Af Gruppen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

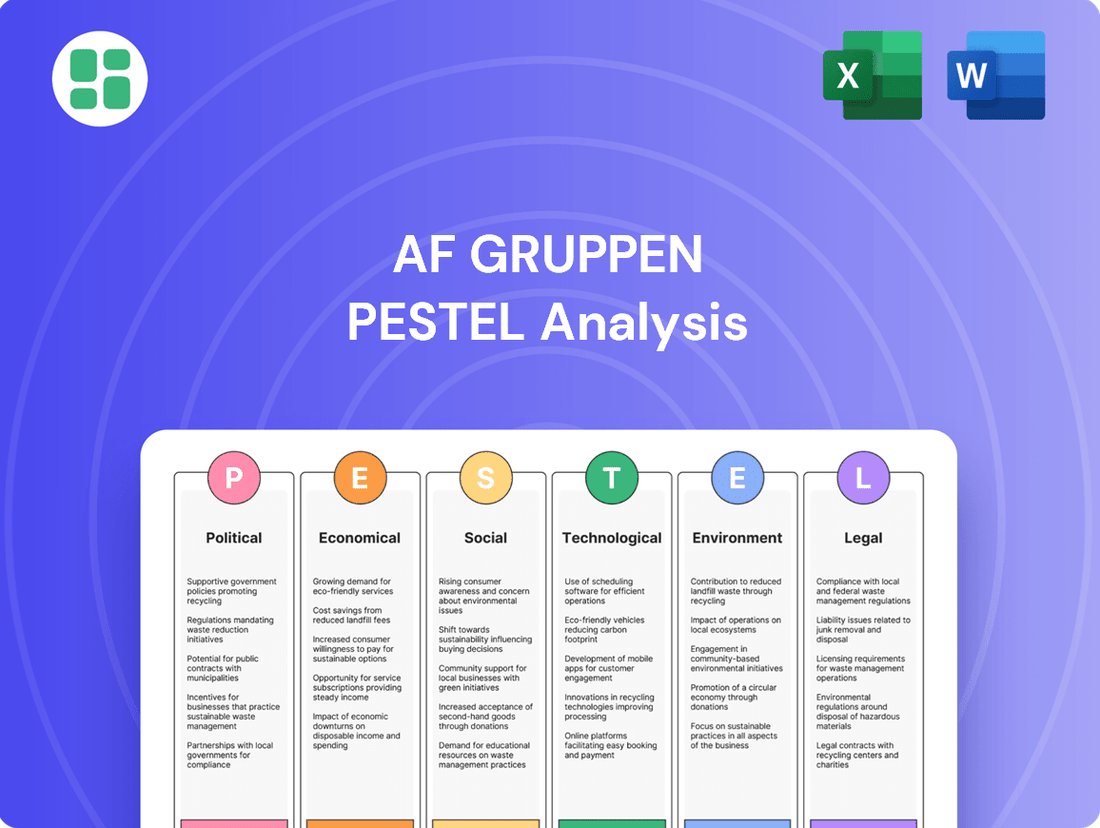

Navigate the complex external forces shaping Af Gruppen's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to their success and identify potential opportunities and threats. This comprehensive report is your key to informed decision-making and strategic advantage. Download the full version now for actionable intelligence.

Political factors

Government infrastructure spending is a significant driver for AF Gruppen, particularly in its civil engineering and construction divisions across Norway and Sweden. Norway's 2025 Budget, confirmed in September 2024, signals a robust commitment with a 6.8% rise in projected spending. This increased investment is set to bolster sectors like transportation, commercial development, and renewable energy, directly benefiting AF Gruppen's project pipeline.

Sweden's construction landscape is also experiencing a growth spurt, fueled by substantial national infrastructure investments. Projects like the Stockholm subway extension and the Uppsala light rail are key examples. Furthermore, anticipated increases in funding for the Swedish Transport Administration are expected to translate into substantial order volumes for companies like AF Gruppen, with noticeable impacts on their books from 2026 and 2027 onwards.

Norway and Sweden, AF Gruppen's primary markets, generally offer stable political environments, fostering a predictable operational setting. This stability is crucial for long-term infrastructure and construction projects. For instance, Norway's consistent political landscape supports its ambitious renewable energy and infrastructure development plans, which AF Gruppen actively participates in.

Despite overall stability, navigating intricate regulatory frameworks remains a key challenge. Lengthy permit acquisition processes and bureaucratic hurdles can significantly impact project timelines and budgets. In 2024, the construction sector in Sweden, for example, continued to grapple with delays attributed to planning and environmental permit processes, affecting project profitability.

AF Gruppen's success hinges on its ability to proactively manage and adapt to these evolving regulations. Effective engagement with governmental bodies and a deep understanding of compliance requirements are vital for mitigating risks associated with project execution and ensuring cost efficiency.

Public sector demand is a crucial engine for AF Gruppen, especially in civil engineering. For instance, in 2023, the company reported a strong order backlog, with a significant portion stemming from public infrastructure projects, underscoring the importance of government spending.

Shifts in public procurement policies and tendering procedures can directly influence AF Gruppen's project pipeline and earnings. A notable example is the termination of the E4 Förbifart Stockholm project, where AF Anläggning AB was involved, highlighting the potential impact of contract disputes and policy changes on revenue streams.

