Af Gruppen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

Af Gruppen operates in a dynamic construction sector, where understanding the competitive landscape is crucial for success. Our Porter's Five Forces analysis delves into the intense rivalry among existing players, the bargaining power of both suppliers and buyers, and the ever-present threats of new entrants and substitute products.

The complete report reveals the real forces shaping Af Gruppen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AF Gruppen's bargaining power with suppliers can be significantly impacted when dealing with specialized materials or components. In 2024, for instance, the market for advanced environmental remediation technologies, a niche area for AF Gruppen, might feature only a handful of providers. This limited supplier base grants them considerable leverage to dictate pricing and terms, potentially increasing AF Gruppen's input costs.

The construction and civil engineering industries in Norway and Sweden, where AF Gruppen operates, frequently experience a deficit in highly skilled professionals. This includes crucial roles like project managers, engineers, and specialized craftspeople.

This scarcity directly translates into increased bargaining power for available skilled labor. Consequently, this can lead to upward pressure on wages, potentially affecting AF Gruppen's project expenses and adherence to schedules. For instance, in 2024, reports indicated a persistent shortage of skilled construction workers across Scandinavia, with some estimates suggesting a gap of tens of thousands of professionals needed to meet project demands.

AF Gruppen must actively compete for this limited talent pool. This competition naturally drives up operational costs as the company strives to attract and retain essential personnel, impacting overall profitability.

AF Gruppen’s profitability is directly impacted by the volatility of raw material prices, such as steel, concrete, and timber. Recent inflationary pressures and persistent supply chain issues have driven up these costs significantly. For instance, global steel prices saw considerable increases in 2021 and 2022, impacting construction firms worldwide.

This price volatility poses a particular challenge for AF Gruppen, especially when undertaking fixed-price contracts. The company's ability to negotiate favorable terms with suppliers or to effectively pass on increased material costs to its clients becomes a critical factor in maintaining healthy profit margins.

Switching Costs for AF Gruppen

AF Gruppen likely faces moderate switching costs from its suppliers. While established relationships exist, transitioning to new providers for specialized construction materials or advanced technological solutions can involve significant expenses. These include costs associated with re-qualifying new suppliers, establishing new logistical networks, and potential project timeline disruptions.

These switching costs empower incumbent suppliers, limiting AF Gruppen's leverage in price negotiations. This is especially relevant in large-scale, complex infrastructure projects where the integration of specialized components is crucial. For instance, in 2024, the construction industry globally saw continued emphasis on supply chain resilience, further increasing the importance of reliable, albeit potentially costly, supplier relationships.

- High Re-qualification Expenses: Adopting new suppliers for critical components often requires rigorous testing and certification processes, adding to overall project costs.

- Logistical Integration Challenges: Establishing new supply chains involves setting up new delivery routes, inventory management systems, and potentially training internal staff, all contributing to switching costs.

- Project Delays and Risk: The transition period to new suppliers can introduce unforeseen delays and risks, impacting project timelines and profitability, thus reinforcing the value of existing supplier relationships.

Supplier's Forward Integration Potential

Suppliers, particularly those offering specialized construction services or pre-fabricated building components, possess the potential for forward integration. If such a supplier were to move into direct construction or property development, they would be directly competing with AF Gruppen, thereby amplifying their bargaining power.

This threat is less pronounced for suppliers of basic, commoditized materials. However, for providers of niche skills or advanced modular solutions, the capability to integrate forward presents a more significant concern, potentially impacting AF Gruppen's operational costs and market position.

- Forward Integration Threat: Suppliers specializing in prefabricated modules or advanced construction techniques can enter AF Gruppen's core business.

- Increased Bargaining Power: Direct competition from suppliers enhances their leverage over AF Gruppen.

- Commodity vs. Specialty: The risk is considerably lower for suppliers of standard materials compared to those offering specialized services.

