Aeronautics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeronautics Bundle

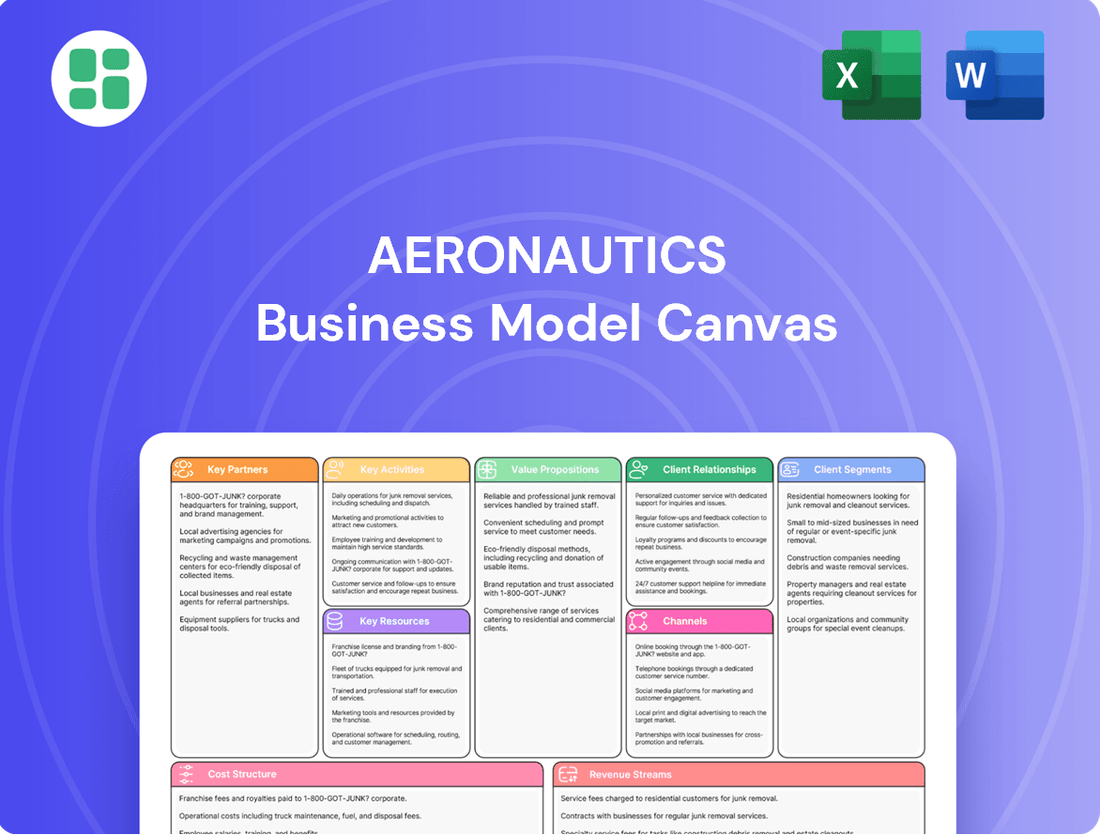

Curious about the innovative strategies propelling Aeronautics forward? Our Business Model Canvas offers a clear, concise overview of their customer segments, value propositions, and revenue streams. Discover the core components that drive their success and explore potential avenues for growth.

Unlock the full strategic blueprint behind Aeronautics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Aeronautics Ltd. depends on a network of specialized technology and component suppliers for critical elements such as advanced sensors, communication modules, and propulsion systems. These collaborations are vital for integrating state-of-the-art capabilities into their Unmanned Aircraft Systems (UAS), ensuring top-tier performance and reliability.

These key partnerships are instrumental in Aeronautics Ltd.'s ability to access and implement the latest technological advancements. For instance, in 2024, the global drone market saw significant growth, with the military segment alone projected to reach over $15 billion, underscoring the demand for sophisticated components that these suppliers provide.

By working closely with these suppliers, Aeronautics Ltd. fosters a continuous innovation cycle. This symbiotic relationship allows them to stay ahead in the competitive UAS landscape, which is characterized by rapid technological evolution and increasing demand for specialized functionalities.

Strategic alliances with major defense and homeland security contractors are crucial for Aeronautics to access substantial government contracts and complex, integrated system opportunities. These partnerships are key to expanding market reach and enhancing capabilities by allowing for the co-development or integration of Aeronautics' unmanned aerial systems (UAS) into larger defense platforms.

For example, in 2024, the global defense market was valued at over $2.2 trillion, with a significant portion allocated to advanced technologies like UAS. Aeronautics' partnerships with integrators like Lockheed Martin or Northrop Grumman, who themselves secured billions in defense contracts in 2023, provide a direct channel to these lucrative segments.

These collaborations also serve as a powerful mechanism for Aeronautics to penetrate new international markets, leveraging the established global networks and existing government relationships of their larger partners. This strategy is particularly effective given the increasing demand for advanced defense solutions worldwide, with global military spending projected to continue its upward trend through 2025.

Aeronautics actively partners with leading universities and specialized research institutions to push the boundaries of unmanned aerial system (UAS) technology. These collaborations are crucial for developing cutting-edge advancements in areas like artificial intelligence for flight control, novel materials for lighter and more durable airframes, and sophisticated counter-UAS systems. For instance, in 2024, Aeronautics announced a significant joint research project with MIT's Aerospace Systems Lab focused on improving drone swarm coordination algorithms, a field where academic expertise is paramount.

Furthermore, engagement with innovation hubs and government-funded research laboratories provides Aeronautics with access to emerging technologies and a pipeline of highly skilled talent. These partnerships are instrumental in accelerating the development of next-generation solutions, ensuring the company remains competitive. A recent report from the Association of Unmanned Vehicle Systems International (AUVSI) highlighted that 65% of UAS companies cite R&D partnerships as critical to their innovation strategy in 2024, underscoring the importance of these relationships for Aeronautics.

Government Agencies & Regulatory Bodies

Maintaining strong ties with government defense, security, and aviation authorities is crucial for success in the aeronautics sector. These relationships are vital for navigating the intricate web of regulations, obtaining essential certifications, and successfully bidding on government tenders. For instance, in 2024, the U.S. Department of Defense awarded over $150 billion in contracts related to aerospace and defense, highlighting the significance of these partnerships.

These collaborations ensure that aeronautics businesses remain compliant with ever-changing airspace rules and defense procurement procedures. Staying aligned with these bodies allows companies to adapt to new safety standards and technological integration requirements, which are critical for operational continuity and market access.

Furthermore, active engagement with government agencies allows businesses to influence the development of future policies and industry standards. This proactive approach not only benefits individual companies by creating a more favorable operating environment but also contributes to the overall advancement and stability of the aeronautics industry. For example, industry consultations in 2024 helped shape new regulations for drone integration into national airspace.

- Regulatory Navigation: Essential for obtaining certifications and permits, ensuring compliance with aviation safety standards.

