Aflac Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Discover how Aflac leverages its distinctive "duck" mascot for powerful brand recognition and customer engagement, a key element of its promotional strategy. This analysis delves into how their product offerings, pricing models, and distribution channels complement this iconic approach.

Unlock the full strategic blueprint behind Aflac's marketing success. Our comprehensive 4Ps analysis goes beyond the surface, providing actionable insights into their product development, pricing architecture, distribution network, and promotional campaigns.

Ready to elevate your marketing strategy? Get instant access to an in-depth, editable 4Ps Marketing Mix Analysis for Aflac, perfect for business professionals, students, and consultants seeking a competitive edge.

Product

Aflac's core product, supplemental health and life insurance, acts as a crucial financial safety net, bridging the coverage gaps often present in major medical plans. These policies are designed to provide tangible financial support when individuals need it most.

The key feature of Aflac's offerings is the direct cash benefit paid to policyholders. This cash can be used for a wide array of expenses, from medical bills and deductibles to everyday living costs and lost income during recovery. For instance, in 2024, Aflac reported paying out over $2.2 billion in claims, demonstrating the real-world impact of these benefits.

This direct cash payout model offers unparalleled flexibility. Unlike traditional health insurance that may dictate provider networks or service usage, Aflac's benefits empower policyholders to allocate funds according to their specific needs. This autonomy is a significant advantage, especially during times of unexpected illness or injury, allowing individuals to manage their financial recovery effectively.

Aflac distinguishes itself with a broad and specialized range of supplemental insurance. This includes offerings like accident, cancer, critical illness, hospital indemnity, and short-term disability insurance, designed to provide financial support during specific health events.

In the 2024-2025 period, Aflac Japan strategically broadened its portfolio. They introduced 'Tsumitasu,' a product focused on retirement asset building and post-retirement nursing care needs, alongside a new cancer insurance product, reflecting market demand for long-term financial security and health protection.

Complementing these efforts, Aflac U.S. has also expanded its product suite. The addition of dental and vision insurance in 2024-2025 demonstrates a commitment to meeting a wider array of consumer health and wellness needs, making Aflac a more comprehensive provider for individuals and families.

Aflac's introduction of the Digital Legacy Planning Platform, LifeVault™, through its expanded partnership with Empathy, directly addresses the Product element of the marketing mix. This digital tool, available to selected group term life insurance certificate holders from July 1, 2025, offers a tangible benefit beyond traditional insurance coverage. It provides a legally compliant and user-friendly method for policyholders to organize crucial end-of-life documents like wills and advance healthcare directives, thereby adding significant value and differentiation to Aflac's life insurance offerings.

Portability and Affordability

Aflac's product design strongly emphasizes portability, a key selling point for individuals navigating career changes or retirement. This feature allows policyholders to retain their coverage without premium increases, a significant advantage in 2024 and 2025's dynamic job market. For instance, Aflac's voluntary benefits are often elected through employers, but their portability ensures continued protection even if employment status changes.

Affordability is another cornerstone, with Aflac striving to offer policies that accommodate diverse financial situations. This approach makes supplemental insurance accessible, providing a safety net for unexpected medical expenses. In 2024, Aflac continued to highlight the value proposition of its offerings, aiming to provide financial security without undue burden on policyholders' budgets.

The predetermined benefit structure offers a clear financial advantage. These benefits are paid directly to the policyholder, regardless of any other insurance coverage they may have, including primary health insurance. This direct payout mechanism simplifies the claims process and provides immediate financial relief, a crucial factor for individuals facing medical bills in the current economic climate.

- Portability: Aflac policies can be taken with the policyholder when changing jobs or retiring, without premium increases.

- Affordability: Products are designed to be budget-friendly, offering financial security.

- Predetermined Benefits: Payouts are made regardless of other insurance, providing an additional layer of financial protection.

- Value Proposition: Aflac aims to deliver accessible financial security in 2024 and 2025.

Customer-Centric Development

Aflac's customer-centric development strategy is key to its growth, focusing on creating supplemental insurance products that tackle increasing out-of-pocket medical costs. The company actively designs offerings to match customer needs and preferences, differentiating itself in the market.

