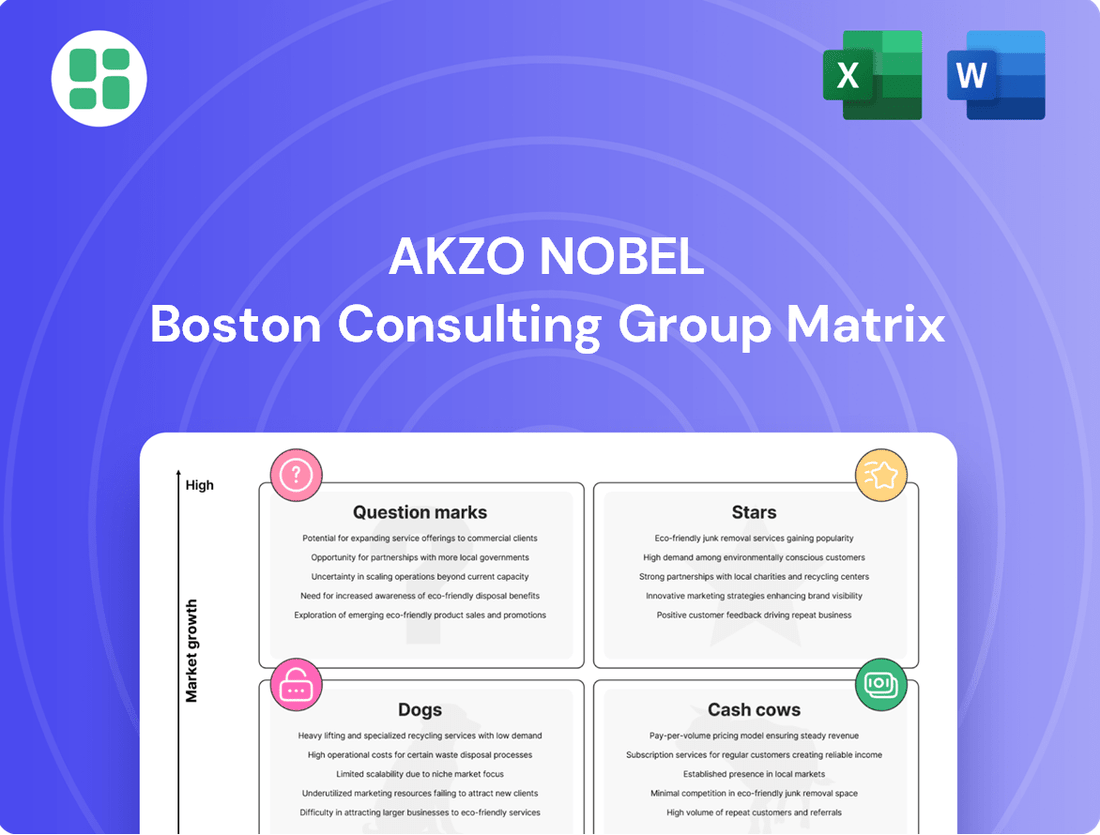

Akzo Nobel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Want to understand Akzo Nobel's product portfolio at a glance? This preview highlights key areas, but the full BCG Matrix report unlocks the strategic positioning of each product. Discover which are your Stars, Cash Cows, Dogs, and Question Marks to make informed decisions.

Don't miss out on the critical insights needed to optimize Akzo Nobel's product strategy. Purchase the complete BCG Matrix to gain a comprehensive understanding of market share and growth potential, empowering you to allocate resources effectively and drive future success.

Stars

AkzoNobel's marine and protective coatings business is a star in its portfolio, demonstrating robust performance. The segment experienced a notable 10% organic growth in Q2 2024, fueled by strong demand in key growth markets such as the Middle East and Southeast Asia. This impressive growth trajectory highlights AkzoNobel's strong competitive standing in a rapidly expanding sector.

