Aflac Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Aflac's competitive landscape is shaped by five key forces, from the intense rivalry among existing insurers to the significant bargaining power of its large corporate clients. Understanding these dynamics is crucial for navigating the supplemental insurance market.

The complete report reveals the real forces shaping Aflac’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aflac's suppliers are largely fragmented across various sectors like technology, marketing, and administrative services. This broad distribution of suppliers means no single entity holds significant leverage over Aflac.

For instance, in 2024, the IT services market, a key area for insurers, remained highly competitive with numerous providers offering cloud, software, and cybersecurity solutions. This competitive landscape inherently limits the bargaining power of any individual IT vendor.

The ability to switch between multiple vendors for essential services like office supplies or marketing campaigns further dilutes supplier influence. This fragmentation allows Aflac to negotiate favorable terms and pricing, as suppliers compete to secure Aflac's business.

For Aflac, the bargaining power of suppliers is largely influenced by switching costs. When Aflac procures standard items like office supplies, the ease of changing providers means suppliers have less leverage. However, the situation shifts dramatically with specialized IT services or crucial re-insurance partners.

The complexity of integrating new systems or migrating vast amounts of sensitive data can make switching prohibitively expensive and time-consuming. For instance, a disruption in a core IT system could impact claims processing and customer service, highlighting the high stakes involved. In 2023, Aflac reported approximately $2.3 billion in technology and development expenses, underscoring the significant investment in its systems and the potential costs associated with supplier changes.

The uniqueness of supplier inputs significantly influences Aflac's bargaining power. For most of Aflac's operational needs, such as standard IT infrastructure or general marketing services, the inputs are readily available from multiple suppliers, meaning these suppliers have limited power to dictate terms. This broad availability helps Aflac maintain favorable pricing and contract conditions.

However, certain specialized areas present a different dynamic. For instance, highly specific actuarial software or niche consulting services required for complex risk modeling might be sourced from only a few providers. In these cases, the uniqueness of the input grants those particular suppliers greater bargaining leverage over Aflac.

Aflac strategically mitigates supplier power by developing certain capabilities internally. By building in-house expertise in areas like data analytics or claims processing, Aflac reduces its reliance on external suppliers for these critical functions, thereby strengthening its negotiating position.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Aflac's core supplemental insurance business, known as forward integration, is generally considered low. This is primarily due to the substantial hurdles involved in entering the insurance sector.

Launching an insurance product requires immense capital investment, deep understanding of complex regulations, and building a trusted brand. These barriers make it difficult for most of Aflac's current suppliers, who typically provide administrative services or technology, to realistically compete.

For instance, establishing an insurance operation involves securing licenses in multiple states, managing actuarial risks, and building a sales force. These are significant undertakings that most suppliers are not equipped to handle.

- Entering the supplemental insurance market requires substantial capital and regulatory expertise.

- Aflac's suppliers are generally not positioned to manage the complexities of insurance underwriting and claims.

- The highly regulated nature of the insurance industry presents significant barriers to entry for potential new competitors.

Importance of Aflac to Suppliers

Aflac's substantial size and consistent demand make it a crucial client for many of its suppliers, especially smaller, niche businesses. For instance, in 2023, Aflac reported total revenues of $22.46 billion, underscoring the significant volume of business it injects into its supply chain. This scale means suppliers often rely heavily on Aflac's patronage, which inherently curtails their ability to dictate terms or demand excessively favorable conditions.

The reliance of these suppliers on Aflac's business creates a power dynamic where they are less likely to risk disrupting the relationship through aggressive negotiations. This is particularly true for specialized service providers whose offerings might be tailored to Aflac's specific needs. Losing Aflac as a client could represent a substantial financial setback for such firms, further diminishing their bargaining leverage.

- Significant Revenue Contribution: Aflac’s substantial annual revenues, reaching $22.46 billion in 2023, highlight its importance as a major client for its suppliers.

- Dependence of Niche Suppliers: Smaller and specialized suppliers often find Aflac to be a disproportionately large source of their income, increasing their dependence.

- Reduced Leverage: Suppliers are hesitant to push for unfavorable terms due to the risk of jeopardizing a stable and significant revenue stream from Aflac.