This approach involves strengthening support for their sales agents and fostering deeper partnerships with businesses. These collaborations are crucial for effectively addressing evolving customer demands.

- Product Relevance: Aflac aims to develop supplemental insurance that directly addresses the growing financial burden of medical expenses not covered by primary insurance.

- Customer Tailoring: Products are meticulously designed to align with the specific needs, preferences, and expectations of targeted customer segments.

- Competitive Differentiation: This customer focus helps Aflac's products stand out from those offered by competitors in the supplemental insurance market.

- Partner Ecosystem: Enhancing agent support and deepening business partner relationships are vital for better meeting customer requirements.

Aflac's product strategy centers on providing accessible, portable supplemental insurance that complements primary health coverage. The company's offerings, such as accident, cancer, and critical illness insurance, are designed to deliver direct cash benefits to policyholders, helping to offset out-of-pocket medical expenses and lost income. In 2024, Aflac continued to expand its U.S. portfolio with dental and vision insurance, while Aflac Japan introduced retirement asset building and nursing care products, reflecting a commitment to evolving customer needs for financial security.

The introduction of the Digital Legacy Planning Platform, LifeVault™, through its partnership with Empathy, adds a unique value-added service to select life insurance policies starting July 1, 2025. This platform assists policyholders in organizing essential end-of-life documents, further differentiating Aflac's life insurance products by providing tangible support beyond financial payouts.

Aflac's emphasis on portability ensures policyholders can maintain coverage even when changing jobs, a critical feature in the dynamic 2024-2025 labor market. This, combined with an affordable pricing structure and predetermined, direct cash benefits that bypass coordination with other insurance, solidifies Aflac's position as a provider of essential financial protection.

| Product Category | Key Feature | 2024/2025 Expansion/Focus |

|---|---|---|

| Supplemental Health Insurance | Direct cash benefits for medical expenses, deductibles, and lost wages. | Continued focus on accident, cancer, critical illness, hospital indemnity. U.S. added dental and vision. |

| Life Insurance | Financial support for beneficiaries. | Introduction of LifeVault™ digital legacy planning platform for select group term life policyholders from July 1, 2025. |

| Retirement & Long-Term Care | Asset building and support for nursing care needs. | Aflac Japan introduced 'Tsumitasu' product. |

| Portability | Coverage retention without premium increases upon job change. | Key selling point in the 2024-2025 employment landscape. |

