Gallagher PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

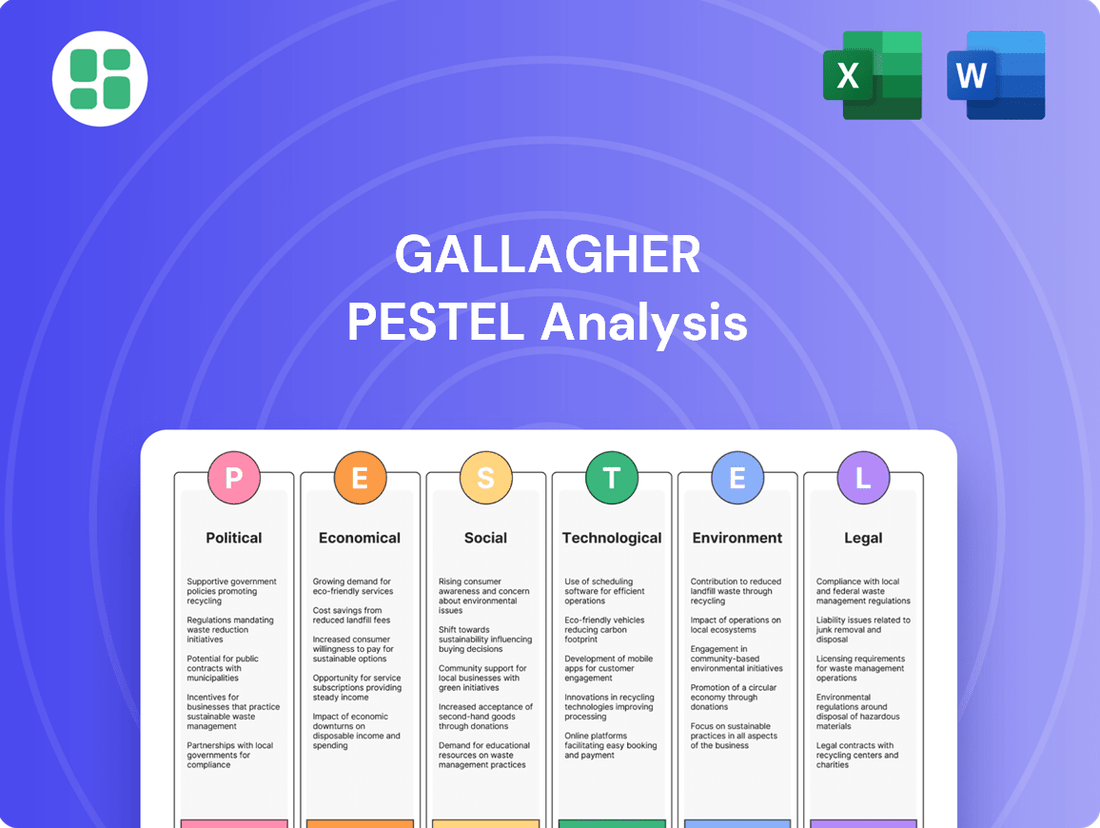

Navigate the complex external landscape impacting Gallagher with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental forces shaping their operations and future growth. Equip yourself with actionable intelligence to refine your own strategies and gain a competitive edge. Download the full analysis now for immediate insights.

Political factors

Gallagher, like all global insurance players, navigates a complex web of regulations that vary significantly by jurisdiction. Adhering to these rules, which cover everything from financial solvency to consumer data protection, is paramount for maintaining market presence and smooth operations. For instance, the implementation of the UK's Consumer Duty in 2023 and ongoing discussions around US state-level cybersecurity insurance mandates in 2024-2025 directly influence how Gallagher designs its products and manages its operational expenses.

Gallagher, as a global insurance broker and risk management firm, is significantly influenced by geopolitical stability and evolving trade policies. Political instability in key regions where Gallagher operates or serves clients can create significant headwinds. For instance, the ongoing conflicts and political realignments in Eastern Europe and the Middle East, as of mid-2025, continue to introduce uncertainty, potentially impacting client risk appetites and the demand for specialized coverage.

Trade policies are another critical political factor. The United States' approach to trade agreements and tariffs, which saw shifts throughout 2024 and is expected to remain a focus in 2025, directly affects the economic health of many of Gallagher's corporate clients. For example, increased tariffs on goods imported or exported between major economic blocs could reduce the revenue and operational stability of businesses, thereby altering their need for comprehensive insurance and risk mitigation strategies.

Furthermore, international relations play a crucial role. The state of diplomatic ties between nations can influence cross-border business activities and investment flows, which in turn impacts the insurance market. A strengthening of global trade alliances or the emergence of new protectionist measures will directly shape the landscape for Gallagher's international clients and its own global operational strategy.

