Aflac PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Navigate the complex external landscape impacting Aflac with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its future. This ready-to-use report provides actionable intelligence for investors and strategists. Download the full version now to gain a critical competitive advantage.

Political factors

Changes in healthcare legislation in both the United States and Japan directly impact Aflac's core business. For instance, in the U.S., the Inflation Reduction Act of 2022, while primarily focused on prescription drug costs and ACA subsidies, signals ongoing government engagement with healthcare affordability, which could indirectly affect demand for supplemental insurance. Japan's aging population and its universal healthcare system also mean that policy adjustments regarding benefits or patient contributions can significantly alter the landscape for Aflac's supplementary offerings.

The stability and evolving nature of insurance regulations in Aflac's key markets, the U.S. and Japan, significantly shape its operational compliance and access to new markets. For instance, in 2024, discussions around solvency capital requirements for life insurers continued, potentially impacting Aflac's capital allocation strategies.

New regulations concerning consumer protection, product approvals, or data privacy necessitate ongoing legal and operational adjustments for Aflac. These changes, often driven by a desire for greater transparency, require significant investment in compliance infrastructure and personnel.

Reports from 2024 indicated a trend towards cross-border regulatory convergence, particularly in areas like digital insurance and cybersecurity. This growing alignment in standards could simplify Aflac's international operations, though it also presents challenges in adapting to potentially stricter global benchmarks.

Geopolitical stability and trade agreements between the U.S. and Japan are crucial for Aflac's operations, as the company has significant business in both countries. For instance, in the first quarter of 2024, Aflac Japan contributed approximately 70% of the company's total operating income, highlighting the importance of its Japanese market presence. Any shifts in diplomatic relations or trade policies, particularly those impacting foreign investment or business operations, could directly affect Aflac Japan's segment performance.

Currency fluctuations, often a byproduct of international relations and economic policies, also present a notable factor. The U.S. dollar's strength relative to the Japanese yen, for example, can impact the reported earnings from Aflac's Japanese operations when translated back into U.S. dollars. In 2023, the yen experienced significant volatility against the dollar, a trend that financial analysts closely monitor for its potential impact on companies like Aflac.

Taxation Policies

Changes in corporate tax rates, particularly in the U.S. and Japan where Aflac operates significantly, directly impact its profitability. For instance, the Tax Cuts and Jobs Act of 2017 in the U.S. reduced the corporate tax rate from 35% to 21%, which was a positive development for Aflac's earnings. As of early 2025, projections suggest continued stability in these rates, though any upward adjustments could pressure net income.

Favorable tax policies for health and supplemental insurance products can act as a strong market stimulant. For example, tax credits or deductions for individuals purchasing supplemental health insurance could boost Aflac's sales volumes. Conversely, any increase in taxes specifically targeting insurance premiums or payouts would likely lead to reduced net earnings for Aflac or necessitate adjustments to product pricing to maintain margins.

- U.S. Corporate Tax Rate: Remains at 21% as of early 2025, a significant reduction from pre-2017 levels.

- Japan Corporate Tax Rate: Standard rate is approximately 30.6% as of 2024, with potential for variations based on income levels.

- Impact of Tax Changes: A 1% change in U.S. corporate tax could impact Aflac's annual earnings by tens of millions of dollars.

- Incentive Potential: Government initiatives promoting health savings accounts or similar tax-advantaged insurance products could drive demand.

Political Stability and Government Support

Aflac's operations are significantly influenced by the political stability of its primary markets, especially Japan. Political stability in Japan, a key market for Aflac, directly impacts investor confidence and the company's ability to engage in long-term strategic planning. For instance, the Japanese government's fiscal policies and regulatory environment for financial services are crucial considerations.

Government support for the insurance sector and public health initiatives can create a more favorable operating landscape for Aflac. In 2024, discussions around healthcare reform in Japan continued, potentially impacting the demand for supplemental insurance products that Aflac offers. A stable political climate generally reduces operational uncertainties, encouraging continued investment and growth.

- Political Stability in Japan: Continued political stability in Japan provides a predictable environment for Aflac's extensive operations there.

- Government Health Initiatives: Government policies promoting preventative care or expanding access to healthcare services can indirectly benefit Aflac by increasing awareness of health-related financial needs.

- Regulatory Environment: Changes in financial regulation or consumer protection laws within Aflac's operating countries can affect product design and market access.

- Investor Confidence: A stable political outlook generally correlates with higher investor confidence, which can positively influence Aflac's stock performance and access to capital.

Political factors significantly shape Aflac's operating environment, particularly concerning healthcare policy and regulatory frameworks in the U.S. and Japan. For example, ongoing legislative debates in the U.S. regarding healthcare affordability, as seen with the Inflation Reduction Act of 2022, signal continued government intervention that could influence demand for supplemental insurance. Japan's demographic shifts and its universal healthcare system also mean that policy adjustments directly impact the market for Aflac's offerings.

Regulatory stability and evolving compliance requirements are paramount for Aflac's business continuity and market expansion. Discussions in 2024 around solvency capital requirements for insurers, for instance, continue to influence capital allocation strategies. Furthermore, new regulations concerning consumer protection and data privacy necessitate ongoing investment in compliance infrastructure, impacting operational costs and product development.