Aflac's suppliers generally have low bargaining power due to the fragmented nature of its supply chain and the availability of alternative providers for most services. This fragmentation allows Aflac to negotiate favorable terms, as suppliers compete for its business. For instance, the IT services market in 2024 remained highly competitive, limiting the leverage of individual vendors.

Switching costs are a key factor; while standard supplies have low switching costs, specialized IT or reinsurance can involve significant expense and complexity, granting those suppliers more leverage. Aflac's significant investments, such as $2.3 billion in technology and development in 2023, underscore these potential switching costs.

The uniqueness of inputs also plays a role; readily available inputs give Aflac an advantage, while niche services for complex modeling can empower specific suppliers. Aflac mitigates this by developing in-house capabilities, reducing reliance and strengthening its negotiating position.

The threat of forward integration by suppliers is low due to high barriers in the insurance sector, including capital, regulatory hurdles, and brand building. Aflac's substantial size, evidenced by $22.46 billion in revenues in 2023, makes it a critical client for many suppliers, reducing their leverage and encouraging them to maintain favorable terms.

| Factor | Aflac's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Supplier Fragmentation | High (e.g., multiple IT, marketing, admin service providers) | Low |

| Switching Costs (Standard Services) | Low (e.g., office supplies) | Low |

| Switching Costs (Specialized Services) | High (e.g., core IT integration, reinsurance) | High for specific suppliers |

| Uniqueness of Inputs | Low for most, high for niche services | Low for general, High for niche |

| Aflac's Size & Revenue Contribution | Significant ($22.46 billion revenue in 2023) | Low (suppliers rely on Aflac's business) |

