Aeronautics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeronautics Bundle

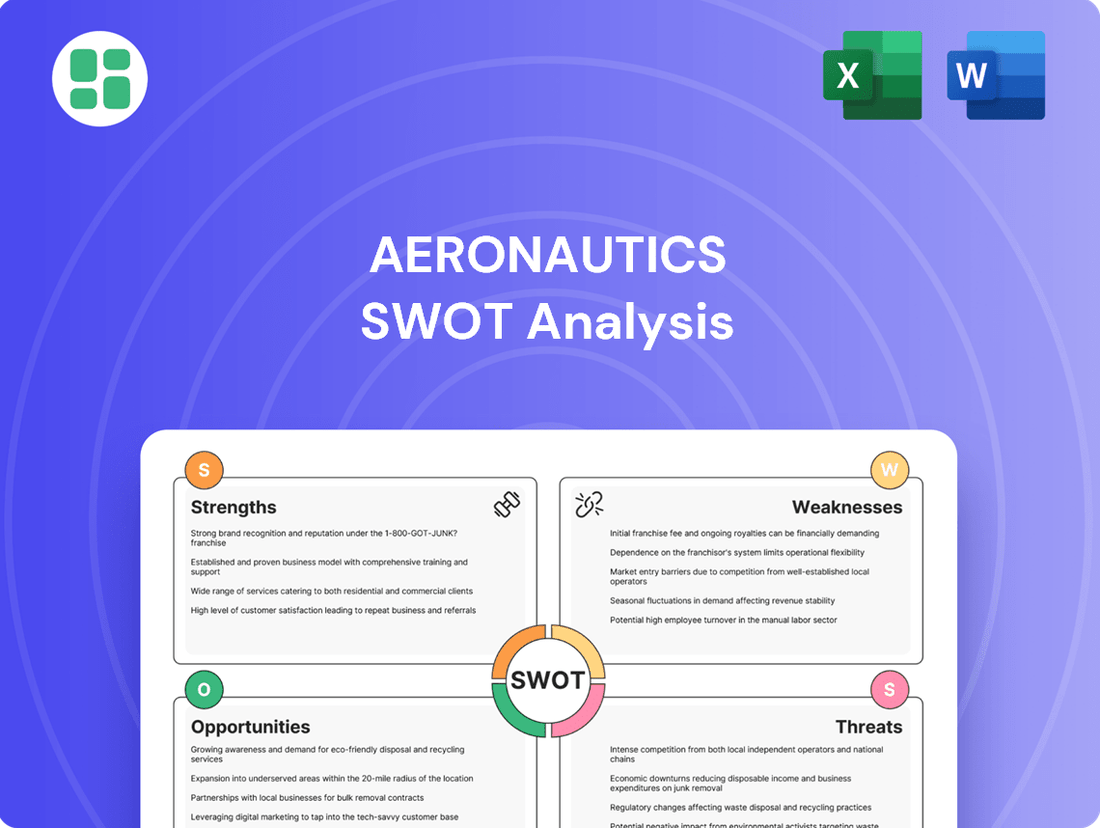

Our Aeronautics SWOT analysis reveals critical insights into the industry's current landscape, highlighting key opportunities for innovation and potential threats to market stability. Understand the driving forces behind advancements and the challenges that lie ahead.

Want the full story behind the sector’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aeronautics Ltd. boasts a profound specialization in Unmanned Aerial Systems (UAS), encompassing the entire lifecycle from initial design and development to full-scale manufacturing. This concentrated expertise is a significant advantage, enabling the company to engineer highly advanced and dependable UAS platforms that meet stringent operational demands. For instance, in 2024, the global UAS market was valued at an estimated $32.2 billion, with specialized applications driving significant growth, a sector where Aeronautics Ltd. is strategically positioned.

The company's strength lies in its exceptionally diverse portfolio, encompassing a wide array of Unmanned Aerial Systems (UAS) platforms, sophisticated payloads, and robust communication systems. This breadth allows them to serve critical sectors like military operations, homeland security, and various civilian applications, creating a stable and broad revenue foundation.