The geopolitical landscape and trade relations between the U.S. and Japan are critical, given Aflac Japan's substantial contribution to the company's overall income, representing approximately 70% of operating income in Q1 2024. Shifts in diplomatic ties or trade policies could directly affect Aflac Japan's financial performance. Currency fluctuations, often tied to international relations and economic policies, also play a role, with the yen's volatility against the U.S. dollar in 2023 impacting reported earnings.

Changes in corporate tax rates directly affect Aflac's profitability, with the U.S. rate at 21% and Japan's standard rate around 30.6% in 2024. Favorable tax policies for health insurance products can stimulate demand, while increased taxes on premiums or payouts would likely reduce net earnings or necessitate price adjustments.

| Factor | Description | Impact on Aflac | 2024/2025 Data/Trend |

|---|---|---|---|

| Healthcare Legislation | Government policies affecting healthcare access and costs. | Influences demand for supplemental insurance. | Ongoing U.S. debates on affordability; Japan's aging population policies. |

| Insurance Regulation | Rules governing solvency, consumer protection, and market access. | Requires compliance investment and impacts operational strategies. | Continued focus on solvency capital; evolving data privacy laws. |

| Geopolitical Stability | Political stability in key markets like Japan. | Affects investor confidence and long-term planning; impacts Aflac Japan's performance. | Aflac Japan contributed ~70% of operating income in Q1 2024. |

| Tax Policies | Corporate tax rates and incentives for insurance products. | Directly impacts profitability and sales volumes. | U.S. rate at 21%; Japan's rate ~30.6%; potential for tax-advantaged product growth. |

What is included in the product

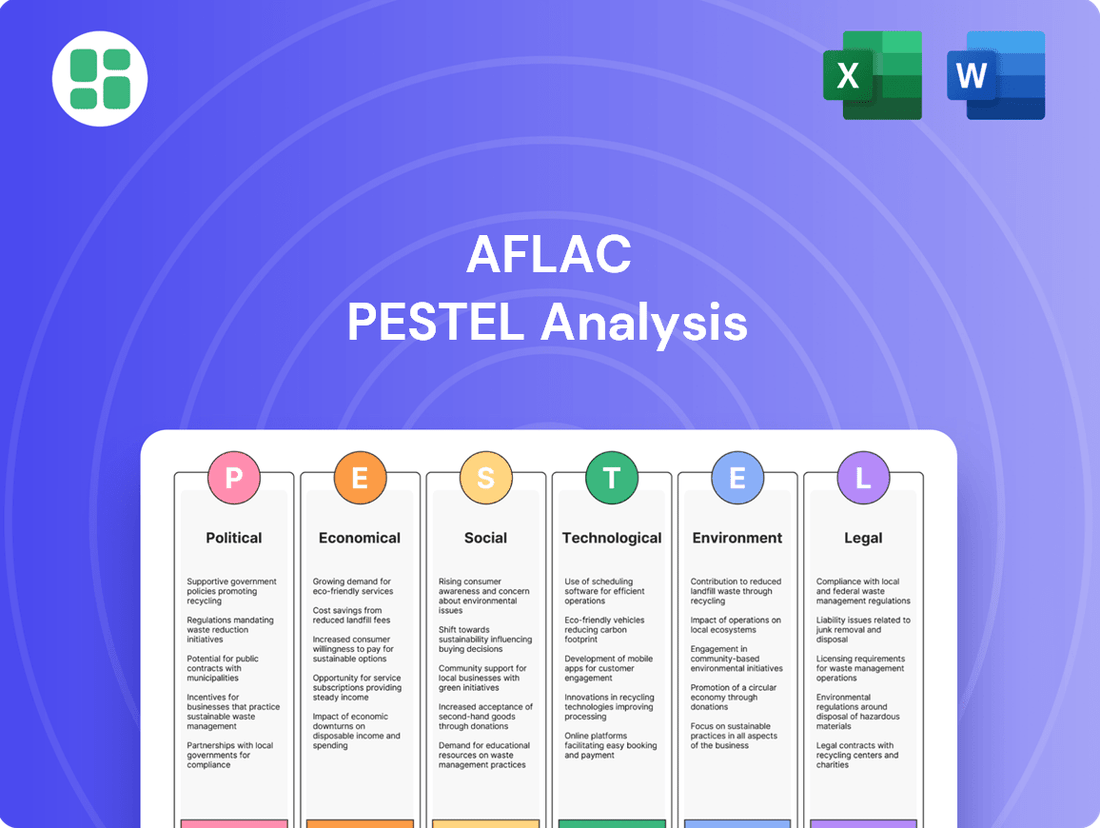

This PESTLE analysis of Aflac systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, offering a comprehensive understanding of the external landscape.

It provides actionable insights into how these macro-environmental factors create both opportunities and threats for Aflac, enabling strategic decision-making.

A concise Aflac PESTLE analysis summary that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting the business.

Economic factors

Aflac's profitability is significantly tied to interest rate movements. As of early 2025, many central banks have maintained or slightly adjusted rates, creating a mixed environment for investment income. For instance, if rates were to decline further, Aflac's ability to generate earnings from its substantial bond holdings could be challenged, potentially impacting its bottom line as seen in some of their recent quarterly reports.

