Gallagher Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Curious about Gallagher's winning formula? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic blueprint for success. Discover how they achieve market dominance and unlock your own growth potential.

Partnerships

Gallagher’s extensive network of over 500 global insurance carriers and underwriters in 2024 is a cornerstone of its business model. These relationships grant Gallagher access to a diverse array of insurance products, enabling them to tailor solutions for clients with varied needs and risk exposures.

This broad carrier access allows Gallagher to negotiate competitive terms and conditions, ensuring clients receive optimal coverage and pricing. The depth of these partnerships is critical for navigating complex insurance markets and securing specialized coverage for niche industries.

Gallagher’s partnerships with reinsurers are crucial for managing significant risks and offering expanded capacity to clients. This allows them to handle complex insurance needs, particularly for substantial assets and niche insurance requirements.

These collaborations are vital for providing robust, all-encompassing solutions. The reinsurance market saw positive renewal outcomes for property and specialty risks in January 2025, suggesting Gallagher's active participation and the favorable conditions for such partnerships.

Gallagher's strategic alliances with technology providers are crucial for bolstering its digital infrastructure and analytical prowess. These collaborations are instrumental in delivering cutting-edge client solutions, such as sophisticated risk evaluation instruments and more efficient claims handling processes.

Key technology partners like Guidewire Software, Microsoft Azure, and Salesforce enable Gallagher to innovate and optimize its service offerings. For instance, Guidewire's insurance platform is central to modernizing Gallagher's core operations, enhancing customer experience and operational agility.

Acquired Firms and Their Principals

Gallagher's growth is heavily fueled by acquiring insurance brokerage and risk management businesses. These acquisitions are crucial for expanding Gallagher's reach and capabilities. The principals of these acquired firms are often retained, bringing valuable client relationships, specialized knowledge, and deep market understanding.

This strategy ensures a smooth transition and leverages the existing expertise within the acquired entities. In 2024 alone, Gallagher successfully integrated 48 new firms, a testament to the aggressive pace of its acquisition strategy. These deals directly contributed to a significant increase in the company's annualized revenue.

- Acquisition Volume: Gallagher completed 48 acquisitions in 2024.

- Revenue Impact: These acquisitions significantly boosted Gallagher's annualized revenue.

- Principal Retention: Retaining principals from acquired firms is a key strategy for continuity and leveraging expertise.

- Strategic Value: Acquired firms bring established client bases, specialized skills, and local market penetration.

Specialized Consulting Firms

Gallagher collaborates with specialized consulting firms to broaden its service offerings, especially in leadership development, human resources, and compensation strategies. These partnerships allow Gallagher to provide clients with a more comprehensive suite of advisory services that complement its core insurance and risk management solutions.

By integrating external expertise, Gallagher enhances its ability to address complex organizational challenges. For instance, the acquisition of Dion Leadership Inc. in 2025 significantly bolstered Gallagher's talent consulting practice, enabling the delivery of integrated solutions that cover talent acquisition, development, and retention.

- Expanded Advisory Services Partnering with specialized consultants allows Gallagher to offer expertise in areas like leadership, HR, and compensation, moving beyond traditional insurance.

- Holistic Client Solutions Acquisitions, such as Dion Leadership Inc. in 2025, integrate specialized talent consulting, providing clients with end-to-end talent management support.

- Strategic Capability Enhancement These partnerships are crucial for building a more robust advisory platform, directly addressing evolving client needs in talent and organizational effectiveness.

Gallagher's key partnerships are multifaceted, spanning insurance carriers, reinsurers, technology providers, and acquired entities. These collaborations are essential for sourcing diverse products, managing risk, enhancing digital capabilities, and expanding market reach.

The strategic acquisition of firms, such as the 48 integrated in 2024, directly fuels revenue growth and integrates specialized expertise. Furthermore, alliances with consulting firms, exemplified by the 2025 acquisition of Dion Leadership Inc., broaden advisory services, offering clients comprehensive talent and organizational solutions.

| Partner Type | Examples/Focus | 2024/2025 Impact |

|---|---|---|

| Insurance Carriers & Underwriters | 500+ global network | Access to diverse products, competitive terms |

| Reinsurers | Risk management, expanded capacity | Favorable renewal outcomes in January 2025 for property/specialty |

| Technology Providers | Guidewire, Microsoft Azure, Salesforce | Modernized operations, enhanced customer experience |

| Acquired Brokerages/Consultancies | 48 firms acquired in 2024; Dion Leadership Inc. (2025) | Revenue growth, expanded service offerings (e.g., talent consulting) |

What is included in the product

A strategic framework detailing Gallagher's core business components, including customer segments, value propositions, and revenue streams.

Provides a structured framework to systematically identify and address business model weaknesses, alleviating the pain of strategic uncertainty.

Activities

Gallagher's core activity of insurance brokerage and placement is central to its business model. This involves expertly matching client needs with the right insurance carriers across a wide spectrum of coverage, from property and casualty to employee benefits and specialized lines. The company's brokerage segment is a significant revenue generator, demonstrating robust growth with a notable increase in Q1 2025.

Gallagher's key activities revolve around delivering robust risk management and consulting services. This involves conducting thorough risk assessments, developing mitigation strategies, and offering expert advice to help businesses navigate intricate risk landscapes. For instance, in 2024, Gallagher continued to focus on emerging risks, offering specialized workshops to educate clients on evolving threats.

The company also provides critical risk control consulting and appraisals. These services are designed to directly assist clients in lowering their overall cost of risk, a crucial element for profitability and operational stability. Gallagher's commitment to this area helps businesses proactively manage potential financial and operational disruptions.

Gallagher's key activities include claims administration and management, primarily through its Gallagher Bassett subsidiary. This involves efficiently managing claims and acting as a strong advocate for their clients, a core component of their risk management services.

