Gallagher Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

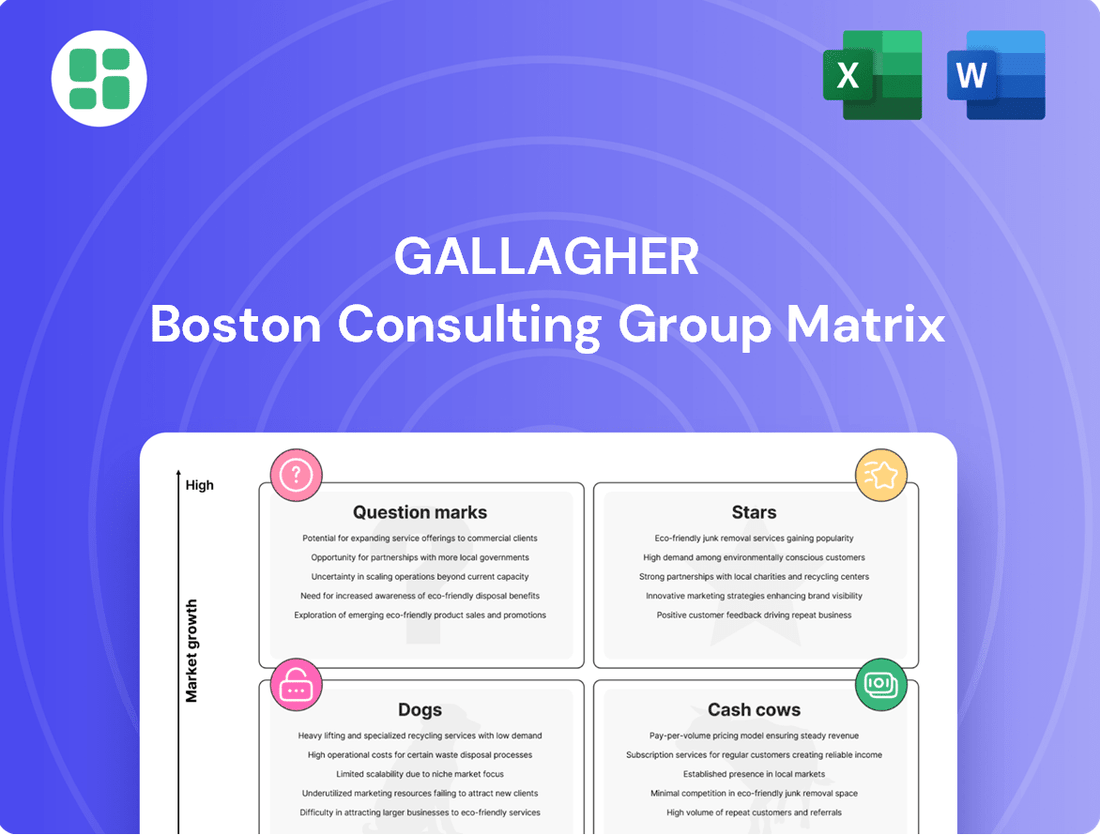

Uncover the strategic positioning of a company's product portfolio with the Gallagher BCG Matrix, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This insightful framework helps identify growth opportunities and resource allocation needs. Purchase the full BCG Matrix for a comprehensive analysis, actionable strategies, and a clear roadmap to optimize your business's market performance.

Stars

Cyber Risk & Insurance Solutions is a star performer for Gallagher, reflecting the booming global cyber insurance market. This sector is projected for double-digit annual growth, with premiums expected to surpass $16 billion by 2025. Gallagher's strategic emphasis here taps into a critical and expanding need.

The increasing frequency and sophistication of cyber threats, coupled with stricter data privacy regulations, are fueling demand for robust cyber insurance. Gallagher's comprehensive offerings in this space underscore its strong position and ability to capture significant market share in this high-growth segment.

Gallagher's strategic focus on specialty broking, bolstered by consistent acquisitions of firms with niche expertise, positions it strongly in high-growth, specialized insurance markets. This approach allows them to cater to evolving client needs in complex or developing risk environments, driving higher margins and market share.

