Akzo Nobel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Akzo Nobel operates in a dynamic market shaped by intense rivalry and significant buyer power, as indicated by our Porter's Five Forces analysis. Understanding these forces is crucial for navigating the coatings and chemicals industry.

The complete report reveals the real forces shaping Akzo Nobel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AkzoNobel faces significant challenges from raw material cost volatility, a common issue in the paints and coatings sector. Fluctuations in prices for key inputs like petrochemicals, titanium dioxide, and resins directly impact the company's profitability.

While global supply chain disruptions have lessened, some residual difficulties in sourcing materials from Europe continue to affect costs. This ongoing exposure means AkzoNobel must remain agile in managing its procurement strategies.

For instance, AkzoNobel's Q1 and Q2 2025 performance highlighted how elevated prices for these essential materials were offset by robust cost reduction efforts. This demonstrates the critical need for effective cost management to navigate inflationary pressures and maintain margins amidst lower sales volumes.

For highly specialized chemicals or unique pigments crucial for AkzoNobel's high-performance coatings, the supplier landscape can become more concentrated. This concentration can empower individual suppliers, particularly when these inputs are essential for innovative and sustainable product lines, such as bio-based or low-VOC formulations.

AkzoNobel is actively working to lessen the influence of its suppliers. A key part of this strategy involves boosting its own production of crucial raw materials, such as resins. This move aims to decrease the company's reliance on external suppliers for these essential components.

The company is also embracing a 'local-for-local' production approach. With numerous plants strategically located across various countries, AkzoNobel is reducing its dependence on lengthy global supply chains. This decentralized model offers greater resilience against disruptions from geopolitical issues and regional material scarcity.

Switching Costs for Raw Materials

Even though AkzoNobel is a major purchaser, changing suppliers for specific, specialized raw materials can still be costly. These costs include reformulating products, conducting rigorous testing, and obtaining necessary regulatory approvals. This situation can create a form of supplier lock-in, granting them a degree of bargaining power.

Despite these challenges, AkzoNobel's continuous investment in research and development, along with its focus on sustainability, is actively exploring alternative materials. This strategic approach aims to reduce long-term switching costs by building a more diverse and resilient raw material supply chain.

- High Reformulation Costs: Significant expenses are incurred when adapting existing product formulations to accommodate new raw materials.

- Testing and Validation: New materials require extensive testing to ensure performance, safety, and compliance, adding to switching expenses.

- Regulatory Hurdles: Gaining approval for new materials in regulated markets can be a lengthy and costly process.

- Diversification Strategy: AkzoNobel’s R&D efforts to find new material sources aim to mitigate supplier dependency and reduce future switching costs.

Impact of Sustainability Requirements on Supply Chain

Growing pressure for sustainable products, such as low-VOC and bio-based coatings, significantly impacts AkzoNobel's raw material sourcing. This trend empowers suppliers who can offer eco-friendly inputs, potentially increasing their bargaining power.

AkzoNobel's ambitious goal to slash its value chain carbon emissions by 50% by 2030 directly translates into a need for suppliers aligned with these sustainability mandates. This requirement can strengthen the position of suppliers demonstrating strong environmental credentials and compliance.

- Increased Demand for Eco-Friendly Inputs: Regulatory shifts and consumer preferences are pushing companies like AkzoNobel towards materials with lower environmental impact, such as those that are bio-based or PVC-free.

- Supplier Innovation as a Differentiator: Suppliers investing in and providing sustainable material solutions gain a competitive edge, potentially commanding better terms due to their unique offerings.

- Alignment with Carbon Reduction Targets: AkzoNobel's commitment to a 50% value chain carbon emission reduction by 2030 necessitates a supply chain that actively contributes to this goal, favoring compliant and proactive suppliers.

