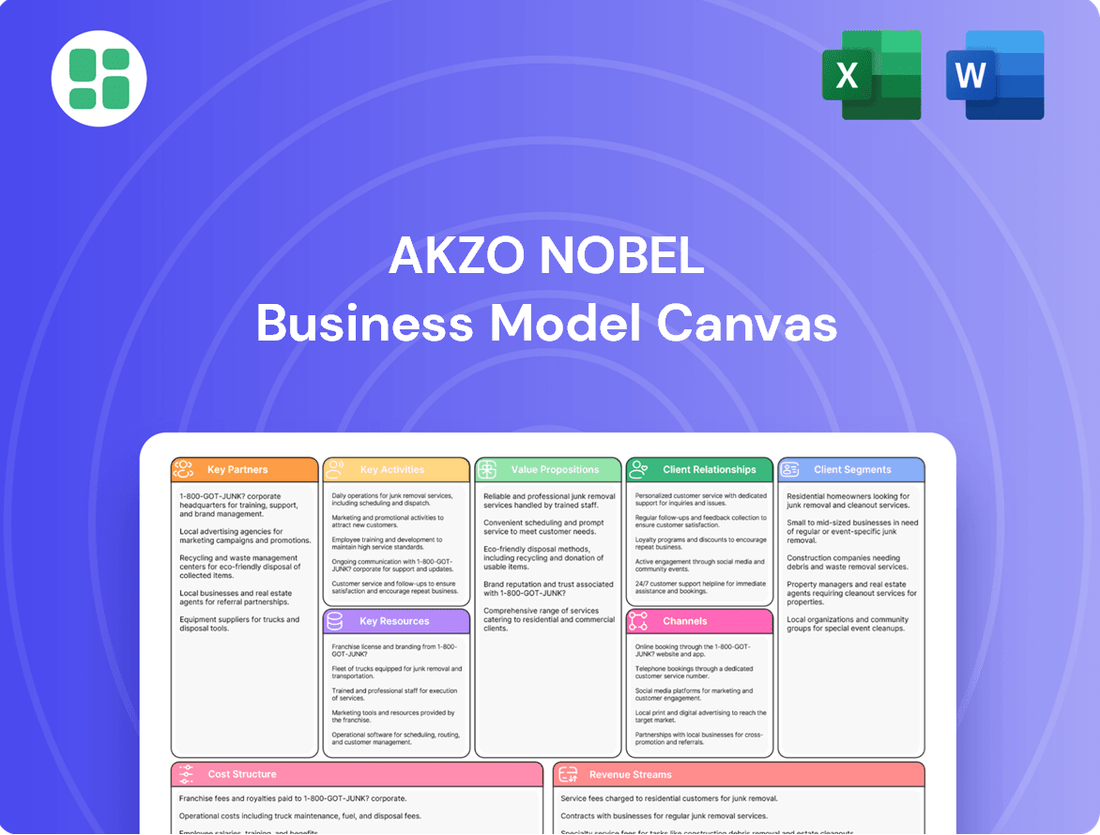

Akzo Nobel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Uncover the core strategies driving Akzo Nobel's global success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering invaluable insights for your own strategic planning. Download the full canvas to gain a competitive edge.

Partnerships

AkzoNobel's business model hinges on a robust global network of raw material suppliers, providing critical components like resins, pigments, and solvents. These partnerships are vital for maintaining a consistent supply chain, controlling costs, and fostering innovation, particularly in the development of sustainable materials. For instance, in 2023, AkzoNobel continued its focus on sourcing more bio-based and circular raw materials, aiming to reduce its environmental footprint and meet growing consumer demand for eco-friendly products.

AkzoNobel actively collaborates with leading universities and research institutes globally to drive innovation in coatings. For instance, their partnership with the University of Sheffield focuses on developing next-generation sustainable materials, contributing to their extensive R&D pipeline.

The company also teams up with technology firms to integrate advanced solutions, such as AI for predictive maintenance in coating application and digital twins for optimizing manufacturing. These collaborations are vital for staying ahead in areas like smart coatings and eco-friendly formulations.

Furthermore, AkzoNobel engages with other industry players in joint ventures and development projects to accelerate the creation of novel coating technologies. These strategic alliances are instrumental in bringing cutting-edge products and sustainable solutions to market faster, reinforcing their commitment to innovation.

AkzoNobel's success hinges on strong alliances with distributors and major retail chains. These partnerships are absolutely crucial for getting their decorative paints into the hands of a wide array of customers. Think about it – without these networks, reaching everyone who wants to paint their home would be a massive challenge.

In 2024, AkzoNobel continued to leverage these relationships to ensure their products are readily available. These collaborations aren't just about shelf space; they're about efficient logistics, making sure paint gets from the factory to the store, and ultimately to the consumer, without a hitch. This broad market penetration is a cornerstone of their strategy.

Key Customers and OEMs

AkzoNobel cultivates strategic alliances with key industrial clients and Original Equipment Manufacturers (OEMs) across vital sectors such as automotive, aerospace, and marine. These partnerships are foundational, often leading to the joint development of bespoke coating solutions and streamlined supply chains tailored to precise industry demands.

These collaborations are crucial for AkzoNobel's innovation pipeline, ensuring their products align with evolving industry standards and performance requirements. For instance, in 2024, AkzoNobel announced a multi-year agreement with a leading automotive manufacturer to supply advanced, low-VOC coatings, reflecting a commitment to sustainability and performance.

- Automotive Sector: Partnerships with major car manufacturers for advanced paint systems, including those focused on electric vehicle battery protection and lightweight material coatings.

- Aerospace Industry: Collaborations with aircraft OEMs for specialized coatings that enhance fuel efficiency, corrosion resistance, and durability in extreme conditions.

- Marine Applications: Long-term relationships with shipbuilders and marine operators for antifouling and protective coatings that reduce drag and environmental impact.

Sustainability and Circular Economy Partners

AkzoNobel actively collaborates with organizations dedicated to advancing sustainability and the circular economy. These partnerships are crucial for meeting ambitious environmental goals and driving the development of more eco-friendly products and processes.

Key collaborations include alliances with entities focused on renewable energy sourcing, waste reduction initiatives, and the establishment of circular material flows. For instance, in 2024, AkzoNobel continued its efforts to increase the use of renewable electricity, aiming for 100% by 2030, and partnered with several organizations to explore innovative recycling technologies for paint waste.

