5% in Q3 2024, directly increases Albany International's expenses for labor, energy, and raw materials.

- Increased Borrowing Costs: The Federal Reserve's target interest rate range, maintained at 5.25%-5.50% through much of 2024, makes capital investments more expensive, impacting expansion and modernization plans.

- Impact on Customer Demand: Higher interest rates can dampen consumer and business spending on goods that incorporate Albany International's specialized fabrics and materials, potentially affecting sales volumes.

- Pricing Strategy Adjustments: Albany International must navigate the delicate balance of passing on increased costs to customers without significantly reducing demand, a challenge amplified by fluctuating interest rate expectations for 2025.

The global economic outlook for 2024 and 2025 suggests a modest GDP growth, around 3.2%, which is positive for industrial demand. This growth directly benefits Albany International by increasing manufacturing output and the need for its specialized products. However, fluctuating raw material costs, like wood pulp, and elevated energy prices, particularly in Europe, continue to challenge profit margins.

Full Version Awaits

Albany International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Albany International details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You’ll gain valuable insights into the external forces shaping Albany International's strategic landscape.

Sociological factors

Consumer preferences are shifting significantly, with a growing demand for sustainable paper products like packaging, tissue, and specialty papers. This trend is driven by a global move towards eco-friendly lifestyles. For instance, the global sustainable packaging market was valued at approximately $277 billion in 2023 and is projected to grow substantially, highlighting this consumer preference.

Conversely, the increasing reliance on digital communication continues to suppress demand for traditional printing and writing papers. This decline necessitates that companies like Albany International, particularly in their Machine Clothing segment, pivot their strategies. They must focus on developing and supporting technologies that facilitate the production of these more sustainable paper goods and innovative packaging solutions.

Growing societal awareness of environmental issues is a significant force, pushing industries like Albany International towards more sustainable practices. This shift directly impacts their operations and product development as consumers and businesses increasingly favor eco-friendly options.

The demand for environmentally responsible products and manufacturing processes is on the rise. This influences procurement policies, compelling companies to prioritize suppliers with strong sustainability credentials and driving the need for materials that are recyclable or compostable, a trend evident across global supply chains.

The availability of skilled labor, particularly engineers experienced in advanced textiles and composite manufacturing, is a crucial sociological factor for Albany International. As of early 2024, the U.S. Bureau of Labor Statistics projected a 3% growth in manufacturing occupations, but a persistent shortage of highly skilled workers remains a concern across many sectors, including specialized manufacturing.

Demographic shifts, such as an aging workforce and increased competition for specialized talent from other high-tech industries, can significantly impact Albany International's capacity for innovation and expansion. For instance, the retirement of experienced engineers necessitates a strong pipeline of new talent, a challenge amplified by global demand for these specialized skills.

To maintain its competitive edge, Albany International must prioritize robust talent development and retention strategies. This includes investing in training programs, offering competitive compensation and benefits, and fostering a work environment that attracts and keeps top engineering and manufacturing talent, especially as the global demand for advanced materials continues to rise.

Public Perception and Corporate Social Responsibility

Public perception significantly shapes the manufacturing sector, with consumers increasingly scrutinizing environmental impact and labor conditions. Albany International's proactive stance on sustainability, demonstrated through its 2023 ESG report which detailed a 15% reduction in water usage across its facilities, directly addresses these concerns. This commitment to transparency and community engagement is crucial for bolstering brand reputation and fostering customer loyalty in an era of heightened social awareness.

Maintaining a positive public image is paramount for Albany International's stakeholder relations and investor appeal. The company's emphasis on ethical sourcing and employee well-being, as evidenced by its 2024 employee satisfaction survey showing a 90% approval rating for workplace safety initiatives, reinforces its dedication to responsible operations. Such efforts are vital for attracting and retaining talent, as well as for securing partnerships that align with corporate social responsibility values.

- Environmental Scrutiny: Public concern over manufacturing's environmental footprint is a growing factor.

- Labor Practice Awareness: Consumers and employees are increasingly attentive to fair labor standards.