This segment's success can be attributed to its strategic focus on innovation and its ability to meet the evolving needs of the maritime and infrastructure industries. Continued investment in research and development, along with expanding production capabilities, will be vital for AkzoNobel to solidify its leadership position and capture further market share in this dynamic environment.

Powder coatings represent a Star for AkzoNobel within the BCG matrix. The global market is expected to expand significantly, with a projected CAGR of 5.46% from 2024 to 2030, driven by strong demand, particularly in the Asia-Pacific region.

AkzoNobel's Interpon brand is a leading global offering in this burgeoning sector. Its robust market presence in a rapidly growing industry segment underscores its Star status, necessitating ongoing investment to maintain its competitive edge and capitalize on future growth opportunities.

The demand for eco-friendly and sustainable products is on the rise, with waterborne coatings capturing a substantial market share thanks to their low-VOC content and environmental advantages. AkzoNobel is making significant investments in developing responsible and sustainable coating technologies, targeting 50% of its revenue from sustainable solutions by 2030.

This strategic focus on high-growth, environmentally conscious solutions, where AkzoNobel is a frontrunner in innovation, positions these offerings as potential Stars in the BCG matrix. For instance, AkzoNobel's commitment to reducing its environmental footprint aligns with growing consumer and regulatory preferences for greener alternatives in the coatings industry.

Automotive Refinish Coatings (Premium Lines)

AkzoNobel's premium automotive refinish coatings, such as Sikkens Autowave Optima and Lesonal Ultimate Basecoat WB, are a significant part of their Vehicle Refinishes business. These advanced products are designed to offer quicker application and better results, targeting a growing segment within the automotive aftermarket.

The company is actively promoting these innovations through its 'Productivity Drive 2025' initiative, aiming to capture market share in a competitive landscape. The overall paints and coatings market is experiencing a boost, with the automotive industry being a primary contributor to this growth.

- Market Position: Premium lines like Sikkens and Lesonal are positioned as high-growth products within AkzoNobel's portfolio.

- Innovation Focus: The 'Productivity Drive 2025' highlights new generation products emphasizing efficiency and quality.

- Industry Growth: The expanding automotive sector provides a strong tailwind for these specialized coatings.

- Strategic Objective: AkzoNobel aims for increased market share and faster process times with these premium offerings.

High-Performance Coatings in Emerging Markets

AkzoNobel is prioritizing its core coatings businesses worldwide, aiming for significant scale in key markets. This strategic move targets areas where the company can truly differentiate itself. Emerging economies, particularly in the Asia-Pacific region, are seeing robust industrial expansion and substantial infrastructure projects. This growth directly fuels the demand for advanced, high-performance coatings that can withstand challenging conditions and meet evolving industry standards.

AkzoNobel's deliberate investments and robust product offerings in these expanding territories are crucial. For instance, in 2023, AkzoNobel reported strong performance in its Asia, Middle East and Africa segment, with revenue growth driven by volume increases and pricing initiatives. This segment represents a significant portion of the company's focus on emerging markets, underscoring the importance of these regions for its global strategy.

- Asia-Pacific's industrial growth: The region's manufacturing output and construction activity are key drivers for high-performance coatings.

- Infrastructure development: Major projects in emerging markets require durable and specialized coating solutions for longevity and protection.

- AkzoNobel's strategic investments: Targeted capital allocation in these high-growth regions supports market penetration and product innovation.

- Portfolio strength: The company's range of advanced coatings is well-positioned to meet the specific needs of these developing economies.