AF Gruppen faces significant supplier bargaining power when dealing with specialized construction materials and skilled labor shortages. In 2024, the scarcity of qualified professionals in the Norwegian and Swedish construction sectors, estimated to be in the tens of thousands, directly increased labor costs. Furthermore, the company's moderate switching costs with specialized suppliers, coupled with the threat of forward integration from niche service providers, further empower suppliers in price and term negotiations.

| Factor | Impact on AF Gruppen | 2024 Relevance |

|---|---|---|

| Specialized Materials/Tech | Limited suppliers grant pricing leverage | High demand for advanced environmental solutions |

| Skilled Labor Shortage | Upward pressure on wages and project costs | Tens of thousands of professionals needed in Scandinavia |

| Switching Costs | Incumbent suppliers retain leverage | Emphasis on supply chain resilience increases reliance on established relationships |

| Forward Integration Threat | Potential for competition from specialized service providers | Modular construction and advanced techniques offer integration opportunities |

What is included in the product

This analysis dissects the competitive forces impacting Af Gruppen, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Af Gruppen's market landscape.

Customers Bargaining Power

AF Gruppen's substantial involvement with public sector entities, including government agencies for major infrastructure undertakings, often grants these clients considerable bargaining power. These clients typically secure large projects via competitive bidding processes, which enables them to set terms, insist on advantageous pricing, and enforce rigorous quality and delivery schedules.

For instance, in 2023, AF Gruppen secured several significant public infrastructure contracts in Norway and Sweden, such as road and rail development projects. While these contracts represent substantial revenue streams, they also involve intense negotiation, with public sector clients frequently leveraging their scale to influence contract conditions and pricing, thereby impacting AF Gruppen's profit margins.

In residential development, particularly for individual buyers or smaller developers, price sensitivity is a significant factor. This is especially true when markets cool down or interest rates climb, directly impacting AF Gruppen's pricing power for new homes and commercial spaces.

For example, Sweden saw a notable drop in residential building permits in early 2024, suggesting buyers are becoming more cautious. This trend underscores how economic conditions can amplify customer price sensitivity, forcing developers to be more competitive.

If a few major clients account for a significant chunk of AF Gruppen's income, those key customers gain substantial leverage. They can use their purchasing volume to negotiate more favorable terms, request discounts, or demand tailored services, potentially impacting AF Gruppen's profitability.

AF Gruppen's broad range of services, including construction, civil engineering, and property development, helps to spread this risk. However, large-scale projects, such as major infrastructure developments or offshore contracts, frequently involve a smaller number of significant clients, thereby increasing their bargaining power.

Customer's Ability to Delay or Cancel Projects

Customers, particularly those in uncertain economic periods or facing their own financial challenges, can significantly impact AF Gruppen by delaying or canceling ongoing projects. This flexibility on their part can directly translate into higher expenses for AF Gruppen, stemming from underutilized resources and potential contractual penalties.

The broader economic environment and specific industry trends within Norway and Sweden play a crucial role in amplifying this customer power. For instance, a slowdown or contraction in key sectors, such as the Norwegian construction industry experiencing a downturn in 2024, can embolden customers to postpone or halt commitments, knowing that contractors like AF Gruppen may be more eager to retain business.

- Economic Uncertainty: In 2024, many sectors faced inflationary pressures and interest rate hikes, making project financing more challenging for clients.

- Sector-Specific Downturns: The Norwegian construction sector, a key market for AF Gruppen, saw a projected contraction in activity for 2024, increasing client leverage.

- Project Flexibility: Clients with significant project scope often retain contractual clauses allowing for delays or cancellations, especially in long-term infrastructure or property development.

Customer Access to Multiple Competitors

In the Norwegian and Swedish construction sectors, customers enjoy a wealth of options, with numerous competent contractors readily available. Major players like Skanska and Veidekke, alongside other established firms, present a competitive landscape. This abundance of choice significantly lowers the effort and cost for customers to switch between providers, thereby strengthening their negotiating position.

AF Gruppen operates within this environment where customers can easily compare offerings and secure more favorable terms. To maintain its client base, the company must consistently deliver exceptional value, superior quality, and unwavering reliability. For instance, in 2023, the Norwegian construction sector saw significant activity, with AF Gruppen reporting revenues of NOK 25.7 billion, underscoring the scale of operations and the need to differentiate in a crowded market.

- Customer Choice: Access to multiple competitors like Skanska and Veidekke in Norway and Sweden.

- Low Switching Costs: Customers can easily move between contractors, increasing their leverage.

