Af Gruppen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

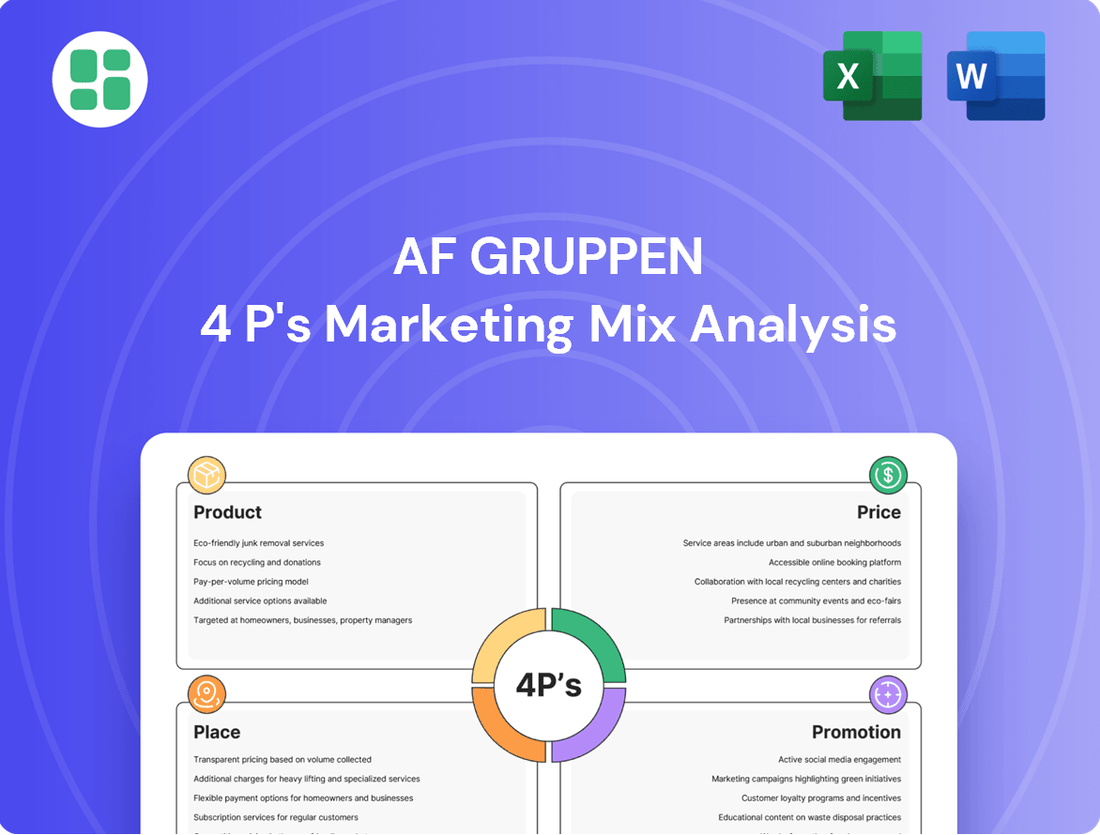

Af Gruppen's marketing success is built on a robust 4Ps strategy, from their diverse product portfolio to their strategic pricing and widespread distribution. Understanding how they leverage promotion to connect with their target audience reveals key insights into their market dominance.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis for Af Gruppen, covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights into a market leader.

Product

AF Gruppen's comprehensive construction services cover the entire project lifecycle, from initial planning and design to final execution and renovation. This extensive offering includes major infrastructure, commercial, and public building projects, showcasing their adaptability to varied client requirements.

Their capabilities extend to highly complex projects, such as the construction of new hospitals and significant motorway developments. For instance, in 2023, AF Gruppen reported a total revenue of NOK 27,473 million, with a substantial portion attributed to their diverse construction activities across various sectors.

Af Gruppen is a major player in property development, with a strong presence in both Norway and Sweden. Their portfolio includes a wide range of residential and commercial projects, demonstrating their broad capabilities in the real estate sector.

A significant area of expertise for Af Gruppen is building renewal. This involves complex projects like converting large commercial spaces and undertaking combination efforts that include demolition, rehabilitation, and new construction, highlighting their skill in breathing new life into existing properties.

