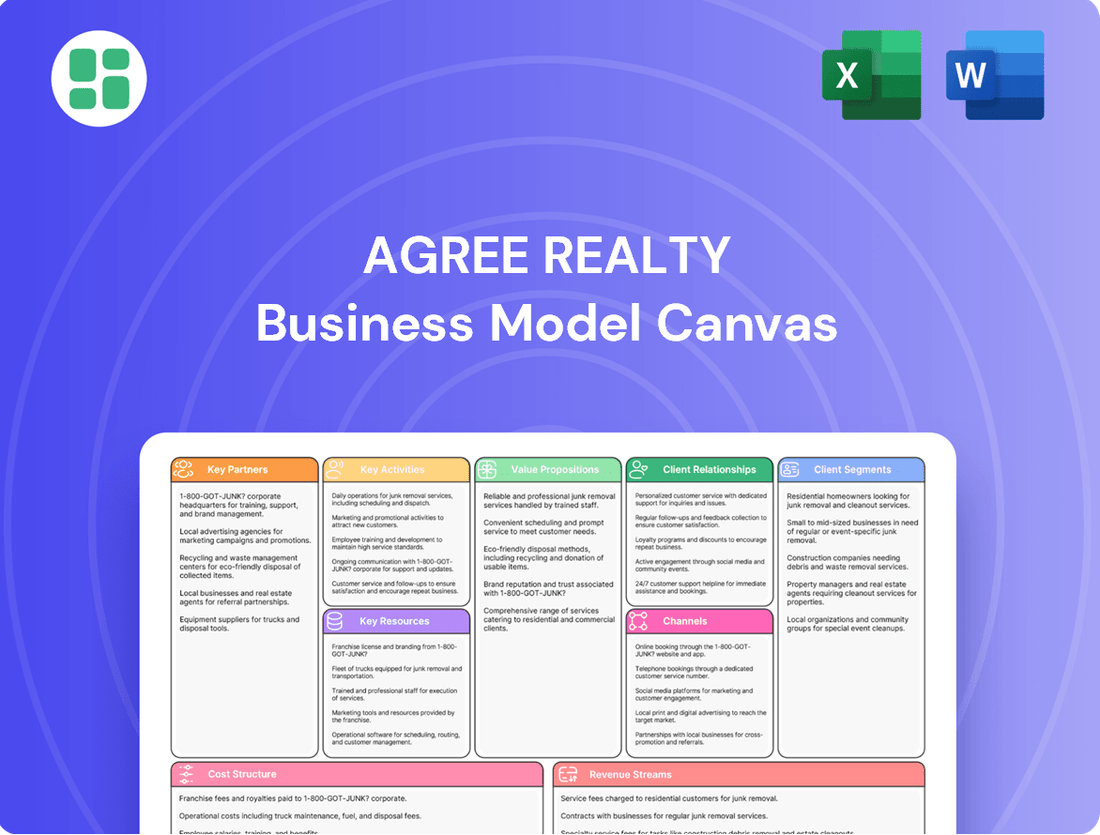

Agree Realty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

Unlock the strategic blueprint behind Agree Realty's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively manage key resources, cultivate vital partnerships, and deliver compelling value propositions to their diverse customer segments. Discover the core revenue streams and cost drivers that fuel their growth.

Ready to dissect Agree Realty's proven strategy? Our full Business Model Canvas provides an in-depth, section-by-section analysis of their operations, from customer relationships to key activities. Download the complete, editable file to gain actionable insights for your own business planning or competitive analysis.

Partnerships

Agree Realty cultivates strategic partnerships with developers to identify and construct new net-leased retail properties. These relationships are fundamental to growing their portfolio with resilient assets in prime locations, ensuring a consistent influx of high-quality real estate investments.

In 2024, Agree Realty continued to leverage these developer relationships to expand its footprint. For instance, their investment in new retail development projects, often initiated through these partnerships, contributed to their ongoing portfolio growth, which stood at over 2,000 properties by the end of the first quarter of 2024.

Agree Realty actively partners with commercial real estate brokers and advisory firms. These collaborations are crucial for identifying promising acquisition targets and streamlining property transactions, ensuring efficient deal execution.

These strategic alliances grant Agree Realty access to valuable off-market deals, often not publicly listed. Furthermore, they provide critical expert market insights, significantly strengthening their acquisition strategy and expanding their geographic footprint across the United States.

Agree Realty actively cultivates partnerships with a diverse array of financial institutions and lenders, including major banks and institutional investors. These relationships are critical for securing the necessary capital to fund property acquisitions and development projects. For instance, in 2024, Agree Realty successfully accessed various forms of debt financing, demonstrating the strength of these key partnerships.

These collaborations are instrumental in optimizing Agree Realty's cost of funds, allowing them to secure more favorable interest rates and terms. This access to capital directly fuels the company's growth strategy, enabling them to pursue a robust pipeline of potential acquisitions and development opportunities across the United States.

National and Regional Retail Tenants

National and regional retail tenants are more than just customers; they are crucial partners for Agree Realty. These strong, enduring relationships are vital for securing long-term leases, which in turn guarantees consistent and predictable rental income. This stability is a cornerstone of the REIT's financial health.

The partnerships with these retailers directly contribute to a diversified tenant portfolio, mitigating risks associated with over-reliance on any single tenant. For instance, as of the first quarter of 2024, Agree Realty's portfolio occupancy rate remained robust at 99.4%, demonstrating the strength of these tenant relationships.

- Tenant Diversification: Partnerships with a broad range of national and regional retailers reduce the impact of any single tenant's performance on Agree Realty's overall revenue.

- Lease Stability: Long-term lease agreements with these key tenants provide predictable cash flows, essential for maintaining financial stability and supporting dividend payouts.

- Occupancy Rates: Strong tenant relationships help maintain high occupancy rates, a key indicator of a healthy real estate portfolio. Agree Realty's 99.4% occupancy in Q1 2024 highlights this.

