Agree Realty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

Agree Realty navigates a retail real estate landscape where buyer power from large tenants significantly shapes lease terms, while the threat of new entrants remains moderate due to capital intensity. Understanding these forces is crucial for any investor or strategist looking at the sector.

The complete report reveals the real forces shaping Agree Realty’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of prime real estate locations, especially those considered essential and recession-proof, can be limited, granting property owners significant bargaining power. Agree Realty's focus on these desirable, often high-demand retail assets means they may face higher acquisition costs or more stringent lease terms from sellers, particularly in competitive markets. For instance, in 2024, retail property cap rates in many major metropolitan areas remained compressed, reflecting strong investor demand and, consequently, increased seller leverage.

Suppliers of capital, like banks and institutional investors, wield considerable influence over Agree Realty. As a Real Estate Investment Trust (REIT), Agree Realty is inherently capital-intensive, meaning it relies heavily on external funding. Changes in interest rates and the overall availability of money in the market directly affect how much Agree Realty has to pay for its loans and how attractive its stock is to investors.

Agree Realty's financial strength, demonstrated by its investment-grade credit ratings of Baa1 from Moody's and BBB+ from S&P, helps to lessen the power of these capital suppliers. These strong ratings allow Agree Realty to access a variety of funding sources at more reasonable costs. For instance, in 2024, the company successfully issued bonds and utilized forward equity programs, securing capital efficiently.

Agree Realty's reliance on construction companies and developers for its development and Developer Funding Platform (DFP) projects means these suppliers hold significant bargaining power. This power can be amplified by factors like ongoing labor shortages in the construction sector or the persistent inflation of material costs, which were notably high throughout 2024 and are expected to remain a concern into 2025.

The company's commitment to 25 development and DFP projects in 2025 underscores this dependence. When specialized construction expertise is required, or when market conditions lead to increased demand for construction services, the bargaining power of these suppliers naturally strengthens, potentially impacting Agree Realty's project costs and timelines.

Property Management and Maintenance Services

The bargaining power of suppliers for property management and maintenance services for Agree Realty is generally low, primarily due to their net-lease model. In this structure, tenants are responsible for most operating expenses, minimizing Agree Realty's direct need for extensive third-party property management. When services are required, such as for common areas, the availability of specialized providers and the competitive nature of the property services market limit supplier leverage.

Agree Realty's focus on net-leased retail properties means tenants bear the brunt of property upkeep. For instance, in 2024, the majority of Agree Realty's portfolio consists of single-tenant net lease properties. This structure inherently shifts the operational burden away from the landlord. Consequently, Agree Realty's reliance on external property management and maintenance is significantly reduced compared to traditional landlords.

- Limited Reliance: The net-lease structure minimizes Agree Realty's direct dependency on property management and maintenance suppliers.

- Tenant Responsibility: Tenants typically handle operational expenses, including most maintenance and repairs.

- Supplier Competition: The market for property management and maintenance services is often fragmented, providing Agree Realty with multiple options and reducing individual supplier power.

- Specialization Factor: While specialization can increase supplier power, the scope of services outsourced by Agree Realty is usually limited to areas not covered by tenant leases.

Technology and Data Providers

Technology and data providers, particularly those offering specialized PropTech solutions and market analytics, can wield some influence in the real estate sector. Agree Realty, like many in the industry, depends on these services for critical functions such as identifying acquisition targets, assessing tenant viability, and refining its property portfolio. The distinctiveness and essential nature of these technological tools can amplify the bargaining power of their suppliers.

However, while crucial for informed decision-making, the financial impact of these technology and data services on Agree Realty's overall operating expenses is generally less substantial compared to major cost centers like capital financing or property acquisition. For instance, in 2024, the real estate technology market saw significant investment, with funding rounds for PropTech firms reaching billions, indicating a robust and competitive supplier landscape where individual providers might have limited leverage on pricing for a company like Agree Realty.

- PropTech Dependence: Agree Realty utilizes data for strategic decisions, making reliable technology suppliers important.

- Market Analytics Value: Accurate market data is essential for Agree Realty's acquisition and tenant analysis processes.

- Supplier Influence: The uniqueness and necessity of specialized tools can grant suppliers some bargaining power.

- Cost Impact: The influence of these providers on Agree Realty's total operating costs is typically less significant than capital or property expenses.

