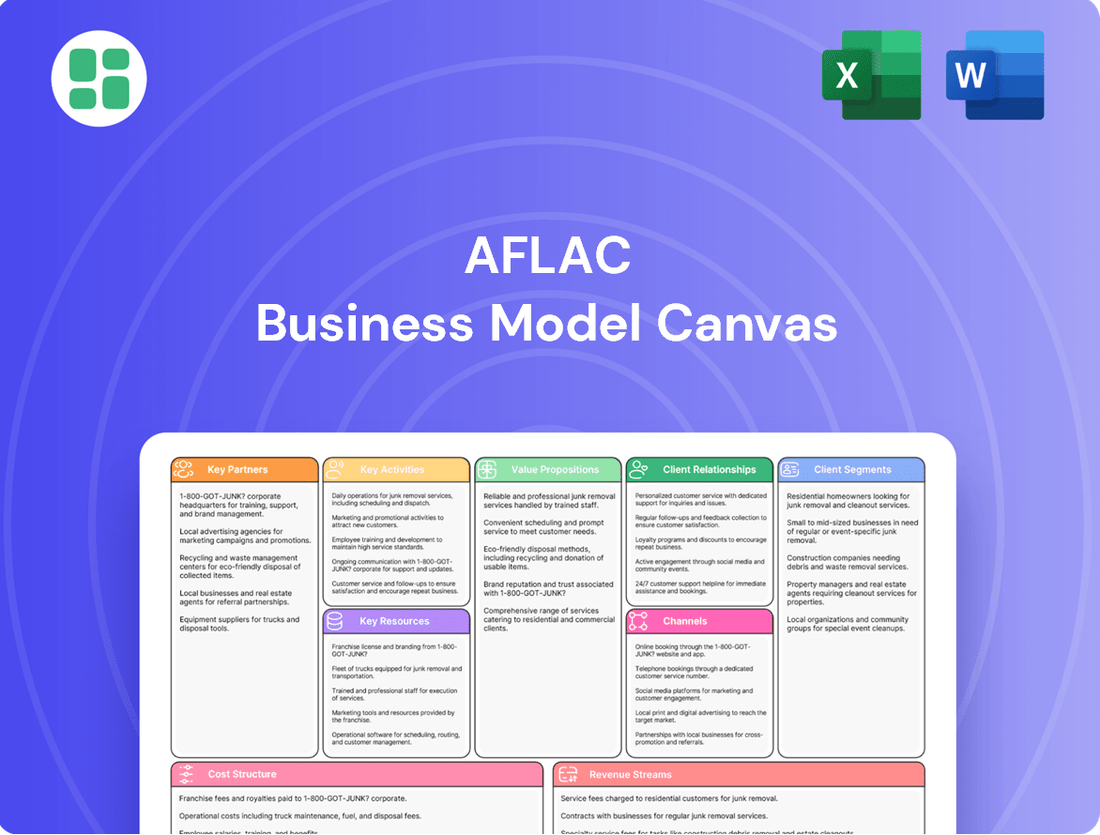

Aflac Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Unlock the strategic blueprint behind Aflac's success with our comprehensive Business Model Canvas. This detailed analysis reveals how Aflac effectively targets its customer segments, builds strong partnerships, and drives revenue through its unique value propositions. Gain actionable insights into their operational activities and cost structure.

Ready to dissect Aflac's winning formula? Our full Business Model Canvas provides a crystal-clear, section-by-section breakdown of how they operate, from customer relationships to revenue streams. Download it now to gain a competitive edge and accelerate your own strategic planning.

Partnerships

Aflac's key partnerships with employers are crucial for its worksite distribution strategy. By integrating supplemental insurance into employee benefits, Aflac leverages payroll deductions for easy policy access and payment, a model that benefits both employees and employers by simplifying administration.

In 2023, Aflac reported that its U.S. voluntary benefits segment, which heavily relies on employer partnerships, generated substantial premium income. This segment continues to be a cornerstone of their business, demonstrating the enduring value of these employer relationships in reaching a broad customer base.

The Aflac Group further strengthens these ties by specifically engaging larger employers, typically those with 100 or more employees, often through established relationships with benefits brokers. This targeted approach ensures that Aflac's offerings are presented to a significant portion of the workforce, solidifying its position as a leading provider of supplemental insurance.

Aflac's business model hinges on a robust network of independent agents and brokers, especially in the U.S. These partners are vital for Aflac to reach diverse customer segments, from individuals to businesses of all sizes.

The company is strategically increasing its sales volume through brokers, targeting mid- to large-case markets to broaden its client base and revenue streams.

Aflac Japan leverages an extensive network of financial institutions, particularly banks, as crucial partners for product distribution. This strategic alliance allows Aflac to reach a vast customer base across Japan, significantly broadening its market penetration for key offerings like cancer and medical insurance.

The depth of this partnership is remarkable, with approximately 90% of Japanese banks having established agreements with Aflac. This near-universal adoption by banks underscores the trust and mutual benefit derived from these collaborations, facilitating Aflac's ability to offer its specialized insurance solutions effectively.

Technology and Digital Solution Providers

Aflac strategically partners with technology and digital solution providers to boost its digital offerings and customer experience. A notable collaboration is with Nayya, focusing on personalized digital benefits guidance and claims integration, aiming to simplify the benefits landscape for users.

Further enhancing its digital ecosystem, Aflac has partnered with Empathy to provide digital legacy planning services, such as LifeVault, directly to its life insurance policyholders. These alliances are designed to streamline operations and deliver enriched value propositions to Aflac’s customer base.

These key partnerships underscore Aflac's commitment to digital transformation and customer-centric innovation. For instance, Nayya's platform aims to improve benefits utilization, a critical factor in employee satisfaction and retention, especially as digital tools become paramount in HR functions.

- Nayya Partnership: Enhances personalized benefits guidance and claims processing.

