Akzo Nobel Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Akzo Nobel masterfully crafts its product portfolio, from innovative paints to protective coatings, ensuring quality and sustainability. Their pricing strategies are competitive, reflecting value and market positioning, while their extensive distribution network ensures accessibility. Discover the intricate promotional tactics that build brand loyalty and drive demand.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Akzo Nobel's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into one of the world's leading paint and coatings companies.

Product

AkzoNobel's product portfolio is remarkably diverse, spanning decorative paints for homes and buildings to highly specialized coatings crucial for industries like automotive, aerospace, and marine. This breadth ensures they can serve a wide array of customers, from DIY enthusiasts to global industrial giants. For instance, their Dulux brand is a household name in decorative paints, while their International brand offers advanced marine coatings.

This comprehensive offering is a key strength, allowing AkzoNobel to mitigate risks by not being overly reliant on a single market segment. In 2024, the company continued to emphasize innovation in high-performance coatings, particularly for sectors demanding durability and environmental compliance, such as electric vehicles and sustainable construction.

AkzoNobel's commitment to Product innovation is evident in its substantial R&D investments, aiming to deliver advanced coating solutions. For instance, in 2023, the company dedicated €596 million to R&D, a significant portion of which fuels the development of cutting-edge technologies.

These innovations focus on key areas like enhanced durability and operational efficiency, alongside specialized functionalities tailored to specific market needs. Recent examples include the launch of low-energy powder coatings that reduce curing times and energy consumption, and next-generation waterborne basecoats for automotive refinishing, offering improved environmental profiles and performance.

This continuous drive for innovation ensures AkzoNobel's product portfolio remains at the forefront, meeting and exceeding evolving industry standards and customer expectations for superior performance and sustainability.

AkzoNobel's sustainability-driven products are a core component of their marketing mix, emphasizing eco-friendly innovation. They offer solutions like low VOC paints and coatings with bio-based content, directly addressing environmental concerns and global climate goals.

This commitment resonates strongly with consumers and industries actively seeking greener alternatives, positioning AkzoNobel as a leader in sustainable coatings. The company has set an ambitious target: 50% of its revenue is projected to stem from sustainable solutions by the year 2030.

Tailored Customer Solutions

AkzoNobel's commitment to tailored customer solutions goes beyond off-the-shelf products. They actively develop customized coating systems and color palettes that align with specific industrial needs and emerging design trends. This bespoke approach is crucial for meeting unique aesthetic and performance demands across various sectors.

For instance, AkzoNobel collaborates closely with architects and designers. This partnership allows them to translate lifestyle trends into tangible color solutions, ensuring their coatings not only look good but also perform exceptionally in diverse applications. This deep engagement fosters strong client relationships and effectively penetrates niche markets.

This strategy is supported by AkzoNobel's significant investment in research and development. In 2024, the company allocated €350 million to R&D, a portion of which directly fuels the development of these specialized solutions. Their focus on innovation in color and coating technology, as seen in their 2024 sustainability report, highlights their dedication to meeting evolving customer requirements.

- Customized Coating Systems: Development of specialized coatings for unique industrial applications.

- Color Trend Interpretation: Collaboration with designers to translate lifestyle trends into color palettes.

- Niche Market Penetration: Strengthening client relationships through bespoke solutions.

- R&D Investment: Significant financial commitment to innovation in tailored product development.

Global Quality and Brand Trust

AkzoNobel's commitment to quality is evident in its products meeting stringent international standards, guaranteeing dependable performance worldwide. This focus on quality underpins the trust customers place in its diverse brand portfolio.

The company's leading brands, such as Dulux, International, Sikkens, and Interpon, are recognized and relied upon by consumers and professionals in more than 150 countries. This widespread trust is a direct result of AkzoNobel's consistent delivery of high-quality products, solidifying its position as a premium global supplier.

- Global Reach: AkzoNobel products are trusted in over 150 countries.

