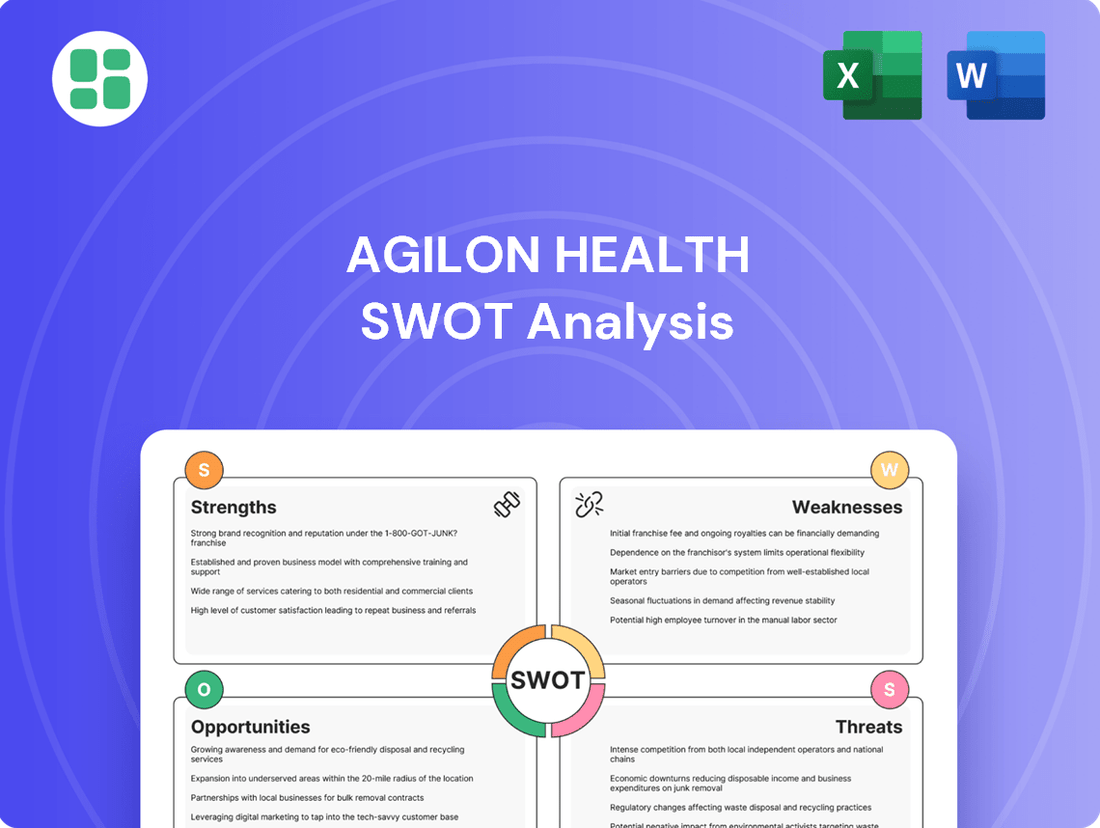

agilon health SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

agilon health Bundle

Agilon Health's strengths lie in its unique value-based care model and strong physician partnerships, but its reliance on a few key partners presents a significant risk. Understanding these dynamics is crucial for anyone looking to invest or compete in this space.

Want the full story behind Agilon Health's market position, including its competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Agilon Health's core strength is its successful value-based care model, which enables primary care physicians to shift from traditional fee-for-service to a fully risk-based, outcome-focused system. This approach is designed to enhance patient health results and lower overall healthcare expenditures by emphasizing preventive measures and coordinated care for senior populations.

In 2023, agilon health reported a significant increase in its membership, reaching 1.1 million members, a testament to the growing adoption of its model. The company's focus on managing risk effectively within these partnerships is a key differentiator, driving improved financial performance for its physician partners.

agilon health's expanding physician network is a significant strength, as shown by its continued success in forming new long-term agreements with prominent physician practices throughout 2024 and into 2025. This strategic growth has boosted agilon's Physician Network to encompass over 3,000 primary care physicians.

This robust network now serves more than 700,000 senior patients across over 30 distinct communities. The ability to attract and retain a large number of physicians highlights the value proposition agilon offers to healthcare providers and their patients.

Agilon Health's specialization in senior patient care, particularly within the Medicare Advantage space, is a significant strength. This focus allows them to deeply understand and cater to the unique health needs of this demographic, a segment experiencing substantial growth. In 2023, Medicare Advantage enrollment reached over 31 million beneficiaries, a figure projected to continue climbing.