Agree Realty faces moderate bargaining power from suppliers of capital, influenced by market interest rates and capital availability. Its strong credit ratings, Baa1 from Moody's and BBB+ from S&P, help mitigate this power, allowing for efficient capital access. For example, in 2024, the company successfully utilized various funding avenues.

Construction and development suppliers can exert significant influence, particularly given labor shortages and material cost inflation observed in 2024, which are expected to persist. Agree Realty's commitment to 25 development and DFP projects in 2025 highlights this reliance, where specialized needs can amplify supplier leverage.

Suppliers for property management and maintenance services generally have low bargaining power for Agree Realty due to its net-lease model, where tenants handle most operational expenses. This structure, with the majority of its 2024 portfolio in single-tenant net lease properties, minimizes Agree Realty's direct need for these services.

Technology and data providers, especially those offering specialized PropTech, can have some influence due to the essential nature of their services for strategic decisions. However, their overall cost impact on Agree Realty's operations is typically less significant than other major expenses, despite substantial investment in the PropTech market in 2024.

What is included in the product

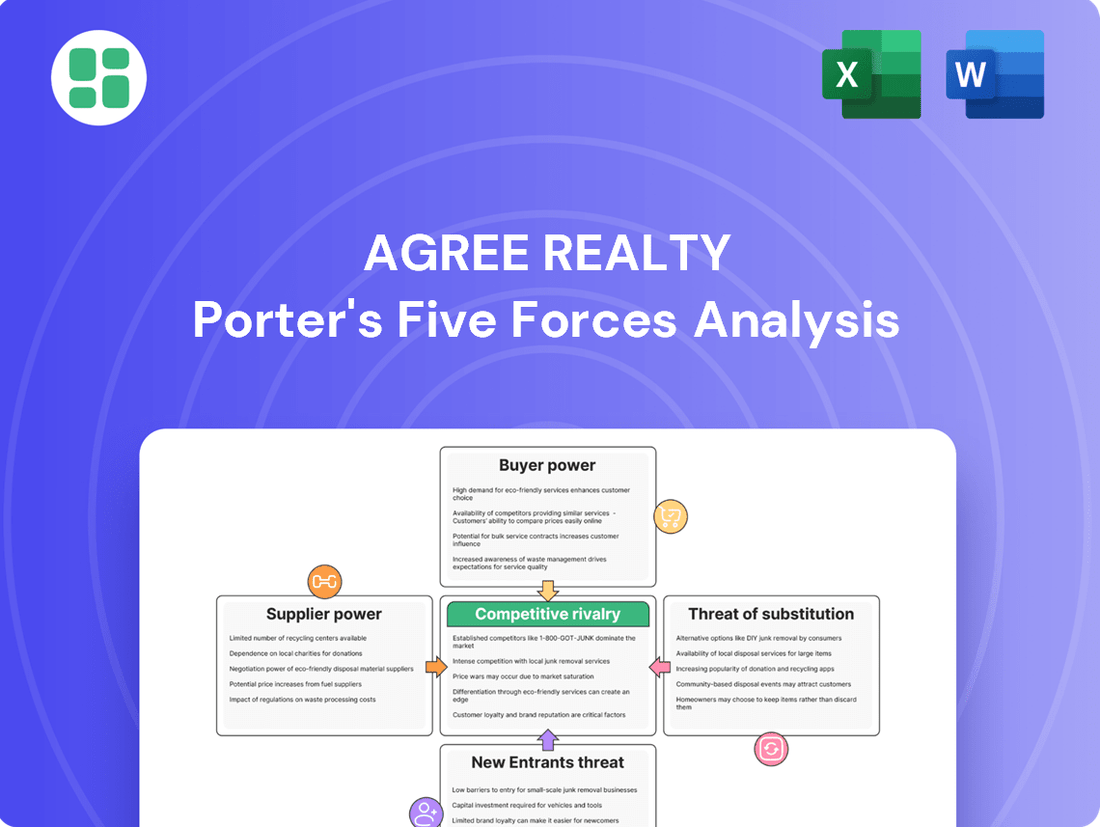

This Porter's Five Forces analysis specifically examines the competitive landscape for Agree Realty, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its retail real estate portfolio.

