Agree Realty SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

Agree Realty's strong portfolio of essential retail tenants and strategic geographic diversification present significant strengths, while potential economic downturns and rising interest rates pose notable threats. Understanding these dynamics is crucial for informed investment decisions.

Want the full story behind Agree Realty's competitive advantages, potential vulnerabilities, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Agree Realty's strength lies in its high-quality, investment-grade tenant base, which accounts for a significant portion of its rental income. As of the first quarter of 2024, approximately 68% of its annualized base rents came from these creditworthy retailers.

This concentration on tenants like Walmart, Home Depot, and CarMax, all recognized for their financial stability, provides Agree Realty with exceptionally stable cash flows and a reduced risk of tenant defaults.

The focus on investment-grade tenants directly translates to enhanced income security and a more predictable revenue stream for the company's shareholders.

Agree Realty's strength lies in its exceptionally diversified portfolio, spanning all 50 U.S. states and covering a broad spectrum of retail tenants. This geographical and sectoral spread, encompassing essential categories like grocery, home improvement, and auto parts, significantly reduces the risk associated with any single market or industry downturn.

Agree Realty's core strength lies in its stable and predictable cash flow, primarily generated from long-term net leases. This model shifts property operating expenses to tenants, ensuring consistent income for Agree Realty. The company's weighted-average remaining lease term, reported between 8.0 and 13.4 years as of early 2024, underscores the longevity and reliability of these cash flows, making it an attractive option for investors prioritizing steady income streams.

Robust Balance Sheet and Strong Liquidity

Agree Realty boasts a robust balance sheet and exceptional liquidity, a key strength that underpins its financial stability. The company has consistently maintained what is often described as a 'fortress balance sheet,' with liquidity levels frequently reported in the range of $2.0 billion to $2.3 billion as of early 2024. This substantial cash position, combined with the absence of any significant debt maturities until 2028, offers considerable financial maneuverability.

This strong financial footing is further evidenced by a conservative leverage profile. Agree Realty's net debt to recurring EBITDA has remained within a healthy range, typically between 3.1x and 3.4x. Such a low leverage ratio provides ample flexibility for pursuing new investment opportunities and ensures resilience even during periods of economic uncertainty.

- Fortress Balance Sheet: Consistently strong financial health with substantial liquidity.

- Liquidity Position: Over $2.0 billion to $2.3 billion in readily available funds.

- Debt Maturity Profile: No material debt maturities until 2028, reducing near-term refinancing risk.

- Conservative Leverage: Net debt to recurring EBITDA between 3.1x and 3.4x, indicating low financial risk.

Strategic Focus on Essential and Recession-Resistant Retail

Agree Realty's strategic focus on essential and recession-resistant retail is a significant strength. They prioritize tenants in sectors like grocery and auto parts, which tend to perform well regardless of economic downturns. This approach provides a more stable and predictable income stream.

Many of these essential retailers also leverage an omni-channel strategy, where their physical stores are crucial components of their overall sales and distribution network. This integration makes their physical locations indispensable to their business model, bolstering the long-term value of Agree Realty's portfolio.

- Tenant Diversification: In Q1 2024, Agree Realty's portfolio was approximately 99% leased, with a strong concentration in necessity-based retail.

- Top Tenant Performance: Their top tenants, including industry leaders in grocery and auto parts, demonstrate consistent performance, contributing to reliable rental income.

- Omni-channel Integration: A significant portion of their tenants utilize physical stores as vital hubs for e-commerce fulfillment, enhancing lease stability.

Agree Realty's strength is its high-quality tenant base, with approximately 68% of annualized base rents in Q1 2024 coming from investment-grade retailers. This focus on stable companies like Walmart and Home Depot ensures predictable cash flows and minimizes default risk.

The company's portfolio is geographically diverse, spanning all 50 U.S. states and featuring a broad mix of retail tenants. This diversification across essential sectors such as grocery and auto parts reduces exposure to any single market or industry downturn.