- Renewable Energy Initiatives: Partnerships with renewable energy providers to power operations with clean energy sources.

- Circular Economy Projects: Collaborations with waste management and recycling companies to close material loops.

- Sustainable Sourcing: Working with suppliers and industry groups to ensure responsible and sustainable raw material procurement.

- Eco-Product Development: Joint ventures with research institutions and technology firms to create paints and coatings with reduced environmental impact.

AkzoNobel's key partnerships extend to its distribution networks and retail partners, ensuring broad market access for its decorative paints. These relationships are fundamental for efficient logistics and product availability, reaching a diverse customer base. In 2024, AkzoNobel reinforced these ties, focusing on supply chain optimization to meet consumer demand effectively.

Strategic alliances with industrial clients and OEMs, particularly in automotive, aerospace, and marine sectors, are vital for developing tailored coating solutions. These collaborations drive innovation, ensuring AkzoNobel's products meet stringent industry performance and sustainability standards. A 2024 agreement with a major automaker for low-VOC coatings exemplifies this focus.

Collaborations with universities and research institutes fuel AkzoNobel's R&D pipeline, focusing on next-generation sustainable materials and coatings. Partnerships with technology firms integrate advanced solutions like AI for manufacturing optimization. These alliances are crucial for maintaining a competitive edge in developing innovative and eco-friendly product lines.

AkzoNobel also partners with organizations promoting sustainability and the circular economy, supporting its environmental targets. These include collaborations on renewable energy sourcing and innovative paint waste recycling technologies. In 2024, the company continued its push towards 100% renewable electricity by 2030, underscoring its commitment to eco-friendly operations.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Example |

|---|---|---|---|

| Raw Material Suppliers | Global chemical and material providers | Ensuring supply chain stability, cost control, sustainable material innovation | Increased sourcing of bio-based and circular raw materials |

| Research & Development | Universities (e.g., Sheffield), Research Institutes | Driving innovation in coatings, developing sustainable materials | Next-generation sustainable material research |

| Technology Firms | AI and digital solution providers | Integrating advanced technologies for manufacturing and product development | AI for predictive maintenance, digital twins |

| Industry Players | Other coating companies, joint ventures | Accelerating development of novel coating technologies | Joint ventures for faster market entry of cutting-edge products |

| Distribution & Retail | Distributors, major retail chains | Broad market penetration for decorative paints, efficient logistics | Ensuring product availability and efficient supply chain management |

| Industrial Clients & OEMs | Automotive, Aerospace, Marine manufacturers | Developing bespoke coating solutions, streamlining supply chains | Multi-year agreement for low-VOC automotive coatings |

| Sustainability Organizations | Renewable energy providers, circular economy initiatives | Meeting environmental goals, developing eco-friendly products | Exploring paint waste recycling, increasing renewable electricity usage |

What is included in the product

Akzo Nobel's Business Model Canvas details its strategy for serving diverse customer segments like consumers and industries through various channels, offering value propositions centered on innovative and sustainable coatings and chemicals.

The Akzo Nobel Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for easy understanding and discussion.

Activities

AkzoNobel's commitment to Research and Development is central to its business model, fueling the creation of novel paints and coatings. In 2023, the company dedicated €335 million to R&D, a significant investment aimed at enhancing product performance and sustainability. This focus ensures AkzoNobel remains at the forefront of technological advancements, offering differentiated products that meet the dynamic demands of the global market.

Innovation is not just about new products; it's also about improving existing ones and developing environmentally friendly solutions. AkzoNobel's R&D efforts in 2024 are geared towards reducing the environmental footprint of its offerings, such as developing low-VOC (volatile organic compound) paints and coatings that improve air quality. This strategic approach to innovation allows the company to maintain its competitive edge and address the growing consumer preference for sustainable options.

Akzo Nobel's manufacturing and production activities are centered around its extensive global network of facilities. These sites are dedicated to producing a broad portfolio of paints, coatings, and specialty chemicals, serving diverse markets worldwide. A core focus is placed on continuously optimizing production efficiency across these operations.

Key activities involve strategically increasing manufacturing capacity, particularly in high-growth segments such as powder coatings. The company also actively implements industrial excellence programs to drive continuous improvement and maintain high operational standards throughout its production processes.

In 2024, Akzo Nobel continued to invest in its manufacturing footprint. For instance, the company announced plans to expand its powder coatings production capacity in various regions, responding to growing market demand. These investments underscore a commitment to enhancing output and meeting customer needs effectively.

AkzoNobel leverages targeted sales and marketing to promote its extensive brand portfolio, including Dulux and Sikkens, across diverse markets. In 2023, the company focused on digital engagement and strengthening brand perception, contributing to its revenue growth.

Effective brand management is crucial for AkzoNobel's success. The company's marketing efforts in 2024 are designed to highlight the quality and innovation of its products, aiming to maintain brand loyalty and attract new customers in a competitive landscape.

Supply Chain Management and Logistics

AkzoNobel's key activities heavily involve managing a vast and intricate global supply chain. This encompasses everything from securing raw materials worldwide to ensuring finished products reach customers efficiently and on time. In 2024, the company continued its strategic focus on building a more robust and resilient supply network to navigate potential disruptions.

Key to their operations is optimizing inventory levels across their extensive network. This allows them to meet demand fluctuations while minimizing holding costs. A significant metric they track is on-time-in-full (OTIF) delivery, a measure of customer satisfaction and operational efficiency. For instance, in the first half of 2024, AkzoNobel reported improvements in their supply chain performance, contributing to their overall business objectives.

- Global Sourcing and Procurement: Securing a consistent supply of diverse raw materials from various international suppliers.

- Inventory Optimization: Implementing advanced forecasting and management systems to balance stock levels and reduce waste.

- Logistics and Distribution: Efficiently managing transportation, warehousing, and delivery to ensure timely product arrival at customer sites.

- Supplier Relationship Management: Building strong partnerships with key suppliers to enhance reliability and collaboration.

Sustainability Initiatives and ESG Reporting

AkzoNobel actively implements and reports on ambitious sustainability targets, a crucial key activity. This includes significant investments in reducing carbon emissions and increasing the use of circular materials across its operations. For instance, by the end of 2023, the company had achieved a 35% reduction in its Scope 1 and 2 absolute greenhouse gas emissions compared to a 2018 baseline, demonstrating tangible progress toward its 2030 goals.