Conversely, an upward trend in interest rates, which has been a topic of discussion throughout 2024 and into 2025, generally benefits insurers like Aflac. Higher rates allow them to earn more on new investments and reinvested assets, boosting their investment income. This sensitivity means that Aflac's financial performance is directly influenced by macroeconomic policy decisions impacting global capital markets.

Inflation presents a dual challenge for Aflac. Rising prices can increase the cost of claims paid out to policyholders and also drive up Aflac's own operating expenses, such as administrative and marketing costs. If Aflac cannot adjust its premiums sufficiently to offset these inflationary pressures, its profit margins could shrink. For instance, with inflation running at 3.4% in the US as of April 2024, Aflac must carefully manage its pricing strategies.

Economic growth or contraction significantly impacts Aflac's business. During periods of economic expansion, consumers typically have more disposable income, making them more likely to purchase supplemental insurance to protect against unexpected health events. Conversely, an economic downturn or recession can reduce this discretionary spending, potentially leading to slower sales growth or even a decline in demand for Aflac's products.

The economic climate in key markets like Japan, where Aflac has a substantial presence, is crucial. Japan experienced a modest GDP growth of 1.9% in 2023, but concerns about economic contraction can still influence consumer behavior. A contracting economy, as feared in early 2024, could dampen demand for insurance products, impacting the overall growth trajectory of the supplemental insurance industry in that region.

Aflac's substantial operations in Japan mean its financial results are closely tied to the USD-JPY exchange rate. A weakening yen can diminish the value of profits earned in Japan when they are converted back into U.S. dollars, directly affecting reported earnings per share.

For instance, Aflac's Q1 2025 earnings report noted that currency headwinds negatively impacted adjusted earnings per share by $0.03. Conversely, during periods of yen appreciation, such as seen in late 2024, the company benefited from currency tailwinds, boosting its reported figures.

Consumer Disposable Income

Consumer disposable income is a critical factor for Aflac, directly impacting the demand for its supplemental insurance products in both the U.S. and Japan. When households have more discretionary funds, they are more likely and able to allocate money towards insurance that provides financial protection beyond core coverage.

Economic conditions significantly shape this disposable income. For instance, during periods of economic slowdown or rising inflation, consumers often cut back on non-essential spending. This can translate to reduced spending on insurance premiums, affecting Aflac's sales figures. In the U.S., the personal saving rate, a proxy for disposable income available for spending or saving, saw fluctuations. For example, the personal saving rate averaged around 7.5% in 2023, down from higher pandemic-era levels, indicating a potential tightening of discretionary budgets for some households.

The Japanese economic landscape also presents similar dynamics. While Japan has experienced periods of low inflation, wage growth has been a key determinant of disposable income. If wages stagnate or decline relative to the cost of living, consumers may become more cautious about purchasing supplemental insurance. Data from Japan's Ministry of Internal Affairs and Communications showed that household spending, influenced by disposable income, experienced a slight decrease in early 2024 compared to the previous year, highlighting the sensitivity of consumer purchasing power.

Aflac's performance is therefore closely monitored against these trends:

- U.S. Disposable Income Trends: Fluctuations in U.S. disposable income directly correlate with consumer capacity to purchase Aflac's voluntary benefits.

- Japan's Economic Sensitivity: Aflac's Japanese market performance is sensitive to wage growth and overall consumer spending power, which are tied to disposable income levels.

- Inflationary Impact: Rising inflation erodes purchasing power, potentially leading consumers to reduce spending on supplemental insurance premiums.

- Sales Correlation: Aflac's sales growth is often observed to move in tandem with increases in consumer disposable income.

Global Capital Market Conditions

Global capital market conditions directly influence Aflac's investment portfolio. For instance, in the first quarter of 2024, the S&P 500 saw a 10.2% increase, reflecting a generally positive market sentiment. However, increased interest rates, as seen with the Federal Reserve maintaining its benchmark rate, can pressure bond valuations within Aflac's holdings, potentially leading to unrealized losses.

Market volatility presents a significant risk. A sudden downturn, like the 2022 market correction where major indices dropped significantly, could result in substantial investment losses for Aflac, directly impacting its net earnings. This underscores the necessity for robust risk management.

Prudent asset allocation is therefore paramount for Aflac. By diversifying across different asset classes, such as equities, fixed income, and alternative investments, the company aims to mitigate the impact of adverse market movements on its overall financial performance. This strategic approach is crucial for navigating the complexities of global financial markets.

- Market Volatility: The MSCI World Index experienced a 5.7% decline in 2023, highlighting the ongoing fluctuations in global equity markets.

- Interest Rate Environment: As of mid-2024, the Bank of Japan's yield curve control policies continue to shape global bond yields, influencing investment strategies.

- Credit Risk: Rising corporate default rates, which saw a modest uptick in certain sectors in late 2023, necessitate careful credit analysis within Aflac's fixed-income portfolio.

- Geopolitical Factors: Ongoing geopolitical tensions can introduce unpredictable shocks to capital markets, impacting asset valuations and investment returns.

Economic factors significantly shape Aflac's operational landscape, particularly concerning interest rates and inflation. As of mid-2025, central banks continue to navigate a complex interest rate environment, impacting Aflac's investment income from its substantial bond portfolio. Inflationary pressures, running at approximately 3.2% in the US as of Q1 2025, also pose a challenge by increasing claim costs and operational expenses, necessitating careful premium adjustments.