Agree Realty benefits from stable, predictable cash flow derived from long-term net leases, where tenants cover property operating expenses. The weighted-average remaining lease term, between 8.0 and 13.4 years in early 2024, highlights the reliability of these income streams.

A key strength is Agree Realty's robust balance sheet and substantial liquidity, with readily available funds often exceeding $2.0 billion to $2.3 billion as of early 2024. The absence of significant debt maturities until 2028 provides considerable financial flexibility.

| Metric | Value (Early 2024) | Significance |

|---|---|---|

| Investment Grade Tenant Rent | ~68% | Ensures stable and predictable income. |

| Portfolio Lease Rate | ~99% (Q1 2024) | Maximizes occupancy and rental income. |

| Weighted-Average Lease Term | 8.0 - 13.4 years | Provides long-term revenue visibility. |

| Liquidity | $2.0 - $2.3 billion | Offers financial flexibility and stability. |

| Net Debt to Recurring EBITDA | 3.1x - 3.4x | Indicates a conservative and low-risk leverage profile. |

What is included in the product

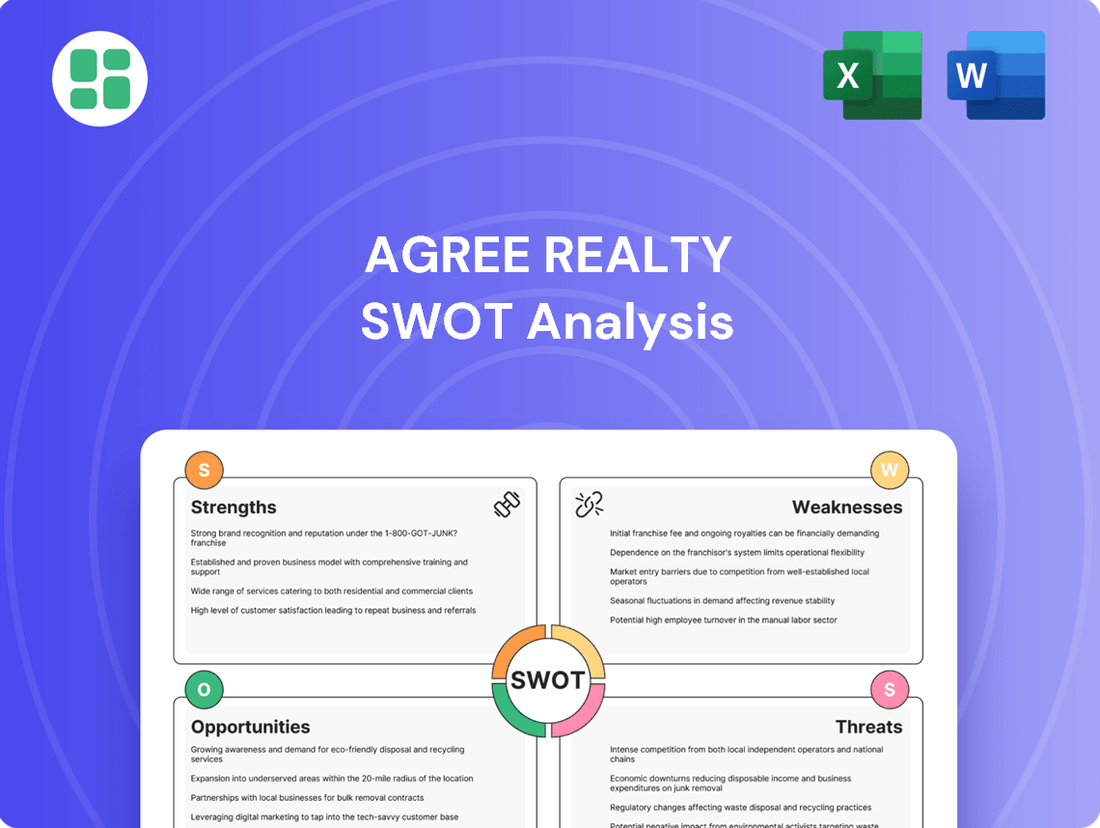

Delivers a strategic overview of Agree Realty’s internal strengths and weaknesses, alongside external opportunities and threats impacting its retail real estate portfolio.