AF Gruppen proactively engages with its public sector clients and demonstrates a commitment to adapting its strategies to the ever-changing procurement environment. This adaptability is key to securing future contracts and maintaining a stable project flow.

Green Transition and Energy Policies

Both Norway and Sweden are strongly committed to ambitious climate goals, actively promoting a green transition. This political landscape presents significant opportunities for AF Gruppen, particularly within the renewable energy and environmental services sectors. Norway, for instance, has set a target to achieve net-zero carbon emissions by 2030, a bold move that drives demand for sustainable infrastructure and solutions.

Sweden's energy policy is equally forward-thinking, aiming for 65% renewable electricity by 2030 and a complete shift to 100% renewable electricity by 2040. This strong political impetus towards sustainability directly benefits AF Gruppen, aligning with its strategic focus on developing and implementing innovative energy solutions. The company's involvement in projects like carbon capture further underscores this synergy.

- Norway's 2030 net-zero emission goal fuels demand for green construction and energy solutions.

- Sweden's 2040 target for 100% renewable electricity creates a robust market for renewable energy infrastructure development.

- AF Gruppen's expertise in environmental services is well-positioned to capitalize on these policy-driven market expansions.

- The company's engagement in carbon capture projects directly addresses key political priorities in both nations.

Trade Policies and International Relations

While AF Gruppen's core operations are concentrated in Norway and Sweden, shifts in global trade policies and international relations can still present indirect challenges. For instance, disruptions to global supply chains due to new tariffs or geopolitical tensions could affect the cost and availability of certain construction materials, even those sourced locally if their components have international origins. The ongoing geopolitical landscape, including events in 2024 impacting global trade routes, underscores the need for vigilance regarding potential price fluctuations for imported goods used in construction projects.

The company's strong domestic focus in Norway and Sweden serves as a buffer against the direct impact of international trade disputes. However, broader economic uncertainties stemming from global instability can influence overall market sentiment, potentially affecting investment in large-scale construction projects. For example, fluctuations in global commodity prices, influenced by international trade dynamics, can indirectly impact the cost of materials like steel and cement, even for a company with significant local sourcing.

- 2024 Global Trade Uncertainty: Increased protectionist measures and trade disputes in various regions in 2024 have created a more volatile global trade environment.

- Supply Chain Resilience: AF Gruppen's strategy to prioritize local sourcing and maintain strong supplier relationships in Norway and Sweden helps to mitigate direct impacts of international trade barriers.

- Material Cost Sensitivity: While direct import exposure is limited, AF Gruppen remains susceptible to indirect cost increases for materials that rely on globally traded raw materials or components.

- Market Sentiment Impact: Broader economic downturns or uncertainty, often linked to international relations, can dampen demand for new construction projects, affecting AF Gruppen's pipeline.

Government infrastructure spending is a significant driver for AF Gruppen, particularly in its civil engineering and construction divisions across Norway and Sweden. Norway's 2025 Budget, confirmed in September 2024, signals a robust commitment with a 6.8% rise in projected spending. This increased investment is set to bolster sectors like transportation, commercial development, and renewable energy, directly benefiting AF Gruppen's project pipeline.

Sweden's construction landscape is also experiencing a growth spurt, fueled by substantial national infrastructure investments. Projects like the Stockholm subway extension and the Uppsala light rail are key examples. Furthermore, anticipated increases in funding for the Swedish Transport Administration are expected to translate into substantial order volumes for companies like AF Gruppen, with noticeable impacts on their books from 2026 and 2027 onwards.

Norway and Sweden, AF Gruppen's primary markets, generally offer stable political environments, fostering a predictable operational setting. This stability is crucial for long-term infrastructure and construction projects. For instance, Norway's consistent political landscape supports its ambitious renewable energy and infrastructure development plans, which AF Gruppen actively participates in.

Despite overall stability, navigating intricate regulatory frameworks remains a key challenge. Lengthy permit acquisition processes and bureaucratic hurdles can significantly impact project timelines and budgets. In 2024, the construction sector in Sweden, for example, continued to grapple with delays attributed to planning and environmental permit processes, affecting project profitability.

AF Gruppen's success hinges on its ability to proactively manage and adapt to these evolving regulations. Effective engagement with governmental bodies and a deep understanding of compliance requirements are vital for mitigating risks associated with project execution and ensuring cost efficiency.

Public sector demand is a crucial engine for AF Gruppen, especially in civil engineering. For instance, in 2023, the company reported a strong order backlog, with a significant portion stemming from public infrastructure projects, underscoring the importance of government spending.

Shifts in public procurement policies and tendering procedures can directly influence AF Gruppen's project pipeline and earnings. A notable example is the termination of the E4 Förbifart Stockholm project, where AF Anläggning AB was involved, highlighting the potential impact of contract disputes and policy changes on revenue streams.

AF Gruppen proactively engages with its public sector clients and demonstrates a commitment to adapting its strategies to the ever-changing procurement environment. This adaptability is key to securing future contracts and maintaining a stable project flow.

