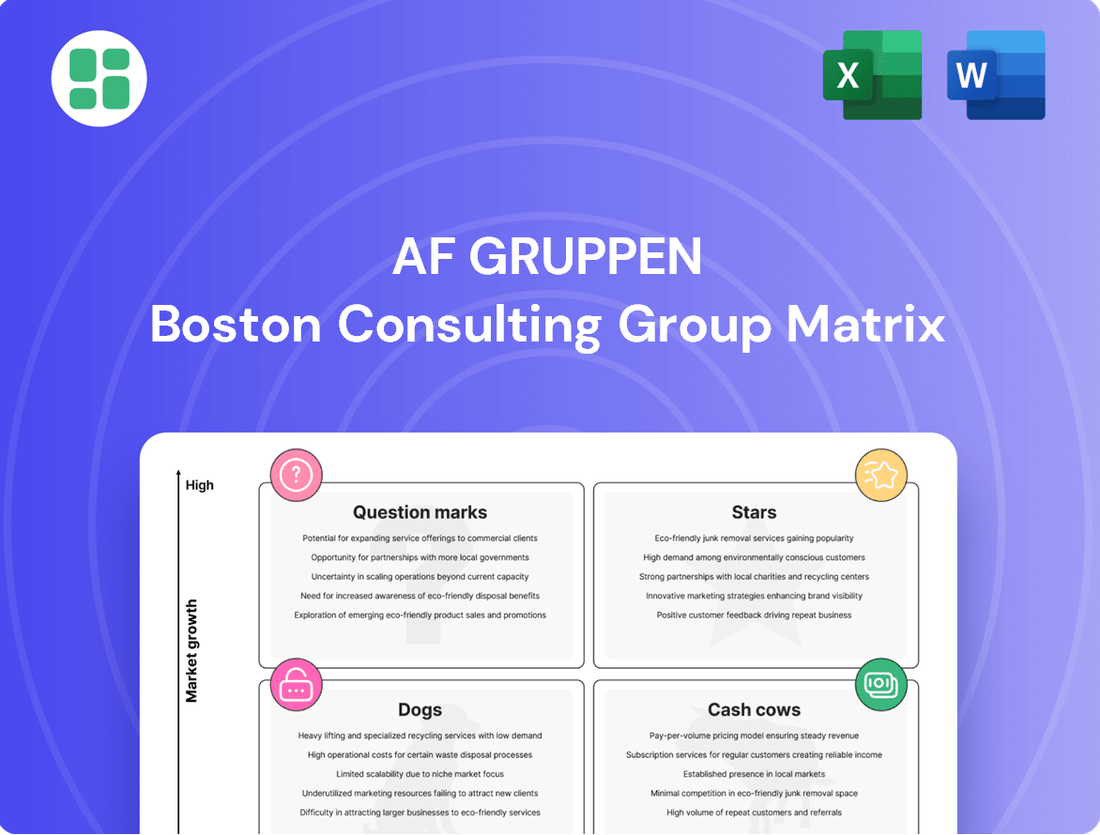

Af Gruppen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

Curious about Af Gruppen's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio is performing in the market. Understand which segments are driving growth and which might need a closer look.

Unlock the full potential of this analysis by purchasing the complete Af Gruppen BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the comprehensive breakdown that will guide your strategic planning. Get the full report today and transform your understanding of Af Gruppen's market dynamics.

Stars

AF Gruppen's Civil Engineering segment, primarily AF Anlegg, is a standout performer. This area saw a robust 16% revenue increase in the first quarter of 2025 compared to the prior year, showcasing strong operational momentum.

The segment's success is fueled by a substantial project pipeline and consistent demand from Norway's public sector. This positions AF Anlegg as a dominant force in its market, with excellent growth potential.

A prime example of this strength is the recent acquisition of the NOK 6,350 million E6 Roterud–Storhove highway project. This significant contract underscores AF Anlegg's leading market position and its capacity for continued expansion.

AF Gruppen is actively expanding its offshore wind capabilities, aiming to be a comprehensive service provider for offshore wind foundations. This strategic move capitalizes on their strong background in concrete construction and the specialized AF Miljøbase Vats facility. The company's focus on EPCI for these foundations demonstrates a clear intent to secure a substantial position in this booming sector, which is crucial for the global energy transition.