What is included in the product

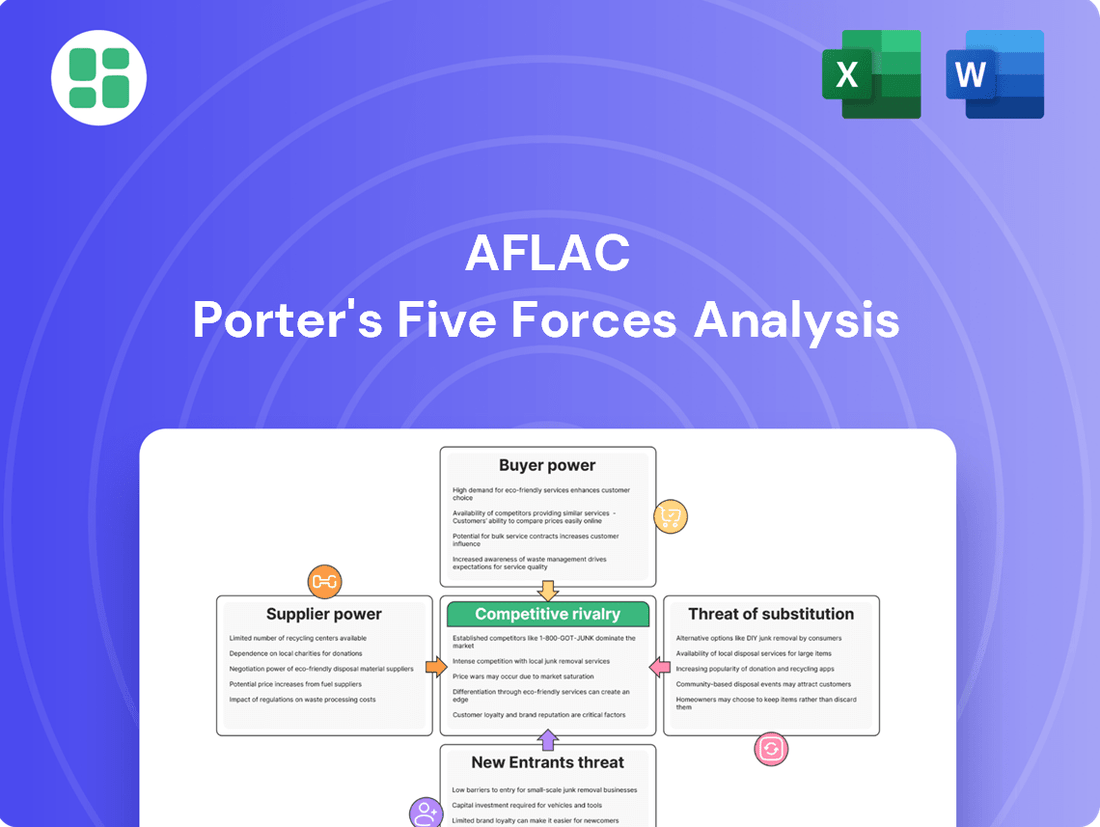

Aflac's Porter's Five Forces Analysis reveals the intense competition in the supplemental insurance market, the significant bargaining power of customers, and the moderate threat of new entrants and substitutes, all impacting Aflac's strategic positioning.

Quickly identify and mitigate competitive threats with a visual representation of each force, enabling proactive strategic adjustments.

Customers Bargaining Power

Aflac's business model is built upon serving a massive and diverse customer base, encompassing millions of individual policyholders and a wide array of businesses. This widespread distribution means there isn't a significant concentration of customers; no single client or small group holds substantial sway over Aflac's operations or pricing strategies.

This broad customer reach is a key factor in mitigating the bargaining power of customers. Because Aflac has so many policyholders, the impact of any one customer demanding lower prices or different terms is minimal, thereby protecting Aflac's profitability and operational flexibility.

Switching supplemental insurance policies for customers, while generally less complex than changing primary health coverage, still presents hurdles. These include the administrative effort of re-enrollment and the potential loss of continuity benefits, such as pre-existing condition clauses or accumulated waiting periods. For instance, a customer moving from one accident insurance policy to another might have to re-qualify for coverage based on their current health status.

The increasing availability of digital platforms and streamlined online application processes could, however, lower these switching costs. As of 2024, many insurers are investing heavily in user-friendly digital interfaces, making it simpler for customers to compare plans and initiate a switch. This ease of transition can impact customer loyalty, as a lower barrier to entry for competitors means customers may be more inclined to explore alternative offerings if they perceive better value or coverage.

Customers for supplemental insurance, especially with healthcare costs and inflation on the rise, are paying much closer attention to prices. This heightened sensitivity means they are actively looking for the most cost-effective solutions to manage their expenses.

The trend of increasing deductibles and out-of-pocket expenses in primary health insurance plans directly fuels this customer price sensitivity. As individuals face higher upfront medical bills, the appeal of affordable supplemental coverage becomes even stronger, making price a critical factor in their purchasing decisions.

For instance, in 2024, many consumers reported that price was a primary driver when choosing insurance, with some studies indicating over 60% of individuals consider cost the most important factor. This trend directly impacts how Aflac and its competitors must position their offerings.

Information Availability to Customers

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online comparison tools, customer reviews, and readily available digital platforms empower individuals to thoroughly research and compare offerings from various companies, including Aflac.

This heightened transparency makes it easier for consumers to scrutinize policy features, understand pricing structures, and gauge customer satisfaction across the market. For instance, in 2024, a significant portion of consumers actively used online resources to research insurance products before making a purchase, driving a more competitive landscape.

- Increased Online Research: In 2024, studies indicated that over 70% of consumers used online tools to compare insurance policies.

- Impact on Pricing: This readily available information often leads to price sensitivity among customers, pressuring providers to offer competitive rates.

- Demand for Transparency: Customers are increasingly demanding clear and straightforward policy details, making it harder for companies to obscure terms or pricing.

Threat of Backward Integration by Customers

The threat of backward integration by Aflac's customers, whether individuals or businesses, is extremely low. This is primarily because the barriers to entry in the insurance industry are substantial.

Operating an insurance company requires significant capital, deep expertise in actuarial science and risk management, and navigating a complex web of state and federal regulations. For instance, in 2024, the average capital required to start a new insurance carrier can run into the tens or even hundreds of millions of dollars, depending on the lines of business. This level of investment and regulatory compliance is simply not feasible for most of Aflac's customer base.

- High Capital Requirements: Starting an insurance company demands substantial financial resources, often exceeding millions of dollars, making it impractical for most customers.