- Rental Income Predictability: The consistent rental payments from these established retailers form the bedrock of Agree Realty's reliable income stream.

Professional Service Providers

Agree Realty actively collaborates with professional service providers, including legal counsel, environmental consultants, and accounting firms. These engagements are critical for conducting thorough due diligence, ensuring compliance with complex regulations, and maintaining operational efficiency in their real estate dealings.

These specialized partnerships are instrumental in mitigating risks inherent in real estate transactions and ongoing property management. By leveraging the expertise of these external professionals, Agree Realty ensures adherence to all relevant legal and regulatory frameworks, safeguarding their investments and operational integrity.

- Legal Counsel: Essential for navigating property acquisitions, leasing agreements, and potential litigation, ensuring all contracts and transactions are legally sound.

- Environmental Consultants: Crucial for assessing and managing environmental risks associated with properties, ensuring compliance with environmental regulations and protecting against future liabilities.

- Accounting Firms: Provide vital services for financial reporting, tax compliance, and auditing, ensuring the accuracy and transparency of Agree Realty's financial operations.

Agree Realty's key partnerships extend to property management firms, ensuring the efficient upkeep and operational effectiveness of its extensive retail portfolio. These collaborations are vital for maintaining asset quality and tenant satisfaction across their numerous locations.

The REIT also engages with capital markets participants, including investment banks and equity research analysts. These relationships are crucial for accessing public equity markets, facilitating capital raises, and maintaining investor confidence through transparent communication and performance reporting.

In 2024, Agree Realty continued to strengthen its relationships with key retailers, which form the backbone of its net-lease strategy. These partnerships ensure stable, long-term rental income, a critical component of their business model. The company's portfolio occupancy remained exceptionally high, reaching 99.4% in the first quarter of 2024, underscoring the strength of these tenant relationships.

| Partnership Type | Role | Impact on Agree Realty | 2024 Data Point |

| Developers | Property identification and construction | Portfolio growth with new assets | Continued investment in new development projects |

| Commercial Real Estate Brokers | Acquisition target identification | Access to off-market deals and market insights | Streamlined property transactions |

| Financial Institutions | Capital provision | Funding for acquisitions and development | Successful access to various debt financing in 2024 |

| Retail Tenants | Lease agreements | Stable, predictable rental income and diversification | 99.4% portfolio occupancy (Q1 2024) |

| Professional Service Providers | Due diligence and compliance | Risk mitigation and operational integrity | Ensured adherence to legal and regulatory frameworks |

What is included in the product

This Business Model Canvas outlines Agree Realty's strategy of acquiring, developing, and managing a portfolio of net lease retail properties, focusing on resilient tenants and long-term lease agreements.

It details their customer segments (retail tenants), value propositions (stable, passive income for investors), key resources (real estate portfolio, management expertise), and revenue streams (rental income).

Provides a clear, one-page overview of Agree Realty's strategy, simplifying complex real estate investment for stakeholders.

Activities

Agree Realty's primary focus is pinpointing, scrutinizing, and acquiring prime net-leased retail properties. This rigorous process involves thorough due diligence, detailed financial modeling, and a comprehensive risk assessment to confirm each purchase meets their investment standards for essential, resilient, and recession-proof assets.

In 2024, Agree Realty continued its strategic acquisition program, adding approximately $1.2 billion in new investments to its portfolio. This activity underscores their commitment to expanding their holdings of high-quality, net-leased retail assets across the United States, demonstrating continued confidence in the sector.

Agree Realty actively manages its extensive portfolio by closely monitoring each property's financial performance, the creditworthiness of its tenants, and upcoming lease expirations. This diligent oversight is crucial for maximizing asset value and securing consistent rental income streams. For instance, in 2023, Agree Realty reported total rental revenue of $523.7 million, underscoring the importance of effective portfolio management.

Strategic asset dispositions and proactive portfolio rebalancing are key activities to maintain optimal diversification and build resilience against economic downturns. This approach ensures the portfolio remains robust and adaptable to evolving market conditions, a strategy that has served them well in navigating the real estate landscape.

Agree Realty actively negotiates and manages long-term net lease agreements with a diverse portfolio of national and regional tenants. This core activity is designed to generate stable and predictable rental income, forming the backbone of their revenue generation strategy.

Maintaining robust relationships with these tenants is paramount. Strong tenant relations contribute significantly to high occupancy rates, ensuring consistent rent collection and fostering opportunities for lease renewals, which are vital for Agree Realty's ongoing success as a Real Estate Investment Trust.

As of the first quarter of 2024, Agree Realty reported a robust portfolio occupancy rate of 99.1%, underscoring the effectiveness of their tenant relationship management and lease negotiation strategies. Their portfolio is diversified across 22 industries, with retail tenants making up 97.7% of rental revenue.

Capital Allocation and Financing Activities

Agree Realty strategically allocates capital, a critical function for funding its portfolio of retail properties. This involves a disciplined approach to raising both equity and debt to finance acquisitions and development projects. In 2024, the company continued to manage its balance sheet effectively, optimizing its debt structures to maintain a healthy financial profile and ensure ample liquidity for ongoing operations and future growth.

The company's financing activities are geared towards supporting its growth strategy, which includes acquiring income-producing retail properties and developing new ones. This requires careful consideration of market conditions and interest rate environments to secure favorable terms for debt issuance and to manage its cost of capital efficiently.

- Capital Raising: Agree Realty actively manages its capital structure by issuing equity and debt to fund its strategic objectives.

- Balance Sheet Management: The company focuses on maintaining a strong balance sheet by optimizing its debt-to-equity ratios and managing its financial leverage.

- Liquidity: Ensuring sufficient liquidity is paramount to support property acquisitions, development costs, and day-to-day operational needs.

- Financing Costs: Agree Realty aims to minimize its cost of capital by securing attractive financing terms in the debt markets.