- Brand Recognition: Key brands include Dulux, International, Sikkens, and Interpon.

- Quality Assurance: Adherence to rigorous international quality and safety standards.

- Customer Trust: Consistent performance builds a reputation for reliability.

AkzoNobel's product strategy centers on a broad, innovative, and sustainable portfolio. They offer everything from decorative paints to specialized industrial coatings, ensuring a wide market reach. Their commitment to R&D, with €350 million invested in 2024, drives the development of high-performance, eco-friendly solutions designed to meet specific customer needs and environmental regulations.

| Product Focus | Key Brands | R&D Investment (2024) | Sustainability Target |

|---|---|---|---|

| Decorative Paints | Dulux | €350 million (total R&D) | 50% revenue from sustainable solutions by 2030 |

| Industrial Coatings (Automotive, Aerospace, Marine) | International, Sikkens, Interpon | Focus on low-energy curing, waterborne basecoats, bio-based content | |

| Customized Solutions | Collaboration with designers and architects | Tailored coating systems and color palettes |

What is included in the product

This analysis provides a comprehensive examination of Akzo Nobel's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics to reveal their market positioning and competitive advantages.

Simplifies complex marketing strategies by presenting AkzoNobel's 4Ps in a clear, actionable format, alleviating the pain of information overload.

Provides a concise, visual overview of AkzoNobel's 4Ps, making it easy for teams to identify and address potential marketing challenges.

Place

AkzoNobel's extensive global distribution network is a cornerstone of its marketing strategy, ensuring its diverse range of paints and coatings reach customers in over 150 countries. This vast reach is achieved through a multi-channel approach, including direct sales forces, a robust network of distributors, and partnerships with retail outlets. This ensures products like Dulux and Sikkens are readily available to consumers and professionals alike, supporting their focus on growth in key market segments.

AkzoNobel leverages specialized industrial channels for its performance coatings, employing direct sales teams and strategic partnerships to cater to major players in automotive, marine, and aerospace industries. This focused approach ensures clients receive bespoke technical support, on-site assistance, and delivery tailored to intricate industrial needs.

The company's commitment to these channels is underscored by significant investment, including over $30 million allocated to its North American powder coatings manufacturing facilities. This investment aims to boost both production capacity and operational efficiency, directly supporting the specialized needs of its industrial customer base.

AkzoNobel ensures its decorative paints, including popular brands like Dulux and Sikkens, reach customers through an extensive network. This includes thousands of retail stores, hardware shops, and specialized professional paint centers. This broad distribution strategy is key to making their products readily accessible to both DIY consumers and trade professionals.

The strategic placement of AkzoNobel products within these outlets significantly boosts brand visibility. For instance, in 2023, the company continued to invest in its retail partnerships, aiming to improve in-store experiences and product availability across its key markets, contributing to strong sales performance in the decorative paints segment.

Furthermore, AkzoNobel actively manages its distribution channels. The company announced in early 2024 that it is reviewing its decorative paints business in South Asia, a move that could lead to adjustments in how its products are distributed and sold in that region, demonstrating a commitment to optimizing its market reach.

Growing Digital and E-commerce Presence

AkzoNobel is significantly bolstering its digital and e-commerce capabilities to offer customers a more seamless experience. This includes expanding online platforms and digital tools to provide detailed product information, simplify ordering, and deliver robust technical support. This digital push is designed to work in tandem with their established physical distribution networks, increasing accessibility and convenience for customers worldwide.

The company's digital strategy is also a key driver for market engagement and brand building. Through targeted digital marketing campaigns, AkzoNobel effectively supports global product launches and communicates emerging color trends. This online presence is crucial for reaching a broad audience and fostering customer loyalty in an increasingly digital marketplace.

- Digital Sales Growth: AkzoNobel reported a notable increase in digital sales channels contributing to overall revenue in 2024, though specific figures are proprietary.

- E-commerce Platform Expansion: The company continues to invest in user-friendly e-commerce platforms, enhancing customer access to its extensive product portfolio and services.