Offers a clear, actionable framework to identify and leverage Agree Realty's competitive advantages, mitigating risks by proactively addressing weaknesses and threats.

Weaknesses

As a real estate investment trust (REIT), Agree Realty's profitability is directly tied to interest rate movements. An increase in interest rates, such as the Federal Reserve's continued efforts to combat inflation throughout 2024 and into 2025, raises the cost of capital for Agree Realty. This makes it more expensive to finance new property acquisitions and to refinance existing debt, potentially squeezing profit margins and impacting the company's ability to grow its portfolio.

While Agree Realty's net lease structure generally passes most operating expenses to tenants, the company has experienced an upward trend in its own operating expenses. For instance, depreciation and amortization costs saw a significant increase, contributing to higher overheads.

These rising costs, if they persist, could negatively impact Agree Realty's net income and overall profitability, potentially squeezing margins even with a strong tenant base.

Agree Realty's ambitious expansion, particularly its aggressive acquisition and development strategy, creates a significant dependency on external capital markets. This reliance means that any disruption or unfavorable shifts in the equity or debt markets could directly hinder its growth trajectory.

For instance, if interest rates were to rise sharply in 2024 or 2025, the cost of issuing new debt would increase, potentially making it less attractive to fund acquisitions through borrowing. Similarly, a downturn in the equity markets could depress Agree Realty's stock price, making equity offerings a less viable or more dilutive option for raising capital.

Mixed Profitability Metrics Despite Operational Growth

While Agree Realty has shown commendable growth in its Core Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) per share, a closer look at recent quarterly performance reveals a mixed picture. For instance, in the first half of 2025, the company experienced a slight dip in net income per share compared to the same period in 2024. This divergence between FFO/AFFO growth and net income per share suggests potential underlying profitability pressures or the impact of non-cash accounting adjustments that warrant investor attention.

This can be further illustrated by the following points:

- FFO/AFFO Growth: Consistent year-over-year increases in these key operational metrics indicate strong underlying business performance.

- Net Income Per Share Dip: A marginal decrease in net income per share for Q1 and Q2 2025, despite operational expansion.

- Potential Profitability Pressures: The discrepancy may point to rising operating costs, interest expenses, or other factors impacting the bottom line.

- Investor Scrutiny: Such mixed metrics can lead to investor concerns about the sustainability of earnings quality and the impact of accounting treatments.

Market Saturation in Certain Retail Regions

Agree Realty's expansion, especially in retail, could encounter headwinds from market saturation in some areas. This intensified competition for prime locations might inflate acquisition prices or constrain expansion possibilities in already well-developed markets.

For instance, while Agree Realty's portfolio is diverse, certain submarkets within retail real estate, particularly those with a high concentration of similar retail concepts, might already be at capacity. This saturation can make it harder to find new, high-yield investment opportunities.

- Increased Acquisition Costs: In saturated markets, the demand for available properties often outstrips supply, driving up purchase prices and potentially impacting the yield on new investments.

- Limited Growth Opportunities: As more retail centers or individual stores fill up, the available space for new tenants or acquisitions diminishes, creating a ceiling for organic growth in those specific regions.

- Higher Tenant Vacancy Risk: In a saturated market, retailers may face increased competition from neighboring businesses, potentially leading to higher tenant turnover or longer vacancy periods, which could affect rental income.

Agree Realty's reliance on external capital markets for its aggressive expansion strategy presents a significant weakness. Should market conditions deteriorate, such as rising interest rates in 2024-2025 or a downturn in equity markets, the cost and availability of funding could severely impede its growth plans.

