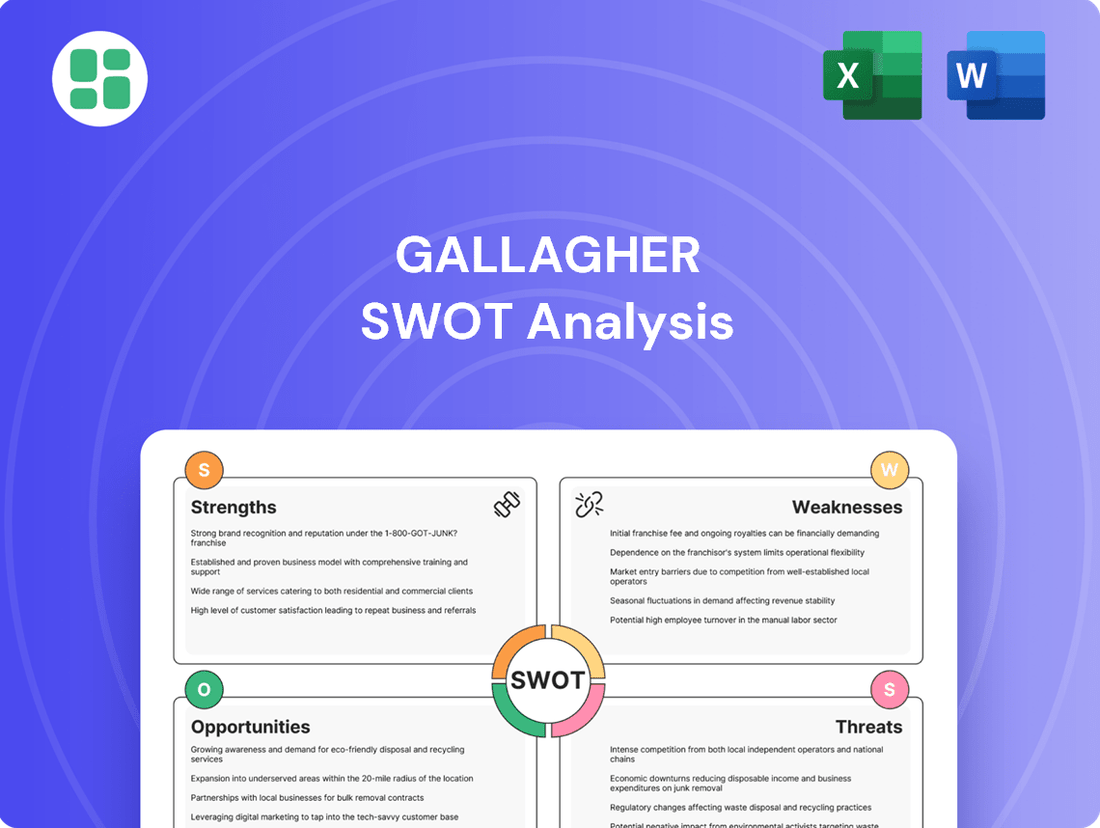

Gallagher SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Gallagher's robust brand recognition and diversified service offerings present significant strengths. However, understanding their competitive landscape and potential regulatory shifts is crucial for navigating future opportunities.

Want the full story behind Gallagher's market advantages, potential challenges, and strategic growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Gallagher's global market leadership is undeniable, positioning it as the third-largest insurance brokerage worldwide. This vast operational footprint, spanning roughly 130 countries, allows for unparalleled service to a broad spectrum of clients across numerous sectors.

The company's significant scale is a key advantage, enabling it to secure favorable terms and deliver robust, all-encompassing solutions. This market dominance is further validated by its impressive financial performance, with a track record of double-digit revenue growth, including 16 consecutive quarters of this growth through the first quarter of 2025.

Gallagher's robust acquisition strategy is a significant strength, evidenced by its completion of 48 mergers in 2024 and an additional 11 in the first quarter of 2025. These acquisitions consistently add substantial annualized revenue, expanding the company's market presence and diversifying its service portfolio.