This crucial function directly impacts client satisfaction and retention. The risk management segment, which heavily relies on these claims services, demonstrated robust growth, with revenue increasing in Q1 2025, underscoring the effectiveness of their claims handling operations.

Mergers and Acquisitions (M&A)

Gallagher’s growth is significantly driven by its mergers and acquisitions (M&A) strategy, focusing on acquiring insurance brokerage and risk management firms worldwide. This approach broadens their market presence, diversifies service portfolios, and enhances their workforce capabilities.

The company's aggressive M&A pace is evident with 11 new mergers completed in the first quarter of 2025. This strategic expansion continued with the December 2024 announcement of their acquisition of AssuredPartners, a major move to bolster their market position.

Key M&A activities include:

- Global Expansion: Acquiring firms to increase geographic reach and client base.

- Service Diversification: Integrating specialized services to offer a more comprehensive suite of solutions.

- Talent Acquisition: Bringing in experienced professionals and leadership from acquired entities.

- Market Consolidation: Participating actively in industry consolidation to gain scale and competitive advantage.

Talent and Expertise Development

Gallagher prioritizes continuously investing in its global workforce's training and development to ensure they offer expert advice. This commitment to talent fosters deep industry knowledge and strong client relationships.

By focusing on retention, Gallagher maintains a skilled team capable of delivering innovative solutions. The company boasts over 56,000 employees worldwide, underscoring the scale of this key activity.

- Continuous Investment: Gallagher dedicates resources to ongoing training and professional development for its employees.

- Expertise Cultivation: This focus ensures professionals possess deep industry knowledge and essential interpersonal skills.

- Client-Centric Solutions: The development of talent directly supports the ability to provide expert advice and innovative solutions to clients.

- Global Workforce: Gallagher's commitment extends to its vast team of over 56,000 employees across the globe.

Gallagher's key activities are centered on providing comprehensive insurance brokerage and risk management services. This includes sourcing appropriate insurance coverage for clients, offering expert risk consulting, and managing claims efficiently through subsidiaries like Gallagher Bassett. The company's strategic mergers and acquisitions also form a critical activity, fueling expansion and service enhancement.

The company's focus on talent development ensures its workforce remains adept at delivering specialized advice and innovative solutions. This investment in people underpins Gallagher's ability to foster strong client relationships and maintain a competitive edge in the market.

Gallagher's commitment to its employees is evident in its continuous training programs, aiming to cultivate deep industry knowledge and client-centric approaches. This dedication to its global workforce of over 56,000 professionals is fundamental to its operational success and service delivery.

| Key Activity | Description | Recent Data/Impact |

|---|---|---|

| Insurance Brokerage & Placement | Matching client needs with insurance carriers across various coverage types. | Significant revenue driver, showing robust growth in Q1 2025. |

| Risk Management & Consulting | Conducting risk assessments, developing mitigation strategies, and providing expert advice. | Focus on emerging risks and client education in 2024. |

| Risk Control & Appraisals | Assisting clients in lowering their overall cost of risk. | Proactive management of financial and operational disruptions. |

| Claims Administration & Management | Efficiently managing claims and advocating for clients. | Core component of risk management services, supporting segment growth in Q1 2025. |

| Mergers & Acquisitions (M&A) | Acquiring insurance brokerage and risk management firms globally. | 11 new mergers completed in Q1 2025; acquisition of AssuredPartners announced December 2024. |

| Workforce Training & Development | Investing in employee training to ensure expert advice and client relationships. | Supports over 56,000 employees worldwide. |