Property Development and Redevelopment

Beyond simply acquiring existing properties, Agree Realty actively participates in property development and redevelopment. This includes undertaking build-to-suit projects, where they construct new facilities specifically tailored to the needs of their anchor tenants. This strategic approach allows them to create unique, high-value assets.

These development activities are crucial for enhancing property value and securing long-term lease agreements. By delivering custom-built spaces, Agree Realty attracts and retains high-credit tenants, ensuring stable and predictable rental income streams. These projects are often situated in strategically important retail corridors.

In 2024, Agree Realty continued to emphasize its development pipeline. For instance, they completed several build-to-suit projects for major retailers, contributing to their portfolio diversification and rental growth. These investments underscore their commitment to proactive portfolio management and value creation through development.

- Build-to-Suit Projects: Constructing custom facilities for specific tenant requirements.

- Value Enhancement: Increasing asset worth through strategic development.

- Tenant Attraction: Securing long-term leases with creditworthy tenants.

- Strategic Locations: Focusing development in prime retail areas.

Agree Realty's core activities revolve around the acquisition, management, and strategic disposition of net-leased retail properties. They meticulously identify and acquire high-quality assets, focusing on tenants with strong creditworthiness and in resilient retail sectors. This proactive approach to portfolio management ensures stable rental income and long-term value creation.

In 2024, Agree Realty continued to bolster its portfolio through strategic acquisitions, adding approximately $1.2 billion in new investments. This expansion highlights their commitment to acquiring essential, resilient retail assets across the United States. Their portfolio management is robust, as evidenced by a 99.1% occupancy rate in Q1 2024, with 97.7% of rental revenue coming from retail tenants across 22 industries.

| Activity | Description | 2024 Data/Impact |

|---|---|---|

| Property Acquisition | Identifying, scrutinizing, and acquiring prime net-leased retail properties. | Added ~$1.2 billion in new investments. |

| Portfolio Management | Monitoring property performance, tenant creditworthiness, and lease expirations. | 99.1% occupancy rate (Q1 2024). |

| Lease Negotiation & Management | Securing long-term net lease agreements with diverse tenants. | Ensures stable, predictable rental income. |

| Capital Allocation & Financing | Raising equity and debt to fund acquisitions and development. | Managed balance sheet effectively, optimizing debt structures. |

| Property Development & Redevelopment | Undertaking build-to-suit projects and enhancing property value. | Completed several build-to-suit projects for major retailers. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This comprehensive overview accurately reflects the structure and content of the complete file, ensuring no surprises and full transparency. You can be confident that what you see is precisely what you'll get, ready for immediate use.

Resources

Agree Realty’s high-quality net-leased retail portfolio is its core tangible asset. This portfolio is comprised of properties leased to robust national and regional retailers, providing a consistent stream of rental income. As of the first quarter of 2024, Agree Realty owned and operated a portfolio of 2,100 retail properties across 49 states, demonstrating significant scale and diversification.

Agree Realty leverages significant financial resources, including robust access to both debt and equity markets, to fuel its acquisition and development pipeline. This access is paramount for securing the substantial capital needed for strategic property purchases and new construction projects.

The company's strong balance sheet health, evidenced by favorable credit ratings, directly translates into advantageous borrowing terms and the ability to secure financing consistently. As of the first quarter of 2024, Agree Realty reported total assets of approximately $5.1 billion, underscoring its substantial financial foundation and capacity for ongoing investment.

These strong relationships with lenders and a solid financial standing empower Agree Realty to pursue continuous growth and capitalize on attractive investment opportunities as they arise in the retail real estate sector.

Agree Realty's experienced management and acquisition team is a cornerstone of its business model. This team possesses deep expertise across real estate acquisition, development, asset management, and capital markets. Their collective industry knowledge, established relationships, and strategic foresight are crucial for identifying and executing successful investment opportunities.

In 2024, Agree Realty continued to leverage this team's capabilities to expand its portfolio of high-quality net lease retail properties. The team's acumen in navigating complex transactions and managing diverse assets directly contributes to the company's consistent performance and growth, underpinning its ability to generate stable rental income and capital appreciation for shareholders.

Proprietary Market Data and Analytics

Agree Realty leverages proprietary market data and analytics to pinpoint high-performing retail locations. This involves a deep dive into demographic trends, consumer spending patterns, and competitive landscapes. For instance, in 2024, their rigorous site selection process, informed by extensive data, continues to drive their strategy of acquiring well-located, necessity-based retail properties.

The utilization of these advanced analytical tools allows Agree Realty to identify optimal tenant mixes and predict long-term property value. This data-driven approach is crucial for underwriting new acquisitions and managing their existing portfolio effectively, aiming to maximize investment returns.

- Data-Driven Site Selection: Utilizes comprehensive market data and demographic information to identify optimal retail locations.

- Tenant Identification: Employs analytical tools to select tenants that enhance property performance and long-term value.

- Investment Performance Enhancement: Aims to improve investment outcomes through informed decision-making based on market insights.

- Portfolio Management: Leverages data for effective management and optimization of their real estate portfolio.

Strong Tenant Relationships and Brand Reputation

Agree Realty's established, long-standing relationships with a diverse base of national and regional retail tenants are a cornerstone of its business model. This deep network, cultivated over years, provides a stable foundation for consistent rental income and reduces vacancy risk.

The company's strong reputation within the real estate industry acts as a powerful catalyst, significantly facilitating new lease agreements and renewals. This positive brand perception allows Agree Realty to attract and retain high-quality tenants, ensuring a robust pipeline of future opportunities and lease extensions.

- Tenant Diversification: As of the first quarter of 2024, Agree Realty's portfolio consisted of 2,000+ retail properties, with tenants spanning 25 distinct retail sectors, showcasing significant diversification.

- Top Tenant Concentration: The top 10 tenants represented approximately 45% of rental revenue in Q1 2024, highlighting the importance of these key relationships.

- Lease Expirations: A substantial portion of leases are long-term, with a weighted average remaining lease term of over 7 years as of Q1 2024, underscoring the stability derived from strong tenant relationships.