This aggressive inorganic growth, highlighted by the pending $13.45 billion acquisition of AssuredPartners, bolsters Gallagher's specialized capabilities and geographic reach. The company's strong M&A pipeline and demonstrated financial capacity to execute these strategic buyouts underscore its commitment to sustained expansion.

Gallagher's diverse service portfolio is a significant strength, encompassing a broad spectrum of insurance solutions like property & casualty, employee benefits, and specialty coverages. This is complemented by robust risk management consulting, analytics, and third-party claims administration, allowing them to cater to a wide array of client needs.

This diversification across brokerage and risk management segments enables Gallagher to effectively navigate various market cycles and capture opportunities across different industries. For instance, in 2023, Gallagher's Brokerage segment saw a revenue increase of 13.5% year-over-year, demonstrating the strength of its core offerings while its Consulting segment grew by 10.5%, highlighting the synergy between its diverse services.

The company's capacity to offer end-to-end risk solutions not only deepens client relationships but also fosters significant cross-selling opportunities. This integrated approach allows them to become a more indispensable partner for their clients, driving sustained growth and market penetration.

Consistent Organic Revenue Growth

Gallagher's consistent organic revenue growth is a significant strength, underscoring its ability to expand its business internally. This internal growth is not reliant on acquisitions alone, showcasing the company's operational effectiveness. For instance, Gallagher achieved a robust 7% organic revenue growth in Q4 2024, which then accelerated to an impressive 9% in Q1 2025.

This upward trend in organic growth points to successful strategies like cross-selling services to existing clients and strong client retention. It also highlights Gallagher's adeptness at leveraging favorable market dynamics, such as the increasing renewal premiums observed in casualty insurance lines. This internal momentum is a crucial contributor to the company's overall financial stability and its expanding market presence.

Key aspects of this strength include:

- Sustained Organic Growth: Achieved 7% in Q4 2024 and 9% in Q1 2025, demonstrating consistent internal expansion.

- Effective Client Engagement: Driven by successful cross-selling initiatives and high client retention rates.

- Market Opportunity Capture: Capitalizing on favorable market conditions, including rising renewal premiums in key insurance sectors.

- Balanced Growth Strategy: Complements acquisition-driven growth with strong organic performance, fortifying financial health and market share.

Strong Financial Performance and Margin Expansion

Gallagher demonstrated exceptional financial performance throughout 2024, achieving total revenues exceeding $11.4 billion. This growth was accompanied by a notable increase in net earnings, underscoring the company's profitability.

The company has consistently improved its margins, with adjusted EBITDAC margins showing an upward trend in both Q4 2024 and Q1 2025. This expansion is a direct result of effective cost management strategies and enhanced operational efficiency.

- Robust Revenue Growth: Full-year 2024 revenues surpassed $11.4 billion.

- Increased Net Earnings: Significant growth in net earnings reported for 2024.

- Margin Expansion: Consistent improvement in adjusted EBITDAC margins observed in late 2024 and early 2025.

- Operational Efficiency: Strong financial discipline and cost optimization driving profitability.

Gallagher's financial strength is a cornerstone of its success, marked by substantial revenue growth and expanding profit margins. The company's ability to consistently deliver strong financial results, even amidst market fluctuations, highlights its sound management and operational efficiency.

Gallagher's financial performance in 2024 was exceptional, with total revenues exceeding $11.4 billion. This robust top-line growth translated into increased net earnings, showcasing the company's profitability. Furthermore, Gallagher has demonstrated a consistent ability to improve its margins, with adjusted EBITDAC margins trending upward through Q4 2024 and into Q1 2025, a testament to effective cost management and operational enhancements.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Total Revenue | >$11.4 billion | Not specified |

| Adjusted EBITDAC Margin | Upward Trend | Upward Trend |

What is included in the product

Delivers a strategic overview of Gallagher’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis into an actionable framework for immediate problem-solving.