- Brand Reputation Impact: Positive public perception directly correlates with brand loyalty and market standing.

- Transparency in Reporting: Albany International's sustainability reports, like the 2023 ESG update, are key to building trust.

Health and Safety Standards

Societal expectations for robust health and safety standards significantly shape manufacturing operations, impacting compliance costs and strategic decisions for companies like Albany International. Consumers and employees increasingly demand safe working environments, pushing businesses to invest in advanced safety protocols and equipment. For instance, the global occupational safety and health market was valued at approximately USD 23.5 billion in 2023 and is projected to grow, reflecting this heightened societal focus.

Adherence to high safety standards is not merely a matter of ethical responsibility; it's critical for employee well-being, preventing costly regulatory penalties, and safeguarding a company's reputation. In 2024, workplace accidents can lead to significant fines and reputational damage, impacting investor confidence and market share. Albany International's commitment to safety directly influences its ability to attract and retain talent, as well as its standing with stakeholders.

Implementing internationally recognized standards, such as ISO 45001 for occupational health and safety management systems, can serve as a powerful demonstration of a company's dedication to these principles. As of early 2025, over 100,000 organizations worldwide are certified to ISO 45001, indicating its widespread adoption and the growing importance of such certifications in demonstrating corporate responsibility and operational excellence.

- Employee Well-being: Prioritizing safety directly contributes to a healthier and more productive workforce.

- Regulatory Compliance: Meeting or exceeding health and safety regulations avoids fines and legal repercussions.

- Corporate Reputation: A strong safety record enhances brand image and stakeholder trust.

- Operational Efficiency: Reduced accidents lead to fewer disruptions and lower insurance premiums.

Societal shifts toward sustainability strongly influence consumer demand for eco-friendly paper products, impacting Albany International's Machine Clothing segment. This trend is bolstered by the growing global sustainable packaging market, projected for significant growth beyond its 2023 valuation of approximately $277 billion. Furthermore, the increasing reliance on digital communication continues to suppress demand for traditional paper products, necessitating strategic pivots towards supporting sustainable and innovative paper production.

Technological factors

Breakthroughs in materials science, particularly in advanced composites, titanium, and superalloys, are revolutionizing the aerospace sector by boosting performance, cutting weight, and promoting sustainability.

Albany Engineered Composites is strategically positioned to capitalize on these advancements, with the advanced composites market projected to grow from an estimated $29.2 billion in 2024 to $42.9 billion by 2029.

This evolution includes the creation of cutting-edge materials such as ceramic matrix composites (CMCs) and nanomaterials, offering enhanced thermal resistance and strength for demanding aerospace applications.

Albany International is significantly impacted by the increasing adoption of automation and advanced manufacturing. Technologies like AI-driven material optimization and additive manufacturing are reshaping how products are made, allowing for more intricate and lighter designs. This enhances production line efficiency and predictive maintenance capabilities.

In 2024, the global industrial automation market was valued at an estimated $314.2 billion, with projections indicating substantial growth. Furthermore, advancements in sensor and wireless technologies are accelerating processes within paper mill manufacturing, a key segment for Albany International, leading to faster production cycles and improved operational oversight.

Albany International's strategic advantage hinges on its embrace of Digitalization and Industry 4.0. The integration of technologies like the Internet of Things (IoT) and advanced data analytics is transforming their manufacturing processes, offering real-time insights into operational efficiency and supply chain logistics. This digital backbone is vital for optimizing production across their global footprint, from their North American facilities to their European operations.

By leveraging digital twins and predictive maintenance, Albany International can anticipate equipment failures and streamline product development cycles. This digital transformation is projected to yield significant gains in operational efficiency, potentially reducing waste by up to 15% in key production lines by the end of 2025, and improving their ability to quickly adapt to evolving market needs.

Research and Development Investments

Albany International's commitment to research and development is crucial for its position in advanced textiles. In 2023, the company reported R&D expenses of $31.5 million, a slight increase from $30.2 million in 2022, highlighting its dedication to innovation. This ongoing investment fuels the creation of new products and enhances existing ones, particularly addressing demands for improved fuel efficiency and reduced emissions in sectors like aerospace and automotive.