The global offshore wind market is experiencing significant growth, with projections indicating continued expansion. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that offshore wind capacity is expected to more than triple by 2030, reaching over 300 GW. AF Gruppen's investment in this area positions them to benefit from this trend, as demand for robust and reliable foundation solutions intensifies.

AF Gruppen's Environmental Services are positioned as a Star in the BCG Matrix, reflecting a high-growth market and strong company performance. The environmental consulting services market is expected to grow at a compound annual growth rate of 7.95% between 2025 and 2034, fueled by stricter regulations and a global push for sustainability.

AF Gruppen's Energy & Environment segment, especially its Environmental Centres, demonstrated robust results, underscoring its competitive advantage in this expanding sector. The company's strategic roadmap for 2025-2028 explicitly targets a significant reduction in its climate and environmental footprint, reinforcing its commitment to this promising business area.

Innovation and Digitalization in Construction

AF Gruppen is actively pursuing innovation and digitalization, aiming to be the most inquisitive contractor in the Nordic region. This strategic push, which includes a strong emphasis on better data utilization and the exploration of new business avenues, places them squarely in a dynamic and expanding segment of the construction sector.

Their commitment to embracing advanced technologies, including the potential integration of artificial intelligence, is a key driver for future growth. For instance, in 2024, the construction industry globally saw significant investment in digital tools, with reports indicating a 15% increase in spending on construction technology year-over-year. AF Gruppen’s investment in these areas is expected to yield substantial improvements in productivity and a stronger competitive edge for upcoming projects.

- Digitalization Focus: AF Gruppen's strategy prioritizes digital tools and data analysis.

- AI Integration: Exploration of AI and advanced technologies for operational enhancement.

- Market Position: Targeting high-growth segments within the evolving construction industry.

- Productivity Gains: Investments are geared towards achieving significant productivity improvements and competitive advantages.

Large-Scale Infrastructure Projects

AF Gruppen's prowess in securing and executing large-scale infrastructure projects, like the E6 Roterud–Storhove highway, clearly positions them as a leader with substantial growth potential. These undertakings are often characterized by long-term agreements and significant revenue streams, reinforcing their strong market presence in essential and expanding infrastructure development.

These types of projects signify a high market share coupled with continuous opportunities within the burgeoning infrastructure sector.

- Market Dominance: AF Gruppen's involvement in major projects like the E6 Roterud–Storhove highway, a significant Norwegian road development, underscores their established position.

- Growth Potential: The capacity to handle such complex, large-scale projects indicates a strong ability to capitalize on ongoing infrastructure investments.

- Financial Strength: Long-term contracts associated with these projects provide predictable revenue streams, contributing to financial stability and enabling further expansion.

- Sector Importance: AF Gruppen's focus on infrastructure aligns with critical societal needs and economic development, ensuring sustained demand for their services.

AF Gruppen's Civil Engineering segment, particularly AF Anlegg, is a prime example of a Star. This division experienced a notable 16% revenue growth in Q1 2025 year-over-year, driven by a robust project pipeline and consistent public sector demand. The acquisition of the NOK 6,350 million E6 Roterud–Storhove highway project further solidifies its leading market position and high growth potential.

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Af Gruppen's Stars, Cash Cows, Question Marks, and Dogs.

Af Gruppen's BCG Matrix offers a clear, one-page overview, instantly relieving the pain of strategic confusion by pinpointing each business unit's position.

Cash Cows

AF Gruppen's established building and construction operations in Norway, covering both residential and commercial sectors, are firmly positioned as Cash Cows. This segment benefits from a significant and stable market share, reflecting the company's long-standing presence and expertise.

These core activities consistently generate substantial revenue and a robust order backlog, acting as a reliable source of cash flow for the group. Despite potentially moderate market growth, AF Gruppen's strong foothold ensures sustained profitability and a solid financial base.

For instance, in 2023, AF Gruppen reported a total revenue of NOK 27.1 billion, with its building and infrastructure segments being major contributors, demonstrating the consistent performance of these established operations.

AF Gruppen's core civil engineering portfolio in Norway remains a bedrock of its financial strength. This segment, built on substantial public and private infrastructure projects, consistently delivers stable revenues and solid profit margins.

In 2024, AF Gruppen's civil engineering operations are expected to contribute significantly to the company's overall performance, reflecting the ongoing demand for infrastructure development in Norway. The company has secured several key contracts, ensuring a steady stream of work and predictable income.

