Gallagher Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Gallagher's competitive landscape is shaped by intense rivalry, powerful buyers, and the constant threat of new entrants. Understanding these forces is crucial for any business operating within or looking to enter their market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Gallagher’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of insurance carriers significantly influences the bargaining power of suppliers within the insurance brokerage sector. A market dominated by a few large, established carriers, like those seen in many mature insurance markets, can exert considerable leverage over intermediaries such as Gallagher. These powerful carriers underwrite the very policies that brokers distribute, allowing them to dictate terms, pricing structures, and the availability of coverage, often referred to as capacity.

For instance, in 2024, the global insurance market continues to be characterized by a consolidation trend, with a handful of major players holding substantial market share in key regions. This concentration means that a broker’s ability to negotiate favorable terms is directly tied to the competitive landscape among these dominant carriers. If carriers face limited competition, they are less incentivized to offer competitive pricing or flexible policy terms to brokers.

However, Gallagher's strategic approach, leveraging its extensive global reach and a broad, diversified client portfolio, serves to counterbalance this supplier power. By representing a vast number of clients across various industries and geographies, Gallagher enhances its own market presence and bargaining clout. This scale allows Gallagher to negotiate from a position of strength, offering carriers access to a significant volume of business and reducing its dependence on any single underwriter.

The bargaining power of suppliers, in this case, insurers, is significantly shaped by the availability of underwriting capacity. When the insurance market experiences a shortage of capacity, meaning fewer insurers are willing or able to take on risk, these suppliers gain considerable leverage. This tightness in capacity, often seen during periods of heightened economic uncertainty or following major catastrophic events, allows insurers to dictate terms and command higher premiums, directly impacting the cost of insurance for businesses and individuals.

Conversely, a market flooded with ample underwriting capacity shifts the power dynamic. In such scenarios, numerous insurers compete for business, leading to more favorable terms and lower premiums for insurance buyers. This abundance of capacity empowers brokers and their clients to negotiate from a stronger position, seeking out the best coverage at the most competitive prices. For instance, during 2024, the global commercial insurance market saw a notable easing of capacity in certain lines, such as property and casualty, allowing for more competitive pricing and broader coverage options compared to the preceding years.

Gallagher, as a large insurance brokerage, faces some supplier bargaining power due to the administrative effort and potential disruption involved in shifting a substantial portion of its business from one major insurance carrier to another. This can foster a degree of reliance on established carrier partnerships.

However, Gallagher's core business model thrives on providing clients with a wide array of choices from multiple carriers. This inherent flexibility in sourcing insurance products for its clients significantly lowers the practical switching costs for Gallagher itself when seeking alternative solutions, as its primary function is to connect clients with suitable carriers.

Threat of Forward Integration by Carriers

Insurance carriers possess the capability to move into direct sales, effectively cutting out brokers. This forward integration threat is a constant consideration in the industry.

However, the intricate nature of risk management and the specialized services brokers offer often diminish the appeal of direct carrier sales for many clients, especially in commercial and specialty insurance sectors. Brokers bring crucial expertise and established client relationships that carriers typically lack in-house.

For instance, in 2024, while direct-to-consumer insurance models continue to grow, particularly in personal lines, the market share for independent brokers in commercial lines remained substantial. Many businesses, facing complex exposures, still prefer the tailored advice and advocacy provided by brokers.

- Forward Integration Threat: Carriers can bypass brokers by selling directly to customers.

- Broker Value Proposition: Brokers offer expertise and client relationships that carriers often lack.

- Market Reality (2024): Direct sales are growing in personal lines, but brokers retain significant share in complex commercial and specialty insurance.

Specialized Technology and Data Providers

Gallagher's reliance on specialized technology and data providers for critical functions like analytics and claims processing means these suppliers can hold some sway. If a provider offers unique, proprietary technology with few substitutes, their bargaining power increases, potentially impacting Gallagher's costs and operational flexibility.

