Agree Realty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

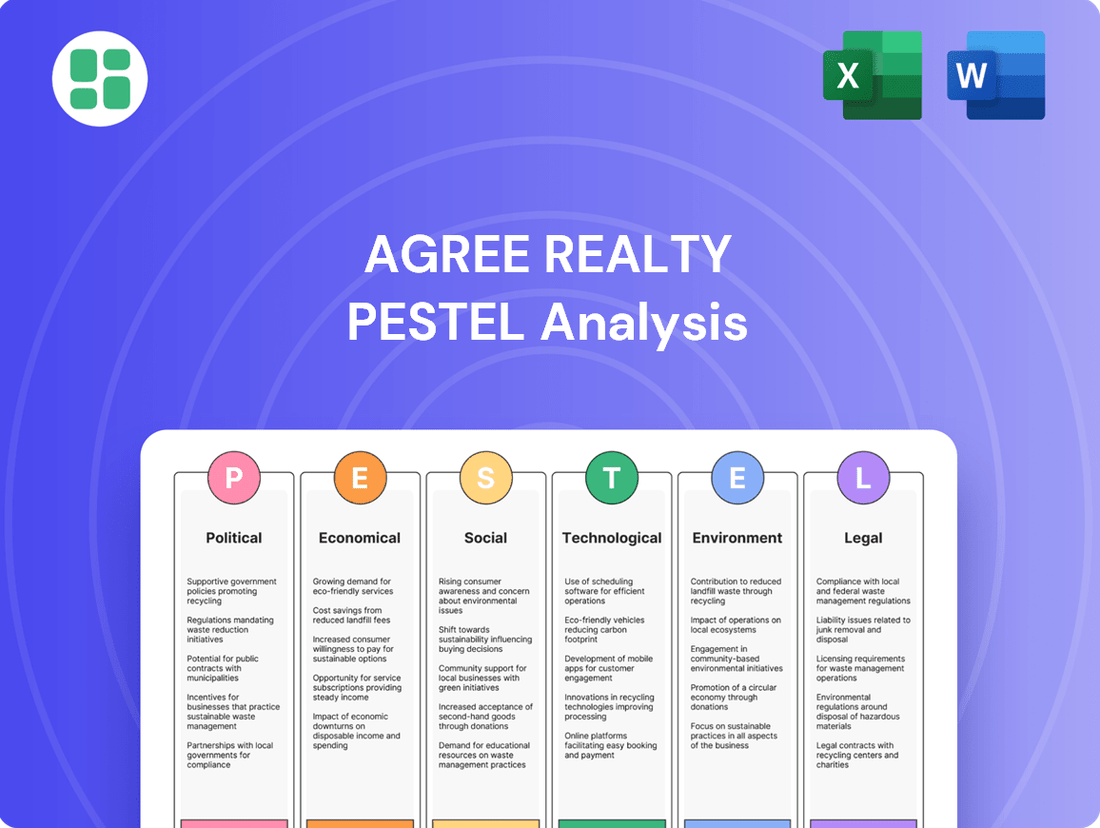

Navigate the complex external forces shaping Agree Realty's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Gain a strategic advantage by leveraging these expert insights to inform your investment decisions or business strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in federal, state, and local regulations directly influence Agree Realty's ability to operate and its financial success. For instance, evolving zoning laws and land use policies can alter where and how the company can develop properties, impacting acquisition strategies and potential returns.

Building codes and environmental regulations, which are subject to frequent updates, can increase construction costs and project timelines. For example, stricter energy efficiency mandates implemented in 2024 across several states may require additional investment in building materials and technologies for Agree Realty's new developments, potentially affecting project budgets by 5-10%.

Conversely, deregulation or the introduction of incentives for commercial development, such as tax credits for green building initiatives passed in late 2024 in some regions, can create more favorable conditions for Agree Realty's expansion plans, potentially lowering overall development expenses and accelerating market entry.

Changes in corporate tax rates and specific REIT tax legislation directly impact Agree Realty's profitability. As a Real Estate Investment Trust, Agree Realty must distribute at least 90% of its taxable income to shareholders, making it particularly susceptible to shifts in tax incentives or burdens. For instance, a stable tax environment supports consistent cash flow and enhances investor confidence, a key factor for REITs.

Trade policies and tariffs, while not directly impacting Agree Realty's physical properties, can significantly influence its retail tenants. For instance, increased tariffs on goods imported by retailers could raise their operating costs, potentially affecting their financial health and their capacity to manage lease payments. This indirect pressure on tenant profitability can, in turn, impact Agree Realty's rental income stability.