- Brand Recognition: Agree Realty's consistent focus on acquiring high-quality, investment-grade tenants reinforces its brand as a reliable and preferred landlord in the net lease sector.

Agree Realty's key resources include its substantial portfolio of high-quality net-leased retail properties, which generated consistent rental income. The company also possesses significant financial resources, including strong access to debt and equity markets, bolstered by a healthy balance sheet with total assets of approximately $5.1 billion as of Q1 2024. Furthermore, its experienced management and acquisition team, coupled with proprietary market data and analytics, are critical for identifying and executing successful investment strategies.

Established relationships with a diverse base of national and regional retail tenants are also a vital resource. As of Q1 2024, Agree Realty's portfolio was diversified across 25 retail sectors, with its top 10 tenants accounting for about 45% of rental revenue. The company also benefits from a weighted average remaining lease term of over 7 years, indicating the stability provided by these strong tenant relationships.

| Key Resource | Description | 2024 Data/Context |

| Real Estate Portfolio | High-quality net-leased retail properties | 2,100 properties across 49 states (Q1 2024) |

| Financial Resources | Access to debt and equity markets, strong balance sheet | Total Assets: ~$5.1 billion (Q1 2024) |

| Management & Analytics | Experienced team and proprietary data | Drives site selection and tenant identification |

| Tenant Relationships | Diversified base of national and regional retailers | Top 10 tenants: ~45% of revenue (Q1 2024) |

| Lease Structure | Long-term leases | Weighted average remaining lease term: >7 years (Q1 2024) |

Value Propositions

Agree Realty's value proposition centers on delivering stable and predictable cash flow to investors. This is achieved through a portfolio heavily weighted towards long-term net leases, a structure that minimizes landlord responsibilities and maximizes rental income stability. For instance, as of the first quarter of 2024, 99.4% of Agree Realty’s annualized base rent came from investment-grade tenants, underscoring the quality and reliability of their income streams.

This focus on high-quality tenants and long-term lease agreements translates directly into consistent returns for investors. The predictability of these cash flows makes Agree Realty an attractive investment for those prioritizing income generation and capital preservation. The company's commitment to this strategy has historically provided a reliable income stream, a key draw for many in the investment community.

Agree Realty's portfolio resilience is a cornerstone of its value proposition, achieved through significant diversification across essential retail sectors. This includes a strong presence in grocery, home improvement, auto parts, and discount retail, spreading risk and ensuring stability.

This broad sector exposure means that even if one retail segment faces headwinds, others can continue to perform well. For instance, as of the first quarter of 2024, Agree Realty's portfolio was approximately 34% weighted towards grocery and pharmacy tenants, sectors known for their recession-resistant nature.

Furthermore, the company's geographic diversification across 47 states in the U.S. mitigates risks associated with localized economic downturns or regional challenges. This widespread footprint ensures that Agree Realty is not overly reliant on any single market, bolstering its overall stability.

Agree Realty's core strategy revolves around acquiring and developing properties leased to businesses that are essential, meaning they provide goods and services people need regardless of economic conditions. Think grocery stores, pharmacies, and dollar stores.

This focus on e-commerce resistant and recession-proof tenants significantly minimizes the risk of vacancies. For instance, in 2024, Agree Realty reported a 99.4% portfolio occupancy rate, underscoring the resilience of its tenant base.

By concentrating on these stable sectors, Agree Realty ensures a more predictable and consistent stream of rental income. This approach enhances the long-term value and stability of its real estate portfolio, making it attractive to investors seeking reliable returns.

Efficient Capital Deployment and Growth

Agree Realty provides capital partners and shareholders with a clear path for deploying funds into high-quality real estate, specifically focusing on properties with robust growth prospects.

Their disciplined approach to acquiring new assets, coupled with a strong ability to access capital markets, allows for steady expansion and the creation of enduring value for investors.

For instance, in 2024, Agree Realty continued its strategic growth, demonstrating its commitment to efficient capital deployment. The company reported a significant increase in its real estate portfolio, reflecting successful acquisitions and development projects.

- Capital Deployment Efficiency: Agree Realty’s strategy centers on investing in well-located, necessity-based retail properties, which typically exhibit stable cash flows and resilience.

- Growth Potential: The company actively seeks opportunities in growing markets and with creditworthy tenants, ensuring the underlying assets have strong potential for appreciation and rental income growth.

- Access to Capital: Agree Realty leverages its strong balance sheet and relationships with lenders and equity partners to secure the necessary capital for its expansion plans, a key enabler of its growth trajectory.

- Value Creation: Through a combination of strategic acquisitions, effective property management, and prudent financial stewardship, Agree Realty aims to deliver consistent total shareholder returns.

Reliable and Long-Term Real Estate Solutions for Tenants

Agree Realty offers retail tenants dependable, well-maintained real estate assets situated in prime locations. These properties are offered under long-term net lease agreements, providing stability and predictability for businesses.

This approach allows tenants to concentrate on their core business activities, freeing them from the complexities of property management. By securing their operational sites for extended periods, tenants gain a significant competitive advantage.

In 2024, Agree Realty's portfolio comprised over 2,000 properties, with a significant majority operating under net lease agreements. This strategy underscores their commitment to providing stable, long-term solutions.

- Long-Term Stability: Net lease structures offer tenants predictable occupancy costs and security for their business locations.

- Operational Focus: Tenants can dedicate resources to their primary business operations, unburdened by property maintenance.

- Strategic Locations: Agree Realty prioritizes sites that offer high visibility and accessibility, crucial for retail success.

- Portfolio Strength: As of early 2024, the company’s portfolio value exceeded $5 billion, reflecting the scale and quality of its real estate offerings.

Agree Realty's value proposition to investors is built on generating stable, predictable cash flows through a portfolio of high-quality, net-leased retail properties. This strategy is reinforced by a tenant base predominantly composed of investment-grade retailers, ensuring reliable rental income. For example, as of the first quarter of 2024, 99.4% of Agree Realty’s annualized base rent was derived from investment-grade tenants, highlighting the security of its revenue streams.