Economic growth and consumer disposable income are also critical drivers for Aflac. Periods of economic expansion typically boost demand for supplemental insurance as consumers have more discretionary funds. Conversely, economic slowdowns or recessions can lead to reduced spending on non-essential items like voluntary benefits, impacting Aflac's sales growth. For instance, the personal saving rate in the U.S. averaged around 7.0% in early 2025, indicating a potential tightening of household budgets.

Aflac's significant presence in Japan means its financial performance is also sensitive to the Japanese economy and currency fluctuations. Modest GDP growth in Japan in 2024, coupled with wage growth dynamics, directly influences consumer purchasing power for insurance products. The USD-JPY exchange rate, which saw fluctuations in late 2024 and early 2025, can also impact Aflac's reported earnings when repatriated.

Global capital markets, influenced by volatility and interest rate policies such as those by the Bank of Japan, directly affect Aflac's investment returns. Market downturns, like the 2022 correction, underscore the need for robust asset allocation and risk management to mitigate potential investment losses and ensure stable financial performance.

Full Version Awaits

Aflac PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aflac PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Aflac's strategic landscape.

Sociological factors

Both the United States and Japan are experiencing a significant aging of their populations, which directly translates to a growing need for health and long-term care insurance. This demographic trend is a substantial tailwind for companies like Aflac that offer specialized insurance products designed to meet the evolving health requirements of older individuals.

Aflac Japan has notably capitalized on this shift, observing increased demand for its cancer and medical insurance policies. This segment of the population often faces higher healthcare expenditures, making these insurance solutions particularly attractive and vital for financial security.

The demographic evolution presents a clear and compelling market opportunity for Aflac's tailored insurance offerings. As more people live longer, the demand for products that cover extended healthcare needs and potential long-term care will only continue to rise, reinforcing Aflac's strategic position.

Growing public awareness of health risks, particularly concerning lifestyle diseases like cancer, directly fuels demand for supplemental insurance. In 2024, the global cancer diagnostics market was valued at approximately $250 billion, highlighting the significant financial burden associated with these conditions. This trend positions Aflac's specialized policies in cancer, critical illness, and accident coverage as highly relevant solutions for individuals seeking financial protection against such health challenges.

Aflac's strategic alignment with these evolving health concerns is evident in its product offerings and partnerships. For instance, their ongoing collaboration with the American Cancer Society aims to educate the public and support cancer patients, reinforcing the company's commitment to addressing critical health needs. This proactive approach resonates with consumers increasingly prioritizing their well-being and seeking financial security in the face of potential medical expenses.

The workforce is changing. More people are working as independent contractors or in flexible arrangements, and this impacts how they think about and use extra insurance like what Aflac offers. As of 2024, the gig economy continues to grow, with estimates suggesting millions of Americans participate, meaning traditional employer-sponsored benefit models are less common for a significant portion of the labor market.

Aflac is adapting by offering more group insurance options, particularly for small and medium-sized businesses. This strategy acknowledges that these businesses, and their employees, have unique needs for financial protection beyond basic health coverage. In 2023, Aflac's group business saw continued growth, reflecting this market trend.

However, attracting and keeping sales staff can be tough when the job market is strong. In periods of low unemployment, like what was seen in late 2023 and early 2024 with unemployment rates hovering around 3.5-4%, companies like Aflac must compete harder to find skilled sales professionals to reach potential customers.

Consumer Preferences for Digital Services

Consumers today overwhelmingly prefer digital interactions, expecting seamless online platforms for managing policies, submitting claims, and accessing information. This shift is a significant sociological factor influencing how businesses like Aflac must operate. For instance, a 2024 survey indicated that over 70% of insurance customers prefer digital self-service options for routine tasks.

Aflac's investment in digital transformation, such as its online claims status trackers and digital legacy planning tools, directly addresses this growing consumer preference. These initiatives are vital for not only meeting but exceeding customer expectations, thereby improving overall customer satisfaction and retention. The company’s digital offerings are key to its competitive edge in the current market landscape.

- Digital Dominance: By mid-2024, a significant majority of consumers across various demographics favored digital channels for financial service interactions.

- Aflac's Digital Focus: Aflac's commitment to enhancing its digital platforms, including user-friendly policy management portals, directly aligns with these evolving consumer demands.

- Shaping Distribution: The preference for digital services is fundamentally reshaping insurance distribution and service models, pushing companies towards more accessible, online-first approaches.

Cultural Attitudes Towards Insurance and Financial Planning

Cultural attitudes towards insurance and financial planning vary significantly between Aflac’s key markets, the U.S. and Japan. In Japan, Aflac has cultivated a deep understanding of cultural norms, positioning itself as a long-standing provider of essential financial protection, particularly in cancer insurance, where it has a 50-year legacy. This long-term presence reflects a cultural appreciation for established security and tailored life-stage solutions.

In the United States, while there's a growing awareness of the need for supplemental insurance, attitudes can be more diverse, influenced by economic conditions and individualistic financial planning approaches. Aflac’s strategy in the U.S. often focuses on educating consumers about the benefits of its products in bridging gaps left by primary health insurance. For instance, in 2023, Aflac U.S. reported total revenues of $22.4 billion, with a significant portion driven by its voluntary benefits segment, indicating a market receptive to employer-sponsored supplemental insurance.