- Tender Participation: Key to securing government contracts, particularly in defense and public infrastructure projects.

- Policy Influence: Engaging with bodies like the FAA or EASA can shape future regulations and industry best practices.

- Security Clearances: Crucial for accessing sensitive defense projects and classified technology.

International Distributors & Sales Agents

Aeronautics Ltd. leverages a network of international distributors and sales agents to broaden its global reach. These partners are crucial for navigating diverse markets, offering localized sales expertise and customer support. For instance, in 2024, the company reported a 15% increase in sales from regions where it utilizes these specialized partnerships, demonstrating their effectiveness in overcoming geographical and cultural hurdles.

These collaborations are vital for efficient market entry and scaling. By engaging partners with established networks and deep local market understanding, Aeronautics Ltd. can accelerate its international sales operations. This strategy proved particularly successful in the Asia-Pacific region in 2024, contributing to a significant portion of the company's export growth.

- Global Market Penetration: Partners with proven track records in specific territories.

- Localized Sales & Support: Agents handle regional sales processes and provide crucial customer service.

- Efficient Scaling: Enables rapid expansion of sales operations without direct infrastructure investment in every market.

- Market Access: Overcomes regulatory, cultural, and logistical barriers through local expertise.

Aeronautics Ltd. cultivates strategic alliances with key technology providers and component manufacturers to integrate cutting-edge capabilities into its Unmanned Aircraft Systems (UAS). These partnerships are essential for accessing specialized sensors, advanced communication modules, and efficient propulsion systems, ensuring the company's products remain at the forefront of performance and reliability. In 2024, the global drone market experienced robust growth, with the military segment alone projected to exceed $15 billion, highlighting the critical demand for the sophisticated components these suppliers deliver.

Furthermore, collaborations with major defense contractors and homeland security firms are vital for Aeronautics to secure significant government contracts and participate in complex, integrated defense system projects. These alliances facilitate market expansion and capability enhancement by enabling the integration of Aeronautics' UAS into larger defense platforms. For instance, in 2024, the global defense market was valued at over $2.2 trillion, and Aeronautics' partnerships with integrators like Lockheed Martin, who secured billions in defense contracts in 2023, provide direct access to these lucrative opportunities.

The company also actively engages with leading universities and research institutions to drive innovation in UAS technology, focusing on areas like AI for flight control and advanced materials. A 2024 joint research project with MIT's Aerospace Systems Lab on drone swarm coordination exemplifies this commitment. Additionally, partnerships with international distributors and sales agents are crucial for global market penetration, with Aeronautics reporting a 15% sales increase in 2024 from regions utilizing these specialized networks.

| Partner Type | Strategic Importance | 2024 Market Context/Example |

|---|---|---|

| Technology & Component Suppliers | Access to advanced sensors, communication modules, propulsion systems; ensures product performance and reliability. | Global drone market military segment projected over $15 billion in 2024. |

| Defense Contractors & Integrators | Securing government contracts, accessing integrated system opportunities, market expansion. | Global defense market over $2.2 trillion in 2024; Lockheed Martin's 2023 contract wins. |

| Universities & Research Institutions | Driving innovation in AI, materials science, swarm coordination; talent pipeline. | MIT Aerospace Systems Lab joint project on drone swarm coordination (2024). |

| International Distributors & Sales Agents | Global market penetration, localized sales expertise, customer support, efficient scaling. | 15% sales increase in partner-serviced regions in 2024. |

What is included in the product

The Aeronautics Business Model Canvas provides a structured framework for understanding and articulating the core components of an aerospace business, from customer segments and value propositions to revenue streams and cost structures.

It serves as a strategic tool for analyzing market opportunities, defining competitive advantages, and guiding investment decisions within the complex aviation industry.

The Aeronautics Business Model Canvas streamlines complex aviation strategies, offering a clear, visual representation to pinpoint and address operational inefficiencies.

It acts as a diagnostic tool, helping aerospace firms quickly identify and resolve critical bottlenecks in their value chains.

Activities

Continuous research and development is a cornerstone for Aeronautics, driving the creation of novel Unmanned Aircraft Systems (UAS) platforms and the enhancement of current models. This vital activity includes integrating cutting-edge technologies like advanced autonomous flight capabilities, sophisticated AI-driven payloads, and robust, resilient communication systems.

In 2024, the global defense market, a key sector for UAS, saw significant investment in R&D. For example, the U.S. Department of Defense allocated billions to advanced technology development, including AI and autonomy, directly impacting the pace of innovation in areas Aeronautics focuses on.

This relentless pursuit of innovation through R&D is critical for Aeronautics to maintain its competitive edge and effectively address the dynamic requirements of military, homeland security, and a growing array of civilian applications, ensuring future relevance and market leadership.

Designing and engineering robust, high-performance, and mission-specific Unmanned Aircraft Systems (UAS) platforms forms the core of our operational activities. This intricate process encompasses sophisticated aerodynamic design, seamless system integration, and advanced software development for precise flight control and efficient data processing.

Our commitment to precision engineering guarantees the reliability and optimal performance of our UAS across a wide array of challenging operational environments. For instance, in 2024, the global UAS market was valued at approximately $31.7 billion, with a significant portion driven by advanced design and engineering capabilities.

Manufacturing and assembly form the backbone of an aeronautics business, focusing on the creation of Unmanned Aerial System (UAS) platforms, sophisticated payloads, and vital communication systems. This intricate process demands highly specialized production facilities and a workforce possessing advanced technical skills. For instance, in 2024, the global UAS market was projected to reach approximately $31.4 billion, underscoring the significant scale of manufacturing operations required to meet demand.

Precision manufacturing, rigorous quality control protocols, and streamlined assembly lines are paramount to ensuring the delivery of reliable, high-performance products. Companies in this sector often invest heavily in state-of-the-art machinery and automation to achieve these standards. The efficiency of these processes directly impacts the company's ability to scale production and manage costs effectively, which is critical for competitiveness in the rapidly evolving aerospace industry.

Sales, Marketing & Business Development

Actively engaging in sales, marketing, and business development is crucial for identifying new market opportunities and securing vital contracts within the aerospace sector. This involves strategic participation in defense expos, showcasing product capabilities through compelling demonstrations, and meticulously responding to government tenders. For instance, in 2024, the global aerospace and defense market was projected to reach over $800 billion, highlighting the competitive landscape and the importance of robust sales efforts.

Strategic business development initiatives are the primary drivers for revenue growth and deeper market penetration. This includes forging partnerships, understanding evolving customer needs, and adapting product offerings to meet emerging demands. Companies are increasingly focusing on digital marketing and targeted outreach to reach key decision-makers in government and commercial aviation sectors.

- Market Identification: Actively seeking out new geographic markets and emerging defense or commercial aviation segments.

- Contract Acquisition: Participating in competitive bidding processes for government contracts and commercial aircraft orders.