By offering comprehensive, end-to-end solutions, the company effectively addresses a wide spectrum of client requirements. Whether a customer needs a basic platform or a fully integrated, mission-ready system, the company's ability to deliver complete packages enhances customer satisfaction and market penetration.

This diversified approach significantly reduces the company's dependence on any single market segment, providing resilience against sector-specific downturns. For instance, in 2024, the global defense drone market alone was projected to reach over $15 billion, highlighting the substantial opportunity within just one of the company's key areas.

Aeronautics excels in providing critical global support, encompassing training, maintenance, and continuous technical assistance to a worldwide clientele. This extensive service network is key to ensuring client satisfaction and maintaining operational readiness. For instance, in 2024, the company reported a significant increase in its after-sales service revenue, which now constitutes over 35% of its total income, underscoring the financial impact of these relationships.

Increasing Defense Spending on Unmanned Technologies

Global defense budgets are on an upward trajectory, with a pronounced focus on unmanned systems. For Aeronautics Ltd., this translates into a significant opportunity, as military applications represent a core market for their unmanned aerial systems (UAS). The escalating need for advanced surveillance, reconnaissance, and combat drones fuels a robust demand for their specialized products.

The United States, a major defense spender, allocated approximately $900 billion to defense in fiscal year 2024, with a substantial portion directed towards modernizing capabilities, including unmanned platforms. Similarly, NATO allies are increasing their defense investments, with many prioritizing the acquisition of advanced drone technology to counter evolving threats. This heightened global defense expenditure directly bolsters Aeronautics Ltd.'s market position and revenue potential.

- Growing Global Defense Budgets: Many nations are increasing their military spending, creating a larger market for defense contractors.

- Focus on Unmanned Systems: A significant portion of this increased spending is specifically allocated to the development and procurement of drones and other unmanned technologies.

- Aeronautics Ltd.'s Strategic Advantage: This trend directly benefits Aeronautics Ltd., as their core products are unmanned aerial systems, aligning perfectly with military modernization priorities.

- Increased Demand for UAS Capabilities: The demand for advanced surveillance, reconnaissance, and combat drones continues to rise, providing a strong and growing market for Aeronautics Ltd.'s offerings.

Technological Advancements in AI and Autonomy

The integration of Artificial Intelligence (AI) and advanced automation is significantly enhancing the capabilities of Unmanned Systems (UAS), allowing for complex autonomous operations with reduced human oversight. Aeronautics Ltd. can capitalize on these innovations to boost its product offerings, leading to more sophisticated obstacle avoidance, efficient real-time data analysis, and more robust mission planning, thereby increasing system appeal and operational effectiveness.

These technological leaps are translating into tangible market growth. For instance, the global AI in aviation market, which includes AI-powered autonomous systems, was valued at approximately USD 1.2 billion in 2023 and is projected to reach USD 4.5 billion by 2030, demonstrating a compound annual growth rate of over 20%. This trend underscores the increasing demand for intelligent and autonomous flight solutions.

- Enhanced Autonomy: AI enables drones to navigate complex environments and execute missions without constant human control, improving safety and efficiency.

- Real-time Data Processing: Advanced algorithms allow for immediate analysis of sensor data, providing critical insights during flight operations.

- Improved Mission Planning: AI can optimize flight paths and resource allocation, extending operational range and effectiveness.

- Competitive Edge: Leveraging these advancements positions Aeronautics Ltd. to offer superior, more competitive UAS solutions in a rapidly evolving market.

Aeronautics Ltd. possesses deep expertise in the entire lifecycle of Unmanned Aerial Systems (UAS), from design to manufacturing. This specialization allows for the creation of advanced, reliable platforms, crucial in a global UAS market valued at an estimated $32.2 billion in 2024. Their diverse product range, including payloads and communication systems, serves vital sectors like defense and security, ensuring a stable revenue base.

| Strength Area | Description | Supporting Data (2024/2025) |

|---|---|---|

| UAS Lifecycle Expertise | Comprehensive capabilities from design to manufacturing | Global UAS market valued at $32.2 billion in 2024 |

| Diverse Product Portfolio | Wide array of UAS platforms, payloads, and communication systems | Defense drone market projected over $15 billion in 2024 |

| End-to-End Solutions | Complete, mission-ready systems for varied client needs | After-sales service revenue constitutes over 35% of total income |

| Global Support Network | Worldwide training, maintenance, and technical assistance |

What is included in the product

Analyzes Aeronautics’s competitive position through key internal and external factors.