- Empathy Partnership: Introduces digital legacy planning services like LifeVault.

- Strategic Goal: Streamline processes and add value for policyholders.

- Digital Focus: Reinforces Aflac's commitment to digital transformation in customer service.

Healthcare Providers and Networks

Aflac collaborates with healthcare providers and networks, especially for its dental and vision insurance products. These relationships are crucial for managing network-based benefits and ensuring Aflac's policyholders receive smooth service for these specific plans.

To enhance growth and efficiency in its dental insurance operations, Aflac transferred the administration of its network dental insurance to a third-party administrator. This strategic move allows Aflac to focus on its core business while leveraging specialized expertise for its dental offerings.

- Network Administration: Partnerships with healthcare providers and networks are vital for the administration of Aflac's dental and vision insurance plans, ensuring policyholders can access services within these networks.

- Service Delivery: These collaborations are key to delivering seamless and efficient services to individuals who utilize Aflac's network-based benefits.

- Third-Party Delegation: In 2024, Aflac strategically outsourced the administration of its network dental insurance to a third-party entity to foster expansion and streamline operations.

Aflac's key partnerships are foundational to its business model, particularly its employer-sponsored worksite distribution strategy. These relationships, often facilitated by benefits brokers for mid- to large-sized employers, enable Aflac to offer supplemental insurance directly through payroll deductions, simplifying access and administration.

In Japan, Aflac leverages a vast network of financial institutions, with approximately 90% of Japanese banks partnering with the company for product distribution. This extensive reach through banks is critical for Aflac's success in offering its core insurance products, such as cancer and medical insurance, to a broad customer base.

The company also actively cultivates partnerships with technology providers like Nayya and Empathy. These collaborations enhance Aflac's digital offerings, providing personalized benefits guidance and digital legacy planning services, thereby improving the overall customer experience and streamlining operations.

Aflac's strategic outsourcing of its network dental insurance administration to a third-party administrator in 2024 highlights its focus on operational efficiency and growth in specialized areas, while continuing to rely on healthcare provider networks for service delivery.

| Partnership Type | Key Collaborators | Strategic Importance | 2024/Recent Impact |

| Employer Distribution | Employers (100+ employees), Benefits Brokers | Core for U.S. voluntary benefits segment, facilitates payroll deduction. | Continued reliance for substantial premium income. |

| Financial Institutions | Japanese Banks (~90% penetration) | Primary distribution channel in Japan for cancer and medical insurance. | Enables broad market penetration and customer access. |

| Technology & Digital | Nayya, Empathy | Enhances customer experience, personalized benefits guidance, digital legacy planning. | Supports digital transformation and value-added services. |

| Healthcare Networks | Dental and Vision Networks | Essential for administering network-based benefits. | Outsourced dental administration to a third-party administrator in 2024 for efficiency. |

What is included in the product

A detailed breakdown of Aflac's strategy, outlining its customer segments, value propositions, and revenue streams as a supplemental insurance provider.

This model highlights Aflac's unique distribution channels and key partnerships, demonstrating how it delivers value to policyholders through employer-sponsored benefits.

Aflac's Business Model Canvas provides a clear, structured framework to identify and address the specific financial anxieties and healthcare-related uncertainties faced by individuals and businesses.

It helps Aflac pinpoint and alleviate customer pain points by clearly defining value propositions and customer segments, ensuring their supplemental insurance solutions meet critical needs.

Activities

Aflac’s product development is a core activity, focusing on creating and improving supplemental health and life insurance. This ensures their offerings align with what customers need and what the market is asking for.

Recent product launches highlight this commitment. In Japan, Aflac introduced Miraito, a new cancer insurance product, alongside Tsumitasu, designed for asset building and nursing care. The U.S. market saw enhancements to dental and vision coverage.

These innovations are crucial for Aflac's competitive edge. For instance, in the first quarter of 2024, Aflac Japan’s premium income from new business grew by 15.3%, demonstrating the market’s positive reception to their new product strategies.

Aflac's core activity centers on meticulous underwriting of insurance policies, a crucial step in assessing and managing risk to ensure the company's financial health and profitability. This disciplined approach underpins profitable growth in both its U.S. and Japan operations.

The company actively manages its benefit ratios and expense ratios, striving to keep them within predefined target ranges. For instance, in the first quarter of 2024, Aflac reported a combined ratio in its U.S. segment of 92.3%, indicating effective risk and expense management and a solid underwriting performance.

Aflac's sales and distribution management is central to its success, focusing on an extensive network of independent agents and brokers. In 2024, Aflac continued to leverage its strong relationships with employers, a key distribution channel, to offer voluntary benefits directly to employees. This approach allows them to effectively reach customers where they work.

The company actively recruits and trains its sales force, ensuring they are equipped to explain Aflac's products clearly. For instance, Aflac reported that its U.S. sales force remained a significant driver of growth, with a focus on enhancing agent productivity through digital tools and ongoing professional development. This commitment to training supports their direct-to-consumer and employer-sponsored sales strategies.

Optimizing distribution channels means meeting customers where they prefer to buy. Aflac's strategy includes direct-to-consumer outreach, alongside its traditional workplace distribution. This multi-channel approach, supported by a robust agent network, aims to maximize policyholder acquisition and retention across diverse market segments.

Claims Processing and Management

Aflac's core promise to policyholders is to deliver cash benefits swiftly, making efficient claims processing a critical key activity. The company prioritizes a streamlined and user-friendly claims filing process, aiming for rapid turnaround times, often within four business days. This commitment to speed and ease is supported by significant investments in digital platforms and automated systems designed to boost both the velocity and precision of claims handling.

This focus on efficient claims management is directly tied to Aflac's value proposition, ensuring policyholders receive the financial support they need without undue delay. In 2024, Aflac continued to emphasize digital transformation within its claims operations, aiming to further reduce processing times and enhance customer satisfaction.