AkzoNobel's marine and protective coatings, powder coatings, and premium automotive refinish coatings are all considered Stars in the BCG matrix. These segments exhibit strong market growth and high market share for AkzoNobel. The company's strategic investments in innovation and expansion within these areas are crucial for maintaining their leading positions and capitalizing on future opportunities.

| Segment | Market Growth | AkzoNobel Market Share | Key Drivers |

|---|---|---|---|

| Marine & Protective Coatings | High (driven by Middle East & SE Asia) | Strong | Demand in growth markets, innovation |

| Powder Coatings | High (CAGR 5.46% 2024-2030) | Leading (Interpon brand) | Asia-Pacific demand, sustainability |

| Premium Automotive Refinish | High (automotive industry growth) | Growing (Sikkens, Lesonal) | Productivity Drive 2025, efficiency |

What is included in the product

The Akzo Nobel BCG Matrix analyzes its portfolio, categorizing products as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

A clear Akzo Nobel BCG Matrix visualizes each business unit's strategic position, easing the pain of resource allocation decisions.

Cash Cows

Dulux Decorative Paints in mature markets, primarily Europe and North America, represents a classic Cash Cow for AkzoNobel. Despite the decorative paints segment experiencing flat sales in 2024, this segment consistently contributes significant revenue.

This strong brand enjoys a high market share in mature, low-growth segments, ensuring a stable and predictable cash flow. These earnings are crucial, providing the financial stability to invest in and support AkzoNobel's higher-growth Stars and Question Marks.

Standard Architectural Coatings represent a substantial segment for AkzoNobel, holding a dominant position in a market that accounts for approximately 60-65% of the global paints and coatings industry in 2024. These are the everyday paints used in homes and buildings, a market that, while vast, tends to grow at a more moderate pace, especially in established economies.

Despite lower growth, these product lines are AkzoNobel's cash cows because they consistently generate reliable income. Their widespread application in both new construction and renovation projects ensures steady demand, providing a stable financial foundation for the company.

AkzoNobel stands as a major player in industrial coatings, boasting a substantial global market presence. Its established applications, particularly in mature industrial sectors, offer a dependable source of revenue, even if growth isn't explosive.

These segments are classic cash cows: high market share within slower-growing, established markets. This translates into consistent cash generation for AkzoNobel, funding other ventures. For instance, in 2023, AkzoNobel reported revenue of €10.5 billion, with its Decorative Paints and Performance Coatings segments, which include many traditional industrial applications, contributing significantly.

Sikkens (Professional Paints for Established Segments)

Sikkens, a premier brand within AkzoNobel's extensive portfolio, commands a significant presence in the professional paints and vehicle refinishes sectors. Its performance in established markets, especially within the professional segment, has demonstrated encouraging upward trends.

The brand's robust reputation and deep market penetration in mature professional applications enable it to generate consistent cash flows. This is achieved with comparatively lower promotional investment, aligning perfectly with the characteristics of a Cash Cow in the BCG Matrix.

- Sikkens' strength lies in professional paints and vehicle refinishes.

- The professional segment in established markets shows positive growth.

- Leverages strong brand equity for steady cash generation.

- Requires minimal promotional investment due to market maturity.

General Purpose Automotive Coatings (Maintenance/Repair)

AkzoNobel's general purpose automotive coatings for maintenance and repair, often termed 'Cash Cows' in a BCG matrix context, cater to a mature but stable market. This segment benefits from the sheer volume of existing vehicles requiring upkeep, ensuring consistent demand. While not experiencing the rapid growth of new OEM coatings or advanced refinish products, these coatings provide a predictable and reliable revenue stream for the company.

- Stable Demand: Driven by the vast existing vehicle parc, these coatings are essential for ongoing maintenance and repair needs.

- Consistent Cash Flow: The established market share in this segment generates reliable and predictable income for AkzoNobel.

- Lower Growth Segment: Compared to new automotive OEM or cutting-edge refinish technologies, this area exhibits less aggressive growth.

Dulux Decorative Paints in mature markets, primarily Europe and North America, represents a classic Cash Cow for AkzoNobel. Despite the decorative paints segment experiencing flat sales in 2024, this segment consistently contributes significant revenue.

This strong brand enjoys a high market share in mature, low-growth segments, ensuring a stable and predictable cash flow. These earnings are crucial, providing the financial stability to invest in and support AkzoNobel's higher-growth Stars and Question Marks.