Continuous monitoring and investment in renewable energy sources are fundamental to these initiatives. AkzoNobel is committed to sourcing 100% of its electricity from renewable sources by 2030. This strategic focus also extends to developing innovative products designed for a lower environmental impact throughout their lifecycle, aligning with evolving market demands and regulatory expectations.

- Carbon Emission Reduction: AkzoNobel aims to cut its Scope 1 and 2 emissions by 50% by 2030 against a 2018 baseline.

- Circular Material Use: The company is working towards sourcing 50% of its raw materials from renewable or recycled sources by 2030.

- Renewable Energy Procurement: AkzoNobel is on track to achieve 100% renewable electricity usage by 2030.

- Product Innovation: Developing and launching products with reduced environmental footprints is a core sustainability activity.

AkzoNobel's key activities are deeply rooted in innovation, manufacturing excellence, and robust supply chain management, all underpinned by a strong commitment to sustainability. The company actively invests in research and development to create next-generation paints and coatings, focusing on performance and environmental benefits. In 2023, R&D expenditure reached €335 million, reflecting this dedication.

Manufacturing operations are optimized for efficiency and capacity expansion, particularly in growth areas like powder coatings, with strategic investments in 2024 to meet rising demand. The company also prioritizes effective sales and marketing strategies, leveraging its well-known brands like Dulux and Sikkens to drive market penetration and customer engagement.

Supply chain management is critical, involving global sourcing, inventory optimization, and efficient logistics to ensure timely delivery. AkzoNobel reported improvements in supply chain performance in the first half of 2024. Sustainability is a core activity, with ambitious targets for carbon emission reduction and renewable energy use; by the end of 2023, they achieved a 35% reduction in Scope 1 and 2 emissions against a 2018 baseline.

| Key Activity | 2023 Focus/Data | 2024 Focus/Data |

|---|---|---|

| Research & Development | €335 million invested in R&D | Continued focus on low-VOC and sustainable products |

| Manufacturing & Production | Optimizing efficiency, expanding powder coatings capacity | Further investments in production capacity |

| Sales & Marketing | Digital engagement, strengthening brand perception | Highlighting product quality and innovation |

| Supply Chain Management | Building a robust and resilient network | Improvements in OTIF delivery metrics |

| Sustainability | 35% Scope 1 & 2 GHG reduction (vs. 2018 baseline) | On track for 100% renewable electricity by 2030 |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, reflecting the comprehensive structure and content that defines Akzo Nobel's strategic approach. This isn't a sample or a mockup; it's a direct snapshot of the complete deliverable, ensuring you get precisely what you see. Upon completing your order, you will gain full access to this exact, ready-to-use Business Model Canvas for Akzo Nobel.

Resources

AkzoNobel's intellectual property and brands are cornerstones of its business model, featuring a robust patent portfolio and proprietary technologies. This strong IP foundation underpins its market leadership and innovation capabilities.

Globally recognized brands such as Dulux, International, Sikkens, and Interpon represent significant intangible assets. These brands not only drive consumer preference but also command premium pricing, contributing substantially to AkzoNobel's revenue streams.

In 2023, AkzoNobel continued to invest in R&D, with a focus on sustainable coatings and advanced materials, further strengthening its IP position. The company reported €1.1 billion in sales for its Decorative Paints segment in Q1 2024, a testament to the enduring strength of brands like Dulux.

AkzoNobel's manufacturing facilities and global network are critical to its business model, encompassing a vast array of production plants and distribution centers strategically located in over 150 countries. This extensive physical infrastructure is fundamental to their ability to produce goods locally, ensuring efficient supply chains and broad market penetration. For instance, in 2023, AkzoNobel operated approximately 180 manufacturing sites worldwide, a testament to their commitment to a robust global footprint.

AkzoNobel's success hinges on its human capital, with highly skilled scientists, R&D professionals, and engineers driving innovation in areas like sustainable coatings. In 2024, the company continued to invest in its workforce, emphasizing technical expertise to maintain its leadership in developing advanced paint and coatings solutions.

The company's sales teams and technical experts are crucial for providing essential customer support and understanding market needs. This expertise ensures that AkzoNobel's products meet diverse customer requirements across various industries, from automotive to aerospace, contributing to their strong market position.

Financial Capital

Akzo Nobel's access to substantial financial capital is a cornerstone of its business model, enabling significant investments in research and development. For instance, in 2023, the company reported €278 million in R&D expenses, a critical component for developing innovative and sustainable solutions in the coatings and chemicals sectors.

This financial strength also fuels Akzo Nobel's capacity for expansion and strategic moves. The company's operational resilience is bolstered by its ability to fund manufacturing upgrades and pursue acquisitions that align with its growth strategy, ensuring it remains competitive in a dynamic global market.

- Research & Development: €278 million invested in R&D in 2023 to drive innovation.

- Capital Expenditures: Funds allocated for expanding manufacturing capacity and upgrading facilities.

- Strategic Acquisitions: Financial resources available to acquire complementary businesses.

- Sustainability Initiatives: Investment in eco-friendly technologies and processes to meet environmental goals.

Raw Materials and Supply Agreements

AkzoNobel’s ability to secure a consistent supply of diverse raw materials is paramount, often achieved through strategic, long-term supply agreements. This approach is crucial for maintaining uninterrupted production schedules and effectively managing potential disruptions within its global supply chain.

These agreements are vital for mitigating price volatility and ensuring the availability of key inputs like titanium dioxide, resins, and solvents, which are fundamental to AkzoNobel's extensive paint and coatings portfolio. For instance, in 2024, the company continued to focus on optimizing its procurement strategies to navigate fluctuating commodity markets.

- Diversified Sourcing: AkzoNobel maintains relationships with multiple suppliers across different geographic regions to reduce dependency on any single source.

- Long-Term Contracts: Securing multi-year agreements provides price stability and guaranteed volumes for critical raw materials.

- Supplier Collaboration: Working closely with suppliers on innovation and sustainability initiatives strengthens the supply chain and ensures access to high-quality materials.

- Inventory Management: Strategic inventory levels are maintained to buffer against short-term supply interruptions.

