Albany International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albany International Bundle

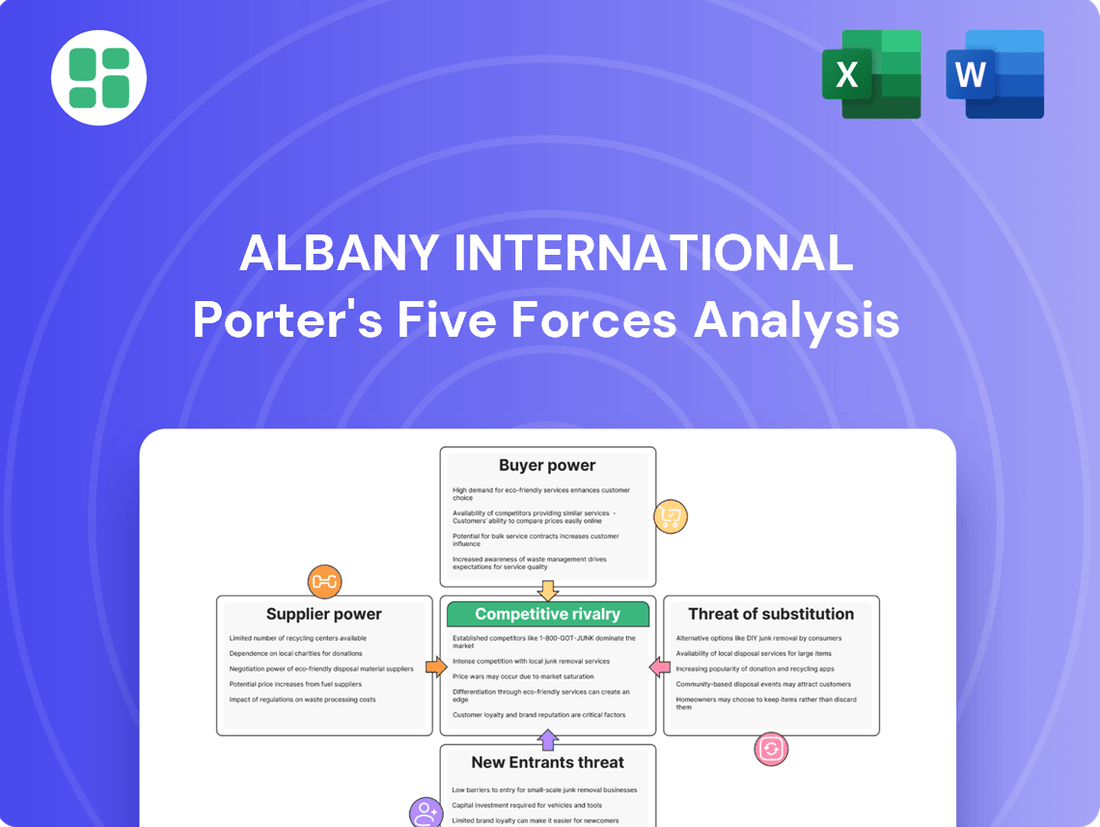

Albany International operates in a landscape shaped by moderate buyer power and intense rivalry among existing players. Understanding the nuances of supplier bargaining power and the threat of substitutes is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Albany International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Albany International's reliance on specialized raw materials, especially for demanding aerospace applications, means that a small number of highly specialized suppliers can wield considerable influence. When few alternatives exist for critical components, these suppliers gain significant bargaining power, potentially driving up costs for Albany.

This concentration in the supply chain for advanced textiles and composites presents a clear risk. For instance, if a key supplier of a unique polymer fiber used in aerospace components experiences production issues, Albany could face significant disruptions and be forced to pay premium prices due to the lack of readily available substitutes.

Albany International faces significant supplier bargaining power due to the high switching costs associated with its highly engineered materials, particularly within the demanding aerospace sector. The process of qualifying new materials alone can be complex and time-consuming, often requiring extensive testing and validation to meet rigorous industry specifications.

Beyond material qualification, switching suppliers necessitates retooling production processes and ensuring unwavering compliance with stringent aerospace standards. These substantial upfront investments create a strong lock-in effect, making it challenging and costly for Albany International to transition to alternative suppliers, even in the face of price increases.