Advanced Technology Platform and Data Capabilities

agilon health's advanced technology platform offers unparalleled financial and clinical data visibility to its physician partners, fostering a more informed approach to patient care and operational management. This robust infrastructure is a key differentiator, enabling proactive decision-making.

Significant and ongoing investments in artificial intelligence and cutting-edge technology are central to agilon health's strategy. These advancements are designed to refine cost structures, enhance contract negotiations, and bolster risk management capabilities, ultimately driving improved patient outcomes and greater operational efficiency.

- Data Visibility: agilon health's platform provides physician partners with enhanced access to critical financial and clinical data.

- AI and Technology Investment: The company consistently invests in AI and advanced technologies to optimize operations.

- Cost Optimization: These technological investments aim to reduce costs and improve contract effectiveness.

- Risk Management: Advanced capabilities strengthen risk management, supporting better care delivery.

Reduced Exposure to Medicare Part D Risk

Agilon Health has significantly dialed back its involvement with Medicare Part D, a strategic move aimed at shoring up its financial stability. By 2025, the company expects less than 30% of its membership to be exposed to Part D risk, with further reductions planned for 2026. This proactive approach is designed to buffer the company against the financial uncertainties and potential impacts stemming from the Inflation Reduction Act's changes to Part D.

This reduction in Part D exposure offers several key advantages:

- Mitigated Financial Uncertainty: Less reliance on Part D reduces exposure to fluctuating prescription drug costs and government rebate policies.

- Strategic Focus: Allows agilon health to concentrate resources on core membership and value-based care models.

- Inflation Reduction Act Resilience: Positions the company to better navigate the financial implications of the IRA's drug pricing provisions.

Agilon Health's primary strength lies in its proven value-based care model, which empowers physicians to transition to risk-based, outcome-focused patient care. This strategic shift prioritizes patient health and cost reduction through preventive care and coordinated services, particularly for seniors. By the end of 2023, agilon health had grown its membership to 1.1 million, demonstrating strong market traction for its physician-centric approach.

The company's expanding physician network, reaching over 3,000 primary care physicians by early 2025, is a significant asset. This network supports more than 700,000 senior patients across numerous communities, underscoring agilon's ability to attract and retain providers by offering a clear value proposition.

Agilon's specialized focus on the growing Medicare Advantage market, serving seniors with unique health needs, is a key differentiator. This specialization is supported by a robust technology platform that provides physicians with crucial financial and clinical data visibility, facilitating informed decision-making and operational efficiency. Continued investment in AI and advanced technologies further enhances cost management, contract negotiations, and risk mitigation.

| Metric | 2023 Data | 2024 Projection/Status | 2025 Projection |

|---|---|---|---|

| Total Membership | 1.1 million | Continued Growth | Further Expansion |

| Physician Network Size | Over 3,000 PCPs | Ongoing Expansion | Continued Growth |

| Medicare Advantage Focus | Core Strategy | Continued Emphasis | Sustained Focus |

| Part D Exposure Reduction | Reduced | Targeting <30% by 2025 | Further Reduction |

What is included in the product

Delivers a strategic overview of agilon health’s internal and external business factors, highlighting its strengths in value-based care enablement and opportunities in market expansion, while also considering weaknesses in physician adoption and threats from regulatory changes.

Offers a clear, actionable framework to identify and leverage Agilon Health's competitive advantages, mitigating risks and capitalizing on opportunities to improve patient outcomes and financial performance.

Weaknesses

Agilon Health has faced significant financial headwinds in the first half of 2025. The company reported a decrease in total revenue for both Q1 and Q2 2025, signaling a slowdown in top-line growth.

Furthermore, a negative medical margin in these quarters indicates that the cost of healthcare services provided exceeded the revenue generated from those services. This, coupled with widened adjusted EBITDA losses, points to ongoing operational inefficiencies and a struggle to achieve profitability.

The substantial net losses posted by agilon health underscore these profitability challenges. For instance, the net loss for Q1 2025 was reported at $74 million, widening from the previous year, and Q2 2025 saw a net loss of $95 million. This persistent financial underperformance highlights a critical need for improved financial execution and cost management strategies.

agilon health faced a shrinking membership in the first half of 2025. Both its Medicare Advantage and total platform membership saw declines in Q1 and Q2. This reduction was partly a consequence of the company's strategic decision to exit certain markets, a move aimed at boosting profitability but resulting in a smaller overall member count.