The company's commitment to essential, e-commerce resistant retail sectors, such as grocery and pharmacies, further solidifies its value proposition by offering resilience against economic downturns. This sector focus, combined with broad geographic diversification across 47 states, mitigates localized risks and enhances portfolio stability. In early 2024, Agree Realty’s portfolio value exceeded $5 billion, demonstrating the scale and robustness of its real estate holdings.

For retail tenants, Agree Realty provides dependable, well-maintained properties in prime locations under long-term net lease agreements. This structure allows tenants to focus on their core operations without the burden of property management, fostering business growth and stability. In 2024, the company’s portfolio included over 2,000 properties, with a significant portion operating under these advantageous net lease terms.

| Key Value Proposition Elements | Description | Supporting Data (Q1 2024/2024) |

|---|---|---|

| Predictable Cash Flow | Stable income from long-term net leases with creditworthy tenants. | 99.4% of annualized base rent from investment-grade tenants. |

| Portfolio Resilience | Diversification across recession-resistant retail sectors and geographies. | 34% weighted towards grocery/pharmacy; presence in 47 states. |

| Tenant Benefits | Reliable, well-located properties under net lease agreements. | Over 2,000 properties in portfolio; focus on operational ease for tenants. |

| Investor Returns | Efficient capital deployment into high-quality growth-oriented assets. | Portfolio value exceeding $5 billion. |

Customer Relationships

Agree Realty cultivates proactive relationships with its tenants, offering dedicated support for property matters and ensuring adherence to lease agreements. This commitment is vital for maintaining high tenant satisfaction and encouraging long-term occupancy, contributing to stable revenue streams.

In 2024, Agree Realty's focus on tenant relations is demonstrated by its consistently high occupancy rates, which have remained robust even amidst evolving market conditions. For instance, their portfolio occupancy has historically hovered around 98%, a testament to their effective management and tenant support strategies that minimize turnover.

Agree Realty actively cultivates investor confidence through consistent, transparent communication. This includes detailed financial reports, quarterly earnings calls, and informative investor presentations, ensuring stakeholders are kept abreast of the company's performance and strategic direction.

For instance, during their 2024 investor day, Agree Realty highlighted their robust leasing pipeline and provided updates on their portfolio growth, reinforcing their commitment to keeping investors informed about key operational and financial developments.

Agree Realty cultivates deep relationships with its anchor tenants, viewing them as strategic partners rather than just lessees. This proactive approach involves understanding their long-term expansion strategies and collaboratively identifying suitable real estate opportunities.

This partnership model fosters loyalty and repeat business, evident in Agree Realty's portfolio. For instance, in 2024, a significant portion of their leasing activity involved existing, strong national retailers, reinforcing the success of this collaborative strategy and contributing to their robust occupancy rates.

Dedicated Investor Relations Team

Agree Realty’s dedicated investor relations team acts as a crucial bridge, offering a direct line for both individual and institutional investors. This personalized approach ensures that investor questions are promptly addressed and that valuable insights into the company's performance and strategy are readily available.

This focused engagement is fundamental to fostering robust investor confidence and trust. By consistently meeting investor needs and maintaining open communication channels, Agree Realty cultivates enduring relationships, which is vital for long-term shareholder value.

- Primary Contact Point: A specialized team dedicated to managing all investor communications.

- Information Dissemination: Providing timely updates and insights on company performance and strategic initiatives.

- Relationship Cultivation: Building and maintaining strong connections with individual and institutional investors.

- Investor Needs Fulfillment: Ensuring that investor inquiries and concerns are addressed effectively and efficiently.

Professional Property Management Oversight

Even in net lease agreements where tenants typically handle maintenance, Agree Realty actively oversees property upkeep. This ensures that all their retail properties, including those leased to tenants like Walmart and Dollar General, consistently meet high standards. This proactive approach is crucial for maintaining the long-term value of their real estate portfolio.

Agree Realty's commitment to property quality extends to intervening when necessary to ensure standards are met. This diligent oversight fosters strong, positive relationships with their tenants. For instance, in 2024, Agree Realty continued to focus on enhancing its portfolio through strategic acquisitions and development projects, reinforcing its commitment to asset quality and tenant satisfaction.

- Tenant Responsibility Oversight Agree Realty monitors tenant-managed maintenance in net leases to uphold property quality.

- Asset Value Protection This oversight safeguards the long-term value and appeal of their retail assets.

- Reinforcing Tenant Relationships Proactive engagement ensures tenant satisfaction and strengthens partnerships.

- Strategic Portfolio Enhancement Continued investment in property quality supports Agree Realty's growth and tenant retention strategies.

Agree Realty prioritizes strong relationships with its tenants and investors, viewing them as crucial partners for sustained success. This approach is evident in their high occupancy rates and consistent communication strategies.

In 2024, Agree Realty maintained its focus on fostering these connections. Their robust leasing pipeline, highlighted at their investor day, and the significant portion of leasing activity involving existing national retailers underscore the effectiveness of their partnership model and commitment to tenant satisfaction.

| Relationship Type | Key Actions | 2024 Impact/Focus |

|---|---|---|

| Tenant Relationships | Proactive support, property oversight, lease adherence | High occupancy (historically ~98%), strong tenant retention |

| Investor Relations | Transparent communication, detailed reports, earnings calls | Cultivating investor confidence, shareholder value |

| Anchor Tenant Partnerships | Collaborative strategy, understanding expansion | Repeat business, reinforcing portfolio strength |

Channels

Agree Realty’s direct acquisition team and deep industry networks are crucial for sourcing investment opportunities. This in-house capability allows them to identify and pursue properties directly, often bypassing traditional brokerage channels.

In 2024, Agree Realty continued to leverage these relationships, demonstrating their commitment to proprietary deal flow. This direct approach is key to their strategy of efficiently acquiring high-quality, net-lease retail properties, ensuring a consistent pipeline of attractive assets.