The retail sector, a core focus for Agree Realty, is particularly sensitive to these economic shifts. A report from the U.S. Chamber of Commerce in late 2023 highlighted that tariffs can lead to higher prices for consumers and reduced sales volumes for businesses, directly impacting the revenue streams of Agree Realty's lessees. This could translate to a greater risk in tenant creditworthiness and a potential softening of demand for retail leasing.

Government Spending and Infrastructure Development

Government investments in infrastructure, like roads and public transport, directly boost the appeal and accessibility of Agree Realty's properties. These improvements can funnel more customers to retail centers and encourage residential growth, ultimately strengthening demand for their net-leased properties.

For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocates significant funds towards improving transportation networks and other public works. By 2024, a substantial portion of this funding will be actively deployed, potentially enhancing connectivity to Agree Realty's portfolio locations. This focus on infrastructure development is projected to continue through 2025, creating a favorable environment for real estate accessibility and economic activity around their assets.

- Increased Property Accessibility: Infrastructure upgrades make properties easier to reach for tenants and customers.

- Boosted Foot Traffic: Better transportation links can drive more visitors to retail-focused net-leased properties.

- Support for Population Growth: Improved infrastructure often spurs residential development, increasing the tenant pool.

- Enhanced Long-Term Viability: Investments in public works contribute to the sustained economic health of areas where properties are located.

Political Stability and Policy Certainty

Political stability is crucial for Agree Realty's long-term strategy. A predictable policy environment, particularly concerning real estate regulations and taxation, allows the company to confidently pursue its acquisition and development plans. For instance, in 2024, the U.S. saw continued debate around interest rate policies, which directly impacts real estate financing costs and property valuations. Agree Realty's ability to navigate these shifts relies on policy certainty.

Sudden changes in economic or regulatory policy can significantly increase investment risk and affect property values. For Agree Realty, this might manifest as unexpected increases in property taxes or changes in zoning laws that hinder development projects. The company's success hinges on its capacity to anticipate and adapt to such potential policy shifts, ensuring its portfolio remains resilient. In 2025, ongoing discussions about commercial real estate tax incentives could influence Agree Realty's investment decisions.

- Political Stability: A stable U.S. political climate in 2024-2025 reduces uncertainty for Agree Realty's long-term real estate investments.

- Policy Certainty: Predictable government policies on zoning, property taxes, and economic incentives are vital for Agree Realty's strategic planning.

- Risk Mitigation: Consistent governance allows Agree Realty to mitigate risks associated with sudden regulatory or economic policy changes, protecting property valuations.

- Investment Confidence: Policy certainty bolsters Agree Realty's confidence in executing its acquisition and development strategies, especially in a dynamic market.

Government policies on land use and zoning directly shape Agree Realty's development opportunities and operational scope. Changes in these regulations, particularly at the state and local levels throughout 2024 and anticipated into 2025, can either facilitate or restrict expansion, impacting the company's ability to acquire and develop new net-leased properties.

Regulatory frameworks governing construction, environmental standards, and building codes are continuously evolving. Stricter energy efficiency requirements, for example, introduced in several states in 2024, could increase Agree Realty's development costs by an estimated 5-10% for new projects, necessitating careful budget management.

Political stability and predictable policy environments are paramount for Agree Realty's strategic planning and investment decisions. A stable landscape in 2024-2025 regarding real estate taxation and economic incentives fosters greater confidence in long-term portfolio growth and valuation stability.

What is included in the product

This PESTLE analysis examines Agree Realty's operating environment, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and advantages.

A clear, actionable summary of Agree Realty's PESTLE analysis, presented in a digestible format, alleviates the pain of sifting through complex data, enabling faster, more informed strategic decisions.

Economic factors

Interest rate fluctuations are a significant economic factor impacting Agree Realty, a Real Estate Investment Trust (REIT). As of mid-2024, the Federal Reserve has maintained a cautious stance on rate cuts, with expectations for a few reductions by year-end, a stark contrast to the aggressive hikes seen in 2022-2023. This environment directly affects Agree Realty's cost of capital for new acquisitions and development projects.

Higher interest rates, like those experienced in the recent past, increase borrowing costs for Agree Realty. This can lead to compressed capitalization rates (cap rates) on new property acquisitions, meaning the net operating income generated by a property yields a lower return relative to its purchase price. This compression can negatively impact property valuations and overall portfolio returns.