Preview Before You Purchase

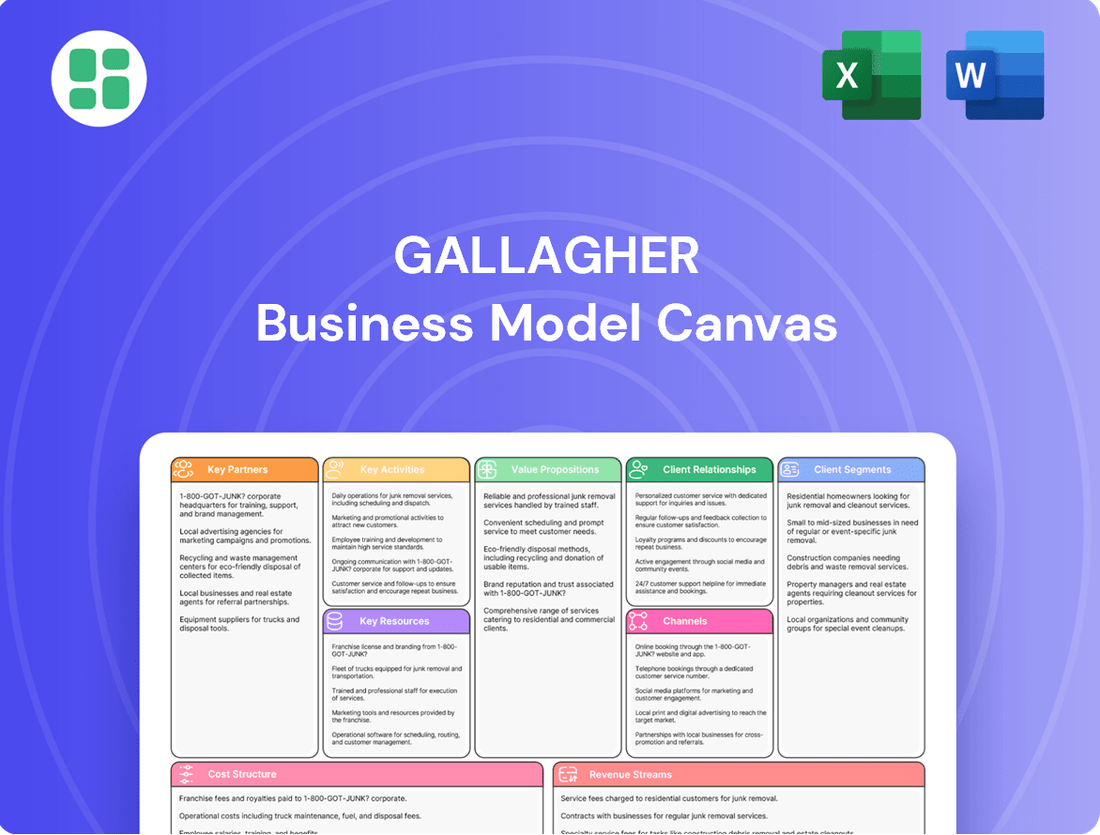

Business Model Canvas

The Gallagher Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the precise structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this ready-to-use, professional Business Model Canvas.

Resources

Gallagher's most vital asset is its expansive global network, comprising over 56,000 dedicated professionals. This team includes skilled brokers, insightful risk consultants, adept claims specialists, and knowledgeable HR advisors.

The deep expertise and specialized knowledge held by these individuals are crucial for providing tailored solutions and driving client success. Their collective industry insights and established client relationships form the bedrock of Gallagher's value proposition.

As of early 2024, Gallagher's workforce continues to be a primary driver of its market position, enabling the company to offer comprehensive risk management and benefits solutions across diverse sectors.

Gallagher's extensive global network, spanning over 130 countries as of early 2024, is a cornerstone of its business model. This widespread presence allows them to cater to a diverse international clientele, offering tailored solutions and localized expertise that resonate with specific market needs. This geographic breadth is crucial for supporting multinational corporations and pursuing strategic growth opportunities across varied economic landscapes.

Gallagher's proprietary data, analytics, and technology platforms are central to its operations. These advanced systems, including sophisticated data analytics tools and digital platforms, are crucial for effective risk assessment, streamlined policy management, and efficient claims processing. In 2024, the company continued its significant investment in these areas, aiming to bolster data-driven insights for its clientele.

Strong Brand Reputation and Client Trust

Gallagher's strong brand reputation and the deep trust it has cultivated with clients are cornerstones of its business model. This isn't just about being well-known; it's about being recognized for integrity, a client-first approach, and consistently delivering exceptional service. This reputation is a significant intangible asset that underpins their ability to attract and retain business.

The foundation of this trust is built on a history of reliable performance and a steadfast commitment to core values, often referred to as 'The Gallagher Way.' This consistent adherence to principles fosters a sense of security and dependability for their clients, encouraging long-term relationships. For instance, in 2024, Gallagher was again recognized by Forbes as one of America's Best Insurance Employers, a testament to their sustained focus on employee and client satisfaction.

This brand equity translates directly into tangible business advantages. It allows Gallagher to command premium pricing, reduce customer acquisition costs, and benefit from strong client loyalty. The trust factor is particularly crucial in the insurance and financial services sectors, where clients are entrusting significant financial assets and risk management needs to their providers.

- Brand Reputation: Gallagher’s long-standing history, dating back to 1927, has cemented its image as a reliable and ethical partner in the insurance brokerage and risk management industry.

- Client Trust: This trust is earned through consistent delivery of value, personalized service, and a commitment to acting in the client's best interest, fostering enduring relationships.

- 'The Gallagher Way': This internal philosophy emphasizes integrity, respect, and a strong ethical compass, guiding all interactions and reinforcing client confidence.

- Market Recognition: Continued positive rankings and awards, such as those from Forbes in 2024, validate Gallagher's reputation and reinforce client trust in its services.

Financial Capital and Acquisition Capacity

Gallagher's ability to pursue its growth objectives hinges on robust financial capital. This includes not only substantial cash reserves but also a strong capacity to access capital markets, which is crucial for funding both its ambitious merger and acquisition (M&A) strategy and its organic growth initiatives. This financial strength allows the company to execute its strategic vision effectively.

The company's substantial financial resources are a cornerstone of its business model. As of early 2025, Gallagher demonstrated a significant financial cushion, with over $2 billion in acquisition capacity readily available. This capacity is vital for capitalizing on strategic opportunities as they arise, ensuring the company can maintain its aggressive expansion pace.

- Financial Reserves: Gallagher maintains significant cash reserves to support immediate operational needs and strategic investments.

- Access to Capital Markets: The company leverages its strong credit standing and relationships to access debt and equity financing when needed.

- Acquisition Capacity: As of early 2025, Gallagher had over $2 billion in available capacity for acquisitions, enabling continued M&A activity.

- Funding Growth: This financial firepower directly fuels both bolt-on acquisitions and larger strategic transactions, as well as investments in organic growth.

Gallagher's key resources are its extensive global network of over 56,000 professionals, its proprietary data and technology platforms, its strong brand reputation built on trust and client focus, and its robust financial capital, including significant acquisition capacity. These elements collectively enable Gallagher to deliver specialized risk management and benefits solutions worldwide.

Value Propositions

Gallagher's comprehensive risk solutions offer a vast array of insurance, risk management, and consulting services, designed to tackle the multifaceted risks businesses face. This integrated approach ensures clients receive tailored strategies that go beyond simply securing coverage.

For instance, in 2024, Gallagher continued to emphasize its ability to provide specialized solutions, such as cyber risk and environmental liability, reflecting the growing complexity of the risk landscape. Their consulting arm actively assists clients in developing proactive risk mitigation plans, fostering resilience.