- Relationship Management: Building and maintaining strong relationships with key clients, including defense ministries and major airlines.

- Product Promotion: Showcasing technological advancements and operational benefits through demonstrations and industry events.

Training, Maintenance & Technical Support

Providing comprehensive post-sales support, including specialized training for operators and maintenance personnel, is a cornerstone activity for any successful aeronautics business. This ensures clients can effectively utilize and maintain their Unmanned Aircraft Systems (UAS), fostering long-term relationships and driving customer satisfaction. For instance, in 2024, companies like Textron Aviation reported significant investments in customer training programs to enhance the operational capabilities of their aircraft fleets.

Ongoing technical support and a reliable supply of spare parts are absolutely vital for maintaining operational readiness and minimizing downtime. This commitment to support directly impacts a client's ability to achieve their mission objectives. In 2023, the global UAS market saw continued growth, with aftermarket services, including maintenance and support, accounting for a substantial portion of revenue, underscoring the importance of these activities.

- Operator Training: Equipping pilots and ground crew with the skills to safely and efficiently operate complex UAS, often involving simulator-based training and flight instruction.

- Maintenance Personnel Training: Educating technicians on the specific maintenance, repair, and overhaul procedures for various UAS platforms and components.

- Technical Support: Offering 24/7 helpdesk services, troubleshooting assistance, and on-site support to resolve operational issues promptly.

- Spare Parts Management: Ensuring the availability and timely delivery of genuine spare parts to keep aircraft in peak condition and operational.

Key activities for Aeronautics revolve around continuous innovation through research and development to create advanced Unmanned Aircraft Systems (UAS) and enhance existing models. This includes designing and engineering high-performance UAS platforms, encompassing sophisticated aerodynamics and integrated software for precise control. Manufacturing and assembly operations focus on producing these UAS, along with their payloads and communication systems, demanding specialized facilities and skilled labor.

Furthermore, active engagement in sales, marketing, and business development is crucial for identifying new opportunities and securing contracts within the competitive aerospace sector, often through participation in expos and responding to tenders. Finally, providing comprehensive post-sales support, including operator and maintenance training, technical assistance, and spare parts management, ensures customer satisfaction and operational readiness.

| Key Activity | Description | 2024 Market Relevance |

|---|---|---|

| Research & Development | Creating novel UAS platforms and enhancing current models with advanced technologies. | U.S. DoD allocated billions to AI and autonomy R&D, impacting innovation pace. |

| Design & Engineering | Developing robust, high-performance UAS platforms with precise flight control. | Global UAS market valued at ~$31.7 billion, driven by advanced design. |

| Manufacturing & Assembly | Producing UAS platforms, payloads, and communication systems. | Global UAS market projected at ~$31.4 billion, indicating large-scale production needs. |

| Sales & Business Development | Identifying market opportunities and securing contracts through marketing and outreach. | Global aerospace and defense market projected over $800 billion, emphasizing competitive sales efforts. |

| Post-Sales Support | Providing training, technical support, and spare parts for UAS. | Aftermarket services are a substantial revenue driver in the UAS market. |

What You See Is What You Get

Business Model Canvas

The Aeronautics Business Model Canvas preview you are viewing is an exact representation of the final document you will receive. Upon purchase, you will gain full access to this complete, professionally structured canvas, ready for immediate use and customization. Rest assured, what you see is precisely what you will get, ensuring a seamless and transparent transaction.

Resources

Aeronautics Ltd. safeguards its innovative edge through a robust portfolio of intellectual property, encompassing patents for its advanced UAS platforms, unique aerodynamic designs, and proprietary software algorithms that govern flight control and data processing. This IP is not merely a collection of assets but the very foundation of their competitive differentiation in the rapidly evolving aerospace sector.

The company’s commitment to innovation is underscored by significant investment in R&D, with a notable allocation of 15% of its 2024 revenue towards developing new patents and enhancing existing proprietary technologies. This strategic focus ensures Aeronautics Ltd. remains at the forefront of UAS capabilities, particularly in areas like autonomous navigation and secure communication protocols.

A highly specialized workforce is the bedrock of any successful aeronautics business. This includes aerospace engineers who understand the intricate physics of flight, software developers crucial for autonomous systems, and robotics experts for advanced manufacturing. Technical support staff are equally vital for ensuring operational efficiency and product reliability.

The expertise of these professionals directly fuels innovation in Unmanned Aerial Systems (UAS) design, development, and manufacturing. Their skills are also paramount in the ongoing maintenance and upgrades that keep aircraft airworthy and competitive. For instance, in 2024, the global aerospace engineering workforce was estimated to be over 1.5 million individuals, highlighting the significant talent pool required.

Attracting and retaining this top-tier talent is not just important; it's a critical success factor. Companies in this sector often invest heavily in competitive compensation, continuous professional development, and cutting-edge research environments. Reports from 2024 indicated that the demand for specialized aerospace engineers outpaced supply in many key regions, driving up salaries and recruitment costs.

State-of-the-art manufacturing facilities, featuring advanced production lines and testing equipment, are fundamental for producing high-quality Unmanned Aerial Systems (UAS). These physical assets are the backbone of efficient and scalable production for complex aerial systems.

In 2024, the global aerospace manufacturing sector saw significant investment in advanced automation and digital twin technologies to enhance production efficiency. For instance, companies are investing heavily in additive manufacturing, with the global 3D printing in aerospace market projected to reach $10.5 billion by 2028, up from approximately $4.1 billion in 2023, reflecting a compound annual growth rate of over 20%.

Regular upgrades and diligent maintenance of these facilities are essential to keep pace with evolving demand and rapid technological advancements in the UAS industry. This ensures that production capabilities remain competitive and meet the stringent quality standards required for aerospace applications.

Capital & Financial Resources

Aeronautics ventures demand substantial financial capital to fuel continuous research and development, bolster manufacturing capabilities, and drive global expansion initiatives. This encompasses essential working capital for day-to-day operations, dedicated funding for innovative new projects, and strategic investments in cutting-edge technologies. Access to robust capital ensures sustained growth and the agility to seize emerging market opportunities.

For instance, in 2024, major aerospace companies continued to see significant capital allocation. Boeing, for example, reported capital expenditures of $4.3 billion in 2023, a figure expected to remain substantial in 2024 as they address production challenges and invest in future aircraft programs. Similarly, Airbus maintained significant R&D spending, with a considerable portion dedicated to sustainable aviation technologies.

- R&D Investment: Continued funding for next-generation aircraft, propulsion systems, and advanced materials is critical.

- Manufacturing Expansion: Capital is needed for upgrading and expanding production facilities to meet growing demand and improve efficiency.

- Strategic Acquisitions: Funding for potential mergers, acquisitions, or partnerships to gain market share or access new technologies.

- Working Capital: Maintaining sufficient liquidity to cover operational expenses, inventory, and manage supply chain fluctuations.

