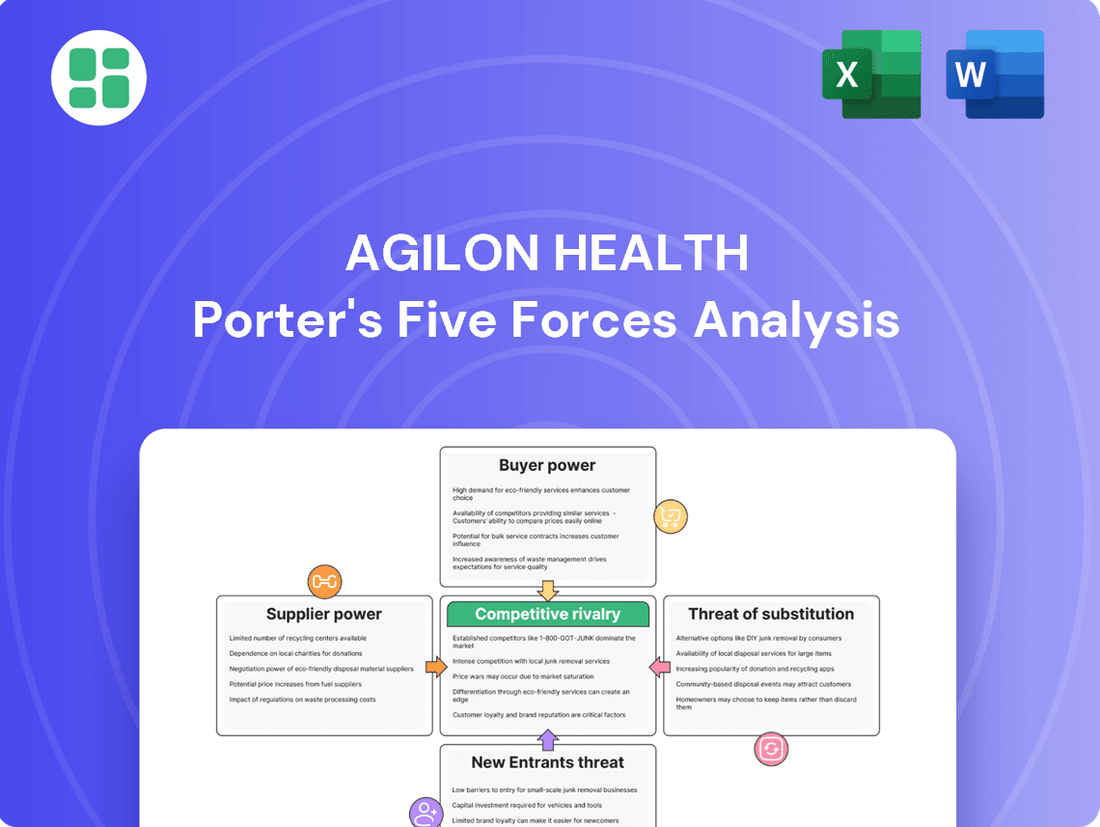

agilon health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

agilon health Bundle

agilon health navigates a complex landscape shaped by intense rivalry and the significant bargaining power of providers. Understanding these forces is crucial for anyone looking to grasp their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore agilon health’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Agilon Health's reliance on specialized healthcare technology and software vendors presents a significant challenge. The market for these critical infrastructure components is highly concentrated, with a handful of providers dominating the landscape. This means Agilon, like many in the industry, often has limited choices for essential systems.

The concentration of these specialized vendors grants them considerable bargaining power. For example, in 2024, the top three medical technology suppliers accounted for 62.5% of Agilon's essential infrastructure procurement. This dependence on a few key players, especially for unique or proprietary solutions, can translate into higher costs and less favorable contract terms for Agilon.

Agilon health's reliance on a select group of technology and service providers for its value-based care platform significantly influences supplier bargaining power. In 2023, agilon's annual supplier spending reached $47.3 million, with a notable concentration among four key technology vendors.

This concentrated vendor base means these essential partners hold considerable sway, as their technology and services are critical to agilon's operational success. The company's business model, built around a comprehensive platform, inherently creates this dependency, making it challenging to switch providers without substantial disruption.

While Agilon Health faces moderate switching costs when changing critical healthcare technology infrastructure suppliers, these costs still grant existing suppliers a degree of bargaining power. Estimates suggest that migrating a single technology system can cost around $2.7 million, with implementation taking 12 to 18 months and potentially leading to productivity dips between 22% and 35%.