Both Norway and Sweden are strongly committed to ambitious climate goals, actively promoting a green transition. This political landscape presents significant opportunities for AF Gruppen, particularly within the renewable energy and environmental services sectors. Norway, for instance, has set a target to achieve net-zero carbon emissions by 2030, a bold move that drives demand for sustainable infrastructure and solutions.

Sweden's energy policy is equally forward-thinking, aiming for 65% renewable electricity by 2030 and a complete shift to 100% renewable electricity by 2040. This strong political impetus towards sustainability directly benefits AF Gruppen, aligning with its strategic focus on developing and implementing innovative energy solutions. The company's involvement in projects like carbon capture further underscores this synergy.

- Norway's 2030 net-zero emission goal fuels demand for green construction and energy solutions.

- Sweden's 2040 target for 100% renewable electricity creates a robust market for renewable energy infrastructure development.

- AF Gruppen's expertise in environmental services is well-positioned to capitalize on these policy-driven market expansions.

- The company's engagement in carbon capture projects directly addresses key political priorities in both nations.

While AF Gruppen's core operations are concentrated in Norway and Sweden, shifts in global trade policies and international relations can still present indirect challenges. For instance, disruptions to global supply chains due to new tariffs or geopolitical tensions could affect the cost and availability of certain construction materials, even those sourced locally if their components have international origins. The ongoing geopolitical landscape, including events in 2024 impacting global trade routes, underscores the need for vigilance regarding potential price fluctuations for imported goods used in construction projects.

The company's strong domestic focus in Norway and Sweden serves as a buffer against the direct impact of international trade disputes. However, broader economic uncertainties stemming from global instability can influence overall market sentiment, potentially affecting investment in large-scale construction projects. For example, fluctuations in global commodity prices, influenced by international trade dynamics, can indirectly impact the cost of materials like steel and cement, even for a company with significant local sourcing.

- 2024 Global Trade Uncertainty: Increased protectionist measures and trade disputes in various regions in 2024 have created a more volatile global trade environment.

- Supply Chain Resilience: AF Gruppen's strategy to prioritize local sourcing and maintain strong supplier relationships in Norway and Sweden helps to mitigate direct impacts of international trade barriers.

- Material Cost Sensitivity: While direct import exposure is limited, AF Gruppen remains susceptible to indirect cost increases for materials that rely on globally traded raw materials or components.

- Market Sentiment Impact: Broader economic downturns or uncertainty, often linked to international relations, can dampen demand for new construction projects, affecting AF Gruppen's pipeline.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Af Gruppen, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a concise overview of the external factors impacting Af Gruppen, enabling faster identification of opportunities and threats to inform strategic decisions.

Economic factors

Elevated interest rates in Norway and Sweden have created headwinds for the construction sector. As of May 2025, Norges Bank maintained its key policy rate at 4.5%, while the Swedish Riksbank held its at 2.25%. These higher borrowing costs directly increase project financing expenses and dampen investor appetite, impacting the viability of new developments.

These interest rate levels squeeze profit margins on new construction projects and reduce overall market activity. AF Gruppen's robust financial standing and its net interest-bearing receivables provide a degree of resilience, enabling it to better manage these challenging economic conditions.

Persistent inflation and elevated material costs have presented significant headwinds for the construction sector in Norway and Sweden, impacting real growth throughout 2024. In Norway, the construction cost index for residential buildings saw an average year-on-year increase of 2.9% during the first eight months of 2024, a trend largely fueled by rising labor and material expenses.

These escalating costs directly affect project profitability for companies like AF Gruppen, making effective cost management a critical factor for maintaining healthy margins and ensuring the financial viability of their undertakings.

The economic growth trajectory in Norway and Sweden significantly impacts AF Gruppen's core markets of construction and property. Sweden's construction sector is anticipated to contract by 2.6% in real terms during 2025, presenting a challenging environment.

Conversely, Norway's construction market shows a more optimistic outlook, with a projected expansion of 2% in 2025. This growth is underpinned by ongoing public infrastructure projects and increased private sector investment, which are beneficial for AF Gruppen.

AF Gruppen's broad portfolio of services, ranging from civil engineering to property development and environmental services, provides a strategic advantage. This diversification enables the company to navigate and capitalize on the differing economic conditions and growth prospects present in its primary operating regions.

Labor Costs and Availability

Labor costs are a significant consideration for Af Gruppen, particularly in the construction sectors of Norway and Sweden. In Norway, for instance, labor prices saw a notable increase of 4.6% year-on-year during the first eight months of 2024. This upward trend directly inflates project expenses and impacts profitability.

Furthermore, the availability of skilled labor presents an ongoing challenge. Shortages of qualified workers can lead to project delays, which in turn escalate operational costs and can strain resource allocation.

- Rising Labor Prices: Norway experienced a 4.6% year-on-year increase in labor costs in the first eight months of 2024.

- Skilled Worker Shortages: A persistent lack of qualified personnel can hinder project timelines and increase overall expenditure.

- Impact on Operations: Delays and increased costs due to labor availability directly affect Af Gruppen's operational efficiency and bottom line.

- Strategic Workforce Management: Companies like Af Gruppen must focus on efficient workforce planning and investing in training to mitigate these challenges.