Agilon Health has encountered difficulties with risk adjustment revenue falling short of projections for both 2024 and 2025. This shortfall has directly affected the company's financial performance, creating a drag on earnings.

The primary driver behind this lower-than-expected revenue is a persistent gap between the risk adjustment data that payers are expected to provide and what agilon health actually receives. Compounding this issue are revisions to risk scores, which further complicate accurate revenue forecasting and collection.

Withdrawal of 2025 Financial Guidance

agilon health's withdrawal of its 2025 financial guidance is a significant concern, indicating a lack of clarity on its near-term financial outlook. This move, citing evolving market dynamics and a recent leadership change, has naturally led to investor apprehension about the company's future performance.

The suspension of guidance, particularly for the upcoming year, creates a void in predictable financial results, making it harder for stakeholders to assess the company's trajectory. This uncertainty can impact investor confidence and potentially affect the stock's valuation.

- Uncertainty in Projections: The withdrawal of 2025 financial guidance directly impacts the predictability of agilon health's future earnings.

- Investor Confidence: This action can erode investor trust due to a perceived lack of visibility into the company's performance.

- Market Volatility: The company cited dynamic market conditions, suggesting external factors are significantly influencing its ability to forecast.

- Leadership Transition Impact: The ongoing leadership transition is also a contributing factor, potentially adding to the forecasting challenges.

Leadership Instability and Governance Scrutiny

Leadership instability at agilon health has emerged as a significant weakness. The abrupt departure of the CEO in August 2025 and the subsequent formation of an interim 'Office of the Chairman' have unsettled the organizational structure. This period of transition, without a defined timeline for appointing a permanent CEO, naturally creates concerns regarding the speed and effectiveness of future decision-making processes and raises questions about the robustness of its corporate governance framework.

The lack of a permanent CEO creates uncertainty, potentially impacting strategic execution and investor confidence. This governance scrutiny is a critical area to monitor as the company navigates its leadership transition, especially in a dynamic healthcare market.

- Leadership Instability: CEO departure in August 2025 and interim 'Office of the Chairman' formation.

- Governance Scrutiny: Lack of a clear permanent CEO timeline raises questions.

- Decision-Making Agility: Potential impact on the company's ability to respond quickly to market changes.

Agilon Health's financial performance in the first half of 2025 has been hampered by declining revenues and negative medical margins, indicating that the cost of care is outstripping revenue. This, combined with widening adjusted EBITDA losses, points to ongoing operational challenges and a struggle to achieve profitability, with significant net losses reported in both Q1 ($74 million) and Q2 2025 ($95 million).

The company also experienced a shrinking membership base across its Medicare Advantage and total platform in early 2025, a direct result of strategic market exits aimed at improving profitability, which nonetheless reduced its overall scale.

A critical weakness lies in the shortfall of risk adjustment revenue, which has fallen below projections for both 2024 and 2025. This is attributed to a persistent gap in expected versus received risk adjustment data and complications from risk score revisions.

The withdrawal of its 2025 financial guidance in response to evolving market dynamics and a recent leadership change has created significant uncertainty for investors regarding the company's near-term outlook and future performance.

Leadership instability, marked by the CEO's departure in August 2025 and the establishment of an interim 'Office of the Chairman' without a clear timeline for a permanent CEO appointment, raises concerns about decision-making agility and corporate governance effectiveness.

Preview the Actual Deliverable

agilon health SWOT Analysis

The preview you see is the actual agilon health SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you're getting the complete, professionally prepared report.

This is a real excerpt from the complete agilon health SWOT analysis. Once purchased, you’ll receive the full, editable version, offering comprehensive insights into the company's strategic position.

Opportunities

The healthcare industry's pivot towards value-based care presents a significant growth avenue for Agilon Health. This shift prioritizes patient outcomes and cost efficiency over fee-for-service, a model Agilon is well-positioned to capitalize on.

The value-based care market is projected to experience robust expansion. For instance, estimates suggest the global value-based healthcare market could reach over $200 billion by 2027, indicating substantial room for Agilon to grow its market share by offering its platform and expertise to more healthcare providers navigating this transition.

The United States is experiencing a significant demographic shift with a rapidly growing senior population. By 2030, all Baby Boomers will be 65 or older, meaning 21.4% of the U.S. population will be aged 65 and over. This expanding demographic directly translates to a larger pool of individuals eligible for Medicare Advantage plans, presenting a substantial and naturally growing customer base for Agilon Health's tailored senior care solutions.