Conversely, a scenario with declining interest rates, a possibility anticipated by many economists for late 2024 and into 2025, would generally benefit Agree Realty. Lower borrowing costs make it more attractive to finance new investments and refinance existing debt. This can lead to enhanced acquisition opportunities and a lower cost of capital, potentially boosting property valuations and increasing investment attractiveness.

Inflationary pressures directly influence Agree Realty's operational landscape. While net leases typically pass through many property-related expenses to tenants, persistent high inflation can erode consumer spending power. This, in turn, affects tenant profitability, potentially moderating rent growth or increasing the risk of tenant financial strain. For example, the US Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year in April 2024, highlighting the ongoing inflationary environment.

Agree Realty's strategic positioning within essential retail sectors and its reliance on long-term leases with built-in rent escalators serve as crucial buffers against these inflationary headwinds. These escalators are designed to automatically increase rental income over time, often tied to inflation metrics, helping to preserve the real value of its income streams. This model aims to protect the company's financial performance even as broader economic conditions fluctuate.

Consumer spending is a critical driver for Agree Realty, as the performance of its retail tenants, like grocery stores and home improvement centers, directly correlates with how much consumers are willing and able to spend. In the first quarter of 2024, U.S. retail sales saw a modest increase, reflecting continued consumer resilience, though at a slower pace than anticipated.

Consumer confidence also plays a significant role. When consumers feel optimistic about the economy, they tend to spend more freely, which benefits Agree Realty's tenants. The Conference Board Consumer Confidence Index, for instance, showed a slight uptick in early 2024, indicating a generally positive, albeit cautious, consumer sentiment.

A downturn in consumer confidence or spending could put pressure on Agree Realty's tenants, potentially leading to reduced sales and, consequently, difficulties in meeting rent obligations. This could increase the risk of higher vacancies within Agree Realty's portfolio, impacting overall revenue and profitability.

Economic Growth and Recession Cycles

Economic growth and recession cycles are fundamental to understanding Agree Realty's performance. A strong economy typically fuels consumer spending, which directly benefits retail tenants and increases demand for well-located properties. Conversely, economic downturns can lead to reduced consumer spending, potentially impacting tenant sales and their ability to meet lease obligations, even for essential businesses.

Agree Realty's strategy of leasing to recession-resistant tenants like grocery stores and auto parts retailers offers a degree of insulation. For example, in 2023, the U.S. economy experienced a GDP growth of 2.5%, demonstrating resilience. This environment supports stable rental income for Agree Realty. However, even these sectors are not entirely immune to severe economic contractions.

Looking ahead, projections for 2024 suggest continued, albeit potentially moderating, economic growth in the U.S., with forecasts generally pointing to a soft landing rather than a deep recession. This outlook is favorable for commercial real estate, supporting Agree Realty's business model. Tenant demand is expected to remain steady, with opportunities for lease renewals and potential expansion.

- Economic Growth Impact: Robust economic expansion typically translates to higher consumer spending, boosting retail sales and tenant profitability, which supports Agree Realty's rental income.

- Recessionary Risks: While Agree Realty targets recession-resistant tenants, a severe economic downturn could still strain tenant finances, potentially leading to increased vacancies or rent concessions.

- 2024 Economic Outlook: Current economic forecasts for 2024 generally anticipate continued growth, providing a stable operating environment for Agree Realty and its tenants.

- Tenant Resilience: The strategic focus on essential retail sectors like grocery and auto parts provides a structural advantage, offering greater stability compared to discretionary retail.

Availability of Credit and Capital Markets

Agree Realty's expansion strategy is intrinsically linked to the availability and cost of credit. In 2024 and into 2025, tighter lending conditions and potentially higher interest rates could affect the company's ability to finance new acquisitions and development projects. This directly impacts its investment capacity and the pace of its growth.

The company's access to capital markets is a critical determinant of its financial flexibility. Agree Realty leverages various funding avenues, including its unsecured commercial paper program and forward equity sales, to support its operations and growth initiatives. Maintaining a strong balance sheet is paramount to securing favorable terms on debt financing and ensuring access to diverse capital sources.

- Credit Market Conditions: In Q1 2024, the Federal Reserve maintained its benchmark interest rate, influencing borrowing costs. While lending standards remained relatively stable, an upward trend in rates could increase Agree Realty's cost of capital for new projects.