Suppliers offering unique inputs, like proprietary technologies or specialized materials crucial for Albany International's advanced products, wield significant bargaining power. For instance, if a supplier provides a unique, high-performance fiber essential for Albany's lightweight composite materials used in the aerospace sector, this uniqueness grants them considerable leverage.

This dependency on specific, differentiated inputs means Albany International is more susceptible to price increases or unfavorable terms from these suppliers. In 2024, the aerospace sector continued its robust recovery, with Boeing and Airbus delivering a combined 1,276 aircraft, underscoring the demand for advanced materials and the potential power of their suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward to produce advanced textile or composite components themselves significantly boosts their bargaining power over Albany International. This is especially true if a supplier holds proprietary material science knowledge or specialized manufacturing techniques that enable them to directly challenge Albany's existing product offerings.

If suppliers can effectively replicate Albany's value-added processes, they gain leverage. This could lead to reduced market share and profitability for Albany as competition intensifies from its own supply chain. For instance, a key supplier of specialized resins or high-performance fibers could decide to develop their own finished composite parts, directly entering Albany's market space.

- Supplier Capability: Suppliers possessing advanced R&D and manufacturing capabilities are more likely to pursue forward integration.

- Market Incentives: High profit margins in Albany's end markets can incentivize suppliers to capture more value by moving downstream.

- Competitive Landscape: If Albany's suppliers are concentrated and have few alternative customers, forward integration becomes a more attractive strategic option for them.

Input Impact on Product Quality and Cost

The quality and cost of Albany International's final products are significantly shaped by the inputs received from its suppliers. In demanding sectors like aerospace, where the performance and safety of composite structures are non-negotiable, the dependability of raw materials is absolutely crucial. Suppliers who can consistently deliver superior or more cost-effective materials often hold considerable leverage, as their offerings directly impact Albany's competitive edge and overall profitability.

Suppliers of specialized composite materials, for instance, can exert strong bargaining power if they are one of the few providers capable of meeting Albany's stringent specifications. For example, in 2024, the global aerospace composites market saw continued demand for advanced materials, with key suppliers often operating with limited competition for highly specialized resins and fibers. This limited competition allows these suppliers to potentially dictate terms, influencing Albany's cost structure and, consequently, its pricing strategies for its own products.

- Supplier Dependence: Albany's reliance on a limited number of suppliers for critical, high-performance materials strengthens supplier bargaining power.

- Material Differentiation: Suppliers offering unique or proprietary materials that enhance product performance or durability can command higher prices.

- Cost Pass-Through: Increased raw material costs from suppliers, particularly for specialty chemicals or advanced fibers, can be passed on to Albany, impacting its margins.

- Quality Impact: The quality and consistency of supplier inputs directly affect the reliability and performance of Albany's engineered fabrics and composite structures, making supplier reliability a key factor in their power.

Albany International's bargaining power with its suppliers is notably constrained by the specialized nature of its raw materials, particularly for the aerospace industry. Suppliers of unique, high-performance fibers and resins, often with limited competition, can dictate terms. For instance, the aerospace sector's robust recovery in 2024, with significant aircraft deliveries, amplified demand for these specialized inputs, strengthening supplier leverage.

The high switching costs associated with qualifying new, specialized materials, coupled with the need to retool production processes to meet stringent aerospace standards, create a strong lock-in effect for Albany. This makes it economically challenging and time-consuming to find and implement alternative suppliers, even when facing price increases.

Suppliers who possess advanced R&D and manufacturing capabilities, or who hold proprietary material science knowledge, pose a significant threat through potential forward integration. If these suppliers can effectively replicate Albany's value-added processes, they can directly compete, eroding Albany's market share and profitability.

| Factor | Impact on Albany International | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Few suppliers for specialized materials grant them significant power. | Continued strong demand in aerospace increased reliance on key suppliers. |

| Switching Costs | High costs due to material qualification and process retooling limit flexibility. | Rigorous aerospace certification processes maintain these high costs. |

| Material Differentiation | Unique or proprietary materials enhance supplier pricing power. | Advancements in composite materials further differentiate supplier offerings. |

| Forward Integration Threat | Suppliers entering Albany's market space increases competitive pressure. | Profitability in advanced materials incentivizes suppliers to move downstream. |

What is included in the product

This analysis dissects the competitive forces impacting Albany International, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of industry forces.