Furthermore, despite overall FFO/AFFO growth, a slight dip in net income per share observed in early 2025, compared to 2024, suggests potential underlying profitability pressures or impacts from accounting adjustments that warrant close investor attention.

Market saturation in certain retail submarkets can also pose a challenge, potentially inflating acquisition costs and limiting opportunities for new, high-yield investments, thereby capping growth in specific regions.

The company's operating expenses have also seen an upward trend, with depreciation and amortization costs notably increasing, which could squeeze profit margins even with a strong tenant base.

| Metric | 2024 (Est.) | 2025 (Est.) | Trend Impact |

|---|---|---|---|

| Cost of Capital (Interest Rates) | Rising | Continued Rise | Negative (Higher financing costs) |

| Operating Expenses (Depreciation & Amortization) | Increasing | Continued Increase | Negative (Higher overheads) |

| Market Saturation | Growing Concern | Persistent | Negative (Higher acquisition costs, limited growth) |

| Net Income Per Share vs. FFO/AFFO | Mixed Signals | Mixed Signals | Cautionary (Potential profitability pressures) |

What You See Is What You Get

Agree Realty SWOT Analysis

This is the same Agree Realty SWOT analysis document included in your download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

Opportunities

Agree Realty is proactively signaling its robust growth outlook by elevating its 2025 investment guidance to an impressive $1.4 billion to $1.6 billion. This aggressive capital deployment strategy is aimed squarely at expanding its portfolio through new retail net lease acquisitions and strategic development projects.

This substantial commitment of capital is expected to fuel significant portfolio growth and, consequently, drive higher revenue streams in the coming years. The company's confidence in its investment pipeline underscores a strategic push for market share and enhanced financial performance.

Agree Realty's Developer Funding Platform (DFP) offers a distinct pathway for expansion, complementing its established acquisition strategies. This platform allows the company to initiate new development projects, creating bespoke properties designed to meet the specific requirements of top-tier tenants.

By engaging in these DFP projects, Agree Realty can secure longer, more favorable lease terms, thereby enhancing the long-term value of its portfolio. For instance, in 2024, Agree Realty actively pursued development opportunities, aiming to deliver customized retail spaces that attract and retain high-quality tenants in growing markets.

Agree Realty has a proven track record of successfully navigating market downturns by acquiring distressed assets. For instance, during periods of market stress, they have actively pursued lender-owned properties, a strategy that allows them to secure real estate at potentially more favorable valuations.

This opportunistic approach enables Agree Realty to enhance its portfolio with assets offering superior risk-adjusted returns. By capitalizing on market dislocations, the company can strategically strengthen its holdings and improve overall portfolio performance, a key advantage in volatile economic environments.

Leveraging Strong Tenant Relationships and Omni-Channel Focus

Agree Realty's strong ties with national, omni-channel retailers who depend on their physical stores is a significant advantage. These tenants are actively integrating online and in-store experiences, making their brick-and-mortar presence crucial for their success. This strategic alignment positions Agree Realty favorably within a resilient retail sector that is adapting to changing consumer habits.

This focus on omni-channel tenants ensures sustained demand for Agree Realty's properties. For instance, in Q1 2024, the company reported a 99.1% portfolio occupancy rate, demonstrating the strength of its tenant base. Their top 10 tenants, including industry leaders like Walmart and Home Depot, are all actively engaged in omni-channel strategies, underscoring the long-term viability of their retail footprints.

- Tenant Diversification: Agree Realty's tenant base is diversified across various resilient retail sectors, mitigating risk.

- Omni-channel Adaptation: The company's tenants are leaders in adapting to evolving consumer behaviors by integrating online and physical retail.

- Property Demand: This strategic focus on omni-channel retailers ensures consistent demand for Agree Realty's well-located properties.

- Portfolio Performance: A high occupancy rate, such as the 99.1% reported in Q1 2024, reflects the strength and stability of these tenant relationships.