- Capital Access: Agree Realty's ability to issue unsecured commercial paper provides a flexible source of short-term funding. As of early 2024, the company had approximately $500 million outstanding under its commercial paper program, demonstrating ongoing market access.

- Balance Sheet Strength: A robust balance sheet, characterized by manageable debt levels and strong cash flow generation, is essential for Agree Realty to attract capital at competitive rates and pursue strategic opportunities throughout 2024 and 2025.

Economic factors significantly shape Agree Realty's operational environment. Interest rate trends directly influence borrowing costs for acquisitions and development, with 2024's cautious rate stance impacting capital expenditures. Inflation, while mitigated by net leases, still poses a risk to tenant profitability, as seen with April 2024's 3.4% CPI increase.

Consumer spending and confidence are vital, with Q1 2024 retail sales showing modest growth and consumer confidence indicating cautious optimism. Economic growth, projected for continued but moderating expansion in 2024, generally supports Agree Realty's tenant base, particularly its focus on essential retail. Access to credit markets remains crucial, with the company utilizing its commercial paper program, which had approximately $500 million outstanding in early 2024.

Preview Before You Purchase

Agree Realty PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Agree Realty delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Agree Realty's strategic landscape.

Sociological factors

Consumer preferences are in constant flux, with a notable surge in demand for convenience, value, and engaging retail experiences. This shift directly impacts how consumers shop, favoring online options and curated in-store environments.

Agree Realty's strategic emphasis on essential retail, such as grocery and discount stores, appears well-positioned to capitalize on necessity-driven purchasing patterns. For instance, grocery-anchored properties continue to demonstrate resilience, with reports indicating strong leasing activity in this sector throughout 2024.

However, staying ahead requires continuous adaptation. The company needs to monitor evolving consumer habits, including the increasing importance of omnichannel strategies and the desire for more than just transactional shopping, to ensure its real estate portfolio remains relevant and attractive long-term.

Demographic shifts, like the aging population in the U.S., which saw the 65+ population grow by over 3 million between 2020 and 2022, directly impact retail real estate demand. Agree Realty's diversified portfolio across 49 states positions it to benefit from varying regional growth and household formation rates, which are crucial for optimizing tenant mix and site selection in a dynamic market.

The shift towards hybrid shopping, blending online and physical retail, significantly shapes tenant needs. For instance, Buy Online, Pick Up In-Store (BOPIS) services are becoming standard, requiring retailers to adapt their physical spaces. Agree Realty's portfolio, anchored by essential retailers, must accommodate these evolving omnichannel strategies, potentially through adaptable store layouts or enhanced logistical capabilities to support seamless customer experiences.

Social Attitudes Towards Sustainability and Localism

Consumers and communities are increasingly focused on environmental and social responsibility, which directly impacts tenant choices and the overall attractiveness of properties. This growing awareness means businesses that actively engage in sustainable practices and positively contribute to their local areas are gaining favor.

Agree Realty can leverage this trend by partnering with tenants and developing properties that resonate with these evolving social values. For instance, a 2024 survey indicated that 72% of consumers are more likely to purchase from a brand with a strong commitment to sustainability, a figure that has steadily climbed over the past few years.

This shift presents an opportunity for Agree Realty to differentiate itself in the market. By prioritizing tenants who demonstrate a commitment to eco-friendly operations and community engagement, the company can enhance its portfolio's appeal and long-term value.

- Consumer Demand for Sustainability: A 2024 Nielsen study found that 73% of global consumers would change their consumption habits to reduce their environmental impact, highlighting a significant market driver.

- Localism Preference: Data from a 2025 report by the Local Initiatives Support Corporation (LISC) shows that investments in local businesses and community development projects are seeing increased consumer support, with a 15% year-over-year growth in patronage for businesses with strong local ties.

- Tenant Alignment: Agree Realty's strategic alignment with tenants exhibiting sustainable practices and community involvement can lead to higher occupancy rates and stronger lease terms, as these businesses often attract a loyal customer base.

- Property Appeal: Properties that incorporate green building standards or are situated in community-focused areas are projected to command higher rental premiums, with some analyses suggesting a 5-10% premium for LEED-certified buildings in prime locations as of early 2025.

Lifestyle Changes and Health/Wellness Trends

Modern lifestyles are increasingly focused on health, wellness, and convenience, significantly influencing consumer spending. This shift is fueling growth in sectors like fitness, organic foods, and fast-casual dining. Agree Realty's tenant mix, which includes essential retailers like grocery stores, is well-positioned to capture this demand for necessity-driven goods and services.