However, the landscape for enterprise software and data services is generally competitive. The availability of numerous vendors offering similar solutions tends to dilute the power of any single supplier. For instance, in 2024, the global market for big data and business analytics software was projected to reach hundreds of billions of dollars, indicating a robust ecosystem with many players.

- Supplier Specialization: Providers offering highly unique or proprietary technology for analytics or claims administration can gain leverage.

- Market Competition: The broad availability of alternative vendors in enterprise software and data services generally limits individual supplier power.

- Industry Data: The vastness of the 2024 big data and business analytics market, valued in the hundreds of billions, highlights the competitive nature and available alternatives for Gallagher.

The bargaining power of suppliers, primarily insurance carriers, is a key factor for Gallagher. When carriers are concentrated, they can dictate terms and pricing, especially when underwriting capacity is tight, as observed in certain insurance lines during 2024. This concentration limits a broker's negotiation leverage.

However, Gallagher mitigates this by leveraging its global scale and diverse client base, giving it significant volume to negotiate from a position of strength. The availability of ample capacity in markets like commercial property and casualty in 2024 further empowers brokers and their clients to secure better terms.

The threat of carriers integrating forward by selling directly to customers exists, but brokers like Gallagher provide specialized expertise and client relationships that are difficult for carriers to replicate, especially in complex commercial insurance markets where brokers maintained substantial market share in 2024.

Suppliers of specialized technology and data also hold some power, but the broad competitiveness of the enterprise software market, valued in the hundreds of billions in 2024, generally keeps individual supplier power in check.