AkzoNobel's key resources include its strong intellectual property, globally recognized brands like Dulux and Sikkens, and an extensive network of manufacturing facilities. The company also relies heavily on its skilled workforce, particularly in R&D and technical expertise, and its robust financial capital which enables investment in innovation and expansion.

| Resource Category | Key Assets/Activities | 2023/2024 Data Points |

| Intellectual Property & Brands | Patents, proprietary technologies, brand equity | €1.1 billion Decorative Paints sales (Q1 2024) |

| Physical Resources | Manufacturing sites, global distribution network | Approx. 180 manufacturing sites worldwide (2023) |

| Human Capital | R&D scientists, engineers, sales & technical experts | Continued investment in workforce expertise (2024) |

| Financial Capital | Investment in R&D, capital expenditures, acquisitions | €278 million R&D expenses (2023) |

| Supply Chain | Raw material sourcing agreements, supplier relationships | Focus on optimizing procurement strategies (2024) |

Value Propositions

AkzoNobel's value proposition centers on delivering innovative and high-performance coatings that offer exceptional durability and protection. These advanced solutions cater to demanding sectors like automotive, aerospace, and marine, ensuring extended product lifecycles and enhanced performance.

The company's commitment to cutting-edge technology translates into coatings with superior aesthetic qualities and robust protective properties. This focus on advanced material science allows AkzoNobel to meet the stringent requirements of various industries, from protecting aircraft from extreme conditions to providing long-lasting finishes for vehicles.

For instance, in 2024, AkzoNobel's aerospace coatings are crucial for maintaining aircraft integrity and reducing drag, contributing to fuel efficiency. Similarly, their automotive coatings provide both visual appeal and critical protection against corrosion and wear, a key factor in vehicle longevity and resale value.

AkzoNobel offers a widening array of sustainable products, including coatings with low volatile organic compounds (VOCs), those derived from bio-based materials, and powder coatings. These innovations significantly reduce environmental impact, a key draw for eco-conscious consumers and a crucial factor in meeting increasingly stringent environmental regulations.

AkzoNobel's broad product portfolio, encompassing decorative paints and high-performance coatings, ensures customers worldwide have access to solutions for diverse needs. This extensive offering is bolstered by a robust portfolio of well-recognized brands, providing reliability and quality across its global operations.

The company's global reach means these products are available to a wide array of industries and consumers across different continents. In 2024, AkzoNobel continued to leverage this to serve sectors ranging from automotive and aerospace to construction and consumer goods, demonstrating its capacity to meet varied international demands.

Technical Expertise and Customer Support

AkzoNobel distinguishes itself by providing robust technical expertise and dedicated customer support. This commitment ensures customers receive comprehensive guidance on product application and performance optimization. For instance, in 2024, AkzoNobel’s technical service teams responded to over 150,000 customer inquiries globally, addressing complex project challenges and ensuring the correct use of their advanced coating technologies.

This value proposition is crucial for clients aiming to achieve specific project outcomes and maintain high standards in their applications. AkzoNobel’s color expertise, a key component of this offering, helps customers select and apply colors accurately, reducing rework and enhancing aesthetic appeal. Their support extends to helping clients navigate regulatory requirements and sustainability goals related to product use.

- Technical Guidance: Offering detailed application advice and troubleshooting for optimal product performance.

- Color Expertise: Providing specialized support for color matching and selection to meet aesthetic and branding needs.

- Customer Support: Ensuring responsive assistance for project-specific challenges and product inquiries.

- Performance Optimization: Helping customers achieve the best possible results and longevity from AkzoNobel products.

Efficiency and Productivity Enhancements

AkzoNobel's commitment to efficiency and productivity is a core value proposition, directly impacting customer operations. Through innovations such as rapid-cure coatings, AkzoNobel significantly reduces drying times, allowing for faster turnaround on projects and increased throughput. For instance, their Interpon powder coatings can cure in as little as 10 minutes at 200°C, a substantial improvement over traditional methods.

Further enhancing operational efficiency, AkzoNobel leverages AI-driven application processes. These advanced systems optimize paint usage, minimize waste, and ensure consistent, high-quality finishes, leading to direct cost savings for their clients. This technological integration streamlines workflows and reduces the need for rework.

Digital tools provided by AkzoNobel also play a crucial role in boosting productivity. These platforms offer predictive maintenance insights for coating equipment and real-time performance monitoring, enabling customers to anticipate issues and maintain optimal operational flow. This proactive approach minimizes downtime and maximizes asset utilization.

- Reduced Curing Times: Innovations like fast-cure technologies shorten production cycles.

- Optimized Application: AI-enabled processes minimize material waste and improve finish quality.

- Digital Support: Online tools offer performance monitoring and predictive maintenance for equipment.

- Cost Savings: These enhancements translate directly into lower operational expenses for customers.

AkzoNobel's value proposition is built on delivering superior coatings that offer both aesthetic appeal and robust protection, crucial for extending the life and enhancing the performance of assets across industries. This focus on innovation ensures products meet the demanding requirements of sectors like automotive and aerospace, contributing to durability and efficiency.

The company champions sustainability through its product development, offering eco-friendly options like low-VOC and bio-based coatings. This commitment addresses growing environmental concerns and regulatory pressures, making AkzoNobel a preferred partner for environmentally conscious businesses. In 2024, AkzoNobel reported that 77% of its revenue came from products with a sustainability advantage.

AkzoNobel provides comprehensive technical support and color expertise, ensuring customers achieve optimal results and meet specific project needs. Their global presence guarantees accessibility to a wide range of solutions and brands, serving diverse markets from construction to consumer goods.

Furthermore, AkzoNobel drives operational efficiency for its clients through technologies like rapid-cure coatings and AI-driven application processes. For example, their powder coatings can reduce application time significantly, boosting customer productivity and reducing operational costs.

| Value Proposition Area | Key Offering | Customer Benefit | 2024 Data/Example |

|---|---|---|---|

| Innovation & Performance | High-performance, durable coatings | Extended product lifecycle, enhanced functionality | Aerospace coatings reduce drag, improving fuel efficiency. |

| Sustainability | Low-VOC, bio-based, powder coatings | Reduced environmental impact, regulatory compliance | 77% of revenue from products with a sustainability advantage (2024). |

| Customer Support & Expertise | Technical guidance, color matching | Optimal application, aesthetic accuracy, problem resolution | Global technical service teams handle numerous inquiries annually. |

| Efficiency & Productivity | Rapid-cure, AI-optimized application | Faster project turnaround, reduced waste, cost savings | Interpon powder coatings cure in as little as 10 minutes at 200°C. |

Customer Relationships

For its B2B clients and substantial industrial customers, AkzoNobel offers dedicated account managers and specialized technical experts. This personalized approach guarantees that solutions are precisely tailored to client needs, fostering ongoing support and building robust, enduring partnerships.