Customers Bargaining Power

Albany International's customer base includes major players in industries like paper manufacturing and aerospace. In these sectors, a few large customers or critical defense programs can represent a substantial portion of the company's revenue, giving them significant leverage.

This concentrated customer power allows these entities to negotiate for lower prices, more favorable contract terms, or highly specialized product configurations. The aerospace sector, in particular, where large commercial and military aircraft programs are dominant, exemplifies this dynamic, as key clients can dictate terms due to the high volume and strategic importance of their orders.

Customer switching costs are a key factor influencing Albany International's bargaining power of customers. In the Machine Clothing segment, where specialized fabrics are crucial for paper manufacturing, changing suppliers can lead to costly operational downtime and the need for extensive equipment recalibration. For instance, a paper mill might face weeks of adjustment if switching to a new fabric supplier, impacting production efficiency and output.

However, this power is somewhat mitigated. While operational disruption is a concern, customers may still explore alternatives if Albany's pricing or product performance becomes less competitive. This creates a dynamic where the perceived value proposition, not just switching friction, dictates customer loyalty and bargaining strength.

In Albany's aerospace sector, the situation is different. The stringent qualification process for new composite material suppliers for critical aircraft components involves extensive testing and regulatory approvals. This lengthy and expensive procedure significantly raises switching costs for aerospace manufacturers, thereby diminishing their bargaining power relative to Albany International.

Customer price sensitivity is a significant factor influencing Albany International's bargaining power of customers. For instance, in the paper and tissue industry, where companies often contend with slim profit margins, the cost of machine clothing is a critical consideration. This means Albany International must remain competitive on pricing to secure and retain business in these sectors.

Even in industries like aerospace, where product performance is paramount, cost control remains a key objective for customers, particularly for large-volume production runs. This dual focus on performance and cost means that Albany International faces pressure to offer attractive pricing, which can directly affect its profitability and pricing strategies.

Customer Information and Transparency

Albany International's customers, particularly large industrial and government clients, are increasingly well-informed. Access to market data, competitive bid information, and detailed product specifications significantly boosts their negotiating leverage.

This transparency forces Albany International to not only compete on price but also to clearly articulate its value proposition, highlighting product performance and service advantages. Companies with robust procurement functions are adept at utilizing this readily available information to secure favorable terms.

- Informed Buyers: Large buyers can access and compare pricing and specifications across multiple suppliers, increasing their ability to negotiate favorable terms.

- Competitive Bidding: Government and large industrial contracts often involve competitive bidding processes, further empowering customers by creating a transparent pricing environment.

- Information Access: The digital age provides customers with unprecedented access to market intelligence and competitor analysis, leveling the playing field.

Threat of Backward Integration by Customers

Customers, especially large-scale manufacturers, may explore backward integration to produce their own machine clothing or composite materials. This is more probable if Albany International's offerings become commoditized or if production volumes make in-house manufacturing economically viable. For instance, if a significant portion of a customer's input costs are tied to Albany's machine clothing, and the technology is relatively accessible, they might consider developing their own capabilities.

While the complex nature of specialized composites might deter backward integration, the threat is more pronounced within Albany's Machine Clothing segment. This potential for customers to bring production in-house directly enhances their bargaining power. In 2023, Albany International reported that its Machine Clothing segment generated approximately $575 million in revenue, indicating a substantial market where customer leverage could be a factor.

- Threat of Backward Integration: Customers may produce their own machine clothing or composite components.

- Cost and Volume Justification: Integration is more likely if Albany's products are standardized or volumes are high.

- Segment Vulnerability: The Machine Clothing segment faces a higher risk compared to specialized composites.

- Impact on Bargaining Power: Customer integration capabilities increase their leverage over Albany International.