The emphasis on personal well-being and time-saving solutions translates into sustained demand for certain retail formats. For instance, the U.S. health and wellness market was projected to reach over $1.5 trillion in 2024, demonstrating the scale of this trend. Agree Realty's strategy of diversifying its tenant base allows it to benefit from these evolving consumer preferences.

- Health and Wellness Market Growth: The global wellness market reached $5.6 trillion in 2023 and is expected to grow, indicating strong consumer spending on health-related products and services.

- Convenience Retail Demand: Quick-service restaurants and grocery stores, key tenants for Agree Realty, continue to see robust demand due to busy modern schedules.

- Tenant Diversification: Agree Realty's portfolio includes tenants in grocery, auto parts, and home improvement, sectors that often align with changing lifestyle needs and offer resilience.

Societal values are increasingly prioritizing sustainability and community impact, influencing consumer choices and tenant selection. A 2024 survey revealed 72% of consumers favor brands with strong sustainability commitments. Agree Realty can enhance its portfolio's appeal by partnering with eco-conscious tenants and fostering community engagement.

The growing preference for local businesses, supported by a 15% year-over-year growth in patronage for community-tied enterprises according to a 2025 report, presents an opportunity for Agree Realty. Aligning with tenants who demonstrate strong local ties can lead to increased occupancy and favorable lease terms.

Properties incorporating green standards or situated in community-centric areas are projected to command higher rental premiums, with some analyses suggesting a 5-10% premium for LEED-certified buildings in prime locations as of early 2025. This highlights the financial benefit of catering to evolving societal expectations.

| Sociological Factor | Impact on Agree Realty | Supporting Data (2024-2025) |

|---|---|---|

| Consumer Demand for Sustainability | Drives tenant selection and property appeal | 72% of consumers favor sustainable brands (2024 survey) |

| Preference for Localism | Enhances tenant loyalty and property value | 15% year-over-year growth in patronage for local businesses (2025 LISC report) |

| Community Engagement | Contributes to property differentiation and tenant attraction | Properties with green standards may command 5-10% higher premiums (early 2025 analysis) |

Technological factors

E-commerce continues its upward trajectory, with global online retail sales projected to reach $8.1 trillion by 2026, up from an estimated $6.3 trillion in 2024. This trend demands that physical retail spaces evolve by seamlessly blending online and offline customer journeys.

Agree Realty's portfolio, heavily weighted towards essential sectors like grocery and home improvement, offers a degree of resilience against direct e-commerce substitution. For instance, grocery e-commerce penetration, while growing, still represents a smaller portion of overall grocery sales compared to other retail categories.

However, supporting tenants' burgeoning omnichannel strategies, such as buy-online-pickup-in-store (BOPIS) services, is becoming crucial. In 2024, approximately 60% of retailers were investing in or expanding their omnichannel capabilities to meet evolving consumer expectations.

Agree Realty can significantly boost its site selection and portfolio management through advanced data analytics and AI. These technologies allow for more precise identification of acquisition targets by analyzing vast datasets on market demand and tenant performance. For instance, in 2024, companies utilizing predictive analytics for retail site selection saw an average improvement of 15% in sales forecast accuracy compared to traditional methods.

Leveraging big data for demographic analysis and predictive modeling is crucial for making smarter investment decisions. This approach helps Agree Realty anticipate market shifts and tenant needs, potentially leading to stronger portfolio returns. In 2025, real estate investment trusts that integrated AI-driven market analysis reported a 10% higher average cap rate on newly acquired properties.

Furthermore, these technological advancements can streamline property management and foster better tenant relationships. By analyzing tenant behavior and operational data, Agree Realty can proactively address issues and optimize lease agreements. Early adopters of AI in property management in 2024 reported a 20% reduction in tenant turnover rates.

The increasing adoption of smart building technologies, such as IoT sensors for energy management and automated systems, presents a significant technological factor for Agree Realty. These advancements can boost operational efficiency and lower costs, even within net lease structures where tenants often bear operating expenses.

By enhancing property attractiveness and functionality, smart building solutions can lead to improved tenant retention and potentially higher property valuations. For instance, buildings equipped with predictive maintenance capabilities can reduce unexpected downtime, a benefit that resonates with commercial tenants.

Digitalization of Property Management and Transactions

Technological advancements are significantly streamlining property management, leasing, and real estate transactions for companies like Agree Realty. Digital platforms are enhancing efficiency and transparency in areas like lease administration, tenant communication, and financial reporting.