This commitment to broad and deep expertise allows Gallagher to act as a true partner, helping organizations navigate and manage their exposures effectively. Their 2024 performance, with reported revenue growth, underscores the market's demand for such robust risk management capabilities.

Gallagher's value proposition centers on its profound expertise and specialized industry knowledge, offering clients tailored advice. This deep understanding allows them to navigate complex insurance markets and regulatory landscapes effectively.

Clients gain access to niche specialists who provide insights specific to their sectors and unique challenges. For instance, in 2024, Gallagher reported significant growth in its specialty insurance segments, a testament to its focused expertise in areas like cyber risk and construction.

Gallagher's value proposition centers on significantly reducing a client's total cost of risk through adept policy negotiation and proactive risk mitigation. This approach not only safeguards assets but also optimizes financial resources, making it a compelling advantage for businesses seeking value.

By implementing efficient claims management processes, Gallagher ensures that clients experience smoother, less disruptive resolutions. This focus on minimizing financial and operational impact, a critical element in asset protection, directly contributes to overall business resilience and cost savings.

For instance, in 2024, businesses that partnered with Gallagher saw an average reduction in their insurance premiums by up to 15% due to expert negotiation, alongside a demonstrable decrease in claim-related expenses through tailored risk management programs.

Global Reach with Localized Service

Gallagher's value proposition centers on its ability to blend a vast global network with personalized, local service. This means clients benefit from international expertise while receiving support that understands their specific regional needs and cultural nuances.

This approach is particularly effective for multinational corporations. Gallagher's hub-and-spoke model ensures that clients can access a wide range of services and expertise, regardless of their location, while still getting the tailored attention of local teams.

For instance, Gallagher’s global presence allows it to serve clients in over 130 countries. In 2024, the company continued to expand its international reach, acquiring several regional brokerages to strengthen its localized service capabilities. This strategy ensures that clients receive consistent, high-quality support that is also deeply integrated into their local markets.

- Global Network: Access to expertise and resources in over 130 countries.

- Localized Service: Culturally relevant, on-the-ground support tailored to specific regions.

- Hub-and-Spoke Model: Efficiently serves multinational clients by connecting global capabilities with local delivery.

- Acquisition Strategy: Continuous expansion through acquiring regional firms to enhance local presence and service.

Strategic Advisory and Consulting

Gallagher’s Strategic Advisory and Consulting segment extends well beyond standard insurance brokerage. It offers specialized guidance in critical areas such as employee benefits design, human resources management, and executive compensation strategies. This allows clients to build more resilient and high-performing workforces.

This strategic focus is a key differentiator, enabling Gallagher to partner with businesses to proactively address complex organizational challenges. For instance, in 2024, the demand for tailored HR and benefits consulting remained robust as companies navigated evolving workforce expectations and regulatory landscapes.

- Enhanced Workforce Planning: Gallagher’s consultants help organizations align their human capital strategies with overarching business objectives.

- Optimized Compensation Structures: Providing expertise to design competitive and motivating compensation packages.

- Benefits Program Innovation: Assisting clients in developing benefits programs that attract and retain top talent.

- Risk Mitigation in HR: Offering insights to navigate compliance and reduce HR-related risks.

Gallagher's value proposition is built on delivering comprehensive, integrated risk management solutions, encompassing insurance, consulting, and advisory services. This holistic approach ensures clients receive tailored strategies that address their unique exposures and foster resilience.

The company's deep industry expertise and specialized knowledge allow it to navigate complex markets and regulatory environments, providing clients with access to niche specialists. In 2024, Gallagher saw significant growth in specialty insurance segments, highlighting the market's need for focused expertise.

Gallagher aims to reduce a client's total cost of risk through expert policy negotiation and proactive risk mitigation, optimizing financial resources and minimizing disruption. For instance, 2024 data indicated that clients experienced average premium reductions of up to 15% alongside decreased claim-related expenses.

By combining a vast global network with personalized local service, Gallagher offers multinational corporations seamless support across diverse regions. Their 2024 expansion through strategic acquisitions further solidified this localized service capability in over 130 countries.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Integrated Risk Solutions | Comprehensive insurance, risk management, and consulting services. | Continued emphasis on specialized solutions like cyber and environmental liability. |

| Deep Industry Expertise | Tailored advice and niche specialists for complex markets. | Significant growth reported in specialty insurance segments. |

| Total Cost of Risk Reduction | Expert negotiation and proactive risk mitigation. | Clients saw average premium reductions of up to 15% and decreased claim expenses. |

| Global Reach, Local Service | Worldwide network with personalized, region-specific support. | Expansion in over 130 countries, strengthening local presence through acquisitions. |

Customer Relationships

Gallagher prioritizes building enduring client connections through dedicated account managers. These professionals act as direct points of contact, offering personalized service and expert advice tailored to each client's specific requirements.

This hands-on approach ensures a deep understanding of client needs, fostering trust and long-term partnerships. For instance, in 2024, Gallagher reported a significant portion of its revenue stemming from its established client base, underscoring the success of this relationship-centric model.

Gallagher cultivates deep client relationships through an advisory and consultative approach, moving beyond transactional exchanges to become a trusted strategic partner. This involves offering proactive insights and ongoing consultation, including crucial guidance on emerging risks. For instance, in 2024, Gallagher's focus on risk management solutions helped clients navigate evolving cyber threats, with reported cyber insurance claims increasing by an estimated 15% globally compared to 2023.

Gallagher cultivates deep, long-standing client relationships, with many partnerships extending over several decades. This longevity is built on a foundation of consistently excellent service and a proactive approach to adapting solutions as client needs change.

This dedication to enduring collaboration is a central tenet of Gallagher's business model, reflecting a strategy focused on mutual growth and trust. For instance, in 2024, Gallagher reported strong client retention rates, underscoring the success of this long-term partnership approach.