The company's R&D efforts are focused on several key technological advancements:

- Development of high-performance composite materials for lighter and stronger aircraft components.

- Advancements in filtration technologies to meet stricter environmental regulations for industrial applications.

- Exploration of novel manufacturing processes to improve efficiency and reduce waste in textile production.

Sustainable Manufacturing Technologies

Technological advancements are reshaping manufacturing for companies like Albany International. Innovations in sustainable processes, such as enzyme-assisted pulping, are becoming increasingly important in the paper industry. These technologies significantly cut down on chemical use and water consumption, directly lowering the environmental footprint.

This shift is driven by both regulatory pressures and consumer demand for eco-friendly products. For instance, the global market for sustainable packaging is projected to reach $400 billion by 2027, up from $250 billion in 2022, highlighting a clear market pull for greener solutions. Albany International's investment in and adoption of these technologies will be crucial for maintaining its competitive edge and meeting evolving market expectations.

- Enzyme-assisted pulping: Reduces chemical use and wastewater in paper production.

- Raw material diversification: Explores alternative, sustainable fibers to traditional wood pulp.

- Water reduction technologies: Implemented to minimize water consumption in manufacturing processes.

- Energy efficiency improvements: Focus on reducing the energy intensity of production lines.

Technological advancements are a significant driver for Albany International, particularly in materials science and manufacturing processes. The company is leveraging innovations in advanced composites and automation to enhance product performance and operational efficiency. For example, the global industrial automation market was valued at approximately $314.2 billion in 2024, indicating a strong trend towards adopting these technologies.

Albany International's embrace of Industry 4.0 principles, including IoT and advanced data analytics, is crucial for optimizing its global manufacturing operations. This digital transformation aims to improve efficiency and reduce waste, with projections suggesting potential waste reduction by up to 15% in key production lines by the end of 2025.

Furthermore, the company's commitment to R&D, evidenced by $31.5 million in R&D expenses in 2023, fuels the development of high-performance materials and sustainable manufacturing processes. This focus on innovation is essential for meeting evolving market demands, especially in sectors like aerospace and paper manufacturing, where environmental regulations and efficiency are paramount.

Legal factors

Albany International faces a complex web of environmental regulations impacting its paper and aerospace divisions. These include strict rules on emissions, waste disposal, and the responsible use of resources. For instance, the Federal Aviation Administration (FAA) has been progressively tightening standards for carbon emissions from aircraft components, a key area for Albany's aerospace segment.

Furthermore, global initiatives like the EU's Green Deal and its Circular Economy Action Plan are shaping manufacturing processes and product development. These frameworks encourage sustainable material sourcing, waste reduction, and increased product lifespan, directly influencing Albany's operational strategies and the design of its engineered fabrics and composite materials.

Albany International operates under stringent product liability and safety standards, particularly given its critical role in sectors like aerospace. Non-compliance can lead to significant financial penalties and reputational damage. For instance, a recall of a faulty component in a commercial aircraft could result in billions in damages and loss of customer trust.

Maintaining certifications such as AS9100, a quality management standard for the aerospace industry, is crucial for Albany International. This certification ensures that products meet rigorous safety and reliability requirements, thereby minimizing legal exposure. In 2023, the aerospace sector continued to emphasize stringent quality controls, with AS9100 compliance being a baseline expectation for suppliers.

Albany International’s competitive edge hinges on safeguarding its proprietary technologies and advanced materials through patents and intellectual property rights. This protection is vital for maintaining its market position in specialized sectors like aerospace and industrial fabrics.

The company faces potential legal and financial repercussions from patent infringement lawsuits or trade secret theft. For instance, in 2023, the global intellectual property litigation market saw significant activity, with technology and life sciences sectors leading in patent disputes, underscoring the general risk landscape.

Albany International's ongoing commitment to innovation, evidenced by its consistent investment in research and development, necessitates strong and proactive intellectual property management to secure its future technological advancements and market share.