In 2024, Gallagher's ongoing investment in specialty areas, including cyber, environmental, and professional liability, reflects a commitment to capturing leadership in emerging niches. For instance, the cyber insurance market alone saw significant growth, with premiums projected to reach over $10 billion globally by the end of 2024, presenting a clear opportunity for Gallagher's specialized broking capabilities.

Gallagher's strategic approach to global expansion, focusing on 'tuck-in' acquisitions in around 130 countries, is a clear indicator of its ambition to secure significant market share in rapidly growing international markets. This aggressive yet targeted expansion fuels its revenue growth by entering new territories and enhancing its existing service portfolio.

The company's commitment to broadening its international presence allows it to effectively leverage diverse market conditions and emerging opportunities across the globe. For instance, Gallagher's revenue from its International segment grew by 12.9% on a constant currency basis in the first quarter of 2024, reaching $546.8 million, underscoring the success of this global strategy.

AI-Powered Analytics and Advisory

Gallagher's AI-powered analytics and advisory services are positioned as a Star in the BCG matrix, reflecting their high growth potential and strong market position within the insurance sector.

The integration of AI is revolutionizing efficiency and data analysis in insurance, and Gallagher's commitment to these advanced capabilities is a key driver for this classification. These services enhance risk assessment, refine underwriting, and create more sophisticated client solutions, thereby solidifying Gallagher's competitive advantage.

With businesses actively seeking data-driven strategies for risk management, Gallagher's expertise in AI-powered analytics is set to capture significant market share. For instance, the global AI in insurance market was valued at approximately USD 2.5 billion in 2023 and is projected to grow substantially, with Gallagher well-placed to benefit from this expansion.

- Enhanced Risk Assessment: AI algorithms analyze vast datasets to identify and quantify risks with greater accuracy than traditional methods, leading to more precise pricing and coverage.

- Improved Underwriting Precision: AI enables faster and more accurate underwriting decisions by automating data collection and analysis, reducing manual errors and speeding up the process.

- Advanced Client Solutions: Gallagher leverages AI to offer personalized risk management strategies and innovative insurance products tailored to specific client needs, driving client retention and acquisition.

- Market Growth Potential: The increasing demand for data-driven insights in risk management fuels the growth of AI in insurance, positioning Gallagher's services as a high-potential area for revenue generation.

ESG and Climate Risk Consulting

The increasing global emphasis on Environmental, Social, and Governance (ESG) criteria and climate change risks has created a significant growth opportunity in the consulting sector. Gallagher is actively positioning itself within this expanding market.

Gallagher's commitment is evident through its 2024 Impact Report, which details its ESG initiatives, and the strategic appointment of a Head of Climate Strategy. These actions underscore the firm's dedication to addressing evolving client needs in this critical area.

By offering expertise in managing physical, transition, and financial risks associated with environmental challenges, Gallagher is establishing a robust presence in this rapidly growing advisory field. This strategic focus aligns with the increasing demand for specialized ESG and climate risk consulting services.

- Growing Market Demand: The global ESG consulting market is projected to reach $20.6 billion by 2027, indicating substantial growth potential.

- Gallagher's Strategic Moves: The firm's 2024 Impact Report and the hiring of a Head of Climate Strategy highlight its proactive approach to ESG and climate risk.

- Comprehensive Risk Management: Gallagher assists clients in navigating physical risks (e.g., extreme weather), transition risks (e.g., policy changes), and financial risks tied to environmental factors.

- Expertise in a Niche Area: This specialization allows Gallagher to capitalize on the increasing need for specialized advice in a complex and evolving regulatory landscape.

Gallagher's Cyber Risk & Insurance Solutions, AI-powered analytics, and ESG/Climate Risk consulting are all positioned as Stars in the BCG matrix. These areas represent high-growth markets where Gallagher demonstrates strong competitive positioning and is actively investing to capture significant market share.

The company's strategic focus on these burgeoning segments, supported by targeted acquisitions and technological integration, highlights its adaptability and forward-thinking approach to capitalize on evolving client needs and market trends. This strategic alignment is crucial for sustained revenue growth and market leadership.

Gallagher's proactive engagement in these high-potential areas, such as the rapidly expanding cyber insurance market and the increasing demand for AI-driven insights, underscores its ability to identify and leverage lucrative opportunities. The firm’s commitment to innovation and specialized expertise in these sectors solidifies their Star status.

