agilon health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

agilon health Bundle

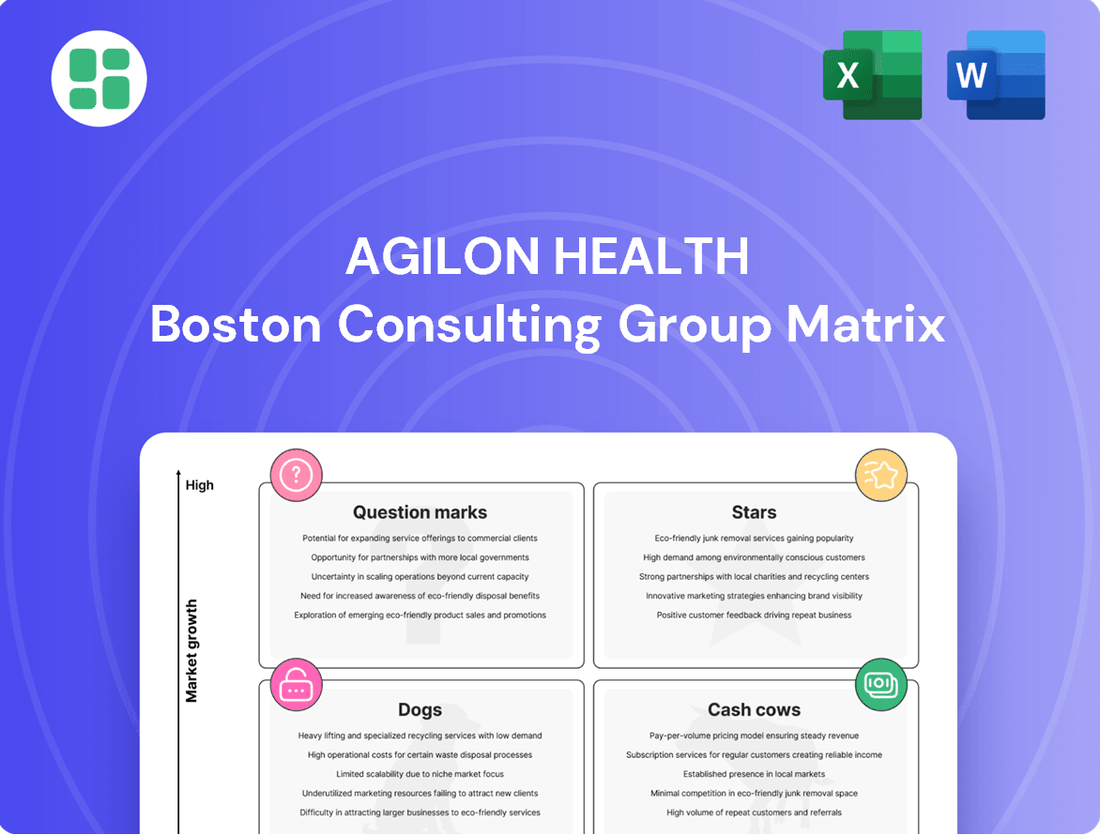

Agilon Health's BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. By identifying which services are Stars, Cash Cows, Dogs, or Question Marks, you can unlock crucial strategic direction.

Don't miss out on the complete picture; purchase the full Agilon Health BCG Matrix to gain detailed quadrant analysis and actionable insights that will guide your investment and resource allocation decisions for maximum impact.

Stars

agilon health's core value-based care model, focused on partnering with primary care physicians to serve senior patients, is a significant driver of growth. This strategy taps into a high-demand market for healthcare solutions that prioritize outcomes over volume.

Despite some recent membership shifts, the fundamental need for value-based care remains robust. For instance, in the first quarter of 2024, agilon health reported a membership base of 407,000, demonstrating the continued adoption of their model.

The company's ongoing investment in enhancing this model underscores its commitment to long-term financial sustainability and its position as a Star performer in the BCG matrix.

agilon health's commitment to expanding its physician network is a key driver of its growth. The company has successfully added new physician partnerships, extending its reach into new states like Illinois, slated for 2025. This strategic expansion is designed to capture a greater portion of the burgeoning value-based care market.