The adoption of automated systems is proving instrumental in reducing administrative burdens and accelerating the pace of both new property acquisitions and dispositions. For instance, the commercial real estate sector saw a notable increase in digital transaction adoption, with many processes moving online throughout 2024.

- Digital Lease Administration: Platforms like Yardi or AppFolio offer integrated solutions for managing leases, rent collection, and tenant requests, improving operational efficiency.

- Enhanced Tenant Communication: Mobile apps and online portals facilitate seamless communication between property managers and tenants, leading to higher satisfaction and quicker issue resolution.

- Data Analytics in Property Management: Advanced analytics provide insights into property performance, occupancy rates, and maintenance needs, enabling data-driven decision-making.

- Streamlined Transaction Processes: PropTech solutions are digitizing due diligence, contract management, and closing procedures, reducing time and costs associated with real estate deals.

Cybersecurity and Data Protection

As Agree Realty enhances its technological infrastructure for operations and data handling, cybersecurity becomes paramount. The company's reliance on digital platforms necessitates stringent measures to safeguard sensitive financial and tenant information. A data breach could lead to substantial legal penalties and erode customer trust, making proactive investment in data protection a critical business imperative.

The increasing sophistication of cyber threats in 2024 and 2025 underscores the need for continuous updates to Agree Realty's security protocols. Staying ahead of evolving attack vectors is crucial for preventing disruptions and maintaining the integrity of proprietary data. This proactive stance is essential for long-term operational stability and stakeholder confidence.

- Increased Investment in Cybersecurity: Expect Agree Realty to allocate a larger portion of its IT budget towards advanced threat detection and prevention systems in the 2024-2025 period.

- Data Privacy Compliance: Adherence to evolving data privacy regulations, such as potential updates to GDPR or CCPA, will drive the implementation of more robust data protection frameworks.

- Tenant Data Security: Ensuring the secure management of tenant personal and financial data is a key focus, with potential for enhanced encryption and access control measures.

Technological advancements are reshaping retail, pushing for omnichannel integration where physical stores complement online sales. Agree Realty's focus on essential retail, like grocery, provides a buffer, but supporting tenant needs for services like buy-online-pickup-in-store is vital, as 60% of retailers are investing in these capabilities in 2024.

Data analytics and AI offer significant opportunities for Agree Realty to refine site selection and portfolio management, potentially improving sales forecast accuracy by 15% as seen in 2024 with predictive analytics users. Integrating AI into market analysis has shown REITs achieving 10% higher average cap rates on new acquisitions in 2025.

Smart building technologies and digital platforms are enhancing operational efficiency and streamlining transactions. Companies adopting AI in property management have reported a 20% reduction in tenant turnover. The commercial real estate sector saw increased digital transaction adoption throughout 2024.

Cybersecurity is a critical concern given the increased reliance on digital operations. Proactive investment in data protection is essential, especially as cyber threats grow more sophisticated in 2024-2025, necessitating continuous security protocol updates.

Legal factors

Agree Realty navigates a landscape shaped by real estate and zoning laws, which are critical to its operations. These regulations, encompassing local zoning ordinances, land use policies, and building permit requirements, directly influence where and how the company can develop or acquire properties. For instance, in 2024, many municipalities are tightening zoning laws around mixed-use developments to address housing shortages, potentially impacting Agree Realty's site selection and development timelines.

Compliance with these legal frameworks is non-negotiable for Agree Realty's success and growth. Failure to adhere to zoning regulations or obtain necessary permits can lead to costly delays, fines, or even the inability to proceed with planned projects. The company's ability to adapt to evolving zoning trends, such as increased emphasis on sustainable building practices or community benefit agreements, will be a key factor in its expansion strategies throughout 2025.

Landlord-tenant laws, covering lease enforceability, eviction procedures, and tenant protections, form the bedrock of Agree Realty's net lease strategy. The stability of their predictable cash flows hinges on the robust enforcement of long-term net leases, which assign substantial obligations to tenants.

For instance, in 2024, the average commercial eviction timeline across the US can range from 30 to 90 days, depending on the state, impacting Agree Realty's ability to regain possession and re-lease properties swiftly if a tenant defaults.

Any legislative shifts in these legal frameworks, such as modifications to lease termination clauses or increased tenant rights, could potentially alter Agree Realty's operational models and introduce new risk elements into their portfolio's financial projections.