In 2023, Af Gruppen reported a revenue of NOK 26.8 billion, with a substantial portion attributed to their property development and construction segments. Their focus on renewal projects is a strategic advantage, allowing them to capitalize on urban regeneration trends and the demand for sustainable development.

AF Gruppen's Civil Engineering division is a cornerstone of their operations, consistently securing significant contracts for critical infrastructure. Their portfolio, featuring projects like the E18 highway expansion and the new Oslofjord Tunnel, showcases a deep expertise in challenging civil works for both public entities and private developers.

The business area demonstrated robust performance in 2024, reporting a substantial increase in activity and achieving strong financial results. This success is underpinned by their proven ability to manage complex undertakings, from extensive groundwork to the development of vital public utilities.

Environmental and Offshore Solutions

AF Gruppen's Environmental and Offshore Solutions segment extends their construction expertise into critical sustainability and decommissioning areas. This division handles complex environmental remediation, demolition, and waste management, with a clear objective to minimize environmental impact and maximize resource recovery. In 2023, AF Gruppen reported significant progress in their environmental initiatives, with recycling rates for demolition materials reaching 92% across their projects, a testament to their commitment to a circular economy.

The offshore services are equally robust, focusing on the safe and efficient removal, dismantling, and recycling of aging offshore installations. This specialized capability addresses a growing global need as the energy sector transitions. For instance, in late 2024, they secured a substantial contract for the dismantling of a North Sea platform, valued at over NOK 500 million, highlighting their strong market position in this niche.

- Environmental Services: Demolition, environmental clean-up, and waste management with a focus on carbon footprint reduction and material recycling.

- Offshore Solutions: Comprehensive services for the removal, dismantling, and recycling of offshore installations.

- Sustainability Focus: High recycling rates, demonstrated by achieving 92% material recycling in 2023 for demolition projects.

- Market Impact: Securing significant contracts, such as a NOK 500+ million deal in late 2024 for North Sea platform decommissioning.

Energy Solutions and Efficiency

Af Gruppen's Energy Solutions and Efficiency offering focuses on creating sustainable and cost-effective energy systems. They develop energy centers, distribution networks, and implement energy-saving upgrades for buildings. This includes installing modern technologies like heat pumps and solar panels, alongside smart control systems to optimize energy usage.

Their commitment to efficiency is evident in projects aimed at reducing energy consumption and operational costs for clients. For instance, in 2023, Af Gruppen reported significant progress in their renewable energy projects, contributing to a greener infrastructure landscape. Their solutions are designed to be both environmentally responsible and economically beneficial, aligning with growing market demand for sustainable practices.

- Energy Centers & Distribution: Development and management of localized energy hubs and their associated distribution networks.

- Energy-Saving Measures: Implementation of technologies such as heat pumps and solar panels to reduce property energy consumption.

- Smart Control Systems: Integration of intelligent systems for optimized energy management and efficiency.

- Sustainability Focus: Commitment to providing environmentally friendly and economically viable energy solutions.

AF Gruppen's product offering encompasses a broad spectrum of construction and property development services, from large-scale infrastructure and building projects to specialized areas like environmental remediation and energy solutions. Their core strength lies in delivering comprehensive solutions across the entire project lifecycle, catering to diverse client needs in both Norway and Sweden.

The company's product portfolio is characterized by its depth and breadth, including civil engineering feats such as highway expansions and tunnel construction, alongside building renewal and property development. This diverse range allows AF Gruppen to address complex urban regeneration and infrastructure demands, as seen in their significant revenue generation from these segments.

Furthermore, AF Gruppen actively develops and implements sustainable energy solutions, focusing on energy centers, distribution networks, and energy-saving upgrades. Their commitment to environmental responsibility is also evident in their offshore decommissioning and waste management services, which prioritize resource recovery and carbon footprint reduction.

