Agree Realty Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

Agree Realty's marketing strategy is a masterclass in real estate investment, meticulously aligning its offerings with market demands, competitive pricing, strategic property placement, and impactful promotional campaigns. Understand how these elements create a powerful synergy for growth.

Dive deeper into the specific tactics that drive Agree Realty's success. Our comprehensive 4Ps analysis breaks down their product portfolio, pricing architecture, distribution channels, and promotional mix, offering actionable insights for your own business strategies.

Go beyond the surface-level understanding. Access the full, editable Marketing Mix Analysis for Agree Realty and gain immediate, professionally written insights perfect for business planning, academic research, or client presentations. Save time and elevate your strategic thinking.

Product

Agree Realty's core product is its extensive net leased retail property portfolio. This collection features properties leased to a wide array of national and regional retailers, spanning various retail segments. As of December 31, 2024, Agree Realty's portfolio comprised 2,370 properties strategically located in all 50 states, demonstrating significant geographic diversification.

This tangible asset base is the engine driving Agree Realty's income generation. It offers investors a direct pathway to participate in the performance of a well-diversified group of income-producing real estate. By June 30, 2025, the company had further expanded its footprint, growing the portfolio to 2,513 properties.

Long-term, triple net lease agreements are the bedrock of Agree Realty's product offering. This structure shifts the burden of property taxes, insurance, and maintenance to the tenant, creating a highly stable revenue stream for Agree Realty.

As of June 30, 2025, these leases boast a weighted-average remaining term of approximately 8.0 years. This extended duration is a key factor in providing predictable cash flows and mitigating short-term market volatility for investors.

Furthermore, these agreements typically include built-in rent escalators. These provisions are crucial for enhancing long-term value by ensuring that rental income grows over time, keeping pace with inflation and increasing property values.

Agree Realty's property acquisition strategy centers on essential and recession-resistant tenants, a key element in their marketing mix. This includes retailers like grocery stores, home improvement centers, and auto parts suppliers, sectors that historically perform well even during economic slowdowns. For instance, as of Q1 2024, over 90% of Agree Realty's rental income was derived from investment-grade tenants, underscoring their commitment to stability.

This deliberate focus on 'resistance-proof' assets is designed to create a robust and dependable income stream for investors, mitigating risks associated with economic volatility and the ongoing shift towards e-commerce. By prioritizing sectors less susceptible to disruption, Agree Realty aims to safeguard investor capital and provide consistent returns.

Furthermore, the company actively seeks out retailers with strong omni-channel capabilities, recognizing that physical store locations remain vital components of their overall business models. This strategic alignment ensures that their leased properties are integral to tenant success, further solidifying the stability of Agree Realty's portfolio in the evolving retail landscape.

Diverse and Investment-Grade Tenant Base

Agree Realty's product strength is significantly bolstered by its diverse and investment-grade tenant base. This diversification spans 28 distinct retail sectors, providing a robust buffer against industry-specific downturns. The inclusion of numerous investment-grade rated retailers further solidifies the stability and reliability of its rental income stream.

As of June 30, 2025, a substantial 67.8% of Agree Realty's annualized base rents originated from investment-grade retail tenants. This high concentration of creditworthy tenants is a key differentiator, exceeding the industry average and underscoring the quality of its real estate portfolio. This strategic tenant selection minimizes default risk and ensures consistent cash flow.

- Diversified Retail Sectors: Tenant base covers 28 retail sectors, reducing single-sector dependency.

- High Investment-Grade Concentration: 67.8% of annualized base rents from investment-grade tenants as of June 30, 2025.

- Risk Mitigation: Diversification across sectors and tenant credit quality lowers overall portfolio risk.

- Peer Outperformance: Tenant credit quality significantly surpasses that of many industry competitors.

Stable and Predictable Cash Flow Stream

Agree Realty's core investor appeal lies in its consistent and predictable cash flow generation, directly fueling its monthly dividend distributions. This stability is built upon a foundation of long-term net leases, ensuring reliable income from its properties.

The company strategically partners with essential and investment-grade tenants, minimizing default risk and enhancing cash flow predictability. This deliberate tenant selection, coupled with a diversified portfolio across various industries and geographies, further bolsters the resilience of its earnings.

Agree Realty is committed to delivering durable earnings growth, with its growing monthly dividend supported by a prudent payout ratio. For instance, as of the first quarter of 2024, the company reported a robust occupancy rate of 99.1%, underscoring the strength of its tenant base and lease agreements.

- Long-term Net Leases: Securing predictable rental income.

- Investment-Grade Tenants: Mitigating default risk.

- Portfolio Diversification: Spreading risk across industries and locations.

