Aflac SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

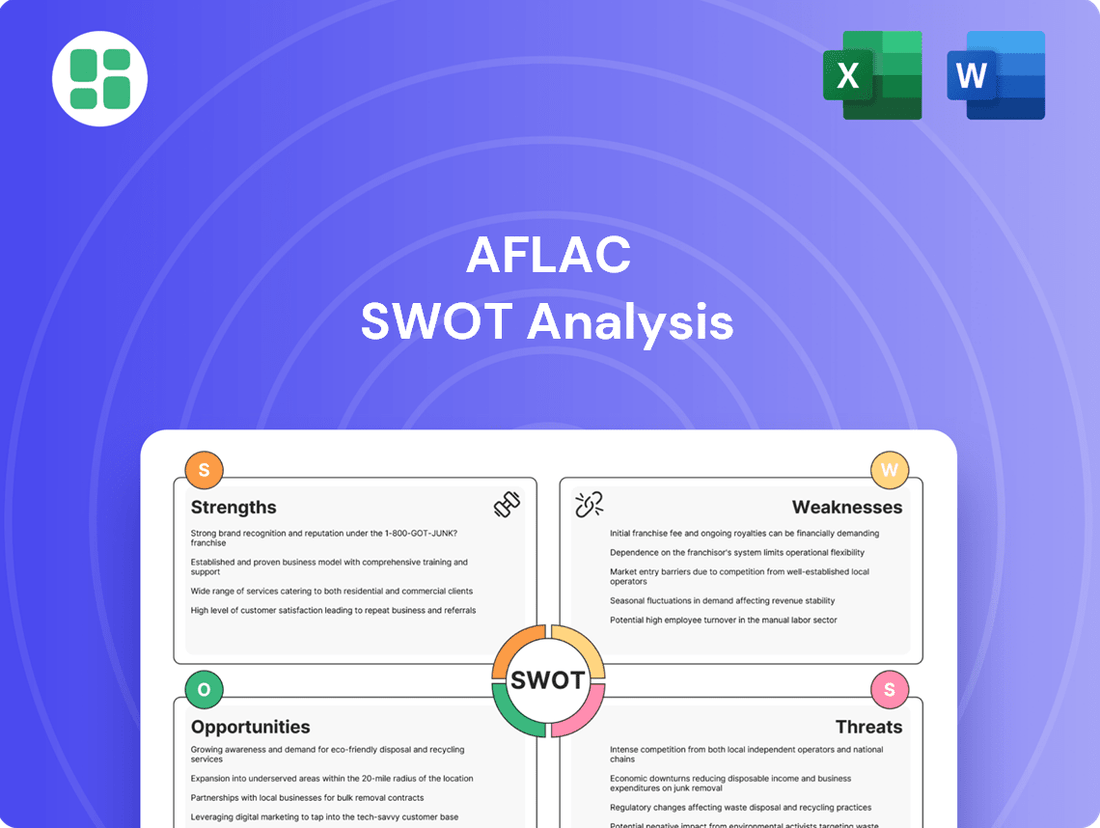

Aflac's strong brand recognition and customer loyalty are significant strengths, but the competitive insurance landscape presents a key challenge. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Aflac's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aflac's brand recognition is exceptionally high, largely due to its memorable Aflac Duck advertising. This consistent, decades-long campaign has built significant consumer trust and familiarity, making the brand a household name in the supplemental insurance sector.

This strong brand equity translates into a competitive advantage, helping Aflac stand out in a crowded insurance landscape and fostering customer loyalty. The company's reputation is further solidified by its repeated inclusion in Fortune's World's Most Admired Companies list, underscoring its commitment to quality and customer satisfaction.

Aflac commands a leading position in the supplemental insurance market across both the United States and Japan. Its strength is particularly pronounced in Japan, where it holds significant sway in specialized segments such as cancer and medical insurance.

This established market leadership is a direct result of Aflac's enduring presence and its dedicated focus on the supplemental insurance sector. For instance, in the U.S. market, Aflac remains a top provider of voluntary worksite benefits, with a substantial portion of its revenue derived from these offerings.

The company's considerable market share in these key geographies provides a robust platform for its ongoing operations and future expansion initiatives. In 2023, Aflac's total revenue reached $22.4 billion, underscoring its scale and market penetration.