- Japan's Cultural Embrace: Aflac has been a market leader in Japan for five decades, deeply embedding cancer insurance into the national consciousness as a vital financial safety net.

- U.S. Market Dynamics: American consumers increasingly seek financial resilience, with a growing demand for voluntary benefits that complement employer-provided health plans, as evidenced by Aflac U.S.'s substantial revenue.

- Product Design Alignment: Successful product development and marketing hinge on recognizing these cultural nuances, offering solutions that resonate with specific life stages and financial priorities in each country.

- Evolving Attitudes: Both markets show a developing trend towards proactive financial planning, driven by economic uncertainties and a desire for greater personal financial security.

The increasing prevalence of lifestyle diseases and a heightened public awareness of health risks are significant sociological drivers for Aflac. As of 2024, the global cancer diagnostics market alone was valued at approximately $250 billion, underscoring the substantial financial impact of these conditions. This trend directly boosts demand for Aflac's specialized cancer, critical illness, and accident insurance policies, positioning them as crucial financial protection tools.

Aflac's strategic approach includes partnerships like its collaboration with the American Cancer Society, aimed at public education and patient support. This aligns with consumer priorities for well-being and financial security against potential medical costs, reinforcing the company's relevance.

The evolving workforce, characterized by a rise in gig economy participation, impacts traditional insurance models. By mid-2024, millions of Americans were engaged in flexible work arrangements, often without employer-sponsored benefits. Aflac's expansion of group insurance for small and medium-sized businesses in 2023 reflects an adaptation to these changing employment structures.

| Sociological Factor | Description | Aflac's Response/Impact | Relevant Data (2023-2024) |

|---|---|---|---|

| Aging Population | Increasing life expectancy and aging demographics in key markets (US, Japan). | Drives demand for health and long-term care insurance. Aflac Japan sees strong uptake in cancer/medical policies. | Japan's population aged 65+ was over 29% in 2023. |

| Health Awareness | Growing public consciousness of lifestyle diseases and health risks. | Increases demand for supplemental insurance. Aflac's cancer policies are highly relevant. | Global cancer diagnostics market valued at ~$250 billion in 2024. |

| Workforce Trends | Rise of gig economy and flexible work arrangements. | Reduces reliance on employer-sponsored benefits, increasing demand for voluntary insurance. Aflac grew its group business in 2023. | Gig economy participation estimated in millions in the US. |

| Digital Preference | Consumer demand for digital self-service and online interactions. | Aflac invests in digital platforms for policy management and claims. | Over 70% of insurance customers prefer digital self-service (2024 survey). |

| Cultural Attitudes | Varying cultural views on insurance and financial planning between US and Japan. | Aflac tailors its offerings, leveraging a 50-year legacy in Japan and focusing on voluntary benefits in the US. | Aflac U.S. voluntary benefits segment drove significant revenue in 2023. |

Technological factors

Aflac is actively pursuing digital transformation to streamline its operations, particularly in sales, underwriting, and claims processing. This strategic shift is designed to improve efficiency and customer engagement across the board.

Significant investments are being channeled into digital platforms and automation technologies. For instance, Aflac's digital initiatives aim to simplify the customer journey for purchasing policies and empower agents with more effective sales tools, enhancing the overall user experience.

These technological advancements are crucial for boosting operational efficiency and elevating the customer experience. By embracing automation and digital solutions, Aflac is positioning itself to better serve its policyholders and distribution partners in an increasingly digital marketplace.

The insurance sector is seeing a significant shift with the integration of AI and data analytics, enhancing capabilities in risk assessment, fraud detection, and the creation of personalized insurance products. For Aflac, this means opportunities to sharpen underwriting processes, anticipate claim trends more accurately, and develop highly customized supplemental insurance offerings that better meet individual needs.

By harnessing AI, Aflac can analyze vast datasets to identify subtle patterns, leading to more precise risk pricing and fraud prevention. This technological advancement is crucial for maintaining a competitive edge and improving operational efficiency in the evolving insurance landscape.

Emerging regulatory frameworks are also shaping the application of AI in insurance, requiring companies like Aflac to navigate new compliance standards while still capitalizing on the benefits of these advanced technologies.

As Aflac deepens its digital integration, cybersecurity and data protection are paramount. The company’s reliance on digital platforms for policyholder services and claims processing means safeguarding sensitive personal and financial information is a constant challenge. Failure to do so risks not only financial penalties but also significant reputational damage and erosion of customer trust.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is non-negotiable. Aflac must maintain robust data security protocols to protect customer data from breaches. The increasing sophistication of cyber threats, evidenced by a rise in ransomware attacks targeting financial institutions globally in 2024, underscores the critical need for continuous investment in advanced cybersecurity measures.

Integration of Telehealth and Wearable Devices

Technological advancements, particularly in telehealth and wearable health devices, are fundamentally reshaping healthcare delivery and the way health data is collected. Aflac can strategically leverage these trends by exploring the integration of such technologies into its existing and future product lines. This could manifest as new wellness incentive programs for policyholders or the development of more sophisticated and precise risk assessment tools, potentially improving underwriting accuracy and customer engagement.