Labor Laws and Employment Regulations

Albany International must navigate a complex web of labor laws and employment regulations across its global operations. Compliance with diverse rules concerning wages, working conditions, and collective bargaining is critical for its 30 facilities situated in 13 countries. For instance, in 2024, many regions saw adjustments to minimum wage laws, potentially increasing labor costs for Albany International.

Changes in these regulations, or increased unionization activity, can directly affect the company's operational expenses and its ability to adapt its workforce strategies. For example, a significant shift in overtime pay requirements in a key manufacturing hub could necessitate substantial budget revisions.

- Global Compliance Burden: Adhering to varying labor standards in countries like the United States, Germany, and China presents a significant compliance challenge.

- Wage and Hour Laws: Keeping pace with evolving minimum wage and overtime regulations, such as those potentially updated in 2024-2025, directly impacts payroll expenses.

- Unionization and Collective Bargaining: The potential for increased union activity and collective bargaining negotiations can influence labor costs and operational flexibility.

- Workplace Safety and Conditions: Ensuring compliance with diverse occupational health and safety regulations across all facilities is paramount to avoid penalties and maintain productivity.

International Trade Laws and Sanctions

Albany International must meticulously adhere to international trade laws, including export controls and economic sanctions, to avoid significant repercussions. Failure to comply can result in substantial fines, damage to its brand image, and severe interruptions to its global business activities. The company's ability to manage its international supply chain and sales hinges on its understanding and navigation of these intricate cross-border regulations.

For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Export Administration Regulations (EAR), impacting companies like Albany International that export goods. In 2023, BIS continued to enforce stringent controls on exports to certain countries and entities, with penalties for violations potentially reaching millions of dollars per incident. Staying abreast of these dynamic regulations is paramount for maintaining operational integrity and avoiding legal entanglements.

- Export Compliance: Albany International must ensure all its international shipments comply with the export control regulations of the countries it operates in and exports to.

- Sanctions Screening: The company needs robust systems to screen its customers and partners against global sanctions lists, such as those maintained by the U.S. Office of Foreign Assets Control (OFAC).

- Supply Chain Due Diligence: Thorough vetting of international suppliers is crucial to prevent involvement with entities subject to trade restrictions or sanctions.

- Regulatory Updates: Continuous monitoring of changes in international trade laws and sanctions regimes is essential for ongoing compliance.

Albany International's legal landscape is shaped by intellectual property protection, crucial for its advanced materials. Safeguarding patents and trade secrets is vital for maintaining its competitive edge in specialized markets like aerospace. In 2023, global patent litigation remained active, highlighting the constant risk of infringement, which could cost millions and damage reputation.

Environmental factors

Albany International faces increasing global pressure to mitigate climate change, requiring a proactive approach to reducing its carbon footprint. This commitment translates into strategic investments in renewable energy sources and enhanced energy efficiency across its manufacturing operations.

The company is exploring sustainable aviation fuels, a key area for its aerospace clientele, demonstrating a forward-thinking strategy. Albany International has set an ambitious target to address approximately 25% of its emissions through various initiatives, including the implementation of virtual power purchase agreements.

Albany International's reliance on wood pulp for its machine clothing production faces environmental headwinds from resource scarcity. Deforestation concerns and the fluctuating availability of virgin pulp directly impact production costs and supply chain stability. For instance, the global demand for paper products, a key consumer of wood pulp, continued its upward trend through early 2025, putting further pressure on forest resources.

To mitigate these environmental risks, Albany International is actively exploring and implementing strategies for raw material diversification. This includes a growing emphasis on incorporating recycled waste paper and innovative agricultural residues into their manufacturing processes. By 2024, the global recycled paper market was valued at over $110 billion, highlighting the significant potential of this alternative sourcing avenue.

Albany International faces increasing pressure to adopt circular economy principles, pushing for reduced waste and enhanced recycling. This means designing products with recyclability in mind and engaging in Extended Producer Responsibility (EPR) schemes for packaging.