Continued Dividend Growth and Sustainability

Agree Realty's consistent dividend growth presents a significant opportunity. The company maintains a conservative payout ratio, typically around 72-73% of its Adjusted Funds From Operations (AFFO) per share. This disciplined approach allows for sustained increases in its monthly dividends, making Agree Realty an attractive option for investors prioritizing income.

This commitment to shareholder returns is underpinned by stable cash flows, reinforcing the sustainability of its dividend policy. As of the first quarter of 2024, Agree Realty reported AFFO of $0.96 per share, further demonstrating its capacity to support ongoing dividend payments and potential increases.

- Dividend Payout Ratio: Approximately 72-73% of AFFO per share, indicating a conservative approach.

- Dividend Growth: Consistent increases in monthly dividends, appealing to income-focused investors.

- Cash Flow Stability: Supported by reliable cash generation, ensuring dividend sustainability.

- AFFO per Share (Q1 2024): $0.96, highlighting the financial capacity to maintain and grow dividends.

The company's elevated 2025 investment guidance of $1.4 billion to $1.6 billion signals a strong growth trajectory, primarily through new retail net lease acquisitions and development projects. This aggressive capital deployment is designed to significantly expand its portfolio and boost future revenue streams.

Agree Realty's Developer Funding Platform (DFP) provides a key avenue for expansion by enabling the creation of bespoke properties for top-tier tenants, securing longer, more favorable lease terms. This strategic development focus, evident in their 2024 pursuits, aims to attract and retain high-quality tenants in growing markets.

The company's ability to opportunistically acquire distressed assets during market downturns, such as lender-owned properties, allows for the acquisition of real estate at potentially more favorable valuations. This strategy enhances the portfolio with assets offering superior risk-adjusted returns.

Agree Realty benefits from strong relationships with national, omni-channel retailers who rely on their physical store presence, ensuring sustained demand for its well-located properties. The company's Q1 2024 portfolio occupancy rate of 99.1% underscores the strength and stability of these tenant relationships, with top tenants actively pursuing omni-channel strategies.

| Opportunity | Description | Supporting Data (2024/2025 Focus) |

| Portfolio Expansion | Aggressive capital deployment for new acquisitions and development. | 2025 Investment Guidance: $1.4B - $1.6B |

| Developer Funding Platform (DFP) | Creating bespoke properties for top-tier tenants, securing favorable lease terms. | Active pursuit of development opportunities in 2024. |

| Opportunistic Acquisitions | Acquiring distressed assets during market downturns for favorable valuations. | Strategy of acquiring lender-owned properties. |

| Omni-channel Tenant Strength | Leveraging relationships with retailers integrating online and physical presence. | Q1 2024 Occupancy Rate: 99.1%; Top tenants actively engaged in omni-channel strategies. |

Threats

Ongoing global economic uncertainties, including persistent inflation and the risk of recession, present a significant threat to Agree Realty. These conditions can dampen consumer spending, directly impacting the sales and profitability of Agree Realty's retail tenants. For instance, the U.S. inflation rate remained elevated in late 2024, hovering around 3.5%, which squeezes household budgets and reduces discretionary spending, a key driver for retail sales.

This economic environment directly affects tenant performance, potentially leading to delayed rent payments or even defaults, which would negatively impact Agree Realty's rental income and overall financial health. A slowdown in tenant profitability could also reduce their capacity for expansion or investment in their own businesses, indirectly affecting Agree Realty's long-term growth prospects.

Even with Agree Realty's focus on investment-grade tenants, the risk of tenant bankruptcies or financial difficulties, particularly in the retail industry, persists. This is a constant concern for any real estate investment trust.

While Agree Realty boasts a diversified portfolio, the default of a significant tenant could result in vacant properties, a decrease in rental income, and difficulties in finding new tenants, impacting overall financial performance.

For instance, in the first quarter of 2024, retail sales growth showed signs of slowing, with some sectors experiencing more pressure than others, highlighting the ongoing vulnerability of retail tenants to economic shifts.