With a network now exceeding 3,000 primary care physicians, agilon health is demonstrating significant growth potential. These new collaborations are vital for boosting patient enrollment and solidifying the company's position as a leader in the healthcare landscape.

agilon health is making significant investments in its data platform and artificial intelligence capabilities. These advancements are designed to boost how efficiently they operate, improve how they predict financial results, and ultimately lead to better patient care.

While the full impact of these technological upgrades is still unfolding, they are poised to be a key driver for optimizing agilon health's core business. For instance, by mid-2024, agilon health reported that its data analytics initiatives were contributing to improved risk adjustment accuracy, a critical factor in their value-based care model.

These strategic tech investments are expected to sharpen agilon health's competitive edge. By leveraging AI and enhanced data, the company anticipates stronger performance metrics and a reinforced market standing as they continue to navigate the evolving healthcare landscape.

Focus on Quality Outcomes

Agilon Health's dedication to high-quality outcomes is a cornerstone of its strategy, particularly within the competitive Medicare Advantage landscape. The company aims for superior quality scores, often targeting 4.25 stars or higher in its established markets. This pursuit of excellence directly translates into tangible benefits, enhancing patient loyalty and attracting new physician partners.

This focus on quality is not merely aspirational; it’s a driver of growth. By consistently achieving better patient outcomes, agilon health strengthens its appeal to both beneficiaries and healthcare providers. This can lead to increased market share as more physicians and patients recognize the value of their approach. The company's commitment aligns perfectly with the broader shift towards value-based healthcare, where reimbursement is increasingly tied to patient results rather than service volume.

For instance, in 2024, agilon health continued to emphasize its quality performance as a key differentiator. The company's model is designed to incentivize physicians to prioritize patient well-being and comprehensive care, which naturally leads to higher star ratings. These ratings are crucial for Medicare Advantage plans, impacting everything from member enrollment to government reimbursements.

- Quality Scores as a Growth Engine: Targeting 4.25 stars or higher in year two plus markets is a strategic objective for agilon health.

- Patient Retention and Acquisition: Superior quality performance directly supports better patient retention and attracts new physician partners.

- Value-Based Healthcare Alignment: The company's focus on outcomes is a direct response to the evolving demands of value-based care models.

- Market Share Impact: Improved quality metrics are designed to fuel market share growth in the competitive Medicare Advantage space.

Strategic Long-Term Growth Priorities

agilon health's commitment to long-term growth is evident through its strategic investments in technology and clinical programs. This focus positions the company to capitalize on the high-growth potential within its target market, even amidst short-term challenges. The company's dedication to increasing value for all stakeholders reinforces its Star classification.

agilon health's strategic priorities are geared towards sustained expansion. In 2024, the company continued to invest in its platform, aiming to improve care coordination and member outcomes. This strategic allocation of resources is designed to solidify its market position and drive future revenue growth.

- Technology Investments: Continued focus on platform enhancements to improve efficiency and data analytics.

- Clinical Program Development: Expansion of value-based care initiatives to improve member health and reduce costs.

- Partner Value Enhancement: Initiatives aimed at strengthening relationships and delivering greater economic benefits to physician groups.

- Market Expansion: Strategic efforts to broaden reach within the Medicare Advantage and potentially other value-based care segments.

agilon health's focus on achieving high quality scores, often targeting 4.25 stars or above in its markets, directly supports its Star classification. This dedication to superior patient outcomes not only enhances patient loyalty but also attracts new physician partners, fueling growth. These quality metrics are crucial for success in the Medicare Advantage space, influencing enrollment and reimbursement.

The company's strategic investments in technology and clinical programs are designed to capitalize on the value-based care market's growth. By improving care coordination and member outcomes, agilon health aims to solidify its market position and drive future revenue. These efforts underscore its commitment to increasing value for all stakeholders.

agilon health's commitment to quality is a key differentiator in the competitive Medicare Advantage landscape. By consistently delivering better patient outcomes, the company strengthens its appeal to beneficiaries and providers alike, potentially leading to increased market share. This aligns perfectly with the broader shift towards value-based healthcare.