AkzoNobel actively partners with key customers, fostering co-creation to develop tailored products and innovative solutions. This collaborative approach ensures deep integration into customer needs, directly addressing specific challenges and driving mutual growth.

In 2024, AkzoNobel continued to highlight its commitment to co-creation, with a significant portion of its R&D pipeline being influenced by direct customer feedback and joint development projects. This strategy is designed to accelerate the introduction of high-performance coatings that meet evolving market demands, such as those for sustainable building materials and advanced automotive finishes.

Akzo Nobel enhances customer relationships through robust self-service and digital tools, particularly for professional painters and smaller businesses. These platforms provide easy access to product details, color visualization, and streamlined order processing, fostering convenience and efficiency.

Brand Loyalty and Community Engagement

AkzoNobel cultivates brand loyalty in its decorative paints division, notably with brands like Dulux, through consistent marketing and community engagement. This strategy fosters an emotional bond, encouraging repeat business and a sense of belonging.

In 2024, AkzoNobel continued to invest in digital platforms and loyalty programs to deepen customer relationships. For instance, their 'ColourFutures' trend forecasting and associated digital tools provide ongoing value, driving engagement beyond the initial purchase.

- Brand Recognition: Leveraging established brands like Dulux to build trust and familiarity.

- Community Initiatives: Engaging local communities through sustainability projects and sponsorships to create positive associations.

- Digital Engagement: Utilizing apps and online content to offer inspiration, advice, and exclusive offers, fostering a continuous connection.

- Customer Loyalty Programs: Rewarding repeat customers with exclusive benefits and early access to new products, incentivizing continued patronage.

Industry Events and Showcases

AkzoNobel actively participates in and hosts key industry events and showcases, such as coatings exhibitions and sustainability forums. In 2024, the company continued this strategy to highlight its latest innovations in paints and coatings, including advanced sustainable solutions.

These events serve as crucial platforms for AkzoNobel to demonstrate new product lines, share valuable technical expertise, and foster direct interactions with a broad spectrum of customers, from architects and specifiers to end-users and distributors. This engagement is vital for building stronger customer relationships and gathering real-time market intelligence.

- Showcasing Innovation: Events allow AkzoNobel to present its newest paint and coating technologies, often focusing on sustainability and performance enhancements.

- Expertise Sharing: AkzoNobel uses these forums to share technical knowledge and best practices, positioning itself as a thought leader in the industry.

- Direct Customer Engagement: Participation facilitates direct conversations with customers, enabling the collection of feedback and understanding of evolving market needs.

- Relationship Building: These interactions strengthen partnerships and foster loyalty among diverse customer segments.

AkzoNobel nurtures customer relationships through a multi-faceted approach, blending personalized service with digital convenience. For major industrial clients, dedicated account managers and technical experts ensure tailored solutions and ongoing support, fostering deep partnerships.

For professional painters and smaller businesses, robust digital platforms offer easy access to product information, color tools, and streamlined ordering, enhancing efficiency. Loyalty programs and community engagement, particularly with brands like Dulux, build brand affinity and encourage repeat business.

In 2024, AkzoNobel's R&D pipeline was significantly shaped by customer co-creation, with a focus on developing high-performance, sustainable coatings. Their digital tools, like 'ColourFutures', continue to provide ongoing value and engagement beyond the point of sale.

AkzoNobel actively engages customers through industry events and showcases, presenting innovations and sharing technical expertise. This direct interaction allows for feedback collection and strengthens partnerships across various customer segments.

| Customer Relationship Strategy | Key Activities | Target Segments | 2024 Focus/Data Point |

| Dedicated Account Management & Technical Support | Personalized solutions, ongoing technical assistance | B2B clients, large industrial customers | Continued emphasis on tailored solutions for specific industrial needs. |

| Digital Self-Service & Tools | Easy access to product info, color visualization, online ordering | Professional painters, small businesses | Investment in digital platforms to enhance user experience and accessibility. |

| Co-creation & Joint Development | Collaborative product development, addressing specific client challenges | Key industrial partners | Significant portion of R&D pipeline influenced by customer feedback and joint projects. |

| Brand Loyalty & Community Engagement | Marketing, community initiatives, loyalty programs | Decorative paints consumers (e.g., Dulux users) | Strengthening emotional bonds and encouraging repeat purchases through consistent engagement. |

| Industry Events & Innovation Showcases | Product launches, technical knowledge sharing, direct interaction | Architects, specifiers, end-users, distributors | Highlighting innovations in sustainable coatings and advanced finishes. |

Channels

AkzoNobel leverages a global direct sales force to engage with major industrial clients, original equipment manufacturers (OEMs), and government-led projects. This direct approach is crucial for handling intricate contract negotiations and providing tailored technical advice. In 2024, AkzoNobel reported that its coatings segment, which heavily relies on this direct sales channel for its industrial and automotive coatings, continued to be a significant revenue driver, with sales in this area demonstrating resilience amidst global economic shifts.

AkzoNobel relies heavily on its extensive network of authorized distributors to effectively serve its diverse B2B customer base. This network is vital for reaching smaller businesses and professional painters who may not purchase in large volumes directly from AkzoNobel.

These distributors offer essential localized services, including readily available inventory and on-the-ground technical support, ensuring that customers have timely access to AkzoNobel's product range. This decentralized approach enhances customer satisfaction and market penetration.

In 2024, AkzoNobel continued to strengthen these partnerships, with distributors playing a key role in the company's strategy to expand its market reach within the coatings sector. For instance, their coatings division reported strong performance, partly attributed to the efficient reach provided by these distribution channels.

AkzoNobel leverages a dual-pronged approach for its decorative paints segment, operating its own dedicated brand stores while simultaneously forging strategic alliances with major retail partners. This includes collaborations with prominent hardware stores and specialized paint shops, ensuring broad market penetration and enhanced brand exposure across diverse consumer touchpoints.