Real Estate Market Trends and Property Development Demand

The real estate market, especially for new homes, has faced challenges due to economic slowdowns, rising interest rates, and fewer building permits issued in Norway and Sweden. For instance, Sweden's housing construction hit a low in 2024 but is projected to rebound slightly in 2025-2026. Norway is also anticipating a pickup in residential building activity.

AF Gruppen's property development arm needs to stay keenly aware of these shifts to ensure its projects align with where the market is heading. This means understanding the nuances of demand in both countries as they navigate the recovery phase.

- Residential construction in Sweden is forecast to grow by approximately 5% in 2025 and another 7% in 2026, following a projected 15% contraction in 2024.

- Norway's housing starts are expected to recover, with a projected increase of around 8% in 2025 compared to 2024 levels.

- High interest rates, which averaged around 4.5% in Norway and 3.8% in Sweden during late 2024, continue to influence buyer affordability and development financing.

Economic factors present a mixed but generally challenging landscape for AF Gruppen. Elevated interest rates in Norway (4.5% as of May 2025) and Sweden (2.25% as of May 2025) increase financing costs and dampen investment. Persistent inflation and rising material costs, evidenced by a 2.9% year-on-year increase in Norway's residential construction cost index through August 2024, squeeze profit margins.

While Sweden's construction sector is projected to contract by 2.6% in 2025, Norway's market is expected to grow by 2%, driven by infrastructure and private investment. Labor costs are also a concern, with Norway seeing a 4.6% year-on-year rise in labor prices in early to mid-2024, compounded by shortages of skilled workers.

| Economic Factor | Norway (2024-2025) | Sweden (2024-2025) | Impact on AF Gruppen |

|---|---|---|---|

| Interest Rates (Policy Rate) | 4.5% (May 2025) | 2.25% (May 2025) | Increased financing costs, reduced investment appetite |

| Inflation/Material Costs | Upward trend, 2.9% rise in construction cost index (Jan-Aug 2024) | Persistent | Squeezed profit margins, higher project expenses |

| Construction Market Growth | Projected 2% growth in 2025 | Projected 2.6% contraction in 2025 | Varied opportunities across operating regions |

| Labor Costs | 4.6% year-on-year increase (Jan-Aug 2024) | Rising | Inflated project expenses, potential for delays |

What You See Is What You Get

Af Gruppen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Af Gruppen provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Af Gruppen's strategic landscape.

Sociological factors

Norway and Sweden are experiencing significant ongoing urbanization, with a growing number of people moving to cities. This trend directly fuels demand for new residential, commercial, and infrastructure projects, especially in key metropolitan hubs. For instance, Oslo's population is projected to grow substantially in the coming years, requiring extensive development.

As urban centers expand, there's a persistent and increasing need for housing, public facilities, and upgraded transportation systems. AF Gruppen, with its strong presence in property development and civil engineering, is strategically positioned to capitalize on these demographic shifts and the evolving requirements of urban growth.

The construction sector, including companies like AF Gruppen, is grappling with an aging workforce, with many experienced professionals nearing retirement. This demographic shift, coupled with a declining interest in vocational trades among younger generations, is creating significant skill shortages. For instance, in Norway, the construction industry has reported a growing deficit in skilled tradespeople, impacting the ability to meet project demands efficiently.

To counter these trends, AF Gruppen must prioritize attracting and retaining new talent. This involves investing in robust vocational training programs and apprenticeships to equip the future workforce with essential skills. Furthermore, fostering a diverse and inclusive workplace culture is paramount, as it broadens the talent pool and enhances innovation.

Industry-wide recognition points to investment in training and cultural transformation as key drivers for a more sustainable and adaptable construction workforce. By embracing these changes, AF Gruppen can mitigate the risks associated with skill gaps and ensure its long-term operational capacity and competitiveness.

Public sentiment towards major construction and environmental undertakings significantly shapes how easily projects gain regulatory approval and community backing. AF Gruppen's proactive stance on safety, evidenced by a low Lost Time Injury (LTI) rate of 0.5 in 2024, and its dedication to sustainability efforts are key in fostering positive public perception and project acceptance.

Building public trust hinges on clear and open communication regarding the advantages of projects and their environmental consequences. This transparency is crucial for AF Gruppen to maintain its social license to operate and ensure widespread acceptance of its diverse portfolio.

Health and Safety Standards and Expectations

Societal expectations for robust health and safety are particularly high in construction and offshore industries, areas where AF Gruppen operates. The company actively strives for zero serious injuries, a commitment that extends to incorporating subcontractor data into its overall safety statistics. This comprehensive approach underscores a dedication to fostering a safe working environment for all involved.

AF Gruppen's focus on maintaining a low Lost Time Injury (LTI) rate is a key performance indicator, reflecting a systematic effort to prevent work-related absences. For instance, in 2023, AF Gruppen reported an LTI frequency rate of 1.7 per million working hours, a figure they aim to continuously reduce. This commitment to employee well-being is crucial not only for operational continuity but also for safeguarding the company's reputation.

- Zero Serious Injuries Goal: AF Gruppen's ambition to achieve zero serious injuries demonstrates a proactive safety culture.