The global cyber insurance market alone is projected to exceed $16 billion by 2025, and the AI in insurance market was valued at approximately $2.5 billion in 2023, demonstrating the significant growth trajectories these areas represent for Gallagher.

| Business Unit | BCG Category | Market Growth | Gallagher's Position |

|---|---|---|---|

| Cyber Risk & Insurance Solutions | Star | High (Double-digit annual growth, >$16B by 2025) | Strong, leveraging increasing demand and sophisticated threats |

| AI-Powered Analytics & Advisory | Star | High (AI in insurance market ~ $2.5B in 2023, significant growth) | Well-positioned, enhancing efficiency and client solutions |

| ESG & Climate Risk Consulting | Star | High (ESG consulting market ~$20.6B by 2027) | Growing presence, addressing critical client needs and regulatory shifts |

What is included in the product

The Gallagher BCG Matrix analyzes a company's portfolio by product or business unit, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Clear visualization of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Gallagher's core Property & Casualty (P&C) brokerage is a definite cash cow, a bedrock of their operations. This segment consistently churns out substantial revenue and is a major contributor to the company's overall profits. It’s a mature business, so while growth might not be explosive, its stability and strong profit margins mean it reliably generates significant cash flow for Gallagher.

The longevity of Gallagher's client relationships, coupled with their extensive service offerings and a solid grip on established P&C markets, underpins this segment's success. Think of it as a well-oiled machine that keeps on delivering, even as other parts of the business explore new avenues.

Gallagher's large corporate employee benefits consulting is a prime example of a Cash Cow. This segment operates in a mature, stable market where Gallagher has cemented a strong presence. These critical services, encompassing health insurance, retirement plans, and wellness programs, are non-negotiable for large enterprises, guaranteeing consistent, recurring revenue streams.

The demand for comprehensive employee benefits remains robust, with the U.S. employee benefits consulting market valued at approximately $15.2 billion in 2023 and projected to grow at a modest CAGR of 3.5% through 2030. Gallagher's established expertise and deep client relationships in this area translate into reliable cash generation, requiring minimal incremental investment for promotion or market expansion.

Gallagher Bassett, Gallagher's third-party claims administration (TPA) unit, stands as a significant player, recognized as one of the world's largest in this space. This position suggests a strong market share within a mature and steady service industry.

The TPA segment is a consistent revenue generator, driven by the high volume of claims managed for a diverse client base. This stability is a hallmark of established businesses in predictable sectors.

While TPA services typically exhibit lower growth rates due to their mature nature, they offer highly predictable and substantial cash flows. These reliable earnings are crucial for funding other, potentially higher-growth initiatives within the broader Gallagher organization.

General Risk Management Consulting Services

Gallagher's general risk management consulting services, encompassing areas like risk control and advisory, cater to a broad and stable client base. These essential services address ongoing needs within mature industries, providing a reliable revenue stream.

The significant market share Gallagher holds in this fundamental service sector translates into consistent cash flow. This stability is further bolstered by relatively predictable and manageable investment requirements, characteristic of cash cow businesses.

- Steady Income Generation: Ongoing client needs in mature sectors ensure consistent revenue.

- High Market Share: Dominance in essential risk management services provides a strong foundation.

- Stable Investment Needs: Lower reinvestment requirements compared to growth-oriented businesses.

- Reduced Volatility: Less susceptible to market fluctuations due to the essential nature of services.

Global Reinsurance Brokerage

Gallagher's Global Reinsurance Brokerage operates as a Cash Cow within its business portfolio. This segment benefits from its position as a major player in a mature, stable market, enabling consistent revenue generation through established relationships and recurring commission streams.

The reinsurance market is characterized by large, predictable transactions, which translates into a reliable and substantial cash flow for Gallagher. This stability is a hallmark of a Cash Cow, requiring less investment for maintenance while yielding significant returns.

- Stable Revenue: Gallagher's reinsurance operations consistently generate substantial commissions and fees due to the recurring nature of risk transfer agreements.

- Mature Market Dominance: Leveraging its significant global presence, Gallagher benefits from long-term partnerships and a well-established infrastructure in the reinsurance sector.