Aflac's strength lies in its extensive and varied product offerings, covering everything from accident and cancer insurance to dental, vision, and life policies. This broad range allows them to serve a wide spectrum of customer needs, creating multiple avenues for revenue generation.

In 2023, Aflac's U.S. segment reported total revenues of $17.5 billion, with its supplemental insurance products forming a significant portion of this. The company's ability to offer such diverse coverage is key to adapting to changing consumer preferences and mitigating risks associated with over-reliance on a single product.

Robust Financial Performance and Capital Management

Aflac has consistently shown strong financial performance, with revenue growth and profitability underpinning its operations. This financial strength allows for strategic investments in new products and market expansion, ensuring continued development. As of the first quarter of 2024, Aflac reported a net earnings per diluted share of $1.44, demonstrating sustained profitability.

The company's robust balance sheet and disciplined capital management are key strengths. Aflac's commitment to shareholder returns is evident in its status as a 'Dividend Aristocrat,' a title earned by increasing its dividend payouts for over 25 consecutive years. This track record highlights a reliable approach to capital allocation and a dedication to rewarding investors.

- Consistent Revenue Growth: Aflac has a history of steady revenue increases, providing a stable financial foundation.

- Profitability: The company consistently generates profits, enabling reinvestment and shareholder distributions.

- Dividend Aristocrat Status: Aflac's long-standing practice of increasing dividends signals financial health and shareholder focus.

- Strong Balance Sheet: A solid financial position supports strategic initiatives and resilience during economic fluctuations.

Extensive Distribution Network and Customer Focus

Aflac boasts a robust distribution network, leveraging independent agents, brokers, and strategic partnerships, particularly within the crucial worksite channel that targets small businesses. This expansive reach is a significant driver for effective policy dissemination and customer acquisition. In 2023, Aflac’s U.S. segment reported total revenues of $17.5 billion, underscoring the scale of its operations.

The company's dedication to customer experience is evident in its streamlined claims process, highlighted by the 'One Day Pay' initiative. Furthermore, digital tools such as the Claims Tracker are actively deployed to boost customer satisfaction and foster long-term loyalty. This focus on efficiency and digital engagement is key to maintaining a competitive edge in the insurance market.

- Extensive Distribution: Aflac effectively reaches customers through a wide array of agents, brokers, and worksite partnerships.

- Customer-Centricity: Initiatives like 'One Day Pay' and the Claims Tracker demonstrate a strong commitment to customer satisfaction.

- Digital Engagement: Investment in digital tools enhances the policyholder experience and streamlines operations.

Aflac's brand recognition is exceptionally high, largely due to its memorable Aflac Duck advertising. This consistent, decades-long campaign has built significant consumer trust and familiarity, making the brand a household name in the supplemental insurance sector.

This strong brand equity translates into a competitive advantage, helping Aflac stand out in a crowded insurance landscape and fostering customer loyalty. The company's reputation is further solidified by its repeated inclusion in Fortune's World's Most Admired Companies list, underscoring its commitment to quality and customer satisfaction.

Aflac commands a leading position in the supplemental insurance market across both the United States and Japan. Its strength is particularly pronounced in Japan, where it holds significant sway in specialized segments such as cancer and medical insurance.

This established market leadership is a direct result of Aflac's enduring presence and its dedicated focus on the supplemental insurance sector. For instance, in the U.S. market, Aflac remains a top provider of voluntary worksite benefits, with a substantial portion of its revenue derived from these offerings.

The company's considerable market share in these key geographies provides a robust platform for its ongoing operations and future expansion initiatives. In 2023, Aflac's total revenue reached $22.4 billion, underscoring its scale and market penetration.

Aflac's strength lies in its extensive and varied product offerings, covering everything from accident and cancer insurance to dental, vision, and life policies. This broad range allows them to serve a wide spectrum of customer needs, creating multiple avenues for revenue generation.

In 2023, Aflac's U.S. segment reported total revenues of $17.5 billion, with its supplemental insurance products forming a significant portion of this. The company's ability to offer such diverse coverage is key to adapting to changing consumer preferences and mitigating risks associated with over-reliance on a single product.

Aflac has consistently shown strong financial performance, with revenue growth and profitability underpinning its operations. This financial strength allows for strategic investments in new products and market expansion, ensuring continued development. As of the first quarter of 2024, Aflac reported a net earnings per diluted share of $1.44, demonstrating sustained profitability.