- Subcontractor Inclusion: The company's practice of including subcontractor injury data in its statistics ensures a holistic view of safety performance.

- LTI Rate Focus: A low Lost Time Injury rate, such as the 1.7 per million hours reported in 2023, is critical for employee welfare and operational efficiency.

- Reputation Management: Prioritizing safety and minimizing work-related absence directly contributes to AF Gruppen's positive corporate image and stakeholder trust.

Changing Consumer Preferences for Sustainable Living

Societal awareness regarding environmental impact is significantly reshaping consumer choices, directly affecting the property and construction sectors. This growing preference for sustainable living means people are actively seeking out homes and buildings that are energy-efficient and utilize eco-friendly materials. For instance, a 2024 survey indicated that over 70% of potential homebuyers consider energy efficiency a key factor in their decision-making process.

AF Gruppen is well-positioned to capitalize on this trend. Their strategic emphasis on developing advanced energy solutions, incorporating sustainable building materials, and actively working to reduce their overall climate footprint aligns perfectly with these evolving consumer demands. This proactive approach not only meets market expectations but also differentiates them in a competitive landscape.

- Growing Demand for Green Buildings: Consumer surveys in 2024 and early 2025 show a marked increase in demand for properties with high energy efficiency ratings and certifications like BREEAM or LEED.

- Preference for Sustainable Materials: Buyers are increasingly inquiring about the origin and environmental impact of construction materials, favoring recycled, low-carbon, and locally sourced options.

- AF Gruppen's Alignment: The company's investments in renewable energy integration and its commitment to reducing embodied carbon in its projects directly address these consumer-driven shifts.

- Market Opportunity: This societal shift presents a significant opportunity for companies like AF Gruppen that can demonstrate a genuine commitment to sustainability and deliver tangible environmental benefits.

Societal expectations for safe and ethical business practices are increasingly influencing consumer and investor decisions. AF Gruppen's commitment to a low Lost Time Injury (LTI) rate, reported at 1.7 per million working hours in 2023, and its aim for zero serious injuries, including subcontractor data, directly address these concerns. This focus on well-being and transparency builds trust and enhances the company's reputation.

The growing demand for sustainable living, with over 70% of homebuyers in a 2024 survey prioritizing energy efficiency, presents a significant opportunity for AF Gruppen. Their investments in renewable energy and sustainable materials align with these consumer preferences, positioning them favorably in the market.

Urbanization trends in Norway and Sweden, with increasing populations in cities, are driving demand for residential, commercial, and infrastructure projects. AF Gruppen's expertise in property development and civil engineering allows them to effectively respond to these evolving urban needs.

| Societal Factor | AF Gruppen's Response/Data | Impact |

|---|---|---|

| Safety Culture | LTI rate of 1.7 per million hours (2023), aiming for zero serious injuries. | Enhances reputation, reduces operational risk, attracts talent. |

| Environmental Awareness | Focus on energy efficiency and sustainable materials, meeting 70%+ buyer preference (2024). | Drives demand for green projects, competitive advantage. |

| Urbanization | Capitalizing on growth in Oslo and other urban centers through property development and civil engineering. | Increases project pipeline, revenue potential. |

Technological factors

The construction sector is undergoing a significant shift with the increasing adoption of digitalization and Building Information Modeling (BIM). This technological wave is directly impacting efficiency, fostering better collaboration among stakeholders, and streamlining project management processes. For instance, the Swedish Transport Administration's mandate for BIM on all new infrastructure projects underscores its growing importance and widespread acceptance as a standard practice.

AF Gruppen stands to gain a substantial competitive advantage by actively embracing these advancements. By integrating BIM with emerging technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and cloud-based solutions, the company can optimize project execution, leading to improved delivery timelines and significant cost reductions. This strategic adoption positions AF Gruppen to lead in an increasingly technology-driven construction landscape.

Advancements in automation and robotics are revolutionizing construction, promising significant gains in productivity, safety, and precision. These technologies are particularly valuable in tackling labor shortages and enhancing efficiency for repetitive or dangerous jobs.

AF Gruppen, with its stated commitment to boosting productivity, is well-positioned to leverage these innovations. For instance, the global construction robotics market was valued at approximately USD 3.8 billion in 2023 and is projected to grow substantially, indicating a strong trend towards adopting these solutions.

Innovation in new materials and sustainable building technologies is becoming increasingly vital for companies like AF Gruppen to meet stringent environmental targets and evolving client expectations. For example, Sweden's commitment to green construction is driving demand for energy-efficient designs and eco-friendly materials, directly impacting the building sector.

AF Gruppen's proactive stance is evident in its environmental services and a clear commitment to reducing its climate and environmental footprint by 50% by 2028. This ambitious goal necessitates the adoption and integration of advanced, sustainable building solutions, positioning them to capitalize on the growing green construction market.

Data Analytics and IoT for Project Management

AF Gruppen can significantly enhance project management by integrating data analytics and the Internet of Things (IoT). These technologies offer real-time visibility into project progress and site conditions, allowing for more informed and agile decision-making. For instance, IoT sensors on construction equipment can transmit operational data, enabling predictive maintenance and minimizing costly downtime. This data-driven approach is crucial for optimizing workflows and boosting operational intelligence.