Instantly identify and quantify competitive pressures with a visually intuitive, five-force framework, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Agree Realty's customers, its retail tenants, are largely national and regional businesses, with a strong emphasis on investment-grade credit quality. As of the second quarter of 2025, 67.8% of its tenants held investment-grade ratings, a testament to the financial stability of its tenant roster. This diverse and high-quality tenant base, featuring prominent names like Walmart, Tractor Supply, and Dollar General, significantly limits the bargaining power of any individual tenant.

Agree Realty's revenue is primarily derived from long-term net leases, a structure that significantly dampens customer bargaining power. As of the second quarter of 2025, the weighted-average remaining lease term stood at approximately 8.0 years. This extended duration locks tenants into agreements, making it difficult for them to renegotiate terms or exit properties prematurely.

The net-lease model further strengthens Agree Realty's position by transferring most property operating expenses, such as taxes, insurance, and maintenance, directly to the tenant. This arrangement reduces the tenant's dependence on Agree Realty for property upkeep, thereby diminishing their leverage in any potential negotiations.

Agree Realty's portfolio is built on properties that are essential and fungible, meaning tenants find them highly desirable and adaptable. This inherent quality reduces the likelihood of tenants seeking significant concessions, as finding truly comparable alternatives becomes challenging.

The company's focus on recession-resistant retail, often occupied by essential service providers, further strengthens its position. For instance, properties leased to national grocery chains or pharmacies are critical to these tenants' operations, giving Agree Realty leverage in negotiations. In 2024, retail properties with strong essential service tenants continued to demonstrate resilience and high occupancy rates, underscoring the value of this strategy.

Tenant Diversification and Concentration

Agree Realty's tenant diversification strategy is key to mitigating customer bargaining power. While its largest tenant, Walmart, represented 6.0% of annualized base rent as of the first quarter of 2024, this concentration is considered manageable. This broad geographic spread across all 50 states and diversification across numerous retail sectors significantly dilutes the influence any single tenant can exert.

The company's portfolio, as of Q1 2024, comprises 2,000+ properties. This extensive and varied tenant base means that the loss or renegotiation of terms with any one tenant has a limited impact on overall revenue. This widespread distribution across different retail categories, from grocery stores to home improvement, further insulates Agree Realty from sector-specific downturns, thereby reducing the collective bargaining leverage of its customer base.

- Tenant Concentration: Walmart accounts for 6.0% of annualized base rent (Q1 2024).

- Geographic Diversification: Properties located in all 50 U.S. states.

- Sector Diversification: Presence across various essential retail sectors.

- Portfolio Size: Over 2,000 properties as of Q1 2024.

Market Conditions for Retail Space

The bargaining power of customers, in this case tenants, is significantly shaped by the broader retail real estate market conditions. A high vacancy rate across the industry can empower tenants by providing them with numerous alternative locations, thereby increasing their negotiating leverage for lease terms and rental rates.

However, Agree Realty's strategic positioning within necessity-based and high-quality retail properties acts as a strong countermeasure. These types of assets typically experience robust demand, insulating them from the broader market fluctuations that might otherwise amplify tenant power. This focus is evident in Agree Realty's impressive portfolio occupancy rate, which stood at 99.6% as of the second quarter of 2025, demonstrating sustained tenant demand for their properties.

- Tenant Leverage Factors: A surplus of retail space generally increases tenant bargaining power.

- Agree Realty's Mitigation: Focus on essential, high-quality retail properties reduces tenant leverage.

- Occupancy Data: Agree Realty's 99.6% occupancy as of Q2 2025 highlights strong tenant retention and demand.

Agree Realty's customers, primarily national and regional retail tenants, possess limited bargaining power due to the company's strategic focus on high-quality, essential retail properties and its robust portfolio diversification. The company's emphasis on investment-grade tenants, which constituted 67.8% of its tenant base in Q2 2025, and long-term net leases with a weighted-average remaining term of 8.0 years, further solidifies its negotiating position.