- Low Investment Needs: As a mature business, the reinsurance brokerage requires minimal capital expenditure for growth, allowing it to be a strong generator of free cash flow.

- Contribution to Cash Flow: In 2023, the global reinsurance market saw robust activity, with major reinsurers reporting strong premium growth, indicating the significant cash-generating potential Gallagher taps into.

Gallagher's core Property & Casualty (P&C) brokerage is a definite cash cow, a bedrock of their operations. This segment consistently churns out substantial revenue and is a major contributor to the company's overall profits. It’s a mature business, so while growth might not be explosive, its stability and strong profit margins mean it reliably generates significant cash flow for Gallagher.

The longevity of Gallagher's client relationships, coupled with their extensive service offerings and a solid grip on established P&C markets, underpins this segment's success. Think of it as a well-oiled machine that keeps on delivering, even as other parts of the business explore new avenues.

Gallagher's large corporate employee benefits consulting is a prime example of a Cash Cow. This segment operates in a mature, stable market where Gallagher has cemented a strong presence. These critical services, encompassing health insurance, retirement plans, and wellness programs, are non-negotiable for large enterprises, guaranteeing consistent, recurring revenue streams.

The demand for comprehensive employee benefits remains robust, with the U.S. employee benefits consulting market valued at approximately $15.2 billion in 2023 and projected to grow at a modest CAGR of 3.5% through 2030. Gallagher's established expertise and deep client relationships in this area translate into reliable cash generation, requiring minimal incremental investment for promotion or market expansion.

Gallagher Bassett, Gallagher's third-party claims administration (TPA) unit, stands as a significant player, recognized as one of the world's largest in this space. This position suggests a strong market share within a mature and steady service industry.

The TPA segment is a consistent revenue generator, driven by the high volume of claims managed for a diverse client base. This stability is a hallmark of established businesses in predictable sectors.

While TPA services typically exhibit lower growth rates due to their mature nature, they offer highly predictable and substantial cash flows. These reliable earnings are crucial for funding other, potentially higher-growth initiatives within the broader Gallagher organization.

Gallagher's general risk management consulting services, encompassing areas like risk control and advisory, cater to a broad and stable client base. These essential services address ongoing needs within mature industries, providing a reliable revenue stream.

The significant market share Gallagher holds in this fundamental service sector translates into consistent cash flow. This stability is further bolstered by relatively predictable and manageable investment requirements, characteristic of cash cow businesses.

- Steady Income Generation: Ongoing client needs in mature sectors ensure consistent revenue.

- High Market Share: Dominance in essential risk management services provides a strong foundation.

- Stable Investment Needs: Lower reinvestment requirements compared to growth-oriented businesses.

- Reduced Volatility: Less susceptible to market fluctuations due to the essential nature of services.

Gallagher's Global Reinsurance Brokerage operates as a Cash Cow within its business portfolio. This segment benefits from its position as a major player in a mature, stable market, enabling consistent revenue generation through established relationships and recurring commission streams.

The reinsurance market is characterized by large, predictable transactions, which translates into a reliable and substantial cash flow for Gallagher. This stability is a hallmark of a Cash Cow, requiring less investment for maintenance while yielding significant returns.

- Stable Revenue: Gallagher's reinsurance operations consistently generate substantial commissions and fees due to the recurring nature of risk transfer agreements.

- Mature Market Dominance: Leveraging its significant global presence, Gallagher benefits from long-term partnerships and a well-established infrastructure in the reinsurance sector.

- Low Investment Needs: As a mature business, the reinsurance brokerage requires minimal capital expenditure for growth, allowing it to be a strong generator of free cash flow.

- Contribution to Cash Flow: In 2023, the global reinsurance market saw robust activity, with major reinsurers reporting strong premium growth, indicating the significant cash-generating potential Gallagher taps into.

