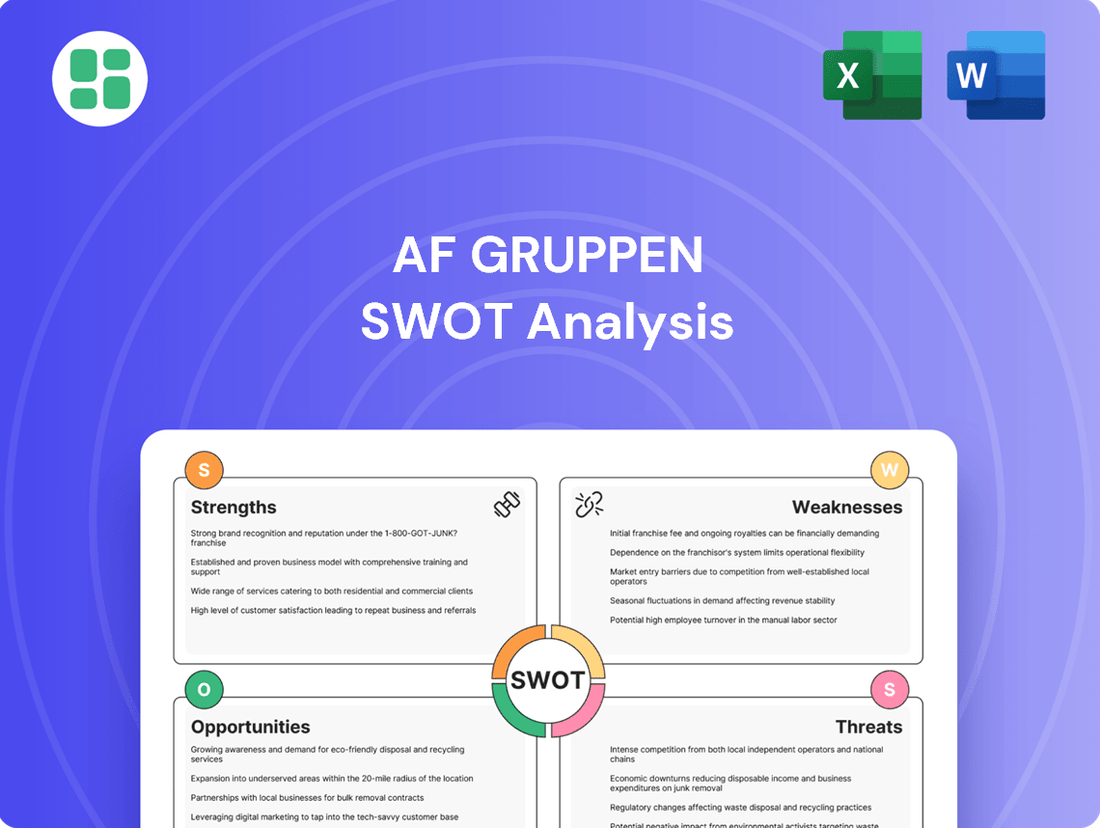

Af Gruppen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

AF Gruppen demonstrates strong market presence and a diversified project portfolio, yet faces potential challenges from economic downturns and intense competition. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind AF Gruppen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AF Gruppen’s strength lies in its remarkably diversified service portfolio. The company actively participates in construction, property development, civil engineering, environmental services, and even offshore and energy solutions. This broad operational base, as evidenced by their continued revenue generation across these segments through 2024, significantly reduces dependence on any single market, creating a more resilient business model.

This strategic diversification translates into multiple, stable revenue streams, a key advantage in volatile economic conditions. For instance, their robust performance in infrastructure projects in 2024, alongside steady contributions from property development, highlights the benefits of this multi-faceted approach. The ability to manage projects from initial development through to execution and environmental remediation offers significant synergies and enhanced control over project lifecycles.

AF Gruppen boasts a robust presence in its core markets of Norway and Sweden. This deep penetration provides them with invaluable local market knowledge, well-established industry connections, and significant brand loyalty. For instance, in 2023, AF Gruppen reported revenue of NOK 27.8 billion, with a substantial portion originating from these Nordic strongholds.

AF Gruppen's specialized expertise in niche sectors, particularly offshore decommissioning and recycling, sets it apart. This deep knowledge allows the company to tackle complex projects, such as the dismantling of offshore installations, a growing area driven by the energy transition. For instance, AF Gruppen's successful completion of projects like the dismantling of the Valemon platform in 2023 highlights their capability in this specialized field.