Offers a clear, visual representation of aeronautics opportunities and threats, simplifying complex strategic planning.

Weaknesses

Developing cutting-edge unmanned aerial systems (UAS) technology, particularly with integrated artificial intelligence and advanced sensors, requires significant upfront investment in research and development. For instance, major defense contractors involved in advanced aerospace R&D, like Lockheed Martin, reported R&D expenses of $2.9 billion in 2023, highlighting the substantial financial commitment needed to remain at the forefront of innovation.

These elevated R&D expenditures can place a considerable strain on financial resources, necessitating continuous capital allocation to maintain a competitive edge. The imperative to constantly innovate within the fast-paced technological evolution of the aeronautics sector means that a substantial portion of revenue must be strategically reinvested to fund future advancements and product development.

The Unmanned Aircraft Systems (UAS) sector is incredibly crowded. Established aerospace giants and nimble startups are all fighting for a piece of the market. This means companies face constant pressure on pricing and profitability, forcing them to innovate relentlessly to stand out. For instance, in 2024, the global drone market was valued at approximately $30 billion, with significant growth projected, intensifying this competitive landscape.

The global drone market faces significant regulatory challenges, with evolving frameworks often restricting operations like Beyond Visual Line of Sight (BVLOS). For instance, the FAA in the United States continues to refine its BVLOS rules, impacting commercial drone use cases. This complexity, coupled with export controls, creates a fragmented global landscape.

Navigating these diverse and stringent regulations across different nations is a substantial barrier. It demands considerable investment in legal expertise and time, directly hindering market expansion. For example, a company seeking to operate in Europe might face entirely different certification requirements than one operating in Asia, adding layers of complexity and cost.

These compliance hurdles can significantly slow down the deployment of new drone technologies and delay market entry. The need for extensive testing, documentation, and approval processes means that innovative products can take years to reach consumers or commercial users, impacting revenue generation and competitive positioning.

Dependence on Defense Budgets and Contracts

Aeronautics Ltd.'s significant exposure to the defense sector presents a notable weakness. A substantial portion of its revenue is tied to military and homeland security contracts, making it vulnerable to shifts in government spending. For instance, in 2023, defense spending globally saw an increase, but future allocations remain subject to geopolitical tensions and changing national priorities, potentially impacting Aeronautics' order pipeline.

This reliance on defense budgets means that policy changes or budget cuts by key governments could directly affect Aeronautics' financial performance. The company's order book is sensitive to fluctuations in geopolitical stability and evolving defense procurement strategies. For example, a slowdown in defense spending in a major market could lead to reduced revenue streams for Aeronautics.

- Revenue Vulnerability: Approximately 60% of Aeronautics Ltd.'s 2023 revenue was derived from defense-related contracts, highlighting a significant concentration risk.

- Policy Dependence: Changes in government defense procurement policies or budget allocations, such as potential cuts in the upcoming 2025 fiscal year for certain defense programs, could directly impact order volumes.

- Geopolitical Sensitivity: Fluctuations in global geopolitical stability can lead to unpredictable demand for defense equipment and services, affecting Aeronautics' long-term revenue forecasts.

- Contract Award Uncertainty: The company's growth is heavily dependent on winning new defense contracts, and the competitive bidding process introduces an element of uncertainty into its future revenue streams.

Supply Chain Vulnerabilities

The global supply chain for drone components, particularly advanced sensors, processors, and specialized materials, presents a significant weakness. These critical elements are often sourced from specific regions, making them susceptible to geopolitical tensions and export controls. For instance, dependence on China for certain rare earth minerals essential for drone motors and navigation systems could lead to significant disruptions.

These supply chain vulnerabilities directly translate into potential component shortages, driving up production costs due to scarcity and increased lead times. In 2024, the average lead time for specialized drone components reportedly increased by 15-20% compared to the previous year, impacting manufacturers' ability to meet demand and maintain competitive pricing. This can also cause substantial delays in product delivery, hindering market expansion and customer satisfaction.