Weaknesses

Gallagher faces substantial integration risks following its aggressive acquisition strategy, notably the massive $13.45 billion acquisition of AssuredPartners. Successfully merging such a large entity involves navigating complex challenges in harmonizing distinct corporate cultures and aligning disparate operational systems.

The ability to effectively realize the projected cost and revenue synergies from this significant deal is paramount. Any missteps in the integration process could result in considerable operational disruptions, escalating costs, and a delay in achieving the anticipated return on investment, impacting overall financial performance.

Arthur J. Gallagher & Co. is currently trading at a forward Price/Earnings (P/E) ratio that stands considerably above the broader market average and its industry peers. For instance, as of early 2024, its forward P/E was reported to be in the high 20s, while the S&P 500's was closer to the mid-teens.

This premium valuation suggests that investors have high expectations for the company's future growth and profitability. Such elevated expectations can create a scenario where there's less room for the stock price to climb further, as much of the anticipated success is already priced in.

Consequently, any instance where Gallagher's performance falls short of these ambitious projections, even slightly, could trigger investor caution. This might lead to increased stock price volatility as the market reassesses its valuation based on the actual results.

Gallagher's free cash flow yield has been negative, largely driven by significant cash expenditures supporting its aggressive acquisition strategy. For example, in the trailing twelve months ending March 31, 2024, Gallagher reported negative free cash flow of $1.3 billion, resulting in a negative free cash flow yield.

While these acquisitions are a key growth driver, a sustained negative free cash flow yield prompts scrutiny regarding the long-term viability of its cash generation capabilities. This situation could potentially constrain financial flexibility for alternative investments or distributions to shareholders.

Regulatory Scrutiny on Major Deals

Gallagher's pursuit of large-scale acquisitions, exemplified by the AssuredPartners deal, faces significant regulatory headwinds. These transactions are subject to rigorous antitrust reviews by government agencies, such as the U.S. Justice Department, which can substantially delay closing timelines.

The extended review period for the AssuredPartners acquisition underscores the potential for regulatory hurdles to introduce uncertainty and prolong the integration process. This can divert critical resources and management attention away from core business operations.

- Regulatory Delays: The AssuredPartners deal closing was impacted by antitrust reviews, highlighting potential timeline disruptions for future large-scale M&A.

- Resource Strain: Prolonged regulatory scrutiny can tie up significant financial and human resources, affecting operational efficiency.

- Integration Uncertainty: Regulatory reviews can create uncertainty around deal completion, complicating post-acquisition integration planning.

Potential for Talent Retention Challenges

Gallagher's rapid expansion, fueled by numerous acquisitions, presents a significant hurdle in retaining the talent and specialized knowledge from the companies it integrates. This constant influx of new teams can strain human resources, making it difficult to maintain a cohesive culture and prevent the departure of valuable employees. For instance, a key challenge post-acquisition is ensuring that the acquired firm's top performers feel valued and integrated, rather than alienated, which is critical for maintaining service consistency.

The company's growth strategy necessitates a robust focus on managing its increasingly diverse and geographically dispersed workforce. Without proactive measures, cultural integration can falter, leading to a loss of the very expertise Gallagher sought to acquire. This is particularly relevant as Gallagher continues its global push, aiming to solidify its position in new markets.

- Talent Drain Risk: Acquisitions can lead to key employees leaving if integration is not handled smoothly.

- Cultural Dilution: Merging different company cultures can be challenging, potentially impacting employee morale and retention.

- HR Strain: The sheer volume of acquisitions can overwhelm HR departments, impacting their ability to support new employees effectively.

- Service Continuity: Loss of experienced staff post-acquisition can directly affect the quality of services delivered to clients.

Gallagher's aggressive acquisition strategy, while a growth engine, introduces substantial integration risks. The $13.45 billion AssuredPartners acquisition, for example, presents a complex challenge in merging cultures and systems, with the success of synergy realization being critical. Failure here could lead to operational disruptions and delayed ROI.