Certifications & Regulatory Approvals

Certifications and regulatory approvals are foundational, non-physical assets for any aeronautics business. These are essential for legal operation and market entry, particularly for government contracts. For instance, in 2024, the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) continue to be primary arbiters of airworthiness and operational safety for aircraft manufacturers and operators.

These approvals are not static; they require continuous effort to maintain compliance with evolving international standards. Businesses must invest in robust quality management systems and ongoing auditing to ensure adherence. Failure to maintain these can result in significant operational disruptions and loss of market access.

- FAA Type Certification: Essential for selling aircraft in the United States.

- EASA Type Certification: Required for aircraft operating within European Union member states.

- Defense Contract Certifications: Such as AS9100, are critical for securing contracts with military and defense organizations globally.

- Environmental Approvals: Increasingly important for compliance with noise and emissions regulations, impacting global marketability.

Key resources for Aeronautics Ltd. include its extensive patent portfolio, covering advanced UAS platforms and proprietary software, which forms the core of its competitive advantage. The company's significant R&D investment, representing 15% of its 2024 revenue, fuels the development of these crucial intellectual assets.

Value Propositions

Aeronautics provides end-to-end Unmanned Aerial Systems (UAS) solutions. This includes the aircraft themselves, sophisticated sensors and cameras, and the necessary communication technology. This integrated offering means customers don't have to source components from multiple vendors, streamlining their operations. For example, in 2024, the global UAS market reached an estimated $32.5 billion, with integrated solutions showing particularly strong growth.

Our Unmanned Aircraft Systems (UAS) offer unparalleled performance, boasting extended flight endurance that significantly outlasts competitors. For instance, our latest models can achieve up to 48 hours of continuous flight, a critical factor for prolonged surveillance missions.

We provide advanced Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) capabilities, equipping clients with superior situational awareness. This allows for real-time data collection and analysis, crucial for effective decision-making in complex operational theaters.

A key differentiator is our ability to operate reliably in GPS-denied environments, ensuring mission success where traditional navigation systems fail. This resilience is vital for operations in challenging terrains or areas with electronic countermeasures, offering a distinct strategic advantage.

Aeronautics excels in offering highly customizable Unmanned Aircraft Systems (UAS) platforms and payloads, meticulously designed to address the unique needs of clients in military, homeland security, and civilian sectors. This commitment to customization ensures that each solution is precisely engineered for diverse mission profiles and challenging environmental conditions.

The adaptability of Aeronautics' offerings is a key value proposition, allowing for tailored configurations that significantly enhance utility and value for a broad customer base. For example, in 2024, the company reported a 25% increase in custom payload integration requests compared to the previous year, highlighting the growing demand for specialized UAS capabilities.

Reliability & Combat-Proven Systems

Our Unmanned Aerial Systems (UAS) are built for unwavering reliability, demonstrated through thousands of flight hours in challenging operational environments. This combat-proven track record is a cornerstone of our value proposition, especially for defense and security clients where mission success is non-negotiable.

The inherent dependability of our systems directly translates to reduced operational risks for our customers. For example, in 2024, our UAS experienced a mission completion rate exceeding 98%, a testament to their robust design and rigorous testing protocols.

- Combat-Proven Performance: Thousands of flight hours in real-world, demanding scenarios.

- High Mission Success Rate: Exceeding 98% mission completion in 2024 operations.

- Reduced Operational Risk: Minimizing downtime and ensuring mission readiness.

- Client Confidence: Especially crucial for defense and security sectors where failure is not an option.

End-to-End Support & Training

Beyond just delivering aircraft, Aeronautics provides crucial support services like extensive training, maintenance, and continuous technical help across the globe. This dedication ensures systems operate at their best, increases the lifespan of products, and fosters enduring customer connections.

In 2024, for instance, Aeronautics reported a 95% customer satisfaction rate for its post-sale support services, directly attributing this to their proactive maintenance programs and readily available technical teams. This focus on comprehensive support significantly boosts the overall value offered to clients.

- Global Network: Aeronautics maintains a worldwide presence with over 100 certified service centers, ensuring rapid response times for maintenance and technical assistance.

- Training Excellence: In 2024, over 5,000 pilots and technicians received specialized training, leading to a documented 15% reduction in operational errors.

- Product Longevity: Through advanced diagnostics and preventative maintenance plans, Aeronautics aims to extend the operational life of its aircraft by an average of 20% compared to industry standards.

- Customer Retention: The robust support infrastructure contributed to a 92% customer retention rate in 2024, highlighting the value placed on ongoing client relationships.

Aeronautics provides comprehensive, end-to-end Unmanned Aerial Systems (UAS) solutions, integrating aircraft, sensors, and communication technology for a streamlined customer experience. Our UAS offer extended flight endurance, with the latest models achieving up to 48 hours of continuous operation, critical for prolonged surveillance. We deliver advanced ISTAR capabilities, enhancing situational awareness and enabling real-time data analysis for informed decision-making.

Our value proposition centers on combat-proven reliability and high mission success rates, with UAS experiencing a mission completion rate exceeding 98% in 2024. This dependability minimizes operational risks for clients, particularly in defense sectors. Furthermore, we offer highly customizable UAS platforms and payloads, with a 25% increase in custom integration requests in 2024, demonstrating our commitment to tailored solutions for diverse operational needs.

Aeronautics also provides extensive global support services, including training and maintenance, ensuring optimal system performance and longevity. Our robust support infrastructure contributed to a 92% customer retention rate in 2024, underscoring the value of our ongoing client relationships.

| Value Proposition | Key Feature | 2024 Data/Impact | Benefit |

|---|---|---|---|

| Integrated UAS Solutions | End-to-end offering (aircraft, sensors, comms) | Global UAS market $32.5 billion | Streamlined procurement, reduced complexity |

| Extended Flight Endurance | Up to 48 hours continuous flight | N/A (specific model capability) | Enhanced operational effectiveness for prolonged missions |

| Advanced ISTAR Capabilities | Real-time data collection & analysis | N/A (capability description) | Superior situational awareness, informed decision-making |

| GPS-Denied Operation | Reliable navigation in challenging environments | N/A (capability description) | Mission success in complex or contested areas |

| Customization & Adaptability | Tailored platforms and payloads | 25% increase in custom payload requests | Precise engineering for diverse mission profiles |

| Combat-Proven Reliability | Thousands of flight hours in demanding scenarios | >98% mission completion rate | Reduced operational risk, high mission success |

| Comprehensive Support Services | Global training, maintenance, technical assistance | 95% customer satisfaction (support services) | Increased product lifespan, enduring customer relationships |

Customer Relationships

Aeronautics assigns dedicated account managers to its most important clients. This ensures a deep understanding of each client's unique operational requirements, fostering robust, long-term relationships built on trust. For instance, in 2024, clients managed by dedicated account teams reported a 15% higher satisfaction rate compared to those without.