The market for prime net-leased retail properties, Agree Realty's core focus, is intensely competitive. Institutional investors and private capital alike are actively pursuing these sought-after assets, driving up demand. This heightened competition directly impacts acquisition costs, potentially leading to higher purchase prices and compressed cap rates.

For instance, in late 2024, reports indicated that cap rates for high-quality net-leased retail properties remained at historically low levels due to strong investor demand. This trend could compress Agree Realty's potential investment yields, making it more challenging to secure attractive opportunities that meet their return hurdles.

Evolving Retail Landscape and Consumer Behavior Shifts

The retail sector's continuous evolution, driven by e-commerce expansion and shifting consumer habits, presents a significant challenge. Agree Realty's reliance on essential and omni-channel retailers, while a strength, means it must remain agile. A substantial move away from physical retail spaces could negatively affect property valuations and the demand for tenant spaces.

For instance, e-commerce sales in the U.S. reached approximately $1.14 trillion in 2023, representing a notable portion of total retail sales. This ongoing digital shift necessitates that Agree Realty's tenant base, even those focused on essentials, effectively integrate online and offline experiences to maintain relevance and foot traffic.

- E-commerce Growth: Continued expansion of online shopping channels may reduce reliance on physical retail footprints for certain consumer goods.

- Consumer Preferences: A growing preference for convenience and digital engagement could impact the traditional brick-and-mortar model.

- Tenant Adaptation: The ability of Agree Realty's tenants to successfully blend online and offline retail strategies is crucial for sustained demand.

Impact of Tariffs and Construction Costs

Tariffs on imported goods could negatively impact retailers within Agree Realty's portfolio, potentially squeezing their profit margins and affecting their ability to lease space. For instance, a 25% tariff on certain Chinese goods, as implemented by the U.S. in recent years, directly increases costs for many retailers.

Rising construction costs present a significant external threat to Agree Realty's development pipeline. These increased expenses can directly impact the profitability of new projects, potentially leading to delays or scaled-back development plans. In 2024, construction material costs, such as lumber and steel, have seen notable volatility, with some reports indicating year-over-year increases of 10-15% for key inputs.

- Tariff Impact: Increased import duties can reduce retailer profitability, potentially impacting their leasing decisions and financial stability.

- Construction Cost Escalation: Higher material and labor costs for new developments can decrease project profitability and lead to development delays.

- Project Viability: Significant increases in construction expenses could make certain new development projects less financially attractive or even unfeasible.

- Market Competitiveness: If Agree Realty's development costs outpace competitors, it could affect its ability to secure prime locations and tenants.

Intensifying competition for prime net-leased properties drives up acquisition costs and compresses capitalization rates, making it harder for Agree Realty to secure attractive yields. For example, in late 2024, cap rates for high-quality net-leased retail properties remained near historic lows due to robust investor demand, potentially limiting Agree Realty's investment return potential.

The ongoing evolution of the retail sector, fueled by e-commerce growth and changing consumer preferences, poses a continuous challenge. While Agree Realty focuses on essential and omni-channel retailers, a significant shift away from physical stores could negatively impact property values and tenant demand. E-commerce sales in the U.S. are projected to continue their upward trend, reaching an estimated $1.3 trillion by the end of 2024, underscoring the need for tenants to maintain strong omnichannel strategies.

Rising construction costs, including materials and labor, directly threaten the profitability and feasibility of Agree Realty's development pipeline. In 2024, construction material prices experienced volatility, with some key inputs like lumber and steel seeing year-over-year increases of up to 15%, potentially delaying or scaling back new projects.

Global economic uncertainties, such as persistent inflation and recession risks, can dampen consumer spending, directly impacting the performance of Agree Realty's retail tenants and potentially leading to rent payment issues. For instance, U.S. inflation in late 2024 hovered around 3.5%, squeezing household budgets and reducing discretionary spending crucial for retail sales.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Agree Realty's official financial filings, comprehensive market research reports, and expert commentary from industry analysts, ensuring a robust and informed assessment.