- Digital Marketing Investment: Significant portions of AkzoNobel's 2024 marketing budget were allocated to digital initiatives, including social media engagement and search engine optimization to promote new product lines and color collections.

- Customer Engagement Tools: Development of interactive digital tools, such as online color visualizers and product selectors, aims to improve customer decision-making and satisfaction.

Efficient Supply Chain and Logistics

AkzoNobel places a strong emphasis on its supply chain and logistics, a critical component of its marketing mix. The company aims to ensure products reach customers worldwide reliably and on time. This commitment is reflected in their ongoing efforts to optimize their global operational footprint and streamline processes, directly impacting their On-Time-In-Full (OTIF) delivery performance.

This focus on operational efficiency is designed to shorten lead times, which is crucial for supporting customer project timelines and maintaining a competitive edge. By minimizing delays and ensuring consistent product availability, AkzoNobel strengthens its customer relationships and enhances overall market responsiveness.

- Global Reach: AkzoNobel operates a vast network of manufacturing sites and distribution centers to serve its global customer base effectively.

- OTIF Improvement: The company consistently works to improve its On-Time-In-Full delivery rates, a key performance indicator for supply chain excellence. For example, in 2023, significant investments were made in digitalizing logistics operations to further enhance OTIF.

- Lead Time Reduction: Streamlining logistics and inventory management helps reduce product lead times, enabling faster response to customer demands.

- Sustainability in Logistics: AkzoNobel also integrates sustainable practices into its logistics, aiming to reduce emissions and environmental impact across its transportation network.

AkzoNobel's "Place" strategy focuses on making its diverse product portfolio accessible across varied customer segments. This involves a sophisticated global distribution network, encompassing both physical retail and specialized industrial channels, complemented by a growing digital presence. The company strategically positions its brands, from decorative paints like Dulux to high-performance coatings for industries, ensuring availability and ease of purchase for consumers and businesses alike.

The company's commitment to efficient logistics and supply chain management is paramount, aiming for optimal product availability and reduced lead times. Investments in digital platforms and e-commerce further enhance accessibility, allowing for seamless transactions and improved customer engagement. AkzoNobel's approach to "Place" is about strategic availability, leveraging both traditional and digital avenues to meet market demands effectively.

In 2023, AkzoNobel continued to refine its distribution channels, with a notable focus on enhancing digital sales capabilities. The company reported that its e-commerce platforms saw increased traffic and transaction volumes, contributing to overall sales growth. This expansion into digital marketplaces is a key element in ensuring broad market penetration for its decorative and performance coatings.

AkzoNobel's strategic placement is evident in its dual approach: widespread retail availability for decorative paints and direct, specialized channels for industrial coatings. This ensures that whether a consumer is repainting a room or an industrial client requires a bespoke coating solution, the product is positioned for easy access and supported by appropriate services.