Agree Realty actively cultivates relationships with a network of external real estate brokers and specialized advisory firms. This strategic approach is crucial for identifying and thoroughly evaluating potential property acquisitions across diverse markets.

These partnerships are instrumental in broadening Agree Realty's market reach, granting them access to a wider spectrum of available investment properties that might otherwise remain undiscovered. For instance, in 2024, their proactive engagement with brokerage networks contributed to a significant portion of their new lease acquisitions, demonstrating the tangible impact of these collaborations on deal flow.

Agree Realty's corporate website is a vital conduit for investor communication, offering easy access to crucial documents like quarterly earnings reports and press releases. In 2024, the company continued to leverage this platform to ensure transparency and provide stakeholders with up-to-date information on its retail property portfolio and strategic initiatives.

Beyond their own digital presence, Agree Realty's information is readily available on major financial data aggregators and investment research platforms. This widespread accessibility ensures that potential investors and industry analysts can easily find and analyze Agree Realty's performance metrics and strategic positioning within the real estate investment trust sector.

Financial Advisors and Wealth Management Firms

Agree Realty engages financial advisors and wealth management firms as key partners to reach both individual and institutional investors. These professionals often integrate Real Estate Investment Trusts (REITs), like those offered by Agree Realty, into broader, diversified investment portfolios, acting as crucial conduits for capital and information flow.

These intermediaries are vital for Agree Realty's distribution strategy, enabling them to tap into a wide base of potential investors who rely on expert guidance for their financial planning. By building strong relationships with these firms, Agree Realty can effectively communicate its value proposition and secure investment capital.

- Channel: Financial Advisors and Wealth Management Firms.

- Investor Reach: Individual and institutional investors.

- Role: Recommending REITs as part of diversified portfolios.

- Function: Distributing information and attracting capital.

Industry Conferences and Investor Roadshows

Agree Realty actively participates in key real estate investment trust (REIT) conferences and industry events. These gatherings offer a crucial platform for direct engagement with potential investors, financial analysts, and industry peers. In 2024, the company continued this strategy to showcase its portfolio and growth trajectory.

Investor roadshows are a vital component of Agree Realty's outreach, providing opportunities to articulate its business model and financial performance. These events allow for in-depth discussions on the company's strategy, its robust tenant base, and future expansion plans directly with the financial community.

These channels are instrumental in building and maintaining investor confidence. For instance, participation in events like NAREIT's REITwise: Real Estate Opportunity &

The company leverages these interactions to:

- Showcase its diversified, high-quality retail portfolio.

- Communicate its financial strength and dividend growth strategy.

- Gather valuable market feedback and investor sentiment.

- Attract new institutional and retail investors.

Agree Realty's direct acquisition team and deep industry networks are crucial for sourcing investment opportunities, allowing them to identify and pursue properties directly. In 2024, this proprietary deal flow remained key to their strategy of efficiently acquiring high-quality, net-lease retail properties.

The company also actively cultivates relationships with external real estate brokers and advisory firms, broadening market reach and accessing a wider spectrum of available investment properties. This proactive engagement with brokerage networks contributed significantly to their new lease acquisitions in 2024.

Agree Realty's corporate website serves as a vital conduit for investor communication, offering easy access to reports and press releases, ensuring transparency. Their information is also readily available on major financial data aggregators, facilitating easy analysis by investors and analysts.

Financial advisors and wealth management firms are key partners for reaching both individual and institutional investors, integrating Agree Realty's REITs into diversified portfolios. These intermediaries are vital for distributing information and attracting capital.

Agree Realty actively participates in key REIT conferences and investor roadshows, providing platforms for direct engagement and articulating their business model. For instance, participation in events like NAREIT's REITwise allows them to highlight their retail-focused net lease strategy to capital providers.

| Channel | Investor Reach | Role | Function |

|---|---|---|---|

| Direct Acquisition Team & Industry Networks | N/A (Internal Sourcing) | Identify & Pursue Properties | Proprietary Deal Flow |

| External Brokers & Advisory Firms | N/A (Deal Sourcing) | Identify & Evaluate Properties | Broaden Market Reach |

| Corporate Website & Financial Aggregators | Individual & Institutional Investors | Provide Information & Transparency | Facilitate Analysis |

| Financial Advisors & Wealth Management Firms | Individual & Institutional Investors | Recommend REITs, Integrate Portfolios | Distribute Information, Attract Capital |

| REIT Conferences & Investor Roadshows | Institutional & Retail Investors | Showcase Portfolio, Communicate Strategy | Build Confidence, Attract Investors |

Customer Segments

Agree Realty's national and regional net-leased retail tenants are primarily robust, established chains. These include vital sectors like grocery, home improvement, auto parts, and discount stores, which have demonstrated resilience. For instance, as of Q1 2024, Agree Realty's portfolio saw a strong occupancy rate of 99.4%, highlighting the stability of these tenant relationships.

These tenants are crucial because they typically enter into long-term net leases. This structure offers Agree Realty a predictable and consistent stream of rental income, a cornerstone of their business model. In 2023, the company reported that over 90% of its rental revenue came from investment-grade tenants, underscoring the quality of this customer segment.

Institutional investors like pension funds and endowments are crucial for Agree Realty. These large entities are on the hunt for reliable income streams and ways to spread out their investment risks, and Agree's focus on stable retail properties fits the bill perfectly. In 2024, Agree Realty's portfolio, primarily composed of net lease retail properties, continued to offer that sought-after predictable cash flow, making it an attractive option for these sophisticated investors looking for long-term stability.

Individual investors and retail shareholders are a cornerstone of Agree Realty's ownership, often drawn to the reliable income streams and growth potential offered by real estate investment trusts (REITs). These investors, who typically manage their portfolios through online brokerage platforms, value Agree Realty's track record of consistent dividend payouts and its strategy of investing in high-quality, necessity-based retail properties.

