Aeronautics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeronautics Bundle

Navigate the complex external forces shaping the aeronautics industry with our PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are impacting key players. Gain a strategic advantage by downloading the full analysis to uncover actionable insights and future-proof your business decisions.

Political factors

Global defense spending saw a significant 8.1% jump in 2024, hitting a record $2.3 trillion due to rising geopolitical tensions. This upward trend is projected to persist into 2025, with nations prioritizing military modernization, directly boosting demand for advanced aeronautical technologies like unmanned aerial systems (UAS).

The U.S. Department of Defense's fiscal 2025 budget proposal of $849.8 billion underscores a strategic shift towards enhancing capabilities, particularly in unmanned systems. These substantial government investments are critical drivers for innovation and procurement within the aeronautics sector.

International trade dynamics, particularly export controls, significantly shape the aeronautics sector. China's revision of UAV export controls in July 2024, which now includes high-precision inertial-measurement equipment and prohibits military end-uses, exemplifies how geopolitical considerations directly impact technology transfer and market access for unmanned aerial systems.

These evolving regulations mean that nearly all Unmanned Aircraft Systems (UAS) face some form of export restriction, directly influencing global sales volumes and the feasibility of international research and development partnerships within the aeronautics industry.

Ongoing geopolitical instability, exemplified by the protracted Russia-Ukraine war and simmering tensions in the Middle East and Indo-Pacific, directly fuels a surge in global military spending. This heightened security environment compels nations to prioritize defense modernization, driving demand for advanced aerospace technologies.

In response to these security challenges, many countries are significantly increasing their defense budgets. For instance, NATO members, excluding the US, committed to spending at least 2% of their GDP on defense by 2024, a target that many are now exceeding, leading to substantial investments in new military hardware and capabilities, including Unmanned Aerial Systems (UAS).

Government Support for R&D

Governments worldwide are significantly increasing their investments in critical technology sectors, including cyber, space, and advanced defense systems. This strategic focus directly benefits the aeronautics industry, particularly companies involved in developing next-generation technologies like artificial intelligence, robotics, and advanced air mobility (AAM). For instance, the U.S. Department of Defense's budget for fiscal year 2024 includes substantial allocations for AI and autonomous systems, signaling strong governmental backing for innovation in these areas. This translates into considerable funding and partnership opportunities for aerospace firms specializing in advanced unmanned aerial systems (UAS) and other cutting-edge aviation technologies.

This heightened governmental support for research and development is a powerful catalyst for growth within the aeronautics sector. It not only provides direct financial injections through grants and contracts but also fosters an environment conducive to technological advancement. Companies that align their R&D efforts with these governmental priorities are well-positioned to secure lucrative contracts and drive innovation. For example, the European Union's Horizon Europe program has dedicated significant funding to aerospace research, with a strong emphasis on sustainable aviation and digital technologies, creating a fertile ground for companies focused on these advancements.

- Increased R&D Funding: Governments are channeling more resources into aerospace R&D, particularly in AI, robotics, and AAM.

- Strategic Technology Prioritization: Cyber, space, and next-generation defense technologies are key focus areas for government investment.

- Opportunity for UAS Companies: This governmental focus creates substantial funding and partnership opportunities for advanced UAS developers.

- Economic Impact: Government support stimulates innovation, job creation, and economic growth within the aeronautics sector.

Political Relationships with Client Nations

Political relationships and alliances significantly shape the aerospace industry, impacting market access and collaboration. For instance, the U.S. Department of Commerce and State revised space-related export controls in October 2024, easing licensing requirements for key allies such as Australia, Canada, and the United Kingdom. This move is expected to streamline technology transfer and foster deeper cooperation among these nations.

These evolving diplomatic ties directly influence defense contractors and aerospace manufacturers. Strong alliances can unlock new markets and facilitate joint ventures, while strained relationships can lead to trade barriers and reduced opportunities. The aerospace sector, heavily reliant on international trade and technology sharing, is particularly sensitive to these geopolitical shifts.

- October 2024 Export Control Updates: Eased licensing for space-related exports to Australia, Canada, and the UK by the U.S. Department of Commerce and State.

- Impact on Market Access: Facilitates easier trade and collaboration with allied nations, potentially boosting sales and joint development programs.