- Negotiating Power: The wide array of choices empowers customers to demand better pricing and terms.

- AF Gruppen's Imperative: Continuous demonstration of superior value, quality, and reliability is crucial for client retention.

Customers of AF Gruppen, particularly large public sector clients and those in significant infrastructure projects, wield considerable bargaining power. This is due to their ability to leverage competitive bidding, negotiate terms, and enforce strict schedules, as seen in 2023 infrastructure contracts. Individual buyers, especially during economic slowdowns like the early 2024 dip in Swedish building permits, also exhibit high price sensitivity, impacting AF Gruppen's pricing flexibility.

The availability of numerous competent contractors in Norway and Sweden, including major players like Skanska and Veidekke, means customers face low switching costs and have ample choice. This competitive landscape empowers clients to demand better pricing and terms, making it imperative for AF Gruppen to consistently deliver superior value and reliability, as evidenced by their NOK 25.7 billion revenue in 2023.

| Factor | Impact on AF Gruppen | Example/Data Point |

|---|---|---|

| Public Sector Clients | High bargaining power through competitive tenders and large project scale. | 2023 infrastructure contracts in Norway and Sweden involved rigorous negotiation. |

| Individual Buyers/Developers | Price sensitivity amplified by economic conditions. | Early 2024 slowdown in Swedish residential building permits indicated increased buyer caution. |

| Customer Choice & Switching Costs | Low switching costs and abundant competitors strengthen customer leverage. | Presence of firms like Skanska and Veidekke in the Norwegian and Swedish markets. |

| Economic Environment | Downturns increase client willingness to delay or cancel projects. | Projected contraction in the Norwegian construction sector for 2024. |

Preview Before You Purchase

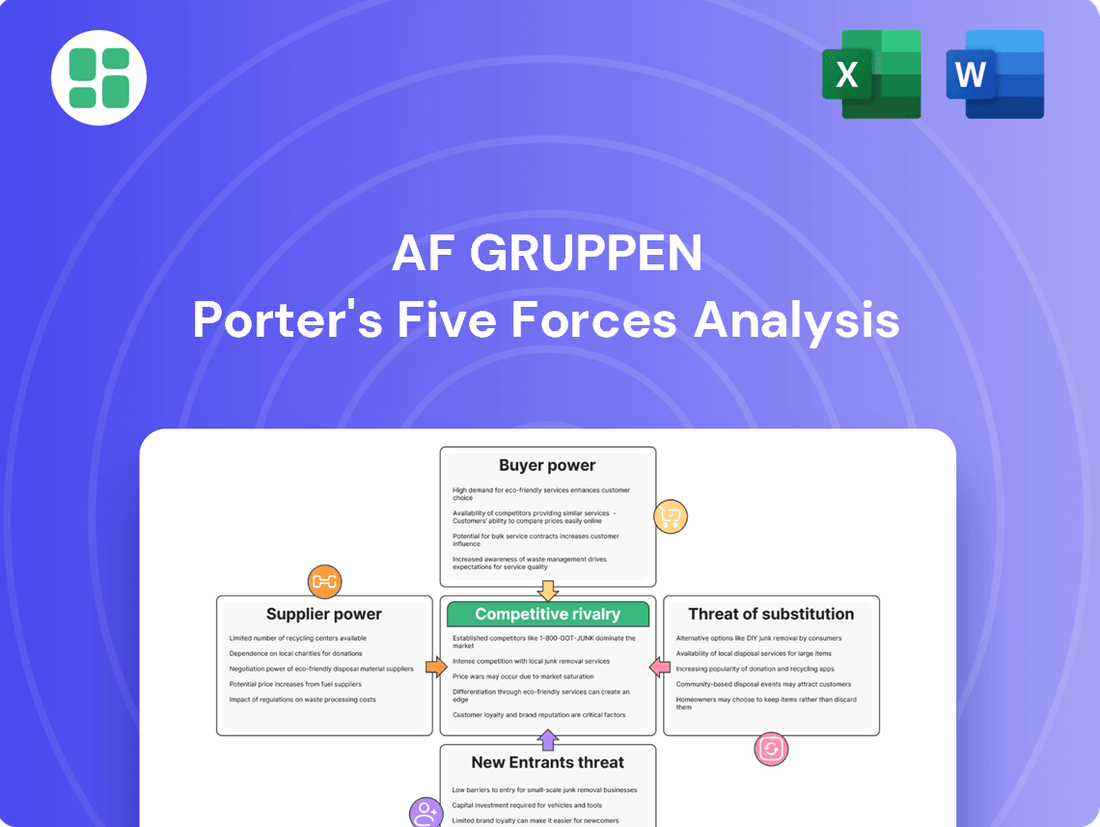

Af Gruppen Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Af Gruppen, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into Af Gruppen's strategic positioning within the construction and engineering sector.