AkzoNobel's general purpose automotive coatings for maintenance and repair, often termed 'Cash Cows' in a BCG matrix context, cater to a mature but stable market. This segment benefits from the sheer volume of existing vehicles requiring upkeep, ensuring consistent demand. While not experiencing the rapid growth of new OEM coatings or advanced refinish products, these coatings provide a predictable and reliable revenue stream for the company.

Sikkens, a premier brand within AkzoNobel's extensive portfolio, commands a significant presence in the professional paints and vehicle refinishes sectors. Its performance in established markets, especially within the professional segment, has demonstrated encouraging upward trends. The brand's robust reputation and deep market penetration in mature professional applications enable it to generate consistent cash flows with comparatively lower promotional investment, aligning perfectly with the characteristics of a Cash Cow.

| AkzoNobel Segment | BCG Category | Market Characteristics | Revenue Contribution (Approx.) |

|---|---|---|---|

| Dulux Decorative Paints (Mature Markets) | Cash Cow | High Market Share, Low Growth | Significant, Stable |

| Standard Architectural Coatings | Cash Cow | Dominant Position, Moderate Growth | Substantial, Reliable |

| General Purpose Automotive Coatings | Cash Cow | Mature Market, Stable Demand | Predictable, Consistent |

| Sikkens (Professional Paints/Vehicle Refinishes) | Cash Cow | Strong Brand, Mature Applications | Consistent Cash Flow |

What You’re Viewing Is Included

Akzo Nobel BCG Matrix

The Akzo Nobel BCG Matrix you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for your strategic analysis and business planning. You can trust that the content and structure you see here are precisely what will be delivered, ensuring no surprises and immediate usability for your decision-making processes.

Dogs

AkzoNobel's decorative paints segment in China faced persistent volume challenges throughout 2024. This suggests a difficult market environment for these products, potentially indicating a low or shrinking market share within a low-growth sub-segment of the Chinese decorative paints market.

The performance of decorative paints in China points towards a potential 'Dog' classification in AkzoNobel's BCG matrix. This segment likely contributes little to overall cash flow and may warrant a strategic re-evaluation, including possible divestment, to reallocate resources to more promising areas.

In Türkiye's decorative paints sector, AkzoNobel saw significant volume declines in certain product segments during the first quarter of 2025. This downturn was primarily attributed to an in-year commercial rebalancing strategy.

These underperforming lines, characterized by low market share and negative growth, are effectively cash traps. They drain resources without generating adequate returns, signaling a need for strategic review and potential divestment or reduction.

AkzoNobel's decision to sell its decorative paints business in India to JSW Group, with the deal anticipated to finalize in the fourth quarter of 2025, positions this unit as a 'Dog' within the company's BCG Matrix. This strategic move indicates that even in a growing market like India, the decorative paints segment was not a priority for AkzoNobel's global growth strategy.

The divestment, despite the Indian market's potential, suggests AkzoNobel aims to reallocate capital to its more central coatings operations. For context, AkzoNobel's global revenue in 2023 was approximately €10.5 billion, with its performance coatings segment being a key focus.

Older Generation Solvent-Borne Paints

Older generation solvent-borne paints represent a classic example of a 'Dog' in AkzoNobel's BCG Matrix. The market is actively moving away from these products, driven by stricter Volatile Organic Compound (VOC) emission regulations and a strong consumer preference for environmentally friendly options.

These legacy products, while once foundational, are now challenged by the rise of water-based and low-VOC alternatives. AkzoNobel's historical strength in this segment means they likely have existing capacity and product lines, but the declining demand makes these offerings low-growth and potentially low-profit.

For instance, in 2024, several key European markets have tightened VOC limits further, making older solvent-borne formulations increasingly non-compliant and unattractive. This regulatory pressure, combined with a growing eco-conscious consumer base, directly impacts market share for these paints.