In 2024, agilon health continued to emphasize its quality performance as a critical factor. The company's model incentivizes physicians to prioritize patient well-being, directly impacting star ratings. These ratings are vital for Medicare Advantage plans, affecting enrollment and government reimbursements.

| Metric | 2023 Performance | 2024 Target/Update | Impact on Star Classification |

|---|---|---|---|

| Average Quality Score (Target) | N/A (Focus on improvement) | 4.25+ stars in year two plus markets | Drives patient retention and physician acquisition |

| Membership Base | 377,000 (End of 2023) | 407,000 (Q1 2024) | Indicates market acceptance and growth potential |

| Physician Network Size | Over 3,000 | Continued expansion | Broadens reach and patient enrollment capacity |

What is included in the product

The agilon health BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions.

A clear, one-page BCG Matrix visually categorizes agilon health's business units, simplifying complex strategic decisions.

Cash Cows

Agilon Health's established physician partnerships in mature geographies, particularly those in 'year 2+' markets, are a significant driver of consistent and predictable medical margins. These long-standing relationships, often built over several years, require minimal incremental investment, allowing for a stable and reliable cash flow generation. In 2024, these mature markets are expected to contribute substantially to agilon's overall profitability, forming the bedrock of its operational success.

agilon health's capital-light strategy is a key driver of its cash cow status. By partnering with physician groups instead of directly owning clinics, they avoid significant upfront investments. This allows them to efficiently scale their operations and generate substantial cash from existing, high-performing segments.

This approach dramatically reduces capital expenditure needs, letting agilon health effectively 'milk' profits from its established market share. As of the first quarter of 2024, agilon health reported a strong balance sheet, with approximately $470 million in cash and cash equivalents, underscoring their ability to support this efficient, cash-generative model.

agilon health's optimized clinical programs are a clear cash cow. These initiatives are designed to effectively manage medical cost trends, leading to substantial gross savings. For instance, in 2023, agilon reported that its value-based care model generated $1.4 billion in gross savings.

The company enhances its medical margin by focusing on improved physician onboarding and diligent clinical expense management for its existing patient base. This operational efficiency directly fuels strong and consistent cash flow for agilon health.

Medicare Advantage Patient Retention

agilon health's Medicare Advantage patient retention is a prime example of a cash cow. Their ability to maintain high retention rates, often around 90%, within existing partnerships creates a predictable and stable revenue stream. This consistent membership base significantly minimizes costs associated with member churn, a critical factor in the capitated payment model.

Sustaining these strong retention figures is fundamental to agilon health's ability to generate consistent cash flow from its established markets. This stability allows for greater financial planning and resource allocation, reinforcing the cash cow status of these operations.

- High Retention Rates: Medicare Advantage patient retention often exceeds 90%, demonstrating a loyal member base.

- Reduced Churn Costs: Consistent membership minimizes expenses related to acquiring new patients and managing transitions.

- Reliable Revenue: Capitated payment structures benefit from predictable membership numbers, ensuring a steady income.

- Market Stability: Strong retention solidifies agilon health's presence and cash-generating capacity in its core markets.

Consolidated Platform Operations

Consolidated Platform Operations at agilon health are a prime example of a Cash Cow within the BCG Matrix. Their commitment to operational discipline and platform consolidation directly fuels efficiency and optimizes their cost structure, thereby maximizing the cash generated from established business units.

By meticulously streamlining processes and effectively leveraging their technology, agilon health ensures that the mature segments of their business consistently operate with robust profit margins. This unwavering focus on operational efficiency is the bedrock of their Cash Cow status, demonstrating a clear path to sustained profitability.

- Maximizing Cash Flow: Operational discipline and consolidation enhance efficiency, directly increasing cash generation from existing business.

- Profit Margin Enhancement: Streamlined processes and technology adoption lead to high profit margins in mature business segments.