Rivalry Among Competitors

AF Gruppen faces significant competitive pressure from established domestic and Nordic players like Veidekke and Skanska. These giants actively compete across construction, civil engineering, and property development in key markets such as Norway and Sweden.

The mature nature of the construction and property sectors intensifies this rivalry. Companies are constantly vying for major contracts and seeking to expand their market share, leading to tight margins and a need for constant innovation and efficiency.

For instance, in 2023, Veidekke reported revenues of NOK 41.6 billion, demonstrating its substantial scale and market presence, which directly challenges AF Gruppen's position.

The Norwegian construction market is projected to grow by 2% in 2025, with a stronger rebound expected from 2026 to 2029, averaging 3.5% annual growth. This steady expansion, however, is tempered by a more uncertain outlook in Sweden, which anticipates a decline in 2025 before a subsequent recovery.

Periods of slower market growth naturally intensify competitive rivalry. When the overall pie isn't expanding rapidly, companies must vie more aggressively for each available project, potentially leading to price wars and reduced profit margins.

While significant government investment in infrastructure and renewable energy projects presents substantial growth opportunities, these attractive prospects also serve to draw in a larger number of competitors, further escalating the intensity of rivalry within the sector.

The construction sector, where AF Gruppen operates, is inherently capital-intensive. High upfront investments in specialized equipment, such as cranes and tunneling machinery, along with the need for a skilled workforce and extensive operational infrastructure, contribute to substantial fixed costs. For instance, in 2024, major infrastructure projects often require hundreds of millions of dollars in initial capital outlay.

These significant fixed costs, coupled with the specialized nature of construction assets that have limited resale value outside the industry, erect formidable exit barriers. Companies are thus incentivized to continue operations, even when market conditions are unfavorable, to spread these fixed costs over a larger volume of work and avoid substantial losses on asset disposal.

This dynamic forces companies like AF Gruppen to maintain a competitive presence and bid aggressively to secure projects, ensuring their substantial overheads are covered. The need to utilize expensive assets prevents companies from easily exiting the market, intensifying rivalry among existing players.

Differentiation and Specialization

AF Gruppen's diverse offerings, including specialized offshore and environmental services, provide a degree of differentiation. However, in the highly competitive arenas of general construction and civil engineering, achieving distinctiveness is more challenging. Here, differentiation often hinges on established reputation, superior project management skills, and the adoption of advanced technologies like Building Information Modeling (BIM).

The company's competitive edge is significantly bolstered by its robust operational execution and adept project management capabilities. These strengths are crucial in navigating the complexities of large-scale projects and ensuring client satisfaction, which in turn reinforces its market position.

- Reputation and Track Record: AF Gruppen's history of successful project delivery is a key differentiator, particularly in securing large, complex contracts.

- Project Management Excellence: The company’s ability to manage projects efficiently, on time, and within budget is a critical competitive advantage.

- Technological Adoption: Implementing technologies like BIM enhances precision, reduces waste, and improves collaboration, setting AF Gruppen apart from less technologically advanced competitors.

- Specialized Services: Niche services in areas like offshore and environmental solutions create unique market positions and reduce direct competition in those segments.

Competitive Bidding and Price Competition

Competitive rivalry within the construction sector, particularly for AF Gruppen, often intensifies through aggressive bidding on both public and private tenders. This dynamic directly translates into considerable pressure on profit margins as companies vie for new projects.

AF Gruppen, while prioritizing profitability, must navigate this intense price competition to secure contracts and maintain its substantial order backlog. The need to win bids, even at tighter margins, is a strategic imperative in a market where securing work is paramount.