E-commerce Platforms

AkzoNobel increasingly utilizes e-commerce platforms to reach both business-to-business (B2B) and business-to-consumer (B2C) customers. These digital storefronts provide a convenient way for clients to browse extensive product catalogs, access detailed technical specifications, and place orders directly. This strategic move aligns with evolving customer expectations for seamless, online purchasing experiences.

The company's e-commerce strategy is designed to support a modern customer journey, offering 24/7 accessibility and personalized interactions. By investing in these digital channels, AkzoNobel aims to enhance customer engagement and streamline the sales process. For instance, in 2023, AkzoNobel reported a significant increase in digital sales, reflecting the growing importance of these platforms in their overall revenue generation.

- B2B E-commerce: Facilitates bulk orders, account management, and access to specialized industrial coatings and solutions.

- B2C E-commerce: Offers direct-to-consumer sales for decorative paints and related products, enhancing brand accessibility.

- Digital Integration: Platforms often integrate with CRM systems to provide tailored customer experiences and support.

- Growth Driver: E-commerce is a key channel for driving sales growth and expanding market reach, especially in regions with high digital adoption.

OEM and Project Partnerships

AkzoNobel’s OEM and Project Partnerships channel is pivotal for embedding its coatings and specialty chemicals directly into the manufacturing processes of Original Equipment Manufacturers (OEMs) and the execution of major construction projects. This strategic approach ensures that AkzoNobel’s products become integral components within a vast array of finished goods and infrastructure.

These partnerships are characterized by deep integration and often involve long-term contracts, providing AkzoNobel with predictable revenue streams and significant market penetration. Tailored supply agreements are crucial, allowing for customized product formulations and delivery schedules to meet the specific technical requirements and production timelines of partners. For instance, in the automotive sector, AkzoNobel supplies coatings that are applied during the manufacturing of vehicles, enhancing both aesthetics and durability. In 2023, AkzoNobel reported that its Decorative Paints segment, which includes many products used in construction projects, saw revenue grow by 4% on a like-for-like basis, reflecting the ongoing demand in this channel.

- OEM Integration: AkzoNobel's coatings are applied to products like cars, aircraft, and appliances during their initial manufacturing.

- Project-Based Supply: The company provides coatings and materials for large-scale construction projects, such as stadiums, bridges, and residential developments.

- Long-Term Contracts: These partnerships typically involve multi-year agreements that secure consistent business.

- Customized Solutions: AkzoNobel develops specific product formulations and delivery logistics to meet partner needs.

AkzoNobel's channel strategy is multifaceted, encompassing direct sales to large industrial clients, a robust distributor network for broader market reach, and strategic retail partnerships for its decorative paints. E-commerce platforms are also increasingly vital for both B2B and B2C transactions, offering convenience and accessibility.

These channels are supported by OEM and project-based partnerships, ensuring AkzoNobel's products are integrated into manufacturing and construction. In 2024, the company continued to focus on optimizing these channels, with digital sales showing continued growth, contributing to the overall resilience of its coatings business.

| Channel | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force | Engages major industrial clients, OEMs, government projects. Crucial for complex negotiations and tailored advice. | Continued to be a significant revenue driver for the coatings segment, demonstrating resilience. |

| Distributor Network | Serves smaller businesses and professional painters. Offers localized inventory and technical support. | Strengthened partnerships to expand market reach in the coatings sector. |

| Retail Partnerships & Brand Stores | Dual approach for decorative paints, partnering with hardware stores and operating own brand stores. | Ensures broad market penetration and enhanced brand exposure for consumer products. |

| E-commerce Platforms | Facilitates B2B and B2C sales, offering online catalogs, technical specs, and direct ordering. | Key growth driver, with significant increases in digital sales reported in 2023, reflecting evolving customer expectations. |

| OEM & Project Partnerships | Embeds coatings into manufacturing processes (OEMs) and large construction projects. | Decorative Paints segment revenue grew 4% (like-for-like) in 2023, indicating strong demand in this channel. |

Customer Segments

AkzoNobel serves a wide array of industrial and commercial clients, often referred to as Business-to-Business (B2B) customers. These are businesses that rely on AkzoNobel's coatings for their own manufacturing processes and product finishing.

Key sectors within this segment include major manufacturers in the automotive, aerospace, marine, and coil coating industries. Additionally, clients in the protective coatings sector, which safeguard infrastructure and industrial assets, are crucial. For instance, in 2023, AkzoNobel reported strong performance in its Decorative Paints and Performance Coatings segments, with the latter encompassing many of these industrial applications.

These customers have specific and demanding needs. They require coatings that offer high performance, durability, and specialized properties tailored to their unique applications. This often involves custom-formulated solutions designed to meet stringent industry standards and environmental regulations, ensuring the longevity and aesthetic appeal of their products and assets.

Professional painters and contractors are a cornerstone customer segment for AkzoNobel's decorative and performance coatings. These professionals rely on AkzoNobel for products that offer superior durability, excellent coverage, and ease of application, crucial for efficiency on both residential and commercial job sites.

Their demands extend to consistent product availability and technical support to ensure project success and client satisfaction. In 2024, AkzoNobel's extensive distribution network and focus on product innovation directly address these needs, supporting contractors in delivering high-quality finishes that meet stringent project specifications.

Individual homeowners and DIY enthusiasts represent a significant customer base for Akzo Nobel, actively purchasing decorative paints for both interior and exterior projects. These consumers prioritize ease of use, an extensive color palette, and confidence in the brand's reputation, looking for products that simplify their decorating tasks and deliver desired aesthetic results.

In 2024, the global DIY market, particularly for home improvement and decor, continued its robust growth trajectory, with consumers investing in their living spaces. Akzo Nobel's Dulux brand, for instance, consistently ranks high in consumer preference surveys in key markets, reflecting this segment's reliance on established and trusted names for quality and performance.

Building and Construction Companies

Building and construction companies, including developers, architects, and general contractors, are key customers for AkzoNobel. These businesses seek coatings for a wide range of applications, from residential and commercial new builds to extensive renovation projects and critical infrastructure development. In 2024, the global construction market was valued at approximately $14.5 trillion, with coatings representing a significant portion of material spend, emphasizing the demand for high-performance solutions.