What is included in the product

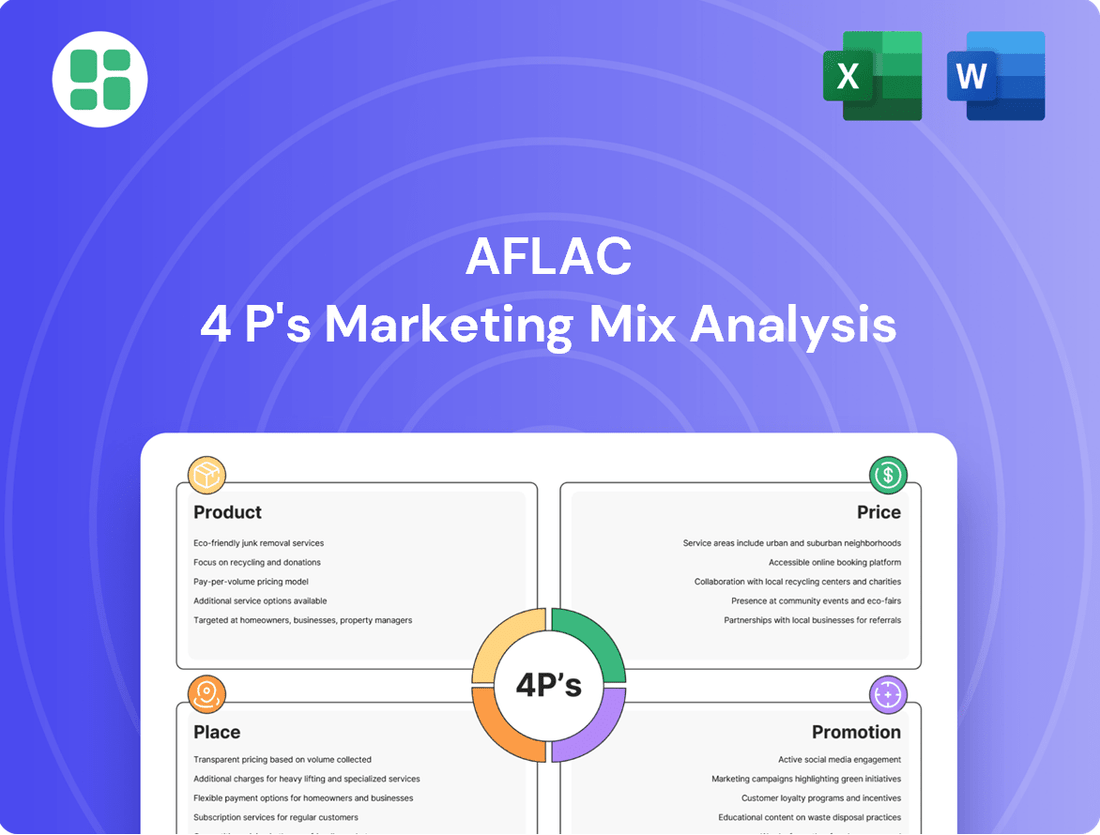

This analysis provides a comprehensive examination of Aflac's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking a detailed understanding of Aflac's marketing approach, grounded in real-world practices and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Aflac's 4Ps for effective decision-making.

Place

Aflac's distribution hinges on a strong direct-to-consumer and worksite approach. This dual strategy allows them to connect with individuals and businesses effectively. In 2024, Aflac reported that its worksite channel continued to be a significant driver of new business, with a notable increase in enrollment numbers compared to the previous year.

The company leverages independent associates to reach small businesses, while brokers are key to serving mid-to-large case markets in the U.S. This multi-pronged effort ensures broad market penetration. Aflac's commitment to expanding these channels in 2025 aims to make their supplemental insurance even more accessible to diverse customer segments.

Aflac's extensive agent network is a cornerstone of its marketing strategy, enabling direct sales and personalized customer engagement. This human infrastructure is vital for explaining the nuances of supplemental insurance, a product category that often requires clear communication.

In Japan, Aflac's reach is particularly impressive, with approximately 6,600 sales agencies and partnerships covering 90% of the nation's banks as of recent reports. This vast network ensures that Aflac can effectively connect with a broad customer base, offering tailored solutions and building trust.

The U.S. market also benefits from a robust agent force, facilitating face-to-face interactions that are key to understanding individual needs and preferences. This direct approach allows agents to act as educators and trusted advisors, driving policy adoption.

Aflac leverages strategic alliances with entities like banks and other financial institutions, especially in Japan, to broaden its product distribution beyond its internal sales teams. This approach is crucial for reaching consumers through their preferred purchasing channels, thereby enhancing market penetration.

In 2023, Aflac's Japan segment reported total revenues of approximately $16.1 billion, underscoring the significance of its distribution network, which includes these vital partnerships. These alliances are continuously refined to maximize customer reach and acquisition.

These partnerships are instrumental in expanding Aflac's market presence and creating new avenues for customer acquisition, allowing the company to offer financial protection to a wider audience.

Digital and Online Platforms

Aflac is actively enhancing its digital and online platforms to complement its traditional agent-based model. This strategic shift aims to improve customer accessibility and operational efficiency. For instance, MyAflac provides policyholders with a convenient portal for policy management and claims submission, streamlining interactions.

The company is also leveraging digital solutions for expanded services, such as its LifeVault™ platform, which offers digital legacy planning. This initiative caters to a growing customer preference for digital engagement, making Aflac's offerings more convenient and user-friendly. In 2024, Aflac reported that a significant portion of its customer service interactions were handled through digital channels, reflecting the success of these investments.

- Digital Transformation: Aflac is investing in digital tools to modernize its customer experience.

- Online Policy Management: MyAflac allows customers to easily manage policies and file claims online.

- Legacy Planning: LifeVault™ expands digital services into legacy planning, a growing area of interest.