- Claims Processing Speed: Aflac aims for claims to be processed and paid within four business days.

- Digital Integration: Leveraging advanced digital platforms and automation for efficiency and accuracy.

- Customer Focus: Simplifying the claims filing experience for policyholders.

- Value Proposition Alignment: Directly supports Aflac's promise of timely financial support.

Investment Portfolio Management

Aflac's investment portfolio management is crucial, especially since a substantial part of its income stems from these assets. Aflac Global Investments actively manages this large portfolio to align with capital, risk, and liquidity goals, thereby safeguarding long-term asset performance and financial stability.

- Strategic Asset Allocation: Aflac Global Investments continually reviews and updates its strategic asset allocation. This ensures the portfolio remains aligned with the company's objectives for capital generation, risk management, and liquidity needs.

- Long-Term Performance Focus: The management strategy emphasizes achieving consistent long-term asset performance. This is vital for maintaining Aflac's financial strength and its ability to meet its obligations to policyholders.

- Risk Mitigation: A key activity involves actively managing the risks inherent in a large investment portfolio. This includes diversification across various asset classes and geographies to buffer against market volatility.

- Capital Deployment: The investment activities are also geared towards efficient capital deployment, supporting Aflac's growth initiatives and ensuring adequate capital reserves for operational needs and unexpected events.

Aflac's key activities encompass product development, underwriting, sales and distribution, and claims processing. These are supported by robust investment portfolio management.

In 2024, Aflac Japan's premium income from new business saw a 15.3% increase, driven by new products like Miraito and Tsumitasu. The U.S. segment reported a combined ratio of 92.3% in Q1 2024, reflecting effective underwriting and expense management.

The company emphasizes swift claims processing, targeting four business days for completion, and leverages digital platforms for efficiency. Aflac Global Investments manages a substantial portfolio to ensure long-term asset performance and financial stability.

| Key Activity | Description | 2024 Data/Focus |

| Product Development | Creating and enhancing supplemental insurance products. | New cancer and asset-building products in Japan; dental/vision enhancements in the U.S. |

| Underwriting | Assessing and managing risk for profitability. | Maintaining target benefit and expense ratios; Q1 2024 U.S. combined ratio of 92.3%. |

| Sales & Distribution | Leveraging independent agents and employer channels. | Focus on agent productivity and employer-sponsored voluntary benefits. |

| Claims Processing | Efficient and timely payment of policyholder claims. | Target of four business days for processing; digital platform investment. |

| Investment Management | Managing assets to support capital, risk, and liquidity goals. | Strategic asset allocation and long-term performance focus. |

Delivered as Displayed

Business Model Canvas

The Aflac Business Model Canvas you are previewing is the complete, final document you will receive upon purchase. This is not a sample or a mockup; it is an exact representation of the detailed strategic framework you will gain access to. Once your order is complete, you will download this same comprehensive Business Model Canvas, ready for your analysis and application.

Resources

Aflac's business model relies heavily on its significant financial capital and reserves. These resources are crucial for its core operations, enabling the company to underwrite new insurance policies and meet its obligations to policyholders by paying out claims.

As of the close of 2024, Aflac showcased a strong financial foundation, reporting total assets exceeding $166.4 billion. This substantial asset base is a testament to its financial stability and capacity to manage its liabilities effectively.

This robust financial strength not only assures policyholders of Aflac's ability to fulfill its commitments but also supports the company's consistent track record of delivering dividend payouts to its shareholders, reinforcing investor confidence.

Strong brand recognition, epitomized by the iconic Aflac Duck, is a cornerstone of Aflac's business model. This familiarity fosters significant customer trust and loyalty in both the U.S. and Japanese markets, directly impacting customer acquisition and retention rates.

Aflac's consistent designation as one of the World's Most Ethical Companies for 19 consecutive years, as of 2024, further bolsters its reputation. This sustained ethical standing enhances its appeal, not just to policyholders, but also to potential business partners and investors, solidifying its competitive advantage.

Aflac's business model relies heavily on its human capital, encompassing its independent sales agents, internal employees, and management. In 2024, Aflac continued to invest in training its sales force, recognizing their crucial role in distributing its insurance products. This dedicated workforce is key to the company's operational efficiency and expansion.

The expertise of Aflac's agents in product details and customer engagement is paramount. Internally, employees in areas like product development, claims processing, and customer support are essential. Management provides strategic direction, ensuring the company adapts to market changes and maintains its competitive edge.

Aflac's commitment to employee development and a compelling employee value proposition supports this vital resource. This focus helps attract and retain talent, fostering a culture of continuous improvement that directly impacts Aflac's ability to serve its customers and achieve its growth objectives.

Advanced Technology and Digital Platforms

Aflac's advanced technology and digital platforms are central to its operations. The MyAflac system, for instance, streamlines policy management and claims processing, enhancing customer convenience. This focus on digital tools is a cornerstone of their strategy to improve efficiency and customer engagement.

These digital capabilities directly support Aflac's ongoing digital transformation. By investing in and optimizing platforms like MyAflac, the company aims to provide a seamless experience for policyholders, from enrollment to claims submission. This digital-first approach is designed to meet evolving customer expectations.

Aflac actively seeks partnerships with technology companies to bolster its digital infrastructure. These collaborations allow Aflac to integrate cutting-edge solutions, further enhancing its service offerings and operational agility. For example, in 2023, Aflac continued to invest in cloud migration and data analytics to improve its digital customer journey.

Key aspects of Aflac's digital platform strategy include:

- MyAflac Portal: A comprehensive online hub for policyholders to manage their accounts, file claims, and access information.

- Digital Claims Processing: Enabling faster and more efficient claims submission and adjudication through online channels.

- Customer Service Enhancements: Utilizing digital tools to provide responsive and personalized support to customers.

- Data Analytics Integration: Leveraging data to understand customer behavior and improve digital service delivery.