The company's robust balance sheet and disciplined capital management are key strengths. Aflac's commitment to shareholder returns is evident in its status as a Dividend Aristocrat, a title earned by increasing its dividend payouts for over 25 consecutive years. This track record highlights a reliable approach to capital allocation and a dedication to rewarding investors.

Aflac boasts a robust distribution network, leveraging independent agents, brokers, and strategic partnerships, particularly within the crucial worksite channel that targets small businesses. This expansive reach is a significant driver for effective policy dissemination and customer acquisition. In 2023, Aflac’s U.S. segment reported total revenues of $17.5 billion, underscoring the scale of its operations.

The company's dedication to customer experience is evident in its streamlined claims process, highlighted by the One Day Pay initiative. Furthermore, digital tools such as the Claims Tracker are actively deployed to boost customer satisfaction and foster long-term loyalty. This focus on efficiency and digital engagement is key to maintaining a competitive edge in the insurance market.

| Strength | Description | Supporting Data (2023/Q1 2024) |

| Brand Recognition & Equity | High consumer trust and familiarity due to long-standing advertising campaigns. | Household name in supplemental insurance; recognized for quality. |

| Market Leadership | Dominant position in U.S. and Japan for supplemental insurance, especially cancer and medical. | Top provider of voluntary worksite benefits in the U.S.; significant market share in Japan. |

| Product Diversification | Wide range of offerings including accident, cancer, dental, vision, and life insurance. | U.S. segment revenue of $17.5 billion in 2023, with diverse product contributions. |

| Financial Strength & Profitability | Consistent revenue growth, strong profitability, and disciplined capital management. | Total revenue of $22.4 billion in 2023; Q1 2024 diluted EPS of $1.44. Dividend Aristocrat status for over 25 years. |

| Distribution Network & Customer Focus | Extensive reach through agents, brokers, and worksite partnerships, supported by customer-centric digital tools. | U.S. segment revenue of $17.5 billion in 2023; initiatives like One Day Pay enhance customer satisfaction. |

What is included in the product

Analyzes Aflac’s competitive position through key internal and external factors, highlighting its strong brand recognition and supplemental insurance market leadership while also considering potential regulatory changes and market saturation.

Aflac's SWOT analysis highlights key areas for improvement, offering a clear roadmap to address internal weaknesses and external threats, ultimately relieving the pain of strategic uncertainty.

Weaknesses

Aflac's significant reliance on its Japanese market is a key weakness. In the first quarter of 2024, Aflac Japan accounted for a substantial majority of the company's total revenue, highlighting its concentrated exposure. This deep integration means that economic downturns or regulatory changes within Japan can disproportionately impact Aflac's overall financial performance.

This concentration also exposes Aflac to specific regional risks. For instance, demographic shifts in Japan, such as an aging population and declining birth rates, could affect demand for its insurance products over the long term. Furthermore, currency fluctuations between the Japanese Yen and the US Dollar can significantly impact reported earnings when translated back to the parent company's reporting currency.

Aflac's financial results are susceptible to the ups and downs of the investment markets, primarily through its net investment gains and losses. For instance, in the first quarter of 2024, Aflac reported net investment losses of $348 million, a significant swing from the $1.3 billion gain in the same period of 2023, directly impacting its overall profitability.

This volatility in investment income creates a degree of unpredictability in Aflac's reported financial performance, even when its core insurance operations remain stable. Such fluctuations can make it challenging for investors and analysts to forecast earnings with consistent accuracy.

The supplemental health insurance sector is incredibly crowded, with many established companies and emerging insurtech firms vying for customers. This intense competition puts constant pressure on Aflac to defend its market position and profitability.

Aflac must continually invest in new products, robust marketing campaigns, and superior customer service to stay ahead of rivals. For instance, in 2024, the company continued to emphasize its digital transformation efforts to enhance customer engagement and streamline operations in response to competitive pressures.

Challenges in U.S. Sales Growth in Specific Segments

While Aflac's overall U.S. net earned premiums have seen an upward trend, the company has encountered headwinds in specific market segments. For instance, Aflac has faced difficulties in growing sales within the dental DBA (Doing Business As) market. This suggests that even with a robust brand reputation, certain niche areas of its U.S. business are subject to significant market pressures and heightened competition.

To navigate these segment-specific obstacles, Aflac will likely need to implement tailored strategies. These could involve adapting product offerings to better suit the evolving needs of these particular markets or exploring new distribution channels to reach a wider customer base. The intensity of competition in these areas necessitates a focused and agile approach to sales and marketing efforts.