What is included in the product

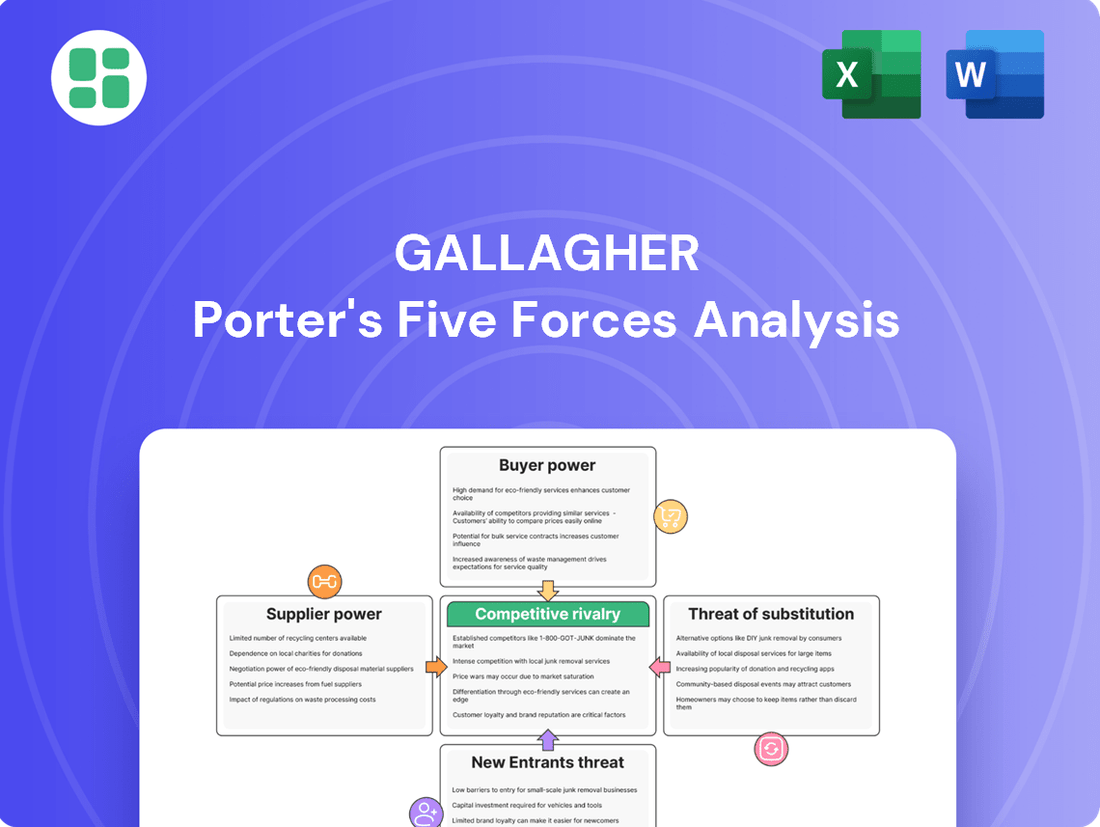

Gallagher's Five Forces analysis dissects the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Uncover hidden competitive threats and opportunities with a visual, interactive dashboard that simplifies complex market dynamics.

Customers Bargaining Power

Gallagher's extensive global reach means it serves a wide array of clients across numerous sectors. This broad client base, encompassing millions of customers, inherently dilutes the influence any single client can exert. For instance, in 2023, Gallagher reported serving over 1.5 million clients globally, a testament to its diversified customer portfolio.

For businesses, particularly those with intricate risk exposures, transitioning between insurance brokers represents a considerable investment of time, effort, and can potentially disrupt ongoing risk management strategies. Gallagher's deep understanding of a client's specific business operations and the tailored risk solutions they provide contribute to these high switching costs.

The development of strong, long-standing relationships, coupled with specialized industry knowledge and the seamless integration of various risk management services, creates significant inertia for clients looking to change brokers. This makes it challenging for competitors to lure away Gallagher's established clientele, thereby reinforcing Gallagher's bargaining power.

In 2024, the average cost for a business to switch major service providers, including financial and insurance intermediaries, can range from 10% to 25% of annual contract value, factoring in due diligence, contract negotiation, and implementation phases. Gallagher's ability to demonstrate value and maintain these client relationships effectively mitigates this cost for their customers, thus reducing their incentive to switch.

While clients can easily compare prices for many goods and services, the insurance market, particularly for complex risk management solutions, presents a different scenario. The intricate nature of insurance products and the specialized advice required often make a straightforward price-to-price comparison challenging for customers. For instance, a 2024 report indicated that while online quote comparison tools exist for basic personal lines insurance, over 60% of commercial clients still rely on broker expertise for evaluating complex liability or specialty coverages, highlighting the informational asymmetry.

Gallagher's value proposition extends beyond mere price. Their deep industry knowledge and tailored risk mitigation strategies are crucial for many clients, especially those dealing with unique or high-risk exposures. This consultative approach means that clients often prioritize the expertise and comprehensive service offered by Gallagher over a potentially lower, but less suitable, price point from a less specialized provider. In 2023, Gallagher reported that over 75% of their new large commercial clients cited the firm's advisory services as a primary reason for choosing them.

Threat of Backward Integration by Clients

The threat of backward integration by clients, particularly large corporations, can impact the bargaining power of customers. These entities might explore developing their own risk management functions or even establishing self-insurance pools. For instance, a major multinational corporation could potentially build an internal team to handle its complex global insurance needs, thereby reducing reliance on external brokers.

This potential for clients to bring services in-house is more significant for very large customers possessing substantial financial and operational resources. However, the significant investment in specialized expertise and the ongoing costs associated with managing intricate, global risk exposures often make outsourcing to specialized firms like Gallagher a more cost-effective and efficient strategy. For example, the global insurance and risk management market was valued at over $5 trillion in 2024, highlighting the scale and complexity involved.

- Large corporations may develop in-house risk management or self-insurance.

- This threat is more pronounced for clients with significant financial resources.

- The cost and expertise for internal global risk management can be prohibitive.

- Outsourcing to specialists like Gallagher often remains a more efficient solution.

Importance of Broker Services to Clients

For many businesses, especially those facing intricate risks, Gallagher's expertise in crafting bespoke insurance, offering risk management advice, and handling claims is indispensable. This reliance on specialized knowledge significantly diminishes the bargaining power of clients, as the value provided transcends simple policy procurement.