- Cost Structure Optimization: A focus on efficiency helps to reduce operating costs, further boosting profitability.

- Sustained Profitability: These attributes solidify agilon health's platform operations as a reliable source of significant cash flow.

agilon health's mature physician partnerships are the epitome of a cash cow. These established relationships in 'year 2+' markets generate predictable medical margins with minimal new investment, ensuring stable cash flow. In 2024, these mature markets are the financial backbone of agilon's operations, contributing significantly to profitability.

The company's capital-light model, which partners with physician groups rather than owning clinics, is a key driver of its cash cow status. This strategy avoids large upfront costs, allowing for efficient scaling and substantial cash generation from high-performing segments. As of Q1 2024, agilon held approximately $470 million in cash and equivalents, highlighting their efficient, cash-generative model.

Optimized clinical programs are another significant cash cow for agilon health, effectively managing medical costs and yielding substantial gross savings. In 2023, their value-based care model achieved $1.4 billion in gross savings. This focus on improved physician onboarding and diligent clinical expense management for existing patients directly fuels consistent cash flow.

Medicare Advantage patient retention, often around 90%, exemplifies agilon health's cash cow strategy. This high retention creates a predictable revenue stream and minimizes the costly churn associated with acquiring new members in a capitated payment model. Sustaining these strong retention figures is crucial for consistent cash generation from established markets.

| Metric | 2023 (Actual) | Q1 2024 (Actual) | 2024 (Projected) |

|---|---|---|---|

| Gross Savings (Value-Based Care) | $1.4 Billion | N/A | N/A |

| Cash and Cash Equivalents | N/A | ~$470 Million | N/A |

| Medicare Advantage Retention | ~90% | ~90% | ~90% |

What You’re Viewing Is Included

agilon health BCG Matrix

The agilon health BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no surprise alterations; you get the precise strategic analysis ready for immediate application in your business planning.

Dogs

agilon health has strategically exited specific markets and terminated unprofitable payor contracts, a clear indication of segments that were draining resources without yielding sufficient returns. These actions align with the characteristics of Dogs in the BCG matrix, signifying areas with low market share and limited growth potential.

In 2023, agilon health reported a net loss of $155 million, partly influenced by the costs associated with exiting certain markets and restructuring partnerships. This move to divest from underperforming segments aims to reduce underwriting risks and bolster overall financial health.

agilon health's risk adjustment programs are showing underperformance, with lower-than-expected contributions projected for both 2024 and 2025. This has directly hit their revenue and medical margin, signaling that past strategies in this area aren't delivering the anticipated financial returns.

This segment is essentially a cash drain, acting as a cash trap that demands immediate strategic review or a complete overhaul to mitigate further financial strain.

The escalating costs within Medicare Part D have become a substantial obstacle for agilon health, directly impacting revenue and shrinking medical margins. This unfavorable trend has led to a reduction in profitability for this segment.

Despite agilon's ongoing initiatives to lessen its reliance on Part D, the current financial performance firmly places this area in the Dog category of the BCG Matrix. It's characterized by limited growth potential and a low return on investment, which has demonstrably harmed the company's overall financial health.

For instance, in the first quarter of 2024, agilon reported a medical margin of 8.8%, down from 10.8% in the prior year, a decline partly attributed to Part D headwinds. The company is actively pursuing strategies to manage and reduce this exposure.

Legacy or Inefficient Operational Segments

Legacy or inefficient operational segments within agilon health might represent areas that haven't kept pace with evolving market demands or haven't scaled effectively. These segments could be characterized by disproportionately high general and administrative expenses compared to their revenue generation, impacting overall operational efficiency.

The company's stated strategic focus on urgency, accountability, and performance directly implies a need to identify and rectify these less productive areas. For instance, if a specific legacy program or platform requires significant ongoing investment without commensurate returns, it would fall into this category.

- Legacy Systems: Older IT infrastructure or operational processes that are costly to maintain and hinder agility.

- Underperforming Initiatives: Programs or business units that have failed to gain traction or achieve profitability targets.