Proprietary Data and Market Insights

Aflac leverages its extensive, proprietary data on policyholder behavior, market trends, and healthcare costs across the U.S. and Japan. This unique dataset allows for deep insights into customer needs and market dynamics.

These insights directly inform Aflac's product development, enabling the creation of tailored insurance solutions. For example, in 2024, Aflac continued to focus on supplemental health insurance products designed to address specific out-of-pocket medical expenses, a direct result of analyzing policyholder claims data.

The company's underwriting decisions are also heavily influenced by this proprietary information, leading to more accurate risk assessment and pricing. Furthermore, this data fuels targeted marketing strategies, ensuring Aflac can effectively reach and engage its customer base, maintaining a significant competitive advantage in its core markets.

- Proprietary Data Access: Extensive policyholder behavior, market trends, and healthcare cost data in the U.S. and Japan.

- Informed Decision-Making: Data drives product development, underwriting, and marketing strategies.

- Competitive Edge: Tailored offerings and precise market targeting enhance Aflac's market position.

- 2024 Focus: Continued emphasis on supplemental health products informed by claims data analysis.

Aflac's intellectual property, including its brand recognition and ethical reputation, are vital intangible assets. The iconic Aflac Duck, a symbol of trust and familiarity, significantly aids customer acquisition and retention in both the U.S. and Japan. This strong brand equity is a key differentiator in the competitive insurance landscape.

Aflac's sustained recognition as one of the World's Most Ethical Companies for 19 consecutive years, as of 2024, further solidifies its reputation. This ethical standing not only builds trust with policyholders but also attracts business partners and investors, reinforcing its competitive advantage.

The company's deep understanding of its customer base, honed through years of data collection and analysis, represents significant intellectual capital. This proprietary data informs everything from product development to targeted marketing efforts.

Aflac's intellectual property assets are critical for maintaining its market position and driving future growth.

Value Propositions

Aflac's direct cash benefits offer a crucial financial safety net. These payments go straight to policyholders, empowering them to cover costs that traditional health insurance might miss, like deductibles or co-pays.

This direct cash infusion provides much-needed flexibility when unexpected medical bills arise. For instance, in 2024, Aflac reported paying out over $1.8 billion in claims, demonstrating the tangible financial support provided to its customers facing health challenges.

Aflac's core value proposition lies in providing supplemental insurance, acting as a crucial financial safety net that goes beyond traditional major medical coverage. This specialization is vital because even with health insurance, many individuals face significant out-of-pocket expenses.

These policies are designed to bridge the financial chasm that opens up when health insurance coverage stops, directly addressing the accumulation of medical bills. For instance, in 2024, the average deductible for a health insurance plan remained a substantial concern for consumers, highlighting the need for additional protection.

Aflac's offerings fill this gap by providing cash benefits that policyholders can use for a wide range of expenses, from co-pays and deductibles to everyday living costs incurred during recovery. This financial flexibility empowers individuals and families to manage unexpected medical costs without derailing their overall financial stability.

Aflac's supplemental insurance policies are designed to provide a crucial safety net, offering policyholders peace of mind by covering out-of-pocket medical expenses that traditional health insurance might not fully address. This financial buffer allows individuals and families to concentrate on healing and recovery without the overwhelming worry of mounting medical bills.

In 2024, Aflac continued its commitment to reducing financial stress for its policyholders. The company's focus on benefits like direct cash payments for medical treatments and hospital stays directly addresses the anxieties surrounding unexpected healthcare costs, a significant concern for many Americans.

Ease of Use and Fast Claims Processing

Aflac designs its services with simplicity in mind, making it easy for policyholders to navigate their benefits. This commitment extends directly to how claims are handled, aiming for a streamlined and stress-free experience during critical times.

The company actively promotes straightforward claim submission methods, including convenient online portals. This digital approach significantly speeds up the process, allowing policyholders to submit necessary documentation with minimal effort.

Aflac's dedication to efficiency is evident in its rapid claims payment. In 2024, Aflac continued its tradition of processing and paying accepted claims swiftly, often within four business days. This quick turnaround ensures that individuals receive their financial support promptly when facing health events or other covered situations.

- Simplified Claim Submission: Online and mobile options available for policyholders.

- Rapid Processing: Aiming for quick review and approval of submitted claims.

- Fast Payouts: Many accepted claims are paid within four business days.

- Customer Focus: Prioritizing a smooth and supportive experience during difficult times.

Portable and Affordable Protection

Aflac's value proposition centers on providing portable and affordable protection. Aflac policies are individually owned, ensuring they remain with the policyholder regardless of employment changes or retirement. This portability is a key differentiator, offering continuous coverage. In 2024, Aflac continued to emphasize the value of this individual ownership, a feature highly appreciated by a workforce experiencing increased job mobility.

Furthermore, Aflac offers a diverse portfolio of products designed for affordability. These options cater to a wide range of financial capacities, making essential financial security accessible. This commitment to accessible pricing means individuals can secure long-term protection without undue financial strain, a critical factor for many consumers navigating economic uncertainties.

The company's strategy ensures that policyholders can maintain their coverage, often without premium increases upon job transition. This stability is invaluable, particularly in a dynamic labor market. For instance, Aflac's focus on individual policies means that a worker leaving a company doesn't lose their crucial supplemental coverage, a significant benefit that contributes to financial peace of mind.

- Individual Ownership: Policies stay with the insured, even after job changes or retirement.

- Premium Stability: Often, coverage can be retained without an increase in premiums.

- Affordable Options: Products are designed to fit various budgets, ensuring accessibility.

- Long-Term Security: Aflac provides a means for individuals to build lasting financial protection.

Aflac's value proposition centers on providing supplemental insurance that acts as a financial safety net, covering out-of-pocket expenses traditional health insurance often misses. This direct cash benefit offers flexibility for deductibles, co-pays, and other medical costs, easing financial burdens during health events.