Proactive Communication and Education

Gallagher fosters deep client loyalty through proactive engagement, sharing insights on evolving market dynamics and critical regulatory shifts. This educational approach, often delivered via interactive workshops and informative webinars, ensures clients are not just aware but also equipped to navigate complex challenges.

For instance, in 2024, Gallagher hosted over 150 educational sessions, reaching more than 25,000 clients, covering topics from cybersecurity threats to the latest insurance compliance mandates. This commitment to knowledge sharing directly contributes to client retention and satisfaction.

- Proactive Trend Analysis: Gallagher regularly disseminates research on emerging risks and market opportunities, helping clients anticipate and adapt.

- Regulatory Updates: Clients receive timely alerts and explanations regarding new compliance requirements impacting their industries.

- Educational Webinars and Workshops: Over 25,000 clients participated in Gallagher-led sessions in 2024, enhancing their risk management capabilities.

- Personalized Guidance: Beyond general information, Gallagher provides tailored advice based on individual client needs and industry specifics.

Digital Engagement and Support

Gallagher leverages digital platforms to offer clients seamless access to their information, service requests, and claims management. This digital-first approach ensures convenience and boosts efficiency in client interactions. For instance, in 2024, Gallagher reported a significant increase in digital self-service adoption, with over 60% of routine policy inquiries now handled through online portals or mobile apps. This not only improves client satisfaction by providing instant support but also frees up human resources for more complex advisory roles.

- Enhanced Client Accessibility: Digital channels provide 24/7 access to policy details, claims status, and support resources, catering to diverse client needs and schedules.

- Streamlined Service Delivery: Online portals and apps simplify common tasks like updating information or submitting claims, reducing processing times and improving operational efficiency.

- Increased Responsiveness: Digital tools enable faster communication and issue resolution, fostering stronger client relationships through consistent and timely engagement.

- Data-Driven Insights: The use of digital platforms allows Gallagher to gather valuable data on client behavior and preferences, informing service improvements and personalized offerings.

Gallagher's customer relationships are built on a foundation of dedicated, personalized service delivered by account managers who act as direct client liaisons. This advisory approach fosters trust and long-term partnerships by deeply understanding and proactively addressing client needs, including evolving risks like cyber threats.

In 2024, Gallagher's commitment to client education was evident, with over 150 sessions reaching more than 25,000 clients on critical topics. Furthermore, digital platforms saw increased adoption, with over 60% of routine inquiries handled online, enhancing accessibility and efficiency.

This focus on enduring collaboration, proactive insights, and digital convenience contributes to Gallagher's strong client retention rates, a key indicator of the success of its relationship-centric strategy.

| Customer Relationship Aspect | 2024 Data/Activity | Impact |

|---|---|---|

| Dedicated Account Management | Direct client liaisons providing tailored advice | Fosters trust and deep understanding of needs |

| Client Education Initiatives | 150+ sessions, 25,000+ clients reached | Enhances risk management capabilities and client preparedness |

| Digital Self-Service Adoption | 60%+ of routine inquiries handled online | Improves accessibility, efficiency, and client satisfaction |

| Client Retention | Strong retention rates reported | Underscores success of long-term partnership approach |

Channels

Gallagher leverages a robust direct sales force and an expansive global broker network to connect with its clientele. These teams are crucial for building and nurturing client relationships, acting as expert advisors deeply embedded within their local business communities.

In 2024, Gallagher's commitment to this channel is evident in its continued investment in talent development and market penetration. The company's sales and brokerage operations are the primary drivers of revenue growth, reflecting the enduring value of personalized client engagement and specialized advice.

Gallagher's strategic acquisitions are a cornerstone of its growth, acting as a primary channel to expand market reach and tap into new customer segments. By acquiring other firms, Gallagher effectively absorbs their existing client portfolios, immediately bolstering its customer base and revenue streams.

In 2023, Gallagher completed 32 acquisitions, adding an estimated $235 million in annualized revenue. This aggressive acquisition strategy is crucial for integrating new capabilities and broadening the company's service offerings across diverse industries.

Gallagher leverages its digital platforms, including its primary website and dedicated client portals, as key channels for distributing essential information and delivering a range of services. These online touchpoints are designed to streamline client interactions and provide easy access to resources.

In 2024, Gallagher reported continued growth in digital engagement, with a significant portion of client inquiries and service requests being handled through these online portals. This digital-first approach enhances efficiency and client satisfaction by offering 24/7 access to policy details, claims tracking, and risk management tools.

Referrals and Industry Reputation

Gallagher's business model heavily relies on referrals from its existing client base, a testament to the trust and value it provides. This organic growth channel is crucial, as a significant portion of new business originates from these satisfied customers. A strong industry reputation, cultivated over many years, further bolsters this referral engine.

This emphasis on client satisfaction and a solid reputation translates into tangible business results. For instance, Gallagher has consistently reported strong organic growth rates, often exceeding industry averages, which is directly attributable to these powerful channels. Their commitment to service excellence fosters a loyal customer network that actively recommends their services.

- Referrals: A substantial percentage of Gallagher's new client acquisition stems from recommendations by existing, satisfied clients.

- Industry Reputation: Decades of operation have built a robust reputation, acting as a powerful magnet for new business.

- Client Trust: The organic growth through referrals highlights the deep trust clients place in Gallagher's expertise and service delivery.

- Organic Growth Driver: Referrals and reputation are key components driving Gallagher's consistent and sustainable business expansion.

Industry Events and Thought Leadership

Gallagher leverages industry events and thought leadership as key channels to connect with potential clients and solidify its position as an authority. Participating in major conferences, such as the 2024 WSIA Annual Convention, provides direct engagement opportunities. These events are crucial for demonstrating expertise and understanding market needs.