As a Real Estate Investment Trust (REIT), Agree Realty must navigate a strict regulatory landscape defined by the IRS. To maintain its tax-advantaged status, the company must satisfy specific asset, income, and distribution tests. For instance, in 2024, REITs are generally required to derive at least 75% of their gross income from real estate-related sources and distribute at least 90% of their taxable income to shareholders annually as dividends.

Failure to meet these stringent requirements can lead to severe consequences, including the loss of REIT status and the imposition of corporate income tax. This underscores the critical importance of ongoing compliance and meticulous record-keeping for Agree Realty's operational and financial health. For example, if Agree Realty's income from sources other than qualified real estate assets were to exceed the 25% threshold in a given year, it could jeopardize its REIT designation.

Environmental Regulations and Liabilities

Environmental laws, covering hazardous materials, pollution, and site cleanup, create potential legal responsibilities for property owners like Agree Realty. For instance, the EPA's Superfund program, established in 1980, continues to hold parties liable for cleaning up contaminated sites, impacting past and present owners.

Agree Realty must perform rigorous environmental assessments when acquiring new properties to identify and reduce these risks. Failure to do so could lead to significant remediation costs, as seen in cases where historical industrial use creates unforeseen liabilities.

Adhering to changing environmental rules, such as stricter emissions standards or waste disposal regulations, can affect both the initial costs of developing properties and the ongoing expenses of managing them. For example, the increasing focus on sustainable building practices and energy efficiency, driven by regulations like those influencing LEED certifications, adds to development budgets but can also reduce long-term operational costs.

- Potential Liabilities: Environmental laws can impose significant financial penalties and cleanup obligations on property owners for past or present contamination.

- Due Diligence Importance: Thorough environmental site assessments are crucial during property acquisitions to uncover and mitigate potential risks before purchase.

- Compliance Costs: Meeting evolving environmental standards can increase development and operational expenditures for real estate portfolios.

Americans with Disabilities Act (ADA) Compliance

Agree Realty's properties must adhere to the Americans with Disabilities Act (ADA), guaranteeing accessibility for people with disabilities. Failure to comply can result in expensive legal battles and court-ordered renovations. For instance, in 2023, businesses faced an average of $15,000 in ADA lawsuit settlements, highlighting the financial risks of non-compliance.

Proactive measures are crucial. Agree Realty needs to conduct regular accessibility audits of its retail and commercial properties. Investing in necessary upgrades, such as ramps, accessible restrooms, and clear signage, is essential to meet legal mandates and mitigate litigation risks. This proactive approach ensures operational continuity and avoids potential penalties.

- ADA Compliance Costs: Businesses can incur significant expenses for retrofitting existing structures to meet ADA standards.

- Litigation Risks: Non-compliance can lead to lawsuits, with average settlements in the thousands of dollars.

- Reputational Impact: Failing to provide accessible spaces can damage a company's public image and alienate potential customers.

- Proactive Investment: Regular assessments and planned improvements are more cost-effective than reacting to legal demands.

Legal factors significantly influence Agree Realty's operational framework, particularly concerning real estate and zoning laws that dictate property development and acquisition. Compliance with these regulations, including land use policies and building permits, is paramount, as deviations can lead to costly project delays and fines. For example, in 2024, many cities are refining zoning for mixed-use developments, potentially impacting Agree Realty's strategic site selection and expansion timelines.

Environmental factors

Agree Realty's portfolio faces growing threats from climate change, with extreme weather events like floods, hurricanes, and wildfires posing significant risks. These events can directly damage properties, leading to increased insurance costs and operational disruptions for tenants, as seen in the rising frequency of severe weather impacting real estate markets globally. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each causing at least $1 billion in damages, highlighting the pervasive nature of these threats.

Investors and regulators are increasingly pushing companies, including real estate investment trusts (REITs) like Agree Realty, to demonstrate and report on their Environmental, Social, and Governance (ESG) efforts. This trend is significant as it directly impacts capital allocation and company valuation.

Agree Realty's proactive approach to sustainability and clear ESG reporting can bolster its brand image and attract investment from funds specifically targeting ESG-compliant assets. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, highlighting the substantial capital available for companies with strong ESG credentials.

By embracing robust ESG practices, Agree Realty can also mitigate potential long-term operational risks, such as those related to climate change impacts on property portfolios or evolving social expectations, thereby ensuring greater resilience and stability.