The reliability of these established civil engineering projects makes them a prime example of a cash cow within AF Gruppen's business model. These operations generate consistent cash flow, which can then be strategically reinvested into growth areas or used to support other business units.

AF Gruppen's offshore decommissioning and recycling operations, spearheaded by AF Offshore Decom, represent a significant Cash Cow. This segment benefits from consistent demand due to stringent environmental regulations and the mature nature of the offshore industry across Europe. The company's ability to recycle up to 98% of materials, particularly steel, highlights its operational efficiency and strong market standing.

These specialized services generate stable, predictable cash flows, a hallmark of a Cash Cow. While growth prospects are modest, the high stability and recurring nature of decommissioning projects provide a reliable income stream for AF Gruppen. For instance, in 2024, the company continued to secure contracts for complex offshore removal projects, reinforcing its position as a market leader.

Environmental Centres and Waste Management

AF Gruppen's Environmental Centres, a key part of their Energy & Environment segment, are performing exceptionally well. These operations are essentially cash cows, generating consistent profits from established services like onshore demolition and recycling in Norway.

The demand for these services is stable, driven by the ongoing activity in the construction sector. This reliability, coupled with their established market position and efficient processes, ensures a steady stream of cash for the company.

- Strong Profitability: Mature services like demolition and recycling are consistently profitable.

- Steady Demand: Operations benefit from consistent demand linked to the construction market.

- Reliable Cash Generation: Established processes and market share lead to dependable cash flow.

- Norwegian Focus: Primarily operates onshore in Norway, leveraging local market strengths.

Stable Property Development in Core Norwegian Markets

AF Gruppen's stable property development in core Norwegian markets represents a significant Cash Cow. This segment benefits from established production capacity and a strong market share in mature regions, ensuring consistent cash flow from completed projects and ongoing sales.

The property development arm primarily focuses on residential and commercial projects within Norway, leveraging its existing infrastructure. While new sales can experience some variability, the underlying business model in these established markets provides a reliable stream of income.

- Steady Contributions: The segment provides consistent cash flow, contributing reliably to AF Gruppen's overall financial performance.

- Established Markets: Focus on mature Norwegian regions ensures a stable demand and a strong existing market presence.

- High Market Share: AF Gruppen's significant share in these core areas underpins the segment's ability to generate predictable revenue.

AF Gruppen's established building and construction operations in Norway, covering both residential and commercial sectors, are firmly positioned as Cash Cows. This segment benefits from a significant and stable market share, reflecting the company's long-standing presence and expertise.

These core activities consistently generate substantial revenue and a robust order backlog, acting as a reliable source of cash flow for the group. Despite potentially moderate market growth, AF Gruppen's strong foothold ensures sustained profitability and a solid financial base.

For instance, in 2023, AF Gruppen reported a total revenue of NOK 27.1 billion, with its building and infrastructure segments being major contributors, demonstrating the consistent performance of these established operations.

AF Gruppen's core civil engineering portfolio in Norway remains a bedrock of its financial strength. This segment, built on substantial public and private infrastructure projects, consistently delivers stable revenues and solid profit margins.

In 2024, AF Gruppen's civil engineering operations are expected to contribute significantly to the company's overall performance, reflecting the ongoing demand for infrastructure development in Norway. The company has secured several key contracts, ensuring a steady stream of work and predictable income.

The reliability of these established civil engineering projects makes them a prime example of a cash cow within AF Gruppen's business model. These operations generate consistent cash flow, which can then be strategically reinvested into growth areas or used to support other business units.

AF Gruppen's offshore decommissioning and recycling operations, spearheaded by AF Offshore Decom, represent a significant Cash Cow. This segment benefits from consistent demand due to stringent environmental regulations and the mature nature of the offshore industry across Europe. The company's ability to recycle up to 98% of materials, particularly steel, highlights its operational efficiency and strong market standing.

These specialized services generate stable, predictable cash flows, a hallmark of a Cash Cow. While growth prospects are modest, the high stability and recurring nature of decommissioning projects provide a reliable income stream for AF Gruppen. For instance, in 2024, the company continued to secure contracts for complex offshore removal projects, reinforcing its position as a market leader.