The company emphasizes simplified claim submission through online and mobile channels, coupled with rapid processing and payouts, often within four business days, as seen in 2024 operations. This focus on efficiency ensures policyholders receive swift financial support.

Furthermore, Aflac offers portable and affordable protection, with policies owned individually and often retainable without premium increases upon job transitions. This ensures continuous coverage and long-term financial security for policyholders, a key advantage in today's mobile workforce.

| Value Proposition | Key Features | 2024 Data/Impact |

|---|---|---|

| Financial Safety Net | Direct cash benefits for out-of-pocket medical costs | Over $1.8 billion in claims paid |

| Simplified & Swift Claims | Easy submission, fast processing and payouts | Many claims paid within 4 business days |

| Portable & Affordable Protection | Individually owned policies, stable premiums | Continued emphasis on individual ownership for job mobility |

Customer Relationships

Aflac builds robust customer connections via its dedicated agents and direct sales team, offering tailored support. In 2024, Aflac’s agent force continued to be a cornerstone of its customer engagement strategy, facilitating personalized policy discussions and enrollment assistance.

These agents serve as trusted advisors, guiding individuals and businesses through the complexities of benefits selection and claims, thereby fostering loyalty and repeat engagement.

Aflac empowers policyholders through extensive digital self-service options. Customers can easily manage policies, file claims, and arrange direct deposits via the MyAflac app and the Aflac website, offering unparalleled convenience and control.

This digital focus enhances customer engagement and efficiency. In 2024, Aflac reported that a significant portion of its claims were submitted digitally, reflecting the growing reliance on these platforms for policy management and support.

Aflac's customer relationships are often built through employers who offer Aflac policies as part of their employee benefits. This employer-facilitated model streamlines the process for both the company and its employees. In 2024, Aflac continued to strengthen these partnerships, aiming to provide seamless enrollment and claims experiences for millions of covered individuals.

Proactive Claims Assistance and Support

Aflac prioritizes a compassionate and proactive approach to customer relationships, especially during the often-stressful claims process. They aim to be a source of support beyond just financial compensation.

This commitment is exemplified by strategic partnerships, such as the one with Empathy. This collaboration allows Aflac to offer comprehensive loss support services, including guidance on digital legacy planning, further demonstrating a dedication to policyholders' well-being.

In 2023, Aflac reported paying out billions in claims, underscoring their role in providing financial relief. For instance, their supplemental insurance products played a crucial role for many families navigating unexpected medical events, with a significant portion of claims processed efficiently.

- Proactive Claims Support: Aflac focuses on guiding policyholders through the claims process with empathy and efficiency.

- Partnerships for Holistic Support: Collaborations like the one with Empathy extend support beyond financial payouts to include emotional and practical assistance.

- Financial Impact: Aflac's claims payments in 2023 reached billions, highlighting the tangible financial assistance provided to customers during critical times.

Educational Resources and Communication

Aflac fosters enduring customer connections by offering insightful educational materials. A prime example is the Aflac WorkForces Report, which educates individuals on financial well-being and the critical role of supplemental insurance in their financial planning. This commitment to knowledge sharing builds trust and encourages sustained engagement.

By equipping customers with relevant data and understanding, Aflac strengthens its relationships. For instance, the 2024 Aflac WorkForces Report highlighted that 60% of employees experienced financial stress, underscoring the need for accessible financial education and supplemental benefits. This proactive approach positions Aflac as a supportive partner in their customers' financial journeys.

- Educational Content: Aflac provides resources like the WorkForces Report to inform customers about financial wellness.

- Trust Building: Empowering customers with knowledge cultivates long-term trust and loyalty.

- Engagement: Ongoing communication and valuable information keep customers actively engaged with Aflac's offerings.

- Market Relevance: Reports like the 2024 WorkForces Report demonstrate Aflac's understanding of current financial challenges faced by employees.

Aflac's customer relationships are multifaceted, blending personal agent interaction with robust digital self-service. This dual approach aims to provide convenience and tailored support throughout the policy lifecycle. The company's commitment to proactive engagement is evident in its educational initiatives and its focus on compassionate claims handling.

In 2024, Aflac continued to leverage its agent network for personalized customer interactions, while simultaneously enhancing digital platforms for policy management and claims submission. The 2024 Aflac WorkForces Report indicated that 60% of employees experienced financial stress, highlighting the importance of Aflac's role in providing financial education and supplemental benefits.

Aflac's strategy emphasizes building trust through consistent support and valuable information, positioning itself as a partner in customers' financial well-being, particularly during challenging times.

| Customer Relationship Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Personalized Support | Dedicated agents and direct sales teams offer tailored guidance. | Agents are a cornerstone of customer engagement, facilitating personalized policy discussions. |

| Digital Self-Service | MyAflac app and website for policy management and claims. | Significant portion of claims submitted digitally, showcasing platform reliance. |

| Employer-Facilitated Model | Policies offered through employer benefits programs. | Continued strengthening of employer partnerships for seamless enrollment. |

| Proactive & Compassionate Claims | Support beyond financial compensation during claims. | Partnership with Empathy for comprehensive loss support services. |

| Financial Education | Resources like the WorkForces Report to inform customers. | 60% of employees experienced financial stress, underscoring the need for education. |

Channels

Worksite Direct Sales is Aflac's cornerstone channel in the U.S., reaching employees directly where they work, especially within small businesses. This approach leverages the convenience of payroll deduction, simplifying premium payments for policyholders and ensuring consistent revenue for Aflac.

In 2024, Aflac reported that its U.S. group voluntary benefits segment, which heavily relies on worksite sales, continued to be a significant contributor to its overall business. This channel's effectiveness is underscored by the fact that a substantial portion of Aflac's U.S. policyholders obtain coverage through their employers.

Aflac is strategically growing its presence in the U.S. through broker distribution networks. This expansion is key to reaching larger employers and diversifying how they offer their products.