- Regulatory Complexity: The insurance industry is heavily regulated, with stringent compliance requirements that are difficult and costly for external entities to manage.

- Specialized Expertise: Running an insurance business necessitates specialized knowledge in areas like underwriting, claims processing, and actuarial analysis, which most customers lack.

- Lack of Strategic Incentive: For the vast majority of Aflac's customers, the core business is not insurance, and developing in-house capabilities would distract from their primary objectives and offer little strategic advantage.

Aflac's bargaining power with its customers is generally low due to a fragmented customer base where no single entity holds significant sway. However, this is evolving as digital platforms increase price transparency and lower switching costs, making customers more price-sensitive. The trend of rising healthcare expenses in primary insurance further amplifies this price sensitivity.

The ease with which customers can now compare policies online is a significant factor. In 2024, data suggests over 70% of consumers utilized online tools to research and compare insurance options, directly impacting Aflac's ability to command premium pricing without strong value propositions.

The threat of backward integration by customers is negligible, given the substantial capital, regulatory hurdles, and specialized expertise required to operate an insurance company. For instance, the average startup capital for an insurance carrier in 2024 could range from tens to hundreds of millions of dollars.

| Factor | Impact on Aflac | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | Low bargaining power due to fragmented base | Millions of individual policyholders |

| Switching Costs | Moderately low, increasing customer mobility | Digital platforms simplifying comparison and enrollment |

| Price Sensitivity | High, driven by rising healthcare costs and information access | Over 70% of consumers use online tools for comparison |

| Backward Integration Threat | Extremely low due to high barriers to entry | High capital requirements and regulatory complexity |

Same Document Delivered

Aflac Porter's Five Forces Analysis

This preview showcases the complete Aflac Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the supplemental insurance industry. You're looking at the actual document, meaning the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive. Once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The supplemental health insurance market where Aflac operates is remarkably crowded. Think of it as a bustling marketplace with many vendors vying for attention. You have giants like MetLife and Cigna, which offer a broad range of insurance products, competing alongside smaller, niche companies that focus specifically on supplemental coverage.

This vast array of competitors isn't confined to just one region; it spans both the United States and Japan, Aflac's primary markets. This broad geographic presence means Aflac faces a diverse set of rivals with varying strategies and market penetration, intensifying the competition it must navigate.

The U.S. supplemental health insurance market is expected to see a compound annual growth rate of 5.60% between 2025 and 2034. This growth is fueled by increasing healthcare expenses and greater consumer awareness regarding out-of-pocket medical costs.

While this represents moderate expansion, it can still lead to heightened competition. Companies will actively seek to capture a larger portion of this growing market, intensifying rivalry among existing players.

Aflac stands out by offering cash benefits directly to policyholders, a key differentiator. This approach, coupled with its highly recognizable Aflac Duck mascot, fosters strong brand loyalty and distinct market positioning.

While Aflac has a unique value proposition, the competitive landscape is dynamic. Competitors are actively innovating, introducing customizable insurance plans and integrated services that enhance policyholder experience and require Aflac to maintain a consistent pace in its own product development and innovation efforts.

Exit Barriers

Exit barriers for companies like Aflac are substantial, largely due to the immense capital required for operations, stringent regulatory compliance, and the long-term nature of insurance contracts. These factors make exiting the market a complex and costly endeavor, encouraging established players to remain active.

The insurance sector, in particular, faces significant hurdles for companies looking to leave. These include:

- Substantial Capital Investments: Insurers must maintain significant reserves and capital to meet policyholder obligations, often running into billions of dollars. For example, in 2023, the U.S. life insurance industry held over $4.5 trillion in general account assets, representing a massive capital commitment.

- Regulatory Obligations: Insurance is a heavily regulated industry, with strict solvency requirements, consumer protection laws, and reporting mandates that are difficult and expensive to unwind upon exit. State-specific regulations add another layer of complexity.

- Long-Term Policyholder Commitments: Insurers are bound by contracts that can last for decades, such as life insurance or annuities. Transferring or fulfilling these long-term obligations requires careful planning and financial provision, making a clean exit challenging.