Robust Financial Position and Order Backlog

AF Gruppen's financial strength is a significant advantage, underpinned by a substantial and consistent order backlog. This backlog provides excellent visibility into future revenue streams, offering a degree of stability in project execution and financial planning.

The company's robust financial position is further evidenced by key metrics. For example, as of the first quarter of 2025, AF Gruppen reported an impressive order backlog totaling NOK 44,232 million. This figure demonstrates sustained demand for their diverse range of services and a strong market presence.

- Strong Financial Health: AF Gruppen maintains a solid financial foundation, enabling it to weather market fluctuations and invest in growth opportunities.

- High Order Backlog: The significant order backlog of NOK 44,232 million (Q1 2025) provides substantial revenue visibility and operational security for the coming periods.

- Sustained Demand: The consistently high backlog reflects ongoing demand for AF Gruppen's construction and infrastructure services, indicating market confidence.

- Future Revenue Security: The order backlog acts as a crucial buffer, ensuring a predictable revenue stream and supporting long-term strategic planning and investment.

Commitment to Sustainability and Innovation

AF Gruppen is demonstrating a strong commitment to sustainability, setting ambitious targets to halve its climate and environmental footprint by 2028 and achieve climate neutrality by 2050. This forward-thinking approach is not just an environmental imperative but a strategic advantage, as it directly addresses the growing market demand for green solutions.

The company's dedication to innovation in this area is evident in its active efforts to reduce waste and greenhouse gas emissions across its operations. For instance, AF Gruppen has been a pioneer in developing and implementing low-emission construction techniques. This focus positions them favorably in a market increasingly prioritizing environmentally responsible partners and projects, potentially leading to enhanced brand reputation and new business opportunities.

Key initiatives include:

- Targeting a 50% reduction in climate and environmental footprint by 2028.

- Aiming for complete climate neutrality by 2050.

- Investing in and developing green construction technologies and materials.

- Implementing waste reduction programs and circular economy principles.

AF Gruppen's diversified business model, spanning construction, property development, and environmental services, provides resilience. This broad operational scope, evident in their consistent revenue generation across segments through 2024, mitigates risks associated with any single market downturn.

Their strong financial health is a significant asset, supported by a substantial order backlog. As of Q1 2025, this backlog stood at NOK 44,232 million, ensuring revenue visibility and operational stability.

The company's deep market penetration in Norway and Sweden, backed by a 2023 revenue of NOK 27.8 billion, offers local expertise and established relationships.

AF Gruppen's specialization in niche areas like offshore decommissioning, demonstrated by projects like the Valemon platform dismantling in 2023, provides a competitive edge in growing sectors.

| Metric | Value | Period |

|---|---|---|

| Total Revenue | NOK 27.8 billion | 2023 |

| Order Backlog | NOK 44,232 million | Q1 2025 |

| Key Markets | Norway, Sweden | Ongoing |

What is included in the product

Delivers a strategic overview of Af Gruppen’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Af Gruppen's strategic challenges.

Weaknesses

AF Gruppen's heavy reliance on Norway and Sweden presents a significant weakness. This geographic concentration means the company is particularly vulnerable to economic downturns, regulatory shifts, or even adverse weather patterns specific to these Nordic markets. For instance, a slowdown in Norway's oil and gas sector, a key driver for construction, could directly and disproportionately affect AF Gruppen's project pipeline and profitability.

AF Gruppen's significant presence in construction and property development exposes it to the volatility of economic cycles, interest rate fluctuations, and consumer sentiment. This reliance on industries sensitive to macroeconomic conditions presents a notable weakness.

The current challenging property market, exacerbated by elevated interest rates, has directly impacted AF Gruppen's property development segment, leading to diminished sales volumes. For instance, in the first quarter of 2024, the company reported a slowdown in its property development activities due to these headwinds.

AF Gruppen has faced project-specific hurdles, notably in its civil engineering segment. A significant contract termination in Sweden resulted in shutdown and termination expenses, directly impacting profitability. These disputes highlight a vulnerability to contractual disagreements and their substantial financial repercussions.

Profitability Variations Across Business Areas

While AF Gruppen's overall profitability has seen an uptick, certain business areas within construction and property development have recently shown results that fall short of expectations. This inconsistency across the company's diverse operations points to a need for closer management attention or strategic recalibration in these specific segments.

For instance, in Q1 2024, AF Gruppen reported an operating profit of NOK 312 million, a significant increase from NOK 173 million in Q1 2023. However, within this, the Property Development segment experienced a decline in profit compared to the previous year, highlighting the uneven performance across business units.