- High G&A Costs: Segments with administrative overhead that significantly outweighs their contribution to the company's strategic goals.

- Market Adaptation Lag: Operations that have not evolved to meet current healthcare market dynamics or regulatory changes.

Segments with High Medical Cost Trends Unmitigated by Programs

Even with agilon health's clinical programs, certain segments continue to experience high medical cost trends that aren't being effectively managed. These areas represent a significant challenge, as they fail to generate positive medical margins, directly impacting profitability.

These underperforming segments become the 'Dogs' in the BCG Matrix context. For instance, if a specific member population in 2024 showed a 15% year-over-year increase in medical costs that wasn't offset by care management, it would fall into this category. This indicates that the investment in clinical programs for these groups isn't yielding the desired return, creating a drag on agilon's overall financial health.

The persistence of these unmitigated cost trends, particularly into 2025, underscores the difficulty in turning these segments around. It suggests that the current strategies may not be robust enough to counter the rising expenses in these particular areas.

- Persistent High Medical Costs: Segments where medical cost trends outpace mitigation efforts.

- Negative Medical Margins: These areas are unprofitable due to unmanaged cost increases.

- Drag on Performance: The financial burden of these segments negatively impacts overall company results.

- 2024 Data Example: A segment experiencing a 12% increase in per-member-per-month costs with no corresponding revenue or savings growth.

agilon health's strategic exits and contract terminations highlight segments with low market share and limited growth potential, fitting the 'Dog' profile in the BCG matrix. The company's 2023 net loss of $155 million was partly due to restructuring costs, aiming to reduce risks and improve financial health.

Underperforming risk adjustment programs are projected to contribute less revenue in 2024 and 2025, impacting medical margins. Similarly, escalating Medicare Part D costs have reduced profitability, and despite efforts to diversify, this segment remains a 'Dog' with limited ROI.

Legacy systems and underperforming initiatives, characterized by high administrative costs and a lag in market adaptation, also represent 'Dogs'. These areas require significant investment without commensurate returns, creating a financial drag on the company.

Segments with persistent high medical costs, particularly in 2024, that aren't offset by care management, are unprofitable and negatively impact overall financial health. For instance, a 15% year-over-year increase in medical costs for a specific member population in 2024, without corresponding savings, exemplifies this 'Dog' category.

| BCG Category | agilon Health Segment Example | Key Characteristics | Financial Impact (2024/2025 Outlook) |

| Dogs | Medicare Part D Operations | High costs, low growth, reduced profitability | Continued pressure on medical margins; 8.8% medical margin in Q1 2024 vs 10.8% prior year |

| Dogs | Underperforming Clinical Programs | High medical cost trends, negative medical margins | Drag on overall performance; potential 12% increase in PM3 costs without savings |

| Dogs | Legacy Systems/Inefficient Operations | High G&A, market adaptation lag | Cash drain, requires strategic review or overhaul |

Question Marks

agilon health's 'Class of 2025' physician partnerships are a prime example of a Stars in the BCG matrix, targeting new geographic markets with substantial growth potential. These ventures, however, begin with a low market share in these nascent regions.

Significant upfront investments, termed 'geography entry costs,' are necessary to establish and scale operations in these new states and communities. This investment phase inherently introduces short-term profitability uncertainty for these initiatives.

The success of these 'Class of 2025' entries hinges on achieving rapid market adoption and seamless integration with existing healthcare ecosystems. For instance, agilon health announced expansion into new markets in 2024, aiming to onboard a significant number of new physician partners.

Agilon health’s investments in emerging technologies and new clinical pathways, separate from its existing data platform, represent high-risk, high-reward opportunities. These ventures are designed to revolutionize care delivery and operational efficiency, but they require significant upfront investment in research and development, along with substantial implementation costs. For instance, the company might explore AI-driven diagnostic tools or novel telehealth models, areas where initial adoption and market validation are still developing.