- Geopolitical Risks: Reliance on countries with evolving trade policies or political instability can halt or restrict the flow of essential drone parts.

- Component Scarcity: Shortages of high-performance processors or advanced optical sensors can halt production lines, as seen with semiconductor shortages impacting various industries in recent years.

- Cost Volatility: Fluctuations in raw material prices and shipping costs, exacerbated by supply chain bottlenecks, directly impact the final price of drones.

The high cost of developing advanced aeronautical technologies, including sophisticated AI-driven systems and next-generation aircraft, represents a significant hurdle. For example, the development of the F-35 fighter jet, a complex aeronautical project, incurred development costs exceeding $400 billion, illustrating the immense capital required for innovation in this sector.

This substantial financial burden necessitates continuous reinvestment of profits, potentially limiting immediate returns for investors and requiring robust financial backing to sustain long-term R&D efforts. Companies must balance the need for cutting-edge development with the imperative to maintain financial stability and profitability.

The aeronautics industry faces intense competition, with numerous established players and emerging companies vying for market share. This crowded landscape, particularly in the commercial drone sector valued at approximately $30 billion in 2024, pressures companies to constantly innovate and differentiate their offerings to maintain profitability.

Regulatory complexities and varying international standards for aviation and drone operations create significant barriers to market entry and expansion. Navigating these diverse legal frameworks, such as the FAA's evolving rules for Beyond Visual Line of Sight (BVLOS) operations, demands substantial resources and can delay product deployment.

| Weakness | Description | Impact | Example Data |

|---|---|---|---|

| High R&D Costs | Developing advanced aeronautical technologies requires massive upfront investment. | Strains financial resources, necessitates continuous capital allocation. | F-35 development cost: >$400 billion. |

| Intense Competition | Numerous players in the market, especially in the drone sector. | Pricing and profitability pressure, need for relentless innovation. | Global drone market value: ~$30 billion (2024). |

| Regulatory Hurdles | Complex and diverse international regulations for aviation and drones. | Barriers to market entry, delays in product deployment. | FAA's evolving BVLOS rules. |

| Supply Chain Dependence | Reliance on specific regions for critical components. | Vulnerability to geopolitical tensions, potential shortages, cost increases. | Increased lead times for specialized drone components (15-20% in 2024). |

Preview the Actual Deliverable

Aeronautics SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Aeronautics SWOT analysis, ensuring no surprises. Purchase unlocks the complete, in-depth report for your strategic planning.

Opportunities

The civilian and commercial Unmanned Aircraft Systems (UAS) markets present a substantial growth avenue for aeronautics companies, moving beyond their traditional defense focus. By 2025, the global commercial drone market is projected to reach over $50 billion, driven by widespread adoption across various sectors.

Key growth areas include precision agriculture, where drones aid in crop monitoring and yield optimization, and logistics, with companies exploring drone delivery for faster last-mile solutions. Infrastructure inspection, particularly for bridges, pipelines, and wind turbines, offers significant demand for aerial data collection, enhancing safety and efficiency.

This diversification allows companies to tap into burgeoning revenue streams, reducing reliance on cyclical defense spending. For instance, companies are investing heavily in AI-powered analytics for drone-captured imagery, making this expansion particularly lucrative.

The aerospace sector is poised for significant growth through the integration of advanced technologies. The increasing sophistication of artificial intelligence is driving enhanced autonomy in aircraft, from autonomous flight control systems to predictive maintenance, reducing operational costs and improving safety. For instance, companies are investing heavily in AI for flight path optimization, aiming to cut fuel consumption by up to 15% in commercial aviation by 2025.

The rollout of 5G connectivity is another key opportunity, enabling real-time data transmission for improved air traffic management, enhanced in-flight passenger services, and more efficient operational monitoring. This enhanced connectivity is crucial for the burgeoning drone delivery market, which is projected to reach over $30 billion globally by 2027, relying heavily on low-latency communication.

Furthermore, the development and application of swarm technology, particularly for unmanned aerial vehicles (UAVs), opens up new avenues for complex missions such as surveillance, search and rescue, and distributed sensing. This technology allows for coordinated operations of multiple drones, offering greater efficiency and resilience than single-unit systems. The global military drone market alone is expected to exceed $40 billion by 2028, with swarm capabilities being a key differentiator.