Potential for Long-Term Contract Negotiations

Agilon health frequently enters into long-term contracts with its suppliers for technology and medical equipment, often spanning 3 to 7 years. These extended agreements can mitigate supplier leverage as they include biennial or annual review clauses, facilitating renegotiation and potentially locking in favorable terms.

While these contracts provide suppliers with a predictable revenue stream and some degree of influence during their term, the structured review process aims to balance power. For instance, in 2024, Agilon's focus on supply chain efficiency through these long-term partnerships is a key strategy to manage costs and ensure service continuity.

- Contract Duration: Typically 3-7 years for technology and medical equipment.

- Renegotiation Potential: Biennial or annual review processes allow for adjustments.

- Supplier Benefit: Stable revenue stream during the contract period.

- Agilon Strategy: Leveraging long-term contracts to enhance supply chain stability and cost management in 2024.

Talent and Clinical Expertise as a Supplier Element

Beyond technology, Agilon's success hinges on specialized clinical talent and deep expertise in value-based care. The availability of physicians and healthcare professionals adept at executing these complex models directly impacts Agilon's capacity for growth and service delivery.

A scarcity of such specialized talent can significantly amplify their bargaining power. For instance, in 2024, the physician shortage continued to be a critical issue across the US, with projections indicating a deficit of up to 124,000 physicians by 2034, according to the Association of American Medical Colleges (AAMC). This trend intensifies the leverage held by experienced clinicians in value-based care arrangements.

- Talent Dependency: Agilon's operational model relies heavily on the recruitment and retention of clinicians skilled in value-based care.

- Market Dynamics: A tight labor market for these specialists can drive up compensation and contract terms, increasing supplier power.

- Impact on Agilon: Limited access to or increased costs for specialized talent could constrain Agilon's expansion and profitability.

Agilon Health faces significant bargaining power from its specialized technology vendors due to market concentration. In 2024, the top three suppliers represented 62.5% of Agilon's essential infrastructure procurement, leading to potentially higher costs and less favorable terms. While long-term contracts with review clauses aim to balance this power, the inherent dependency on these critical systems grants vendors considerable leverage.

| Supplier Type | Concentration (2024) | Impact on Agilon | Contract Length (Typical) | Renegotiation Clause |

| Technology Infrastructure | Top 3 vendors: 62.5% of procurement | Higher costs, less favorable terms | 3-7 years | Biennial/Annual reviews |

| Specialized Clinical Talent | High demand, limited supply | Increased compensation, tighter terms | Varies (often employment contracts) | Performance-based adjustments |

What is included in the product

This analysis examines the competitive forces impacting agilon health, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare market.

Instantly identify and mitigate competitive threats with a comprehensive Porter's Five Forces analysis, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Agilon Health's primary customers are physician groups looking to move into value-based care. These groups often don't have the necessary technology, money, or know-how to manage this transition on their own. This dependence means they often rely heavily on companies like Agilon for support, which can reduce their individual ability to negotiate terms, particularly for smaller or less experienced practices.

The healthcare industry's shift towards value-based care is a significant trend. By 2025, a substantial portion of healthcare organizations anticipate increased revenue from these arrangements, indicating a growing demand for solutions that facilitate this transition.

This increasing adoption of value-based care models empowers physician groups, as they actively seek partners to navigate these new payment structures. Platforms like Agilon health could see their appeal grow, but the emergence of numerous competing solutions could dilute this advantage, thereby increasing customer bargaining power.

The availability of alternative value-based care enablers directly impacts the bargaining power of Agilon Health's customers, which are physician groups. These groups can explore other platforms, such as those offered by Privia Health Group, Oak Street Health, or ChenMed, all of which provide similar value-based care solutions. This competitive landscape means physician groups have choices, thereby strengthening their ability to negotiate terms and pricing with Agilon.

Physician Groups' Desire for Independence and Support

Agilon Health's model is built around supporting physician groups who want to stay independent. This desire for autonomy is a significant factor, as it means these groups might be less inclined to push for lower prices from Agilon, valuing the operational freedom they retain. In 2024, physician groups are increasingly feeling the pressure of administrative burdens and the shift to value-based care, making a partner that offers support without compromising independence highly appealing.