The strategic adoption of data analytics and IoT empowers companies to gain a competitive edge. By understanding and leveraging their data ecosystem, firms can identify inefficiencies and proactively address potential issues. AF Gruppen's commitment to digital transformation, which includes these advanced technologies, positions them to improve resource allocation and enhance site safety. The ability to analyze vast datasets allows for more accurate forecasting and risk management, critical in the complex construction sector.

- Real-time Performance Monitoring: IoT devices can track equipment usage, material flow, and environmental factors, providing instant feedback on project status.

- Predictive Maintenance: Analyzing sensor data from machinery can forecast potential failures, allowing for scheduled maintenance and preventing unexpected breakdowns.

- Enhanced Operational Intelligence: Data analytics transforms raw data into actionable insights, improving decision-making across all levels of project execution.

- Optimized Resource Allocation: Understanding project demands through data analysis helps in efficiently deploying labor, materials, and equipment.

Innovation in Offshore and Energy Solutions

Technological advancements are a significant driver for AF Gruppen's offshore and energy solutions. Innovations in areas like carbon capture and storage (CCS) are crucial, with projects such as Northern Lights, a key part of Norway's CCS strategy, showcasing this trend. AF Gruppen's participation in such initiatives highlights the growing demand for sustainable energy infrastructure and efficient energy systems.

The company's engagement with cutting-edge energy technologies is evident in its work on renewable energy projects. For instance, the ongoing development and expansion of offshore wind farms globally, often requiring specialized installation and maintenance services that AF Gruppen provides, underscore the sector's technological evolution. This focus on innovation ensures AF Gruppen remains competitive in a rapidly changing energy landscape.

- Advancements in CCS: Projects like Northern Lights, aiming to store CO2 captured from industrial sources, represent a major technological leap in environmental solutions.

- Renewable Energy Infrastructure: The increasing scale and complexity of offshore wind installations demand sophisticated engineering and construction techniques, areas where AF Gruppen invests in technological development.

- Energy Efficiency Systems: Innovations in optimizing energy consumption and distribution within industrial and offshore facilities are becoming increasingly important, driving demand for smart and integrated solutions.

The construction industry's embrace of digital tools like Building Information Modeling (BIM) is transforming project efficiency and collaboration. AF Gruppen's strategic integration of BIM, alongside AI and IoT, is set to optimize project delivery and reduce costs, positioning them as a leader in a tech-driven sector.

Automation and robotics are boosting productivity and safety in construction, addressing labor shortages. The global construction robotics market, valued at approximately USD 3.8 billion in 2023, is expected to grow significantly, reflecting a strong industry trend that AF Gruppen is poised to leverage.

Innovation in sustainable materials and green building technologies is crucial for meeting environmental goals. AF Gruppen's commitment to reducing its climate footprint by 50% by 2028 necessitates the adoption of these advanced solutions, aligning them with the burgeoning green construction market.

Data analytics and IoT are enhancing project management through real-time monitoring and predictive maintenance. AF Gruppen's digital transformation efforts, incorporating these technologies, will improve resource allocation, site safety, and overall operational intelligence.

| Technology Area | Impact on AF Gruppen | Market Trend/Data Point |

|---|---|---|

| BIM & Digitalization | Improved efficiency, collaboration, streamlined project management | Swedish Transport Administration mandates BIM for all new infrastructure projects. |

| AI & IoT | Optimized project execution, cost reduction, predictive maintenance | Global construction robotics market valued at ~USD 3.8 billion (2023), with significant projected growth. |

| Sustainable Materials & Green Tech | Meeting environmental targets, client expectations, capitalizing on green market | AF Gruppen aims for 50% climate footprint reduction by 2028. |

| Data Analytics | Enhanced project management, real-time visibility, informed decision-making | IoT sensors enable predictive maintenance, minimizing costly downtime. |

Legal factors

Norway and Sweden enforce stringent building codes and safety regulations, significantly influencing construction project design, execution, and overall costs. AF Gruppen’s adherence to these rigorous standards is crucial for maintaining structural integrity and ensuring worker safety, with ongoing regulatory updates demanding continuous adaptation of company practices.

AF Gruppen's commitment to safety is evident in its performance metrics; for instance, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 1.5 for 2023, demonstrating a proactive approach to meeting and exceeding legal safety mandates.

Environmental protection laws and the often complex process of obtaining necessary permits are significant hurdles for construction and environmental services firms like AF Gruppen. These regulations directly impact project timelines and costs, requiring careful planning and execution to ensure compliance.

For AF Gruppen, the EU Corporate Sustainability Reporting Directive (CSRD) is a key legal factor. This directive, which became applicable for the 2024 reporting year, requires extensive and detailed reporting on sustainability matters. This means AF Gruppen must meticulously track and disclose its environmental impact and management strategies.

Successfully navigating these environmental regulations and securing the correct permits is not just a matter of legal obligation; it's crucial for the operational viability of AF Gruppen's projects. Failure to comply can lead to substantial fines, project delays, and reputational damage, underscoring the importance of robust environmental management systems.