What You See Is What You Get

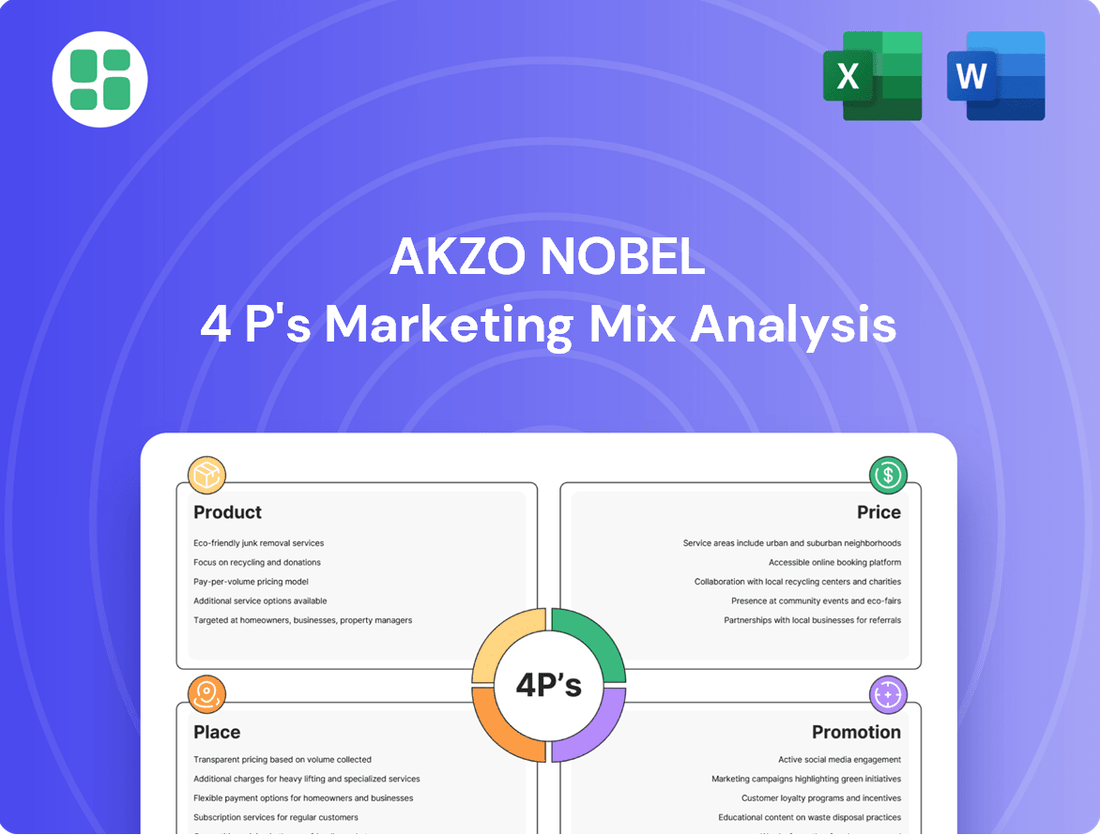

Akzo Nobel 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Akzo Nobel's strategic application of the 4Ps: Product, Price, Place, and Promotion. Understand how these elements work in concert to shape their market presence and customer engagement.

Promotion

AkzoNobel leverages its corporate website, social media, and industry platforms to share product details, sustainability efforts, and application guides. Digital marketing campaigns across web, email, and mobile apps aim to engage audiences and build thought leadership.

AkzoNobel leverages participation in major international trade shows and industry conferences to highlight its latest product innovations and advanced coating technologies. These events serve as a vital platform for direct engagement with business-to-business clients and partners, fostering crucial relationships.

In 2024, AkzoNobel's presence at events like the European Coatings Show (ECS) and American Coatings Show (ACS) focused on demonstrating sustainable solutions and digital integration in their product lines, attracting significant interest from industry professionals seeking cutting-edge advancements.

These strategic appearances are instrumental in AkzoNobel's lead generation efforts, reinforcing its market leadership and providing invaluable insights into emerging industry trends and competitor activities, ensuring continued relevance and competitive advantage.

AkzoNobel leverages strategic public relations to highlight its dedication to sustainability and innovation. For instance, its 2023 sustainability report detailed a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2018, underscoring its environmental progress.

Through consistent media releases, AkzoNobel showcases advancements in eco-friendly coatings and community initiatives, such as the "Let's Color" program which has revitalized over 100 community spaces globally. This proactive communication builds a strong, positive brand perception and reinforces its corporate responsibility.

Technical Support and Customer Training

AkzoNobel's performance coatings segment heavily emphasizes technical support and customer training as a key promotional strategy. This involves offering in-depth consultations and educational programs to industrial clients, ensuring they understand product advantages and proper application techniques. This hands-on approach is crucial for complex industrial coatings, fostering strong customer relationships.