The bargaining power of suppliers for AkzoNobel is moderate, influenced by the specialized nature of certain raw materials and the costs associated with switching suppliers. For instance, reformulating products, rigorous testing, and regulatory approvals can create lock-in effects, giving some suppliers leverage. AkzoNobel's strategic initiatives, such as increasing in-house production of key materials like resins and adopting a 'local-for-local' manufacturing approach, aim to mitigate this power by reducing reliance on external sources and complex global supply chains.

| Factor | Impact on AkzoNobel | Mitigation Strategy |

|---|---|---|

| Specialized Raw Materials | Concentrated supplier base for unique pigments and chemicals can increase supplier leverage. | Investment in R&D for alternative materials and supply chain diversification. |

| Switching Costs | High costs for reformulation, testing, and regulatory approval for new materials. | Focus on long-term supplier relationships and developing internal material expertise. |

| Sustainability Demands | Growing need for eco-friendly inputs empowers suppliers with sustainable solutions. | Collaborating with suppliers on green chemistry and circular economy initiatives. |

| In-house Production | AkzoNobel is increasing its own production of critical raw materials like resins. | Reduces direct reliance on external suppliers for these key components. |

What is included in the product

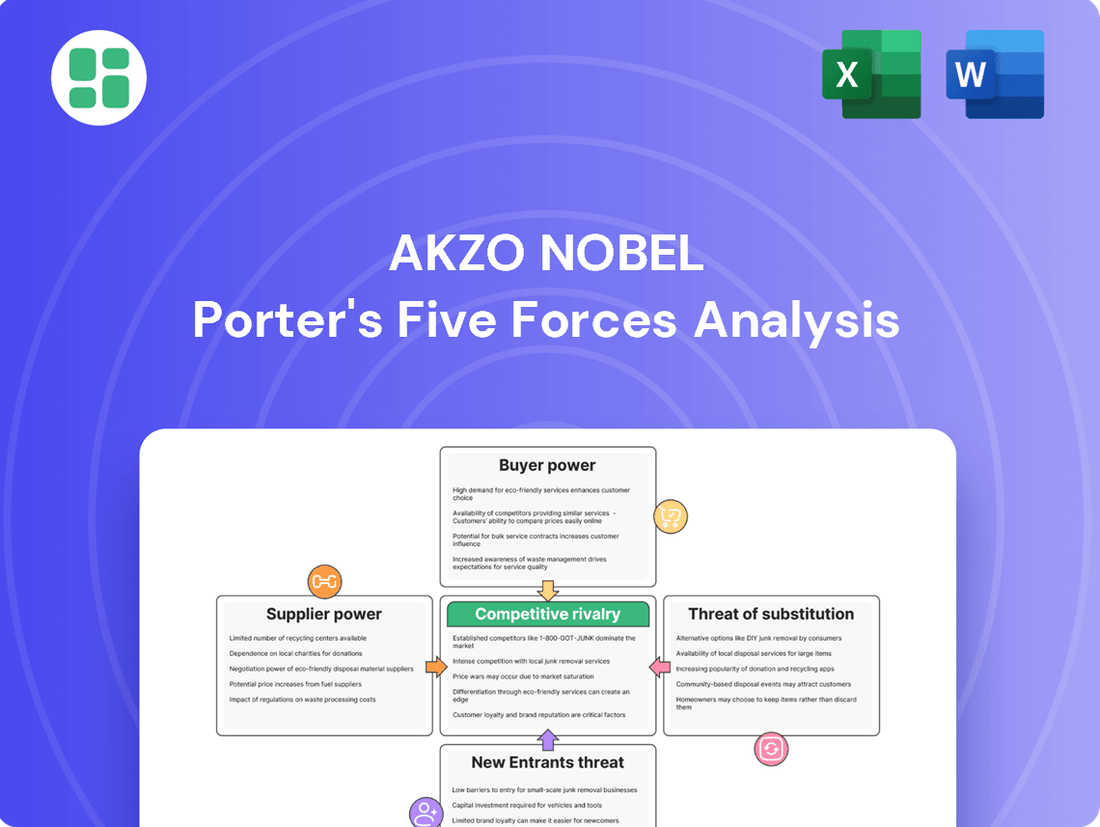

This Porter's Five Forces analysis for Akzo Nobel dissects the competitive intensity within the paints and coatings industry, examining supplier and buyer power, new entrant threats, substitute product risks, and the rivalry among existing players.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

AkzoNobel's customer base is incredibly varied, spanning major industrial players in automotive, aerospace, and marine industries, alongside everyday consumers purchasing decorative paints. This broad reach means that the influence of any one group of customers is lessened, as strength in one market can balance out challenges in another.