Government healthcare policies, especially in the U.S., significantly impact Gallagher's employee benefits and consulting divisions. For instance, changes to the Affordable Care Act (ACA) or new federal/state mandates on coverage requirements directly shape the market for employer-sponsored health plans, influencing Gallagher's advisory services and product offerings.

Reforms such as expanded Medicaid eligibility or shifts in employer mandate enforcement can alter the demand for private employee benefits packages, a core area for Gallagher. As of late 2024, discussions around potential adjustments to ACA subsidies and employer reporting requirements continue, creating an environment where Gallagher's expertise in navigating these complex regulations is crucial for its clients.

Taxation Policies

Corporate taxation policies significantly influence Gallagher's bottom line and strategic decisions. Changes in income tax rates, capital gains taxes, and industry-specific levies directly affect profitability and the company's capacity for investment, including mergers and acquisitions. For instance, a shift in the US corporate income tax rate, which stood at 21% for much of 2024, could alter Gallagher's net earnings and its appetite for expansion.

International tax agreements and domestic tax reforms also play a crucial role. A revision in how foreign-earned income is taxed, or alterations to dividend tax treatments, can impact Gallagher's global financial performance and its ability to repatriate earnings for reinvestment. Such changes can influence the attractiveness of different markets for growth and M&A activities.

- Corporate Income Tax: The prevailing US federal corporate income tax rate of 21% impacts Gallagher's net profit.

- International Tax Landscape: Evolving tax treaties and regulations in countries where Gallagher operates can affect its global tax burden and cash flow.

- Capital Gains Tax: Changes in capital gains tax rates can influence the profitability of Gallagher's investment activities and divestitures.

- Industry-Specific Levies: Any specific taxes targeting the insurance or financial services sector could directly impact Gallagher's operating costs.

Governmental Stance on Mergers & Acquisitions

Gallagher's aggressive growth strategy hinges on strategic acquisitions, making governmental stance on mergers and acquisitions a key political factor. Regulatory bodies' scrutiny of market consolidation, including antitrust reviews, directly impacts Gallagher's ability to expand its global reach and service capabilities. For instance, the ongoing regulatory review of Gallagher's proposed acquisition of AssuredPartners in early 2024 highlights the critical nature of these governmental approvals.

The pace and success of Gallagher's expansion are therefore closely tied to the political climate surrounding M&A activity. In 2023, the US Federal Trade Commission (FTC) continued to signal a more robust approach to antitrust enforcement, potentially increasing the complexity and duration of regulatory reviews for large-scale transactions. This heightened oversight means that Gallagher must navigate a more stringent political landscape when pursuing its acquisition-driven growth agenda.

- Antitrust Scrutiny: Increased governmental focus on market concentration can lead to prolonged review periods and potential divestiture requirements for Gallagher's acquisitions.

- Regulatory Approvals: The speed and outcome of approvals from bodies like the FTC and European Commission are crucial for the timely execution of Gallagher's expansion plans.

- Policy Shifts: Changes in government policy regarding foreign investment or industry consolidation could present either opportunities or challenges for Gallagher's M&A strategy.

- Global Harmonization: Divergent regulatory approaches across different jurisdictions add another layer of political complexity to Gallagher's international acquisition efforts.

Governmental stability and policy continuity are crucial for Gallagher’s long-term planning, as political shifts can alter regulatory frameworks and market conditions. For example, the upcoming US presidential election in late 2024 and subsequent policy directions for 2025 introduce a degree of uncertainty regarding trade, regulation, and economic stimulus measures that impact the insurance sector.

The regulatory environment remains a significant political factor, with ongoing developments in data privacy laws and consumer protection impacting Gallagher's operational procedures. The EU's Digital Services Act and Digital Markets Act, fully in effect by early 2024, alongside evolving state-level regulations in the US concerning insurance data handling through 2025, necessitate continuous adaptation in Gallagher's compliance strategies.

Gallagher's growth through acquisitions is directly influenced by government attitudes towards market consolidation. Increased antitrust scrutiny, as observed with reviews of major insurance sector deals in 2024, can lead to longer approval timelines and potential divestiture requirements, impacting the pace and scope of Gallagher's strategic expansion efforts.

| Political Factor | Impact on Gallagher | Example/Data (2024-2025 Focus) |

|---|---|---|

| Government Stability & Policy Continuity | Affects market predictability and regulatory environment. | US election outcomes in late 2024 influencing economic and trade policies for 2025. |

| Regulatory Frameworks (Data Privacy, Consumer Protection) | Dictates operational procedures and compliance costs. | Ongoing adaptation to EU's DSA/DMA and evolving US state data regulations. |

| Mergers & Acquisitions Policy | Influences expansion strategy and deal execution. | Increased antitrust reviews of insurance sector consolidation in 2024. |

What is included in the product

The Gallagher PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

The global economy's trajectory significantly impacts the demand for insurance and risk management solutions. As of mid-2024, projections from institutions like the IMF suggest moderate global growth, but with persistent recession risks in several key regions. This creates a dual-edged sword for Gallagher: expansionary periods fuel demand for broader coverage, while downturns can lead to reduced client spending.