- Defense Contractor Influence: Direct correlation between strong political relationships and expanded opportunities for defense-focused aerospace companies.

- Geopolitical Sensitivity: The aerospace sector's reliance on global supply chains and technology transfer makes it highly susceptible to changes in international political dynamics.

Heightened geopolitical tensions are driving a significant increase in global defense spending, with a projected $2.3 trillion in 2024 and continued growth expected into 2025. This surge directly fuels demand for advanced aeronautical technologies, particularly unmanned systems, as nations prioritize military modernization. For instance, the U.S. defense budget for fiscal year 2025 highlights substantial investment in these capabilities.

International export controls, such as China's revised UAV regulations in July 2024, directly impact technology transfer and market access for aeronautics companies. These evolving regulations mean that almost all Unmanned Aircraft Systems (UAS) face some form of export restriction, influencing global sales and R&D partnerships.

Governments are strategically prioritizing critical technologies like AI, cyber, and advanced defense systems, channeling increased R&D funding into the aerospace sector. This focus creates significant opportunities for companies developing advanced UAS and other cutting-edge aviation technologies, as seen in the U.S. Department of Defense's fiscal year 2024 allocations.

Political alliances and diplomatic shifts, like the U.S. easing space-related export controls to key allies in October 2024, directly influence market access and collaboration within the aerospace industry. Strong alliances can unlock new markets and facilitate joint ventures, while strained relationships can create trade barriers.

What is included in the product

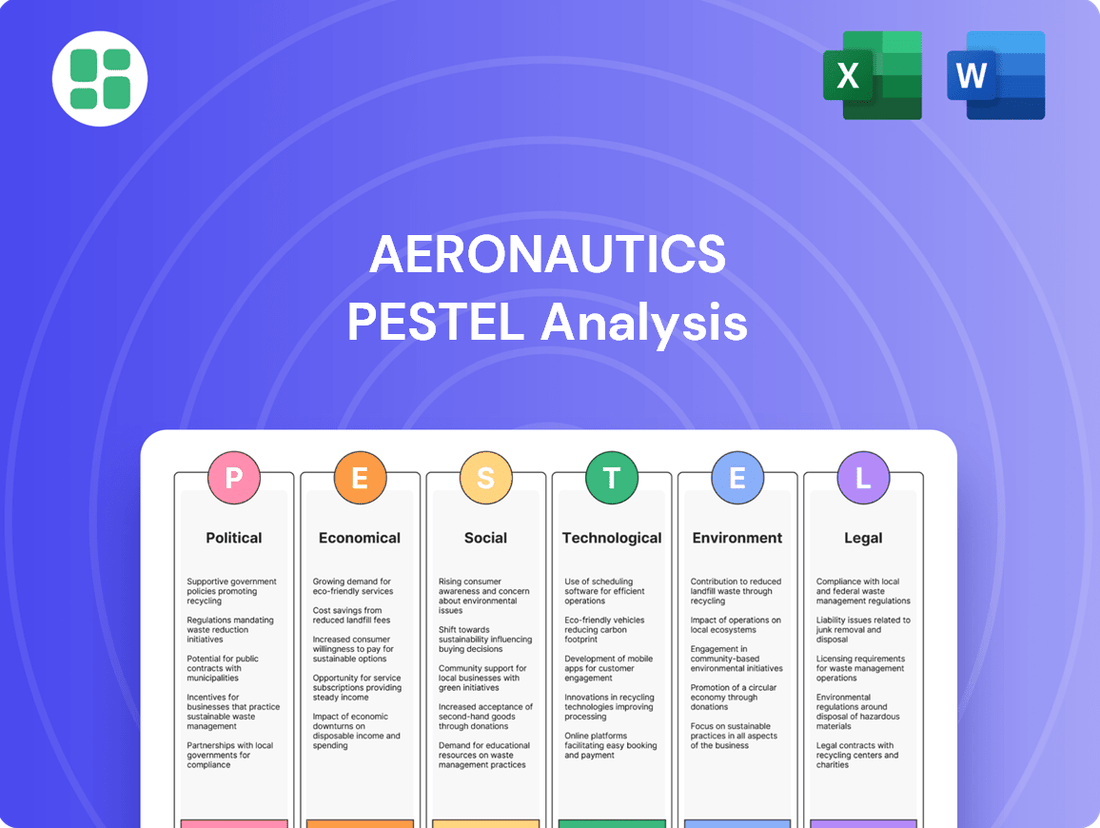

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting the Aeronautics sector across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic framework for understanding market dynamics, identifying opportunities, and mitigating risks for stakeholders within the aerospace and aviation industries.