- Customer Preference: These digital enhancements cater to customers who prefer online interactions and self-service options.

Geographic Segmentation (U.S. and Japan)

Aflac's marketing strategy is deeply rooted in its distinct geographic segmentation, primarily focusing on the United States and Japan. These two markets, Aflac U.S. and Aflac Japan, are managed with tailored distribution and product approaches to effectively capture market share.

Aflac Japan stands as the primary engine for Aflac's consolidated earnings, concentrating on the lucrative third-sector insurance market, which includes cancer and medical insurance. In contrast, Aflac U.S. is actively broadening its customer base by engaging consumers directly, moving beyond its traditional worksite-centric distribution model.

- Aflac Japan's Dominance: In fiscal year 2024, Aflac Japan contributed approximately 75% of the company's total operating income, highlighting its significant role in the group's financial performance.

- U.S. Market Expansion: Aflac U.S. is increasingly focusing on direct-to-consumer channels, aiming to increase its penetration in the voluntary benefits market outside of employer-sponsored programs.

- Tailored Strategies: The company leverages distinct marketing and sales strategies for each segment, recognizing the unique consumer preferences and regulatory environments in both the U.S. and Japan.

Aflac's place in the market is defined by its dual geographic focus on the United States and Japan, each with distinct strategies. This segmentation allows for tailored approaches to distribution and product offerings, maximizing relevance and penetration in diverse consumer landscapes.

Aflac Japan is a powerhouse, generating substantial revenue and focusing on the critical third-sector insurance market. Its extensive network, including partnerships with 90% of Japan's banks, ensures broad accessibility. In 2024, Aflac Japan contributed roughly 75% of the company's operating income, demonstrating its market dominance.

In the U.S., Aflac is actively diversifying its reach beyond the traditional worksite model, embracing direct-to-consumer channels. This expansion aims to capture more of the voluntary benefits market. The company's robust agent network remains a key asset for personalized sales and customer education.

Aflac's digital transformation is also a critical component of its place, enhancing customer access and service. Platforms like MyAflac and LifeVault™ cater to evolving consumer preferences for online management and digital solutions, improving overall customer experience.

| Market Segment | Key Distribution Channels | 2024 Contribution (Approx.) | Strategic Focus |

|---|---|---|---|

| Aflac Japan | Extensive agent network, Bank partnerships (90% of nation's banks) | 75% of operating income | Third-sector insurance (cancer, medical) |

| Aflac U.S. | Worksite, Independent associates, Brokers, Direct-to-consumer (growing) | 25% of operating income | Voluntary benefits, expanding beyond worksite |

Same Document Delivered

Aflac 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Aflac 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

The Aflac Duck, a consistent presence for over two decades, remains central to Aflac's promotional efforts. This iconic character effectively communicates Aflac's core message: bridging the financial gap left by health insurance. Its longevity underscores its impact on brand recognition and recall.

Recent promotional activities, including the 2024-2025 'Duck Dunk' and 'Stunt Duck' campaigns, leverage the duck's established appeal. These initiatives employ humor and the signature quack to educate consumers about the benefits of supplemental insurance. Strategic partnerships, particularly within the sports arena, further amplify the reach of these educational messages.

Aflac's marketing strategy places a strong emphasis on consumer and employer education regarding the importance of supplemental insurance, particularly with rising healthcare expenses. This proactive approach aims to demystify the value proposition of their offerings.

The company actively disseminates knowledge through publications like the Aflac WorkForces Report, which sheds light on financial pressures faced by individuals and the crucial role supplemental benefits play in mitigating these challenges. Data from the 2023 report indicated that 58% of employees struggled to cover a $1,000 emergency expense, underscoring the need for financial safety nets.

By fostering greater awareness and understanding, Aflac positions its products as essential tools for achieving financial security and peace of mind in an unpredictable healthcare landscape.

Aflac leverages strategic sponsorships and partnerships to boost its brand presence and showcase its dedication to social causes. For instance, its commitment to gender equity in sports is evident in its role supplementing prize money for the WNBA, aiming for parity in payouts. This initiative, alongside its enduring collaboration with the American Cancer Society, reinforces Aflac's brand values and resonates with a wider demographic.