Albany International's customers, particularly those in high-volume sectors like paper manufacturing, wield considerable bargaining power. This is amplified by the potential for customers to switch suppliers, although high switching costs in specialized segments like aerospace can mitigate this. Price sensitivity remains a key lever for customers, especially in industries with tighter margins.

| Factor | Impact on Albany International | Example/Data Point |

|---|---|---|

| Customer Concentration | High leverage for major clients | Key clients in aerospace or paper can represent significant revenue portions. |

| Switching Costs (Machine Clothing) | Limits customer power due to operational disruption | Paper mills may face weeks of downtime switching suppliers. |

| Switching Costs (Aerospace) | Significantly limits customer power due to qualification processes | Extensive testing and regulatory approvals for composite suppliers are costly and time-consuming. |

| Price Sensitivity | Pressure on Albany to remain competitive | Paper and tissue companies with slim margins scrutinize machine clothing costs. |

| Information Access | Empowers customers to negotiate better terms | Digital age provides market intelligence and competitor analysis. |

| Threat of Backward Integration | Potential to reduce reliance on Albany | More likely in Machine Clothing if products commoditize or volumes justify in-house production. Albany's Machine Clothing segment revenue was ~$575 million in 2023. |

Same Document Delivered

Albany International Porter's Five Forces Analysis

This preview showcases the complete Albany International Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. You'll gain access to a professionally formatted and ready-to-use strategic assessment, empowering your business decisions.

Rivalry Among Competitors

Albany International faces a competitive landscape populated by both large, globally recognized companies and smaller, specialized firms focusing on advanced textiles and engineered composites. This diversity means rivalry isn't just about scale, but also about specialized expertise and tailored solutions.

Key competitors like Hexcel Corporation and Milliken & Company are significant players, intensifying the competitive pressure on Albany International. This robust competition forces companies to differentiate themselves not only on price but also on their ability to innovate and provide superior customer service. For instance, in 2023, the advanced materials sector, which includes many of Albany's markets, saw continued investment in R&D, with major players like Hexcel reporting substantial expenditures to maintain their technological edge.

The pace at which Albany International's served industries expand significantly shapes how intensely its competitors battle. When industries grow slowly, companies often fight harder for existing customers, leading to more aggressive pricing and marketing. Conversely, rapid growth can mean there's enough business for everyone, reducing the pressure to outmaneuver rivals directly.

In 2024, the paper industry, a key market for Albany's machine clothing, experienced a more moderate growth trajectory. This slower expansion means that competition for market share within this segment is likely to remain a significant factor, potentially driving more intense rivalry among players like Albany International and its competitors.

However, the aerospace composites sector, another area Albany serves, has shown more robust growth. This stronger expansion provides greater opportunities for companies to grow their revenues by capturing new business rather than solely by taking share from existing competitors. For example, increased demand for lightweight materials in new aircraft models in 2024 has opened up new avenues for growth.

Albany International's competitive edge hinges on its capacity to differentiate custom-engineered fabrics and high-performance composite structures. Proprietary technology, exceptional performance, and niche applications are key differentiators that can soften the intensity of rivalry.

However, if rivals can readily mimic these unique selling points, the competitive pressure remains significant. For instance, while Albany International leverages advanced materials and manufacturing, a competitor showcasing a breakthrough in a similar niche could quickly erode this advantage. The company's 2023 annual report highlighted ongoing investment in R&D to maintain its technological lead.

Exit Barriers

High exit barriers in Albany International's specialized textile and advanced composites sectors significantly impact competitive rivalry. These barriers include substantial capital investments in manufacturing facilities and specialized equipment, making it difficult for underperforming firms to leave the market.

This situation can lead to persistent overcapacity and intense price wars, as unprofitable competitors remain active. The specialized nature of these assets further exacerbates the problem, as they are not easily repurposed for other industries.

- High Capital Investment: Specialized textile and advanced composite manufacturing requires significant upfront capital, deterring new entrants and making exits costly.

- Specialized Assets: The difficulty in repurposing specialized machinery and facilities creates a strong disincentive for firms to exit, even when unprofitable.

- Market Overcapacity: The presence of firms that cannot easily exit contributes to market overcapacity, driving down prices and intensifying competition.

- Price Wars: To maintain market share in an oversupplied market, companies often engage in price wars, squeezing profit margins for all players.