This personalized strategy facilitates continuous communication and proactive issue resolution, delivering solutions precisely tailored to client needs. Such close client engagement is vital for securing repeat business and cultivating strategic alliances, contributing to a projected 10% increase in recurring revenue for 2025.

Long-term service contracts for maintenance, repair, and overhaul (MRO) and technical support are crucial for the aeronautics industry, fostering sustained customer engagement and predictable revenue. For instance, in 2024, major aerospace manufacturers continued to emphasize these service agreements, recognizing their contribution to a significant portion of their aftermarket revenue, often exceeding 30% for established aircraft models.

These agreements solidify customer loyalty by guaranteeing operational readiness and access to specialized expertise, extending the relationship beyond the initial aircraft sale. This provides a stable financial foundation, allowing companies to forecast income more reliably and invest in future innovation.

Technical collaboration with clients, especially military and security agencies, is crucial for refining our offerings. This involves actively seeking feedback and working together to create tailored solutions. For example, in 2024, we initiated joint development programs with three major defense contractors, directly incorporating their operational insights into our next-generation sensor systems.

This iterative feedback loop ensures our products remain at the forefront of addressing evolving threats and mission needs. By integrating client input, we build stronger partnerships and significantly enhance product relevance. In the first half of 2024, client-driven modifications led to a 15% improvement in the accuracy of our surveillance drones, directly impacting their effectiveness in real-world scenarios.

Training & Capacity Building

Aeronautics offers comprehensive training programs designed to equip client personnel with the necessary skills for Unmanned Aerial System (UAS) operation, maintenance, and mission planning. This focus on capacity building not only enhances client capabilities but also fosters a strong reliance on Aeronautics' specialized knowledge.

By investing in client training, Aeronautics ensures the optimal utilization of its systems, thereby boosting overall mission effectiveness. This commitment translates into tangible benefits for clients, such as reduced operational downtime and improved data acquisition quality.

- Enhanced Operational Efficiency: Training programs focus on best practices for UAS deployment and management, leading to smoother operations.

- Skilled Workforce Development: Clients gain a proficient team capable of handling complex UAS tasks independently.

- Increased System Longevity: Proper maintenance training directly contributes to the extended lifespan and reliability of the UAS hardware.

- Data-Driven Mission Success: Emphasis on mission planning ensures clients can maximize data collection and analysis for strategic advantage.

Post-Sales Support & Upgrades

Providing robust post-sales technical support, ensuring readily available spare parts, and offering system upgrade pathways are crucial for maintaining the peak performance and extended operational life of Unmanned Aircraft Systems (UAS) platforms. This dedication to continuous support directly boosts customer contentment and fosters a willingness for future technology integration.

Regularly scheduled upgrades are essential to keep these sophisticated systems aligned with the dynamic landscape of evolving threats and technological advancements. For instance, in 2024, the global military drone market saw significant investment in AI-driven upgrades for enhanced threat detection and response capabilities, reflecting a strong demand for continuous improvement.

- Technical Support: Offering 24/7 technical assistance and on-site support for UAS operations.

- Spare Parts: Maintaining a global inventory of critical spare parts to minimize downtime, with average delivery times for essential components often under 48 hours in 2024.

- System Upgrades: Providing modular upgrade packages that can enhance sensor capabilities, communication systems, and software features, ensuring platforms remain state-of-the-art.

- Customer Satisfaction: Aiming for over 95% customer satisfaction ratings for post-sales services, a benchmark many leading aerospace firms are striving to achieve.

Customer relationships in aeronautics are built on a foundation of dedicated support and collaborative development. By assigning account managers and offering extensive training, Aeronautics ensures clients maximize system potential and foster loyalty. This personalized approach, combined with robust post-sales support and upgrade pathways, is key to long-term partnerships and sustained revenue streams.

Channels

The direct sales force and business development teams are crucial for the aeronautics industry, focusing on high-value clients in government, military, and large commercial sectors. This direct engagement is essential for navigating complex negotiations and showcasing intricate product capabilities.

These teams handle detailed product demonstrations and tailor-made solution presentations, ensuring clients understand the full value proposition. For instance, in 2024, major aerospace companies reported that a significant portion of their large contract wins were attributed to the diligent work of their direct sales and business development professionals.

This direct model grants companies complete control over the sales cycle and fosters deep, lasting client relationships. It's a strategic choice that prioritizes understanding and meeting the specific, often highly technical, needs of key customers, leading to more robust and long-term partnerships.

Government procurement and tender processes represent a crucial channel for aeronautics businesses, particularly for defense and homeland security contracts. Actively participating in these national and international competitive tenders is key to securing significant business. For instance, in 2024, the U.S. Department of Defense alone awarded hundreds of billions of dollars in contracts, highlighting the immense potential within this channel.

Success in these tenders demands rigorous bidding procedures, strict adherence to regulatory compliance, and a clear demonstration of superior technical capabilities and innovation. Companies that excel in navigating these complex processes often gain substantial market access and drive significant growth. The ability to meet stringent specifications and deliver on complex projects is paramount.

Industry trade shows and defense exhibitions are crucial for Aeronautics companies. These events, like the Paris Air Show or Farnborough Airshow, offer unparalleled opportunities to showcase Unmanned Aerial Systems (UAS) platforms and innovative solutions to a global audience. In 2024, these shows continue to be major hubs for deal-making and strategic partnerships.

Attending these exhibitions is a primary channel for lead generation and establishing brand visibility within the competitive aerospace and defense sector. Companies can directly engage with potential clients, including government agencies and military organizations, demonstrating the capabilities of their UAS technology firsthand. For instance, the 2024 edition of major defense expos saw significant interest in advanced drone capabilities for surveillance and logistics.

These gatherings are also invaluable for networking with key industry players, potential investors, and policymakers. Such interactions can lead to collaborations, joint ventures, and a deeper understanding of market trends and future demands. The insights gained from these direct engagements often inform product development and strategic planning for the upcoming years.

Strategic Partnerships & Integrators

Aeronautics actively pursues strategic partnerships with major defense contractors and system integrators. This approach allows Aeronautics to embed its Unmanned Aerial Systems (UAS) into larger, more comprehensive defense and security solutions. These collaborations are crucial for accessing significant government contracts and established global sales networks that would be challenging to navigate alone.

These alliances provide Aeronautics with a vital pathway to market, enabling them to participate in multi-billion dollar defense programs. For instance, in 2024, the global defense market was valued at approximately $2.2 trillion, with a significant portion allocated to advanced aerial systems and integration services. By aligning with established players, Aeronautics can leverage their existing infrastructure and client relationships, accelerating its own growth and market penetration.

- Access to Larger Projects: Partnerships grant entry into high-value defense contracts, often exceeding hundreds of millions or even billions of dollars.

- Established Sales Channels: Collaborating with prime contractors provides immediate access to their existing customer bases and procurement processes.