By partnering with brokers, Aflac gains access to a wider market. This allows them to effectively present their group benefits, such as life, disability, dental, and vision insurance, to a broader range of corporate clients.

In 2024, the voluntary benefits market, which Aflac heavily participates in, continued to show robust growth. Aflac's focus on broker channels is well-aligned with this trend, as brokers are often the primary advisors for employers seeking these types of supplemental benefits.

Aflac Japan heavily relies on partnerships with banks and other financial institutions for its distribution. These collaborations allow Aflac to tap into the extensive customer bases and branch networks of these established entities, significantly boosting its reach for cancer and medical insurance products.

In 2024, Aflac Japan continued to leverage these financial institution channels, which are crucial for its dominant market position. For example, Aflac's unique approach of selling specialized insurance through these channels, rather than traditional life insurance sales forces, has been a cornerstone of its success in the Japanese market.

Online Platforms and Mobile Applications

Aflac leverages its corporate website and the MyAflac mobile application as key digital channels for customer interaction. These platforms are designed to provide comprehensive information for prospective clients and robust self-service options for existing policyholders.

Through these online avenues, customers can easily research Aflac's diverse product offerings, manage their policies, submit claims, and access important policy documents. This digital accessibility is crucial for enhancing customer experience and operational efficiency.

In 2024, Aflac reported significant engagement across its digital platforms. For instance, the MyAflac app facilitated millions of policyholder interactions, including claims submissions and account management, underscoring its importance as a primary customer touchpoint.

- Website: Serves as a primary information hub for product details and company news.

- MyAflac App: Enables policy management, claims filing, and access to policy information.

- Digital Engagement: Millions of policyholder interactions occurred via the MyAflac app in 2024.

- Accessibility: Provides convenient and 24/7 access to Aflac services for customers.

Direct-to-Consumer Digital Marketing

Aflac utilizes direct-to-consumer digital marketing to connect with potential customers, moving beyond traditional sales methods. This strategy educates individuals on the benefits of supplemental insurance, aiming to capture a new, digitally-savvy demographic.

The company's digital efforts are designed to attract younger consumers who are more inclined to research and purchase insurance online. This focus on digital engagement is crucial for expanding Aflac's customer base and market reach.

- Digital Reach: Aflac's digital marketing campaigns aim to increase brand awareness and product understanding among a broader audience.

- Customer Acquisition: The strategy focuses on acquiring new and younger customers who are comfortable with online interactions and purchasing decisions.

- Education Focus: Digital channels are used to clearly communicate the value proposition of supplemental insurance, addressing potential customer questions proactively.

- Market Penetration: By engaging directly online, Aflac seeks to penetrate markets where traditional sales channels may have less influence.

Aflac's channels are diverse, encompassing direct sales at the worksite, strategic broker partnerships, vital financial institution alliances in Japan, and robust digital platforms. These channels are critical for reaching different customer segments and ensuring product accessibility.

In 2024, Aflac's U.S. worksite sales remained a significant revenue driver, with the group voluntary benefits segment showing continued strength. Broker networks are expanding Aflac's reach to larger employers, aligning with the growing voluntary benefits market. Meanwhile, Aflac Japan's success is heavily dependent on its bank and financial institution partnerships, which provide access to millions of customers for its specialized insurance products.

Digital channels, including the Aflac website and the MyAflac app, are increasingly important for customer engagement and self-service. The MyAflac app alone facilitated millions of policyholder interactions in 2024, highlighting its role in customer service and claims processing. Direct-to-consumer digital marketing also targets a younger, online-savvy demographic, broadening Aflac's market penetration.

| Channel | Primary Focus | 2024 Key Data/Trend | Strategic Importance |

|---|---|---|---|

| Worksite Direct Sales (U.S.) | Small to mid-sized businesses, employee payroll deduction | Continued strong contributor to U.S. segment revenue. | Core channel for deep market penetration and consistent premium flow. |

| Broker Distribution (U.S.) | Larger employers, expanding product offerings | Growth in voluntary benefits market aligns with broker strategy. | Access to new client segments and diversification of sales avenues. |

| Financial Institutions (Japan) | Banks and financial partners, broad customer access | Crucial for dominant market position in Japan; leverages partner networks. | Enables efficient distribution of specialized insurance products to a vast customer base. |

| Digital (Website & MyAflac App) | Customer information, policy management, claims | MyAflac app facilitated millions of policyholder interactions in 2024. | Enhances customer experience, operational efficiency, and accessibility. |

Customer Segments

Individuals and families are increasingly looking for ways to bridge the gaps left by traditional health insurance. They understand that deductibles and co-pays can still lead to significant out-of-pocket costs. For instance, in 2024, the average annual deductible for employer-sponsored health plans was around $1,700 for individuals and $3,400 for families, highlighting a substantial financial burden.

These customers are often proactive in seeking financial security, especially when facing potential health events. They value Aflac’s supplemental policies because they can provide cash benefits directly to them, which can be used for anything from medical bills to everyday living expenses while they recover. This direct financial support is crucial for maintaining financial stability during challenging times.

Employees of small and medium-sized businesses (SMBs) represent a crucial customer base for Aflac. These individuals gain access to Aflac's supplemental insurance policies primarily through their employers, who leverage worksite marketing channels.

SMBs frequently offer Aflac policies as a valuable, often low-cost or no-cost, addition to their employee benefits packages. This strategy is designed to boost overall compensation and is a key tactic for improving talent retention in competitive labor markets.

In 2024, the SMB sector continues to be a significant contributor to the U.S. economy, with millions of businesses employing tens of millions of workers, many of whom are potential Aflac policyholders. The demand for affordable, supplementary health coverage remains high among these employees, especially given rising healthcare costs.

Aflac actively serves large corporations and group benefit clients, offering a suite of supplemental insurance products designed to enhance existing employee benefit packages. This segment is crucial, with Aflac's U.S. group business revenue reaching $2.2 billion in 2023, demonstrating significant market penetration.