Strategic Stakes

The paper machine clothing and aerospace composites sectors are strategically vital for Albany International and its rivals, leading to fierce competition. Companies are motivated to invest heavily in research and development and even acquire competitors to secure or enhance their market positions. This drive for leadership often means that short-term profitability can be secondary to long-term market share gains, making the competitive environment highly dynamic.

Albany International's competitors, such as Voith and Kadant, also have significant stakes in these markets. For example, the aerospace composites market, where Albany International has a growing presence, is projected to reach approximately $30 billion by 2025, indicating substantial growth potential and thus fueling competitive intensity. This strategic importance means that companies are willing to make aggressive moves.

- Strategic Importance: Paper machine clothing and aerospace composites are critical markets for Albany International and its competitors, driving intense rivalry.

- Investment in R&D: Companies are likely to make substantial investments in research and development to stay ahead in these technologically driven sectors.

- Market Leadership Focus: The pursuit of market leadership can lead companies to prioritize long-term gains over immediate profits, potentially through acquisitions or aggressive pricing.

- Competitive Dynamics: The strategic stakes involved create a dynamic and challenging competitive landscape where companies actively vie for market share and technological advantage.

Albany International operates in markets with a mix of large, established players and specialized niche firms, leading to varied competitive pressures. The aerospace composites sector, a key growth area for Albany, is projected to see continued strong demand, with market size estimates for advanced composites in aerospace reaching tens of billions by the mid-2020s, fueling intense competition. Conversely, the paper machine clothing market, while stable, experiences more moderate growth, intensifying rivalry for existing market share among competitors like Voith and Kadant.

| Competitor | Key Markets | 2023/2024 Focus |

|---|---|---|

| Hexcel Corporation | Aerospace Composites | R&D investment in advanced materials |

| Milliken & Company | Specialty Textiles, Performance Materials | Innovation in engineered fabrics |

| Voith | Paper Machine Clothing, Process Technology | Maintaining market share in paper industry |

| Kadant | Paper Machine Clothing, Fluid Handling | Technological advancements in paper production |

SSubstitutes Threaten

In Albany International's Machine Clothing segment, the threat of substitutes is moderate. While paper-making is a mature industry, innovations in alternative materials for process belts could emerge, or a significant shift towards digital documentation could reduce overall paper demand, impacting the need for traditional paper machine clothing. For instance, advancements in polymer composites might offer new solutions for belt manufacturing.

For Engineered Composites, traditional metallic structures serve as a primary substitute. However, advanced composites like carbon fiber often provide superior strength-to-weight ratios, making them competitive. The market is also seeing potential threats from emerging materials such as basalt fibers, which offer good thermal and chemical resistance, and nanomaterials, which could revolutionize composite properties.

The threat of substitutes for Albany International's products is elevated when alternatives provide a compelling price-performance balance. For example, if advancements in composite materials allow for the production of aerospace components at a substantially lower cost while maintaining comparable performance characteristics to Albany's engineered fabrics, this poses a significant challenge. In 2024, the aerospace industry continued to explore lightweight and cost-effective material solutions, with some reports indicating potential cost savings of up to 15% for certain composite alternatives compared to traditional high-performance textiles in specific applications.

Customers in the aerospace sector are generally hesitant to switch to alternative materials due to the rigorous and expensive qualification processes involved. This inertia is a significant barrier. For instance, the Federal Aviation Administration (FAA) approval for new aircraft materials can take years and cost millions, making companies reluctant to deviate from established, certified components.

However, this resistance isn't absolute. A substantial cost advantage or a breakthrough in performance from a substitute material could compel manufacturers to undertake the qualification process. Consider the ongoing research into advanced composites that promise lighter weight and increased fuel efficiency; if these materials can be certified and offer a compelling return on investment, the propensity to substitute could rise dramatically.

Innovation in Substitute Industries

The threat of substitutes for Albany International is amplified by ongoing innovation in alternative materials and technologies. For instance, advancements in metal alloys and the burgeoning field of 3D printing for metallic components directly challenge traditional engineered fabrics used in papermaking. New papermaking processes themselves could also emerge as substitutes, reducing the demand for Albany's core products. In 2024, the global 3D printing market was valued at approximately $20 billion, with significant growth projected in industrial applications, highlighting the increasing viability of such substitutes.