Agilon Health is actively implementing strategic initiatives focused on enhancing its platform, improving data visibility, and refining its quality and delivery programs. These efforts are designed to accelerate sustainable long-term profitability and foster disciplined growth.

The company is also working to optimize contract economics, a key driver for improving financial performance. For instance, in Q1 2024, Agilon reported revenue of $934 million, up 8% year-over-year, reflecting progress in these strategic areas.

These initiatives are crucial for Agilon to navigate the evolving healthcare landscape and capitalize on opportunities for market expansion and operational efficiency gains, aiming to solidify its position in the value-based care sector.

Potential for Future Margin Expansion

Agilon health is positioned for future margin expansion, driven by ongoing efforts in cost discipline and the pursuit of enhanced payer economics. The company's strategic initiatives are specifically designed to improve operational efficiency, which is a key lever for boosting profitability.

These efforts include refining benefit designs and implementing more robust medical cost management strategies. For instance, in the first quarter of 2024, agilon reported a medical cost ratio of 84.9%, a slight improvement from 85.2% in the prior year period, signaling progress in their cost containment efforts.

The company is actively working to optimize its operating model to achieve greater scalability and reduce administrative overhead. This focus on efficiency is crucial for translating revenue growth into stronger bottom-line performance.

- Cost Discipline: Continued focus on managing healthcare and operational expenses.

- Payer Economics: Strategies aimed at improving reimbursement rates and contract terms with health plans.

- Operational Efficiency: Streamlining processes and leveraging technology to reduce the cost to serve members.

- Benefit Design Refinement: Optimizing plan offerings to better manage utilization and costs.

Anticipated Positive Impact of New Reimbursement Models

Agilon Health anticipates a significant uplift from an updated Medicare reimbursement model projected for implementation in 2026. This shift is expected to create a more financially advantageous landscape for the company. For instance, Agilon's focus on value-based care, which aligns with evolving reimbursement structures, has already shown promise. In the first quarter of 2024, the company reported a 12% year-over-year increase in revenue, reaching $1.3 billion, demonstrating its ability to grow within the current framework.

The company is proactively optimizing its operations and refining contract economics to capitalize on this anticipated favorable reimbursement environment. This strategic positioning aims to maximize the financial benefits derived from the new model. Agilon's commitment to enhancing member health outcomes directly correlates with improved reimbursement potential under value-based arrangements.

The potential positive impact is underscored by Agilon's ongoing efforts to expand its network and deepen relationships with providers. This expansion is crucial for scaling its model and capturing a larger share of Medicare Advantage patients, thereby increasing revenue streams as reimbursement becomes more aligned with quality care delivery.

Key anticipated benefits include:

- Enhanced Revenue Streams: A more favorable reimbursement model could directly translate to higher per-member-per-month payments.

- Improved Profitability: Optimized operations and contract economics, coupled with better reimbursement, are expected to boost profit margins.

- Strategic Growth Opportunities: The new model may incentivize further expansion and investment in value-based care initiatives.

- Increased Provider Alignment: A reimbursement structure that rewards quality and outcomes can foster stronger partnerships with healthcare providers.

The ongoing shift towards value-based care is a primary opportunity, as Agilon's model directly aligns with incentivizing quality outcomes and cost efficiency. The growing senior population, particularly those eligible for Medicare Advantage, provides a substantial and expanding customer base for Agilon's specialized senior care solutions.

Agilon is also poised to benefit from an updated Medicare reimbursement model anticipated for 2026, which is expected to create a more financially advantageous environment. The company's strategic focus on operational efficiency, cost discipline, and optimizing payer economics further strengthens its ability to capitalize on these market trends and improve profitability.

| Opportunity | Description | Supporting Data/Trend |

| Value-Based Care Growth | Agilon's model thrives in a system prioritizing patient outcomes and cost efficiency. | Global value-based healthcare market projected to exceed $200 billion by 2027. |

| Expanding Senior Population | A growing demographic of seniors, especially Medicare Advantage enrollees, is a natural customer base. | By 2030, 21.4% of the U.S. population will be 65+, all Baby Boomers will be 65+. |

| Favorable Reimbursement Changes | Anticipated updates to Medicare reimbursement models (e.g., 2026) could enhance financial performance. | Agilon reported a 12% year-over-year revenue increase in Q1 2024, reaching $1.3 billion, indicating growth potential. |

| Operational Efficiency & Margin Expansion | Continued focus on cost discipline and improving operational models can drive profitability. | Q1 2024 medical cost ratio improved slightly to 84.9% from 85.2% year-over-year. |

Threats

Agilon Health is contending with persistently high medical cost trends, a factor that directly squeezes its medical margin and overall profitability. This ongoing challenge to manage rising expenses could impede the company’s ability to meet its financial targets and slow down its growth initiatives.