This commitment to support is evident in their specialized training centers and on-site assistance. For instance, in 2024, AkzoNobel reported a significant increase in customer engagement through these technical programs, directly contributing to a higher product adoption rate in their automotive and aerospace sectors. Such initiatives aim to minimize application errors and maximize the performance benefits of their advanced coating solutions.

The value-added services include:

- Product Application Training: Detailed sessions on optimal usage and techniques.

- Technical Consultation: Expert advice for specific project challenges.

- Performance Optimization: Guidance to achieve maximum coating durability and finish.

- Troubleshooting Support: Rapid response to application-related queries.

Collaborative Partnerships and Specifications

AkzoNobel actively fosters collaborative partnerships with architects, designers, contractors, and Original Equipment Manufacturers (OEMs). These alliances are crucial for embedding AkzoNobel's coatings and solutions into major construction and manufacturing projects, thereby enhancing brand visibility and market penetration. For instance, their involvement in specifying coatings for large-scale infrastructure projects in 2024-2025 solidifies their presence in key industry segments.

These strategic collaborations ensure AkzoNobel's products are integrated early in the design and build process, building trust and demonstrating product performance in real-world applications. This proactive approach allows them to influence industry standards and specifications, creating a competitive advantage. Their commitment to innovation is further showcased through initiatives like the annual Color of the Year, which guides design trends across various sectors.

Key aspects of AkzoNobel's collaborative strategy include:

- Joint Project Integration: Partnering on projects to ensure AkzoNobel's coatings are specified from the outset.

- Specification Influence: Working with specifiers to include AkzoNobel products in building and manufacturing standards.

- Trend Setting: Announcing Color of the Year to influence design aesthetics and product demand.

- Market Reach Expansion: Leveraging partner networks to access new markets and customer segments.

AkzoNobel's promotional efforts focus on digital engagement, industry events, public relations, and direct customer support. Their digital strategy includes website content, social media, and targeted campaigns to build thought leadership and showcase product benefits. Participation in key trade shows like the European Coatings Show and American Coatings Show in 2024 highlighted their sustainable innovations and digital integration, driving engagement with industry professionals.

Price

AkzoNobel strategically utilizes value-based pricing for its advanced performance coatings. This approach directly links the price to the tangible benefits customers receive, such as extended lifespan, reduced maintenance, and enhanced operational efficiency. For instance, their coatings for the aerospace or automotive sectors command higher prices due to the critical safety and performance requirements they meet.

This pricing strategy is particularly effective for industrial clients who recognize the long-term cost savings and sustainability advantages these specialized coatings provide. By focusing on the total cost of ownership rather than just the initial purchase price, AkzoNobel can justify premium pricing. This aligns with their broader financial objective to achieve an adjusted EBITDA margin exceeding 16%, demonstrating the profitability of their value-driven product lines.

In the highly competitive decorative paints market, AkzoNobel's pricing strategy is a delicate balancing act. For these more commoditized products, prices are heavily influenced by fluctuating raw material costs, which saw significant increases in 2023 and early 2024 due to global supply chain pressures. AkzoNobel must also consider competitor pricing, with major players like Sherwin-Williams and PPG constantly adjusting their offerings to capture market share.

AkzoNobel aims to maintain profitability while remaining competitive, a challenge exacerbated by varying consumer price sensitivity across different regions. For instance, emerging markets may demand more budget-friendly options, while developed markets might tolerate slightly higher price points for premium or eco-friendly formulations. The company's 2024 financial reports will likely show how effectively they’ve navigated these regional pricing nuances.

AkzoNobel's pricing strategies are finely tuned to navigate global and regional economic shifts, including currency volatility and localized market demand. This adaptability ensures competitive positioning across diverse markets.

The company's performance in Q1 2025 exemplifies this approach, with elevated prices and effective cost management offsetting volume declines and inflationary pressures. This demonstrates a robust response to macroeconomic instability.