- Inconsistent Performance: Some construction and property development units have delivered weaker results in recent quarters, impacting overall portfolio consistency.

- Need for Strategic Adjustment: Underperforming segments suggest a requirement for tighter operational controls or strategic reviews to improve profitability.

- Q1 2024 Results Highlight Variance: Despite a strong group-level profit increase, specific business areas within property development showed a profit decline year-on-year, underscoring the unevenness.

Reliance on Large-Scale Projects

AF Gruppen's significant reliance on large-scale infrastructure and construction projects, which constituted a substantial portion of its order backlog in early 2024, presents a key weakness. This concentration means that disruptions to these major undertakings, such as unforeseen delays or budget adjustments, can have a pronounced impact on the company's financial performance.

The vulnerability extends to potential shifts in political priorities or regulatory changes that might affect the initiation or continuation of these large public and private sector projects. For instance, a slowdown in government infrastructure spending, a common concern in many European markets throughout 2024, could directly impact AF Gruppen's revenue streams and project pipeline.

- Concentrated Revenue Streams: A significant portion of AF Gruppen's income is derived from a limited number of very large projects, increasing financial risk if any single project encounters major issues.

- Sensitivity to External Factors: The company is susceptible to economic downturns, changes in government policy, and public sector budget constraints that can affect the pipeline of large-scale infrastructure work.

- Project-Specific Risks: Large projects inherently carry higher risks of cost overruns, extended timelines, and technical challenges that can negatively affect profitability and cash flow.

AF Gruppen's substantial exposure to the Norwegian and Swedish markets creates a significant weakness due to geographic concentration. This makes the company highly susceptible to localized economic downturns, regulatory changes, or even specific industry challenges within these Nordic regions, potentially impacting its overall financial health disproportionately.

The company's reliance on construction and property development exposes it to the inherent volatility of economic cycles and interest rate fluctuations. This sensitivity to macroeconomic conditions, particularly evident in the challenging property market of early 2024 with its elevated interest rates, directly affects sales volumes and profitability in this key segment.

AF Gruppen has encountered project-specific setbacks, such as contract terminations in its civil engineering segment, leading to substantial financial repercussions. These instances highlight a vulnerability to contractual disputes and their significant negative impact on the company's bottom line.

While overall group profits saw an increase in early 2024, certain business units within construction and property development have underperformed compared to expectations. This uneven performance across its diverse operations necessitates closer management oversight and potential strategic adjustments in underperforming areas.

| Weakness | Description | Impact |

| Geographic Concentration | Heavy reliance on Norway and Sweden. | Vulnerability to regional economic downturns and regulatory shifts. |

| Economic Sensitivity | Exposure to construction and property development cycles. | Impacted by interest rate hikes and consumer sentiment, as seen in Q1 2024 property market slowdown. |

| Project-Specific Risks | Vulnerability to contractual disputes and large project disruptions. | Significant financial repercussions from contract terminations, like those experienced in Sweden. |

| Inconsistent Performance | Uneven results across business segments. | Some units show weaker performance, requiring strategic review and tighter controls. |

Preview the Actual Deliverable

Af Gruppen SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Af Gruppen SWOT analysis you see here is exactly what you'll download after purchase, offering a comprehensive overview of their strategic position.

Opportunities

The global push towards sustainability is a major tailwind for AF Gruppen, especially in their environmental services and energy solutions. This trend is creating a growing market for green infrastructure and related services, directly benefiting companies with relevant expertise.

AF Gruppen's established capabilities in areas like demolition, environmental cleanup, and the recycling of offshore installations position them strongly to capitalize on this demand. For instance, the offshore wind sector, a key area for green infrastructure, saw significant investment in 2024, with projections for continued growth through 2025 and beyond, creating a robust pipeline for AF Gruppen's services.

AF Gruppen is strategically expanding into the booming renewable energy sector, particularly offshore wind. Leveraging its established offshore construction expertise, the company is poised to benefit from the significant global investment in this area. For instance, the European offshore wind market alone is projected to see substantial growth, with new capacity additions expected to accelerate through 2030 and beyond, presenting a prime opportunity for AF Gruppen's specialized services.

The company is actively preparing to support offshore wind projects by facilitating the production of foundations and the assembly of wind turbines. This proactive approach signals a clear commitment to capturing market share in this high-growth industry. As of early 2024, several major offshore wind farm developments are underway or in advanced planning stages across Europe, creating immediate demand for the capabilities AF Gruppen is building.