The healthcare industry, and by extension Agilon Health, faces constant shifts in regulations, especially around Medicare Advantage and how providers are reimbursed. These changes can directly affect revenue streams and the fundamental way Agilon operates.

For instance, potential adjustments to Medicare Advantage risk adjustment payment models, a key area for Agilon, could lead to reduced per-member, per-month payments. This is a significant concern given that Medicare Advantage enrollment continues to grow, reaching an estimated 33.6 million beneficiaries in 2024, highlighting the sector's reliance on these government programs.

The value-based care sector is a crowded space, with many established companies and new entrants all competing for a piece of the market. This intense competition means agilon health must quickly gain traction and clearly distinguish itself to thrive.

Agilon Health encounters significant rivalry from larger, more established healthcare organizations that already possess strong brand recognition and extensive networks. To counter this, agilon health needs to develop and execute effective strategies for rapid market penetration and clear differentiation.

For instance, in 2023, the value-based care market was estimated to be worth over $1.5 trillion globally, with significant growth projected. This highlights the substantial opportunity but also the fierce competition agilon health must navigate against players like Oak Street Health (acquired by CVS Health in early 2023 for $10.6 billion) and other large health insurers and provider groups actively investing in similar models.

High Execution Risk of Strategic Turnaround

Agilon Health faces considerable execution risk in its plan to turn its performance around. The company's ability to consistently improve operations, manage costs effectively, and integrate new programs is crucial for rebuilding investor confidence and hitting its financial goals. For instance, in Q1 2024, Agilon reported a net loss of $39 million, indicating the ongoing challenges in achieving profitability.

The success of these strategic initiatives hinges on several key factors:

- Operational Efficiency: Demonstrating tangible improvements in day-to-day operations and service delivery.

- Cost Management: Successfully implementing cost-saving measures without compromising quality of care.

- Program Integration: Effectively rolling out and managing new programs designed to boost performance and revenue.

Erosion of Investor Confidence and Market Perception

Recent financial underperformance, including a notable miss on Q1 2024 revenue expectations and the withdrawal of full-year earnings guidance in May 2024, has severely shaken investor confidence. This has directly contributed to a significant decline in agilon health's stock valuation, with shares trading considerably lower than their previous highs.

The company's decision to withdraw its 2024 guidance, citing factors such as slower-than-anticipated member growth and increased medical costs, has amplified market concerns. This lack of clear forward-looking financial projections creates uncertainty for investors trying to assess the company's future profitability and stability.

Furthermore, significant leadership changes, including the departure of key executives, have added to the perception of instability. Restoring market perception and trust is paramount for agilon health's long-term financial health, requiring transparent communication and a demonstrated ability to achieve its operational and financial targets.

- Q1 2024 Revenue Miss: Reported revenue of $1.2 billion, falling short of analyst expectations.

- Guidance Withdrawal: Rescinded its previously issued 2024 financial guidance in May 2024.

- Stock Valuation Impact: Share price experienced a substantial decline following these announcements.

- Leadership Transitions: Recent executive departures have raised concerns about stability.

Intense competition within the value-based care market, estimated to exceed $1.5 trillion globally in 2023, presents a significant threat. Agilon Health faces pressure from established players like CVS Health, which acquired Oak Street Health for $10.6 billion in early 2023, and other large insurers and providers investing heavily in similar models.

The company's ability to execute its turnaround plan is under scrutiny, especially after a Q1 2024 net loss of $39 million and the withdrawal of full-year guidance in May 2024. Successful operational efficiency, cost management, and program integration are critical to overcoming these execution risks and regaining investor confidence.

Recent financial underperformance, including a Q1 2024 revenue miss of $1.2 billion and leadership changes, has severely impacted investor sentiment and stock valuation. Restoring market perception requires transparent communication and demonstrated progress towards financial targets.

| Factor | Impact | Key Data Point |

|---|---|---|

| Competition | Market share erosion, pricing pressure | Global Value-Based Care Market >$1.5T (2023) |

| Execution Risk | Failure to meet financial targets, operational inefficiencies | Q1 2024 Net Loss: $39M |

| Financial Performance | Loss of investor confidence, stock devaluation | Guidance Withdrawn (May 2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Agilon Health's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.