Albany International must actively monitor these disruptive trends to maintain its competitive position. Emerging research into advanced composite materials, such as carbon nanotubes, presents a potential future threat by offering enhanced properties that could outperform current fabric solutions. The development of more sustainable and cost-effective alternatives in related industries also contributes to this threat landscape.

- Metal Alloys: Increased tensile strength and corrosion resistance in advanced metal alloys can offer durability advantages in certain industrial applications.

- 3D Printing: The ability to create complex, customized metallic parts on-demand reduces reliance on traditional manufacturing and engineered fabrics for specific components.

- New Papermaking Processes: Innovations in papermaking could lead to entirely new methods of fiber formation, potentially bypassing the need for traditional dryer fabrics.

- Advanced Composites: Materials like carbon nanotubes offer exceptional strength-to-weight ratios and thermal stability, posing a long-term threat if integrated into substitute products.

Regulatory or Environmental Pressures

Increasing environmental regulations and a growing emphasis on sustainability can significantly bolster the threat of substitutes for Albany International. For instance, if stricter mandates emerge favoring biodegradable or easily recyclable materials in sectors like aerospace or paper manufacturing, and Albany's core products lack these attributes compared to emerging alternatives, this could accelerate customer shifts. By mid-2024, many industries are facing heightened scrutiny over their carbon footprints and waste generation, making the environmental profile of materials a key purchasing driver.

Consider the paper industry, a significant market for Albany. As of early 2024, there's a noticeable trend towards reduced virgin fiber usage and increased recycled content. Companies in this space are actively seeking materials that align with circular economy principles. If Albany's technologies or materials do not readily support these evolving environmental demands, alternative suppliers offering more sustainable solutions could gain a competitive edge, thereby increasing the threat of substitution.

The aerospace sector, another crucial market, is also experiencing pressure to adopt lighter, more fuel-efficient, and potentially more sustainable materials. Emerging composite materials or advanced polymers with lower environmental impact during production or end-of-life disposal could present a viable substitute for traditional materials that Albany might supply. For example, advancements in bio-based composites are being explored for aircraft interiors and components, driven by both regulatory push and consumer demand for greener travel options.

- Growing demand for sustainable materials in paper production could lead to increased adoption of recycled fiber-based solutions, impacting Albany's traditional offerings.

- Aerospace industry's focus on fuel efficiency and reduced environmental impact may drive the use of lighter, more eco-friendly composite substitutes for traditional materials.

- Regulatory shifts towards circular economy principles and waste reduction are likely to favor materials with higher recyclability and lower lifecycle emissions.

The threat of substitutes for Albany International is moderate to high, depending on the specific segment. In papermaking, while established, innovations in alternative materials for process belts or shifts to digital documentation could reduce demand. For engineered composites, traditional metallic structures are a key substitute, but advanced composites like carbon fiber offer competitive advantages. Emerging materials like basalt fibers and nanomaterials also present potential threats.

| Segment | Primary Substitutes | Key Factors Influencing Threat | 2024 Market Trends Impacting Substitutes |

|---|---|---|---|

| Machine Clothing (Papermaking) | Alternative process belt materials, digital documentation | Price-performance balance, material innovation, paper demand shifts | Exploration of polymer composites, focus on sustainable papermaking inputs |

| Engineered Composites (Aerospace, etc.) | Metallic structures, advanced composites (carbon fiber), emerging materials (basalt fibers, nanomaterials) | Strength-to-weight ratio, cost-effectiveness, qualification processes, environmental regulations | Growth in 3D printing market (valued ~$20 billion in 2024), demand for lightweight, fuel-efficient materials |

Entrants Threaten

The advanced textiles and engineered composites sectors, especially those serving aerospace, necessitate massive capital outlays. Think specialized manufacturing equipment, cutting-edge research and development centers, and the recruitment of highly skilled personnel. These substantial initial investments create a formidable barrier, deterring many potential new players from entering the market.