The dependency on such specialized services, like those offered by Gallagher, is a key factor in the bargaining power of customers. When clients require deep industry knowledge and tailored solutions, their ability to negotiate aggressively on price or terms is often constrained.

- High Switching Costs: Clients often invest considerable time and resources in establishing relationships and processes with specialized brokers like Gallagher, making a switch costly and disruptive.

- Information Asymmetry: Brokers possess specialized market knowledge and risk assessment capabilities that clients may lack, creating an imbalance that favors the broker.

- Value-Added Services: Beyond policy placement, services such as risk mitigation strategies, claims advocacy, and regulatory compliance guidance further solidify client reliance and reduce their bargaining leverage.

The bargaining power of customers is generally low for Gallagher due to high switching costs and the specialized nature of their services. Clients often find it complex and expensive to move to another broker, especially when Gallagher provides tailored risk management solutions and deep industry expertise. This makes it difficult for customers to exert significant price pressure.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Switching Costs | Lowers Customer Bargaining Power | Businesses can spend 10-25% of annual contract value to switch major service providers in 2024. Gallagher's integrated services increase this cost. |

| Information Asymmetry | Lowers Customer Bargaining Power | Over 60% of commercial clients in 2024 rely on broker expertise for complex insurance, indicating a knowledge gap favoring brokers. |

| Value-Added Services | Lowers Customer Bargaining Power | Over 75% of Gallagher's new large commercial clients in 2023 cited advisory services as a key reason for choosing them, demonstrating reliance beyond price. |

Same Document Delivered

Gallagher Porter's Five Forces Analysis

This preview showcases the complete Gallagher Porter's Five Forces Analysis, identical to the document you will receive instantly upon purchase. You're viewing the actual, professionally crafted analysis, ensuring no surprises and immediate usability. What you see is precisely what you'll download, ready to inform your strategic decisions.

Rivalry Among Competitors

Gallagher, like its peers, operates in a global insurance brokerage and risk management arena dominated by formidable players. Marsh McLennan, Aon, and WTW are significant competitors, each boasting extensive global networks and comprehensive service offerings.

These industry giants engage in intense competition for market share, skilled professionals, and strategic acquisition opportunities. For instance, in 2023, Marsh McLennan reported revenues of $22.7 billion, highlighting the scale of operations these companies manage.

This rivalry necessitates continuous innovation and strategic maneuvering for Gallagher to maintain and grow its position. The battle for talent is particularly fierce, as experienced brokers and risk advisors are crucial for client acquisition and retention.

The insurance brokerage sector is witnessing a pronounced trend of consolidation. Major players, including Gallagher, are strategically acquiring smaller and mid-sized firms. This M&A surge is not just about growth; it directly fuels competitive rivalry by creating larger entities with broader market penetration and enhanced service offerings, thereby reshaping the competitive landscape.

While many insurance brokers offer similar core services, differentiation is key to standing out. Firms achieve this through specialization in niche or specialty coverages, offering advanced data analytics for risk assessment, or providing extensive global networks. Gallagher, for instance, highlights its comprehensive suite of insurance solutions and robust risk management consulting as primary differentiators.

In 2024, the insurance brokerage market continued to see firms invest heavily in technology and specialized expertise. Gallagher's own reported revenue for the first nine months of 2024 reached $5.7 billion, up from $5.0 billion in the same period of 2023, underscoring the value placed on expanded services and global reach.

Market Growth Rate

The global insurance brokerage market is on a solid growth trajectory, with projections indicating it will expand from USD 314.00 billion in 2024 to USD 757.80 billion by 2034. This robust expansion offers a degree of breathing room for existing players, as the increasing market size can absorb more participants and provide avenues for organic growth. However, this very growth also intensifies the competition for prime acquisition targets and for securing new business, keeping rivalry high.

The competitive landscape within this growing market is characterized by several key dynamics:

- Market Expansion: The projected growth to USD 757.80 billion by 2034 from USD 314.00 billion in 2024 indicates a healthy expansion, potentially easing some competitive pressures by creating more opportunities.