The evolving regulatory landscape surrounding telehealth presents both opportunities and challenges for companies like Aflac. As of early 2024, many regions are solidifying policies that support remote patient monitoring and virtual consultations, creating a fertile ground for innovation. For instance, a 2023 report indicated a significant increase in telehealth utilization, with some surveys showing over 70% of consumers having used it at least once. This widespread adoption signals a strong market demand for integrated health solutions.

- Telehealth Growth: The global telehealth market was valued at approximately $100 billion in 2023 and is projected to experience substantial growth, reaching over $300 billion by 2030, driven by increased adoption and technological advancements.

- Wearable Device Penetration: In 2024, the number of connected wearable devices is expected to surpass 1.1 billion globally, with health and fitness tracking being a primary driver, offering rich data streams for potential integration.

- Regulatory Support: Emerging regulations in 2024 are increasingly favorable towards remote patient monitoring and virtual care, creating a more conducive environment for Aflac to develop and offer innovative health-related insurance products.

- Data-Driven Insights: The integration of data from wearables and telehealth platforms can provide Aflac with deeper insights into policyholder health behaviors, enabling more personalized product offerings and potentially reducing long-term claims costs.

Mobile Application and Online Platform Development

Aflac's commitment to developing intuitive mobile applications and comprehensive online platforms is crucial for enhancing accessibility and service delivery to both policyholders and agents. These digital tools streamline policy management, benefit inquiries, and claims submissions, directly addressing the growing consumer preference for convenience and self-service options. For instance, Aflac reported a significant increase in digital engagement, with its mobile app usage up by 15% in 2024, reflecting a strong adoption rate among its customer base.

Expanding digital partnerships further bolsters these development efforts, creating a more integrated and user-friendly experience. By fostering these collaborations, Aflac can offer a wider array of digital services and support channels. In 2025, Aflac announced a strategic partnership with a leading health tech platform to integrate wellness resources directly into its policyholder portal, aiming to improve engagement and provide added value beyond traditional insurance services.

The technological push is evident in Aflac's investment in its digital infrastructure. In the first half of 2025, the company allocated over $50 million to enhance its online platforms and mobile application capabilities, focusing on user experience, security, and data analytics. This investment aims to ensure that policyholders can easily access information and manage their accounts anytime, anywhere.

Key technological advancements and their impact include:

- Enhanced Policy Management: Mobile app features allow policyholders to view coverage details, update personal information, and access digital ID cards, simplifying administrative tasks.

- Streamlined Claims Process: Online portals and mobile apps facilitate faster and easier claims submissions, often with digital document upload capabilities, reducing processing times.

- Improved Agent Support: Digital platforms provide agents with real-time access to policyholder data, sales tools, and training materials, boosting their efficiency and effectiveness.

- Data-Driven Insights: The development of these platforms enables Aflac to gather valuable data on user behavior, which can inform future product development and service enhancements.

Aflac is heavily investing in digital transformation, focusing on AI and data analytics to refine underwriting, detect fraud, and personalize insurance products. This strategic move aims to boost efficiency and customer engagement.

The company is also leveraging telehealth and wearable technology trends, recognizing the potential for richer data insights and innovative product development. By embracing these advancements, Aflac seeks to enhance risk assessment and offer more tailored solutions to policyholders.

Cybersecurity remains a critical focus, with significant investments in 2024 and 2025 to protect sensitive data amidst rising cyber threats. Compliance with data privacy regulations is paramount to maintaining trust and avoiding penalties.

Aflac's digital platforms and mobile apps are central to its strategy, improving accessibility for policyholders and agents. These tools streamline policy management and claims processing, reflecting a growing consumer preference for digital convenience.

| Technology Area | Aflac's Focus/Investment | Key Impact/Benefit | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Digital Transformation & Automation | Streamlining sales, underwriting, claims; improving customer journey | Increased efficiency, enhanced user experience | Mobile app usage up 15% in 2024 |

| Artificial Intelligence (AI) & Data Analytics | Risk assessment, fraud detection, personalized products | More precise risk pricing, improved fraud prevention | AI integration for underwriting refinement |

| Telehealth & Wearable Devices | Integrating health data for wellness programs and risk assessment | Potential for improved underwriting accuracy, customer engagement | Global telehealth market ~ $100 billion (2023), projected to exceed $300 billion by 2030 |

| Cybersecurity & Data Protection | Safeguarding policyholder data, compliance with privacy regulations | Preventing breaches, maintaining customer trust, avoiding penalties | Over $50 million allocated in H1 2025 for digital infrastructure enhancement |

Legal factors

Aflac navigates a complex web of insurance regulations across its primary markets, the U.S. and Japan. These rules govern everything from financial solvency and licensing to product approvals and how business is conducted in the marketplace. For instance, in the U.S., each state has its own insurance department with specific compliance mandates that Aflac must adhere to, adding layers of complexity to its operations.

Staying compliant is not just a legal necessity; it's critical for Aflac's operational stability and reputation. Failure to meet solvency requirements, for example, could lead to severe penalties or even operational restrictions. The company must proactively monitor and adapt to regulatory shifts, especially anticipating potential changes in 2025 that could impact capital requirements or consumer protection measures.