While this diversity generally moderates customer power, significant B2B clients, due to their substantial purchase volumes and precise technical specifications, naturally hold more sway than individual retail buyers. For instance, in 2024, large automotive manufacturers often negotiate bulk contracts for coatings, demanding specific performance characteristics and pricing that individual homeowners do not.

Customer price sensitivity is a key factor in AkzoNobel's performance, varying greatly by market segment. In industrial performance coatings, where product specifications and durability are paramount, customers tend to be less sensitive to price. Conversely, the decorative paints market is often more price-elastic, meaning customers are more likely to switch brands based on cost.

AkzoNobel's financial performance in the first half of 2025 reflects this dynamic. While the company has strived to maintain pricing discipline, reports from Q1 and Q2 2025 indicate a dip in volumes for certain segments. This suggests that customers, faced with either price increases or broader economic headwinds, are becoming more cautious about their spending on paints and coatings.

AkzoNobel's robust brand portfolio, featuring names like Dulux, International, and Sikkens, significantly dampens customer bargaining power. This brand strength cultivates loyalty and a perception of superior value, making price-based switching less appealing for consumers. For instance, in 2024, AkzoNobel reported strong performance in its Decorative Paints segment, partly driven by the enduring appeal of its core brands.

Customer Switching Costs

For industrial clients, the effort to switch paint and coating suppliers for a company like AkzoNobel is not a simple decision. It often involves substantial costs. These can include the time and resources needed for re-qualification processes, which means testing new products to ensure they meet stringent performance standards. Additionally, there might be necessary adjustments to existing production lines to accommodate new formulations, and the inherent risk of impacting product performance or voiding warranties with their own end products. This effectively creates a level of customer stickiness, making it less likely for these clients to move to a competitor without a compelling reason.

While the switching costs for consumers buying decorative paints are generally lower, other factors still influence their decisions. Brand reputation is a significant driver, with customers often preferring well-known and trusted names like AkzoNobel's brands. Beyond that, the perceived ease of use and application of a paint product also plays a role. A product that is easy to apply and delivers consistent results can be just as important as price for many DIY consumers, contributing to customer loyalty.

In 2023, AkzoNobel reported that its Decorative Paints segment generated €6.08 billion in revenue. This segment serves a broad consumer base where brand perception and product usability are key differentiators, influencing customer retention even with relatively low direct switching costs.

- Industrial Switching Costs: Re-qualification, production line adjustments, performance/warranty risks.

- Decorative Switching Factors: Brand reputation and ease of use are primary drivers.

- 2023 Decorative Revenue: €6.08 billion for AkzoNobel, highlighting the importance of consumer-facing strategies.

Customer Demand for Sustainable Solutions

A significant and growing portion of AkzoNobel's customer base, encompassing both industrial clients and individual consumers, is actively seeking out coating solutions that prioritize sustainability and minimize environmental impact. This escalating demand is a powerful lever for customers, allowing them to influence supplier choices and product innovation.

AkzoNobel's strategic investment in developing and promoting eco-friendly alternatives, such as water-based paints, low-VOC (volatile organic compound) formulations, and bio-based materials, directly addresses this customer imperative. For instance, in 2024, AkzoNobel reported that its sustainable solutions portfolio, including products with reduced environmental footprint, contributed significantly to its revenue growth, demonstrating a clear market preference.

- Growing Demand: Surveys in 2024 indicated that over 60% of B2B buyers consider sustainability a key factor when selecting suppliers for industrial coatings.

- AkzoNobel's Response: The company's "Paint the Future" initiative actively seeks and invests in sustainable innovations, with a focus on circular economy principles and reduced carbon emissions in its product lines.

- Customer Influence: The ability of customers to shift their purchasing power towards companies with strong environmental credentials directly pressures AkzoNobel to continuously improve its sustainability performance and product offerings.

The bargaining power of AkzoNobel's customers is generally moderate, influenced by market segmentation, brand loyalty, and switching costs. While large industrial clients can exert significant pressure due to volume and technical demands, the company's strong brand portfolio and high switching costs for industrial applications help to mitigate this power. Consumer price sensitivity is higher in the decorative paints segment, but brand reputation and ease of use remain important factors.