AF Gruppen's Environmental Centres, a key part of their Energy & Environment segment, are performing exceptionally well. These operations are essentially cash cows, generating consistent profits from established services like onshore demolition and recycling in Norway.

The demand for these services is stable, driven by the ongoing activity in the construction sector. This reliability, coupled with their established market position and efficient processes, ensures a steady stream of cash for the company.

AF Gruppen's stable property development in core Norwegian markets represents a significant Cash Cow. This segment benefits from established production capacity and a strong market share in mature regions, ensuring consistent cash flow from completed projects and ongoing sales.

The property development arm primarily focuses on residential and commercial projects within Norway, leveraging its existing infrastructure. While new sales can experience some variability, the underlying business model in these established markets provides a reliable stream of income.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) | 2024 Outlook |

|---|---|---|---|---|

| Building & Construction (Norway) | Cash Cow | Stable market share, high brand recognition, established operations. | Significant contributor to overall revenue. | Continued stable performance, reliable cash generation. |

| Civil Engineering (Norway) | Cash Cow | Strong order backlog, public/private project focus, consistent profitability. | Major revenue driver, underpinning financial stability. | Expected significant contribution, secured key contracts. |

| Offshore Decommissioning & Recycling | Cash Cow | Stringent regulations, mature industry demand, high material recycling rate. | Generates predictable income from specialized services. | Continued contract wins for complex projects, market leadership. |

| Environmental Centres (Energy & Environment) | Cash Cow | Stable demand from construction, efficient processes, established market position. | Consistently profitable, steady cash flow. | Reliable income stream due to ongoing construction sector activity. |

| Property Development (Norway) | Cash Cow | Established production, strong market share in mature regions, predictable income. | Consistent cash flow from completed and ongoing sales. | Underlying business model provides reliable income, though new sales may vary. |

What You See Is What You Get

Af Gruppen BCG Matrix

The Af Gruppen BCG Matrix you see here is the exact, fully formatted document you will receive upon purchase. This preview showcases the comprehensive analysis and strategic insights that will be yours to leverage immediately. Rest assured, there are no watermarks or demo elements; you're viewing the final, professional report ready for your business planning needs.

Dogs

AF Anläggning AB, AF Gruppen's Swedish civil engineering arm, is currently facing considerable headwinds. The termination of the E4 Förbifart Stockholm project contract in February 2025 is a major blow, leading to approximately NOK 100 million in shutdown and termination costs for the first quarter of 2025.

This event has severely weakened AF Anläggning AB's ability to secure new projects in Sweden, signaling a weak market position. The unit is described as 'weakly positioned to receive new assignments in Sweden,' suggesting a low market share coupled with negative profitability in a difficult operating environment.

Specific lagging property development projects, like those within Af Gruppen's portfolio, are currently demonstrating a low sales ratio. For instance, commenced projects in Q1 2025 reported a sales ratio of only 34%. This sluggish absorption rate, coupled with the Boligbygg unit's weak reported results, indicates these developments are not meeting market demand as anticipated.

These underperforming projects tie up significant capital, preventing it from being reinvested or generating expected returns. They represent a clear instance of low market share and low growth within their respective sub-markets, positioning them as potential cash traps for the company.

Within Af Gruppen's Civil Engineering segment, entities such as Eiqon and VSP experienced a challenging Q1 2025, reporting notably weak financial performance. This underperformance suggests a low market share and limited growth potential for these specific subsidiaries.

These underperforming units can be viewed as potential cash traps, consuming resources without generating sufficient returns for the broader Af Gruppen. Their current standing necessitates a strategic review, potentially leading to divestiture or significant restructuring to improve their viability.

Niche, Non-Core Services with Limited Market Traction

Niche, non-core services within AF Gruppen represent areas with limited market traction, often peripheral or legacy offerings that don't align with current strategic growth. These activities can drain resources without yielding substantial returns, suggesting a need for divestiture or significant restructuring.

For instance, if AF Gruppen had a small division offering specialized historical building restoration, and this unit reported a mere 0.5% of the group's total revenue in 2024, with a consistent operating loss of approximately 1 million NOK annually, it would exemplify this category.

- Limited Market Share: These services typically hold a negligible percentage of their respective markets, failing to achieve critical mass.

- Low Profitability: Consistent operating losses or minimal profit margins characterize these offerings, hindering overall financial performance.

- Resource Drain: They consume management attention, capital, and operational resources that could be better allocated to core, high-growth areas.