Engaging with these clients typically involves collaboration with insurance brokers to customize offerings. These tailored solutions often include supplemental life, disability, dental, and vision insurance, ensuring comprehensive coverage that aligns with the specific needs of the employer and their workforce.

Japanese Consumers (Cancer and Medical Insurance Focus)

Aflac's Japanese consumers represent a crucial customer segment, particularly for its cancer and medical insurance offerings, where the company holds a leading position. This group comprises individuals and families actively seeking robust health-related coverage to mitigate the significant financial burdens of serious illnesses. In 2024, Japan's aging population and high prevalence of certain diseases underscore the demand for such specialized insurance products.

The Japanese market's unique healthcare landscape and consumer preferences drive Aflac's strategy within this segment. With a focus on providing financial security against unexpected medical expenses, Aflac caters to a demographic that values proactive financial planning for health emergencies.

- Leading Market Share: Aflac Japan consistently holds a dominant position in the cancer insurance market, reflecting strong consumer trust and product appeal.

- Aging Demographics: Japan's rapidly aging population increases the demand for medical and cancer insurance as the risk of age-related illnesses rises.

- High Healthcare Costs: Despite a universal healthcare system, out-of-pocket expenses for advanced treatments and long-term care can be substantial, making supplementary insurance vital.

- Consumer Trust: Aflac has built significant brand recognition and trust in Japan over decades, facilitating continued customer acquisition and retention.

Specific Needs/Life Stage Segments

Aflac deeply understands that people have unique financial needs and are at different points in their lives. This is why they offer specialized products. For instance, in Japan, their Tsumitasu product helps individuals save and plan for their retirement, a crucial life stage for financial security.

Beyond retirement, Aflac also focuses on critical illness coverage, recognizing the significant financial burden these events can place on individuals and families. They also provide essential dental and vision insurance, addressing everyday health needs that impact quality of life and can incur unexpected costs.

This tailored approach allows Aflac to meet a wide array of financial protection requirements. For example, in 2024, the demand for supplemental health insurance, which covers gaps in traditional medical plans, continued to rise as individuals sought more comprehensive financial safeguards against health-related expenses.

- Retirement Planning: Products like Tsumitasu in Japan cater to long-term savings goals.

- Critical Illness Coverage: Addressing the financial impact of serious health conditions.

- Dental and Vision Insurance: Providing coverage for routine and specialized care.

- Life Stage Customization: Offering solutions relevant to individual circumstances and needs.

Aflac's customer base is diverse, encompassing individuals and families seeking to supplement their primary health coverage, particularly to manage deductibles and co-pays. Employees of small and medium-sized businesses (SMBs) are a key segment, accessing Aflac policies through their employers as a valuable benefit. Furthermore, large corporations and group benefit clients engage Aflac for tailored supplemental insurance solutions, including life, disability, dental, and vision coverage. Lastly, Aflac maintains a strong presence in Japan, serving consumers with specialized products like cancer and medical insurance, driven by the nation's demographics and healthcare landscape.

| Customer Segment | Key Needs | Aflac's Offering | 2024 Relevance/Data Point |

|---|---|---|---|

| Individuals & Families | Offsetting out-of-pocket medical costs | Supplemental health, accident, critical illness insurance | Average annual deductibles for employer plans around $1,700 (individual) in 2024. |

| SMB Employees | Enhanced benefits, financial security | Worksite marketing of supplemental policies | SMBs are vital for U.S. employment, driving demand for affordable supplementary coverage. |

| Large Corporations | Comprehensive employee benefits | Customized group life, disability, dental, vision insurance | Aflac's U.S. group business revenue was $2.2 billion in 2023. |

| Japanese Consumers | Protection against serious illness, retirement planning | Leading cancer and medical insurance, Tsumitasu (retirement savings) | Japan's aging population fuels demand for medical and cancer insurance. |

Cost Structure

The most substantial expense for Aflac is undoubtedly the money paid out for claims and benefits to those who hold their policies. This is the heart of what Aflac does: offering financial support when people get sick or injured and their policy covers it. In 2023, Aflac’s total claims and benefits paid out amounted to a significant $18.6 billion, demonstrating the scale of this core cost.

Aflac's sales commissions represent a significant cost, reflecting the reliance on a large agent and broker force to distribute its insurance products. These commissions are crucial for incentivizing sales and expanding market reach.

Marketing and advertising are also substantial expenses, with Aflac investing heavily to build and maintain its brand awareness. The memorable Aflac Duck campaign, for instance, has been a long-standing and effective strategy in capturing consumer attention and driving policy sales.

In 2023, Aflac's selling, general and administrative expenses, which include these commission and marketing costs, totaled $3.5 billion. This highlights the significant financial commitment made to support its sales channels and brand presence in a competitive insurance market.

Administrative and operational expenses form the backbone of Aflac's day-to-day functioning, covering essential costs like employee salaries and benefits for administrative teams, office leases and utilities across its U.S. and Japan operations, and general overheads tied to policy administration and customer support. In 2024, these costs are critical for maintaining efficient service delivery and corporate oversight.

Technology and Digital Transformation Investments

Aflac dedicates substantial resources to its technology and digital transformation initiatives. These investments are vital for maintaining and enhancing its operational capabilities, particularly in areas like claims processing and customer service.

In 2024, Aflac continued to prioritize spending on digital platforms and infrastructure. This includes crucial upgrades to cybersecurity measures to protect sensitive customer data and investments in automation to streamline internal processes. For instance, Aflac reported spending in the billions on technology and digital transformation, reflecting a commitment to staying competitive in the evolving insurance landscape.

- Technology Infrastructure: Ongoing costs for servers, software licenses, and network maintenance.

- Digital Platform Development: Investments in enhancing online customer portals, mobile applications, and agent tools.