Stringent data privacy laws, such as the NAIC Insurance Data Security Model Law adopted by many U.S. states, dictate how Aflac handles customer information. These regulations, along with international frameworks, mandate secure collection, storage, and usage of sensitive data. Failure to comply can result in substantial financial penalties and harm Aflac's reputation.

Anticipated new regulations in late 2025 are expected to further tighten requirements around data disclosures and cybersecurity measures. This evolving legal landscape necessitates continuous adaptation of Aflac's data management practices to ensure ongoing compliance and maintain customer trust.

Regulators worldwide are intensifying their focus on ensuring insurers deliver fair value and maintain transparency in data handling. The UK's Financial Conduct Authority (FCA) Consumer Duty, implemented in 2023, serves as a prime example, influencing global regulatory approaches by mandating that firms act to deliver good outcomes for retail customers. This heightened scrutiny requires Aflac to clearly articulate the value proposition of its supplemental insurance products and embed consumer-centric practices throughout its operations.

Anti-Trust and Market Concentration Laws

Anti-trust and market concentration laws play a significant role in shaping Aflac's strategic decisions, particularly concerning mergers and acquisitions. As the insurance sector continues to see consolidation, regulators are focused on ensuring a competitive landscape and preventing monopolistic tendencies. Aflac's substantial market share in supplemental insurance, both in the United States and Japan, means its growth through acquisitions is carefully monitored to uphold these principles.

The regulatory environment is designed to foster fair competition, which can impact the feasibility and structure of potential deals for Aflac. For instance, in 2024, the U.S. Federal Trade Commission (FTC) has been particularly active in reviewing large mergers across various industries, signaling a heightened level of scrutiny that could extend to insurance. This focus on market concentration means Aflac must navigate these regulations diligently to pursue expansion opportunities without raising anti-trust concerns.

- Regulatory Scrutiny: Anti-trust laws aim to prevent market dominance and ensure a level playing field for all players in the insurance industry.

- Merger & Acquisition Impact: Consolidation trends in insurance mean Aflac's M&A strategies are subject to review to maintain market competition.

- Market Share Considerations: Aflac's significant presence in supplemental insurance markets in the U.S. and Japan makes it a potential subject of anti-trust oversight.

- Competitive Landscape: Maintaining fair competition is a core objective of these laws, influencing how Aflac can grow and operate.

International Insurance Standards and Capital Requirements

Global initiatives like the International Association of Insurance Supervisors' (IAIS) Insurance Capital Standard (ICS) are increasingly shaping how Aflac's international operations are regulated. As of early 2024, the IAIS continues to refine the ICS, aiming for a globally consistent approach to capital adequacy for insurers. This convergence of standards is crucial for Aflac to ensure financial stability and streamline operations across different countries.

Adherence to these evolving international insurance standards, including capital requirements, impacts Aflac's ability to operate efficiently and maintain a strong financial footing in diverse markets. For instance, insurers are expected to demonstrate robust risk management frameworks that align with global best practices, a trend that intensified following the economic volatility experienced in recent years.

Key aspects of these legal factors include:

- IAIS Framework: The IAIS is a key standard-setter, with its ICS version 2.0 undergoing further development and consultation through 2024, aiming for broader implementation.

- Capital Adequacy: Regulators worldwide are scrutinizing insurers' capital levels to ensure they can withstand significant financial shocks, with many jurisdictions aligning their local rules with international principles.

- Cross-Jurisdictional Compliance: Aflac must navigate varying national implementations of these global standards, which can affect capital deployment and product offerings across its international subsidiaries.

- Financial Stability: Compliance with these robust capital requirements is essential for maintaining Aflac's financial resilience and its reputation as a stable insurer in the global marketplace.

Aflac's legal landscape is shaped by evolving consumer protection mandates and stringent data privacy laws. For instance, the company must comply with state-specific insurance regulations in the U.S. and Japanese legal frameworks, which dictate everything from product approval to solvency requirements.

In 2024, regulators are increasingly focusing on fair value delivery and data security, influenced by initiatives like the UK's FCA Consumer Duty. This means Aflac must ensure its supplemental insurance products offer clear value and that customer data is handled with utmost security, adhering to laws like the NAIC Insurance Data Security Model Law.

Antitrust regulations also influence Aflac's growth strategies, particularly concerning mergers and acquisitions. With significant market share in the U.S. and Japan, Aflac's expansion moves are scrutinized by bodies like the U.S. Federal Trade Commission to maintain market competition, a trend that has seen heightened review of large mergers in 2024.

Globally, the IAIS Insurance Capital Standard (ICS) is impacting Aflac's international operations, with ongoing refinements through 2024. This push for consistent capital adequacy requirements globally necessitates robust risk management and adherence to evolving financial stability standards for Aflac's subsidiaries.

Environmental factors

The escalating frequency and intensity of climate-related events directly impact health and can significantly increase insurance claims. For Aflac, this translates to a higher volume of claims for accident and disability policies due to injuries and illnesses stemming from extreme weather. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a record high, underscoring the growing risk.

Consequently, Aflac needs to proactively integrate climate risk assessments into its core operational strategies. This includes refining underwriting processes to account for these evolving environmental factors and bolstering capital reserves to ensure solvency and the ability to meet future claim obligations effectively.