This focus on physician independence can translate into a reduced bargaining power for customers. Physician groups that highly value their autonomy may see Agilon's platform as a solution that allows them to thrive in value-based arrangements while maintaining control over their practice. For example, Agilon's partners reported an average of 25% reduction in administrative burden in 2023, a key metric for independent physicians.

- Physician Autonomy: Agilon's model prioritizes physician independence, a key draw for groups seeking to avoid corporate takeover.

- Value-Based Care Support: Agilon provides the infrastructure and expertise needed for physicians to succeed in value-based payment models, reducing their need to seek concessions from payers.

- Reduced Price Sensitivity: Groups valuing independence may be less sensitive to price negotiations, as the benefits of maintaining control outweigh potential cost savings from other arrangements.

Impact of Membership and Financial Performance on Customer Relationships

Agilon Health's recent financial performance, including declining membership and profitability pressures in 2025, directly impacts its customer relationships. The company's market exits and suspension of full-year guidance in 2025 signal significant operational challenges.

These financial headwinds could amplify the bargaining power of Agilon's physician partners. Facing uncertainty, these partners may demand more advantageous contract terms or explore other network affiliations, thereby strengthening their position.

- Declining Membership: Agilon Health experienced a notable decrease in membership figures leading into 2025, impacting its revenue streams and market presence.

- Profitability Pressures: The company grappled with significant profitability challenges throughout 2025, forcing strategic reviews and operational adjustments.

- Market Exits and Guidance Suspension: In 2025, Agilon Health announced market exits and suspended its full-year financial guidance, indicating a period of considerable instability.

- Increased Physician Bargaining Power: The aforementioned factors collectively empower physician partners, who can leverage Agilon's weakened position to negotiate more favorable terms or seek alternative partnerships.

The bargaining power of Agilon Health's customers, primarily physician groups, is influenced by the availability of alternative value-based care enablers. With options like Privia Health Group and Oak Street Health, physician groups can negotiate better terms, as they are not solely reliant on Agilon. This competitive landscape directly strengthens their ability to influence pricing and contract conditions.

| Factor | Impact on Bargaining Power | Supporting Data/Context |

| Availability of Alternatives | Increases Power | Presence of competitors like Privia Health Group, Oak Street Health, ChenMed offers choice. |

| Physician Autonomy Focus | Decreases Power (initially) | Agilon's model appeals to groups valuing independence, potentially reducing price sensitivity. Partners reported a 25% reduction in administrative burden in 2023. |

| Agilon's Financial Health | Increases Power | Declining membership and profitability pressures in 2025, market exits, and suspended guidance signal weakness, allowing partners to demand better terms. |

Preview the Actual Deliverable

agilon health Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for agilon health, detailing the competitive landscape and strategic implications. You are viewing the exact document you will receive immediately after purchase, offering a complete and professionally formatted analysis of the industry's forces. This ensures you get the full, ready-to-use report without any surprises or placeholder content.

Rivalry Among Competitors

The value-based care enablement market is quite fragmented, with a wide array of participants like major health systems, insurance providers, and dedicated tech firms. This means there are many companies trying to grab a piece of the pie.

Despite the fragmentation, the market is seeing a trend towards consolidation and the formation of strategic alliances. For instance, in 2024, we've observed several key partnerships forming as companies aim to secure physician group collaborations, a critical component for success in value-based care.

Agilon Health operates in a crowded market with direct competitors focused on value-based care, including Privia Health Group, Oak Street Health, and ChenMed. These companies offer similar models, directly challenging Agilon's market share and strategies.

Beyond direct rivals, Agilon also contends with broader healthcare technology and service providers like Veeva Systems and Health Catalyst. Their diverse offerings, while not always a direct match, can indirectly impact Agilon by capturing market attention or providing alternative solutions to healthcare systems.

In 2023, Oak Street Health, a key competitor, was acquired by CVS Health for approximately $10.6 billion, signaling significant consolidation and increased competitive pressure within the value-based care space. This acquisition highlights the strategic importance and financial stakes involved in this sector.

Competitive rivalry within the healthcare sector, particularly for companies like agilon health, is heavily influenced by innovation in technology, data analytics, and care delivery models. Agilon's strategy centers on its integrated primary care platform and its technology-enabled approach to delivering care, aiming to differentiate itself in a crowded market.