The company's premium valuation, with a forward P/E in the high 20s in early 2024 compared to the S&P 500's mid-teens, implies high investor expectations. Any performance shortfall could trigger stock volatility as the market re-evaluates its elevated price.

Gallagher's free cash flow yield turned negative, reaching -$1.3 billion in the twelve months ending March 31, 2024, due to significant acquisition spending. This raises questions about long-term cash generation and could limit financial flexibility.

Regulatory hurdles, particularly antitrust reviews like those for the AssuredPartners deal, can cause significant delays and divert management focus. Such reviews introduce uncertainty and can complicate integration planning.

The rapid pace of acquisitions strains Gallagher's ability to retain talent and maintain a cohesive culture, risking the loss of valuable expertise. This is crucial for service continuity and the success of global expansion efforts.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Integration Risks | Difficulty in merging acquired companies' cultures and systems. | Operational disruptions, delayed synergy realization, reduced ROI. | $13.45 billion AssuredPartners acquisition integration complexity. |

| Premium Valuation | Stock trades at a significantly higher forward P/E ratio than market and peers. | Increased stock volatility if growth expectations are unmet; limited upside potential. | Forward P/E in high 20s (early 2024) vs. S&P 500 mid-teens. |

| Negative Free Cash Flow Yield | High acquisition spending leads to negative free cash flow. | Potential constraint on financial flexibility, questions long-term cash generation. | Negative $1.3 billion free cash flow (TTM ending March 31, 2024). |

| Regulatory Headwinds | Large acquisitions face rigorous antitrust reviews. | Deal delays, resource diversion, integration planning uncertainty. | Antitrust review impact on AssuredPartners deal closing timeline. |

| Talent Retention & Cultural Integration | Challenges in retaining key employees and harmonizing diverse cultures from acquisitions. | Loss of expertise, potential decline in service quality, weakened employee morale. | Difficulty integrating new teams post-acquisition impacting service consistency. |

Full Version Awaits

Gallagher SWOT Analysis

The preview you see is the actual Gallagher SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and complete insights.

This is a real excerpt from the complete Gallagher SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Gallagher SWOT analysis file. The complete version, offering comprehensive strategic details, becomes available after checkout.

Opportunities

The insurance brokerage landscape is actively consolidating, presenting a significant opportunity for Gallagher. As larger entities like Gallagher acquire smaller and mid-sized competitors, the potential to absorb market share and bolster service offerings through strategic bolt-on acquisitions remains robust. This trend is amplified by the industry's healthy expansion, with projections indicating continued growth.

Businesses globally are grappling with a surge in intricate and shifting risks, from escalating cyber threats and volatile supply chains to the tangible impacts of climate change. This escalating complexity directly fuels a greater need for advanced risk management consulting, in-depth analytics, and highly specialized insurance products. Gallagher's established proficiency in these critical domains uniquely positions the company to address this expanding market demand by providing precisely tailored advisory services and solutions.

Gallagher can significantly boost its operations by investing in advanced technologies like artificial intelligence. These investments present a prime opportunity to refine underwriting precision and make claims handling smoother, ultimately driving efficiency. For instance, the insurance industry is increasingly adopting AI for fraud detection, with some studies suggesting AI can reduce fraudulent claims by up to 10%.

Growth in Specialty and Casualty Insurance Lines

While some property insurance markets might be seeing a slowdown, the casualty insurance sector, which includes things like umbrella policies and commercial auto coverage, is still experiencing premium growth. Gallagher is well-positioned to benefit from this trend due to its wide range of products and specialized knowledge.

Gallagher's ability to navigate these hardening market segments is a significant opportunity. The company's deliberate strategy to focus on niche markets and specialized insurance coverages offers clear pathways for targeted expansion and increased revenue.

- Specialty lines like cyber and professional liability are seeing robust demand.

- Commercial auto premiums rose by an estimated 8-12% in 2023, with continued upward pressure expected into 2024.

- Gallagher's brokerage segment reported a 10.5% increase in net revenue for Q1 2024, partly driven by strong performance in specialty lines.

- The company's expertise in complex risks allows it to capture higher premiums in these growing areas.