- Consistent Dividend Growth: Supported by a conservative payout ratio.

Agree Realty's product is its high-quality, net-leased retail real estate portfolio, characterized by long-term leases with strong tenants. This tangible asset base, strategically diversified across all 50 states, provides a stable foundation for income generation. The company's commitment to essential and recession-resistant retail sectors, combined with a focus on investment-grade tenants, underpins the reliability of its rental income stream.

| Metric | Value (as of June 30, 2025) | Significance |

|---|---|---|

| Portfolio Size | 2,513 Properties | Demonstrates significant scale and market presence. |

| Weighted-Average Lease Term | 8.0 Years | Indicates predictable, long-term cash flows. |

| Investment-Grade Tenant Rent | 67.8% of annualized base rents | Highlights strong tenant credit quality and reduced risk. |

| Occupancy Rate | 99.1% (as of Q1 2024) | Confirms high demand and tenant retention. |

What is included in the product

This analysis provides a comprehensive breakdown of Agree Realty's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for understanding their market positioning.

It's designed for professionals seeking a deep dive into Agree Realty's actual marketing practices, ideal for benchmarking, strategic planning, or internal reporting.

Simplifies Agree Realty's complex marketing strategy into actionable 4P insights, alleviating the pain of information overload for busy executives.

Place

Agree Realty's shares, traded under the ticker symbol ADC, are readily available on the New York Stock Exchange (NYSE). This public listing ensures broad accessibility for a diverse investor base, from individual retail investors to substantial institutional funds, facilitating easy trading and providing a clear benchmark for the company's valuation.

The NYSE listing offers significant liquidity for Agree Realty's stock, allowing investors to buy and sell shares efficiently. This transparency is crucial for market participants seeking to understand the company's public market valuation.

Further demonstrating its public market engagement, Agree Realty successfully completed a follow-on public offering in October 2024. This offering generated substantial net proceeds, reinforcing investor confidence and providing capital for future growth initiatives.

Agree Realty's 'place' strategy for asset acquisition is robust, leveraging direct relationships with top-tier tenants, a broad network of real estate brokers, and its innovative Developer Funding Platform. This diverse sourcing method guarantees a steady flow of premium net leased properties.

This strategic sourcing is crucial for maintaining growth. In 2024, Agree Realty successfully acquired 242 retail net lease properties, demonstrating the effectiveness of its acquisition channels.

Looking ahead, the company is projecting significant investment activity. For 2025, Agree Realty anticipates investment volumes to range between $1.4 billion and $1.6 billion, underscoring its commitment to expanding its high-quality portfolio through these established channels.

Agree Realty's commitment to geographic diversification is a cornerstone of its strategy, with a portfolio spanning all 50 U.S. states as of December 31, 2024, and continuing through June 30, 2025. This extensive reach, covering approximately 48.8 million to 52.0 million square feet of gross leasable area, significantly reduces the risk associated with any single market's performance.

This widespread distribution allows Agree Realty to tap into diverse economic conditions and real estate cycles across the nation. By not being overly reliant on any one region, the company enhances the stability and resilience of its income-generating assets.

Online Investor Relations Platforms

Agree Realty leverages its online investor relations platform as a key component of its marketing mix. This digital hub, accessible at agree-realty.com/investors, provides a comprehensive repository for all essential financial data. For instance, during fiscal year 2024, the platform was updated with quarterly earnings reports and SEC filings, ensuring transparency and accessibility for stakeholders.

These platforms are vital for enabling informed decision-making by a diverse audience, from individual investors to financial professionals. They offer direct access to critical documents and communication channels, facilitating in-depth analysis of Agree Realty's performance and strategy. The site features:

- Quarterly Earnings Reports and SEC Filings

- Annual Reports and Investor Presentations

- Webcasts and Transcripts of Earnings Calls

Direct Investment and Institutional Partnerships

Beyond its publicly traded shares, Agree Realty actively pursues direct investment avenues and cultivates partnerships with institutional players. This strategic approach facilitates customized investment frameworks and enables the deployment of substantial capital, thereby expanding the 'place' for significant real estate investment.

These collaborations allow Agree Realty to access capital for larger-scale projects and diversify its funding sources. The company's success in attracting institutional capital underscores its appeal as a stable and reliable real estate investment vehicle.

Agree Realty demonstrated its capacity to secure significant funding in the second quarter of 2025, raising over $800 million in a combination of debt and equity. This substantial capital infusion highlights the trust and confidence institutional investors place in Agree Realty's business model and growth prospects.

- Direct Investment: Agree Realty engages in direct property acquisitions and development projects, often partnering with institutional capital for these ventures.