A clear, actionable overview of the Aeronautics PESTLE Analysis, transforming complex external factors into manageable insights for strategic decision-making.

Economic factors

Global economic conditions significantly influence defense budgets, which in turn impact the aerospace sector. The global defense spending market was valued at an estimated USD 2.7 trillion in 2024. This figure is expected to climb substantially, reaching USD 6.38 trillion by 2035, signaling a strong upward trend for defense-related industries.

However, this growth is not without its hurdles for the aerospace and defense industry. Companies are navigating persistent supply chain disruptions, ongoing economic uncertainty, and the persistent pressure of inflation. These factors can affect project timelines, manufacturing costs, and overall profitability within the sector.

Global defense budgets saw a significant surge, increasing by 9% in 2024. This growth was largely driven by governments prioritizing investments in crucial areas like cybersecurity, space capabilities, and advanced defense technologies.

The demand for aerospace and defense products and services is projected to maintain its upward trajectory through 2025. This sustained increase is a direct consequence of ongoing geopolitical instability, which prompts nations to bolster their defense readiness and technological superiority.

The aerospace and defense sector continues to grapple with persistent supply chain constraints, exacerbated by geopolitical tensions and a notable labor gap. These challenges directly limit production output and significantly increase financial pressures. For instance, the ongoing shortages of critical components, such as advanced semiconductors and specialized alloys, have led to extended lead times and higher material costs throughout 2024 and into early 2025.

In response, aerospace manufacturers are actively prioritizing supply chain resilience. This involves a strategic shift towards diversifying their supplier base, reducing reliance on single sources, and actively redesigning operating models. The aim is to build greater long-term flexibility and mitigate the impact of future disruptions, with many companies investing in near-shoring and regionalizing key parts of their supply networks.

Tariff shifts and trade policy changes also remain a significant factor, adding another layer of complexity and cost. These policy adjustments can unpredictably alter the cost of imported materials and components, impacting the overall financial health of the industry. For example, changes in import duties on titanium or specialized manufacturing equipment can necessitate costly adjustments to procurement strategies and pricing models.

Availability of Investment and Funding

Investment in the aerospace and defense (A&D) sector remained robust through 2024, with the global space market alone reaching an estimated $510 billion. Mergers and acquisitions (M&A) activity within the broader A&D industry also demonstrated stability, indicating a healthy appetite for strategic consolidation and growth. This sustained investment environment is crucial for funding research, development, and manufacturing across the sector.

A significant driver of this investment is the expanding use of Unmanned Aircraft Systems (UAS) across a wide array of commercial applications, from logistics and agriculture to infrastructure inspection. Coupled with ongoing defense procurements and modernization programs, the increasing adoption of UAS technologies is fueling market expansion and attracting substantial capital. This trend is expected to continue, creating opportunities for innovation and market entry.

- Global Space Market Value: $510 billion in 2024.

- M&A Activity: Stable in the A&D sector through 2024.

- Key Investment Driver: Increasing adoption of UAS in commercial and defense sectors.

Currency Fluctuations and Inflation

Currency fluctuations and inflation present significant economic headwinds for the aeronautics sector. In 2024, persistent inflation has notably escalated production costs for raw materials, components, and labor, directly squeezing profit margins for aerospace manufacturers. For instance, the Producer Price Index for aerospace products saw a notable increase throughout 2024, impacting the cost of goods sold.

These economic pressures necessitate careful financial management and strategic pricing adjustments. Companies are actively seeking ways to mitigate rising expenses, whether through supply chain optimization or hedging against currency volatility, especially for international sales and component sourcing.

- Inflationary Impact: Rising input costs in 2024 have put considerable financial strain on aerospace and defense companies, affecting their bottom lines.

- Currency Volatility: Fluctuations in exchange rates can significantly alter the cost of imported components and the revenue generated from international aircraft sales.