Established players like Albany International leverage significant economies of scale in manufacturing, sourcing raw materials, and logistics. This cost advantage, built over years, makes it difficult for new entrants to match their per-unit production costs without substantial upfront investment and volume. For instance, in 2023, Albany International's operational efficiency contributed to its ability to maintain competitive pricing in the global market.

Albany International's significant investment in research and development, evidenced by its robust patent portfolio, creates a formidable barrier to entry. These patents cover specialized manufacturing processes and unique material formulations crucial for their machine clothing and aerospace composite products.

For instance, in 2023, Albany International reported R&D expenses of $59.7 million, highlighting their commitment to innovation. New competitors would need to replicate this level of technological advancement or secure costly licensing agreements, thereby escalating their initial capital outlay and delaying market entry.

Access to Distribution Channels and Customer Relationships

New entrants into Albany International's markets, particularly paper and aerospace, face significant hurdles in securing essential distribution channels and cultivating deep customer relationships. These industries are characterized by lengthy sales cycles and a strong emphasis on demonstrated reliability and performance, making it difficult for newcomers to gain immediate traction.

Albany International's established presence means they have already navigated these complexities, securing preferred supplier status and building trust over years of consistent delivery. For instance, in the aerospace sector, supplier qualification processes can take years and involve rigorous testing and audits, creating a substantial barrier to entry for any new player attempting to displace incumbents.

- Established Distribution Networks: Albany International benefits from existing, well-oiled distribution networks that ensure efficient product delivery and service to a broad customer base.

- Customer Loyalty and Trust: Long-term relationships with key customers in the paper and aerospace sectors are built on a foundation of trust, proven performance, and tailored solutions, which are hard for new entrants to replicate quickly.

- Industry-Specific Requirements: The paper industry often relies on specialized machinery and technical support, while aerospace demands stringent certifications and a track record of safety and dependability, both areas where established players like Albany International have a distinct advantage.

Government Policy and Regulation

Government policy and regulation represent a substantial threat of new entrants for Albany International. Strict regulations, especially within the aerospace sector, demand rigorous safety, quality, and certification standards for materials and components. For instance, the Federal Aviation Administration (FAA) certification process for aerospace materials can take years and involve significant investment, acting as a formidable barrier.

New companies seeking to enter this market must overcome these complex regulatory hurdles, which are both time-consuming and costly. This increased burden of compliance can significantly slow down market entry and deter potential competitors who lack the resources or expertise to navigate such stringent requirements.

- Regulatory Hurdles: Navigating aerospace certifications like AS9100 or specific FAA approvals requires substantial investment and expertise, deterring many new entrants.

- Compliance Costs: The expense associated with meeting these stringent quality and safety standards can be prohibitive for smaller or less capitalized companies.

- Time to Market: The lengthy approval processes can delay a new entrant's ability to generate revenue, making the initial investment riskier.

The threat of new entrants for Albany International is generally low due to significant capital requirements and established brand loyalty. High upfront investments in specialized machinery and R&D, coupled with the need for extensive customer relationships and regulatory compliance, create substantial barriers.

For example, in 2023, Albany International's R&D expenditure was $59.7 million, a figure that new entrants would need to match to compete effectively. Furthermore, industries like aerospace demand years of rigorous testing and certifications, making market entry a lengthy and costly process.

Established distribution networks and customer trust, built over decades, also deter new players. These factors, combined with economies of scale enjoyed by incumbents, mean that new companies face considerable challenges in gaining a foothold.

The regulatory landscape, particularly in aerospace, adds another layer of difficulty, requiring significant investment in compliance and approvals, which can take years.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of specialized equipment and R&D facilities. | Significant financial hurdle, limiting the number of potential entrants. |

| Brand Loyalty & Customer Relationships | Established trust and long-term contracts with key clients. | Difficult for new players to displace incumbents quickly. |

| Regulatory Compliance | Stringent certifications and approvals, especially in aerospace. | Time-consuming and expensive process, delaying market entry. |

| Economies of Scale | Cost advantages from high-volume production and sourcing. | New entrants struggle to match per-unit costs without substantial scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Albany International is built upon comprehensive data from their annual reports, SEC filings, and investor presentations. We also incorporate insights from industry-specific market research reports and trade publications to provide a robust understanding of the competitive landscape.