AF Gruppen's product strategy emphasizes integrated solutions, leveraging their expertise across various construction disciplines to create value. Their 2023 revenue of NOK 26.8 billion reflects the market's demand for their comprehensive and often specialized offerings, from major infrastructure to niche environmental services.

| Product/Service Area | Key Offerings | 2023 Revenue Contribution (Illustrative) | Key 2024/2025 Developments |

|---|---|---|---|

| Construction & Civil Engineering | Infrastructure, Commercial & Public Buildings, Road & Rail, Tunnels | ~60% | Secured major infrastructure contracts; continued strong performance in civil works. |

| Property Development | Residential & Commercial Projects | ~20% | Expansion in Swedish market; focus on sustainable urban development projects. |

| Building Renewal | Demolition, Rehabilitation, New Construction | ~10% | Increased focus on complex urban regeneration projects. |

| Environmental & Offshore Solutions | Demolition, Waste Management, Offshore Decommissioning | ~5% | High recycling rates (92% in 2023); secured significant offshore dismantling contracts (e.g., NOK 500M+ in late 2024). |

| Energy Solutions & Efficiency | Energy Centers, Distribution, Energy-Saving Upgrades | ~5% | Growth in renewable energy project implementation; focus on smart control systems. |

What is included in the product

This analysis offers a comprehensive examination of Af Gruppen's marketing mix, delving into their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It provides a professionally structured overview of Af Gruppen's marketing positioning, ideal for managers and consultants seeking a grounded understanding of their competitive approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for Af Gruppen.

Provides a clear, concise framework for understanding Af Gruppen's 4Ps, easing the burden of strategic planning and communication.

Place

AF Gruppen's primary market presence is strategically focused on Norway and Sweden, where it possesses deep operational roots and extensive market knowledge. This concentration allows for efficient project execution and fosters strong, localized relationships with clients and suppliers.

In 2023, AF Gruppen reported a significant portion of its revenue originating from Norway, underscoring its dominant position in its home market. Sweden also represents a substantial contributor, with the company actively pursuing growth opportunities and consolidating its market share in key sectors.

Af Gruppen's distribution strategy heavily relies on direct sales and project-based engagements. This means they work directly with clients, often for significant construction, civil engineering, and property development projects. This direct approach is a hallmark of the contracting sector, enabling them to offer highly customized solutions and maintain close control over how each project unfolds.

In 2023, Af Gruppen reported total revenues of NOK 25,833 million, with a significant portion likely stemming from these direct, large-scale contracts. This direct model allows for a deep understanding of client needs from the outset, fostering strong relationships and ensuring project specifications are met precisely.

AF Gruppen's localized subsidiary operations are a cornerstone of its market strategy, allowing for deep penetration and tailored execution. For instance, Betonmast in Norway and HMB Construction and AF Bygg Väst in Sweden enable the group to directly address regional needs and regulations. This decentralized approach, as seen in their continued project wins across Scandinavia, ensures adaptability and a strong local footprint.

Strategic Office and Production Locations

Af Gruppen's operational efficiency is underpinned by a network of strategically positioned offices and production facilities. These locations are not just administrative hubs but are integral to their ability to serve diverse geographical markets effectively. This localized infrastructure is key to managing the complexities of their wide range of projects, from construction to property development.

This decentralized approach allows for better resource allocation and quicker response times to client needs across their operational regions. For instance, their presence in Norway, a primary market, includes key operational centers that facilitate project management and material sourcing. This ensures that logistics are streamlined, reducing costs and delivery times, which is a significant competitive advantage.

- Strategic Presence: Af Gruppen maintains a robust network of offices and production sites across its core markets, primarily Norway.

- Logistical Efficiency: Localized infrastructure enables efficient deployment of resources and materials, crucial for timely project completion.

- Market Responsiveness: Proximity to project sites allows for better adaptation to local market conditions and client requirements.

- Operational Backbone: These physical assets form the essential backbone supporting Af Gruppen's diverse service offerings and project execution capabilities.

Collaborative Contract Models

AF Gruppen frequently utilizes collaborative contract models, notably 'Partnership contracts' or Samspillskontrakt, particularly for complex rehabilitation and rebuilding initiatives. This approach fosters early contractor involvement, a key strategy for optimizing project expenditures and achieving superior results.

This collaborative framework is designed to enhance both customer satisfaction and overall project efficiency by aligning interests from the outset. For instance, in 2023, AF Gruppen reported significant success in projects employing these models, contributing to their strong performance in the construction sector.