During economic upswings, businesses often increase their investments, leading to a higher need for property, casualty, and employee benefits insurance. For instance, a robust manufacturing sector expansion in 2024 could translate into greater demand for industrial property and liability coverage. Conversely, if a recession materializes, as some analysts warned for late 2024 or early 2025, clients might scale back on discretionary insurance purchases, potentially affecting Gallagher's revenue streams and profitability.

Interest rate fluctuations are a key economic factor for Gallagher. The company's substantial investment reserves mean that changes in interest rates directly affect its investment income. For instance, higher rates generally boost returns on these reserves, as seen in Gallagher's strong Q4 2024 performance where improved investment income contributed to profitability.

However, the impact isn't uniformly positive. Rising interest rates can also increase the cost of borrowing for Gallagher, potentially making future acquisitions more expensive. Furthermore, clients may adjust their investment strategies in response to changing rate environments, which could influence the demand for Gallagher's services.

Inflation significantly impacts the cost of insurance claims, especially for property and casualty insurance. For example, the U.S. Consumer Price Index (CPI) for all items rose by 3.4% in April 2024 compared to the previous year, indicating that the cost of goods and services, including repairs and replacements, has gone up. This means insurers face higher payouts for claims.

While insurers might increase premium rates to offset these rising claims costs, striking the right balance is key to profitability. If premiums rise too quickly, it can deter customers, while if they don't rise enough, underwriting losses can occur. For instance, many property insurers in 2024 have been forced to implement substantial rate increases, sometimes exceeding 10%, to cope with escalating repair and reconstruction costs driven by inflation.

Insurance Market Cycles (Hard vs. Soft Markets)

The insurance industry is inherently cyclical, oscillating between hard and soft market conditions which significantly impact pricing and the availability of coverage. A hard market is defined by rising premiums, stricter underwriting, and reduced capacity, while a soft market features lower premiums, more competitive terms, and increased capacity. Gallagher, as a major insurance broker, navigates these shifts by leveraging its expertise to secure optimal terms for clients.

Entering 2024 and extending into 2025, the insurance market has largely remained in a hard market phase, with many lines of business experiencing substantial renewal premium increases. This trend is particularly pronounced in casualty insurance, where reinsurers have been more cautious, leading to higher primary pricing. This environment directly benefits Gallagher's brokerage segment, as clients require more sophisticated advice and placement strategies to manage escalating costs and secure necessary coverage.

Gallagher's strategic approach to these market cycles is crucial for its sustained growth and client service. This involves:

- Adapting pricing strategies: Adjusting brokerage fees and client advice to reflect the prevailing market conditions and the value provided in securing coverage.

- Managing risk appetite: Guiding clients on appropriate risk retention levels and coverage limits in a high-premium environment.

- Optimizing capacity deployment: Working with a broad panel of insurers and reinsurers to access available capacity and negotiate the best possible terms for clients, even in challenging markets.

Currency Exchange Rate Volatility

Gallagher's extensive global footprint, spanning around 130 countries, inherently exposes its revenues and expenses to the ebb and flow of currency exchange rates. This inherent exposure means that significant swings in foreign exchange markets can directly influence the company's reported financial results. When earnings generated in foreign currencies are converted back into Gallagher's reporting currency, the prevailing exchange rate at that time dictates the final translated value, impacting overall global revenue and profitability.

For instance, a stronger US dollar relative to other operating currencies would translate foreign earnings into a lower dollar amount, potentially dampening reported revenue growth. Conversely, a weaker dollar could boost reported foreign earnings. This volatility is a constant factor that financial analysts and management must monitor closely.

In 2023, Gallagher reported total revenue of $10.4 billion. The impact of currency fluctuations on this figure is a key consideration for understanding the organic growth versus the translated impact of its international operations. While specific figures for currency impact are often detailed in financial reports, the general principle remains: exchange rate volatility is a material factor in assessing Gallagher's financial performance.

- Global Operations Exposure: Gallagher's presence in approximately 130 countries creates a direct link between its financial performance and currency exchange rate movements.

- Translation Risk: Fluctuations in exchange rates affect the reported value of foreign earnings when translated into Gallagher's primary reporting currency, influencing top-line revenue and bottom-line profitability.

- Impact on Revenue and Profitability: Significant currency volatility can distort the true growth of international segments, making it crucial to analyze both reported and constant currency figures.