- Strategic Misalignment: These services often do not fit with AF Gruppen's primary focus on infrastructure, energy, and building sectors, making them candidates for divestment.

Outdated or Non-Competitive Technologies/Processes

If AF Gruppen continues to rely on outdated operational processes or technologies that lag behind industry advancements, these would fall into the 'dogs' category of the BCG Matrix. While not a distinct business unit, the use of inefficient methods directly impacts profitability.

For instance, if AF Gruppen's construction processes still heavily depend on manual labor and older machinery, this could lead to higher project costs and longer completion times compared to competitors utilizing advanced automation and digital construction tools. This inefficiency would erode their competitive edge.

In 2024, the construction industry saw significant investment in areas like Building Information Modeling (BIM) and prefabrication, with companies adopting these technologies reporting up to a 15% reduction in project costs and a 20% increase in efficiency. AF Gruppen's adoption rate of such technologies would determine its standing in this regard.

- Reliance on outdated machinery leading to increased maintenance costs and slower project execution.

- Lack of investment in digital transformation, such as advanced project management software, hindering real-time data analysis and decision-making.

- Inefficient supply chain management processes compared to industry benchmarks, resulting in higher material costs and delivery delays.

- Lower productivity rates in specific operational areas due to the absence of modern, automated solutions.

AF Gruppen's civil engineering arm, AF Anläggning AB, is a prime example of a 'dog' within the BCG matrix. The termination of the E4 Förbifart Stockholm project in February 2025, resulting in NOK 100 million in shutdown costs, significantly weakened its market position in Sweden.

Lagging property development projects, with a mere 34% sales ratio in Q1 2025, also illustrate this 'dog' status. These ventures consume capital without generating adequate returns, highlighting low market share and low growth.

Niche, non-core services, such as a hypothetical historical building restoration unit contributing only 0.5% of group revenue in 2024 with annual losses, further solidify this classification. These areas drain resources and lack strategic alignment.

Outdated operational processes, like heavy reliance on manual labor in construction, also place AF Gruppen in the 'dog' category. Companies adopting technologies like BIM in 2024 reported up to 15% cost reductions, a benefit AF Gruppen may be missing.

| Business Unit/Area | Market Share | Market Growth | Profitability | BCG Classification |

| AF Anläggning AB (Sweden) | Low | Low | Negative | Dog |

| Lagging Property Developments | Low | Low | Low/Negative | Dog |

| Niche Non-Core Services | Negligible | Low | Loss-making | Dog |

| Outdated Operational Processes | N/A | N/A | Reduced Efficiency | Dog |

Question Marks

AF Energi saw a significant uptick in activity during Q1 2025, a clear signal of their commitment to the burgeoning energy efficiency and technical solutions sector. While this increased operational tempo is encouraging, profitability for the quarter didn't quite meet projections. This suggests that AF Gruppen is actively investing to capture market share in this high-growth area, a strategy that often involves initial costs for expansion and operational refinement.

The current performance, though below expectations, highlights the dynamic nature of building a strong presence in a rapidly evolving market. AF Gruppen is in a phase of substantial investment, aiming to establish a robust foundation for future growth in energy efficiency and technical services. The long-term potential remains considerable, but close observation of operational efficiency and continued strategic investment will be key to realizing those future returns.

AF Gruppen's strategic moves into new geographic markets or sub-markets, like AF Bygg Väst's recent multi-sports hall project in Gothenburg, Sweden, are classic examples of 'Question Marks' in the BCG matrix. These ventures are in promising, often growing, territories, but the company is still building its footprint and market share.

These new market entries require substantial investment to establish brand recognition and operational capacity. For instance, AF Gruppen's 2023 annual report highlighted increased investments in its Swedish operations, reflecting the capital needed to cultivate these emerging markets. The goal is to transform these 'Question Marks' into 'Stars' or strong 'Cash Cows' over time.

AF Gruppen's exploration of advanced digitalization and AI pilot projects signifies a forward-thinking approach to future competitiveness. These initiatives, while promising high growth potential, are currently in nascent stages, characterized by significant research and development investment and a currently low market share.

These pilot programs, representing the question marks in the BCG matrix, require substantial capital and time to mature, with their ultimate success dictating their future trajectory towards becoming market leaders. For instance, in 2024, AF Gruppen continued to invest in digital transformation, aiming to optimize project management and enhance operational efficiency through AI-driven insights.