The impact of this competitive landscape is evident in AF Gruppen's financial performance. For the full year 2024, the company reported a profit margin of 3.5%. This figure underscores the challenging pricing environment and the constant balancing act between securing business and achieving desired profitability.

- Aggressive Bidding: Public and private tenders frequently see intense price competition among construction firms.

- Margin Pressure: The drive to secure contracts can lead to reduced profit margins for companies like AF Gruppen.

- Order Backlog Importance: Maintaining a strong order backlog necessitates participation in competitive bidding processes.

- 2024 Profitability: AF Gruppen's 3.5% profit margin for 2024 reflects the prevailing competitive pricing environment.

Competitive rivalry is a defining characteristic for AF Gruppen, fueled by a landscape populated by large, established Nordic competitors like Veidekke and Skanska. This intense competition is particularly evident in the construction and civil engineering sectors, where companies actively bid for major projects. The mature nature of these markets means that growth is often incremental, forcing players to aggressively pursue market share, which in turn compresses profit margins.

The drive to secure work, even at tighter margins, is a strategic necessity for companies like AF Gruppen to maintain their order backlogs and utilize significant fixed assets. This is underscored by AF Gruppen's reported profit margin of 3.5% for the full year 2024, a figure that illustrates the prevailing pricing pressures within the industry.

| Competitor | 2023 Revenue (NOK Billion) | Key Operating Areas |

|---|---|---|

| Veidekke | 41.6 | Construction, Civil Engineering, Property Development |

| Skanska | (Data not directly comparable for 2023 in NOK for this context) | Construction, Civil Engineering, Infrastructure Development |

SSubstitutes Threaten

The threat of substitutes in construction is evolving with the rise of alternative building techniques. Methods like modular construction and 3D printing are increasingly being explored, particularly for residential and certain commercial projects. For instance, the global 3D printing construction market was valued at approximately USD 0.5 billion in 2023 and is projected to grow significantly, demonstrating a clear shift in the industry.

While these innovative approaches offer potential benefits such as speed and reduced waste, they currently present a moderate threat to established players like AF Gruppen. Their impact is more pronounced in simpler, repetitive construction tasks rather than the large-scale, complex civil engineering and infrastructure projects that form a core part of AF Gruppen's business. The inherent complexities and regulatory hurdles in major infrastructure development still favor traditional, on-site construction methods for the foreseeable future.

Large clients, particularly in the industrial and public sectors, could potentially build or enhance their own construction and maintenance departments. This would naturally lessen their need for external firms such as AF Gruppen. However, this threat is more probable for straightforward maintenance tasks or less complex projects, rather than the large-scale, specialized endeavors AF Gruppen excels at.

The significant investment in capital and specialized knowledge needed for clients to develop these in-house capabilities acts as a substantial barrier. For instance, while a large manufacturing plant might handle routine upkeep, it's unlikely to possess the engineering expertise and equipment for a major new facility construction, a core AF Gruppen offering.

A societal or economic shift favoring extensive refurbishment and renovation of existing structures over new construction projects presents a potential substitute for AF Gruppen's core business. While AF Gruppen does participate in rehabilitation projects, a significant move in this direction could impact demand for their large-scale new construction, civil engineering, and property development services.

In 2024, the construction industry globally continued to see a split in focus. While new infrastructure projects remain vital, particularly in areas like renewable energy and transportation upgrades, there's also a growing emphasis on sustainable building practices, which often include retrofitting and upgrading existing properties. For instance, in the European Union, the Renovation Wave initiative aims to at least double renovation rates in the next decade, highlighting this trend.

Despite this trend, both Norway and Sweden, key markets for AF Gruppen, demonstrate persistent demand for new infrastructure and specific types of new builds. For example, Norway's ongoing investment in its coastal infrastructure and Sweden's continued need for housing and transportation network expansions in urban centers suggest that new construction will remain a significant market segment. AF Gruppen's 2024 performance, with reported revenues of NOK 27,223 million for the full year, indicates continued strength in their traditional new build and infrastructure segments.