- 2023 Revenue Context: With $10.4 billion in revenue in 2023, understanding the currency translation effects is vital for a clear picture of Gallagher's operational performance across its diverse markets.

Economic factors significantly shape the insurance landscape, influencing demand, pricing, and investment returns for companies like Gallagher. Global growth projections for 2024, while indicating moderation, also carry recessionary risks, directly impacting client spending on insurance. Higher interest rates, as observed in late 2023 and early 2024, have boosted investment income for insurers but also increased borrowing costs. Inflation, with the US CPI at 3.4% year-over-year in April 2024, escalates claims costs, necessitating premium adjustments. The insurance market's persistent hard market conditions in 2024, marked by rising premiums, particularly in casualty lines, create opportunities for brokers like Gallagher to demonstrate value by navigating complex placements.

| Economic Factor | Impact on Gallagher | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences demand for insurance products; recessionary risks can reduce client spending. | Moderate global growth projected by IMF, but with persistent recession risks in key regions. |

| Interest Rates | Affects investment income on reserves and cost of borrowing. | Higher rates generally boost investment income; impact on borrowing costs depends on Gallagher's debt levels. |

| Inflation | Increases the cost of insurance claims, especially for property and casualty. | US CPI at 3.4% year-over-year in April 2024, driving up repair and replacement costs. |

| Insurance Market Cycle | Hard markets (rising premiums) benefit brokers by increasing demand for expertise. | Market remains largely in a hard phase, with significant renewal premium increases in many lines. |

Preview the Actual Deliverable

Gallagher PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Gallagher PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain a deep understanding of the external forces shaping Gallagher's strategic landscape.

Sociological factors

Global demographics are shifting, with many developed nations experiencing an aging workforce. This trend, coupled with the increasing presence of younger generations like Gen Z in the labor market, directly impacts the demand for employee benefits and retirement solutions. For instance, an older workforce may prioritize robust health insurance and pension plans, while younger workers often seek flexible work arrangements and mental health support.

Gallagher needs to adapt its consulting services and product offerings to meet these evolving workforce needs. This includes developing strategies for flexible benefits packages, enhancing mental health and well-being programs, and implementing diverse talent attraction and retention strategies. By 2024, it's estimated that over 20% of the workforce in countries like Japan and Italy will be aged 65 and over, highlighting the urgency for tailored solutions.

Public and corporate understanding of complex risks, especially cybersecurity, is on the rise. This heightened awareness fuels a greater demand for specialized insurance and expert risk management advice. Gallagher is well-positioned to capitalize on this trend.

The escalating frequency and evolving tactics of cyberattacks are compelling businesses to actively seek robust protection. This creates substantial growth avenues for Gallagher's cyber insurance solutions. For instance, the global cyber insurance market size was estimated to be around $11.5 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $30 billion by 2028.

Consumers now demand digital convenience for all services, including insurance. This means they expect to buy policies, manage accounts, and file claims online or via mobile apps, all with a personalized touch. For instance, in 2024, a significant portion of insurance renewals and new policy purchases were initiated digitally, reflecting this trend.

Gallagher must prioritize investment in robust digital platforms and user-friendly mobile applications. Offering self-service portals where clients can easily access policy information, make payments, and track claims is crucial. This focus on digital enhancement is key to meeting evolving customer expectations and improving overall service delivery efficiency.

ESG (Environmental, Social, Governance) Considerations

Societal expectations are increasingly shaping business operations, compelling companies like Gallagher to prioritize Environmental, Social, and Governance (ESG) factors. Clients, investors, and regulators are demanding greater transparency and demonstrable commitment to sustainability and ethical practices. For instance, a 2024 survey indicated that over 70% of institutional investors consider ESG performance a material factor in their investment decisions.

Gallagher's proactive approach to ESG, encompassing diversity, equity, and inclusion (DEI) initiatives and sustainable business operations, directly impacts its brand perception and ability to attract and retain clients. In 2023, Gallagher reported a 15% increase in employee participation in its sustainability programs, reflecting growing internal engagement with these crucial issues.

The company's ESG performance influences its attractiveness to a broader investor base, with many funds specifically screening for strong ESG credentials. Gallagher's 2024 sustainability report highlighted a 10% reduction in its carbon footprint compared to 2022, a tangible metric that resonates with environmentally conscious stakeholders.

- Growing Investor Demand: Over 70% of institutional investors in 2024 viewed ESG as a material factor in investment decisions.

- Client Expectations: Clients are increasingly seeking partners with demonstrable commitments to sustainability and ethical conduct.

- Reputational Impact: Strong ESG performance enhances Gallagher's brand image and client relationships.

- Employee Engagement: Gallagher saw a 15% rise in employee participation in sustainability programs in 2023.