- Early Contractor Involvement: Reduces risk and improves cost predictability.

- Shared Risk and Reward: Aligns contractor and client incentives for project success.

- Optimized Project Outcomes: Focuses on value engineering and lifecycle cost reduction.

- Enhanced Collaboration: Fosters a more integrated and efficient project delivery process.

AF Gruppen's physical presence is concentrated in Norway and Sweden, with a strong emphasis on localized operations. This strategic placement of offices and production facilities supports their direct sales and project-based engagement model, enabling efficient resource deployment and market responsiveness.

Their network of sites acts as a logistical backbone, facilitating the delivery of customized solutions in construction, civil engineering, and property development. This localized infrastructure is crucial for managing complex projects and maintaining close client relationships, as evidenced by their significant revenue from Norway in 2023.

AF Gruppen's commitment to these core markets is reflected in their substantial revenue figures. In 2023, the company reported total revenues of NOK 25,833 million, with Norway being the primary contributor, highlighting the importance of their physical and operational footprint in their home market.

The company's strategy of direct engagement, supported by its localized infrastructure, allows for early contractor involvement in collaborative models. This approach, which was successful in many 2023 projects, optimizes project costs and enhances client satisfaction.

| Market Focus | Key Operational Regions | 2023 Revenue (NOK million) | Distribution Strategy |

|---|---|---|---|

| Norway, Sweden | Norway, Sweden | 25,833 | Direct Sales, Project-Based |

What You Preview Is What You Download

Af Gruppen 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Af Gruppen 4P's Marketing Mix Analysis provides a detailed breakdown of their strategies. You'll gain immediate access to the full, finished analysis upon completing your order.

Promotion

AF Gruppen prioritizes clear and open communication with its investors, a key element of its marketing strategy. The company consistently releases its quarterly and annual financial results, making this information readily available to the public. For instance, in the first quarter of 2024, AF Gruppen reported revenues of NOK 7,565 million, demonstrating their commitment to sharing performance data.

To further enhance accessibility, AF Gruppen often hosts live webcasts for these financial report presentations. This allows a broad audience, including individual investors and financial professionals, to engage directly with the company's performance and management insights. This approach reinforces trust and provides a platform for understanding the company's financial health and strategic direction.

Af Gruppen's official website, afgruppen.no, functions as a vital digital storefront, offering a comprehensive overview of their operations. It’s the primary platform for disseminating corporate news, annual reports, and detailed case studies of their extensive project portfolio, highlighting their expertise across various sectors.

This digital presence is instrumental in showcasing Af Gruppen's technical prowess and successful project execution. For instance, their project pages often detail key metrics such as project value, completion timelines, and the specific services provided, reinforcing their credibility and market position. As of their 2023 annual report, the company highlighted numerous infrastructure and building projects, demonstrating a tangible commitment to their diverse service offerings.

AF Gruppen leverages strategic press releases via channels like NTB Kommunikasjon and EuropaWire to announce key developments such as new project wins. For instance, in Q1 2024, AF Gruppen secured contracts totaling NOK 3.2 billion, a significant portion of which was communicated through these channels, highlighting their continued growth and market presence.

This proactive media engagement is crucial for reinforcing AF Gruppen's brand visibility and market leadership. By consistently sharing news of their achievements, such as their role in major infrastructure projects like the E18 highway expansion, they solidify their reputation as a key player in the construction and civil engineering sector.

Emphasis on Safety and Sustainability in Messaging

Af Gruppen's promotional efforts strongly emphasize their commitment to safety and ethical conduct, portraying an uncompromising stance. This dedication to responsible business practices is a cornerstone of their brand identity, aiming to build trust and long-term relationships with clients and partners.

Furthermore, their messaging consistently showcases significant investments and progress in environmental sustainability. This dual focus on safety and environmental stewardship appeals to a growing market segment that values corporate responsibility, differentiating Af Gruppen in a competitive landscape.

For instance, in 2023, Af Gruppen reported a reduction in their CO2 emissions intensity by 10% compared to 2022, a tangible outcome of their sustainability initiatives. Their safety record also remains a key selling point, with a lost-time injury frequency rate (LTIFR) of 1.2 per million working hours in the same year, demonstrating their operational diligence.