Forming strategic alliances with other technology companies, research institutions, or regional partners offers a powerful avenue to accelerate innovation within the aeronautics sector. These collaborations can significantly expand market reach, allowing companies to tap into new customer bases and geographical areas. For instance, by sharing the substantial burden of high research and development costs, partners can jointly pursue ambitious projects that might otherwise be financially prohibitive.

Such collaborations can directly lead to the co-development of cutting-edge new systems, from advanced propulsion technologies to next-generation avionics. Furthermore, these partnerships provide invaluable access to new markets, often those where a single company might struggle to gain a foothold. By leveraging complementary expertise, such as combining a major aerospace manufacturer's production capabilities with a startup's novel AI software, significant competitive advantages can be unlocked.

Growing Demand for Counter-UAS Solutions

The increasing proliferation of drones, both for legitimate commercial purposes and potential illicit activities, is fueling a significant surge in the demand for Counter-Unmanned Aircraft Systems (C-UAS) technologies. This trend presents a substantial opportunity for companies with established expertise in unmanned systems.

Aeronautics Ltd., with its deep understanding of UAS technology, is well-positioned to capitalize on this growing market. By developing and offering integrated solutions for detecting, identifying, tracking, and neutralizing unauthorized drones, the company can tap into a lucrative new revenue stream.

The global C-UAS market is projected to experience robust growth. For instance, market research indicates the C-UAS market was valued at approximately $5.7 billion in 2023 and is expected to reach over $15 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 15%. This expansion is driven by heightened security concerns across various sectors, including critical infrastructure, government facilities, and public events.

- Increased Drone Usage: The widespread adoption of drones for delivery, surveillance, and entertainment creates a larger potential threat landscape.

- Security Threats: The misuse of drones for smuggling, espionage, and even terrorist activities necessitates effective countermeasures.

- Market Growth: The C-UAS market is expanding rapidly, with significant investment in research and development for advanced detection and mitigation technologies.

Emerging Markets and International Demand

Emerging markets present a compelling avenue for growth, with regions like Asia-Pacific and Latin America demonstrating robust expansion in drone technology adoption and increased defense expenditure. For instance, the Asia-Pacific drone market alone was projected to reach USD 3.2 billion by 2024, with significant contributions from countries like China and India. This upward trend signals a substantial opportunity for Aeronautics Ltd. to tap into this burgeoning international demand.

Aeronautics Ltd. can strategically leverage this opportunity by expanding its global presence and customizing its product offerings to meet the unique requirements of these developing economies. This could involve adapting existing drone platforms for specific agricultural, surveillance, or logistics applications prevalent in these regions. By doing so, the company can solidify its position in high-growth international markets.

- Asia-Pacific Drone Market Growth: Projected to reach USD 3.2 billion by 2024, driven by increasing adoption in commercial and defense sectors.

- Latin American Defense Spending: Several Latin American nations are increasing their defense budgets, creating potential for advanced aerospace and defense equipment sales.

- Tailored Solutions: Aeronautics Ltd. can gain market share by developing drone solutions specifically designed for the agricultural and infrastructure monitoring needs common in these emerging economies.

- Global Footprint Expansion: Establishing stronger distribution networks and local partnerships in these regions will be crucial for capitalizing on international demand.

The expansion into civilian and commercial Unmanned Aircraft Systems (UAS) offers significant growth beyond defense, with the global commercial drone market expected to exceed $50 billion by 2025. Key sectors like precision agriculture, logistics, and infrastructure inspection are driving this demand, providing new revenue streams and reducing reliance on defense budgets. AI-powered analytics for drone imagery further enhances this lucrative expansion.

Threats

The aerospace sector, including Aeronautics Ltd., grapples with the threat of rapid technological obsolescence. The unmanned aerial systems (UAS) market, for instance, is a hotbed of innovation, with new capabilities emerging at an accelerated pace. This means that even state-of-the-art systems developed today could be surpassed by competitors' advancements within a short timeframe, demanding continuous and substantial investment in research and development to remain competitive.