Talent Attraction and Retention

Gallagher's success hinges on its ability to attract and retain top talent, especially in critical fields like risk analytics, cybersecurity, and global benefits. These specialized skills are fundamental to delivering high-quality client services and driving innovation within the company.

Societal shifts significantly influence these talent dynamics. Evolving expectations around work-life balance, the persistent demand for competitive compensation packages, and the growing importance of a positive and inclusive company culture are all key factors impacting Gallagher's talent acquisition and retention strategies. For instance, a 2024 report indicated that 70% of employees consider work-life balance a top priority when choosing an employer, and 65% expect flexible work arrangements.

- Talent Specialization: Gallagher's need for expertise in risk analytics, cybersecurity, and global benefits requires a focused approach to recruitment in these niche areas.

- Workforce Demographics: Understanding the preferences of younger generations entering the workforce, who often prioritize flexibility and purpose, is crucial for attracting and retaining them.

- Employee Value Proposition: Gallagher must continually adapt its compensation, benefits, and culture to meet the changing expectations of skilled professionals to remain competitive in the talent market.

Societal values are increasingly influencing business practices, pushing companies like Gallagher to prioritize Environmental, Social, and Governance (ESG) principles. Stakeholders, including clients and investors, are demanding greater transparency and a clear commitment to sustainability and ethical operations. A 2024 survey revealed that over 70% of institutional investors consider ESG performance a significant factor in their investment decisions, underscoring the financial implications of these societal shifts.

Gallagher's commitment to ESG, particularly its diversity, equity, and inclusion (DEI) efforts and sustainable business practices, directly impacts its brand reputation and its ability to attract and retain clients. In 2023, Gallagher observed a 15% increase in employee engagement with its sustainability initiatives, demonstrating a growing internal alignment with these critical values. Furthermore, the company's 2024 sustainability report highlighted a 10% reduction in its carbon footprint compared to 2022, a concrete achievement that appeals to environmentally conscious stakeholders.

| Societal Factor | Impact on Gallagher | Supporting Data (2023-2024) |

|---|---|---|

| Growing ESG Awareness | Increased demand for transparent and sustainable business practices. | 70%+ institutional investors consider ESG in decisions (2024). |

| Client & Investor Expectations | Need for demonstrable commitment to ethical operations and sustainability. | Clients increasingly seek partners with strong ESG credentials. |

| Brand Perception | Enhanced reputation and stronger client relationships through positive ESG performance. | Gallagher's 2023 sustainability report showed 15% employee participation increase in sustainability programs. |

| Environmental Responsibility | Focus on reducing carbon footprint and sustainable operations. | Gallagher reported a 10% carbon footprint reduction (vs. 2022) in its 2024 report. |

Technological factors

The insurance sector is undergoing a significant shift driven by digital transformation and Insurtech. Gallagher needs to embrace these changes by utilizing digital platforms and cloud computing to improve efficiency and client experience. Advanced analytics are also crucial for developing new products and staying competitive.

In 2024, Insurtech funding saw a notable surge, with global investment reaching billions, indicating strong market confidence in technology-driven insurance solutions. Gallagher's strategic focus on digital capabilities, including AI-powered underwriting and personalized customer portals, positions it to capitalize on this trend, aiming to streamline claims processing and offer more tailored risk management services.

Artificial Intelligence (AI) and machine learning are becoming indispensable for Gallagher, particularly in refining underwriting accuracy and streamlining claims processing. By leveraging AI, the company can analyze extensive datasets to pinpoint emerging risk patterns and automate repetitive tasks, thereby boosting operational efficiency and improving client experiences. For instance, in 2024, the insurance industry saw significant investment in AI for fraud detection, with some reports indicating potential savings of billions annually through advanced analytics.

Gallagher's strategic adoption of AI-powered tools allows for more precise risk assessment and the development of highly personalized client solutions. This technological advancement not only enhances the accuracy of risk identification but also frees up human capital for more complex, value-added client interactions. In 2025, it's projected that AI will further revolutionize personalized insurance offerings, allowing for dynamic pricing and coverage adjustments based on real-time data analysis.

Gallagher's reliance on digital systems makes it a target for cybersecurity threats, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, a significant increase from previous years. Protecting sensitive client data from breaches is crucial for maintaining trust and avoiding substantial financial penalties under regulations like GDPR and CCPA.

The increasing sophistication of cyberattacks, including ransomware and phishing schemes, necessitates continuous investment in advanced security measures. This evolving threat landscape directly fuels the demand for cyber insurance, a growing market segment where Gallagher, as a broker, can leverage its expertise.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling are critical for Gallagher's operations, enabling sophisticated risk assessment and more accurate pricing. The company's capacity to harness big data offers a distinct advantage in providing informed brokerage and risk management advice.

Leveraging these technologies allows Gallagher to refine underwriting processes and develop highly personalized client solutions, enhancing its competitive position in the market.