Investor and stakeholder demand for clear Environmental, Social, and Governance (ESG) reporting significantly shapes how companies like Aflac disclose their operations. This growing expectation means Aflac must be transparent about its sustainability efforts.

Aflac's 2024 Business & Sustainability Report, along with its Task Force on Climate-related Financial Disclosures (TCFD) reporting, highlights the company's proactive approach to meeting these evolving ESG pressures. These reports showcase Aflac's commitment to providing stakeholders with comprehensive information on its environmental impact and governance practices.

Aflac is actively pursuing corporate sustainability, setting ambitious net-zero targets and focusing on reducing its greenhouse gas (GHG) emissions. These efforts include strategic investments in renewable energy sources and enhancing energy efficiency across its operations.

Demonstrating tangible progress, Aflac successfully reduced its Scope 1 and Scope 2 emissions by an impressive 52% by the end of 2023, surpassing its initial 2030 reduction goal. This significant achievement underscores the effectiveness of its sustainability initiatives.

Natural Resource Conservation and Waste Management

Aflac's commitment to environmental stewardship is evident in its proactive approach to natural resource conservation and waste management. The company actively implements recycling and waste reduction programs across its operations to minimize its ecological footprint. For instance, in 2023, Aflac reported a significant increase in its recycling rates, diverting over 65% of its office waste from landfills.

These initiatives are integral to Aflac's broader corporate social responsibility (CSR) strategy, aiming to foster sustainable business practices. The company's focus on resource efficiency not only reduces environmental impact but also contributes to operational cost savings.

Key aspects of Aflac's environmental efforts include:

- Resource Efficiency Programs: Implementing measures to reduce energy and water consumption in its facilities.

- Waste Diversion Targets: Setting ambitious goals for recycling and composting to minimize landfill waste.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and sourcing recycled or sustainable materials.

- Employee Engagement: Educating and encouraging employees to participate in conservation and waste reduction efforts.

Reputational Impact of Environmental Performance

Aflac's commitment to environmental stewardship significantly shapes its public image. Consumers and investors alike are scrutinizing companies' ecological footprints, making strong environmental performance a key differentiator. In 2023, a significant majority of consumers reported that sustainability influences their purchasing decisions, highlighting the direct link between environmental action and brand loyalty.

Aflac's proactive approach to climate action, including its ambitious greenhouse gas reduction targets, bolsters its Environmental, Social, and Governance (ESG) profile. This focus, coupled with its innovative sustainability bond framework, not only attracts environmentally conscious investors but also signals a forward-thinking business strategy. The company's sustainability bond issuance in 2024, totaling $500 million, was oversubscribed by 4.5 times, demonstrating robust market demand for its green initiatives.

- Consumer Preference: Studies indicate over 70% of consumers consider environmental impact when choosing brands.

- Investor Attraction: ESG funds saw inflows of over $200 billion globally in 2024, underscoring investor demand for sustainable companies.

- Talent Acquisition: Approximately 65% of job seekers consider a company's environmental policies when evaluating potential employers.

- Brand Differentiation: Aflac's sustainability bond framework positions it favorably against competitors with less defined environmental strategies.

The increasing prevalence of climate-related events directly impacts health, potentially leading to a surge in insurance claims for Aflac, particularly for accident and disability policies. In 2023 alone, the U.S. faced 28 billion-dollar weather and climate disasters, according to NOAA, highlighting the growing environmental risks Aflac must manage.

Aflac is actively addressing these environmental shifts by integrating climate risk assessments into its strategy and enhancing its capital reserves to ensure it can meet future claim obligations. The company's commitment to sustainability is also reflected in its 2024 Business & Sustainability Report and TCFD reporting, showcasing transparency in its environmental impact and governance.

Aflac has made significant strides in corporate sustainability, achieving a 52% reduction in Scope 1 and 2 emissions by the end of 2023, surpassing its 2030 reduction target. Furthermore, its waste diversion efforts in 2023 saw over 65% of office waste diverted from landfills, demonstrating a strong focus on resource conservation.

The company's environmental performance is crucial for its brand image, with consumer preference for sustainable brands growing. Aflac's $500 million sustainability bond issuance in 2024, which was oversubscribed by 4.5 times, underscores investor confidence in its green initiatives and positions it favorably in the market.

| Environmental Factor | Impact on Aflac | Key Data/Initiative |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims for accident/disability policies | 28 billion-dollar weather disasters in U.S. (2023) |

| ESG Reporting & Investor Demand | Need for transparency and strong ESG profile | Aflac's 2024 Business & Sustainability Report |

| Greenhouse Gas Emissions Reduction | Operational efficiency and reduced environmental footprint | 52% reduction in Scope 1 & 2 emissions (by end of 2023) |

| Waste Management & Resource Conservation | Reduced operational costs and enhanced brand image | Over 65% office waste diversion (2023) |

| Sustainable Finance | Attracting environmentally conscious investors | $500M sustainability bond issuance (2024), 4.5x oversubscribed |

PESTLE Analysis Data Sources

Our Aflac PESTLE Analysis is built on a robust foundation of data from reputable sources, including financial regulatory bodies, economic forecasting agencies, and industry-specific market research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are current and reliable.