Companies that excel in providing superior data visibility, leveraging predictive analytics, and implementing efficient care management tools are positioned to gain a significant competitive advantage. For instance, in 2024, the healthcare technology market saw continued investment, with a notable focus on AI-driven diagnostics and personalized patient management systems, areas where agilon health actively competes.

Pressure from Payer Landscape Shifts and Reimbursement Models

The competitive rivalry within the healthcare sector is intensifying due to shifts in the payer landscape, particularly concerning Medicare Advantage (MA) and other reimbursement models. Agilon health, like its peers, faces pressure from potential rate cuts and increased utilization demands within these value-based care arrangements. This dynamic necessitates constant strategic adaptation and proactive renegotiation of payer contracts to ensure sustained financial health. For instance, CMS's proposed Medicare Advantage rate changes for 2024 indicated a potential shift, and while finalized rates can vary, the underlying pressure on providers to manage costs and demonstrate value remains. This environment directly impacts Agilon's ability to maintain profitability.

Companies operating in this space must be agile. Agilon health, for example, needs to continuously assess its network performance and contract terms. The ability to effectively manage patient populations and control costs becomes paramount when payers adjust reimbursement rates or impose stricter utilization guidelines. This competitive pressure forces providers to innovate in care delivery and operational efficiency to thrive. The ongoing evolution of MA benchmarks and risk adjustment methodologies further complicates this, requiring detailed analysis and strategic adjustments to contract negotiations.

- Payer Model Evolution: Medicare Advantage and other value-based care models are constantly changing, impacting provider revenue.

- Rate Cut Pressure: Potential reductions in reimbursement rates from payers create direct financial strain.

- Utilization Management: Increased demands for managing patient utilization require efficient care coordination and cost control.

- Contract Renegotiation: Agilon health must continually adapt and renegotiate payer contracts to maintain financial viability.

Strategic Exits and Measured Growth Approach

Agilon Health's strategic decision to exit underperforming markets and slow new member acquisition for its 2025 cohort signals a significant shift. This move prioritizes profitability and operational efficiency over aggressive expansion, a direct response to intense industry competition.

This measured approach is crucial in a market where profitability is paramount. For instance, in 2023, agilon health reported a net loss of $116 million, highlighting the need for greater financial discipline. By focusing on existing partnerships and optimizing operations, the company aims to improve its financial health.

- Focus on Profitability: Exiting non-core markets allows for reallocation of resources to more profitable ventures.

- Operational Discipline: Reducing new member targets for 2025 indicates a commitment to sustainable, profitable growth.

- Competitive Response: This strategy addresses the intense rivalry by emphasizing financial stability and operational excellence.

- Market Realignment: Strategic exits demonstrate an ability to adapt to market dynamics and competitive pressures.

Competitive rivalry in the value-based care enablement sector is intense, driven by a fragmented market and the pursuit of physician group collaborations. Agilon Health faces direct competition from firms like Privia Health Group and Oak Street Health, the latter acquired by CVS Health for approximately $10.6 billion in 2023, underscoring market consolidation and heightened competition.

Innovation in data analytics and care delivery models is a key battleground, with companies investing heavily in AI-driven diagnostics and personalized patient management. Agilon's strategic focus on its integrated primary care platform and technology aims to carve out a distinct market position amidst these advancements.

The evolving payer landscape, particularly Medicare Advantage, exerts significant pressure, with potential rate adjustments and increased utilization demands. Agilon Health's 2023 net loss of $116 million highlights the imperative for financial discipline and operational efficiency in response to these market dynamics.

Agilon's decision to exit underperforming markets and moderate new member acquisition for 2025 reflects a strategic pivot towards profitability and operational excellence, a direct response to the fierce competition and the need for greater financial stability.

SSubstitutes Threaten

The traditional Fee-for-Service (FFS) model persists as a significant substitute, particularly for physician groups reluctant to embrace financial risk or invest in new infrastructure. Despite the growing momentum towards value-based care (VBC), FFS payments continue to represent a substantial portion of healthcare revenue, enabling practices to entirely bypass VBC arrangements.

Large physician groups or integrated health systems possess the resources to build their own value-based care infrastructure, potentially bypassing third-party partners like Agilon. This internal development, especially for those with significant capital and existing expertise, directly substitutes Agilon's service offerings.