- Claims Automation: Development and implementation of AI and machine learning for faster, more efficient claims processing.

- Cybersecurity: Significant expenditure on protecting systems and data from evolving cyber threats.

Regulatory Compliance and Legal Costs

Aflac, as a major player in the insurance industry, faces significant expenses tied to regulatory compliance. Operating across various states and countries means adhering to a complex web of insurance laws, reporting mandates, and consumer protection regulations. These costs are essential for maintaining their license to operate and ensuring fair practices.

In 2024, the insurance sector, in general, continued to see increased spending on compliance technology and personnel to manage evolving regulatory landscapes. For Aflac, this translates to substantial investments in legal teams, compliance officers, and sophisticated systems to track and report on policyholder data and financial health according to stringent guidelines.

- Regulatory Adherence: Costs associated with meeting state and federal insurance regulations, including solvency requirements and market conduct examinations.

- Legal Expenses: Funds allocated for potential litigation, policyholder disputes, and responding to inquiries or actions from regulatory bodies.

- Reporting and Auditing: Expenses for preparing and submitting numerous financial and operational reports to regulatory authorities, often requiring external audits.

- Compliance Technology: Investments in software and systems to automate compliance processes, monitor changes in regulations, and ensure data integrity.

Aflac's cost structure is heavily dominated by the payout of claims and benefits, which is its primary function. Beyond this, significant expenses are incurred through sales commissions, marketing efforts to build brand awareness, and the operational costs of running a large insurance enterprise. Investments in technology and regulatory compliance are also crucial components of their ongoing financial commitments.

| Cost Category | 2023 (USD Billions) | Key Drivers |

|---|---|---|

| Claims and Benefits Paid | 18.6 | Policyholder payouts for covered events |

| Selling, General & Administrative (SG&A) | 3.5 | Sales commissions, marketing, administrative overhead |

| Technology & Digital Transformation | Billions (estimated) | Platform development, cybersecurity, automation |

| Regulatory Compliance | Significant | Legal, reporting, compliance personnel and technology |

Revenue Streams

Aflac's principal revenue source is the collection of insurance premiums from its extensive range of supplemental health and life insurance policies. This income is generated from both newly issued policies and the continuous renewals from its existing policyholder base across its key markets in the U.S. and Japan. For the fiscal year 2023, Aflac reported total revenue of $22.4 billion, with a significant portion derived from these premium collections.

Aflac's investment income is a cornerstone of its profitability, stemming from the vast portfolio backing its insurance obligations. In 2023, Aflac reported total investment income of $3.8 billion, a solid performance driven by interest, dividends, and capital gains across its diverse holdings.

This substantial income stream is crucial for offsetting claims and operational expenses, contributing significantly to Aflac's bottom line. The company actively manages its investment portfolio to generate consistent returns, ensuring financial stability and supporting its growth initiatives.

Aflac's primary revenue engine is new annualized premiums from selling insurance policies. This is a crucial indicator of their ability to attract new customers and get them to adopt their offerings. For instance, in the first quarter of 2024, Aflac reported U.S. segment total premium and benefit income of $1.5 billion, showcasing the ongoing strength in this revenue stream.

Fees and Charges (e.g., Policy Administration Fees)

Aflac also generates revenue through fees and charges, though these are typically smaller contributors compared to premiums and investment income. These fees can be linked to the administration of policies, the inclusion of specific riders, or optional services offered to policyholders.

For instance, administrative fees might cover the costs associated with managing and servicing insurance policies. Fees for riders, which offer additional coverage beyond the basic policy, also add to this revenue stream. In 2024, while specific figures for these ancillary fees are not as prominently reported as core insurance revenues, they play a role in the company's diversified income sources.

- Policy Administration Fees: These cover the ongoing costs of managing and servicing individual insurance contracts.

- Rider Fees: Charges for optional add-on benefits that enhance the coverage of a primary policy.

- Service Fees: Revenue generated from specific value-added services provided to policyholders.

Revenue from Group Benefits Expansion

Aflac's group benefits expansion is a significant and growing revenue driver. This diversification strategy allows the company to offer a wider array of products, such as group life, disability, dental, and vision insurance, directly to employers. By tapping into the employer-sponsored market, Aflac is effectively broadening its reach beyond its traditional individual supplemental insurance offerings.

In 2023, Aflac's U.S. group business saw continued growth, contributing to the company's overall financial performance. This segment benefits from employers seeking comprehensive benefit packages for their employees, a trend that remained strong through early 2024. The expansion into these ancillary product lines leverages Aflac's established distribution channels and brand recognition within the corporate environment.

- Growing Group Segment: Aflac's group benefits business, including life, disability, dental, and vision, represents an expanding revenue stream.

- Employer Market Focus: This strategy targets the employer-sponsored market, diversifying Aflac's customer base.

- Product Diversification: Expansion beyond individual supplemental plans broadens Aflac's product portfolio.

- 2023 Performance: The U.S. group business demonstrated robust growth in 2023, underscoring the success of this expansion.

Aflac's revenue is primarily driven by insurance premiums collected from its supplemental health and life policies in the U.S. and Japan. Investment income from its substantial asset portfolio is also a critical component, generating returns through interest, dividends, and capital gains. The company also earns revenue from ancillary fees related to policy administration and optional riders.

| Revenue Stream | Description | 2023 Data (USD Billions) |

| Insurance Premiums | Premiums from supplemental health and life policies. | $22.4 (Total Revenue) |

| Investment Income | Income generated from the investment portfolio. | $3.8 |

| Fees and Charges | Administrative fees, rider fees, and service fees. | Not separately itemized but contributes to overall revenue. |

Business Model Canvas Data Sources

The Aflac Business Model Canvas is informed by comprehensive market research, Aflac's internal financial disclosures, and analysis of competitor strategies. These diverse data sources ensure a robust and accurate representation of Aflac's operations and market position.