Technological Advancements in Energy Solutions

Technological advancements in energy solutions present a significant threat of substitution for AF Gruppen. Innovations in renewable energy, such as more efficient solar panels or advanced battery storage, can directly replace the need for traditional energy infrastructure that AF Gruppen often builds. For instance, the global renewable energy capacity saw substantial growth, with solar PV alone adding over 300 GW in 2023, indicating a shift away from fossil fuel-based projects.

Furthermore, energy efficiency technologies can reduce overall energy demand, thereby decreasing the requirement for new energy construction projects. AF Gruppen's strategic focus on adapting to these changes is crucial, but the pace of disruptive technology adoption could rapidly alter market demand. Government mandates, like the EU's target to increase the share of renewables in final energy consumption to 42.5% by 2030, further accelerate this transition, potentially favoring new construction types over traditional ones.

- Rapid technological evolution in renewables: New, more efficient, and cost-effective renewable energy sources can substitute for traditional energy infrastructure.

- Energy efficiency gains: Reduced overall energy demand due to efficiency improvements lessens the need for new energy-related construction.

- Government policies and targets: Stricter regulations and ambitious renewable energy goals steer investment towards alternative energy solutions.

- Shifting consumer and industrial demand: A growing preference for cleaner energy sources directly impacts the market for conventional energy projects.

Non-Construction Solutions for Infrastructure Needs

The threat of substitutes for AF Gruppen's core construction business is evolving. For instance, advancements in digital communication and remote work technologies could potentially reduce the long-term demand for certain types of physical infrastructure, like extensive office buildings or new transportation links. Similarly, sophisticated traffic management systems, utilizing AI and real-time data, might lessen the immediate need for expanding road networks.

While these are often long-term and indirect threats, they underscore the importance of AF Gruppen maintaining agility and exploring diversification. For example, public sector investment trends are shifting; in 2024, global spending on digital infrastructure is projected to continue its upward trajectory, potentially drawing capital away from traditional physical construction projects.

- Digitalization Impact: Increased adoption of remote work and virtual collaboration tools can decrease demand for new office spaces and related transportation infrastructure.

- Smart City Solutions: Advanced traffic management and smart city technologies can optimize existing infrastructure, potentially delaying or reducing the need for new physical construction.

- Investment Diversion: Government and private sector investments in digital transformation may divert funds that would otherwise be allocated to traditional infrastructure development.

- AF Gruppen's Response: The company must remain adaptable, potentially expanding its services into areas like digital infrastructure integration or smart city technology deployment to counter these evolving threats.

The threat of substitutes for AF Gruppen is multifaceted, encompassing new construction technologies, shifts in energy infrastructure, and the impact of digitalization. While innovative building methods like modular construction are emerging, their current impact is limited to less complex projects, leaving large-scale civil engineering largely unaffected. The global 3D construction market, valued at approximately USD 0.5 billion in 2023, illustrates this nascent but growing area.

Entrants Threaten

The construction and civil engineering sectors, particularly for major undertakings like those AF Gruppen engages in, demand significant upfront capital. This includes substantial outlays for specialized machinery, advanced technology, and essential working capital to manage projects from inception to completion. For instance, in 2024, major infrastructure projects in Norway, AF Gruppen's primary market, often require billions of NOK in initial investment.

This considerable financial hurdle effectively acts as a deterrent for many aspiring new companies looking to enter the market. The sheer scale of investment needed to compete on projects of similar magnitude to those AF Gruppen handles makes it difficult for smaller or less capitalized firms to gain a foothold.

Consequently, established firms like AF Gruppen, which possess extensive asset bases and have already achieved economies of scale, are better positioned to absorb these high capital requirements. This existing infrastructure and operational efficiency further solidify their competitive advantage against potential new entrants.

AF Gruppen's established brand reputation, cultivated since 1985, presents a significant barrier to new entrants. Their deep-rooted client relationships, especially within the Norwegian public sector, foster loyalty and trust that newcomers would find incredibly difficult to replicate quickly.

The sheer difficulty for new firms to build comparable credibility and secure access to large-scale, intricate projects is substantial. In construction and infrastructure, a proven track record of quality and punctual delivery is not just important; it's often a prerequisite for winning bids, a hurdle AF Gruppen has cleared over decades.