For instance, a major health system might invest in proprietary analytics platforms or hire specialized teams, negating the need for Agilon's technology and management solutions. This trend was evident in 2024 as many healthcare organizations accelerated their digital transformation efforts, seeking greater control over their data and care models.

Physician groups are increasingly exploring direct contracting with payers, bypassing intermediaries like agilon health. This trend offers them greater control over reimbursement and quality initiatives, directly challenging agilon's partnership model. For instance, many independent physician associations (IPAs) are actively pursuing these direct arrangements, seeking to retain a larger portion of the risk and reward.

Point Solutions and Specialized Vendors

Physician groups might bypass Agilon's integrated platform for specialized, point solutions. These vendors offer focused tools for data analytics, care management, or patient engagement, potentially fragmenting Agilon's value proposition. For example, a practice needing advanced predictive analytics might find a dedicated analytics firm more capable than a generalist platform.

While not a complete substitute for Agilon's end-to-end model, these niche providers can erode the demand for a comprehensive solution. This trend is particularly evident as the healthcare technology market matures, offering more sophisticated and specialized tools. In 2024, the healthcare IT market saw continued investment in best-of-breed solutions, indicating a preference for specialized capabilities in certain areas.

- Fragmented Adoption: Physician groups may adopt individual point solutions for specific functions rather than a single, integrated platform.

- Erosion of Integrated Value: Specialized vendors can offer superior functionality in niche areas, diminishing the perceived value of Agilon's comprehensive offering.

- Market Trend: The healthcare IT sector in 2024 continued to see growth in specialized software, suggesting a market appetite for targeted solutions.

Emerging Digital Health and Telehealth Platforms

The increasing prevalence of digital health and telehealth platforms presents a significant threat of substitutes for agilon health's model. These platforms provide alternative avenues for delivering healthcare services and managing patient groups, especially for managing chronic conditions and implementing preventive measures.

While often seen as complementary, these digital solutions can, in certain scenarios, diminish the perceived need for comprehensive value-based care enablement platforms. They achieve this by offering more focused, specialized services that address specific aspects of care delivery.

- Telehealth Adoption: By the end of 2024, it's projected that over 80% of consumers will have used telehealth services, indicating a strong shift in patient preference for convenient, digitally-enabled care.

- Digital Health Market Growth: The global digital health market was valued at over $300 billion in 2023 and is expected to grow at a CAGR of around 15% through 2030, highlighting the rapid expansion of substitute offerings.

- Chronic Disease Management Apps: Numerous apps and platforms specifically target chronic disease management, offering features like remote monitoring and personalized health plans, directly competing with agilon health's core services in this area.

The threat of substitutes for Agilon Health stems from alternative care delivery and payment models that bypass its integrated platform. The persistent Fee-for-Service (FFS) model allows physician groups to avoid financial risk, while large health systems can build their own VBC infrastructure, negating the need for Agilon's services. Direct contracting with payers and specialized point solutions also fragment Agilon's value proposition, as seen in 2024's healthcare IT market favoring niche capabilities.

| Substitute Type | Description | 2024 Market Trend/Data Point |

|---|---|---|

| Fee-for-Service (FFS) | Traditional payment model, bypasses financial risk for providers. | Remains a substantial portion of healthcare revenue, enabling practices to avoid VBC. |

| In-house VBC Infrastructure | Large health systems building proprietary analytics and management. | Accelerated digital transformation efforts in 2024, seeking greater control. |

| Direct Contracting | Physician groups contracting directly with payers. | Increasingly pursued by IPAs to retain more risk and reward. |

| Specialized Point Solutions | Niche vendors for data analytics, care management, etc. | Continued investment in best-of-breed solutions in 2024, indicating appetite for targeted tools. |

Entrants Threaten

Entering the value-based care enablement market, where agilon health operates, demands significant capital. Companies need to invest heavily in sophisticated technology platforms, robust infrastructure, and establish upfront risk-bearing arrangements with physician groups. Agilon's own model, which involves providing capital to its partners, underscores the substantial financial commitment required to build a competitive footing in this space.

The healthcare sector, particularly for companies like agilon health operating within Medicare Advantage and value-based care, is a minefield of regulations. Newcomers must contend with intricate rules governing Medicare, Medicaid, and patient data privacy under HIPAA. For instance, the Centers for Medicare & Medicaid Services (CMS) constantly updates its policies and reimbursement models, demanding significant investment in compliance infrastructure and expertise.