The company's extensive portfolio, exceeding 2,000 properties across all 50 states as of Q1 2024, minimizes the impact of any single tenant's leverage. Even its largest tenant, Walmart, represented only 6.0% of annualized base rent in Q1 2024, indicating a well-distributed revenue stream. This broad tenant and geographic spread, coupled with a 99.6% occupancy rate in Q2 2025, underscores strong demand and tenant retention, effectively counteracting potential customer power.

| Metric | Data Point | Significance to Customer Bargaining Power |

| Investment-Grade Tenants | 67.8% (Q2 2025) | Indicates financially stable tenants less likely to seek concessions. |

| Weighted-Average Lease Term | ~8.0 years (Q2 2025) | Long-term leases reduce tenant flexibility to renegotiate. |

| Largest Tenant Concentration (Walmart) | 6.0% of ABR (Q1 2024) | Low concentration limits individual tenant influence. |

| Portfolio Occupancy Rate | 99.6% (Q2 2025) | High occupancy signifies strong demand and tenant retention. |

| Portfolio Size | 2,000+ properties (Q1 2024) | Diversification across numerous properties dilutes individual tenant impact. |

Preview the Actual Deliverable

Agree Realty Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Agree Realty delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the retail real estate investment trust sector. This detailed report provides actionable insights to understand Agree Realty's market position and strategic opportunities.

Rivalry Among Competitors

The net lease retail market is substantial and highly fragmented, featuring a wide array of participants. These include numerous publicly traded Real Estate Investment Trusts (REITs), private equity funds, and individual property owners. This broad base of investors creates a competitive landscape where opportunities are actively pursued by many.

While Agree Realty holds a strong position as a market leader, the vast number of properties and varied investment approaches prevent any single entity from achieving complete dominance. This dynamic results in a moderate to high level of rivalry, particularly when it comes to securing attractive acquisition targets. For instance, in 2024, the net lease sector continued to see significant transaction volume, underscoring the ongoing competition for quality assets.

The ability to identify, acquire, and develop prime net-leased properties is a key driver of competition in this sector. Agree Realty's comprehensive investment strategy, encompassing acquisitions, development, and a developer funding platform, positions it strongly. For 2025, the company has projected investments in the range of $1.4 billion to $1.6 billion, demonstrating significant scale and a diversified approach.

While Agree Realty's substantial investment capacity and strategic diversification offer a competitive advantage, it's important to note that other well-capitalized real estate investment trusts (REITs) and private equity funds are also actively competing for similar high-quality assets. This creates a dynamic market where successful execution of acquisition and development plans is crucial for maintaining market share and driving growth.

Competitive rivalry within the real estate investment trust (REIT) sector, particularly for Agree Realty, is heavily shaped by access to and the cost of capital. Companies possessing robust financial health and a lower cost of capital can gain a significant advantage in acquiring prime real estate assets.

Agree Realty's demonstrated financial strength, exemplified by its 'fortress balance sheet' and substantial liquidity of $2.3 billion as of the first quarter of 2024, enables it to outbid rivals for attractive properties. This financial leverage allows Agree Realty to pursue its growth objectives more aggressively and efficiently compared to competitors with less financial capacity.

Tenant Relationships and Underwriting Expertise

Agree Realty's competitive edge is significantly bolstered by its deep-rooted tenant relationships and sharp underwriting acumen. By cultivating strong ties with top-tier, omni-channel retailers, the company secures advantageous, long-term lease agreements. This focus on quality tenants and stringent investment standards, which Agree Realty consistently highlights, serves to mitigate risk and distinguish it from rivals who may target less stable tenants for potentially higher yields.

This strategic approach translates directly into tangible financial benefits. For instance, Agree Realty's portfolio is characterized by long lease durations, with a weighted average remaining lease term of approximately 7.8 years as of the first quarter of 2024. This stability is a direct result of its underwriting expertise, allowing for predictable cash flows and a more resilient business model in the often-volatile retail real estate sector.

- Tenant Quality: Agree Realty prioritizes relationships with industry leaders, ensuring portfolio stability.

- Underwriting Rigor: Sophisticated analysis minimizes risk and secures favorable lease terms.

- Lease Durability: A weighted average remaining lease term of ~7.8 years (Q1 2024) underscores tenant commitment.

- Risk Mitigation: Focus on high-quality tenants differentiates Agree Realty from competitors pursuing higher-risk opportunities.

Property Quality and Diversification

The quality and diversification of a real estate investment trust's (REIT) property holdings are significant drivers of its competitive standing. Agree Realty's strategic focus on investment-grade tenants, businesses that are resilient to e-commerce trends and economic downturns, directly addresses this. This approach helps mitigate risks associated with tenant defaults or lease expirations.

Agree Realty's portfolio is notably diversified across numerous sectors and geographic locations, spanning all 50 states. This broad exposure reduces the impact of localized economic challenges or sector-specific downturns on the company's overall performance. In 2024, Agree Realty continued to demonstrate this by maintaining a high occupancy rate, reporting 99.4% occupancy as of the first quarter of 2024, underscoring the strength and essential nature of its tenant base.