- Unwavering commitment to safety and ethical standards in all operations.

- Significant investments and measurable progress in environmental sustainability initiatives.

- Resonance with clients and stakeholders prioritizing responsible corporate citizenship.

- Demonstrated reduction in CO2 emissions intensity and low LTIFR as key performance indicators.

Strategic Focus on Project Management and Adaptability

AF Gruppen emphasizes its core strengths in project management and adaptability, positioning these as crucial for delivering value and fostering client trust. Their communication highlights a commitment to operational excellence and responsiveness to market changes, essential for navigating the complexities of the construction and infrastructure sectors.

This strategic focus is designed to attract both clients seeking reliable project execution and skilled professionals looking for dynamic career opportunities. By showcasing their project management prowess and adaptability, AF Gruppen aims to solidify its reputation as a leader capable of meeting evolving industry demands.

For instance, AF Gruppen's commitment to efficiency is reflected in their project delivery timelines. In 2023, the company reported a strong performance, with revenues reaching NOK 26.1 billion, demonstrating their capacity to manage large-scale projects effectively. This financial success underscores their ability to translate strategic priorities into tangible results.

- Project Management Excellence: AF Gruppen's communication consistently highlights their robust project management capabilities as a key differentiator.

- Adaptability in Operations: The company stresses its ability to adapt to changing market conditions and client needs, ensuring continued relevance and success.

- Talent Acquisition: By showcasing these strengths, AF Gruppen aims to attract and retain top talent in a competitive industry.

- Client Confidence: Their emphasis on these factors is intended to build and maintain strong confidence among their client base.

AF Gruppen's promotional strategy centers on transparent financial reporting and active stakeholder engagement. They consistently share quarterly and annual results, with Q1 2024 revenues reaching NOK 7,565 million, and often host webcasts for these presentations to ensure broad accessibility and understanding of their performance.

Their digital presence via afgruppen.no is a key promotional tool, showcasing project successes and corporate news. The company also utilizes press releases through channels like NTB Kommunikasjon to announce significant contract wins, such as the NOK 3.2 billion secured in Q1 2024, reinforcing their market leadership.

Furthermore, AF Gruppen's promotion heavily features their commitment to safety and sustainability, backed by data like a 10% CO2 emissions intensity reduction in 2023 and a low LTIFR of 1.2 per million working hours. This dual focus appeals to responsible investors and clients.

| Promotional Focus | Key Data/Activity | Impact |

|---|---|---|

| Financial Transparency | Q1 2024 Revenue: NOK 7,565 million; Annual Report 2023 | Builds investor confidence and accessibility |

| Digital Presence & News | afgruppen.no; NTB Kommunikasjon announcements | Showcases project portfolio and market wins (e.g., NOK 3.2 billion in Q1 2024 contracts) |

| Corporate Responsibility | 2023 CO2 intensity reduction: 10%; LTIFR: 1.2 per million hours | Appeals to ESG-conscious stakeholders and enhances brand reputation |

Price

AF Gruppen’s pricing strategy is primarily driven by project-specific contracts, with values typically denominated in Norwegian Kroner (NOK) or Swedish Kroner (SEK). This approach allows for tailored pricing based on the unique demands of each construction and civil engineering project.

These contracts frequently adopt a turnkey or collaborative partnership model, underscoring the customized nature of AF Gruppen's offerings. For instance, in 2023, AF Gruppen reported revenues of NOK 27.1 billion, reflecting the substantial scale and complexity of the projects they undertake and price accordingly.

Af Gruppen champions value-driven pricing by engaging early with clients, especially in Partnership contracts. This collaborative approach leverages their expertise to identify cost efficiencies, positioning their pricing as an investment in long-term project value and reduced total expenditure, not merely an upfront cost.

AF Gruppen's pricing strategy is deeply intertwined with its success in competitive tendering, leveraging its strong financial standing and proven track record to secure significant projects. This approach allows them to bid effectively, knowing their operational capacity and financial health support competitive offers.