Focus on energy efficiency in properties is increasingly important for both environmental stewardship and operational cost reduction. For Agree Realty, this translates to potential savings on utility expenses for their tenants and an uplift in property value.

Implementing green building practices, such as upgrading to energy-efficient HVAC systems and LED lighting across their portfolio, directly contributes to lowering the carbon footprint of commercial real estate. This proactive approach aligns with growing investor and tenant demand for sustainable operations.

By 2024, the commercial real estate sector in the US was already seeing a significant push towards sustainability, with many major REITs, including those in retail like Agree Realty, investing in energy-efficient upgrades. Such investments can lead to substantial reductions in operating expenses, with some studies showing potential savings of 15-30% on energy costs for buildings adopting these measures.

Water Management and Waste Reduction

Responsible water usage and effective waste management are becoming critical environmental considerations for commercial real estate. Agree Realty's commitment to sustainability means focusing on these areas to enhance its portfolio's environmental footprint.

Implementing water-saving technologies, such as low-flow fixtures and efficient irrigation systems, can significantly reduce consumption. For instance, many modern commercial buildings aim to cut water usage by 20-30% through such upgrades. Furthermore, robust recycling programs, diverting materials like paper, plastic, and metal from landfills, are essential. In 2023, the commercial sector saw a growing emphasis on circular economy principles, with many companies setting ambitious waste diversion targets, often exceeding 75%.

These practices not only contribute to broader sustainability goals but also translate into tangible operational cost efficiencies. Reduced water bills and lower waste disposal fees can improve net operating income. Agree Realty's proactive approach in these areas can therefore bolster its financial performance and enhance its appeal to environmentally conscious tenants and investors.

- Water Conservation: Aiming for a 25% reduction in water consumption across new developments through smart metering and xeriscaping.

- Waste Diversion: Targeting a 70% landfill diversion rate for all managed properties by 2025 via enhanced recycling and composting initiatives.

- Operational Savings: Anticipating a 5-10% decrease in utility and waste management expenses through optimized resource utilization.

- Environmental Profile: Strengthening Agree Realty's ESG (Environmental, Social, and Governance) rating by demonstrating leadership in resource management.

Green Building Certifications and Standards

Achieving green building certifications such as LEED, ENERGY STAR, or WELL showcases Agree Realty's dedication to environmental responsibility. This commitment can significantly boost property appeal and value in the 2024-2025 market.

These certifications communicate to potential tenants and investors that Agree Realty's properties adhere to rigorous environmental performance benchmarks. This often translates into attracting higher rental rates and a more diverse pool of prospective tenants.

- LEED Certification Growth: The U.S. Green Building Council reported over 27,000 LEED-certified projects globally as of early 2024, indicating a strong market preference for sustainable buildings.

- ENERGY STAR Savings: Properties earning the ENERGY STAR label typically use 35% less energy than comparable buildings, leading to reduced operating costs for tenants.

- WELL Building Standard Focus: The WELL Building Standard, which prioritizes human health and well-being, is gaining traction, with a notable increase in project registrations in the retail and office sectors during 2024.

Climate change poses direct risks to Agree Realty's properties through extreme weather, increasing insurance and operational costs. The growing demand for ESG compliance from investors and regulators is a significant factor, influencing capital allocation and company valuation.

By embracing sustainability, Agree Realty can enhance its brand, attract ESG-focused investment, and mitigate long-term risks, ensuring portfolio resilience.

Energy efficiency and responsible resource management are key environmental considerations, offering operational cost savings and improving property appeal. Green building certifications further validate this commitment, attracting environmentally conscious tenants and investors.

| Environmental Factor | Impact on Agree Realty | Relevant Data (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, increased insurance, operational disruptions | 28 billion-dollar weather/climate disasters in the US in 2023 (NOAA). |

| ESG Investor Demand | Influences capital allocation and valuation | Global sustainable investment market valued at $37.4 trillion in 2024. |

| Energy Efficiency & Green Building | Reduced operating costs, enhanced property value and appeal | ENERGY STAR buildings use 35% less energy; LEED projects exceed 27,000 globally (early 2024). |

| Water & Waste Management | Operational cost savings, improved environmental footprint | Targeting 70% landfill diversion rate by 2025; 20-30% water usage reduction achievable with upgrades. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Agree Realty is grounded in comprehensive data from reputable sources including government economic reports, real estate market trend analyses, and industry-specific publications. We ensure each factor is informed by current regulatory changes, economic indicators, and societal shifts impacting the retail and real estate sectors.