Consequently, these high exit barriers contribute to intense competitive rivalry as firms are incentivized to stay and compete rather than incur the costs and complexities of leaving the market.

Intensity of Competition and Strategic Initiatives

Competitive rivalry within the supplemental insurance sector is notably fierce, compelling companies like Aflac to continuously innovate and refine their strategies. This intense competition is characterized by a strong emphasis on product differentiation, the formation of strategic alliances, and a dedicated focus on elevating the customer journey. Companies are actively seeking ways to stand out in a crowded marketplace.

Aflac's strategic responses to this competitive landscape are multifaceted. They are actively pursuing expansion into adjacent markets, such as dental and vision insurance, to broaden their service offerings. Furthermore, Aflac is investing in the enhancement of its digital platforms to improve accessibility and user experience for policyholders. Crucially, Aflac is also focused on nurturing and strengthening its relationships with its sales agent force, recognizing their vital role in customer acquisition and retention.

- Product Innovation: Aflac is expanding its portfolio to include dental and vision coverage, aiming to offer more comprehensive supplemental benefits.

- Digital Enhancement: Significant investment is being made to upgrade digital services, improving policy management and customer interaction.

- Agent Relationships: Strengthening ties with sales agents is a key initiative to ensure continued market reach and personalized customer service.

- Market Expansion: Entering new segments like dental and vision demonstrates a proactive approach to growth amidst intense competition.

The supplemental health insurance market is highly competitive, with numerous players vying for market share. This intense rivalry is further fueled by substantial exit barriers, such as significant capital requirements and regulatory obligations, which encourage companies to remain and compete rather than leave.

Companies like Aflac must continually innovate, differentiate their products, and enhance customer experience to succeed. This dynamic environment necessitates strategic responses, including portfolio expansion and digital investment, to maintain a competitive edge.

The U.S. supplemental health insurance market is projected to grow, but this expansion also intensifies competition as firms aim to capture a larger share of the increasing demand.

Aflac's strategy involves expanding into areas like dental and vision insurance and enhancing its digital platforms to better serve policyholders and maintain its market position.

SSubstitutes Threaten

The threat of substitutes for supplemental insurance is significant. Individuals can opt for personal savings, robust emergency funds, or even readily available credit options to cover unexpected medical expenses. These alternatives directly compete by offering financial flexibility without the need for a dedicated insurance policy.

For instance, the U.S. personal savings rate in April 2024 hovered around 3.2%, indicating a portion of the population relies on accumulated savings. This reliance can diminish the perceived need for supplemental insurance, as individuals feel better equipped to handle unforeseen costs through their own financial resources.

While personal savings or credit can offer immediate access to funds, they often lack the structured benefit payouts characteristic of insurance policies. For instance, using a credit card for medical expenses in 2024 could mean facing interest rates that might exceed 20%, effectively increasing the cost of care and potentially depleting personal savings meant for other purposes.

Supplemental insurance products, like those offered by Aflac, are designed to fill specific gaps that general financial instruments may not efficiently address, particularly during unexpected medical events. These policies provide direct cash benefits, which can be used for deductibles, co-pays, or even non-medical expenses, offering a level of financial certainty that simply drawing from savings or using credit might not provide.

Customer willingness to switch from supplemental insurance to substitutes hinges on their financial savviness, their personal assessment of risk, and any immediate financial pressures they face. For instance, a growing awareness of financial planning, potentially fueled by readily available online resources and educational campaigns, could empower individuals to explore alternatives.

However, the escalating costs of healthcare are a significant driver pushing consumers towards more formalized insurance products. As medical expenses continue to climb, the perceived reliability and comprehensiveness of structured insurance plans become more appealing compared to informal coping mechanisms or relying solely on personal savings.

Perceived Value of Substitutes

The perceived value of substitutes for Aflac's offerings can fluctuate significantly. For instance, if major medical insurance plans become more comprehensive with lower deductibles, the perceived need for supplemental Aflac policies might diminish for some consumers.