- Cost Management: Effective strategies for managing production expenses and hedging currency risks are crucial for maintaining profitability in the current economic climate.

- Competitiveness: Navigating these economic challenges is vital for aerospace firms to remain competitive in a global market characterized by economic uncertainty.

Global economic conditions continue to shape the aeronautics sector, with defense spending remaining a critical factor. The projected increase in global defense spending to USD 6.38 trillion by 2035 highlights sustained government investment in security and advanced technologies.

However, the industry is contending with significant economic headwinds. Persistent inflation in 2024 has driven up production costs for materials, components, and labor, directly impacting aerospace manufacturers' profit margins. For example, the Producer Price Index for aerospace products saw a notable increase throughout 2024, affecting the cost of goods sold.

Currency fluctuations also pose a challenge, affecting the cost of imported components and revenue from international sales. Companies are actively implementing strategies to manage these rising expenses and currency risks to maintain competitiveness.

| Economic Factor | 2024 Impact | Outlook (Early 2025) |

|---|---|---|

| Global Defense Spending | Estimated USD 2.7 trillion | Continued growth expected |

| Inflation | Increased production costs | Persistent pressure on margins |

| Currency Volatility | Impacts international sales and sourcing | Ongoing risk for global operations |

| Supply Chain Costs | Escalated due to shortages | Continued pressure on input prices |

Same Document Delivered

Aeronautics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aeronautics PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry. Gain valuable insights into market trends, regulatory landscapes, and future opportunities.

Sociological factors

The increasing integration of Unmanned Aircraft Systems (UAS) into daily operations, from last-mile delivery trials to agricultural monitoring, signals a growing public acceptance of this technology. For instance, Amazon's Prime Air continues to expand its drone delivery services in select locations, demonstrating a tangible shift in how consumers interact with automated aerial systems.

Despite this progress, public perception remains a critical factor, with privacy and safety concerns frequently cited in surveys and public discourse. A 2024 survey indicated that while a majority of respondents are open to drone deliveries, a significant portion expressed reservations about potential surveillance and the risk of accidents, directly influencing the development of regulatory policies.

The increasing integration of autonomous systems in aeronautics, particularly in Unmanned Aircraft Systems (UAS), brings significant ethical questions to the forefront. Concerns about autonomous decision-making in critical flight situations and the development of autonomous weapons systems are paramount. For instance, the debate around lethal autonomous weapons systems (LAWS) continues, with many nations advocating for human control over the use of force, as highlighted in discussions at the UN Convention on Certain Conventional Weapons.

Addressing these ethical considerations is crucial for fostering public acceptance and ensuring the responsible advancement of aeronautics technology. A lack of transparency or perceived unaccountability in autonomous operations could erode public trust, potentially hindering widespread adoption and investment. Industry stakeholders are actively engaged in developing ethical frameworks and guidelines to navigate these complex issues, aiming to build confidence in the safety and integrity of autonomous flight.

The aerospace and defense sector continues to grapple with significant labor shortages, impacting production schedules and hindering growth. This scarcity of skilled workers, from engineers to assembly line technicians, is a persistent bottleneck. For instance, a 2024 report indicated that over 60% of aerospace companies surveyed experienced difficulties in filling critical positions, a trend that has persisted since at least 2022.

To combat these challenges, the industry is increasingly turning to digital transformation to attract and retain a qualified workforce. Companies are investing in advanced training programs, virtual reality simulations for onboarding, and data analytics to better understand employee needs and career paths. This strategic shift aims to bridge the skills gap and foster a more engaged and productive workforce for the future.

Social Impact of UAS Applications

Unmanned Aircraft Systems (UAS) are increasingly vital for public safety and security. In 2024, agencies are leveraging UAS for real-time monitoring during events and critical infrastructure inspections. Their role in search and rescue operations, particularly in challenging terrains, has become indispensable, with numerous successful deployments reported throughout the year.

However, this growing adoption raises significant privacy concerns. As UAS capabilities expand, so does the potential for pervasive surveillance, prompting a surge in discussions and legislative efforts to establish robust privacy regulations. By mid-2025, it's anticipated that clearer guidelines will be in place to balance public safety benefits with individual privacy rights.