The construction industry in Norway and Sweden is heavily regulated, with stringent environmental standards, building codes, and intricate permitting procedures. These complex requirements demand specialized knowledge and substantial financial investment, creating a significant hurdle for any new company looking to enter the market.

For instance, obtaining the necessary permits can be a lengthy and resource-intensive undertaking, potentially delaying project timelines and increasing initial costs for new entrants. This regulatory environment acts as a powerful deterrent, safeguarding established players like Af Gruppen.

Access to Skilled Workforce and Specialized Expertise

New entrants into the construction and civil engineering sector, particularly those aiming for complex projects like those AF Gruppen undertakes, grapple with securing a skilled workforce. The demand for specialized engineers, experienced project managers, and certified tradespeople often outstrips supply, making recruitment a significant hurdle for newcomers. This scarcity is a persistent issue in the industry, impacting project timelines and quality.

AF Gruppen benefits from its long-standing reputation and robust internal training academies, which cultivate and retain essential expertise. This established talent pipeline acts as a substantial barrier to entry, as new firms struggle to replicate the depth and breadth of skilled personnel. For instance, in 2024, the Norwegian construction sector continued to face a deficit in qualified personnel, with reports indicating a need for thousands of skilled workers across various trades.

- Talent Acquisition Difficulty: New competitors find it challenging to attract and onboard experienced professionals critical for large-scale infrastructure and offshore developments.

- AF Gruppen's Advantage: The company's investment in employee development and its strong employer brand facilitate the retention of specialized talent.

- Market Scarcity: The general shortage of skilled labor in the engineering and construction fields amplifies the difficulties faced by potential new entrants.

- Impact on Newcomers: This talent gap directly increases the cost and complexity for new firms attempting to establish a foothold in AF Gruppen's market segments.

Industry Consolidation and Acquisition Activity

The construction markets in Norway and Sweden are quite mature, which naturally pushes companies towards consolidation. Larger companies often buy out smaller ones, a strategy AF Gruppen itself employs. This activity significantly reduces the pool of independent smaller firms that might otherwise evolve into formidable new competitors.

This ongoing consolidation makes it considerably more challenging for entirely new companies to enter the market and achieve the necessary scale. For instance, AF Gruppen has been active in acquisitions; in 2023, they completed several strategic acquisitions, including the acquisition of the remaining shares in E.P. Installasjon AS, strengthening their position in the electrical installation sector.

- Industry Consolidation: Mature Norwegian and Swedish construction markets drive consolidation through mergers and acquisitions.

- AF Gruppen's Strategy: AF Gruppen actively participates in acquisitions, reducing the number of potential independent new entrants.

- Barriers to Entry: Consolidation raises barriers for new firms seeking to gain market share and achieve economies of scale.

- Impact on Competition: Fewer independent players mean less potential for disruptive new competition to emerge and challenge established firms.

The threat of new entrants for AF Gruppen is generally low due to significant capital requirements, established brand loyalty, and stringent regulatory hurdles in the Norwegian and Swedish construction sectors. High upfront investments for specialized equipment and technology, coupled with the need for extensive experience and a proven track record, create substantial barriers. Furthermore, AF Gruppen's strong reputation and existing client relationships, particularly with public entities, make it difficult for newcomers to gain immediate traction.

| Barrier Type | Description | Impact on New Entrants | AF Gruppen's Advantage |

|---|---|---|---|

| Capital Requirements | High investment in machinery, technology, and working capital for large projects. | Deters smaller, less-funded firms from entering. | Established asset base and economies of scale. |

| Brand Reputation & Relationships | Decades of proven delivery and deep client trust, especially in the public sector. | Difficult to replicate credibility and secure large contracts quickly. | Loyalty and established trust reduce the need for extensive sales efforts. |

| Regulatory Environment | Complex permits, environmental standards, and building codes require specialized knowledge. | Lengthy and costly compliance processes delay market entry. | Expertise in navigating and meeting regulatory demands. |

| Skilled Workforce Access | Scarcity of specialized engineers and experienced tradespeople. | Increased recruitment costs and potential project delays for new firms. | Internal training programs and strong employer brand for talent retention. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Af Gruppen leverages data from their annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from construction industry trade publications and relevant regulatory filings to provide a comprehensive view of the competitive landscape.