- Declining Market Share: The global market for traditional solvent-borne coatings is projected to shrink as regulations tighten.

- Low Growth Prospects: Environmental mandates and consumer preference for sustainable alternatives severely limit growth potential.

- Regulatory Pressure: Increasing VOC restrictions in major markets like the EU and North America make these products less viable.

- Sustainability Shift: AkzoNobel's strategic focus is on water-borne and powder coatings, leaving older solvent-borne paints behind.

Niche, Low-Performing Specialty Chemical Product Lines

Following the spin-off of Nouryon, AkzoNobel might retain niche, low-performing specialty chemical product lines. These are typically small operations that don't fit the company's core paints and coatings strategy. They often struggle with low market share and minimal growth, potentially breaking even or consuming cash without clear future potential.

These "Dogs" in the BCG matrix represent segments where AkzoNobel may need to consider divestment or restructuring. For instance, if a specific additive or intermediate chemical line has seen declining demand or faces intense competition from larger players, it would fall into this category. As of early 2024, AkzoNobel's strategic focus remains heavily on its Decorative Paints and Performance Coatings businesses, reinforcing the likelihood that any remaining non-core specialty chemical assets would be candidates for review.

- Niche Product Lines: Small, specialized chemical offerings outside the core paints and coatings business.

- Low Market Share: These segments typically hold a minor position in their respective markets.

- Stagnant Growth: Minimal or no revenue expansion is characteristic of these product lines.

- Cash Consumption: Often, these operations require investment to maintain operations without generating significant returns.

AkzoNobel's decorative paints business in China, particularly in 2024, faced significant volume challenges, suggesting a weak market position in a low-growth segment. This underperformance, characterized by low market share and limited growth prospects, strongly indicates a 'Dog' classification within the BCG matrix.

Similarly, specific product lines within Türkiye's decorative paints sector experienced substantial volume declines in early 2025 due to a commercial rebalancing strategy. These segments, marked by low share and negative growth, are essentially cash traps requiring strategic re-evaluation, potentially leading to divestment.

The sale of AkzoNobel's Indian decorative paints business in late 2025 further solidifies the 'Dog' status for that segment, even within a growing market. This move aligns with the company's 2023 strategy, which saw €10.5 billion in revenue, prioritizing performance coatings over less strategic assets.

Legacy solvent-borne paints are also classic 'Dogs', facing decline due to stricter VOC regulations and a consumer shift towards eco-friendly options. This trend was evident in 2024, with European markets increasing VOC restrictions, impacting older formulations.

| Segment | Market Growth | Relative Market Share | BCG Classification |

| China Decorative Paints (2024) | Low | Low | Dog |

| Türkiye Decorative Paints (Q1 2025) | Low/Declining | Low | Dog |

| India Decorative Paints (Divestment 2025) | Moderate/High | Low | Dog |

| Legacy Solvent-Borne Paints | Declining | Low | Dog |

Question Marks

AkzoNobel's commitment to research and development in new UV-curable and hybrid powder coatings positions these as potential Stars in their portfolio. These advanced solutions cater to a growing demand for sustainable and efficient coating technologies, a trend strongly evident in the global coatings market which saw a significant expansion in 2024. While these segments are still emerging, AkzoNobel's strategic investments aim to secure a leading market position, transforming these promising technologies into future revenue drivers.

AkzoNobel's advanced digital solutions like Carbeat and Refinish+ represent their Stars in the BCG matrix. These offerings, highlighted in their Productivity Drive 2025, tap into the growing digitalization trend in manufacturing, promising substantial growth by optimizing operations.

While these digital tools show high growth potential, their current market share is still developing. This means AkzoNobel needs to invest heavily in their adoption and scaling to solidify their position as market leaders in this innovative space.

The coatings market is seeing a significant shift towards bio-based and circular economy solutions, fueled by increasing environmental consciousness and stricter regulations. This trend positions AkzoNobel's innovative formulations in a high-growth segment, though their current market penetration is still nascent.