Sustainability is increasingly a key purchasing criterion, giving customers more leverage to influence AkzoNobel's product development and supplier choices. The company's investment in eco-friendly solutions directly responds to this growing customer demand, as evidenced by the strong market preference for its sustainable product lines. For example, in 2024, over 60% of B2B buyers considered sustainability when selecting suppliers for industrial coatings.

| Customer Segment | Key Influencing Factors | Mitigating Factors for AkzoNobel | 2024/2025 Observations |

| Industrial Clients | Volume, Technical Specifications, Sustainability Demands | High Switching Costs (Re-qualification, Production Adjustments), Brand Loyalty | Growing demand for sustainable solutions; price sensitivity noted in some segments impacting volumes. |

| Retail Consumers (Decorative Paints) | Price Sensitivity, Brand Reputation, Ease of Use | Strong Brand Portfolio (Dulux, Sikkens), Perceived Value | 2023 Decorative Paints Revenue: €6.08 billion; brand appeal remains strong despite economic headwinds. |

Full Version Awaits

Akzo Nobel Porter's Five Forces Analysis

This preview showcases the complete Akzo Nobel Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the paints and coatings industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file. This comprehensive analysis will equip you with critical insights into the forces shaping Akzo Nobel's strategic environment.

Rivalry Among Competitors

The paints and coatings sector is fiercely competitive, with major global players such as Sherwin-Williams, PPG Industries, and BASF vying for market share alongside AkzoNobel, a significant force particularly in Europe. This intense rivalry centers on pricing strategies, the introduction of new products, and the expansion of their geographic footprints. In 2024, AkzoNobel's CEO acknowledged that challenging economic conditions amplified this competitive pressure, necessitating increased internal efficiency and cost-saving initiatives.

The paints and coatings sector in developed economies is quite mature, meaning growth is slower, and companies like AkzoNobel face stiff competition for every bit of market share. This maturity often drives companies to seek out new markets or innovate to stand out.

The industry has seen a fair amount of consolidation through mergers and acquisitions, not just among paint makers but also their suppliers. For example, in 2023, Sherwin-Williams acquired Valspar, a significant move that altered competitive dynamics. Such deals can create larger, more dominant players.

AkzoNobel itself is actively managing its competitive stance. In 2024, the company confirmed its plan to sell its stake in Akzo Nobel India, a move aimed at streamlining its operations and focusing on core markets where it can best compete and achieve growth.

Competition in the coatings industry is heavily fueled by ongoing innovation, focusing on product performance, application techniques, and environmental impact. AkzoNobel's commitment to research and development is evident in its pursuit of advanced materials and sustainable solutions.

The company's investment in R&D allows it to introduce cutting-edge products like its Securshield 500 Series and coatings utilizing bio-based materials that cure with UV light. This drive for innovation is essential for AkzoNobel to stay ahead of competitors and clearly distinguish its offerings in the market.

Pricing Strategies and Efficiency Measures

In the coatings industry, intense competition necessitates rigorous pricing strategies and a relentless focus on operational efficiency. Fluctuating raw material costs, as seen in Q1 and Q2 2025, directly impact profitability, making disciplined pricing essential. AkzoNobel's proactive approach to cost reduction, including workforce adjustments and site consolidations, demonstrates a commitment to maintaining margins even when faced with flat organic sales.

AkzoNobel's Q1 and Q2 2025 performance underscores the importance of efficiency measures in a competitive landscape. The company reported expanded adjusted EBITDA margins, a testament to their successful cost reduction initiatives. These efforts, which included workforce reductions and site closures, were vital in offsetting lower volumes in certain segments and maintaining profitability amidst market volatility.

- Pricing Discipline: AkzoNobel's Q1 2025 adjusted EBITDA margin reached 13.1%, up from 11.9% in Q1 2024, indicating successful pricing and cost management.

- Operational Efficiency: The company's Q2 2025 results showed continued margin expansion, with adjusted EBITDA margin at 14.5%, an increase from 13.7% in Q2 2024, driven by efficiency actions.

- Cost Reduction: Workforce reductions and site closures were key components of AkzoNobel's strategy to improve operational efficiency and absorb raw material cost fluctuations.

- Market Responsiveness: Despite flat organic sales and volume declines in some areas during the first half of 2025, AkzoNobel's focus on efficiency allowed them to improve profitability.