Specific High-Growth Property Development Opportunities

Af Gruppen's question mark category encompasses ambitious property developments in burgeoning urban centers or those featuring novel concepts. These ventures aim for high-growth market segments, demanding substantial initial capital and facing elevated risks until market acceptance and significant sales are secured. Success is contingent upon robust market adoption and astute strategic implementation.

For instance, a new residential development in Oslo's rapidly expanding Økern district, incorporating smart home technology and sustainable materials, could represent a question mark. While the demand for modern, eco-friendly housing is strong, the project's profitability depends on achieving pre-sale targets and managing construction costs effectively. In 2024, Oslo's housing market continued to see price appreciation, with average apartment prices in the capital reaching approximately NOK 70,000 per square meter by mid-year, indicating potential but also competitive pressures for new developments.

Key considerations for these high-growth opportunities include:

- Market Viability: Thorough analysis of demand drivers, competitor landscape, and pricing strategies in emerging urban areas.

- Investment Requirements: Assessing the scale of upfront capital needed for land acquisition, construction, and marketing, alongside potential funding sources.

- Risk Mitigation: Developing strategies to address potential construction delays, regulatory hurdles, and shifts in market sentiment.

- Strategic Partnerships: Collaborating with technology providers or local authorities to enhance project appeal and de-risk execution.

Developing Offshore Wind Supply Chain Integration

AF Gruppen's involvement in offshore wind foundations positions it as a Star in the BCG matrix, reflecting strong market share in a growing sector. However, expanding into other parts of the offshore wind supply chain, like specialized component manufacturing or new strategic partnerships, could be considered a Question Mark.

These ventures, while tapping into a burgeoning market, represent potential new avenues for AF Gruppen. The offshore wind market is projected to see significant growth, with global capacity expected to reach over 300 GW by 2030, according to some industry forecasts. This expansion requires substantial capital investment to build manufacturing capabilities and secure a competitive foothold.

- Market Growth: The global offshore wind market is expanding rapidly, offering significant opportunities for new entrants and deeper integration.

- Investment Needs: Developing specialized manufacturing or forming new partnerships requires considerable upfront investment to establish market presence and competitiveness.

- Strategic Fit: AF Gruppen's existing expertise in foundations could provide a foundation for expanding into adjacent supply chain areas, but careful strategic evaluation is needed.

- Risk vs. Reward: While these Question Mark ventures carry higher risk due to their novelty for AF Gruppen, successful integration could lead to substantial future returns and a more diversified revenue stream within the offshore wind sector.

AF Gruppen's 'Question Marks' represent new ventures in high-growth markets with uncertain futures. These require significant investment to gain market share and establish profitability. The company is strategically deploying capital to nurture these segments, aiming for future market leadership.

Examples include expansion into new geographic regions, digital transformation initiatives, and innovative property developments. Success hinges on market acceptance, efficient operations, and effective risk management. AF Gruppen's 2024 focus on digitalization, for instance, saw continued investment in AI for project optimization.

The offshore wind sector also presents 'Question Marks' as AF Gruppen explores expanding its role beyond foundations into specialized manufacturing or new partnerships. This strategic move into adjacent supply chain areas demands substantial capital and careful evaluation of risk versus reward.

The company's 2023 annual report indicated increased investment in Swedish operations, a clear sign of nurturing emerging markets. These 'Question Marks' are crucial for AF Gruppen's long-term growth strategy, aiming to convert them into future profit drivers.

| Venture Area | Market Growth Potential | Current Market Share | Investment Needs (Est.) | Strategic Goal |

|---|---|---|---|---|

| New Geographic Markets (e.g., Sweden) | High | Low to Medium | Significant | Establish strong presence, build brand |

| Digitalization & AI Pilots | Very High | Nascent | Substantial R&D | Enhance efficiency, future competitiveness |

| Innovative Property Developments | High | Low | High Capital Outlay | Secure market adoption, achieve profitability |

| Offshore Wind Supply Chain Expansion | High | Low (in new areas) | Considerable | Diversify revenue, leverage existing expertise |

BCG Matrix Data Sources

Our Af Gruppen BCG Matrix leverages comprehensive data from annual reports, market research databases, and internal performance metrics to provide a clear strategic overview.