Cross-Selling and Client Penetration

Gallagher's extensive range of brokerage, risk management, and consulting services presents a prime opportunity for cross-selling. By offering a more complete suite of solutions to its existing, varied clientele, the company can significantly boost organic revenue. This approach not only deepens client relationships but also fosters greater loyalty.

For instance, Gallagher's 2024 performance highlights this potential. The company reported a 10% increase in revenue from its Brokerage segment in Q1 2024, partly driven by expanding services to existing clients. This demonstrates the tangible impact of leveraging its integrated service model to capture more share of wallet.

- Cross-Selling Potential: Gallagher can offer its risk management and consulting services to clients primarily using its brokerage services, and vice-versa.

- Client Loyalty: Providing comprehensive solutions across multiple client needs strengthens relationships and reduces churn.

- Revenue Growth: Deepening penetration within the existing client base is a cost-effective way to drive top-line growth.

- Service Integration: Gallagher's ability to bundle services makes it easier to present a unified value proposition to clients.

Gallagher is well-positioned to capitalize on the ongoing industry consolidation, enabling it to acquire market share and enhance its service capabilities through strategic acquisitions. The increasing complexity of global risks, from cyber threats to climate change impacts, is driving a greater demand for Gallagher's specialized risk management and insurance solutions. Furthermore, the company can leverage technological advancements, particularly AI, to improve underwriting and claims processing, as seen in the industry's adoption of AI for fraud detection, which studies suggest can reduce fraudulent claims by up to 10%.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Industry Consolidation | Acquiring smaller competitors to gain market share. | Insurance brokerage landscape is actively consolidating. |

| Increasing Risk Complexity | Addressing growing demand for specialized risk management. | Escalating cyber threats, supply chain volatility, climate change impacts. |

| Technological Adoption | Enhancing efficiency through AI in underwriting and claims. | AI adoption in fraud detection potentially reducing claims by up to 10%. |

| Specialty Lines Growth | Benefiting from premium growth in casualty and specialty insurance. | Commercial auto premiums rose 8-12% in 2023; Gallagher's Q1 2024 brokerage revenue increased 10.5%, partly from specialty lines. |

Threats

Gallagher faces significant pressure from established giants like Marsh & McLennan, Aon, and Willis Towers Watson, all competing fiercely for market share in the global insurance brokerage sector. These rivals often employ aggressive pricing tactics and introduce innovative service packages, directly impacting Gallagher's ability to maintain its profit margins and competitive standing.

The insurance sector faces a constantly shifting regulatory environment, with new cybersecurity reporting mandates and heightened data privacy oversight becoming increasingly common. For instance, in 2024, many jurisdictions continued to implement or refine data protection regulations, impacting how companies like Gallagher handle client information.

Failure to adhere to these evolving rules can lead to severe consequences, including substantial fines and legal challenges, potentially costing millions. Gallagher's global operations mean it must navigate a complex web of differing regulations, making compliance a significant operational hurdle.

Gallagher's commitment to adapting its compliance frameworks is crucial for mitigating these risks. The company's proactive approach to understanding and implementing new regulations, such as those related to ESG reporting that gained momentum in 2024, demonstrates its dedication to maintaining operational integrity and avoiding penalties.

Cybersecurity risks, including ransomware and supply chain vulnerabilities, are a significant and growing threat. The average cost of a data breach in 2024 reached $5.15 million, a substantial increase that directly impacts insurers like Gallagher.

These evolving threats can lead to more frequent and costly claims for Gallagher, as well as increased operational expenses for security measures. Furthermore, successful cyberattacks can severely damage Gallagher's reputation and that of its clients, impacting client retention and new business acquisition.

Economic Downturns and Market Softening

Broader economic headwinds, including the potential for downturns or sustained high interest rates, could dampen client demand for Gallagher's insurance and risk management solutions. For instance, if inflation moderates but economic growth slows significantly, businesses might scale back on discretionary spending, impacting Gallagher's service uptake.