- Institutional Partnerships: The company collaborates with a range of institutional investors, including pension funds, insurance companies, and private equity firms, to co-invest in its portfolio.

- Capital Deployment: These partnerships enable larger capital deployments, supporting Agree Realty's strategy of acquiring and developing high-quality, net-lease retail properties.

- Q2 2025 Capital Raise: Agree Realty successfully raised over $800 million in debt and equity during Q2 2025, showcasing its strong access to institutional capital markets.

Agree Realty's 'place' strategy centers on widespread geographic diversification and efficient property sourcing. By operating across all 50 U.S. states as of June 30, 2025, covering approximately 50.4 million square feet of gross leasable area, the company mitigates single-market risk. This broad physical presence is complemented by a robust digital presence, with an investor relations platform providing transparent access to financial data.

The company's acquisition channels, including direct tenant relationships and a Developer Funding Platform, ensure a consistent pipeline of premium net-leased assets. This strategic approach is validated by its projected investment volume of $1.4 billion to $1.6 billion for 2025, demonstrating continued expansion across diverse markets.

Agree Realty also facilitates 'place' for significant capital deployment through direct investment and institutional partnerships. This is evidenced by a successful capital raise of over $800 million in Q2 2025, highlighting strong institutional confidence and enabling larger-scale property acquisitions.

| Metric | As of June 30, 2025 | 2025 Projection |

|---|---|---|

| Geographic Reach | All 50 U.S. States | N/A |

| Gross Leasable Area (Approx.) | 50.4 million sq ft | N/A |

| Projected Investment Volume | N/A | $1.4 billion - $1.6 billion |

| Q2 2025 Capital Raise | Over $800 million | N/A |

Preview the Actual Deliverable

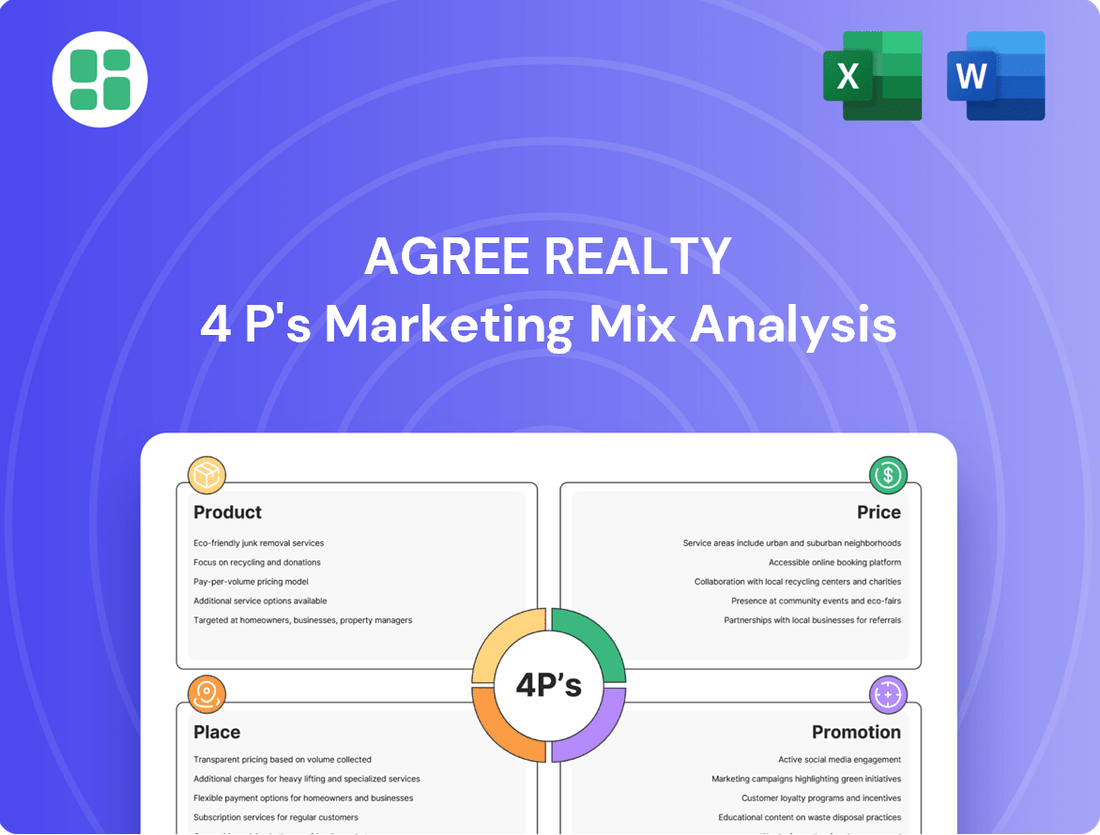

Agree Realty 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Agree Realty's Product, Price, Place, and Promotion strategies, offering valuable insights into their market positioning and operational approach. You'll gain a clear understanding of how these 4Ps contribute to their overall success.