- Intense Rivalry for Growth: Despite market expansion, competition for organic growth remains fierce as brokerages vie for market share and client acquisition.

- Acquisition Competition: The attractiveness of the growing market also fuels intense competition among firms looking to acquire other brokerages to consolidate their position or enter new segments.

- Consolidation Trends: Larger players often seek to acquire smaller or mid-sized firms, leading to a dynamic where strategic acquisitions are a significant competitive battleground.

Talent Acquisition and Retention

The competition for skilled insurance brokers, risk consultants, and other specialized talent is intense. This human capital is absolutely critical in a service-driven industry like insurance and risk management, directly impacting a firm's ability to serve clients and generate revenue.

Companies are pouring significant resources into recruiting and keeping their best people. This can lead to higher operating expenses and, consequently, put pressure on profit margins. For example, in 2024, average base salaries for experienced commercial insurance brokers saw an increase of 5-8% across major markets, with signing bonuses also becoming more common to attract top performers.

- High Demand for Specialized Skills: The need for professionals with expertise in areas like cyber risk, ESG (Environmental, Social, and Governance) consulting, and complex commercial lines drives up demand.

- Talent Wars Impact Costs: Increased competition for talent directly translates to higher recruitment and retention costs, including salaries, benefits, and training.

- Retention as a Key Strategy: Firms are focusing on creating strong company cultures and offering competitive compensation packages to reduce employee turnover, which can cost businesses significantly.

- Impact on Service Quality: The availability and quality of talent directly influence a firm's capacity to deliver superior client service and innovative solutions.

Competitive rivalry in the insurance brokerage sector is fierce, with major players like Marsh McLennan, Aon, and WTW constantly vying for market share and talent. This intense competition drives a need for continuous innovation and strategic acquisitions, as seen with Gallagher's own growth. The market's expansion, projected to reach $757.80 billion by 2034 from $314.00 billion in 2024, intensifies the battle for new business and attractive acquisition targets, making differentiation through specialization and advanced analytics crucial for success.

| Competitor | 2023 Revenue (USD Billions) | Key Differentiators |

| Marsh McLennan | 22.7 | Extensive global network, comprehensive services |

| Aon | 12.2 (2023) | Risk capital and human capital solutions |

| WTW (Willis Towers Watson) | 9.3 (2023) | Talent, health, wealth, and career solutions |

| Arthur J. Gallagher & Co. | 7.5 (2023) | Specialty coverages, risk management consulting |

SSubstitutes Threaten

Clients increasingly bypass traditional brokers by purchasing insurance directly from carriers, particularly for straightforward, standardized policies. This trend is amplified by digital platforms and insurtech innovations that simplify direct purchasing, presenting a significant substitute threat to broker services.

Large corporations increasingly opt for self-insurance or establish captive insurance programs as a direct substitute for traditional insurance brokering. This strategy allows them to retain risk and potentially reduce costs, especially for well-understood or predictable exposures.

For instance, in 2024, the global captive insurance market continued its robust growth, with estimates suggesting it manages hundreds of billions of dollars in risk. This trend underscores the significant threat posed by these internal risk management solutions to traditional insurance intermediaries.

Businesses increasingly build substantial in-house risk management departments, reducing reliance on external consultants like Gallagher. This trend is driven by the desire for greater control and tailored solutions, though it demands significant upfront investment in talent and technology. For example, in 2024, many large corporations continued to expand their internal risk teams, allocating millions to specialized software and personnel.

Alternative Risk Transfer Mechanisms

Beyond traditional insurance policies, clients increasingly turn to alternative risk transfer (ART) mechanisms. These can include financial instruments like derivatives or specialized products such as catastrophe bonds, offering ways to manage potential losses.

These ART solutions act as direct substitutes for conventional insurance. For instance, the global market for insurance-linked securities (ILS), which includes catastrophe bonds, saw significant issuance in 2023, reaching an estimated $15 billion, demonstrating a growing appetite for these alternatives.