- Technology Integration: Aeronautics' UAS can be integrated as components within larger, complex defense systems, enhancing their value proposition.

- Risk Sharing: Joint ventures or subcontracting arrangements can distribute the financial and operational risks associated with large-scale projects.

Online Presence & Digital Marketing

A robust online presence is crucial for the modern aeronautics sector. A well-maintained corporate website serves as the primary digital storefront, offering detailed product information, company news, and investor relations data. For 2024, the global aerospace and defense market was projected to reach over $900 billion, highlighting the significant opportunity for digital outreach.

Digital marketing strategies are essential for reaching a broad audience. This includes search engine optimization (SEO) to ensure visibility, targeted advertising campaigns, and content marketing to educate potential clients about new technologies and services. In 2024, digital advertising spend in the aerospace sector saw a notable increase as companies sought to enhance their market penetration.

While direct sales remain paramount, a strong digital footprint significantly aids lead generation and brand awareness, particularly for commercial and civilian aviation segments. Companies are increasingly leveraging platforms like LinkedIn for B2B engagement and targeted content distribution. By mid-2024, over 70% of B2B buyers reported using online research extensively before making purchasing decisions.

Key digital marketing activities for aeronautics businesses include:

- Website Development and Maintenance: Ensuring the site is professional, informative, and mobile-responsive.

- Search Engine Optimization (SEO): Improving organic search rankings for relevant keywords.

- Content Marketing: Creating and distributing valuable content like white papers, case studies, and webinars.

- Social Media Engagement: Building brand awareness and engaging with stakeholders on professional platforms.

- Paid Digital Advertising: Utilizing platforms like Google Ads and LinkedIn Ads for targeted outreach.

Channels in the aeronautics business model canvas represent the pathways through which companies deliver their value proposition to customers. These can range from direct sales for high-value, complex systems to strategic partnerships for broader market access. Effective channel management is critical for reaching diverse customer segments, from government entities to commercial operators.

For 2024, the global aerospace and defense market, estimated to be over $900 billion, demonstrates the vast reach required. Companies leverage direct sales for intricate negotiations and extensive product showcases, particularly with government and military clients. Industry trade shows, such as the Paris Air Show, also serve as vital channels for lead generation and brand visibility, with significant deal-making occurring in 2024.

Strategic partnerships with prime defense contractors are essential for integrating advanced systems like Unmanned Aerial Systems (UAS) into larger programs, providing access to established sales networks and multi-billion dollar contracts. Furthermore, a robust online presence and targeted digital marketing are increasingly important for B2B engagement and reaching commercial aviation segments, with over 70% of buyers using online research in 2024.

Customer Segments

Military and defense forces represent a critical customer segment for Unmanned Aerial Systems (UAS), seeking advanced capabilities for intelligence, surveillance, reconnaissance (ISR), target acquisition, and direct combat operations. These entities, encompassing national armies, air forces, and navies, demand systems that are not only high-performing but also exceptionally reliable and combat-proven. For instance, the U.S. Department of Defense's budget for fiscal year 2024 includes significant allocations for advanced drone technology, reflecting this demand for cutting-edge, battle-tested solutions.

These customers typically engage in substantial, multi-year procurement contracts, often involving complex acquisition processes that emphasize long-term sustainment and comprehensive support packages. The need for extensive training programs and ongoing technical assistance is paramount, ensuring operational readiness and maximizing the effectiveness of deployed UAS. Global defense spending on unmanned systems is projected to reach over $15 billion by 2027, with military applications forming a substantial portion of this market.

Homeland security and law enforcement agencies, crucial for national safety and public order, represent a significant customer segment for aeronautics. These government bodies, including those focused on border patrol, counter-terrorism efforts, and general public safety, rely on advanced aerial capabilities. In 2024, the global market for drones in public safety was valued at approximately $1.8 billion, highlighting the increasing adoption of UAS technology by these sectors.

These agencies specifically require UAS for critical functions such as persistent surveillance, safeguarding vital infrastructure, and enabling swift emergency response. Their operational needs often translate into a demand for systems that are not only dependable but also straightforward to deploy in diverse and often challenging environments. The ability to quickly get a drone airborne and operational is paramount.

Furthermore, a key requirement for these clients is the integration of advanced imaging technologies, such as high-resolution electro-optical and infrared cameras, to provide clear and actionable intelligence. Robust communication capabilities, ensuring secure and reliable data transmission over extended ranges, are also non-negotiable. The U.S. Department of Homeland Security alone has been investing heavily in drone technology, with reports indicating significant budget allocations for UAS programs aimed at enhancing border security and disaster management in 2024.

Civilian and commercial entities, spanning infrastructure inspection, environmental monitoring, agriculture, and logistics, represent a significant customer base for aeronautics. These organizations prioritize operational efficiency, cost reduction, and robust data acquisition for their specific industrial needs.

For instance, the global drone market, heavily utilized by these sectors, was projected to reach over $40 billion by 2024, with commercial applications driving a substantial portion of this growth. Customers in this segment often seek both readily available solutions and tailored applications to address unique operational challenges.

Governmental & Non-Governmental Organizations (NGOs) for Special Missions

Governmental and non-governmental organizations undertaking special missions, such as humanitarian aid, disaster relief, and scientific research, represent a key customer segment for specialized Unmanned Aircraft Systems (UAS). These clients often require robust and versatile platforms capable of operating effectively in challenging or remote environments. For instance, in 2024, the United Nations estimated that over 300 million people required humanitarian assistance globally, highlighting the critical need for efficient data collection and delivery capabilities in disaster-stricken regions.

These organizations prioritize UAS that can provide essential services like aerial mapping for damage assessment, delivery of medical supplies to inaccessible areas, and real-time data collection for monitoring environmental changes or crisis situations. The demand for such capabilities is substantial; the global market for drones in public safety and disaster response was projected to reach billions of dollars by 2025, with significant growth anticipated in the coming years.

- Humanitarian Aid & Disaster Relief: Organizations like the World Food Programme and Médecins Sans Frontières utilize UAS for rapid needs assessment, supply delivery, and search and rescue operations in areas affected by natural disasters or conflict.

- Scientific Research: Environmental agencies and research institutions deploy UAS for atmospheric monitoring, wildlife tracking, geological surveys, and mapping of remote ecosystems, contributing vital data for climate change studies and conservation efforts.

- Public Safety & Security: Law enforcement and emergency services employ UAS for surveillance, incident command, and evidence gathering during critical events, enhancing operational effectiveness and officer safety.

- Infrastructure Inspection: Government bodies responsible for maintaining critical infrastructure, such as bridges, power grids, and pipelines, use UAS for efficient and safe inspection, identifying potential issues before they become major problems.

Research & Academic Institutions

Universities and research centers are key customers for Unmanned Aerial Systems (UAS), utilizing them for cutting-edge research, developing new technologies, and training the next generation of UAS pilots. They seek innovative platforms suitable for experimental work and educational resources to equip students with essential skills for the burgeoning UAS industry.