These clients place a strong emphasis on product attributes that directly impact project success and long-term value. Durability is paramount, ensuring that finishes withstand environmental factors and wear and tear. Sustainability is increasingly a deciding factor, with a growing preference for low-VOC (volatile organic compound) and eco-friendly formulations that meet stringent environmental regulations and green building certifications. Aesthetic appeal also plays a crucial role, as coatings contribute significantly to the visual quality and marketability of finished properties.

- Demand Drivers: New construction, renovations, and infrastructure projects require protective and decorative coatings.

- Key Priorities: Durability for longevity, sustainability for environmental compliance and appeal, and aesthetic quality for visual impact.

- Market Context: The global construction industry's robust size in 2024 underscores the substantial market for coatings.

- Product Needs: High-performance, eco-friendly, and visually appealing coating solutions are essential for this segment.

Specialty Industries

AkzoNobel caters to specialty industries that require highly tailored coating solutions. These niche markets include consumer electronics, where coatings need to offer specific aesthetic appeal and durability, and wood finishes, demanding both protection and enhanced visual qualities. The company also serves specialized industrial applications, each with its own set of unique technical property requirements and a constant drive for innovation.

In 2024, AkzoNobel's performance in these specialty segments is bolstered by its ongoing investment in research and development. For example, the company has been actively developing advanced coatings for the electronics sector, focusing on scratch resistance and antimicrobial properties. This focus aligns with market trends showing increased consumer demand for products that are both aesthetically pleasing and maintainable.

- Consumer Electronics: Coatings designed for smartphones, laptops, and other devices, offering enhanced durability, aesthetic appeal, and often specialized functionalities like heat dissipation or improved grip.

- Wood Finishes: High-performance coatings for furniture, flooring, and architectural elements, providing protection against wear, moisture, and UV damage while enhancing natural wood beauty.

- Specialty Industrial Applications: Tailored coatings for sectors like aerospace, automotive interiors, and high-performance sporting goods, meeting stringent performance criteria and unique application needs.

AkzoNobel's customer base is diverse, primarily segmented into industrial and commercial clients, professional painters, individual homeowners, building and construction firms, and specialty industries. Each segment has distinct needs regarding performance, aesthetics, and sustainability. For instance, in 2024, the company's focus on innovation in decorative paints directly addresses the demands of both professional painters seeking efficiency and homeowners desiring aesthetic appeal. The industrial sectors, including automotive and aerospace, require highly specialized, durable coatings, a need AkzoNobel meets through tailored solutions, as evidenced by their strong performance in the Performance Coatings segment in 2023.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Industrial & Commercial Clients | High performance, durability, specialized properties, custom formulations | Automotive, aerospace, marine, coil, and protective coatings industries drive demand. |

| Professional Painters & Contractors | Superior durability, excellent coverage, ease of application, product availability, technical support | Crucial for residential and commercial projects; AkzoNobel's distribution network supports their needs. |

| Individual Homeowners & DIY Enthusiasts | Ease of use, extensive color palette, brand reputation, aesthetic results | DIY market growth continues; trusted brands like Dulux are highly preferred. |

| Building & Construction Companies | Durability, sustainability (low-VOC), aesthetic appeal, compliance with regulations | Global construction market valued at ~$14.5 trillion in 2024, with coatings as a significant material spend. |

| Specialty Industries | Highly tailored solutions, specific technical properties, innovation | Consumer electronics and wood finishes require advanced coatings; R&D investment is key. |

Cost Structure

Raw material costs represent a substantial component of AkzoNobel's expenses, with key inputs including resins, pigments, and solvents. These materials are fundamental to the production of paints and coatings, and their availability and pricing can significantly influence the company's financial performance.

In 2024, AkzoNobel, like many in the chemical industry, continued to navigate volatile commodity markets. For instance, titanium dioxide, a crucial white pigment, experienced price shifts influenced by global demand and supply dynamics. Similarly, the cost of petrochemical-derived solvents and various resins is closely tied to crude oil prices, which saw considerable fluctuation throughout the year.

AkzoNobel's manufacturing and production costs are significant, encompassing expenses like energy, labor, and machinery upkeep across its worldwide operations. In 2023, the company reported that cost inflation, particularly in raw materials and energy, impacted its results. For instance, energy prices saw considerable volatility throughout the year.

To combat these rising expenses, AkzoNobel actively pursues efficiency improvements within its production processes. These initiatives are crucial for maintaining profitability and competitiveness in the global coatings market. The depreciation of manufacturing equipment also contributes to the overall cost structure.

Akzo Nobel's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are crucial for developing new coatings, paints, and specialty chemicals, ensuring the company remains competitive and addresses evolving market needs. For instance, in 2023, Akzo Nobel reported €332 million in R&D expenses, a testament to their focus on future growth and technological advancement.

Sales, Marketing, and Distribution Costs

Akzo Nobel's Sales, Marketing, and Distribution Costs are crucial for maintaining its global market presence and acquiring new customers. These expenses cover everything from the salaries of its sales force and the execution of extensive marketing campaigns to advertising, brand promotion efforts, and the intricate logistics involved in distributing its diverse product portfolio worldwide.

In 2024, Akzo Nobel continued to invest heavily in these areas. For instance, the company's marketing and selling expenses represented a significant portion of its operational budget, reflecting the competitive nature of the paints and coatings industry. These investments are directly tied to building brand awareness and driving sales volume across its key segments, including decorative paints and performance coatings.

- Sales Force Compensation: Includes salaries, commissions, and benefits for a global sales team.

- Marketing Campaigns: Investment in advertising, digital marketing, and promotional activities to reach target audiences.

- Brand Promotion: Efforts to enhance brand visibility and customer loyalty through sponsorships and public relations.

- Distribution Logistics: Costs associated with warehousing, transportation, and supply chain management to ensure timely product delivery.

Personnel and Administrative Costs

Personnel and administrative costs form a significant part of AkzoNobel's expense base. These include salaries for management, administrative staff, and IT infrastructure, alongside broader corporate overhead expenses. For instance, in 2023, AkzoNobel reported €10.5 billion in revenue, with personnel costs being a key component of their operating expenses.

To manage these expenditures, AkzoNobel has actively pursued workforce reductions and operational streamlining initiatives. These efforts aim to enhance efficiency and control costs across the organization. The company's commitment to cost discipline is evident in its ongoing transformation programs designed to optimize its administrative functions.