The robust commitment to infrastructure development in Norway and Sweden presents a significant opportunity for AF Gruppen. Governments and private entities are channeling substantial funds into new projects, urban regeneration, and essential upgrades. For instance, Norway's national transport plan for 2022-2033 allocates NOK 1,072 billion for transport infrastructure, signaling sustained demand for construction expertise.

AF Gruppen is well-positioned to capitalize on this trend, evidenced by recent successes. The company secured contracts for key public facilities, including new educational institutions and law enforcement buildings, demonstrating their capability and market trust. This ongoing pipeline of public works ensures a consistent revenue stream and reinforces their market position in the civil engineering sector.

Technological Advancements and Digitalization in Construction

Embracing technological advancements like Building Information Modeling (BIM), automation, and data analytics presents a significant opportunity for AF Gruppen to boost efficiency and cut costs. For instance, the global construction technology market was valued at approximately USD 11.4 billion in 2023 and is projected to grow substantially, indicating a strong demand for these innovations. By integrating these tools, AF Gruppen can streamline project delivery and gain a crucial competitive advantage.

Investing in digitalization can optimize operational performance across all facets of AF Gruppen's business. This includes leveraging data analytics for better resource allocation and predictive maintenance, which can lead to improved project outcomes. The construction industry's digital transformation is accelerating, with companies increasingly adopting cloud-based solutions and AI-driven insights to manage complex projects more effectively.

- Enhanced Project Efficiency: Implementing BIM can reduce design errors by up to 30% and improve coordination among project stakeholders.

- Cost Reduction: Automation in construction, such as robotic bricklaying, has shown potential to lower labor costs by up to 20% in specific applications.

- Improved Data-Driven Decisions: Advanced analytics can provide real-time insights into project progress and risks, enabling proactive management.

- Competitive Edge: Early adoption of new technologies positions AF Gruppen as an industry leader, attracting talent and clients seeking innovative solutions.

Strategic Acquisitions and Partnerships

AF Gruppen has significant opportunities to grow by acquiring or partnering with other companies. This strategy can help them enter new markets or gain specialized skills. For instance, acquiring a firm with expertise in offshore wind installations could bolster their renewable energy sector presence.

Strategic collaborations can also open doors to new geographic regions or specialized market segments within the Nordic countries. AF Gruppen could explore partnerships with companies focused on sustainable construction materials or digital building solutions to enhance their service portfolio.

The company's strong financial position, evidenced by its consistent revenue growth, provides a solid foundation for such strategic moves. In 2023, AF Gruppen reported revenues of NOK 26.6 billion, demonstrating its capacity for investment in growth opportunities.

- Expand market reach through acquisitions in underserved Nordic regions.

- Acquire new capabilities in areas like modular construction or green technologies.

- Strengthen market position by merging with complementary businesses.

- Enter niche markets by partnering with specialized engineering or design firms.

AF Gruppen is well-positioned to benefit from the global shift towards sustainability, particularly in environmental services and renewable energy, with significant investment in offshore wind creating a strong demand for their expertise. The company's strategic expansion into offshore wind, coupled with its established capabilities in offshore construction, allows it to capitalize on this growing market. Furthermore, robust infrastructure development plans in Norway and Sweden, alongside technological advancements like BIM and automation, offer substantial opportunities for increased efficiency and cost reduction.

| Opportunity Area | Description | Supporting Data (2024/2025 Focus) |

|---|---|---|

| Sustainability & Green Infrastructure | Capitalizing on the global demand for environmentally friendly construction and services. | Offshore wind sector investment projected for continued growth through 2025. |

| Renewable Energy Expansion | Leveraging expertise in offshore construction to support the booming offshore wind market. | European offshore wind market capacity additions expected to accelerate. |

| Infrastructure Development | Benefiting from significant government and private sector investment in Norway and Sweden. | Norway's national transport plan (2022-2033) allocates NOK 1,072 billion. |

| Technological Adoption | Enhancing efficiency and reducing costs through BIM, automation, and data analytics. | Global construction technology market valued at approx. USD 11.4 billion in 2023, with strong projected growth. |

| Strategic Acquisitions & Partnerships | Expanding market reach and acquiring specialized skills through M&A or collaborations. | AF Gruppen reported revenues of NOK 26.6 billion in 2023, indicating financial capacity for growth. |

Threats

Economic downturns pose a significant threat to AF Gruppen. A slowdown in Norway or Sweden, marked by high interest rates or inflation, could curb demand for construction and property development, directly impacting AF Gruppen's revenue. For instance, in Q1 2024, AF Gruppen reported a revenue of NOK 7,879 million, and a substantial decrease in project pipelines due to economic headwinds could significantly alter this trajectory.