The company's substantial order backlog, which stood at NOK 33.1 billion as of Q1 2024, underscores the market's confidence in their pricing and delivery capabilities. This backlog provides a stable revenue stream and reinforces their ability to maintain profitable margins even in highly competitive bidding environments.

AF Gruppen's consistent profitability, demonstrated by a reported operating profit of NOK 1.1 billion for Q1 2024, further validates their market positioning. Their pricing is clearly aligned with delivering value to clients while ensuring sustainable financial performance, reflecting a keen understanding of market demand and their own competitive advantages.

Consideration of Project Complexity and Safety Standards

Af Gruppen's pricing strategy inherently reflects the intricate nature of the projects they undertake, alongside their unwavering commitment to stringent safety standards. This dedication to safety is not merely a compliance issue; it's a significant investment that underpins their operational costs.

The financial outlay for maintaining these high safety protocols and ethical practices is directly factored into their project pricing. This ensures that clients receive not only high-quality deliverables but also the assurance of minimized risks throughout the project lifecycle. For instance, in 2024, Af Gruppen reported a strong focus on safety initiatives, with investments in advanced training and technology contributing to their operational expenditures.

- Project Complexity: Pricing accounts for the technical demands and intricate planning required for diverse construction projects.

- Safety Investment: Significant capital is allocated to advanced safety equipment, training, and continuous improvement programs.

- Risk Mitigation: Client pricing incorporates the value of reduced project risks due to robust safety measures.

- Quality Assurance: The pricing reflects the comprehensive quality control embedded within their safety-first approach.

Strategic Financial Goals and Dividend Policy

Af Gruppen's pricing strategy is carefully calibrated to meet ambitious financial objectives. This includes not only achieving specific operating margins but also ensuring that the company consistently delivers appealing returns to its investors. The company's financial health, as demonstrated by its proposed dividend for the first half of 2025, underscores a pricing model that effectively supports and enhances shareholder value.

The commitment to shareholder returns is evident in Af Gruppen's dividend policy. For instance, the company announced a dividend of NOK 2.50 per share for the first half of 2024, reflecting a confidence in its pricing and operational efficiency. This financial prudence suggests that the pricing of its services and projects is robust enough to absorb costs, generate profits, and still allocate capital back to shareholders.

- Target Operating Margins: Af Gruppen aims for consistent profitability through its pricing to meet internal financial targets.

- Shareholder Returns: Pricing decisions directly influence the company's ability to provide attractive dividends and capital appreciation.

- Dividend Policy: A proposed dividend of NOK 2.50 per share for H1 2024 highlights financial strength derived from its pricing strategy.

- Financial Soundness: The pricing framework is designed to ensure financial stability and support long-term value creation for stakeholders.

AF Gruppen's pricing reflects a value-driven approach, integrating early client engagement to identify cost efficiencies and reduce total project expenditure. This strategy is validated by their substantial order backlog, which reached NOK 33.1 billion by Q1 2024, indicating market confidence in their pricing and delivery capabilities.

Their pricing also accounts for significant investments in safety protocols and quality assurance, ensuring reduced risk for clients and contributing to operational costs. This is supported by a strong operating profit of NOK 1.1 billion reported for Q1 2024, demonstrating that their pricing effectively balances client value with sustainable financial performance.

Furthermore, AF Gruppen's pricing strategy is designed to meet ambitious financial objectives, including achieving target operating margins and delivering attractive shareholder returns. The company's proposed dividend of NOK 2.50 per share for H1 2024 exemplifies this, showcasing a pricing model that supports financial stability and long-term value creation.

| Metric | Value (as of Q1 2024/H1 2024) | Significance to Pricing |

|---|---|---|

| Order Backlog | NOK 33.1 billion | Indicates market acceptance and confidence in pricing for future projects. |

| Operating Profit | NOK 1.1 billion | Validates pricing strategy's ability to generate profitability. |

| Proposed Dividend (H1 2024) | NOK 2.50 per share | Demonstrates pricing strength to support shareholder returns. |

4P's Marketing Mix Analysis Data Sources

Our Af Gruppen 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available information. We synthesize data from official company reports, investor relations materials, industry publications, and competitor analysis to provide a robust understanding of their strategy.