Promotion

Agree Realty’s comprehensive investor relations program focuses on transparency and timely communication to its diverse audience of financially-literate decision-makers. This commitment is evident in their regular earnings calls, detailed quarterly and annual reports, and readily available SEC filings like the 10-K and 10-Q.

The company actively updates its investor presentation materials and provides earnings call transcripts, ensuring stakeholders have access to the latest financial performance data and strategic insights. For instance, in their Q1 2024 earnings report, Agree Realty highlighted a net income of $100.5 million, demonstrating their consistent financial reporting practices.

Agree Realty actively cultivates positive relationships with financial media and equity research analysts to bolster its market presence. Favorable coverage in outlets like Bloomberg or reports from analysts at firms such as Baird or Stifel can significantly enhance the company's credibility and investor appeal. This strategic engagement aims to generate awareness and attract a broader base of potential investors by showcasing the company's strengths and growth prospects.

Agree Realty actively engages in key industry conferences like Nareit's REITweek, providing a vital stage for their management team to connect with investors and financial professionals.

These appearances are instrumental in articulating Agree Realty's strategic vision and highlighting their unique value proposition directly to stakeholders, fostering stronger relationships and investor confidence.

For example, at the 2024 REITweek, Agree Realty management likely presented their portfolio performance and growth outlook, reinforcing their position in the net lease sector.

Corporate Website & Digital Presence

Agree Realty actively utilizes its corporate website and digital platforms to communicate its brand identity and investment appeal. The website prominently features its mission to 'Rethink Retail,' offering detailed insights into its expansive property portfolio, strategic direction, and commitment to environmental, social, and governance (ESG) initiatives. This digital hub is crucial for reinforcing its market leadership and strategic positioning.

The company's online presence serves as a primary resource for investors and stakeholders, providing access to critical data and updates. For instance, as of the first quarter of 2024, Agree Realty reported a robust portfolio comprising 2,173 properties, with 99.1% occupancy. This data underscores the tangible strength of their retail real estate holdings, directly supported by the information disseminated through their digital channels.

- Brand Promotion: The website is a key tool for articulating Agree Realty's unique 'Rethink Retail' philosophy and its strategic advantages.

- Information Hub: It provides comprehensive details on the company's portfolio, financial performance, and sustainability efforts, ensuring transparency.

- Investor Relations: Agree Realty's digital presence facilitates communication with shareholders, offering access to earnings reports and corporate news.

- Market Positioning: The consistent online messaging reinforces Agree Realty's standing as a leader in the net lease retail real estate sector.

Emphasis on Portfolio Quality & Resilience

Agree Realty's promotional strategy heavily emphasizes the superior quality and inherent resilience of its real estate portfolio. This focus is designed to attract investors who prioritize stability and dependable income streams.

The company consistently highlights its tenant base, which primarily comprises essential, resistance-proof, and recession-proof businesses. This strategic tenant selection underpins the durability of Agree Realty's revenue generation, even during economic downturns.

This core message of portfolio quality and resilience is a recurring theme in Agree Realty's investor communications. For instance, in their 2024 investor presentations, they detailed how over 90% of their rental income is derived from investment grade tenants, showcasing the strength of their tenant relationships and the essential nature of their lessees' operations.

- Tenant Diversification: Agree Realty's portfolio is diversified across various essential retail sectors, reducing single-tenant or single-sector risk.

- Lease Structure: Long-term net leases are a cornerstone, ensuring predictable cash flow with tenants responsible for property operating expenses.

- Investment Grade Tenants: A significant majority of their tenants are rated investment grade, signifying financial stability and reliability.

Agree Realty's promotional efforts center on its robust portfolio and strong tenant relationships, emphasizing stability and reliable income. The company consistently highlights its tenant base, which is predominantly composed of essential, recession-resistant businesses, ensuring predictable cash flow even through economic fluctuations.

This emphasis on portfolio quality is reinforced by data; for example, as of Q1 2024, over 90% of Agree Realty's rental income came from investment-grade tenants, underscoring the financial health and stability of their lessees.

The company's promotional narrative also stresses the long-term net lease structure, which transfers property operating expenses to tenants, thereby securing consistent revenue streams for Agree Realty.