The publication of insightful reports, like Gallagher's own 'State of the Sector' series, acts as a powerful tool for establishing thought leadership. These reports, often drawing on extensive data and analysis, attract attention from a wide audience of industry professionals and potential clients. For instance, in 2023, Gallagher's research highlighted significant trends in the specialty insurance market, attracting considerable media and client interest.

- Enhanced Brand Visibility: Active participation in events and the dissemination of valuable content directly increases Gallagher's profile within the industry.

- Client Acquisition: Thought leadership content and event presence serve as effective lead generation tools, attracting new business opportunities.

- Market Authority: Regularly publishing data-driven insights positions Gallagher as a trusted source of information, building credibility with clients and prospects.

- Networking Opportunities: Industry events offer invaluable chances to network with peers, potential partners, and a diverse range of clients.

Gallagher utilizes a multi-faceted approach to reach its customers, combining a strong direct sales force with an extensive global broker network. These channels are vital for relationship building and providing expert advice within local markets.

Digital platforms, including the company website and client portals, serve as key channels for information dissemination and service delivery, enhancing client interaction and access to resources. In 2024, digital engagement continued to grow, with a significant portion of client needs met through these online touchpoints.

Strategic acquisitions are a primary channel for Gallagher, enabling market expansion and access to new customer segments by integrating existing client portfolios. In 2023, the company completed 32 acquisitions, adding approximately $235 million in annualized revenue.

Referrals from satisfied clients, bolstered by a strong industry reputation, form a crucial organic growth channel. This client trust directly contributes to Gallagher's consistent performance, often exceeding industry averages in organic growth rates.

| Channel | Description | 2023/2024 Impact |

|---|---|---|

| Direct Sales & Broker Network | Personalized client engagement and expert advice. | Primary revenue driver; continued investment in talent and market penetration in 2024. |

| Digital Platforms | Information dissemination and service delivery. | Increased client interaction and efficiency; significant growth in digital engagement in 2024. |

| Strategic Acquisitions | Market expansion and customer segment access. | 32 acquisitions in 2023 added ~$235M in annualized revenue. |

| Referrals & Reputation | Organic growth through client trust and industry standing. | Drives consistent, above-average organic growth; highlights client satisfaction. |

Customer Segments

Gallagher's large corporate clients are typically multinational enterprises with intricate global operations. These organizations require highly specialized and comprehensive risk management strategies, often necessitating bespoke insurance programs and extensive consulting services to navigate complex international regulatory landscapes and diverse operational risks. For instance, in 2024, the global insurance market for large corporations saw significant adjustments, with cyber insurance premiums for multinational firms experiencing an average increase of 20-30% due to escalating cyber threats.

These sophisticated clients actively seek Gallagher for its ability to provide seamless global coverage, ensuring their assets and liabilities are protected across multiple jurisdictions. Their needs extend beyond standard insurance, demanding in-depth industry-specific expertise and strategic advice on emerging risks, such as supply chain disruptions and climate change impacts, which Gallagher is well-equipped to deliver.

Mid-market businesses represent a core customer segment for Gallagher, with these companies often needing specialized insurance and risk management solutions as they scale. These businesses, typically employing between 50 and 1,000 individuals, require a nuanced approach to protect their expanding operations and workforces. For instance, in 2024, the mid-market sector continued to be a significant driver of growth for the insurance brokerage industry, with many firms seeking Gallagher's expertise to navigate complex risks.

Gallagher's strategic focus includes strengthening its offerings for larger mid-market accounts, recognizing their increasing complexity and potential for substantial risk. This segment values comprehensive coverage and proactive risk mitigation strategies to support their continued development and competitive positioning. The company's commitment to providing tailored advice and access to a broad range of insurance products makes it an attractive partner for these evolving enterprises.

Gallagher serves public entities and government organizations with tailored insurance and risk management solutions. These clients face unique regulatory landscapes and operational complexities, requiring specialized expertise in compliance and risk transfer. For instance, in 2024, many municipal governments are grappling with rising cybersecurity threats, necessitating robust data breach and liability coverage, a key area where Gallagher offers specialized programs.

Specialized Industries and Niche Markets

Gallagher excels by catering to specialized industries and niche markets, recognizing that these sectors demand a profound understanding of unique risks and regulatory landscapes. This strategic focus allows them to offer tailored insurance solutions that larger, more generalized providers might overlook.

Their expertise extends to critical sectors like aerospace, where complex liability and operational risks are paramount. They also serve financial institutions, requiring intricate knowledge of financial crime and regulatory compliance, and the entertainment industry, known for its volatile revenue streams and unique contractual exposures. For non-profit organizations, Gallagher provides coverage that addresses specific governance and fundraising challenges.

- Aerospace: In 2024, the global aerospace insurance market continued to navigate challenges related to supply chain disruptions and evolving cyber threats, with Gallagher demonstrating its capacity to provide specialized hull and liability coverage.

- Financial Institutions: The financial services sector faced increased regulatory scrutiny in 2024, particularly concerning cybersecurity and data privacy. Gallagher's specialized offerings for banks, asset managers, and insurance companies address these evolving compliance needs.

- Non-Profit Organizations: Non-profits in 2024 grappled with rising operational costs and increased demand for services, making robust Directors & Officers (D&O) liability and crime insurance crucial. Gallagher's tailored programs support their mission-driven operations.

- Entertainment: The entertainment sector, including film production and live events, saw a strong rebound in 2024, but also faced unique risks such as event cancellation and intellectual property infringement, areas where Gallagher provides essential coverage.