- Segment-Specific Sales Challenges: Aflac has noted difficulties in sales growth within the U.S. dental DBA market.

- Market Pressures: This indicates that despite overall brand strength, specific market segments face intense competition.

- Strategic Adaptation Required: Addressing these challenges will likely involve targeted strategies and product adjustments.

Exposure to Cybersecurity Threats

Aflac, like many large financial institutions, is increasingly vulnerable to sophisticated cyberattacks and data breaches. The ongoing digital transformation and the handling of vast amounts of sensitive customer data amplify these risks. For instance, a 2023 report by IBM indicated that the average cost of a data breach in the financial sector reached $5.90 million, a significant increase from previous years. This highlights the substantial financial and operational risks Aflac faces in safeguarding its digital infrastructure.

Recent cybersecurity incidents across the financial industry underscore the persistent operational risks associated with digital operations. Aflac's reliance on technology means that a successful cyberattack could result in considerable financial losses, severe reputational damage, and heightened regulatory scrutiny. For example, the Office of the Comptroller of the Currency (OCC) has been increasing its focus on cybersecurity preparedness, with potential penalties for institutions failing to meet evolving standards.

- Increased Vulnerability: Aflac's digital footprint makes it a target for increasingly sophisticated cyber threats.

- Financial Impact: Data breaches in the financial sector averaged $5.90 million in 2023, impacting profitability.

- Reputational Risk: Cybersecurity failures can erode customer trust and damage Aflac's brand image.

- Regulatory Scrutiny: Non-compliance with cybersecurity regulations can lead to fines and operational restrictions.

Aflac's significant reliance on its Japanese market is a key weakness. In the first quarter of 2024, Aflac Japan accounted for a substantial majority of the company's total revenue, highlighting its concentrated exposure. This deep integration means that economic downturns or regulatory changes within Japan can disproportionately impact Aflac's overall financial performance.

This concentration also exposes Aflac to specific regional risks. For instance, demographic shifts in Japan, such as an aging population and declining birth rates, could affect demand for its insurance products over the long term. Furthermore, currency fluctuations between the Japanese Yen and the US Dollar can significantly impact reported earnings when translated back to the parent company's reporting currency.

Aflac's financial results are susceptible to the ups and downs of the investment markets, primarily through its net investment gains and losses. For instance, in the first quarter of 2024, Aflac reported net investment losses of $348 million, a significant swing from the $1.3 billion gain in the same period of 2023, directly impacting its overall profitability.

This volatility in investment income creates a degree of unpredictability in Aflac's reported financial performance, even when its core insurance operations remain stable. Such fluctuations can make it challenging for investors and analysts to forecast earnings with consistent accuracy.

The supplemental health insurance sector is incredibly crowded, with many established companies and emerging insurtech firms vying for customers. This intense competition puts constant pressure on Aflac to defend its market position and profitability.

Aflac must continually invest in new products, robust marketing campaigns, and superior customer service to stay ahead of rivals. For instance, in 2024, the company continued to emphasize its digital transformation efforts to enhance customer engagement and streamline operations in response to competitive pressures.

While Aflac's overall U.S. net earned premiums have seen an upward trend, the company has encountered headwinds in specific market segments. For instance, Aflac has faced difficulties in growing sales within the dental DBA (Doing Business As) market. This suggests that even with a robust brand reputation, certain niche areas of its U.S. business are subject to significant market pressures and heightened competition.

To navigate these segment-specific obstacles, Aflac will likely need to implement tailored strategies. These could involve adapting product offerings to better suit the evolving needs of these particular markets or exploring new distribution channels to reach a wider customer base. The intensity of competition in these areas necessitates a focused and agile approach to sales and marketing efforts.

- Segment-Specific Sales Challenges: Aflac has noted difficulties in sales growth within the U.S. dental DBA market.

- Market Pressures: This indicates that despite overall brand strength, specific market segments face intense competition.

- Strategic Adaptation Required: Addressing these challenges will likely involve targeted strategies and product adjustments.

Aflac, like many large financial institutions, is increasingly vulnerable to sophisticated cyberattacks and data breaches. The ongoing digital transformation and the handling of vast amounts of sensitive customer data amplify these risks. For instance, a 2023 report by IBM indicated that the average cost of a data breach in the financial sector reached $5.90 million, a significant increase from previous years. This highlights the substantial financial and operational risks Aflac faces in safeguarding its digital infrastructure.