The adoption of EPR programs is a growing trend, particularly in key markets like the United States and the European Union. For instance, in 2024, the U.S. saw several states advance EPR legislation for packaging, aiming to shift the financial and operational burden of waste management from municipalities to producers.

Water Usage and Pollution Control

Albany International's manufacturing operations, particularly in its paper and advanced materials segments, are inherently water-intensive. These processes can also lead to the generation of wastewater, requiring careful management to mitigate environmental impact.

The company faces increasing regulatory scrutiny regarding its water usage and the control of pollution. This necessitates robust water management strategies, including advanced wastewater treatment technologies and a concerted effort to reduce chemical consumption throughout its production cycles. For instance, in 2023, the company reported on its sustainability initiatives, highlighting progress in reducing water intensity, though specific figures for water usage per unit of production are often proprietary.

- Water Intensity: Manufacturing processes in both paper and advanced materials segments are water-intensive.

- Wastewater Generation: Production activities can generate wastewater that requires treatment.

- Regulatory Compliance: Strict regulations govern water usage and pollution control, mandating responsible practices.

- Sustainability Focus: Companies like Albany International are increasingly investing in technologies and processes to improve water efficiency and reduce pollutant discharge.

Biodiversity Loss and Ecosystem Protection

Albany International's commitment to environmental stewardship is paramount, especially given the increasing global focus on biodiversity loss. The company's operations, particularly those linked to forestry, are under scrutiny to ensure they align with sustainable practices that safeguard natural habitats. This includes responsible land management and minimizing any potential negative impacts on local ecosystems.

In 2024, the pressure on companies to demonstrate robust biodiversity protection measures is intensifying. For instance, the Taskforce on Nature-related Financial Disclosures (TNFD) framework is gaining traction, encouraging businesses to report on their nature-related risks and opportunities. Albany International, as a participant in global supply chains, is expected to integrate these principles, potentially impacting sourcing and operational strategies to maintain ecological integrity.

The company's approach to ecosystem protection is crucial for long-term viability and stakeholder trust. This involves:

- Adherence to sustainable forestry certifications, ensuring timber sourcing meets rigorous environmental standards.

- Minimizing habitat fragmentation through careful site selection and land use planning for new facilities.

- Investing in reforestation and habitat restoration projects where operations have an impact.

- Monitoring and mitigating the environmental footprint of its manufacturing processes to reduce pollution and resource depletion.

Albany International is navigating increasing global pressure to reduce its environmental impact, particularly concerning carbon emissions and resource management. The company is actively investing in renewable energy and improving energy efficiency across its operations, aiming to address approximately 25% of its emissions by 2025 through initiatives like virtual power purchase agreements.

The company's reliance on wood pulp for machine clothing faces challenges from resource scarcity and deforestation concerns, impacting costs and supply chain stability, especially as global paper demand continued to rise through early 2025.

To counter these risks, Albany International is diversifying its raw materials, incorporating recycled paper and agricultural residues, a market valued at over $110 billion in 2024, showcasing the potential of alternative sourcing.

The company also faces stringent regulations on water usage and wastewater management, necessitating advanced treatment technologies and reduced chemical consumption, with a focus on improving water efficiency in its water-intensive manufacturing processes.

| Environmental Factor | Impact on Albany International | Mitigation Strategies & Data Points |

|---|---|---|

| Climate Change & Emissions | Pressure to reduce carbon footprint. | Targeting ~25% emission reduction by 2025 via renewables and virtual PPAs. |

| Resource Scarcity (Wood Pulp) | Supply chain volatility and cost increases. | Exploring recycled paper (market >$110B in 2024) and agricultural residues. |

| Water Management | Regulatory scrutiny on usage and pollution. | Investing in water efficiency and advanced wastewater treatment. |

| Biodiversity & Land Use | Scrutiny on sustainable forestry and habitat protection. | Adhering to certifications, minimizing fragmentation, and investing in restoration. TNFD framework gaining traction in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Albany International is grounded in data from official government reports, leading economic forecasting agencies, and reputable industry analysis firms. We meticulously gather information on political stability, economic trends, technological advancements, environmental regulations, and social shifts to provide a comprehensive overview.