- General administrative expenses: Salaries for management and support staff, IT infrastructure, and corporate overhead are key cost drivers.

- Workforce optimization: AkzoNobel has implemented workforce reductions and streamlining to control personnel costs.

- Efficiency focus: Ongoing transformation programs aim to optimize administrative functions and reduce overall overhead.

AkzoNobel's cost structure is heavily influenced by raw material prices, manufacturing overhead, and significant investments in research and development. The company also incurs substantial costs related to sales, marketing, and distribution to maintain its global reach.

In 2024, AkzoNobel, like many in the chemical industry, continued to navigate volatile commodity markets, impacting raw material costs. Manufacturing expenses, including energy and labor, also remained a key consideration, with cost inflation being a factor in 2023. The company's commitment to innovation is demonstrated by its R&D spending, which was €332 million in 2023.

Personnel and administrative costs are also significant, with ongoing efforts to streamline operations and improve efficiency. These combined elements form the backbone of AkzoNobel's operational expenses, directly impacting its profitability and competitive positioning in the global coatings market.

| Cost Category | Key Components | 2023 Relevance |

|---|---|---|

| Raw Materials | Resins, pigments (e.g., titanium dioxide), solvents | Volatile commodity markets, linked to crude oil prices |

| Manufacturing & Production | Energy, labor, machinery upkeep | Affected by cost inflation, particularly energy prices in 2023 |

| Research & Development (R&D) | New product development, technological advancement | €332 million spent in 2023, crucial for competitiveness |

| Sales, Marketing & Distribution | Sales force, advertising, logistics | Significant portion of operational budget in 2024, driving sales volume |

| Personnel & Administrative | Management salaries, IT, corporate overhead | Key component of operating expenses; ongoing streamlining efforts |

Revenue Streams

AkzoNobel's decorative paints segment is a significant revenue driver, generating income from both do-it-yourself consumers and professional painters. This includes sales of well-known brands such as Dulux, which holds strong market positions globally. In 2024, the company continued to focus on innovation and sustainability within this segment, aiming to capture market share through product differentiation and brand loyalty.

AkzoNobel's revenue from performance coatings is generated by selling specialized, high-value technical products to a diverse industrial customer base. This includes critical sectors like automotive, where coatings protect vehicles and enhance aesthetics, and aerospace, demanding advanced solutions for durability and performance in extreme conditions.

The marine and protective coatings segments also contribute significantly, offering solutions for harsh environments such as ships and infrastructure projects. AkzoNobel's powder coatings business provides environmentally friendly and durable finishes for various applications, further diversifying this revenue stream.

In 2024, AkzoNobel reported strong performance in its Decorative Paints and Performance Coatings segments. For instance, the company's revenue from Performance Coatings reached approximately €3.7 billion in the first half of 2024, showcasing the substantial income derived from these specialized product sales.

While AkzoNobel has significantly divested its Specialty Chemicals division, the sale of niche chemical products continues to be a minor revenue stream. These sales, though not the primary focus, contribute to the company's diversified income.

The company's strategic shift means that revenue from this segment is considerably less than in previous years, with the core business now centered on paints and coatings. For instance, in 2023, AkzoNobel's overall revenue was approximately €10.5 billion, with specialty chemicals representing a much smaller portion following the Nouryon separation.

Licensing and Technical Services

AkzoNobel generates revenue beyond direct product sales by licensing its advanced, proprietary technologies to other companies. This taps into their deep R&D capabilities. Additionally, they offer specialized technical services and consultancy, especially valuable for intricate industrial applications where their expertise is paramount.

For instance, AkzoNobel's coatings technology is highly sought after. In 2023, their focus on innovation continued, with significant investment in R&D to maintain a competitive edge in these licensing and service areas.

- Licensing Agreements: Revenue from allowing other entities to use AkzoNobel’s patented technologies and formulations.

- Technical Services: Income from providing expert advice, support, and problem-solving for complex industrial coating challenges.

- Consultancy: Fees earned for strategic guidance and implementation support related to coatings and surface treatments.

- Proprietary Technology: Leveraging unique innovations in areas like sustainable coatings or advanced material science for commercial partnerships.

Value-added Services

AkzoNobel enhances its product offerings by providing valuable services that generate additional revenue. These include specialized color consultancy, application training for professionals, and digital tools designed for precise color matching, such as their MIXIT platform. These services aim to optimize customer workflows and improve project outcomes.

These value-added services represent a strategic move to deepen customer relationships and capture more revenue beyond the initial sale of paints and coatings. For instance, the adoption of digital color matching tools can streamline processes for customers, leading to greater efficiency and satisfaction.

- Color Consultancy: Expert advice on color selection and trends.

- Application Training: Skill development for optimal product use.

- Digital Tools: Platforms like MIXIT for color matching and management.

- Workflow Optimization: Solutions to improve efficiency in customer processes.

AkzoNobel's revenue streams are primarily driven by its two core segments: Decorative Paints and Performance Coatings. The Decorative Paints segment caters to both consumers and professionals, with strong brand recognition in markets like Europe and Asia. Performance Coatings, on the other hand, serves industrial clients across various sectors, offering specialized solutions.

In 2024, AkzoNobel continued to see robust performance in these areas. For the first half of 2024, the company reported that its Performance Coatings segment generated approximately €3.7 billion in revenue. This highlights the significant contribution of high-value, technical coatings to the company's overall financial performance.

Beyond direct product sales, AkzoNobel also generates income through licensing its proprietary technologies and offering specialized technical services and consultancy. These services, including color consultancy and digital tools like MIXIT for color matching, add value for customers and create additional revenue opportunities. For example, the company's ongoing investment in R&D in 2023 aimed to strengthen these innovation-driven revenue streams.

| Revenue Stream | Description | 2024 Highlight (H1) |

|---|---|---|

| Decorative Paints | Sales of paints for consumers and professionals. | Strong market presence and brand loyalty. |

| Performance Coatings | Specialized coatings for industrial applications (automotive, aerospace, etc.). | €3.7 billion revenue. |

| Licensing & Technical Services | Revenue from technology licensing, consultancy, and application support. | Focus on innovation and R&D to maintain competitive edge. |

Business Model Canvas Data Sources

The Akzo Nobel Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the paints and coatings industry, and strategic analyses of competitor activities. These diverse data sources ensure each component of the canvas is grounded in actionable intelligence.