Digital and Social Media Engagement

Aflac leverages digital and social media to connect with its audience, employing SEO-optimized blog content and engaging campaigns to attract consumers. This digital strategy is crucial for reaching younger demographics and staying current with communication trends.

In 2024, Aflac's digital marketing efforts likely saw increased investment as companies across sectors prioritized online engagement. For instance, a significant portion of marketing budgets, often exceeding 50%, was allocated to digital channels in 2024, reflecting a broader industry trend towards online outreach.

- Digital Reach: Aflac's online presence aims to capture a younger demographic increasingly reliant on digital platforms for information and services.

- Content Strategy: The company's blog updates, driven by SEO, are designed to enhance discoverability and provide valuable content to potential customers.

- Campaign Effectiveness: Marketing campaigns executed across social media and digital platforms are key to driving consumer interaction and brand awareness.

Public Relations and Ethical Recognition

Aflac strategically leverages public relations and ethical recognition as a core component of its promotional efforts. This focus is evident in its consistent acknowledgment as one of the World's Most Ethical Companies, a distinction it has held for an impressive 19 consecutive years as of 2024. This sustained recognition significantly bolsters Aflac's brand reputation, fostering deep trust and credibility with both its customer base and the investment community.

This ongoing commitment to ethical business practices translates directly into a powerful promotional advantage. The accolades earned by Aflac serve as tangible proof of its corporate responsibility, enhancing its brand image and acting as a significant draw for consumers seeking reliable and trustworthy insurance providers. For instance, in 2023, Aflac reported a 1.7% increase in total revenue to $22.4 billion, demonstrating the financial strength that underpins its ethical standing and promotional success.

- 19 Consecutive Years: Aflac's unbroken streak of being named one of the World's Most Ethical Companies highlights its enduring commitment.

- Enhanced Brand Trust: Ethical recognition directly correlates with increased consumer and investor confidence in Aflac's operations.

- Promotional Asset: These awards function as a key marketing tool, differentiating Aflac in a competitive marketplace.

- Financial Reinforcement: Aflac's stable financial performance, such as its 2023 revenue growth, validates the market's trust in its ethical framework.

Aflac's promotion strategy effectively utilizes its iconic Aflac Duck for brand recognition and educational messaging, amplified by recent campaigns like 'Duck Dunk' and 'Stunt Duck' in 2024-2025. The company also prioritizes consumer and employer education, highlighting the necessity of supplemental insurance amidst rising healthcare costs, as evidenced by the 2023 Aflac WorkForces Report showing 58% of employees struggled with a $1,000 emergency expense.

Strategic sponsorships, including support for gender equity in sports and the American Cancer Society, reinforce Aflac's brand values. Digital marketing, with significant budget allocation to online channels in 2024, targets younger demographics through SEO-optimized content and engaging campaigns.

Aflac's consistent recognition as one of the World's Most Ethical Companies for 19 consecutive years as of 2024 significantly enhances its brand trust and credibility. This ethical standing, coupled with a 1.7% revenue increase to $22.4 billion in 2023, reinforces its promotional strength.

Price

Aflac's pricing strategy for supplemental benefits centers on value-based principles, aiming to provide competitive rates that align with the perceived value of bridging gaps in major medical insurance. The company emphasizes delivering the best value by highlighting how direct cash benefits empower policyholders to manage unexpected out-of-pocket medical expenses, a critical consideration amidst escalating healthcare costs. For instance, in 2024, with average deductibles for employer-sponsored health plans potentially reaching $1,731 for individuals, Aflac's policies offer a tangible financial safety net.

Aflac highlights the affordability of its premiums, designed to accommodate diverse financial situations for individuals and families. This focus on accessibility ensures their supplemental insurance products are within reach for many.

A significant draw is Aflac's commitment to fixed rates, meaning premiums generally remain stable even after a claim is submitted. This predictability is a key benefit, offering policyholders financial certainty over the life of their coverage.

For instance, Aflac's accident insurance premiums can start as low as a few dollars per week, making it an easy add-on for many. This low entry point, combined with the fixed-rate promise, enhances the perceived value and long-term appeal of their offerings.