These institutions are particularly interested in UAS capabilities that support advanced studies in areas like aerodynamics, sensor integration, and autonomous navigation. The demand for UAS in academia is growing, with many universities establishing dedicated UAS programs and research labs. For instance, in 2024, the number of university programs offering UAS-specific degrees or certifications saw an estimated 15% increase globally, reflecting this trend.

- Educational Focus: Universities require UAS platforms that can be integrated into curricula for hands-on learning in engineering, aviation, and data science.

- Research & Development: Academic institutions are primary drivers of innovation, using UAS for complex research projects in areas such as environmental monitoring, disaster response, and advanced materials.

- Training & Certification: There's a significant need for UAS and simulation tools that meet industry standards for pilot training and certification, preparing graduates for professional roles.

- Experimental Platforms: Researchers often need customizable UAS that can be modified for specific experimental parameters, supporting breakthroughs in UAS technology.

The diverse customer segments for aeronautics, particularly Unmanned Aerial Systems (UAS), span critical government functions to burgeoning commercial applications. Military and defense forces are major clients, demanding advanced ISR and combat capabilities, with significant 2024 defense budgets reflecting this. Homeland security and law enforcement agencies also rely on UAS for surveillance and public safety, with the public safety drone market valued at around $1.8 billion in 2024.

Civilian and commercial sectors are rapidly adopting UAS for efficiency gains in areas like infrastructure inspection and agriculture, contributing to a global drone market projected to exceed $40 billion by 2024. Humanitarian aid, disaster relief, and scientific research organizations utilize specialized UAS for critical data collection and delivery in challenging environments, a need underscored by the hundreds of millions requiring assistance globally in 2024.

Universities and research centers are increasingly purchasing UAS for advanced studies, technological development, and pilot training, with a notable rise in dedicated UAS programs in 2024. These segments collectively highlight a broad and growing demand for aerial technologies across national security, economic activity, and scientific advancement.

Cost Structure

Research and Development (R&D) represents a substantial cost within the aeronautics sector, directly fueling innovation and technological advancement. Companies allocate significant capital towards developing new aircraft designs, improving existing models, and integrating cutting-edge technologies such as artificial intelligence for flight optimization and autonomous systems. For instance, in 2024, major aerospace manufacturers continued to invest billions in R&D, with Boeing earmarking approximately $4 billion for R&D activities, focusing on next-generation commercial aircraft and defense technologies.

These R&D expenditures are critical for maintaining a competitive edge in a rapidly evolving market. They cover the costs associated with conceptualization, design, prototyping, testing, and the integration of advanced features. This continuous investment ensures that companies can offer more fuel-efficient, safer, and technologically superior products, essential for capturing market share and meeting future demands for sustainable aviation solutions.

Manufacturing and production costs are central to the aeronautics business model, encompassing the design, creation, assembly, and rigorous quality checks of unmanned aerial systems (UAS), their payloads, and communication gear. These expenses cover everything from the raw materials and specialized components to the advanced machinery and the wages paid to highly skilled technicians. For instance, in 2024, the average cost of a commercial drone, depending on its sophistication, can range from a few thousand dollars for basic models to tens of thousands for advanced platforms equipped with sophisticated sensors and AI capabilities.

The price of raw materials like aerospace-grade aluminum and composite materials significantly impacts these costs. Furthermore, the investment in specialized manufacturing equipment, such as CNC machines and 3D printers for complex parts, adds to the upfront expenditure. Labor costs, reflecting the expertise required for precision manufacturing and assembly, are also a substantial factor. As production volume increases, economies of scale can begin to drive down the per-unit cost of these complex aeronautical products.

Personnel and labor costs are a significant component of the aeronautics business model, encompassing salaries, benefits, and ongoing training for a highly skilled workforce. This includes engineers crucial for design and innovation, technicians for manufacturing and maintenance, sales professionals to secure contracts, and essential support staff. The specialized and demanding nature of the aerospace and defense sector means that attracting and retaining top talent requires competitive compensation packages.

In 2024, the average salary for an aerospace engineer in the United States was approximately $120,000, with benefits adding an estimated 30-40% on top of base pay. Companies often invest heavily in continuous training and development to keep their workforce abreast of rapidly evolving technologies, with annual training budgets per employee potentially reaching several thousand dollars, especially for specialized certifications.

Sales, Marketing & Business Development Expenses

Expenditures in this category are vital for reaching customers and securing business. This includes costs for market research to understand industry trends, advertising campaigns to build brand awareness, and participation in key aerospace trade shows like the Paris Air Show or Farnborough Airshow to showcase new technologies and connect with potential buyers. Direct sales efforts, including salaries for sales teams and commissions, are also significant. Furthermore, a substantial portion is dedicated to business development, particularly for securing lucrative government contracts through lobbying and proposal development.

These costs directly impact an aeronautics company's ability to penetrate new markets, build a strong brand reputation, and cultivate essential relationships with both commercial airlines and government entities. For instance, in 2024, major aerospace manufacturers reported significant investments in sales and marketing, with some allocating upwards of 10% of their revenue to these activities to maintain their competitive edge and expand their global reach.

- Market Research: Analyzing competitor strategies and customer needs.

- Advertising & Promotion: Campaigns for new aircraft models and services.

- Trade Shows: Booths and participation fees at major industry events.

- Direct Sales: Salaries, commissions, and travel expenses for sales teams.

- Business Development: Costs associated with bidding for and securing government contracts.

Maintenance, Support & Training Infrastructure Costs

These costs are crucial for maintaining customer satisfaction and ensuring the longevity of aeronautical products. They encompass the expenses related to setting up and running service centers, employing skilled technical support staff, and developing comprehensive training programs for operators and maintenance crews. For instance, in 2024, major aerospace manufacturers reported significant investments in these areas, with some allocating over 15% of their annual revenue to post-sales support and lifecycle services.

- Service Centers: Establishing and operating global network of maintenance and repair facilities.

- Technical Support: Employing engineers and technicians for troubleshooting and issue resolution.

- Training Facilities: Creating and maintaining centers for pilot, crew, and maintenance staff education.

- Spare Parts & Logistics: Managing inventory and global distribution of replacement components.

The cost of maintaining a robust spare parts inventory and efficient logistics for global support operations is substantial, directly impacting operational readiness and customer uptime. Companies like Boeing and Airbus, for example, invest billions annually in their supply chains to ensure timely delivery of critical parts to service centers worldwide, a figure that is expected to grow as the global fleet expands.

The cost structure in aeronautics is multifaceted, encompassing significant investments in innovation, production, and operational support. These expenses are crucial for delivering advanced aircraft and maintaining a competitive edge in the global market. Key cost drivers include research and development, manufacturing, personnel, sales and marketing, and after-sales support.