- Data-driven insights: Gallagher utilizes advanced analytics to process vast datasets, identifying trends and patterns for better risk evaluation.

- Predictive capabilities: Predictive modeling helps anticipate emerging risks and market shifts, allowing for proactive strategy development.

- Underwriting accuracy: Enhanced data analysis improves the precision of underwriting, leading to more competitive and appropriate pricing for clients.

- Tailored solutions: The ability to analyze client-specific data enables Gallagher to offer bespoke risk management and insurance products.

Automation of Processes

Automation technologies, such as Robotic Process Automation (RPA), are revolutionizing operational efficiency within the insurance sector. For Gallagher, this means automating routine administrative tasks in brokerage and claims management, leading to faster processing and fewer errors. For instance, a 2024 report indicated that companies adopting RPA saw an average reduction of 25% in processing times for customer onboarding.

By integrating automation, Gallagher can achieve significant cost reductions and improve overall processing speed. This strategic move also allows the company to redeploy its valuable human resources towards more complex, client-facing, and strategic initiatives. In 2025, the global RPA market is projected to reach $13.7 billion, highlighting the widespread adoption and expected benefits.

The impact of automation on Gallagher's operations can be further understood through these key benefits:

- Enhanced Efficiency: Automating repetitive tasks like data entry and policy issuance can boost productivity by up to 40%.

- Cost Reduction: Streamlining workflows through automation can lead to savings of 15-30% on operational costs.

- Improved Accuracy: Automated systems minimize human error, resulting in more reliable data and fewer claim disputes.

- Resource Optimization: Freeing up employees from mundane tasks allows them to focus on higher-value activities like customer relationship management and complex problem-solving.

Technological advancements are reshaping the insurance landscape, with Insurtech funding reaching billions globally in 2024, underscoring the sector's digital transformation. Gallagher's strategic investment in AI and machine learning is crucial for enhancing underwriting accuracy and streamlining claims, with AI projected to revolutionize personalized insurance offerings by 2025.

The company's embrace of automation, like RPA, is expected to reduce processing times by an average of 25% for tasks such as customer onboarding, as reported in 2024. Furthermore, Gallagher's reliance on digital systems necessitates robust cybersecurity measures, especially as global cybercrime costs are projected to hit $10.5 trillion annually by 2025, demanding continuous investment in advanced security.

Legal factors

Gallagher operates within a heavily regulated insurance sector, where staying compliant with evolving laws is paramount. Recent shifts, such as the UK's Consumer Duty implemented in 2023, place increased emphasis on fairness and consumer outcomes, impacting product design and client engagement strategies. These regulatory changes, often requiring significant investment in compliance infrastructure, directly influence operational costs and market access.

Gallagher must navigate a complex web of global data privacy and cybersecurity regulations. Laws like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) set stringent standards for handling personal information. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

The evolving landscape of data protection, including new state-level data security laws in the US, necessitates continuous adaptation. Non-compliance not only carries financial risks but also poses a significant threat to Gallagher's reputation and client trust. A data breach in 2023, for example, could cost companies millions in remediation and legal fees, impacting client retention.

Gallagher's aggressive acquisition strategy, a key driver of its expansion, faces scrutiny under antitrust and competition laws across the numerous jurisdictions where it operates. These regulations are designed to prevent any single entity from gaining excessive market power, which could stifle competition and harm consumers.

Regulatory bodies worldwide, including the U.S. Federal Trade Commission (FTC) and the European Commission, meticulously review significant mergers and acquisitions. For instance, Gallagher's proposed acquisition of AssuredPartners, valued at approximately $2.7 billion, would undoubtedly trigger such reviews. The outcome of these reviews can significantly influence the timing and feasibility of Gallagher's growth plans.

Delays or outright prohibitions stemming from antitrust concerns can create substantial headwinds for companies like Gallagher. Such regulatory hurdles can disrupt integration timelines, increase transaction costs, and even lead to the divestiture of certain assets, as has been a common requirement in past large-scale insurance broking mergers to satisfy competition authorities.

Employment and Labor Laws

Gallagher, as a significant global employer, must carefully adhere to a complex web of employment and labor laws. These regulations cover crucial areas such as employee benefits, compensation structures, workplace safety standards, and anti-discrimination policies across its various operating regions. Keeping abreast of evolving legal landscapes is paramount to maintaining compliance and operational efficiency.

Changes in employment legislation can directly influence Gallagher's operational expenditures and necessitate adjustments to its human resource strategies. For instance, shifts in minimum wage laws or mandated paid leave policies can alter labor costs. Furthermore, these legal modifications can impact the design and competitiveness of the employee benefit programs Gallagher offers to its diverse clientele, requiring agile adaptation of its service offerings.