| Business Segment | BCG Category | Key Characteristics | 2023 Data Point | Growth Outlook |

|---|---|---|---|---|

| Property & Casualty Brokerage | Cash Cow | Mature market, stable revenue, strong client retention | Significant contributor to overall revenue and profit | Modest, stable growth |

| Employee Benefits Consulting (Large Corporate) | Cash Cow | Essential services, recurring revenue, established market presence | U.S. market valued at $15.2 billion in 2023 | CAGR of 3.5% through 2030 |

| Gallagher Bassett (TPA) | Cash Cow | High volume of claims, predictable cash flows, mature industry | One of the world's largest TPA providers | Lower growth, high stability |

| Risk Management Consulting | Cash Cow | Broad client base, ongoing needs, stable investment requirements | Significant market share in essential services | Stable, predictable revenue |

| Global Reinsurance Brokerage | Cash Cow | Mature market, recurring commissions, predictable transactions | Robust activity in the global reinsurance market in 2023 | Stable cash flow generation |

Delivered as Shown

Gallagher BCG Matrix

The Gallagher BCG Matrix analysis you are previewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no incomplete sections – just a professionally formatted and data-rich report ready for your immediate strategic application. You're not seeing a sample; you're viewing the exact deliverable that will empower your business decisions. This comprehensive analysis is designed to provide clear insights into your product portfolio's market position and potential, all within a ready-to-use format.

Dogs

In the highly commoditized space of basic Property & Casualty insurance for very small businesses, Gallagher likely encounters significant price competition. This can make it challenging to establish a distinct competitive advantage, potentially leading to low market share and minimal growth contributions.

These undifferentiated offerings might consume valuable resources without generating substantial returns, a common challenge for businesses operating in saturated markets. For instance, in 2024, the small business P&C market saw an average premium increase of only 3.5%, significantly lower than specialized lines, indicating intense pricing pressure.

Given their potential underperformance, these segments could be prime candidates for divestiture or a thorough strategic re-evaluation to optimize resource allocation and focus on more profitable areas. This approach aligns with strategic portfolio management principles to ensure capital is directed towards areas with higher growth potential and competitive differentiation.

Legacy manual claims processing, representing operations not yet fully integrated into Gallagher's advanced TPA systems, would likely be positioned in the Dogs quadrant of the BCG Matrix. These processes are characterized by low growth potential, as automation continues to dominate the insurance landscape, and typically exhibit low market share due to their inherent inefficiencies.

These manual systems are resource-intensive, consuming valuable time and capital without generating commensurate returns, a common trait of Dogs. For instance, a 2024 industry report indicated that manual claims processing can lead to a 30-50% increase in operational costs compared to automated solutions, highlighting their economic disadvantage.

Gallagher's strategy for these legacy operations would likely involve either significant streamlining to improve efficiency or a complete divestment to reallocate resources towards higher-growth, more profitable segments of its business.

These are consulting units acquired by Gallagher that haven't found their footing. They are often small, specialized practices that haven't been effectively woven into the larger Gallagher fabric. This means they lack a clear, standout offering that clients can easily identify and value.

The consequence is that these niche consultancies might be stuck in slow-growing areas of the market or simply aren't capturing enough business. This leads to them not being very profitable and, worse, they can end up draining resources that could be better used elsewhere within Gallagher.

For example, a hypothetical niche consulting practice acquired in 2023 focusing on a very specific regulatory compliance for a shrinking industry might have seen its revenue grow by only 2% in 2024, significantly underperforming Gallagher's average growth rate of 8%. Such units require a serious look to see if they can be improved or if it's time to let them go.

Redundant Regional Brokerage Operations

Following Gallagher's active acquisition approach, some newly acquired regional brokerage offices may exhibit overlapping client bases or service areas. This redundancy can lead to internal competition and operational inefficiencies, potentially classifying them as Question Marks or Dogs in the BCG Matrix if their market share and growth prospects are low.

These redundant operations, if not efficiently integrated, could represent cash traps. For instance, if a newly acquired regional office in a mature market has a market share below 10% and experiences less than 5% annual growth, it might require significant investment for consolidation or optimization without yielding substantial returns. Gallagher's 2024 strategy likely focuses on identifying and addressing such inefficiencies to free up capital for higher-growth opportunities.

- Redundant Operations: Overlapping client bases or geographic coverage from acquisitions.

- Low Growth/Share: Potential classification as Dogs if market share and growth are minimal.

- Cash Traps: Inefficient operations diverting resources from more promising ventures.

- Strategic Solution: Consolidation or specialization is crucial for optimization.