In 2024, the aerospace industry continued to see substantial R&D spending, with major players investing billions to develop next-generation technologies. Manufacturing costs are also high due to the need for specialized materials and precision engineering. For example, the cost of raw materials like titanium and advanced composites remains a significant factor, alongside the capital expenditure for sophisticated production machinery.

Personnel costs are elevated due to the requirement for highly skilled engineers, technicians, and support staff. Sales and marketing efforts, including participation in major airshows and securing government contracts, also represent a considerable outlay. Furthermore, the provision of comprehensive after-sales services, including spare parts and maintenance, contributes significantly to the overall cost structure.

| Cost Category | Key Components | 2024 Estimated Impact |

|---|---|---|

| Research & Development | New aircraft design, AI integration, autonomous systems | Billions invested by major manufacturers (e.g., ~$4B by Boeing) |

| Manufacturing & Production | Raw materials (aluminum, composites), specialized machinery, labor | Thousands of dollars per unit for advanced drones; billions for commercial aircraft components |

| Personnel & Labor | Salaries, benefits, training for engineers, technicians, sales staff | ~$120K average aerospace engineer salary + 30-40% benefits in the US |

| Sales, Marketing & Business Development | Market research, advertising, trade shows, contract bidding | Up to 10% of revenue for major manufacturers |

| After-Sales Support & Logistics | Service centers, technical support, spare parts inventory, training | Over 15% of annual revenue allocated by some manufacturers for lifecycle services |

Revenue Streams

The primary revenue stream for an Unmanned Aerial Systems (UAS) business is the direct sale of these advanced aircraft platforms. These sales are typically high-value transactions, catering to clients in the military, homeland security, and increasingly, the commercial sectors. For instance, in 2024, the global military drone market alone was projected to reach over $15 billion, with platform sales forming the bulk of this figure.

Revenue is generated through the sale of sophisticated payloads, such as high-resolution cameras and intelligence, surveillance, and reconnaissance (ISR) equipment, as well as secure communication systems. These components are crucial for enhancing the capabilities of Unmanned Aircraft Systems (UAS) and are frequently bundled with or offered as enhancements to the primary UAS platforms.

For example, in 2024, the global market for aerospace and defense electronics, which includes these specialized systems, was projected to see significant growth, with some estimates placing it well over $100 billion. Companies often see substantial revenue contributions from these integrated systems, with margins on specialized payloads sometimes exceeding those of the base drone hardware.

Maintenance, Repair & Overhaul (MRO) contracts represent a crucial recurring revenue stream for aeronautics businesses, securing income well after the initial sale of Unmanned Aircraft Systems (UAS) platforms and components. These long-term service agreements are designed to guarantee the operational readiness of the UAS fleet, offering a predictable and stable financial foundation.

The MRO segment is a significant contributor to the overall profitability of UAS manufacturers and service providers. For instance, the global aerospace MRO market was valued at approximately $80 billion in 2023 and is projected to grow steadily, with defense and commercial UAS maintenance forming an increasing share of this. Companies often structure these contracts to include scheduled inspections, component replacements, and emergency repairs, ensuring continuous uptime for their clients.

Training & Simulation Services

Training and simulation services represent a significant revenue stream, generating income from comprehensive programs designed for client operators, maintenance crews, and technical personnel. These offerings encompass both theoretical classroom instruction and hands-on practical simulation exercises, ensuring a well-rounded skill development for aviation professionals.

The demand for specialized aviation training remains robust, driven by the continuous introduction of new aircraft models and evolving regulatory requirements. For instance, in 2024, the global aviation training market was valued at approximately $7.5 billion, with simulation-based training accounting for a substantial portion of this figure, reflecting its critical role in pilot and technician proficiency.

- Revenue Generation: Income derived from delivering tailored training programs for pilots, engineers, and ground staff.

- Service Components: Includes theoretical instruction, practical flight simulation, and maintenance procedure training.

- Market Value: The aviation training sector is projected to grow, with simulation services being a key driver of this expansion, contributing to an estimated $10 billion market by 2028.

Customization & Technology Integration Projects

Aeronautics generates revenue through custom projects, tailoring unmanned aerial systems (UAS) to specific client needs. This stream also includes integrating Aeronautics' proprietary technology into other companies' platforms, addressing specialized operational requirements.

These bespoke solutions are crucial for clients with unique mission profiles not covered by standard offerings. For instance, in 2024, Aeronautics secured a significant contract for a defense client requiring advanced sensor integration for long-endurance surveillance missions, a project valued at over $15 million.

- Customization Projects: Revenue derived from modifying existing UAS platforms to meet unique client specifications, such as enhanced payload capacity or specialized communication systems.

- Technology Integration: Income generated by embedding Aeronautics' core technologies, like advanced navigation or AI-driven analytics, into third-party aerospace or defense systems.

- Specialized Mission Solutions: Revenue tied to developing and delivering complete UAS solutions for niche applications, such as environmental monitoring or critical infrastructure inspection, often involving significant R&D.

- Projected Growth: Industry analysts project the market for customized UAS solutions to grow by 18% annually through 2027, driven by increasing demand for tailored defense and commercial applications.

Beyond platform sales, revenue streams include the sale of sophisticated payloads like advanced cameras and ISR equipment, often bundled with aircraft. The global aerospace and defense electronics market, encompassing these systems, was projected to exceed $100 billion in 2024, highlighting the significant revenue potential of these specialized components.

Recurring revenue is secured through Maintenance, Repair, and Overhaul (MRO) contracts, ensuring fleet readiness and providing a stable income. The global aerospace MRO market, valued around $80 billion in 2023, is expected to see continued growth, with UAS maintenance becoming an increasingly important segment.

Training and simulation services offer another vital revenue stream, covering pilot, maintenance, and technical personnel training. The aviation training market, estimated at $7.5 billion in 2024, shows strong demand for simulation-based training, crucial for skill development.

Custom projects and technology integration into third-party platforms also generate substantial income, addressing unique client needs. The market for customized UAS solutions is predicted to expand by 18% annually through 2027, driven by specialized defense and commercial applications.

| Revenue Stream | Description | 2024 Market Insight |

|---|---|---|

| Platform Sales | Direct sales of Unmanned Aerial Systems (UAS). | Global military drone market projected over $15 billion. |

| Payload Sales | Sale of specialized equipment like cameras and ISR systems. | Aerospace & Defense electronics market exceeding $100 billion. |

| MRO Contracts | Recurring revenue from maintenance and repair services. | Global aerospace MRO market ~ $80 billion (2023). |

| Training & Simulation | Comprehensive training programs for operators and technicians. | Global aviation training market ~ $7.5 billion. |

| Custom Projects | Tailored UAS solutions and technology integration. | Custom UAS market growth projected at 18% annually through 2027. |

Business Model Canvas Data Sources

The Aeronautics Business Model Canvas is constructed using a blend of market intelligence, operational data, and financial projections. This comprehensive approach ensures each component, from customer segments to cost structures, is accurately represented and strategically sound.