Regional Market Dynamics and New Entrants

While global paint markets feature established giants, regional shifts often introduce new competitive forces. For example, the Indian decorative paints sector saw a significant disruption with the 2023 entry of Birla Opus, a new player backed by substantial investment, directly challenging incumbents like AkzoNobel's Indian operations.

AkzoNobel's response includes a focus on localized production and product adaptation to meet diverse regional demands, a strategy crucial for navigating these evolving competitive pressures. This approach acknowledges that a one-size-fits-all strategy is insufficient in a market experiencing dynamic regional growth and the emergence of agile new competitors.

- Regional Market Disruption: Birla Opus's 2023 entry into India's decorative paints market exemplifies how new entrants can rapidly alter regional competitive dynamics.

- AkzoNobel's Localization Strategy: The company is enhancing its regional presence by tailoring production and product offerings to specific market needs, a key competitive maneuver.

- Impact on Market Share: Such regional shifts necessitate continuous adaptation to maintain or grow market share against both established rivals and emerging local players.

Competitive rivalry in the paints and coatings sector is intense, with AkzoNobel facing established global players and new regional entrants. This competition is driven by innovation, pricing, and market expansion, with companies like Sherwin-Williams and PPG Industries being key rivals.

The maturity of developed markets intensifies this rivalry, pushing companies to innovate and seek new growth avenues. Consolidation, such as Sherwin-Williams' 2023 acquisition of Valspar, further reshapes the competitive landscape by creating larger, more dominant entities.

AkzoNobel's strategic moves, like divesting its Indian stake in 2024, aim to sharpen its focus on core markets. The company's commitment to R&D, evidenced by its development of advanced materials and UV-curing coatings, is crucial for differentiation.

In 2024 and the first half of 2025, AkzoNobel focused on operational efficiency and cost reduction to maintain profitability amidst volatile raw material costs and flat organic sales. This included workforce adjustments and site consolidations, leading to margin expansion, with Q1 2025 adjusted EBITDA at 13.1% and Q2 2025 at 14.5%.

| Metric | Q1 2024 | Q1 2025 | Q2 2024 | Q2 2025 |

|---|---|---|---|---|

| AkzoNobel Adjusted EBITDA Margin | 11.9% | 13.1% | 13.7% | 14.5% |

SSubstitutes Threaten

The threat of substitutes for AkzoNobel's paints and coatings is growing due to material innovation. For instance, advanced plastics with inherent color or pre-finished materials are emerging, reducing reliance on traditional coatings in sectors like automotive and construction. In 2024, the global market for advanced materials, which includes these alternatives, saw significant growth, indicating a shift in consumer and industrial preferences.

AkzoNobel's innovation in creating coatings with enhanced durability and longevity presents a unique threat of substitution. As these advanced coatings require less frequent reapplication, they effectively substitute for the need for new product purchases over the product's lifecycle. This is particularly evident in their high-performance protective and marine segments, where extended lifecycles are a key selling point.

Stringent environmental regulations, like those targeting VOC emissions or specific chemicals such as PFAS, are a significant driver for alternative solutions. For instance, the European Union's REACH regulation has already impacted the chemical industry by restricting the use of certain substances, pushing companies to find compliant alternatives. This regulatory pressure can foster innovation in entirely new coating technologies or materials, potentially sourced from outside the traditional paint and coatings sector.

Shifting Construction and Manufacturing Techniques

Changes in construction and manufacturing are a growing threat. For instance, the rise of modular building techniques might lessen the demand for traditional on-site finishing, impacting Akzo Nobel's coatings business. This shift could mean fewer applications for their specialized products.

Furthermore, advancements in materials science are creating base products with inherent protective qualities. Self-cleaning surfaces or materials with built-in corrosion resistance could directly substitute for the protective coatings Akzo Nobel currently supplies, particularly in sectors like architecture and automotive.

- Modular Construction Growth: The global modular construction market was valued at approximately $117.3 billion in 2023 and is projected to grow significantly, potentially reducing the need for certain types of applied finishes.

- Advanced Material Development: Research into self-healing concrete and advanced polymer coatings for metals continues, aiming to integrate protective properties directly into building materials, thereby bypassing traditional coating applications.