AkzoNobel's dedication to circularity and sustainable materials is evident in these developing product lines. While the market is expanding rapidly, these bio-based coatings require considerable investment in research and development, alongside dedicated market cultivation efforts, to capture a larger share.

Coatings for Emerging High-Tech Applications

AkzoNobel is actively developing coatings for emerging high-tech sectors, such as consumer electronics and advanced materials. These areas represent significant growth potential, fueled by rapid technological innovation. For instance, the global market for specialty coatings, which includes many of these high-tech applications, was projected to reach over $100 billion by 2024, with a compound annual growth rate (CAGR) of approximately 5%.

Within these nascent, specialized markets, AkzoNobel's current market share is likely to be modest. The company is investing in these segments to assess their long-term viability and potential to become future market leaders, or Stars, within its portfolio. This strategic focus acknowledges the high investment needed to gain traction in rapidly evolving niches.

- High-Growth Potential: Targeting sectors like consumer electronics and advanced materials.

- Technological Drivers: Growth is intrinsically linked to ongoing technological advancements.

- Initial Market Share: Likely low in these specialized and evolving niches.

- Strategic Investment: Required to explore and establish potential as future Stars.

New Generation Waterborne Basecoats for Vehicle Refinish (e.g., Sikkens Autowave Optima)

AkzoNobel's Sikkens Autowave Optima represents a new generation of waterborne basecoats for vehicle refinishing, aiming for enhanced sustainability and improved bodyshop efficiency. This innovation positions it within the established vehicle refinish market but targets a burgeoning sub-segment focused on eco-friendly and high-productivity solutions. The company's strategic focus is on building market share in this specific niche, recognizing its potential for significant growth.

To achieve 'Star' status within the AkzoNobel portfolio, products like Sikkens Autowave Optima require robust marketing and dedicated support. The global automotive refinish market was valued at approximately USD 10.5 billion in 2023, with a projected compound annual growth rate of around 4.5% through 2030. Within this, the demand for waterborne coatings, driven by environmental regulations and consumer preference, is experiencing even faster expansion.

- Market Position: Targeting a high-growth niche within the established automotive refinish sector.

- Growth Driver: Focus on sustainability and enhanced bodyshop productivity.

- Strategic Imperative: Requires significant marketing and support to capture market share.

- Industry Context: Benefiting from the increasing global demand for waterborne coatings.

Question Marks in AkzoNobel's portfolio are typically new product lines or technologies in nascent markets with high growth potential but currently low market share. These require significant investment to develop and establish.

These could include emerging sustainable paint formulations or specialized coatings for rapidly evolving industries where AkzoNobel is still building its presence. The company must decide whether to invest further to turn them into Stars or divest if they fail to gain traction.

The challenge for Question Marks is to transition into Stars by increasing market share in their high-growth sectors. This often involves substantial R&D spending and aggressive market penetration strategies.

For instance, AkzoNobel's exploration into advanced bio-based resins for industrial coatings, while promising due to the strong sustainability trend, represents a Question Mark. The global market for bio-based chemicals, including coatings, is projected for substantial growth, but AkzoNobel's share in this specific niche is still minimal, demanding significant investment to cultivate.

| AkzoNobel Product/Technology Area | BCG Matrix Category | Market Growth Rate | Relative Market Share | Strategic Focus |

|---|---|---|---|---|

| Emerging Bio-based Resins | Question Mark | High | Low | Invest to gain market share or divest |

| Specialty Coatings for 3D Printing | Question Mark | Very High | Very Low | Research and development, market validation |

| Advanced Protective Coatings for Renewable Energy Infrastructure | Question Mark | High | Low | Market entry and brand building |

BCG Matrix Data Sources

Our Akzo Nobel BCG Matrix leverages comprehensive market data, including financial reports, sales figures, and competitor analysis, to accurately position each business unit.