Businesses Seeking Employee Benefits and HR Consulting

Businesses actively seeking robust employee benefits packages, alongside expert human resources and compensation consulting, represent a key customer segment for Gallagher. These companies understand that strategic HR and benefits management are crucial for attracting and retaining top talent, directly impacting their operational efficiency and bottom line.

Gallagher's value proposition extends beyond simply providing insurance. Their consulting services offer tailored advice on designing competitive benefits plans, navigating complex HR regulations, and optimizing compensation structures to align with business objectives. For instance, in 2024, many businesses are focusing on mental health benefits and flexible work arrangements to boost employee well-being and productivity.

- Employee Benefits Design: Companies require assistance in crafting comprehensive health, dental, vision, and retirement plans.

- HR Consulting: This includes guidance on compliance, employee relations, performance management, and talent acquisition strategies.

- Compensation Analysis: Businesses need data-driven insights to ensure competitive and equitable pay scales.

- Workforce Trends: Staying abreast of evolving employee expectations, such as increased demand for remote work options and wellness programs, is a priority.

Gallagher serves a broad spectrum of clients, from multinational corporations needing complex global risk solutions to mid-market businesses seeking tailored insurance as they grow. They also cater to public entities and specialized industries like aerospace and financial institutions, each with unique regulatory and operational demands.

The company further supports businesses by offering comprehensive employee benefits and HR consulting, recognizing the critical role these functions play in talent management and operational success. This diversified client base highlights Gallagher's ability to adapt its services to a wide array of needs across different organizational sizes and sectors.

| Customer Segment | Key Needs | Gallagher's Value Proposition |

|---|---|---|

| Large Corporations | Global coverage, specialized risk management, regulatory navigation | Bespoke programs, extensive consulting, industry expertise |

| Mid-Market Businesses | Scalable insurance, risk mitigation for growth | Tailored advice, broad product access, proactive strategies |

| Public Entities | Compliance, specialized risk transfer, cybersecurity coverage | Expertise in unique landscapes, tailored programs |

| Specialized Industries (e.g., Aerospace, Financial Institutions) | Deep understanding of unique risks, regulatory compliance | Niche market focus, sector-specific knowledge |

| Businesses seeking Benefits/HR Consulting | Talent attraction/retention, HR compliance, compensation strategy | Competitive plan design, regulatory guidance, data-driven insights |

Cost Structure

Employee compensation and benefits represent a significant cost for Gallagher, reflecting the service-intensive nature of its business. This category encompasses salaries, commissions, bonuses, and comprehensive benefits packages for its extensive global team, which includes brokers, consultants, and support personnel.

In 2023, Gallagher reported total employee compensation and benefits expenses of approximately $3.6 billion. This figure highlights the substantial investment the company makes in its human capital, which is crucial for client acquisition, retention, and service delivery in the insurance brokerage and risk management sectors.

Gallagher's aggressive mergers and acquisitions (M&A) strategy, a cornerstone of its growth, naturally leads to substantial acquisition and integration expenses. These costs encompass not only the upfront purchase prices of acquired businesses but also the intricate processes of due diligence, legal fees, and the often-complex integration of new systems, cultures, and personnel. For instance, in the fourth quarter of 2024 alone, Gallagher successfully completed 20 mergers, each representing a significant investment in these areas.

Gallagher's cost structure heavily features ongoing investments in technology and infrastructure. This includes significant outlays for digital platforms, data analytics, and robust cybersecurity measures to ensure operational efficiency and maintain a competitive edge. For instance, in 2024, companies in the financial services sector, including insurance brokers like Gallagher, are expected to increase IT spending, with global IT spending projected to reach over $5 trillion, reflecting the critical role of technology.

These investments are crucial for supporting Gallagher's core business operations and future growth. The company's commitment to cloud migration and advanced threat detection technologies demonstrates a proactive approach to managing risks and enhancing service delivery. Such expenditures are essential for staying ahead in a rapidly evolving digital landscape, where data security and seamless digital experiences are paramount for client retention and acquisition.

Operating Expenses and Real Estate

Gallagher's cost structure is heavily influenced by its extensive global office network. These operating expenses encompass rent, utilities, and essential administrative functions worldwide. In 2024, the company continued its strategic focus on optimizing these costs through office consolidations, aiming for greater efficiency.

These real estate and operating expenses are a substantial component of Gallagher's overall spending. The company's commitment to streamlining its physical footprint directly impacts its profitability by reducing overhead.

- Global Office Network Costs: Rent, utilities, and general administrative expenses for offices across numerous countries.

- Office Consolidation Initiatives: Strategic efforts to reduce the number of physical office locations to drive cost savings.

- Impact on Profitability: Efficient management of real estate and operating costs is crucial for maintaining healthy profit margins.

Marketing and Business Development

Gallagher's cost structure heavily features expenses dedicated to marketing and business development. These costs are crucial for attracting new clients and solidifying their market presence.

These expenditures encompass a range of activities, including broad marketing campaigns, efforts to build brand recognition, and active participation in key industry events. Furthermore, investments in business development initiatives are made to foster growth and expand market share.

In 2024, Gallagher's commitment to these areas is evident. For example, their strategic use of partnerships and thought leadership content is a significant driver of client acquisition.

- Marketing Campaigns: Funds allocated to advertising, digital marketing, and promotional activities.

- Brand Building: Investments in public relations, content creation, and brand awareness initiatives.

- Industry Events: Costs associated with exhibiting, sponsoring, and attending conferences and trade shows.

- Business Development: Expenses for sales teams, lead generation, and partnership management.

Gallagher's cost structure is significantly shaped by its substantial investments in employee compensation and benefits, totaling approximately $3.6 billion in 2023. This reflects the company's reliance on its skilled workforce for client service and growth.