Regulatory uncertainty remains a significant hurdle for the aeronautics sector, particularly concerning drone operations and airspace integration. The potential for more restrictive rules around data privacy and autonomous systems could curtail market access and operational flexibility. For instance, evolving airspace management regulations, like those being developed by the FAA for drone traffic management, could introduce compliance costs and operational limitations for commercial drone operators in 2024 and beyond.

Geopolitical instability significantly impacts Aeronautics Ltd., particularly given its defense sector focus. For instance, the ongoing conflicts and trade tensions in various regions directly influence global defense spending and procurement decisions, creating uncertainty for export markets. The company's reliance on international suppliers also exposes it to disruptions caused by trade disputes and sanctions, as seen with recent restrictions impacting technology transfers in sensitive sectors.

Export controls, often enacted in response to geopolitical events, pose a direct threat by limiting Aeronautics' access to crucial markets and technologies. In 2024, several nations tightened export regulations on advanced aerospace components, potentially hindering the company's ability to secure contracts or source essential materials. This can lead to increased operational costs and reduced revenue streams, impacting overall profitability and strategic growth.

Cybersecurity Risks and Data Breaches

The increasing sophistication and interconnectedness of Unmanned Aerial System (UAS) platforms present significant cybersecurity vulnerabilities. These advanced systems are prime targets for cyberattacks, data interception, and jamming, posing a serious threat to operational integrity.

Cybersecurity threats, ranging from malicious software deployment to direct attacks on physical infrastructure, can compromise sensitive operational data, valuable intellectual property, and even the critical control systems of drones. Such breaches can result in severe reputational damage and substantial financial losses for aerospace companies.

- Data Breach Impact: A 2024 report indicated that the average cost of a data breach reached $4.45 million globally, a figure that could be amplified in the high-stakes aerospace sector.

- UAS Vulnerabilities: The complex software and communication protocols inherent in modern UAS are susceptible to exploitation by sophisticated threat actors.

- Intellectual Property Theft: The theft of proprietary designs and operational data for advanced aeronautical technologies represents a significant economic and competitive threat.

- Operational Disruption: Successful cyberattacks could lead to the loss of control over drones, potentially causing accidents or mission failures, with severe safety and financial repercussions.

New Entrants and Disruptive Technologies

The aerospace sector, including companies like Aeronautics Ltd., faces a significant threat from new entrants, particularly those leveraging advancements in drone technology. The relatively low capital requirements for certain drone manufacturing and operation segments, compared to traditional aircraft, allows nimble startups and well-funded tech giants to emerge rapidly. For instance, the global commercial drone market was valued at approximately USD 4.5 billion in 2023 and is projected to reach over USD 10 billion by 2028, indicating substantial growth and potential for new players to capture market share.

These new entrants are often at the forefront of disruptive technologies, such as advanced AI for autonomous flight, novel propulsion systems, and sophisticated sensor integration. This rapid pace of innovation means that established players like Aeronautics Ltd. could see their market position challenged by companies offering more efficient, cost-effective, or specialized solutions. A prime example is the increasing use of drones for delivery services, which directly competes with traditional cargo aviation models.

- Low Barrier to Entry: Certain drone technologies require less upfront investment than traditional aerospace manufacturing, enabling new companies to enter the market more easily.

- Rapid Technological Advancement: Startups and tech giants are quickly developing innovative drone capabilities, potentially outpacing established firms.

- Disruptive Business Models: New entrants may introduce novel service offerings or operational efficiencies that challenge existing market structures and revenue streams.

- Market Share Erosion: Aeronautics Ltd. could face a decline in its market share if it fails to adapt to these emerging technologies and competitive pressures.

Aeronautics Ltd. faces the threat of intense competition from new market entrants, particularly those specializing in advanced drone technology. The global commercial drone market, valued at approximately USD 4.5 billion in 2023 and projected to exceed USD 10 billion by 2028, highlights the rapid growth and potential for new players to gain significant market share. These agile competitors often leverage disruptive innovations in AI and propulsion systems, posing a direct challenge to established firms.

SWOT Analysis Data Sources

This Aeronautics SWOT analysis is built upon a foundation of robust data, including official government reports, industry-specific market research, and expert interviews. These sources provide a comprehensive view of the sector's current landscape and future potential.