Commoditized Benefits Administration for Small Firms

Providing basic, commoditized benefits administration to very small businesses, a segment characterized by fragmentation and intense competition, could be considered a 'Dog' within Gallagher's portfolio. This area often yields low profit margins and demands significant administrative resources for relatively modest revenue. For instance, in 2024, the average small business (1-50 employees) spends approximately $4,000 annually on benefits administration, a figure that reflects the cost-sensitivity of this market.

These services typically lack the scalability that drives profitability in larger corporate solutions. Gallagher might struggle to gain substantial market share or achieve strong profitability in this segment unless there's a significant investment in technology to streamline operations and reduce per-client administrative costs. The market for basic benefits administration for small firms is estimated to be worth $8 billion in the US in 2024, but it's highly saturated.

- Low Profitability: Margins are typically thin, often in the single digits for basic services.

- High Administrative Overhead: Servicing numerous small clients requires substantial administrative effort per dollar of revenue.

- Lack of Scalability: The business model is difficult to scale efficiently without significant technological advancements.

- Intense Competition: The market is crowded with providers, driving down prices and limiting differentiation.

Businesses or product lines categorized as Dogs in the BCG Matrix typically exhibit low market share and operate in low-growth industries. These segments often consume more resources than they generate in returns, making them candidates for divestment or significant restructuring. For example, Gallagher's legacy manual claims processing systems, which are resource-intensive and inefficient compared to automated solutions, likely fall into this quadrant. In 2024, the cost of manual claims processing was estimated to be 30-50% higher than automated methods, underscoring their economic disadvantage.

Similarly, niche consulting units acquired by Gallagher that haven't integrated well or operate in shrinking markets also represent potential Dogs. These units may have seen minimal revenue growth, like a hypothetical 2% growth in 2024 for a specialized regulatory compliance practice, far below Gallagher's overall average growth. Basic, commoditized benefits administration for very small businesses, a saturated market with thin margins, also fits this profile. The US market for small business benefits administration was valued at $8 billion in 2024, but intense competition limits profitability and scalability.

Redundant operations from acquisitions, if not efficiently integrated, can also become Dogs. These might include regional brokerage offices with overlapping client bases and low market share (under 10%) and minimal growth (under 5% annually), as observed in some 2024 integration efforts. Such units can act as cash traps, diverting capital from more promising ventures. Gallagher's strategy likely involves consolidating or divesting these underperforming assets to optimize resource allocation.

The core characteristic of Dogs is their inability to generate significant cash flow or market growth. They are often found in mature or declining markets where competition is fierce and differentiation is difficult. Gallagher's approach to these segments would typically involve a strategic decision: either invest heavily to turn them around, which is often not cost-effective, or divest them to free up capital for more promising areas of the business.

Question Marks

Gallagher's incubation and partnerships in Insurtech ventures align with the Question Marks quadrant of the BCG matrix. These are areas with high growth potential but low current market share for Gallagher. For instance, Gallagher's 2024 investment in a new AI-driven claims processing platform, aiming to automate 70% of routine claims by 2025, exemplifies this strategy. Such initiatives are crucial for future disruption.

Blockchain-based insurance solutions, including smart contracts for automated claims processing and decentralized data management, represent a frontier of innovation in the insurance sector. While these technologies promise greater efficiency, transparency, and reduced fraud, their adoption remains nascent. For instance, the global blockchain in insurance market was valued at approximately USD 250 million in 2023 and is projected to grow significantly, but this still represents a small fraction of the overall insurance market.

The potential for disruption is substantial, with applications ranging from parametric insurance triggered by verifiable data to secure digital identities for policyholders. However, significant hurdles remain, including regulatory uncertainty, the need for industry-wide standardization, and the substantial investment required for research and development. This combination of high growth potential and significant adoption challenges positions blockchain-based insurance firmly in the Question Mark quadrant of the BCG matrix.

Gallagher's recent small-scale entries into emerging international markets, such as selective acquisitions in Southeast Asia or Eastern Europe, represent classic Question Marks in the BCG Matrix. These regions, while offering significant growth potential due to rapidly expanding economies and evolving regulatory landscapes, demand substantial upfront investment for infrastructure development and market penetration. For instance, Gallagher's reported investment in establishing a new underwriting hub in Vietnam during 2024, aiming to tap into its burgeoning middle class and increasing demand for specialized insurance, exemplifies this strategy. The success of these ventures is far from assured, making their future profitability a key question.