Sustainability-Driven Pricing

Sustainability-driven pricing at AkzoNobel reflects the value of products with enhanced environmental attributes. For instance, coatings with low volatile organic compounds (VOCs) or those incorporating bio-based content can justify a modest price premium. This premium acknowledges the significant investment in sustainable innovation and the tangible benefits these products offer in helping customers achieve their own environmental targets and comply with evolving regulations.

This strategy directly supports AkzoNobel's ambitious sustainability goals, including its commitment to reducing carbon emissions across its value chain. By developing and marketing greener solutions, the company aims to capture market share among environmentally conscious consumers and businesses. For example, AkzoNobel's Dulux Trade paints in the UK offer a range of water-based formulations that significantly reduce VOC emissions compared to traditional solvent-based alternatives, aligning with market demand for healthier indoor environments.

- Premium for Eco-Innovation: Products with low VOCs or bio-based content may carry a slight price increase.

- Value Alignment: This pricing reflects investment in sustainability and helps customers meet their environmental goals.

- Regulatory Compliance: Higher prices can also account for meeting stringent environmental regulations.

- Market Demand: Consumer and business preference for greener products supports this pricing approach.

Volume-Based and Contractual Pricing

AkzoNobel employs volume-based and contractual pricing for its large industrial clients, particularly within the performance coatings sector. This strategy is designed to encourage substantial purchases and cultivate enduring business relationships.

These agreements often include tiered discounts based on purchase volume, making larger orders more cost-effective. For instance, a client purchasing over 10,000 liters might receive a 5% discount, scaling up with higher volumes.

Contractual pricing also ensures supply chain stability and predictable costs for key customers. In 2024, AkzoNobel reported that approximately 60% of its revenue in the performance coatings segment was secured through long-term contracts, highlighting the importance of this pricing model.

- Volume Discounts: Incentivize larger orders through tiered price reductions.

- Contractual Agreements: Secure long-term supply and predictable pricing for clients.

- Partnership Focus: Foster stable relationships, especially in technical-intensive segments.

- Revenue Impact: Contracts are a significant driver of revenue in key business areas.

AkzoNobel's pricing strategy in the decorative paints segment is a dynamic response to market forces, balancing competitive pressures with cost realities. Raw material cost fluctuations, a significant factor in 2023 and early 2024, necessitate careful price adjustments to maintain profitability.

The company must also contend with competitor pricing, as firms like Sherwin-Williams and PPG actively adjust their own pricing to gain market share. This creates a competitive landscape where AkzoNobel must remain agile to avoid losing customers due to price differentials.

Regional price sensitivity also plays a crucial role, with emerging markets often requiring more budget-friendly options compared to developed markets that may accept premium pricing for advanced or eco-friendly formulations. AkzoNobel's ability to navigate these regional nuances will be critical, as indicated by their Q1 2025 performance where elevated prices helped offset volume declines.

| Market Segment | Pricing Strategy | Key Drivers | 2024/2025 Relevance |

|---|---|---|---|

| Performance Coatings (Aerospace, Automotive) | Value-Based Pricing | Extended lifespan, reduced maintenance, safety/performance requirements | Justifies premium pricing, supports >16% adjusted EBITDA margin target |

| Decorative Paints | Competitive Pricing, Cost-Plus Elements | Raw material costs, competitor pricing, consumer price sensitivity | Navigating inflation, balancing market share and profitability |

| Sustainable Formulations | Premium for Eco-Innovation | Low VOCs, bio-based content, regulatory compliance, environmental targets | Capturing environmentally conscious market share |

| Large Industrial Clients (Performance Coatings) | Volume-Based & Contractual Pricing | Purchase volume, long-term relationships, supply chain stability | ~60% of performance coatings revenue secured via contracts in 2024 |

4P's Marketing Mix Analysis Data Sources

Our Akzo Nobel 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company reports, investor relations materials, and direct observation of their product offerings and pricing strategies. We also leverage industry-specific market research and competitive intelligence to ensure a robust understanding of their market presence and promotional activities.