However, Aflac strategically positions itself by focusing on out-of-pocket expenses that traditional health insurance often leaves uncovered. This includes deductibles, co-pays, and non-medical costs like transportation and lodging related to treatment. In 2024, the average deductible for a preferred provider organization (PPO) plan was approximately $1,730 for individuals and $3,300 for families, according to industry reports, underscoring the potential financial burden Aflac's products can help alleviate.

- Aflac's Value Proposition: Aflac's strength lies in covering costs not typically included in major medical plans, such as deductibles and co-pays.

- Impact of Major Medical Plans: More robust major medical coverage with lower out-of-pocket maximums could reduce the perceived necessity of supplemental insurance.

- Consumer Financial Burden: In 2024, average individual deductibles for PPO plans were around $1,730, highlighting a significant out-of-pocket cost that Aflac policies can address.

- Market Differentiation: Aflac differentiates itself by providing financial support for the direct and indirect costs associated with medical events.

Government Programs and Social Safety Nets

Government programs like Medicare and Medicaid act as substitutes by covering core healthcare needs for many individuals. However, these programs often leave significant gaps in out-of-pocket expenses and non-medical costs. For instance, in 2024, Medicare beneficiaries faced an average of $3,000 in annual out-of-pocket spending for healthcare services, highlighting the need for supplemental coverage.

Supplemental insurance, like that offered by Aflac, directly addresses these gaps, providing financial support for costs not covered by government programs. This can include deductibles, copayments, and even lost wages due to illness or injury. The demand for such supplemental coverage remains robust, as evidenced by the fact that over 65 million Americans were enrolled in Medicare Advantage plans in 2024, many of whom also utilize supplemental insurance.

- Government programs like Medicare and Medicaid offer a baseline of healthcare coverage, acting as a substitute for some essential medical needs.

- These public programs, however, frequently leave substantial out-of-pocket expenses and coverage gaps for beneficiaries.

- In 2024, the average annual out-of-pocket healthcare costs for Medicare beneficiaries reached approximately $3,000, underscoring the reliance on supplemental insurance.

- Aflac's offerings provide crucial financial assistance for these uncovered costs, mitigating the financial burden on individuals and families.

The threat of substitutes for Aflac's supplemental insurance products is considerable, with personal savings, credit, and even government programs like Medicare and Medicaid acting as alternatives. While these substitutes can cover essential needs, they often fall short in addressing the significant out-of-pocket expenses that remain. For instance, in 2024, Medicare beneficiaries faced an average of $3,000 in annual out-of-pocket healthcare spending, highlighting a crucial gap that Aflac's policies are designed to fill.

The effectiveness of substitutes is further challenged by the potential financial burden of relying solely on them. Using credit for medical bills in 2024 could incur interest rates exceeding 20%, making care more expensive. Similarly, while personal savings are valuable, they may not offer the structured benefit payouts that provide financial certainty during unexpected medical events. In contrast, Aflac's products provide direct cash benefits to cover deductibles, co-pays, and other costs, offering a more predictable financial safety net.

| Substitute Option | Key Benefit | Potential Drawback | 2024 Data Point |

|---|---|---|---|

| Personal Savings | Flexibility, no interest | Limited by amount saved, can deplete for other needs | U.S. personal savings rate ~3.2% (April 2024) |

| Credit Cards | Immediate access to funds | High interest rates, potential debt accumulation | Credit card interest rates could exceed 20% |

| Medicare/Medicaid | Covers core healthcare needs | Leaves significant out-of-pocket expenses and non-medical costs | Medicare beneficiaries' average annual out-of-pocket costs ~ $3,000 |

Entrants Threaten

The insurance industry is inherently capital-intensive, demanding substantial financial reserves to comply with stringent regulatory mandates and to adequately cover potential claims. This significant initial investment acts as a major deterrent for potential new companies looking to enter the market.

For example, in 2024, the U.S. property and casualty insurance sector maintained robust capital levels, with total admitted assets exceeding $3 trillion, underscoring the immense financial commitment required to operate and compete effectively.

The insurance industry, a core market for Aflac, faces substantial barriers to entry due to stringent regulatory frameworks in both the U.S. and Japan. These regulations encompass intricate licensing procedures, ongoing compliance mandates, and rigorous solvency standards designed to protect policyholders. For instance, in 2023, the U.S. insurance industry's total admitted assets stood at approximately $15.7 trillion, underscoring the significant capital and operational infrastructure required to operate within this sector.