Real Estate Developers and Property Owners

Agree Realty actively engages with real estate developers and existing property owners who possess net-leased retail assets. These entities are key customer segments because they represent the source of Agree Realty's property acquisitions, providing a crucial pipeline for growth. For instance, in 2024, Agree Realty continued its strategy of acquiring high-quality, net-leased retail properties, demonstrating ongoing demand from sellers in this market.

The value proposition for these developers and owners lies in Agree Realty's ability to offer efficient transaction processes and provide much-needed liquidity for their assets. This allows them to redeploy capital into new projects or other investment opportunities. Agree Realty's commitment to swift and reliable closings makes them an attractive partner for those looking to divest.

- Targeted Acquisitions: Agree Realty focuses on acquiring net-leased retail properties from developers and existing owners.

- Liquidity Provision: These sellers benefit from Agree Realty's ability to provide capital and facilitate timely transactions.

- Strategic Partnerships: Developers may also partner with Agree Realty on future projects, leveraging their capital and expertise.

- Market Presence: Agree Realty’s active acquisition strategy in 2024 underscores its role as a significant buyer in the net-leased retail sector.

Financial Analysts and Research Firms

Financial analysts and research firms act as key influencers for Agree Realty, even though they don't directly purchase services. Their in-depth analysis and reports significantly shape how investors perceive the company's financial health and future prospects. Positive coverage from these entities is vital for attracting capital and maintaining investor confidence.

These stakeholders play a critical role in disseminating information about Agree Realty's operational performance and strategic initiatives. Their recommendations can directly impact the company's stock valuation and its ability to secure favorable financing terms. For instance, in 2024, Agree Realty continued to demonstrate a strong portfolio, which was reflected in analyst reports highlighting its resilient net lease model.

- Influence on Investor Perception: Analysts provide objective evaluations that guide investment decisions.

- Capital Attraction: Positive research coverage can lower the cost of capital for Agree Realty.

- Market Validation: Their reports validate the company's business strategy and execution.

- 2024 Performance Metrics: Analysts closely monitored Agree Realty's occupancy rates and rental income growth throughout 2024.

Agree Realty's primary customer segment consists of robust, established national and regional retail tenants operating in resilient sectors like grocery, home improvement, and auto parts. These tenants, often investment-grade, commit to long-term net leases, providing Agree Realty with stable and predictable rental income. As of Q1 2024, the company maintained a high occupancy rate of 99.4%, underscoring the stability of these tenant relationships.

Institutional investors, including pension funds and endowments, represent another key customer group. They seek reliable income streams and diversification, making Agree Realty's portfolio of necessity-based retail properties an attractive investment. In 2024, the consistent cash flow generated by these properties continued to appeal to these sophisticated investors looking for long-term stability.

Individual investors and retail shareholders are also vital, drawn to Agree Realty's consistent dividend payouts and its strategy of investing in essential retail. These investors often utilize online brokerage platforms to access the company's offerings, valuing the stability and growth potential of REITs.

Real estate developers and property owners with net-leased retail assets are crucial for Agree Realty's growth, serving as the source for property acquisitions. Agree Realty's efficient transaction processes and ability to provide liquidity make it an attractive partner for sellers looking to redeploy capital. The company's active acquisition strategy in 2024 highlights its role as a significant buyer in this market.

| Customer Segment | Key Characteristics | Value Proposition for Agree Realty | 2024 Relevance |

|---|---|---|---|

| Retail Tenants | Established, investment-grade chains in resilient sectors (grocery, home improvement, auto). | Long-term net leases, stable rental income, high occupancy. | 99.4% occupancy in Q1 2024, demonstrating tenant stability. |

| Institutional Investors | Pension funds, endowments seeking reliable income and diversification. | Attractive, predictable cash flow from necessity-based retail properties. | Continued demand for stable, income-generating real estate assets. |

| Individual Investors | Retail shareholders seeking dividends and REIT growth. | Consistent dividend payouts, access to real estate investment. | Valuing track record and strategy focused on essential retail. |

| Developers & Property Owners | Sellers of net-leased retail assets. | Pipeline for property acquisitions, efficient transactions, liquidity provision. | Ongoing acquisitions in 2024 reinforcing market presence. |

Cost Structure

The most substantial cost for Agree Realty centers on acquiring new properties and funding development projects. This capital expenditure encompasses purchase prices, construction expenses, thorough due diligence, and associated closing costs, representing significant investments crucial for the company's expansion strategy.

Financing and interest expenses are a significant cost for Agree Realty, stemming from their use of debt to acquire and develop properties. In 2023, Agree Realty reported interest expense of $104.3 million, reflecting the cost of servicing their outstanding debt obligations. Efficiently managing this cost is vital for their profitability and ability to generate shareholder returns.

While net leases effectively transfer most property operating expenses to tenants, Agree Realty still shoulders certain costs. These include property taxes, insurance, and maintenance, particularly for vacant properties or under specific lease agreements. In 2023, Agree Realty reported total real estate operating expenses of $143.4 million, a portion of which relates to these residual property-level costs.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Agree Realty encompass the essential costs of running its corporate operations. These include compensation and benefits for executive and support staff, rent and utilities for corporate offices, and professional services like legal and accounting. In 2024, effective G&A management is crucial for Agree Realty to maintain strong profitability.

- Salaries and Benefits: Costs associated with corporate leadership, finance, legal, and administrative teams.

- Office Expenses: Includes rent, utilities, maintenance, and supplies for corporate headquarters.

- Professional Services: Fees for legal counsel, accounting audits, and other external advisory services.

- Other Overhead: Miscellaneous administrative costs necessary for business operations.

Professional and Advisory Service Fees

Agree Realty often engages external legal counsel, real estate brokers, tax advisors, and other consultants for specialized expertise. These professional and advisory service fees are a key cost component, essential for navigating complex transactions and ensuring regulatory compliance.

For instance, in 2023, Agree Realty reported $2.1 million in professional fees, highlighting the significant investment in these external services. These costs are crucial for executing strategic acquisitions and managing the company's extensive real estate portfolio effectively.