AF Gruppen faces significant threats from rising costs of key materials like steel and concrete, alongside increasing labor expenses, especially for skilled trades. For instance, global commodity price volatility in 2024 continued to put pressure on construction inputs, directly impacting project budgets.

These escalating expenses can significantly erode profit margins if not passed on to clients or if they exceed initial project estimates. This directly challenges AF Gruppen's ability to maintain profitability and adhere to contractual budgets, particularly on long-term projects.

The contracting and industrial sectors across Norway and Sweden are characterized by intense competition. This dynamic environment means AF Gruppen faces constant pressure from both established rivals and emerging players looking to gain market share.

This heightened competition directly translates into significant pricing pressure. AF Gruppen must carefully manage its bids and project pricing to remain competitive, which can impact its profitability and overall market position.

For instance, in the first quarter of 2024, AF Gruppen reported a significant increase in revenue to NOK 7,283 million, up from NOK 5,208 million in Q1 2023, indicating successful project acquisition despite competitive pressures. However, the ongoing intensity of competition suggests that maintaining these margins will require continuous strategic adaptation and operational efficiency.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations, like the EU's Corporate Sustainability Reporting Directive (CSRD) and Ecodesign for Sustainable Products Regulation (ESPR), demand more rigorous reporting and adherence to heightened sustainability benchmarks. Failure to comply with these increasingly stringent standards, or the substantial costs involved in adapting to them, could significantly impact Af Gruppen's operations and profitability. For instance, the CSRD, which became fully applicable to large companies in 2024, requires extensive disclosure on environmental, social, and governance (ESG) matters, potentially increasing administrative burdens and compliance costs.

These regulatory shifts present a tangible threat to Af Gruppen if not proactively managed.

- Increased compliance costs: Adapting to new environmental reporting and product design standards can necessitate significant investment in new technologies, processes, and personnel.

- Risk of penalties: Non-compliance with regulations such as CSRD or ESPR can lead to substantial fines and reputational damage.

- Operational disruptions: Changes in regulations might require modifications to existing construction methods or materials, potentially causing project delays and cost overruns.

Project Risks and Operational Challenges

Large and complex projects, a staple for AF Gruppen, inherently expose the company to significant risks. These include potential delays and cost overruns, as seen with a recent offshore project adjustment that impacted profitability. For instance, the termination of a civil engineering contract in Sweden in early 2024 also highlights operational vulnerabilities.

These challenges can directly affect financial performance and the company's public image. AF Gruppen's reliance on large-scale infrastructure and construction projects means that even a few significant setbacks can have a material impact. The company's 2023 annual report noted that unforeseen site conditions and supply chain disruptions were key risk factors impacting project timelines and budgets.

- Project Delays: Increased risk of schedule slippage due to complexity and external factors.

- Cost Overruns: Potential for exceeding budget due to material price volatility and unforeseen site issues.

- Operational Disruptions: Contract terminations or disputes can lead to immediate financial and reputational damage.

- Reputational Impact: Project failures can erode client trust and future business opportunities.

Intensified competition in the Norwegian and Swedish construction markets presents a significant threat, potentially leading to pricing pressures and reduced profit margins for AF Gruppen. Despite a reported revenue increase to NOK 7,283 million in Q1 2024, the ongoing competitive landscape necessitates continuous adaptation to maintain market share and profitability.

Rising costs for essential materials like steel and concrete, coupled with increasing labor expenses, directly impact AF Gruppen's project budgets and profit margins. Global commodity price volatility in 2024 continues to challenge construction input costs, potentially affecting the company's ability to adhere to contractual budgets.

Evolving environmental regulations, such as the EU's CSRD and ESPR, introduce compliance costs and operational risks. Failure to adapt to these increasingly stringent standards, which became more applicable to large companies in 2024, could lead to penalties and operational disruptions.

The inherent risks associated with large and complex projects, including potential delays and cost overruns, pose a threat to AF Gruppen's financial performance and reputation. Unforeseen site conditions and supply chain disruptions, noted as key risk factors in the 2023 annual report, can materially impact project timelines and budgets.

SWOT Analysis Data Sources

This Af Gruppen SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive industry analyses, and expert commentary from reputable market research firms, ensuring a well-informed and accurate strategic assessment.