Agree Realty's promotional strategy leverages its digital presence, particularly its website, to communicate its "Rethink Retail" philosophy and showcase its portfolio. This online platform serves as a vital hub for investors, offering detailed information on the company's 2,173 properties (as of Q1 2024) and its commitment to ESG initiatives, thereby reinforcing its market leadership.

Price

For investors, Agree Realty's (ADC) price is its common stock market price on the NYSE. This price is a dynamic reflection of investor sentiment, company operational success, and the overall economic climate. It encapsulates the market's valuation of Agree Realty's extensive real estate portfolio and its projected future earnings, a key component of which is its dividend payout.

As of August 1, 2025, Agree Realty's stock was trading at approximately $73.22 per share. This figure represents the current market's assessment of the company's value, factoring in its rental income streams, property appreciation potential, and its ability to generate consistent shareholder returns.

Agree Realty's dividend policy is a cornerstone of its appeal to income-focused investors. The company consistently delivers monthly cash dividends, a strategy that provides a predictable income stream. This reliability is a significant factor in attracting and retaining investors seeking steady returns.

For July 2025, Agree Realty announced a monthly cash dividend of $0.256 per common share. This translates to an annualized dividend exceeding $3.07 per share. This consistent payout demonstrates the company's commitment to returning capital to shareholders.

The annualized dividend of over $3.07 per share, based on a share price around $72.50, results in an attractive dividend yield of approximately 4.23%. This yield is a key metric for income investors, highlighting the income-generating potential of an investment in Agree Realty.

Agree Realty's 'price' is primarily represented by its lease rates, predominantly structured as triple net (NNN) leases. This means tenants handle property taxes, insurance, and maintenance, creating a stable and predictable net operating income for Agree Realty.

These NNN leases are typically long-term, often with annual rent escalations built in. For instance, in 2024, Agree Realty continued to benefit from these escalators, contributing to its consistent revenue growth and financial stability.

Capitalization Rates on Acquisitions

When Agree Realty considers acquiring new properties, the price is primarily assessed through capitalization rates, or cap rates. This metric is fundamental to understanding the potential return on investment for a real estate asset. For instance, in 2024, the company's acquisitions reflected a weighted-average capitalization rate of 7.5%.

This focus on cap rates underscores Agree Realty's commitment to a disciplined acquisition approach. The goal is to acquire high-quality properties that not only meet but exceed their investment criteria, ensuring they contribute positively to the company's overall financial health. This strategy is crucial for sustainable growth.

- Acquisition Metric: Capitalization rates (cap rates) are the primary valuation tool for Agree Realty's property acquisitions.

- 2024 Performance: Acquisitions in 2024 were finalized at a weighted-average cap rate of 7.5%.

- Strategic Alignment: The company targets attractive cap rates that align with its investment objectives.

- Financial Impact: Acquisitions are chosen to contribute positively to Agree Realty's financial performance.

Cost of Capital & Financing Terms

Agree Realty's cost of capital is a critical component of its investment product's appeal. The company's robust financial health, evidenced by approximately $2.3 billion in total liquidity as of the first quarter of 2024, enables it to secure financing on favorable terms.

This strong liquidity position, coupled with the absence of significant debt maturities until 2028, allows Agree Realty to efficiently fund its growth initiatives. Such favorable financing terms directly impact its long-term profitability and enhance shareholder returns by reducing interest expenses and providing flexibility for strategic acquisitions and development projects.

- Liquidity: Approximately $2.3 billion in total liquidity as of Q1 2024.

- Debt Maturities: No material debt maturities until 2028, providing financial stability.

- Financing Access: Ability to access both debt and equity markets at favorable rates.

- Impact: Supports efficient growth funding, long-term profitability, and shareholder returns.

Agree Realty's pricing strategy is multifaceted, encompassing both its stock market valuation and the fundamental lease rates of its properties. The stock price, around $73.22 as of August 1, 2025, reflects investor confidence and future earnings potential, including its consistent monthly dividends. These dividends, at $0.256 per share for July 2025, offer a yield of approximately 4.23% based on that stock price, making it attractive for income investors.

| Metric | Value (as of Aug 1, 2025) | Significance |

|---|---|---|

| Stock Price | ~$73.22 | Market valuation of ADC's assets and future prospects. |

| Monthly Dividend | $0.256 (July 2025) | Provides a consistent income stream for shareholders. |

| Annualized Dividend | ~$3.07 | Represents the total annual cash return to shareholders. |

| Dividend Yield | ~4.23% | Key indicator for income-focused investors. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Agree Realty is built upon a foundation of publicly available financial disclosures, including SEC filings and annual reports, alongside investor presentations and press releases. We also incorporate data from industry reports and competitive analysis to provide a comprehensive view of their marketing mix.