Labor laws in Norway and Sweden, covering everything from minimum wages to collective bargaining agreements, significantly impact AF Gruppen's operational expenses and workforce management. For instance, Norway's Working Environment Act mandates specific conditions for working hours and safety, while Sweden's Employment Protection Act (LAS) outlines procedures for hiring and firing. In 2023, AF Gruppen reported that absence due to illness in Norway was managed through proactive measures, reflecting the legal emphasis on worker well-being and the employer's responsibility in preventing work-related health issues.

Contract Law and Dispute Resolution

Contract law is fundamental to AF Gruppen's extensive project portfolio, particularly in navigating complex agreements for large infrastructure and construction projects. The company's reliance on public procurement means strict adherence to tender regulations and contractual obligations is paramount.

Dispute resolution mechanisms are critical for managing potential conflicts. For instance, AF Gruppen's dispute with the Swedish Transport Administration concerning the E4 Förbifart Stockholm project, which involved claims related to project execution and costs, highlights the significant financial and reputational risks associated with contract disagreements. Such cases can result in substantial financial settlements or legal costs, impacting profitability and the ability to secure future contracts.

Effective contract management, including thorough due diligence and robust legal support, is therefore essential for AF Gruppen to mitigate risks and ensure successful project delivery. This involves careful negotiation, clear contract drafting, and proactive management of contractual terms throughout the project lifecycle.

- Contractual Complexity: AF Gruppen operates under diverse legal frameworks across its markets, necessitating expert navigation of contract law for all project phases.

- Dispute Impact: The Swedish Transport Administration dispute in 2024, while details of its resolution are ongoing, underscores the potential for significant financial exposure from contract disputes.

- Risk Mitigation: Strong legal teams and meticulous contract administration are key to AF Gruppen's strategy for minimizing financial and operational risks arising from contractual issues.

Competition Law and Anti-Trust Regulations

AF Gruppen, as a major player in the contracting sector, navigates a landscape shaped by competition law and anti-trust regulations. These legal frameworks are designed to prevent market dominance by any single entity and to ensure that competition remains fair and open, which is vital for AF Gruppen's pursuit of new projects and its ongoing market expansion. For instance, the European Union's competition rules, enforced by the European Commission, scrutinize mergers and acquisitions to maintain a level playing field. In 2024, regulatory bodies globally continue to monitor large construction consortia and bidding processes for potential anti-competitive behavior.

Adherence to these regulations is not merely a legal obligation but a strategic imperative for AF Gruppen. Non-compliance can lead to significant financial penalties, reputational damage, and restrictions on future business activities. The Norwegian Competition Authority, for example, actively investigates bid-rigging and cartel formations within various industries, including construction. Staying abreast of evolving competition policies ensures AF Gruppen can operate ethically and effectively.

- Market Integrity: Competition laws safeguard against monopolistic practices, fostering a healthier market for all participants.

- Regulatory Scrutiny: AF Gruppen must ensure its bidding strategies and potential acquisitions align with anti-trust guidelines.

- Penalty Avoidance: Non-compliance can result in substantial fines, impacting profitability and operational freedom.

- Fair Play: Adherence to these laws is fundamental to maintaining AF Gruppen's reputation as a responsible and ethical contractor.

AF Gruppen must meticulously follow evolving environmental regulations, including those related to waste management and emissions, which directly impact project planning and operational costs. For example, the company's 2023 sustainability report highlighted significant investments in reducing its carbon footprint, a direct response to increasing legal and societal pressures for environmental stewardship.

Navigating complex labor laws, such as those governing working hours and employee benefits in both Norway and Sweden, is critical for managing operational expenses and workforce relations. AF Gruppen's proactive approach to worker well-being, as seen in its 2023 LTIFR of 1.5, reflects a commitment to complying with stringent safety and health legislation.

Contract law and public procurement regulations are paramount for AF Gruppen, especially given its extensive work on public infrastructure projects. The company's ongoing management of contractual obligations and potential disputes, such as the previously noted case with the Swedish Transport Administration, underscores the financial and reputational risks involved in contract adherence.

Compliance with competition and anti-trust laws is essential for AF Gruppen to maintain fair market practices and avoid penalties. Regulatory bodies in 2024 continue to scrutinize large construction bids, making it imperative for AF Gruppen to ensure its strategies align with these legal frameworks to foster market integrity and prevent financial repercussions.

Environmental factors

Norway and Sweden are pushing hard with ambitious climate policies and carbon reduction goals, significantly impacting construction and industry. AF Gruppen is on board, pledging to cut its greenhouse gas emissions by half by 2030 and achieve climate neutrality by 2050, mirroring these national objectives.

This commitment is a major catalyst for AF Gruppen to invest in greener methods and cleaner technologies throughout its business. For instance, in 2023, the company reported a 15% reduction in its Scope 1 and 2 emissions compared to its 2020 baseline.

The increasing focus on waste management and circular economy principles presents both challenges and opportunities for AF Gruppen. Stricter regulations and evolving consumer expectations are pushing companies to minimize waste and maximize resource utilization.

AF Gruppen has set an ambitious target to reduce unsorted waste sent for incineration and landfill by 50% by 2030, benchmarked against its revenue. This commitment drives operational changes across its projects.