- Tenant Quality: Agree Realty prioritizes tenants with strong credit ratings, often investment-grade, which enhances portfolio stability.

- E-commerce and Recession Resistance: The portfolio is heavily weighted towards sectors less impacted by online retail growth and economic recessions, such as grocery-anchored retail.

- Geographic and Sector Diversification: Operating across all 50 U.S. states and various retail sub-sectors provides a buffer against regional or industry-specific headwinds.

- Portfolio Resilience: This strategic positioning makes Agree Realty a more robust competitor than REITs with concentrated portfolios or tenants facing greater market pressures.

Competitive rivalry in the net lease retail sector is intense, driven by a fragmented market with numerous participants, including REITs, private equity, and individual owners. Agree Realty's strong market position is challenged by this broad base of investors actively seeking attractive acquisition targets, a trend evident throughout 2024 with significant transaction volumes.

Agree Realty's ability to secure prime net-leased properties is a key differentiator, supported by a projected investment range of $1.4 billion to $1.6 billion for 2025. While its financial strength, including $2.3 billion in liquidity as of Q1 2024, provides an edge, other well-capitalized entities also compete for similar high-quality assets, demanding efficient execution of acquisition and development plans.

The company's competitive advantage is further amplified by its focus on tenant quality, exemplified by a weighted average remaining lease term of approximately 7.8 years as of Q1 2024. This stability, stemming from strong tenant relationships and rigorous underwriting, distinguishes Agree Realty from competitors who may engage with less stable tenants.

Agree Realty's portfolio resilience, demonstrated by a 99.4% occupancy rate in Q1 2024 and diversification across all 50 states, positions it favorably against rivals with more concentrated holdings or tenants facing greater market pressures.

| Metric | Agree Realty (Q1 2024) | Industry Benchmark (Illustrative) |

|---|---|---|

| Liquidity | $2.3 billion | Varies significantly by REIT size |

| Weighted Avg. Remaining Lease Term | ~7.8 years | Typically 5-7 years for net lease REITs |

| Occupancy Rate | 99.4% | Generally high for quality net lease portfolios |

| Projected 2025 Investment | $1.4 - $1.6 billion | Indicates significant competitive capacity |

SSubstitutes Threaten

A significant substitute for Agree Realty's leased properties is when retail tenants choose to own their real estate outright. This allows them to avoid rental payments and gain complete control over their locations. For instance, in 2023, the retail sector saw varying levels of new construction and property acquisition, with some larger, well-capitalized retailers opting for ownership to manage costs and asset appreciation.

However, this path of ownership comes with substantial capital requirements. Retailers must commit significant funds to purchase or develop properties, which could otherwise be invested in inventory, marketing, or expanding their core business operations. This capital-intensive nature of property ownership often makes leasing a more appealing and flexible solution for many retailers, especially those focused on rapid growth or operating with tighter cash flows.

While Agree Realty specializes in net-leased properties, tenants might view other real estate arrangements as alternatives. These could include gross leases, where the landlord covers operating expenses, or sale-leaseback agreements with varied terms, or even shorter-term rental agreements. These options offer different cost structures and flexibility for tenants.

However, the prevalence of net leases among major retailers, driven by their desire for operational autonomy and potential tax advantages, limits the direct substitutability for Agree Realty's core tenant base. For instance, in 2024, a significant portion of Agree Realty's revenue, approximately 99.9%, is derived from its net lease portfolio, highlighting the strong preference for this structure among its target tenants.

The increasing prevalence of e-commerce presents a substantial long-term challenge to traditional physical retail, directly impacting retail Real Estate Investment Trusts (REITs). This shift means consumers can increasingly bypass brick-and-mortar stores for online alternatives.

Agree Realty actively counters this threat by concentrating on retailers that are essential to an omni-channel strategy. These include businesses like grocery stores, home improvement centers, and auto parts retailers, where physical locations remain crucial for customer experience and operational efficiency, even alongside online sales. For instance, in 2024, retailers like Home Depot and Lowe's, key tenants for many retail REITs, reported continued strong performance driven by both in-store and click-and-collect sales, demonstrating the resilience of their physical footprints.

Investment in Other Asset Classes

Investors looking at Agree Realty also consider other asset classes. For instance, bonds offer a different risk-return profile, and their yields can influence investor decisions. As of late 2024, the 10-year Treasury yield has seen fluctuations, making fixed income an attractive alternative for some, especially during periods of market uncertainty.