Recent cybersecurity incidents across the financial industry underscore the persistent operational risks associated with digital operations. Aflac's reliance on technology means that a successful cyberattack could result in considerable financial losses, severe reputational damage, and heightened regulatory scrutiny. For example, the Office of the Comptroller of the Currency (OCC) has been increasing its focus on cybersecurity preparedness, with potential penalties for institutions failing to meet evolving standards.

- Increased Vulnerability: Aflac's digital footprint makes it a target for increasingly sophisticated cyber threats.

- Financial Impact: Data breaches in the financial sector averaged $5.90 million in 2023, impacting profitability.

- Reputational Risk: Cybersecurity failures can erode customer trust and damage Aflac's brand image.

- Regulatory Scrutiny: Non-compliance with cybersecurity regulations can lead to fines and operational restrictions.

Aflac's business model is also susceptible to changes in interest rates. Low interest rate environments can compress net investment income, impacting profitability. Conversely, rapid increases in interest rates can lead to unrealized losses on its fixed-income portfolio, as seen in prior periods. For example, while the Federal Reserve began raising rates in 2022, the full impact on Aflac's investment portfolio and its ability to generate income is an ongoing consideration for 2024 and beyond.

| Weakness | Description | Impact | Data Point/Example |

| Market Concentration (Japan) | Heavy reliance on the Japanese market for revenue. | Exposes Aflac to regional economic and regulatory risks; currency fluctuations impact reported earnings. | Q1 2024: Aflac Japan accounted for a substantial majority of total revenue. |

| Investment Portfolio Volatility | Sensitivity to net investment gains and losses. | Creates unpredictability in financial performance; can significantly impact profitability. | Q1 2024: Reported net investment losses of $348 million (vs. $1.3 billion gain in Q1 2023). |

| Intense Competition | Crowded supplemental health insurance market. | Puts pressure on market position and profitability; necessitates continuous investment in products and marketing. | Ongoing emphasis on digital transformation in 2024 to enhance customer engagement. |

| Segment-Specific Sales Challenges | Difficulties in specific U.S. market segments. | Requires tailored strategies to address competitive pressures in niche areas. | Challenges noted in growing sales within the U.S. dental DBA market. |

| Cybersecurity Risks | Vulnerability to cyberattacks and data breaches. | Potential for significant financial losses, reputational damage, and regulatory penalties. | Average cost of data breach in financial sector was $5.90 million in 2023. |

| Interest Rate Sensitivity | Impact of interest rate fluctuations on investment income. | Low rates compress income; rising rates can cause unrealized losses on fixed-income portfolios. | Ongoing consideration of Federal Reserve rate changes' impact on investment income. |

Same Document Delivered

Aflac SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Rising healthcare expenses and a heightened awareness of out-of-pocket costs are fueling a greater need for supplemental health insurance. This trend is a prime opportunity for Aflac to broaden its reach by providing products that complement traditional medical coverage.

The U.S. supplemental health insurance market is anticipated to experience robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 5-7% through 2025, creating a highly favorable market landscape for Aflac's offerings.

Aflac has a substantial opportunity to boost its operations and customer interactions through digital transformation and AI. By investing in digital sales channels and AI-powered claims processing, the company can significantly improve efficiency and customer satisfaction. For instance, Aflac's digital sales initiatives in 2024 are projected to capture a larger share of the voluntary benefits market, which is increasingly shifting online.

The adoption of insurtech innovations presents a clear path for Aflac to gain a competitive edge. Leveraging AI for tasks like underwriting and customer service can lead to faster response times and more personalized experiences. This focus on technology is crucial as the insurance landscape continues to evolve rapidly, with competitors also investing heavily in digital capabilities to enhance their offerings and reach.

Aflac has a significant opportunity to broaden its product range, addressing the growing demand for comprehensive health and financial wellness solutions. The company’s recent expansion into dental and vision insurance, alongside new cancer insurance products, demonstrates a strategic move to capture a larger share of the supplemental insurance market. This diversification is crucial as consumers increasingly seek integrated benefits.

By focusing on innovation and customization, Aflac can tap into underserved markets. For instance, developing specialized policies for younger demographics, who may have different financial priorities and risk profiles, or creating tailored plans for first responders with unique occupational health needs, presents a clear path for growth. This targeted approach can significantly boost customer acquisition and retention.