Established insurers like Aflac leverage significant brand loyalty, a critical barrier for new entrants. Aflac's brand recognition, built over decades, fosters deep customer trust, making it difficult for newcomers to gain traction. For instance, Aflac's consistent advertising and customer service have cultivated a loyal base, as evidenced by their strong market share in voluntary benefits.

Access to Distribution Channels

Aflac benefits significantly from its deeply entrenched distribution channels, a formidable barrier for newcomers. The company boasts an extensive network of agents, brokers, and strategic alliances, including a significant partnership with Japan Post Group, which grants it widespread customer reach.

New entrants face a substantial challenge in replicating Aflac's established network. Building comparable distribution capabilities requires considerable time, investment, and the cultivation of trust within the market, making it difficult to gain swift access to a broad customer base.

- Established Network: Aflac's extensive agent and broker network, coupled with partnerships like Japan Post Group, provides unparalleled customer access.

- High Setup Costs: New entrants would need substantial capital and time to develop similar distribution infrastructure.

- Customer Trust: Aflac's long-standing relationships and brand recognition in its key markets are difficult for new players to match quickly.

- Market Penetration: The sheer breadth of Aflac's distribution allows for efficient market penetration, a hurdle for any emerging competitor.

Economies of Scale and Experience Curve

Existing insurers like Aflac benefit significantly from economies of scale. This means they can spread their fixed costs, such as technology infrastructure and marketing, over a larger customer base. For instance, in 2023, Aflac reported total revenue of $22.5 billion, indicative of its substantial operational scale.

New entrants would struggle to match these cost efficiencies initially. They'd face a cost disadvantage in areas like underwriting, claims processing, and investment management, making it challenging to compete on price with established players. This barrier is further amplified by the experience curve; as companies process more claims and manage more policies, they become more efficient and reduce per-unit costs.

- Economies of Scale: Aflac's large operational footprint allows for cost advantages in administrative and operational functions.

- Experience Curve: Years of experience in the insurance market translate to more efficient processes and lower per-unit costs for established firms.

- Cost Disadvantage for New Entrants: Start-ups must invest heavily to reach a comparable scale, hindering their ability to offer competitive pricing.

- Market Share Impact: The significant cost advantages held by incumbents like Aflac make it difficult for new companies to gain substantial market share quickly.

The threat of new entrants for Aflac is generally low due to significant barriers. High capital requirements, stringent regulations in both the U.S. and Japan, and the need for extensive distribution networks demand substantial upfront investment, making it difficult for new players to emerge. For instance, in 2023, the U.S. insurance industry's total admitted assets were around $15.7 trillion, illustrating the immense financial scale required.

Aflac's established brand loyalty and deep-rooted distribution channels, including its partnership with Japan Post Group, present formidable challenges for newcomers. Replicating this customer trust and market access would require considerable time and resources. Furthermore, Aflac's economies of scale, supported by its $22.5 billion in total revenue for 2023, allow for cost efficiencies that new entrants would struggle to match initially, creating a significant cost disadvantage.

| Barrier to Entry | Aflac's Advantage | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High, requiring significant financial reserves | Substantial upfront investment needed |

| Regulatory Compliance | Complex licensing and solvency standards in U.S. and Japan | Navigating intricate legal and financial frameworks |

| Brand Loyalty & Trust | Decades of established reputation and customer relationships | Difficulty in building credibility and market acceptance |

| Distribution Channels | Extensive agent network and strategic partnerships (e.g., Japan Post) | Challenging to achieve broad customer reach quickly |

| Economies of Scale | Cost efficiencies from large operational footprint ($22.5B revenue in 2023) | Initial cost disadvantage and pricing pressure |

Porter's Five Forces Analysis Data Sources

Our Aflac Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Aflac's annual reports and SEC filings, alongside industry-specific research from firms like IBISWorld and market intelligence from sources such as Statista. This blend ensures a comprehensive understanding of competitive dynamics.