Furthermore, the company's aggressive mergers and acquisitions strategy incurs considerable acquisition and integration expenses, with 20 mergers completed in the fourth quarter of 2024 alone. Ongoing investments in technology and infrastructure, including cybersecurity and digital platforms, are also critical cost drivers, aligning with the projected over $5 trillion global IT spending in financial services for 2024.

Operating expenses, such as those related to its global office network, are managed through initiatives like office consolidations to optimize overhead. Marketing and business development costs are also substantial, supporting client acquisition and market presence through campaigns, industry events, and partnerships.

| Cost Category | 2023 Data (Approx.) | 2024 Trend/Note |

|---|---|---|

| Employee Compensation & Benefits | $3.6 billion | Crucial for service delivery and client relations. |

| Acquisition & Integration Expenses | Significant due to M&A strategy | 20 mergers completed in Q4 2024. |

| Technology & Infrastructure | Ongoing Investment | Aligns with >$5 trillion global IT spending in financial services for 2024. |

| Global Office Network & Operations | Substantial | Focus on cost optimization via office consolidations. |

| Marketing & Business Development | Significant | Supports client acquisition and market expansion. |

Revenue Streams

Gallagher's core revenue comes from commissions earned when they successfully place insurance policies for their clients. This is a significant part of their business model, as they act as intermediaries between businesses and insurance providers.

These commissions are generated across a wide range of insurance types, including property and casualty, which covers risks to physical assets, and employee benefits, which are crucial for companies offering health and retirement plans. They also earn from specialty coverages, catering to unique or complex risk exposures.

For the first quarter of 2024, Gallagher reported total revenue of $2.1 billion, with brokerage revenue, largely driven by these commissions, showing robust growth. This highlights the substantial impact of their insurance placement services on their overall financial performance.

Gallagher generates revenue through fees for specialized risk management consulting, analytics, and advisory services. This segment is experiencing significant growth within their business model, reflecting increased client demand for expert guidance in navigating complex risk landscapes.

Gallagher Bassett, the company's dedicated risk management division, earns income by charging fees for its expertise in managing and processing insurance claims for other organizations. This is a stable, recurring revenue source, as it is not directly tied to the fluctuations in insurance premium prices.

For the fiscal year 2023, Gallagher's total revenue reached $9.4 billion, with their Risk Management segment contributing significantly to this performance. While specific figures for TPA fees are not broken out, the consistent growth in this segment underscores the value clients place on Gallagher's claims administration services.

Contingent Commissions

Gallagher, like many insurance brokers, benefits from contingent commissions. These are essentially bonus payments from insurance carriers, awarded when a broker demonstrates strong performance in terms of business growth, client retention, and the overall profitability of the policies they place with that carrier. This revenue stream acts as a variable incentive, complementing the more stable base commissions earned on every policy sold.

These contingent commissions are a significant factor in a broker's overall earnings, directly tying their success to the long-term health of the business they generate for insurers. For example, in 2024, the insurance industry continued to see a focus on profitable underwriting, making contingent commissions an attractive performance metric for carriers to incentivize their broker partners.

- Variable Incentive: Contingent commissions are performance-based bonuses paid by insurers to brokers.

- Performance Drivers: These bonuses are typically tied to metrics like business growth, client retention, and policy profitability.

- Supplemental Income: This revenue stream adds to the base commissions earned on placed insurance policies.

- Industry Trend: In 2024, carriers continued to use these incentives to encourage strong broker relationships and profitable business generation.

Fees for Employee Benefits and HR Consulting

Gallagher generates revenue by offering expert advice and services in employee benefits, human resources, compensation strategies, and talent management. This consulting arm provides significant value, broadening the company's service portfolio and creating multiple avenues for income.

In 2024, Gallagher's Consulting segment, which heavily features these services, demonstrated robust performance. For instance, the company reported substantial growth in its brokerage segment, which often complements its consulting offerings, indicating a strong demand for integrated HR and benefits solutions.

- Employee Benefits Consulting: Advising businesses on health insurance, retirement plans, and wellness programs.

- HR Consulting: Providing guidance on compliance, employee relations, and HR best practices.

- Compensation and Talent Management: Developing competitive pay structures and strategies for attracting and retaining top talent.

- Diversified Revenue: This stream supports the core insurance brokerage business by offering a more holistic approach to client needs.

Gallagher's revenue streams are diverse, encompassing commissions from insurance placements, fees for risk management and consulting services, and contingent commissions from insurance carriers. This multi-faceted approach allows them to capture value across various client needs and performance metrics.

The company's brokerage segment, driven by commissions, saw strong growth, contributing significantly to its overall financial performance. Furthermore, their specialized consulting and risk management divisions provide stable, recurring income, underscoring the breadth of their service offerings and client value proposition.

| Revenue Stream | Description | Key Driver | 2023/2024 Impact |

| Insurance Commissions | Earned from placing insurance policies for clients. | Volume and value of policies placed. | Core revenue driver; Q1 2024 revenue $2.1 billion, with brokerage showing robust growth. |

| Risk Management Fees | Fees for claims administration and processing services. | Client contracts for TPA services. | Stable, recurring revenue; Risk Management segment contributed significantly to $9.4 billion total revenue in FY 2023. |

| Consulting Fees | Fees for HR, benefits, compensation, and talent management advice. | Demand for specialized HR and benefits solutions. | Growing segment; Consulting services complement brokerage, showing strong performance in 2024. |

| Contingent Commissions | Performance-based bonuses from insurers. | Business growth, client retention, and policy profitability. | Variable incentive; tied to profitable underwriting focus in the 2024 insurance market. |

Business Model Canvas Data Sources

The Gallagher Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and detailed financial reports. These diverse sources ensure a holistic and accurate representation of Gallagher's strategic approach and market position.