In 2023, Aflac’s U.S. segment saw its voluntary business premiums increase, signaling positive reception to its existing and new offerings. The company’s commitment to expanding its voluntary product portfolio, including dental and vision, is expected to continue driving revenue growth in the 2024-2025 period as these markets show strong consumer interest.

Strategic Partnerships and Acquisitions

Strategic partnerships offer Aflac significant avenues for growth. Collaborating with technology firms, for example, can bolster its digital offerings. Aflac's partnership with Everplans in 2023 to provide digital legacy planning tools exemplifies this strategy, aiming to integrate essential services for customers.

Acquisitions also present a clear opportunity. By acquiring companies with complementary technologies or access to new demographics, Aflac can expedite market penetration and expand its service portfolio. This approach allows for the swift integration of innovative solutions and customer bases, strengthening its competitive position in the evolving insurance landscape.

- Digital Integration: Partnerships like the one with Everplans enhance customer value by offering digital legacy planning, a growing need.

- Market Expansion: Acquisitions can provide immediate access to new customer segments or geographic regions.

- Technological Advancement: Collaborations can accelerate the adoption of new technologies, improving operational efficiency and customer experience.

Targeting Underserved U.S. Workforce Segments

Aflac has a significant opportunity to grow by focusing on U.S. workforce segments that are currently underserved by supplemental health insurance. Many smaller businesses and individual employees lack access to or awareness of the benefits Aflac provides.

This untapped market represents a substantial growth avenue. For instance, in 2024, the U.S. labor force continued to expand, with millions of workers in small to medium-sized businesses, many of whom do not receive employer-sponsored supplemental benefits.

Aflac can leverage its established brand and product offerings to reach these individuals and businesses. This includes:

- Targeting businesses with fewer than 50 employees, a segment that often has less robust benefits packages.

- Engaging independent contractors and gig economy workers who are increasingly seeking portable insurance solutions.

- Educating employees directly on the financial protection offered by voluntary benefits, even when employer sponsorship is limited.

- Expanding digital outreach and enrollment platforms to make Aflac products more accessible to a wider, dispersed workforce.

Aflac is poised to capitalize on the growing demand for supplemental health insurance, driven by rising healthcare costs and increased consumer awareness of out-of-pocket expenses. The U.S. supplemental health insurance market is projected to grow at a CAGR of 5-7% through 2025, presenting a significant opportunity for Aflac to expand its market share.

Digital transformation and insurtech innovations offer Aflac avenues to enhance efficiency and customer experience. By investing in digital sales channels and AI-powered claims processing, Aflac can improve operational performance and customer satisfaction. For example, Aflac’s digital sales initiatives in 2024 are expected to capture a larger share of the voluntary benefits market, which is increasingly shifting online.

Expanding its product portfolio to include dental, vision, and enhanced cancer insurance products allows Aflac to meet the growing demand for comprehensive health and financial wellness solutions. Strategic partnerships, such as the one with Everplans for digital legacy planning, and potential acquisitions of companies with complementary technologies or customer bases, also represent key growth opportunities for Aflac.

Aflac can also target underserved segments of the U.S. workforce, including small businesses and gig economy workers, who often lack comprehensive supplemental benefits. The U.S. labor force continued to expand in 2024, with millions of workers in small to medium-sized businesses potentially lacking robust benefits packages, creating a substantial untapped market for Aflac's offerings.

Threats

The insurance sector, including Aflac, faces a dynamic regulatory landscape in both its primary markets, the U.S. and Japan. For instance, in 2024, discussions around solvency capital requirements and consumer protection measures continued to shape industry practices.

Policy shifts, such as potential changes to healthcare subsidies or new data privacy mandates, could directly affect Aflac's operational costs and the design of its supplemental insurance products. Staying ahead of these evolving compliance demands is crucial for maintaining business continuity and profitability.

Economic uncertainties, including the potential for recessions and persistent high inflation, pose a significant threat to Aflac. These conditions can lead consumers to cut back on discretionary spending, which often includes supplemental insurance products. For instance, during periods of economic contraction, individuals may prioritize essential expenses over additional coverage.