Direct real estate investments or shares in unrelated sectors present further substitution threats. While direct property ownership lacks the liquidity of REITs like Agree Realty, its potential for appreciation can be appealing. The S&P 500, for example, has demonstrated strong performance in 2024, drawing capital that might otherwise flow into REITs.

The appeal of these substitutes hinges on their risk-adjusted returns and how they align with an investor's liquidity needs and market outlook. Agree Realty, as a retail REIT, offers specific advantages:

- Diversification benefits within a real estate portfolio.

- Regular income streams through dividends.

- Liquidity compared to direct property ownership.

Shifting Consumer Behavior

Shifting consumer behavior presents a significant threat of substitution. A permanent move away from physical stores for certain purchases, driven by convenience or evolving preferences, could reduce demand for traditional retail spaces. For instance, the continued growth in e-commerce, which saw accelerated adoption during the pandemic, directly substitutes for brick-and-mortar retail. In 2024, online retail sales are projected to continue their upward trajectory, further solidifying this trend.

Agree Realty proactively mitigates this threat by strategically concentrating on necessity-based and service-oriented retail tenants. These sectors, including grocery stores, pharmacies, and auto service centers, demonstrate greater resilience to consumer behavior shifts compared to retailers focused on discretionary goods. This focus ensures a more stable revenue stream, as consumers will continue to require these essential services regardless of broader retail trends.

The company's portfolio composition is key. By prioritizing tenants whose offerings are less likely to be fully substituted by online alternatives or changing lifestyles, Agree Realty maintains a defensive posture. For example, a significant portion of their net lease portfolio comprises tenants in the grocery and health sectors, which have shown consistent performance. This strategic alignment with essential services acts as a buffer against the broader threat of substitution impacting the retail real estate sector.

The threat of substitutes for Agree Realty's leased properties primarily stems from alternative ways tenants can operate their businesses and how investors can allocate capital. For tenants, owning property outright is a substitute, though it requires significant capital. For investors, other asset classes like bonds or direct real estate offer different risk-return profiles.

The rise of e-commerce is a critical substitute for physical retail spaces, impacting Agree Realty's tenant base. However, Agree Realty mitigates this by focusing on essential retailers like grocery and home improvement stores, which maintain strong physical presence needs. In 2024, these sectors continue to show resilience, with many key tenants reporting robust omni-channel sales performance.

| Substitute Type | Tenant Perspective | Investor Perspective | Agree Realty Mitigation |

|---|---|---|---|

| Property Ownership | Avoids rent, gains control; high capital cost. | Direct real estate investment; illiquid, potential appreciation. | Net lease structure offers operational flexibility for tenants. |

| E-commerce | Bypasses brick-and-mortar; convenience. | S&P 500 performance draws capital; alternative asset class. | Focus on necessity-based retailers with strong physical demand. |

| Alternative Lease Structures | Gross leases, sale-leasebacks offer different cost/flexibility. | Bonds offer different risk-return, influenced by yields (e.g., 10-year Treasury in late 2024). | 99.9% of 2024 revenue from net leases, indicating tenant preference. |

Entrants Threaten

Entering the net-leased retail real estate investment trust (REIT) sector, where Agree Realty operates, demands significant upfront capital. This is primarily for acquiring prime retail properties and undertaking necessary development or redevelopment projects. The sheer scale of investment required acts as a substantial deterrent for potential new players.

Agree Realty, for instance, boasts an enterprise value of approximately $11.6 billion as of mid-2024. The company has also outlined plans for considerable capital deployment throughout 2025, underscoring the substantial financial muscle needed to compete effectively. Any new entrant would need to secure vast amounts of debt and equity financing to even begin to approach this level of operational capacity and market presence.

The threat of new entrants in the net lease retail real estate sector, particularly for a company like Agree Realty, is somewhat mitigated by the specialized knowledge required. Success hinges on deep expertise in net lease structuring, meticulous property underwriting, and, crucially, robust relationships with national and regional retail tenants. Agree Realty, with its decades of experience, has cultivated these essential elements, creating a significant barrier for newcomers aiming to quickly establish a comparable foothold.