A notable softening in insurance premium rates across core business segments presents a direct threat to Gallagher's revenue streams. If market competition intensifies and drives down premiums, it could directly affect Gallagher's profitability and hinder its previously strong growth momentum. For example, a 5% decrease in average premium rates across major lines could translate to a substantial revenue reduction.

- Economic Slowdown: Persistent inflation or an economic contraction in key markets could reduce client spending on insurance and risk advisory services.

- Interest Rate Sensitivity: Elevated interest rates, while potentially boosting investment income, can also increase borrowing costs for clients, indirectly impacting their ability to purchase comprehensive coverage.

- Premium Rate Softening: Increased competition or a perceived reduction in risk could lead to a decline in insurance premium rates, directly impacting Gallagher's top-line growth and profitability, as seen in certain commercial lines during periods of market oversupply.

Challenges in Managing Rapid Global Expansion

Gallagher's rapid global expansion, fueled by acquisitions, poses a significant threat if not managed with precision. The sheer speed of growth can strain the organization's ability to ensure uniform service quality across its diverse international operations. For instance, maintaining the Gallagher brand promise in markets with vastly different customer expectations and service delivery models requires substantial ongoing investment and oversight.

Integrating a growing number of acquired entities presents a complex operational challenge. Each acquisition often brings its own unique IT systems, workflows, and data management practices. Gallagher must invest heavily in harmonizing these disparate systems to achieve operational efficiencies and avoid data silos, a task that becomes exponentially more difficult with each new addition. In 2023, Gallagher completed 27 acquisitions, underscoring the scale of this integration challenge.

Navigating the intricate and often conflicting regulatory landscapes of numerous countries is another considerable threat. Compliance requirements, data privacy laws (like GDPR), and financial reporting standards vary significantly worldwide. Failure to adhere to these diverse regulations can result in substantial fines, reputational damage, and operational disruptions, impacting Gallagher's ability to operate seamlessly across its global footprint.

- Service Quality Dilution: Risk of inconsistent client experience across different regions due to varying operational standards.

- System Integration Complexity: Challenges in merging diverse IT infrastructures and data management systems from acquired companies.

- Regulatory Compliance Burden: Navigating and adhering to a complex web of international laws and regulations.

- Brand Consistency Erosion: Potential for a fragmented brand image if localized operations do not align with global standards.

Gallagher faces intense competition from major global players like Marsh McLennan, Aon, and Willis Towers Watson, who often leverage aggressive pricing and innovative offerings. The insurance industry's evolving regulatory landscape, including stricter data privacy and cybersecurity mandates, presents a significant compliance challenge, with potential for substantial fines. Furthermore, cybersecurity threats, such as ransomware, pose a direct risk, with the average cost of a data breach reaching $5.15 million in 2024, impacting operational costs and client trust.

Economic slowdowns and persistent inflation can reduce client demand for insurance and risk advisory services, while softening premium rates due to market competition directly threaten revenue streams. Gallagher's rapid global expansion through acquisitions, with 27 acquisitions completed in 2023 alone, introduces complexities in maintaining uniform service quality and integrating diverse IT systems. Navigating varied international regulatory frameworks adds another layer of operational risk, potentially leading to penalties and reputational damage.

| Threat Category | Specific Threat | Impact | Data Point (2024/2025) |

|---|---|---|---|

| Competition | Aggressive pricing by rivals | Reduced profit margins, market share erosion | Intense competition in commercial lines |

| Regulatory Environment | Data privacy and cybersecurity mandates | Compliance costs, potential fines | Average data breach cost: $5.15 million (2024) |

| Economic Factors | Economic slowdown/inflation | Decreased client spending on services | Slowing economic growth in key markets |

| Market Dynamics | Premium rate softening | Reduced revenue and profitability | Potential 5% decrease in average premium rates |

| Operational Risks | Integration of acquired entities | Service quality dilution, system complexity | 27 acquisitions completed in 2023 |

SWOT Analysis Data Sources

This Gallagher SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and actionable assessment.