Inflationary pressures directly impact healthcare costs, a key area for insurers. As medical expenses rise, Aflac could face an increase in the volume and cost of claims it needs to pay out. This dynamic can squeeze profit margins if premium increases do not keep pace with escalating healthcare expenditures, a challenge observed across the insurance sector in recent years.

Consequently, these economic headwinds can dampen demand for Aflac's offerings and negatively affect its overall financial performance. The company’s profitability may come under pressure as it navigates a landscape where consumer purchasing power is diminished and operating costs, particularly those related to claims, are on the rise.

Aflac's substantial presence in Japan, where it generates a significant portion of its revenue, makes it vulnerable to shifts in the yen-dollar exchange rate. A strengthening yen against the dollar, for instance, could reduce the value of its Japanese earnings when converted back into U.S. dollars, impacting reported profits.

For example, in the first quarter of 2024, Aflac reported that foreign currency impacts reduced its earnings per share by $0.04. This highlights the tangible effect that currency fluctuations can have on its financial performance.

Managing this currency risk through hedging strategies is crucial for Aflac to mitigate potential negative impacts on its financial results and maintain stability.

Aggressive Competition from Traditional and Insurtech Players

The supplemental insurance landscape is fiercely competitive, with established players and nimble insurtech firms constantly vying for customer attention. Companies like UnitedHealth Group, with its extensive network and diverse product offerings, and newer entrants focusing on digital-first customer journeys, present significant challenges. For instance, in 2024, the insurtech sector saw continued investment, with many startups aiming to disrupt traditional models through AI-driven underwriting and personalized customer experiences, potentially impacting Aflac's market share.

Competitors are actively innovating, often by introducing novel products, adopting aggressive pricing strategies, or enhancing digital engagement platforms. These efforts could chip away at Aflac's established advantages. For example, some competitors in 2024 have focused on embedding supplemental benefits directly into primary health plans, offering a more seamless experience for consumers and potentially drawing them away from standalone offerings.

- Intense Rivalry: The supplemental insurance market is characterized by numerous competitors, including large, diversified insurers and specialized insurtech startups.

- Innovation Pressure: Competitors' advancements in product design, pricing, and digital customer experience necessitate Aflac's continuous innovation to remain competitive.

- Market Share Erosion: Aggressive strategies from rivals, such as offering lower premiums or more user-friendly digital platforms, pose a risk of market share erosion for Aflac.

Risk of Catastrophic Events and Climate Change Impact

Aflac faces significant threats from catastrophic events, a risk amplified by climate change. The increasing frequency and intensity of natural disasters, such as hurricanes and severe storms, can directly impact Aflac's claims payouts. For instance, the U.S. experienced a record 28 separate billion-dollar weather and climate disasters in 2023, according to NOAA, a trend that could strain insurance reserves.

These events also pose operational challenges. Disruptions to infrastructure and communication networks can hinder Aflac's ability to process claims efficiently and maintain customer service. Therefore, robust crisis management and business continuity planning are crucial for mitigating the financial and operational fallout from such occurrences.

- Increased Claims: Climate-related events can lead to a surge in claims, potentially impacting Aflac's profitability.

- Operational Disruption: Extreme weather can damage Aflac's facilities and disrupt its IT systems, affecting service delivery.

- Reputational Risk: Inadequate response to catastrophic events could damage Aflac's brand reputation and customer trust.

Aflac operates in a highly competitive landscape, facing pressure from both established insurers and agile insurtech companies. The increasing sophistication of digital platforms and innovative product offerings from rivals, such as those focused on embedded insurance solutions in 2024, could erode Aflac's market share.

Economic volatility, including persistent inflation and the potential for economic slowdowns, directly impacts consumer spending on supplemental insurance. For example, higher living costs in 2024 may lead individuals to reduce discretionary expenses, impacting Aflac's sales volumes and profitability.

The company is also exposed to significant risks from catastrophic events, exacerbated by climate change. The rise in frequency and severity of natural disasters, as evidenced by the 28 billion-dollar weather events in the U.S. in 2023, can lead to increased claims and operational disruptions for Aflac.

Furthermore, evolving regulatory environments, particularly concerning consumer protection and solvency requirements, present ongoing challenges. Changes in these regulations in 2024 could necessitate adjustments to Aflac's product design and operational procedures, potentially increasing compliance costs.

SWOT Analysis Data Sources

This Aflac SWOT analysis is built upon a robust foundation of data, including their publicly available financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of Aflac's internal capabilities and external market positioning.