Aflac's pricing strategies are carefully calibrated to align with market demand and the competitive landscape in both the U.S. and Japan. The company actively monitors competitor pricing within the supplemental insurance sector. For instance, in 2024, the U.S. supplemental health insurance market was valued at approximately $70 billion, with Aflac holding a significant share, necessitating competitive pricing to maintain this position.

Pricing Policies for Group and Individual Products

Aflac's pricing strategy is designed to be flexible, offering distinct approaches for individual policyholders and group plans. This allows them to effectively reach a broad customer base, from single consumers to large employer groups.

For employers, Aflac emphasizes cost-effectiveness, providing supplemental insurance options that can be offered to employees with minimal or no direct cost to the business. This makes valuable benefits more attainable for a wider range of employees. For instance, Aflac's group offerings often feature competitive group rates, making them an attractive addition to employee benefits packages without straining company budgets.

- Tiered Pricing: Aflac utilizes a tiered pricing structure to accommodate businesses of all sizes, from small enterprises to large corporations.

- Employer Cost Savings: Group policies are often structured so employers can offer benefits at little to no direct cost, enhancing employee value.

- Individual Policy Customization: Individual plans are priced based on specific coverage needs, age, and health factors, ensuring personalized affordability.

- Market Competitiveness: Aflac's pricing aims to remain competitive within the supplemental insurance market, balancing value with accessibility.

Impact of Economic Conditions and Investment Performance

Aflac's pricing is indeed tied to the economic climate and how its investments perform. While premium amounts are generally fixed, the company's overall profitability, which can shape future product offerings and pricing adjustments, is sensitive to economic factors. These include shifts in interest rates, currency fluctuations, particularly between the Yen and the Dollar, and the success or failure of its investment portfolio.

For instance, Aflac reported that its total revenues for the first quarter of 2024 were $5.2 billion, a slight decrease from $5.3 billion in the prior year's quarter. This fluctuation was partly attributed to changes in investment income and the impact of foreign currency translation. The company's investment income, a crucial component of its profitability, is directly affected by market conditions.

- Investment Income Sensitivity: Aflac's profitability is significantly influenced by its investment income, which can fluctuate with market performance and interest rate changes.

- Currency Exchange Impact: Fluctuations in the Yen/Dollar exchange rate directly affect Aflac's reported revenues and earnings, given its substantial operations in Japan.

- Q1 2024 Performance: Aflac's Q1 2024 revenues of $5.2 billion showed a modest year-over-year decline, partly due to investment performance and currency impacts.

- Long-Term Pricing Strategy: While premiums are set, sustained periods of low interest rates or investment losses can indirectly pressure future pricing and product development to maintain profitability.

Aflac's pricing strategy emphasizes value and affordability, with premiums designed to be accessible for individuals and families. They offer fixed rates, providing predictability for policyholders, and even low entry points, like a few dollars a week for accident insurance. This approach aims to make their supplemental benefits a financially sound choice amidst rising healthcare costs.

The company employs tiered pricing for businesses and customizes individual plans based on coverage needs, age, and health. This flexibility allows Aflac to cater to a wide market, from small businesses to large corporations, ensuring competitive group rates that are attractive to employers and employees alike. In 2024, the U.S. supplemental health insurance market, valued at around $70 billion, demands such competitive pricing to maintain market share.

| Pricing Aspect | Description | 2024/2025 Relevance |

|---|---|---|

| Value-Based | Aligning rates with perceived benefits of bridging insurance gaps. | Critical as individual health plan deductibles average $1,731. |

| Affordability | Designed for diverse financial situations. | Low entry points, e.g., accident insurance from a few dollars weekly. |

| Fixed Rates | Premiums generally remain stable post-claim. | Offers financial certainty and predictability. |

| Market Competitiveness | Monitoring and adjusting to competitor pricing. | Essential in a $70 billion U.S. supplemental market. |

4P's Marketing Mix Analysis Data Sources

Our Aflac 4P's Marketing Mix Analysis is grounded in a comprehensive review of Aflac's official communications, including annual reports, investor presentations, and press releases. We also incorporate data from industry reports and competitive analyses to ensure a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.