- Legal Counsel: Essential for contract review, transaction structuring, and dispute resolution.

- Brokerage Fees: Incurred when acquiring or disposing of properties, often a percentage of the transaction value.

- Tax Advisory: Crucial for optimizing tax strategies and ensuring compliance with evolving tax laws.

- Other Consultants: May include environmental assessors, property appraisers, and market analysts.

Agree Realty’s cost structure is primarily driven by property acquisition and development, followed by financing costs. While net leases shift many operating expenses to tenants, the company still incurs residual property taxes and insurance, alongside essential general and administrative overhead. The company also invests in professional services to support its operations and strategic initiatives.

| Cost Category | Description | 2023 Data (Millions) |

|---|---|---|

| Property Acquisition & Development | Purchase prices, construction, due diligence | Significant Capital Expenditure |

| Financing & Interest Expense | Cost of servicing debt | $104.3 |

| Property Operating Expenses | Property taxes, insurance, maintenance (residual) | $143.4 (Total Real Estate Operating Expenses) |

| General & Administrative (G&A) | Salaries, office expenses, professional services | Not explicitly detailed as a single figure, but essential for operations |

| Professional & Advisory Services | Legal, brokerage, tax advisory fees | $2.1 |

Revenue Streams

Agree Realty's main way of making money comes from the rent it collects from its retail properties. These are leased out to big national and regional stores.

The leases are typically long-term and 'net' leases, meaning the tenants pay for most of the property's operating costs. This setup provides a very steady and predictable cash flow for Agree Realty.

For instance, in 2023, Agree Realty reported total rental revenue of $534.5 million, a significant portion of which stems from these long-term net lease agreements.

Agree Realty's revenue streams are significantly bolstered by lease escalations and rent increases embedded within its long-term net lease agreements. These contractual provisions ensure a predictable and growing income stream, with many leases featuring annual rent increases, often tied to a percentage or a consumer price index adjustment.

For instance, in 2024, Agree Realty reported that a substantial portion of its rental income was derived from leases with built-in escalations, contributing to its overall financial stability and providing a hedge against inflation. This organic growth mechanism is a core component of their strategy, enhancing the long-term value and predictability of their real estate portfolio.

Agree Realty, while focused on long-term ownership, strategically generates revenue through property sales and dispositions. These transactions are typically reserved for assets that no longer align with their core portfolio strategy or when market conditions present a favorable opportunity to exit. For instance, in 2023, Agree Realty reported approximately $19.3 million in net proceeds from property dispositions, demonstrating their active management approach to capital allocation.

Development and Redevelopment Fees (If Applicable)

Agree Realty can generate revenue through development and redevelopment fees when they engage in build-to-suit projects or revitalize existing properties. This revenue stream directly contributes to value creation by actively managing and enhancing their real estate portfolio.

For example, during 2024, Agree Realty continued to focus on its portfolio transformation, which often involves strategic redevelopment. While specific fee income from these activities isn't always broken out separately in their primary reporting, the success of these projects is reflected in the overall growth and quality of their net lease portfolio.

- Development Fees: Earned on build-to-suit projects where Agree Realty manages the entire development process for a tenant.

- Redevelopment Income: Achieved through higher rental rates on properties that have undergone significant upgrades or repositioning.

- Portfolio Enhancement: These activities directly contribute to increasing the overall value and attractiveness of Agree Realty's real estate assets.

Reimbursement of Operating Expenses (Pass-Through)

Under its net lease agreements, Agree Realty's tenants are responsible for reimbursing the company for property taxes, insurance, and common area maintenance (CAM). These pass-through reimbursements, while offsetting corresponding expenses incurred by Agree Realty, are recognized as part of its gross revenue.

For instance, in 2024, Agree Realty reported that a significant portion of its rental income was derived from these net lease structures, demonstrating the importance of tenant reimbursements in its overall revenue generation. These reimbursements contribute to the stability of its income stream by aligning property-related costs directly with the tenant occupying the space.

- Tenant Responsibility: Tenants under net leases cover property taxes, insurance, and CAM.

- Revenue Recognition: Reimbursements are included in Agree Realty's gross revenue.

- Expense Offset: These pass-throughs directly offset Agree Realty's operational costs.

- Revenue Stability: Contributes to predictable income by linking costs to occupancy.

Agree Realty's primary revenue driver is rental income from its portfolio of retail properties, predominantly leased to national and regional tenants under long-term net lease agreements. These leases ensure tenants cover operating expenses like property taxes, insurance, and maintenance, providing Agree Realty with a stable and predictable income stream. In 2023, the company generated $534.5 million in total rental revenue, highlighting the significance of these core lease agreements.

Beyond base rent, Agree Realty benefits from contractual rent escalations embedded in its leases, often tied to annual percentage increases or consumer price index adjustments. These escalations contribute to organic revenue growth and act as an inflation hedge. Additionally, the company strategically generates revenue through property sales and dispositions, as seen with $19.3 million in net proceeds from dispositions in 2023, and may earn fees from development and redevelopment projects that enhance its portfolio's value.

| Revenue Stream | Description | 2023 Data (if applicable) |

|---|---|---|

| Rental Income | Base rent from net lease agreements with retail tenants. | $534.5 million (Total Rental Revenue) |

| Lease Escalations | Contractual annual increases in rent. | Contributes to organic growth and inflation protection. |

| Property Dispositions | Proceeds from selling properties. | $19.3 million (Net Proceeds) |

| Development/Redevelopment Fees | Income from managing build-to-suit projects or property upgrades. | Contributes to portfolio enhancement and value creation. |

| Tenant Reimbursements | Pass-throughs for property taxes, insurance, and CAM. | Included in gross revenue, offsetting expenses. |

Business Model Canvas Data Sources

The Agree Realty Business Model Canvas is informed by extensive market research, property portfolio analysis, and financial disclosures. These data sources ensure each component, from revenue streams to cost structures, is grounded in factual information.