Established REITs, including Agree Realty, benefit from investment-grade credit ratings and broad access to capital markets. This allows them to secure financing at significantly lower interest rates compared to newer market participants. For instance, in early 2024, companies with strong credit profiles could access debt at rates well below those available to unproven entities.

New entrants often struggle to obtain favorable financing, facing higher borrowing costs and more restrictive terms. This financial hurdle makes it more challenging for them to compete for desirable properties, thereby limiting their ability to enter the market effectively and scale their operations.

Regulatory and Compliance Hurdles

The real estate investment trust (REIT) sector, including companies like Agree Realty, faces significant barriers to entry due to stringent regulatory and compliance requirements. Operating as a REIT necessitates adherence to specific tax laws and ongoing compliance, such as mandatory dividend distribution rules, which can be complex to manage. For instance, in 2024, maintaining REIT status requires distributing at least 90% of taxable income annually to shareholders.

New entities entering this market must invest heavily in legal and financial expertise to ensure continuous compliance, thereby increasing initial setup costs and the time required to become operational. This regulatory burden acts as a substantial deterrent, limiting the number of new players that can effectively challenge established REITs.

- Regulatory Complexity: REITs must comply with IRS regulations, including asset, income, and distribution tests.

- Compliance Costs: Establishing and maintaining the necessary legal and financial infrastructure to meet REIT requirements is costly.

- Dividend Distribution Mandate: The requirement to distribute at least 90% of taxable income annually impacts capital availability for growth.

- Market Knowledge: Navigating the specialized real estate and financial markets requires deep industry-specific knowledge.

Scalability and Portfolio Diversification

The significant capital investment and extensive operational expertise required to replicate Agree Realty's vast portfolio, spanning thousands of properties across multiple states and diverse retail segments, present a substantial barrier to entry. For instance, as of the first quarter of 2024, Agree Realty owned and operated a portfolio of 2,160 properties, a testament to years of strategic acquisition and development. This scale and diversification are not easily or quickly replicated by newcomers.

New entrants would find it challenging to achieve comparable diversification and scale in a timely manner. This lack of immediate diversification makes them more susceptible to localized economic downturns or tenant-specific problems that could disproportionately impact their business. Agree Realty's 2023 revenue of $557.7 million, generated from a broad tenant base and geographic spread, highlights the resilience built through diversification.

- Significant Capital Requirements: Acquiring a substantial real estate portfolio comparable to Agree Realty's requires billions in capital, a hurdle most new entrants cannot overcome quickly.

- Time and Expertise for Diversification: Building a portfolio of over 2,000 properties across numerous states and retail sectors, as Agree Realty has, takes considerable time, strategic planning, and deep market expertise.

- Vulnerability of Smaller Portfolios: New entrants with smaller, less diversified portfolios are inherently more vulnerable to localized market fluctuations or tenant defaults.

- Established Relationships and Market Access: Agree Realty benefits from established relationships with tenants and lenders, providing advantages in property acquisition and financing that new entrants lack.

The threat of new entrants for Agree Realty is relatively low due to the substantial capital required to enter the net-leased retail real estate sector. Acquiring a portfolio of scale similar to Agree Realty's, which comprised 2,160 properties as of Q1 2024, necessitates billions in investment, a significant barrier for most newcomers.

Furthermore, the specialized knowledge in net lease structuring, property underwriting, and tenant relationship management cultivated by Agree Realty over decades creates a strong competitive advantage. New entrants would struggle to replicate this expertise and the established relationships that facilitate property acquisition and favorable financing terms.

Stringent regulatory and compliance requirements for REITs also pose a considerable hurdle, demanding significant investment in legal and financial infrastructure. The need to distribute at least 90% of taxable income annually, a 2024 requirement, further impacts capital availability for new players.

| Factor | Impact on New Entrants | Agree Realty's Position |

|---|---|---|

| Capital Requirements | Very High | Established, significant financial capacity (Enterprise Value ~$11.6B mid-2024) |

| Specialized Knowledge & Relationships | Low/Developing | High, decades of experience and established tenant/lender relationships |

| Regulatory Compliance | High Cost & Complexity | Established infrastructure for compliance (e.g., 90% dividend distribution) |

| Portfolio Scale & Diversification | Difficult & Time-Consuming | Extensive (2,160 properties Q1 2024), mitigating localized risks |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Agree Realty leverages data from SEC filings, investor presentations, and real estate industry reports. We also incorporate market research from firms specializing in retail and net lease properties to assess competitive pressures.