- Derivatives: Financial contracts whose value is derived from an underlying asset, index, or rate, used for hedging specific risks.

- Catastrophe Bonds: Bonds that transfer a specific set of risks, typically natural disasters, from issuers to investors.

- Parametric Insurance: Policies that pay out based on predefined triggers (e.g., wind speed, earthquake magnitude) rather than actual loss assessment.

- Collateralized Reinsurance: Reinsurance agreements where the reinsurer posts collateral to secure its obligations, reducing counterparty risk.

Technology-Driven Risk Solutions

Emerging technologies, particularly AI and advanced analytics, are significantly altering the risk management landscape. These tools empower businesses to conduct more sophisticated internal risk identification, assessment, and mitigation, potentially lessening their reliance on traditional external brokerage or consulting services.

For instance, in 2024, the adoption of AI in risk management saw substantial growth. A significant percentage of financial institutions reported implementing AI for fraud detection and compliance monitoring, a trend that continues to accelerate. This internal capability building directly addresses the threat of substitutes by offering alternative pathways to manage risk.

- AI-powered risk assessment platforms are becoming more sophisticated.

- Companies are investing in internal data analytics capabilities to reduce external dependency.

- The perceived need for traditional brokers may diminish as in-house technology solutions mature.

- This trend is driven by the desire for greater control and cost efficiency in risk management.

The threat of substitutes for insurance brokers is substantial, driven by direct-to-consumer digital platforms and the rise of alternative risk transfer methods. Businesses are increasingly leveraging sophisticated internal capabilities, including self-insurance and captive programs, to manage their own risks. Furthermore, innovative financial instruments and parametric insurance offer clients alternative ways to achieve risk mitigation, bypassing traditional insurance intermediaries.

| Substitute Type | Description | 2024 Trend/Data Point |

|---|---|---|

| Direct Digital Platforms | Clients purchase policies directly from carriers online. | Continued growth in insurtech, simplifying direct purchasing. |

| Self-Insurance/Captives | Companies manage risk internally. | Global captive market managing hundreds of billions in risk. |

| Alternative Risk Transfer (ART) | Financial instruments like ILS and derivatives. | Insurance-Linked Securities market issuance significant in 2023. |

| In-house Risk Management | Building internal expertise and technology. | Increased corporate investment in AI for risk assessment and fraud detection. |

Entrants Threaten

High capital requirements are a major hurdle for new players looking to enter the insurance brokerage and risk management space. For instance, establishing a global operation like Gallagher, which requires extensive licensing across multiple jurisdictions, robust technology platforms, and significant investment in talent acquisition and retention, can easily run into hundreds of millions of dollars. In 2024, the cost of regulatory compliance alone for a new financial services firm can be prohibitive, making it difficult for smaller entities to compete with established giants.

The insurance sector is characterized by a dense and intricate web of regulations that vary significantly by country and even by state within countries. These rules govern everything from capital requirements and solvency margins to product design, sales practices, and claims handling. For instance, in the United States, the National Association of Insurance Commissioners (NAIC) plays a crucial role in developing model laws and regulations, but each state has its own insurance department that enforces these, often with unique interpretations and additional requirements. In 2023, the global insurance market was valued at trillions of dollars, with significant portions dedicated to compliance efforts by established players.

This extensive regulatory landscape acts as a substantial barrier to entry for potential new competitors. New entrants must invest heavily in legal expertise, compliance infrastructure, and ongoing monitoring to ensure they meet all mandated obligations. Failure to comply can result in severe penalties, including hefty fines and the suspension or revocation of operating licenses. For example, a new insurer might need to secure multiple licenses in different jurisdictions, each with its own application fees and lengthy review processes, adding considerable time and expense before they can even begin operations.

Gallagher, a prominent player in the insurance brokerage sector, benefits significantly from its established brand reputation and the deep trust it has cultivated with clients over decades. This strong market presence makes it difficult for newcomers to gain traction.