In 2024, for example, several jurisdictions saw updates to parental leave policies, potentially increasing benefit costs for employers. Additionally, ongoing scrutiny of pay equity across genders and ethnicities in 2025 may require companies like Gallagher to conduct more rigorous compensation audits and implement corrective measures, impacting HR budgets and strategies.

- Employee Benefits: Navigating varying legal requirements for health insurance, retirement plans, and other benefits across different countries.

- Compensation: Adhering to minimum wage laws, overtime regulations, and pay equity mandates in all operating regions.

- Workplace Safety: Complying with occupational health and safety standards to prevent accidents and ensure a secure working environment.

- Discrimination: Implementing policies and training to prevent discrimination based on age, gender, race, religion, and other protected characteristics.

Litigation and Legal Liabilities

Gallagher's core business as an insurance broker and risk manager inherently involves potential litigation. This includes claims for errors and omissions, breach of contract, and professional negligence, where clients might allege inadequate advice or failure to secure appropriate coverage. The company must navigate a complex legal environment that can influence its financial stability and public image.

The frequency and severity of class-action lawsuits are particularly impactful. For instance, in 2023, the insurance industry saw a notable rise in litigation related to cybersecurity breaches and data privacy, areas where brokers play a crucial role in advising clients. Gallagher's exposure to such claims can lead to significant legal defense costs and potential settlements, directly affecting profitability.

- Errors & Omissions (E&O) Claims: Allegations of mistakes or oversights in policy placement or advice.

- Breach of Contract: Disputes arising from contractual obligations between Gallagher and its clients or insurance carriers.

- Professional Negligence: Claims that Gallagher failed to exercise reasonable professional care, leading to client losses.

- Class-Action Lawsuits: Potential for large-scale litigation impacting numerous clients simultaneously, increasing financial and reputational risk.

Gallagher's operations are subject to a dynamic legal framework, particularly concerning consumer protection and data handling. The implementation of the UK's Consumer Duty in 2023, for example, mandates a higher standard of care for consumers, impacting product development and client interaction strategies. Simultaneously, stringent data privacy laws like GDPR and CCPA, with potential fines reaching up to 4% of global turnover, necessitate robust compliance measures to mitigate significant financial and reputational risks.

Antitrust regulations pose a significant hurdle for Gallagher's growth-by-acquisition strategy, requiring careful navigation of merger reviews by bodies like the FTC and European Commission. The substantial $2.7 billion proposed acquisition of AssuredPartners, for instance, will undergo intense scrutiny, with potential outcomes ranging from approval to mandated divestitures, impacting deal timelines and overall strategic execution.

Employment law compliance is critical, covering diverse areas from compensation and benefits to workplace safety and anti-discrimination. In 2024, evolving parental leave policies and 2025's focus on pay equity may increase HR costs and necessitate proactive audits, influencing operational budgets and human capital management.

Gallagher faces inherent litigation risks, including errors and omissions claims and professional negligence. The increasing prevalence of class-action lawsuits, particularly those stemming from data breaches in 2023, escalates legal defense costs and potential settlement payouts, directly impacting the company's financial performance.

Environmental factors

The escalating frequency and intensity of climate-related natural disasters, such as the record-breaking wildfire seasons in 2023 and the widespread flooding events across Europe, pose a significant challenge to Gallagher's property and casualty insurance operations. These events directly translate into increased claims payouts, forcing the company to continuously adapt its underwriting practices and pricing models to reflect the evolving risk landscape.

Gallagher must implement innovative risk transfer mechanisms and enhance its catastrophe modeling capabilities to effectively manage the financial implications of these climate-driven events. For instance, the insurance industry saw a substantial increase in insured losses from natural catastrophes in 2023, with estimates from agencies like Swiss Re pointing to figures exceeding $100 billion globally, underscoring the urgent need for robust adaptation strategies.

The increasing emphasis on ESG mandates is significantly shaping Gallagher's operational framework and client advisory services. Stakeholder expectations for robust environmental, social, and governance reporting are driving a need for greater transparency and accountability across industries.

Gallagher is actively integrating ESG principles into its own business practices, recognizing that sustainability is no longer a niche concern but a core business imperative. This includes evaluating its own carbon footprint and social impact.

The firm is also positioned to assist clients in navigating their unique sustainability challenges, potentially developing new insurance products and consulting services focused on climate risk, supply chain resilience, and social responsibility. For instance, the global ESG investing market was projected to reach $33.9 trillion in 2021 and is expected to continue its upward trajectory, highlighting the significant opportunity for firms that can effectively address these needs.

Governments globally are intensifying oversight of environmental liability, particularly concerning climate-related financial disclosures for insurers. This regulatory shift mandates insurers like Gallagher to reveal their climate risk exposures and embed climate considerations into their underwriting, directly impacting risk assessment and compliance.