Navigating these complex legal and policy frameworks presents a substantial barrier to entry. Failure to comply can result in severe penalties, making it difficult for less-established entities to compete. In 2023, healthcare organizations faced billions in fines for HIPAA violations alone, underscoring the financial risks associated with non-compliance.

New entrants face a significant hurdle in replicating agilon health's established physician networks. Building trust and fostering long-term partnerships with primary care physician groups is a time-consuming and resource-intensive process. Agilon's existing network of over 3,000 primary care physicians represents a substantial barrier to entry, making it difficult for new companies to quickly scale and gain market traction.

Technological and Data Integration Challenges

The threat of new entrants into the value-based care sector, particularly for companies like agilon health, is significantly influenced by substantial technological and data integration hurdles. Building a sophisticated platform that can seamlessly merge varied healthcare datasets, effectively manage financial risk, and truly support patient-centric care models is an intricate undertaking. New players face considerable technological barriers, such as achieving interoperability across different systems and ensuring robust data security, before they can even begin to offer a competitive service.

Key challenges for potential new entrants include:

- High upfront investment in technology infrastructure: Developing and maintaining advanced data analytics, AI capabilities, and secure cloud-based platforms requires substantial capital.

- Data interoperability and standardization: Integrating data from disparate sources like EHRs, claims data, and patient-generated health data is a complex technical and operational challenge.

- Regulatory compliance and data privacy: Adhering to stringent regulations like HIPAA, and ensuring the security and privacy of sensitive patient information, adds significant complexity and cost.

- Talent acquisition: Securing skilled personnel in data science, cybersecurity, and healthcare informatics is crucial but competitive.

Brand Recognition and Reputation in a Trust-Based Industry

In the healthcare sector, brand recognition and reputation are critical, forming a significant barrier to new entrants. Agilon Health, like other established players, has cultivated deep trust and strong relationships with providers and patients over time. This established credibility makes it challenging for newcomers to quickly gain a foothold, as building similar levels of trust requires substantial investment and a proven history of reliable service delivery.

The difficulty for new entrants is amplified by the sensitive nature of healthcare, where patient outcomes and data security are paramount. Agilon Health’s existing partnerships and its demonstrated ability to manage complex care models contribute to its established reputation. For instance, as of early 2024, Agilon Health reported partnerships with over 300 primary care physician (PCP) groups, a testament to its established network and the trust it has built within the provider community. This extensive network is not easily replicated by new entrants, who would need to invest heavily in both technology and relationship-building to compete.

- Brand Loyalty: Established healthcare providers often benefit from patient loyalty, making it harder for new companies to attract and retain customers.

- Regulatory Hurdles: Navigating the complex healthcare regulatory landscape requires significant expertise and resources, posing a challenge for nascent organizations.

- Partnership Ecosystem: Agilon Health's established relationships with payers and providers create a strong ecosystem that new entrants must overcome.

- Time and Capital Investment: Building a reputable brand and operational infrastructure in healthcare is a long-term, capital-intensive endeavor.

The threat of new entrants for agilon health is considerably low due to the immense capital required to establish a competitive presence in the value-based care sector. Companies need substantial financial backing to invest in advanced technology, build robust infrastructure, and secure risk-bearing agreements with physician groups, a hurdle agilon health itself has overcome through significant investment.

Navigating the stringent regulatory environment of healthcare, particularly within Medicare Advantage, presents another formidable barrier. New entrants must invest heavily in compliance and possess deep expertise to manage intricate rules and avoid costly penalties, as evidenced by billions in fines levied for healthcare data privacy violations in recent years.

Building and maintaining a trusted network of physician partners is a time-consuming and capital-intensive endeavor, making it difficult for new companies to replicate agilon health's established relationships. As of early 2024, agilon health partnered with over 300 primary care physician groups, a scale that new entrants would struggle to achieve quickly.

The technological complexity of data integration, risk management, and patient-centric care models also acts as a significant deterrent. New entrants must overcome substantial technical challenges, including achieving data interoperability and ensuring robust security, to offer a competitive service against established players like agilon health.

Porter's Five Forces Analysis Data Sources

Our agilon health Porter's Five Forces analysis is built upon a foundation of verified data, including agilon health's SEC filings, industry-specific market research reports from firms like Definitive Healthcare, and analyses from financial institutions. This blend of primary and secondary sources ensures a comprehensive understanding of the competitive landscape.