The financial commitment for these unproven innovations can be considerable, with potential for substantial returns if successful, but also the risk of becoming underperforming assets. Consider the development of personalized medicine protocols; while promising, the R&D expenses could be in the tens of millions, with market penetration uncertain for several years. Their classification within the BCG matrix will ultimately depend on their ability to capture market share and generate consistent revenue, potentially evolving into Stars or remaining as Dogs.

ACO REACH model beneficiaries are a developing part of agilon health's member base, and their impact on Adjusted EBITDA is growing. In 2024, this segment contributed a notable portion to agilon's financial performance, reflecting the increasing adoption of this value-based care model.

While the ACO REACH model shows promising growth, it currently represents a smaller share of agilon's total membership compared to Medicare Advantage plans. This suggests a significant opportunity for expansion within a high-potential value-based care market, even though its current market penetration is relatively low.

Initiatives to Enhance Contract Economics

Agilon Health is actively working to improve its contract economics by collaborating with payer partners to refine benefit designs. These efforts are considered high-potential strategies for boosting profitability, but their full financial impact is still developing, placing them in the Question Mark category of the BCG matrix.

The success of these negotiations is crucial for Agilon Health's future revenue and margin growth. For instance, in 2024, the company continued to focus on value-based care arrangements, which inherently link reimbursement to patient outcomes and cost efficiency, directly impacting contract economics.

- Contract Renegotiation: Agilon Health is engaging with payers to renegotiate terms, aiming for more favorable reimbursement rates and risk-sharing models.

- Benefit Design Optimization: The company is working with partners to optimize member benefits, ensuring alignment with cost-effective care delivery and improved patient satisfaction.

- Value-Based Care Expansion: Continued emphasis on expanding value-based care agreements, where payment is tied to quality and cost, directly enhances contract economics.

- Data Analytics for Negotiation: Leveraging advanced data analytics to demonstrate improved patient outcomes and cost savings provides a stronger basis for negotiating better contract terms.

Strategic Pivot for 2026 Performance Improvement

agilon health's strategic pivot for 2026 performance improvement centers on a renewed commitment to execution and operational discipline. This initiative is crucial for reversing recent negative trends, such as the Q1 2024 adjusted EBITDA guidance of $340 million to $360 million, which fell short of some analyst expectations. The company is investing significant resources and management focus into these internal adjustments, acknowledging the uncertain short-term outcome but aiming for a substantial turnaround by 2026.

Key elements of this strategic shift include:

- Enhanced operational efficiency: Streamlining processes and improving resource allocation to drive down costs and boost productivity.

- Focus on core competencies: Concentrating on areas where agilon health can achieve a competitive advantage and deliver superior value.

- Data-driven decision-making: Leveraging analytics to inform strategic choices and measure the impact of operational changes.

- Disciplined capital allocation: Ensuring investments are aligned with strategic priorities and demonstrate a clear path to improved financial returns.

Agilon Health's efforts to optimize contract economics with payers, including renegotiating terms and refining benefit designs, represent initiatives with high potential but uncertain near-term outcomes. These strategies are crucial for improving future revenue and margins, directly impacting the company's financial trajectory.

The company's focus on value-based care arrangements, which tie reimbursement to patient outcomes, is a key driver for these contract economics. For example, Agilon continued to emphasize these arrangements throughout 2024, aiming to secure more favorable terms.

These contract improvements are classified as Question Marks in the BCG matrix due to the inherent uncertainty in achieving desired financial results. Success hinges on effective negotiation and the demonstrable value Agilon provides to its partners.

The company's 2024 performance and guidance adjustments highlight the dynamic nature of these efforts, underscoring the need for continued strategic focus and operational discipline to convert potential into realized gains.

| Initiative | BCG Category | Potential Impact | 2024 Context | Key Success Factors |

|---|---|---|---|---|

| Contract Renegotiation & Benefit Design Optimization | Question Mark | Improved revenue, margin growth | Ongoing focus on value-based care agreements | Demonstrated value, effective negotiation |

BCG Matrix Data Sources

Our agilon health BCG Matrix is informed by comprehensive financial disclosures, detailed market growth data, and expert industry analysis to provide a clear strategic overview.