For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 requiring climate-related disclosures, though the final rule was scaled back. Similarly, the EU's Corporate Sustainability Reporting Directive (CSRD) significantly expands reporting obligations for companies, including insurers, effective from 2024 for some entities, pushing for greater transparency on environmental impacts and liabilities.

Client Demand for Green Insurance Products

Client demand for green insurance products is a significant environmental factor. As awareness of climate change grows, consumers and businesses are increasingly seeking insurance solutions that align with sustainability goals. This trend presents Gallagher with a clear opportunity to innovate and expand its offerings in this burgeoning market.

Gallagher can capitalize on this by developing specialized insurance products for sectors focused on environmental responsibility. This includes coverage for renewable energy projects, such as wind farms and solar installations, which are experiencing substantial growth. For instance, global investment in renewable energy reached an estimated $700 billion in 2024, highlighting the scale of this opportunity.

Furthermore, there's a rising need for insurance for eco-friendly businesses, covering aspects like sustainable supply chains and reduced environmental impact operations. The market for carbon credit insurance is also emerging, providing financial protection against the volatility and risks associated with carbon trading. By proactively addressing these evolving client needs, Gallagher can strengthen its market position and contribute to a more sustainable future.

- Growing Demand: Over 60% of consumers surveyed in a 2024 report indicated a preference for purchasing from brands with strong environmental commitments.

- Renewable Energy Growth: The global renewable energy sector is projected to see a compound annual growth rate (CAGR) of over 8% through 2028, creating a substantial market for specialized insurance.

- Eco-Business Insurance: Insuring businesses that actively reduce their carbon footprint and adopt circular economy principles is becoming a key differentiator.

- Carbon Market Insurance: The voluntary carbon market is expected to grow significantly, with potential for insurance products to mitigate risks in carbon credit origination and trading.

Supply Chain Disruptions due to Environmental Events

Environmental events, such as the record-breaking heatwaves and severe storms experienced globally in 2024, are increasingly disrupting supply chains. These disruptions directly impact Gallagher's clients, affecting everything from manufacturing to logistics and increasing the need for robust risk management strategies.

Gallagher must proactively develop and market insurance and risk advisory services tailored to these evolving environmental threats. This includes solutions designed to mitigate the financial and operational impacts of supply chain interruptions caused by climate-related events, fostering greater client resilience in a volatile world.

- Increased Frequency of Extreme Weather: 2024 saw a significant uptick in weather-related insured losses, with estimates placing global insured catastrophe losses in the tens of billions of dollars, directly impacting supply chain continuity.

- Resource Scarcity Impacts: Droughts and water shortages in key agricultural and manufacturing regions are creating material shortages, driving up costs and necessitating diversified sourcing strategies for Gallagher's clients.

- Supply Chain Resilience Solutions: Gallagher's offerings should focus on business interruption insurance, contingent business interruption coverage, and supply chain risk consulting to help clients navigate these environmental challenges.

The increasing frequency and severity of extreme weather events, such as the widespread flooding and severe storms observed in early 2024, directly impact Gallagher's property and casualty insurance business by driving up claims. This necessitates continuous adaptation of underwriting and pricing models to reflect the evolving climate risk landscape, with global insured losses from natural catastrophes estimated to have exceeded $100 billion in 2023 alone.

Gallagher is strategically positioned to assist clients in navigating sustainability challenges and developing new insurance products for climate risk and supply chain resilience. The global ESG investing market, projected to reach $33.9 trillion in 2021, continues its upward trend, presenting significant opportunities for firms adept at addressing these needs.

Client demand for green insurance products is a growing environmental factor, with over 60% of consumers in a 2024 survey preferring brands with strong environmental commitments. Gallagher can capitalize on this by offering specialized coverage for renewable energy projects, which saw global investment reach an estimated $700 billion in 2024, and for eco-friendly businesses.

| Environmental Factor | Impact on Gallagher | Opportunity/Mitigation | Relevant Data (2023-2025) |

|---|---|---|---|

| Extreme Weather Events | Increased claims, underwriting challenges | Enhanced catastrophe modeling, risk transfer solutions | Global insured losses from natural catastrophes >$100 billion (2023); significant uptick in weather-related insured losses (early 2024) |

| ESG Mandates & Client Demand | Need for transparency, new product development | Develop green insurance, ESG consulting services | ESG investing market significant and growing; >60% consumer preference for environmentally committed brands (2024 survey) |

| Renewable Energy Growth | Market expansion for specialized insurance | Offer coverage for solar, wind, and other green projects | Global renewable energy investment estimated at $700 billion (2024); renewable energy sector CAGR >8% through 2028 |

PESTLE Analysis Data Sources

Our Gallagher PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial news outlets, and leading industry research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable, current information.