- Impact on Coatings Demand: If these material innovations gain widespread adoption, they could lead to a structural decline in demand for Akzo Nobel's protective and decorative coatings in specific market segments.

Uncoated Alternatives or Natural Finishes

The trend towards raw, natural finishes in decorative and architectural projects presents a subtle threat of substitution for Akzo Nobel. Exposed concrete, natural wood, and unpainted metals are gaining traction, particularly in design segments valuing authenticity. This aesthetic shift means some projects may forgo traditional coatings altogether.

While not a direct replacement for all Akzo Nobel products, this preference impacts market share in specific niches. For instance, the global market for natural building materials, including wood and stone, saw continued growth through 2024, driven by sustainability and design preferences. This can divert spending that might otherwise go towards paints and coatings.

- Growing demand for natural finishes: Design trends favor exposed concrete, wood, and metal, reducing the need for coatings in some architectural applications.

- Niche market impact: While a smaller segment, this trend affects specific decorative and architectural markets where authenticity is prioritized.

- Market data: The global natural building materials market continued its upward trajectory in 2024, indicating a shift in consumer preference away from some coated applications.

The threat of substitutes for AkzoNobel's offerings is multifaceted, driven by material innovation and evolving design preferences. Advanced materials with inherent protective qualities and the growing trend towards natural finishes in construction and design are key factors. These substitutes can reduce the demand for traditional paints and coatings, particularly in specific market segments.

| Substitute Category | Example | Impact on AkzoNobel | 2024 Market Trend/Data |

|---|---|---|---|

| Advanced Materials | Pre-finished materials, self-healing concrete | Reduces need for applied coatings | Global advanced materials market saw significant growth. |

| Natural Finishes | Exposed wood, concrete, metal | Decreases demand in decorative segments | Global natural building materials market continued upward trend. |

| Integrated Functionality | Materials with built-in corrosion resistance | Directly replaces protective coatings | Continued R&D in materials science creating new alternatives. |

Entrants Threaten

The paints and coatings sector demands significant upfront capital for state-of-the-art manufacturing plants, robust research and development, and widespread distribution channels. This substantial financial commitment acts as a formidable barrier, deterring potential new entrants. For instance, establishing a competitive manufacturing presence often requires hundreds of millions of dollars in investment.

Achieving economies of scale is crucial for cost competitiveness in this industry, a feat that is exceedingly difficult for newcomers. Established companies like AkzoNobel benefit from lower per-unit production costs due to their large-scale operations, making it challenging for smaller, less capitalized firms to match their pricing and profitability.

AkzoNobel's formidable brand recognition, exemplified by globally trusted names like Dulux and Sikkens, creates a significant barrier for new entrants. These established brands, nurtured over decades and backed by substantial marketing investment, have cultivated deep customer loyalty, especially within the performance coatings sector. For instance, in 2023, AkzoNobel continued to invest heavily in brand building, with marketing and advertising expenses contributing to their strong market position.

The coatings industry faces a formidable barrier to entry due to its complex and ever-evolving regulatory environment. Stringent rules govern every aspect of chemical production, from environmental impact and worker safety to product formulation, including volatile organic compound (VOC) limits and restrictions on per- and polyfluoroalkyl substances (PFAS). For instance, in 2024, the European Union continued to implement REACH regulations, impacting the use of certain chemicals in coatings, requiring extensive testing and documentation.

Navigating this intricate web of regulations demands specialized knowledge and substantial financial investment in compliance. These high upfront costs and the ongoing burden of adherence can significantly deter new companies from entering the market, thereby protecting established players like Akzo Nobel.

Access to Distribution Channels and Raw Materials

Established companies in the coatings industry, such as AkzoNobel, benefit from extensive and efficient distribution networks built over years. These channels are crucial for reaching diverse customer segments, from large industrial clients to individual consumers. For instance, AkzoNobel's global reach allows it to serve markets effectively across various continents.

New entrants often struggle to replicate this established infrastructure, facing significant investment hurdles and time delays in building comparable distribution capabilities. Securing shelf space in retail or access to key B2B supply chains can be a formidable barrier. This is particularly true for specialized coatings requiring specific handling or application expertise.