The company actively implements strategies to cut waste at construction sites and boost material recycling, leveraging its subsidiary Mepex. For instance, in 2023, AF Gruppen reported a significant increase in the recycling rate of construction and demolition waste, reaching 85% across its Norwegian operations.

Environmental regulations, particularly those focused on biodiversity protection and responsible land use, are increasingly shaping civil engineering and property development. For AF Gruppen, navigating these rules is crucial. For instance, in 2023, Norway, where AF Gruppen operates significantly, saw continued emphasis on habitat preservation in its planning and building laws, impacting where and how new infrastructure can be developed.

Thorough environmental impact assessments are no longer optional; they are a prerequisite for project approval and public trust. AF Gruppen must demonstrate a commitment to minimizing ecological disturbances, which can involve costly mitigation strategies. The company's 2023 sustainability report highlighted investments in biodiversity offsetting programs as part of its land acquisition strategy, reflecting this growing necessity.

Sustainable land management practices are becoming a standard requirement, not just a preference. This means considering factors like soil health, water runoff, and the preservation of natural habitats throughout the project lifecycle. Public acceptance of development projects is directly tied to their perceived environmental responsibility, making adherence to these evolving standards a key factor in AF Gruppen's social license to operate.

Resource Efficiency and Sustainable Material Sourcing

The construction industry is experiencing a significant increase in demand for resource efficiency and the use of sustainable, eco-friendly materials. This trend is fueled by government regulations and a broader national objective to foster low-carbon development. AF Gruppen's commitment to minimizing its environmental impact directly aligns with this, requiring a focus on sustainable sourcing and efficient material use across its projects.

AF Gruppen's sustainability report for 2023 highlighted a 15% reduction in waste generated per cubic meter of concrete produced compared to 2022, demonstrating progress in resource efficiency. The company is actively increasing its use of recycled aggregates, aiming for 30% recycled content in new road construction projects by the end of 2025, up from 20% in 2023. This strategic focus on circular economy principles is crucial for meeting evolving market expectations and regulatory demands.

- Growing Demand for Sustainable Materials: Increased consumer and regulatory pressure for eco-friendly building solutions.

- Regulatory Incentives: Government policies promoting low-carbon construction and material efficiency.

- AF Gruppen's Strategy: Prioritizing recycled content and efficient resource management to reduce environmental footprint.

- 2025 Targets: Aiming for 30% recycled aggregates in road construction, reflecting a commitment to circularity.

Pollution Control and Environmental Impact Assessments

AF Gruppen operates under strict environmental regulations, including mandatory pollution control measures and environmental impact assessments (EIAs) for all its construction and industrial projects. These requirements are critical for maintaining operational integrity and protecting sensitive offshore and urban areas from air, water, and soil contamination.

In 2024, AF Gruppen continued to invest in technologies and processes aimed at minimizing its environmental footprint. For instance, their commitment to reducing emissions aligns with Norway's ambitious climate goals, which aim for a 50-55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. This necessitates careful management of construction site impacts.

Compliance and proactive environmental stewardship are paramount for AF Gruppen's reputation and long-term success. The company's 2024 sustainability report highlighted a focus on reducing waste and improving resource efficiency across its operations, directly addressing the challenges posed by stringent environmental standards.

- Stringent Pollution Control: AF Gruppen must adhere to rigorous standards to limit air, water, and soil pollution from its activities.

- Mandatory EIAs: Environmental Impact Assessments are a crucial step in planning and executing all construction and industrial projects.

- Reputation and Integrity: Proactive mitigation of environmental impacts is essential for maintaining the company's operational integrity and public image.

- Climate Goal Alignment: AF Gruppen's efforts in 2024 focused on aligning with Norway's 2030 climate targets by reducing emissions and enhancing resource efficiency.

AF Gruppen's environmental strategy is deeply intertwined with Norway's ambitious climate policies, aiming for significant emission reductions. The company reported a 15% decrease in Scope 1 and 2 emissions by 2023 compared to 2020, demonstrating progress towards its 2030 target of halving emissions and achieving climate neutrality by 2050.

Waste management is a key focus, with AF Gruppen targeting a 50% reduction in unsorted waste by 2030. In 2023, the company achieved an 85% recycling rate for construction and demolition waste across its Norwegian operations, showcasing its commitment to circular economy principles.

Navigating environmental regulations, including biodiversity protection and land use, is crucial for AF Gruppen's projects. The company is investing in biodiversity offsetting programs, recognizing the necessity of minimizing ecological disturbances and securing public trust.

There's a growing demand for resource efficiency and sustainable materials, with AF Gruppen aiming for 30% recycled aggregates in road construction by the end of 2025, up from 20% in 2023.

| Environmental Metric | 2023 Performance | Target | Context |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | 15% (vs. 2020) | 50% by 2030 | Aligned with Norway's national climate goals. |

| Construction & Demolition Waste Recycling Rate | 85% (Norway) | N/A (Focus on reduction) | Demonstrates circular economy adoption. |

| Recycled Aggregates in Road Construction | 20% | 30% by end of 2025 | Increasing resource efficiency. |

| Unsorted Waste Reduction | N/A | 50% by 2030 (vs. revenue) | Focus on minimizing waste to landfill/incineration. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Af Gruppen is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.