Proprietary Digital Client Engagement Platforms

Gallagher's development and rollout of new, proprietary digital client engagement platforms aim to meet the increasing demand for digital interactions, self-service options, and advanced advisory capabilities. These platforms represent a strategic move to enhance client experience and operational efficiency.

However, the current market adoption for these new platforms might be low, and their competitive differentiation against established or emerging industry solutions needs to be clearly defined and communicated. Significant investment is crucial to accelerate adoption and secure a competitive edge in this dynamic digital landscape.

- Market Penetration: While specific adoption rates for Gallagher's proprietary platforms are not publicly detailed, the broader insurance technology sector saw significant investment in digital client portals and engagement tools throughout 2024, with many firms prioritizing these solutions to improve customer retention and acquisition.

- Investment Focus: Companies in the financial services sector, including insurance brokers, are allocating substantial resources towards digital transformation. For instance, industry reports from late 2024 indicated that digital engagement platforms were a top three investment priority for many insurance intermediaries, with budgets often increasing by 15-20% year-over-year for such initiatives.

- Competitive Landscape: The market for digital client engagement is crowded, featuring solutions from established InsurTech providers and innovative startups. Gallagher's platforms must demonstrate unique value propositions, such as seamless integration with advisory services or superior data analytics, to stand out.

- Future Growth Strategy: To drive adoption, Gallagher will likely focus on user-friendly design, robust feature sets, and targeted marketing campaigns highlighting the benefits of self-service and enhanced advisory access, aiming to capture a larger share of the digitally-oriented client base in the coming years.

Advisory for Hyper-Niche, High-Growth Startups

For hyper-niche, high-growth startups, Gallagher can offer specialized risk management and benefits consulting. These emerging companies are expanding rapidly, but Gallagher's current client base within these specific micro-segments is still developing. This presents a significant future opportunity, though it demands tailored, resource-intensive services to establish market share.

These startups, often in sectors like advanced AI development or sustainable biotech, require a deep understanding of unique operational risks and employee benefit structures. For instance, a 2024 report indicated that venture capital funding for AI startups alone reached over $50 billion globally, highlighting the immense growth potential. Gallagher's ability to provide bespoke solutions in these areas, even with a nascent client portfolio, is crucial for capturing future market share.

- Targeting Emerging Industries: Focus on sectors with documented high growth, such as renewable energy technology or specialized software-as-a-service (SaaS) platforms.

- Resource Allocation: Dedicate specialized teams with expertise in niche risks and benefits to serve these clients effectively, acknowledging the higher initial investment.

- Tailored Service Offerings: Develop flexible consulting packages that address the specific, often complex, needs of fast-scaling startups.

- Long-Term Relationship Building: Prioritize building strong relationships to foster loyalty as these companies mature and their needs evolve.

Question Marks represent business units or ventures with low market share but operating in high-growth industries. Gallagher's strategic investments in Insurtech, emerging markets, and niche startup services clearly fall into this category. These initiatives require careful management and significant investment to convert potential into market leadership.

Gallagher's engagement with Insurtech startups, particularly those focused on AI and blockchain, aligns with the Question Mark quadrant. These ventures offer high growth potential within the rapidly evolving insurance landscape but currently represent a small portion of Gallagher's overall business. For example, Gallagher's 2024 investment in an AI claims processing platform aims to boost efficiency, a key indicator of future growth in this segment.

Emerging markets and specialized consulting for hyper-niche, high-growth startups also fit the Question Mark profile. Gallagher's expansion into Southeast Asia, including its 2024 Vietnam hub, and its tailored services for fast-scaling tech companies highlight this strategy. These areas promise substantial future returns but demand considerable upfront investment and strategic focus to gain traction.

The development of proprietary digital client engagement platforms positions Gallagher within the Question Mark quadrant. While these platforms aim to enhance client experience and operational efficiency, their market adoption and competitive differentiation are still being established. Industry reports from late 2024 showed digital engagement as a top investment priority, often with 15-20% year-over-year budget increases.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, industry market research, and competitive benchmarking to provide a comprehensive view of business unit performance and potential.