Furthermore, access to essential raw materials is another critical factor. AkzoNobel, as a major player, likely has established long-term contracts and strong relationships with suppliers, potentially securing better pricing and guaranteed supply of key ingredients like titanium dioxide, resins, and pigments. Newcomers may find it difficult to negotiate similar terms, facing higher input costs or inconsistent availability.

- Distribution Network Barriers: AkzoNobel's established global distribution network provides a significant advantage, making it challenging for new entrants to achieve similar market penetration and customer reach.

- Supplier Relationships: Long-standing relationships with raw material suppliers grant established firms like AkzoNobel preferential pricing and supply security, which are difficult for new companies to match.

- Cost of Entry: The capital required to build a comparable distribution infrastructure and secure reliable raw material sourcing represents a substantial cost barrier for potential new entrants in the coatings market.

Technological and Innovation Barriers

The paints and coatings industry demands constant innovation. AkzoNobel, for instance, is committed to sustainable solutions, investing significantly in research and development to meet evolving performance expectations and environmental regulations. This ongoing need for technological advancement creates a substantial barrier for new companies entering the market.

Newcomers must be prepared for substantial upfront investment in R&D to even begin developing products that can compete with established players like AkzoNobel. Failing to keep pace with rapid technological progress means a high risk of being left behind.

- R&D Investment: Companies in the paints and coatings sector often allocate a significant portion of their revenue to research and development. For example, major players may invest 3-5% of their sales back into R&D to stay competitive.

- Sustainability Focus: The drive towards eco-friendly formulations, such as low-VOC (Volatile Organic Compound) paints, requires specialized knowledge and production processes, adding to the innovation barrier.

- Intellectual Property: Patents on new formulations or application technologies can further solidify the position of incumbents, making it harder for new entrants to replicate their offerings.

The threat of new entrants into the paints and coatings market, where AkzoNobel operates, is generally considered moderate. Significant capital investment for manufacturing, R&D, and distribution, coupled with strong brand loyalty and complex regulations, creates substantial barriers.

New companies face challenges in matching the economies of scale enjoyed by incumbents like AkzoNobel, which translates to lower per-unit costs. For instance, in 2023, major coatings manufacturers continued to invest in optimizing production efficiency to maintain cost competitiveness.

The industry's reliance on established distribution networks and long-term supplier relationships further complicates market entry. For example, securing access to key raw materials at favorable prices in 2024 remains a hurdle for emerging players.

The need for continuous innovation and adherence to evolving environmental standards, such as those concerning VOCs and PFAS, requires significant R&D spending. Companies like AkzoNobel, with dedicated innovation centers, are better positioned to meet these demands.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High upfront costs for manufacturing, R&D, and distribution. | Significant deterrent, requiring substantial funding. | Establishing a new, competitive paint manufacturing facility can cost upwards of $100 million. |

| Economies of Scale | Lower per-unit costs for large-volume producers. | Makes it difficult for new entrants to compete on price. | AkzoNobel's global production capacity allows for significant cost efficiencies compared to smaller operations. |

| Brand Loyalty & Differentiation | Established brands foster customer trust and preference. | New entrants must invest heavily in marketing to build recognition. | AkzoNobel's brands like Dulux and Sikkens have decades of market presence and consumer recognition. |

| Regulatory Environment | Complex and evolving rules on chemical use, safety, and environmental impact. | Requires specialized knowledge and costly compliance measures. | Ongoing implementation of REACH regulations in the EU in 2024 impacts chemical formulations and requires extensive documentation. |

| Distribution Networks | Extensive, established channels for reaching customers. | Replicating these networks is time-consuming and capital-intensive. | AkzoNobel's global logistics and retail partnerships provide a significant competitive advantage. |

| Raw Material Access | Securing reliable supply and favorable pricing for key ingredients. | New entrants may face higher costs or supply inconsistencies. | Long-term contracts with titanium dioxide and resin suppliers provide incumbents with supply security and price stability. |

| R&D and Innovation | Continuous investment in new product development and sustainable solutions. | Newcomers must invest heavily to keep pace with technological advancements. | Major coatings companies often reinvest 3-5% of their revenue into R&D annually. |

Porter's Five Forces Analysis Data Sources

Our Akzo Nobel Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Akzo Nobel's annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry research firms, market intelligence platforms, and competitor financial statements to provide a robust competitive landscape assessment.