New entrants must overcome the substantial hurdle of building similar levels of trust and credibility, a process that typically requires significant time and investment. For instance, in 2024, the insurance brokerage market continued to see consolidation, with larger firms like Gallagher leveraging their established networks and client loyalty.

Difficulty in Building Global Distribution Networks

The sheer difficulty in establishing a global distribution network presents a significant barrier for potential new entrants. Gallagher, for instance, has cultivated a presence in around 130 countries, relying on a combination of wholly-owned subsidiaries and a vast network of correspondent brokers.

Replicating Gallagher's extensive reach requires substantial time, capital investment, and the development of intricate relationships across diverse markets. This complexity makes it exceptionally challenging for newcomers to achieve the same level of market penetration and operational scale.

- Global Reach: Gallagher's operations span approximately 130 countries, a testament to decades of network development.

- Network Complexity: This reach is achieved through a dual strategy of owned operations and a broad network of correspondent brokers, each requiring careful management and integration.

- Barrier to Entry: The time, resources, and established trust needed to build a comparable global distribution system are formidable obstacles for any new competitor aiming to enter the insurance brokerage market.

Economies of Scale and Scope

Incumbent firms in the insurance brokerage sector, like Gallagher, benefit significantly from economies of scale. This means they can spread their fixed costs, such as technology investments and data analytics platforms, over a larger volume of business, leading to lower per-unit costs. For instance, Gallagher's substantial investment in proprietary data analytics tools allows them to offer more precise risk assessments and tailored solutions, a capability difficult for a new entrant to replicate quickly.

Furthermore, economies of scope allow established players to leverage their existing infrastructure and customer base to offer a broader array of integrated services. Gallagher's ability to bundle property and casualty insurance with employee benefits, risk management, and consulting services creates a more comprehensive offering. A new entrant would face considerable challenges in building this integrated service model and achieving the same level of cross-selling efficiency, especially in 2024 where clients increasingly seek holistic solutions.

- Economies of Scale: Reduced per-unit costs through spreading fixed expenses like technology and data analytics over larger business volumes.

- Economies of Scope: Enhanced value by offering a wider range of integrated services, leveraging existing infrastructure and customer relationships.

- Purchasing Power: Incumbents, like Gallagher, command better pricing and terms from insurance carriers due to their significant premium volume.

- Barriers to Entry: New entrants struggle to match the capital investment, operational efficiency, and established relationships that provide incumbents with a competitive edge.

The threat of new entrants in the insurance brokerage sector is generally low, primarily due to substantial barriers to entry. High capital requirements, extensive regulatory compliance, the need for established trust and global distribution networks, and the advantages of economies of scale and scope all make it difficult for newcomers to compete effectively with established firms like Gallagher.

For instance, Gallagher's global presence in approximately 130 countries, built over decades, represents a significant investment in time, capital, and relationship building. Replicating this extensive distribution network is a formidable challenge for any new entrant in 2024.

Furthermore, established players benefit from economies of scale, allowing them to spread fixed costs over larger volumes and achieve lower per-unit costs. Gallagher's investment in proprietary data analytics, for example, provides a competitive edge that is costly and time-consuming for new firms to match.

The complex regulatory environment, with varying rules across jurisdictions, adds another layer of difficulty. New entrants must navigate and comply with these regulations, which can involve significant legal and operational expenses, further deterring market entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for licensing, technology, and talent. | High; can range in the hundreds of millions of dollars. |

| Regulatory Compliance | Navigating complex, country-specific insurance regulations. | High; requires substantial legal and operational investment. |

| Brand Reputation & Trust | Building credibility with clients in a trust-based industry. | High; takes considerable time and consistent performance. |

| Global Distribution Network | Establishing presence and relationships in multiple countries. | Very High; requires decades of effort and significant capital. |

| Economies of Scale & Scope | Leveraging existing infrastructure and customer base for efficiency. | High; difficult for new entrants to match cost advantages and integrated offerings. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available company filings, industry-specific market research reports, and expert commentary from financial analysts. This comprehensive approach ensures a thorough understanding of the competitive landscape.