- Public Safety Enhancements: UAS are actively used in disaster management, providing aerial views for damage assessment and resource allocation.

- Search and Rescue Successes: In 2024, drone technology significantly reduced search times in several high-profile missing person cases.

- Privacy Debates: The proliferation of surveillance drones has intensified public discourse on data collection and individual privacy.

- Regulatory Evolution: Governments worldwide are developing stricter legal frameworks to govern UAS operations and data handling.

Corporate Social Responsibility and Ethical Manufacturing

Societal expectations regarding corporate social responsibility (CSR) are significantly shaping the aeronautics sector, particularly concerning drone manufacturing. Consumers and regulators are increasingly scrutinizing the environmental impact of material sourcing and production processes. For instance, the mining and refining of metals like aluminum and rare earth elements, crucial for drone components, often involve substantial energy consumption and potential habitat disruption. This pressure is driving a shift towards sustainable manufacturing, with companies actively seeking to minimize their carbon footprint throughout the supply chain.

Ethical considerations in manufacturing are paramount, especially as drone technology proliferates. This includes ensuring fair labor practices and safe working conditions for those involved in component production, often across global supply chains. Companies are investing in transparent supply chain management to verify ethical sourcing and manufacturing standards. By 2024, many leading aerospace firms reported setting ambitious sustainability targets, aiming to reduce waste by 20% and increase the use of recycled materials by 15% in their drone production lines.

- Environmental Footprint: The extraction and processing of materials like aluminum, titanium, and specialized plastics used in drones have significant environmental implications, including energy use and waste generation.

- Supply Chain Scrutiny: Growing public and regulatory demand for ethical sourcing is pushing aerospace companies to ensure their entire drone supply chain adheres to strict environmental and labor standards.

- Sustainable Practices: Many aeronautics firms are implementing eco-friendly manufacturing techniques, such as utilizing recycled materials and optimizing energy efficiency in production facilities, to meet CSR expectations.

- Material Innovation: Research and development are increasingly focused on bio-based or more easily recyclable materials for drone construction, aiming to reduce reliance on resource-intensive traditional materials.

Societal expectations are increasingly influencing the aeronautics sector, particularly concerning the integration of Unmanned Aircraft Systems (UAS). Public acceptance, driven by demonstrated benefits in areas like delivery and public safety, is growing, though concerns about privacy and safety persist, as evidenced by ongoing public discourse and regulatory adjustments throughout 2024. Ethical considerations surrounding autonomous decision-making and the potential for misuse are also shaping development, with international bodies actively debating governance frameworks.

The industry faces a significant challenge in attracting and retaining a skilled workforce, with over 60% of aerospace companies reporting difficulties filling critical positions in 2024. To address this, companies are investing in digital transformation, including advanced training and virtual reality simulations, to build a more engaged and capable workforce for the future.

| Factor | 2024 Impact/Trend | 2025 Outlook |

|---|---|---|

| Public Acceptance of UAS | Growing, with increased drone delivery trials and public safety applications. | Continued expansion, contingent on addressing privacy and safety concerns. |

| Workforce Shortages | Over 60% of aerospace firms experienced difficulty filling skilled positions. | Persistent challenge, driving investment in digital training and retention strategies. |

| Ethical Debates (Autonomous Systems) | Active discussions on human control in critical flight and weapons systems. | Increased focus on developing ethical guidelines and transparent accountability frameworks. |

Technological factors

Artificial intelligence and machine learning are revolutionizing aeronautics, driving advancements in autonomous systems and predictive maintenance. In 2024, AI was instrumental in developing autonomous weapons, enhancing cybersecurity, and enabling real-time decision-making for aerospace and defense operations. For instance, the global AI in aerospace market was valued at approximately $10.5 billion in 2023 and is projected to reach over $25 billion by 2028, demonstrating significant growth.

Looking ahead to 2025, AI-powered navigation and sophisticated real-time data processing are set to further minimize human error and boost operational efficiency. This trend is evident in the increasing adoption of AI for flight path optimization and anomaly detection in aircraft systems, aiming to reduce maintenance costs and improve safety. Companies are investing heavily in AI R&D, with a focus on creating more autonomous flight capabilities and intelligent air traffic management systems.

The global defense industry is increasingly prioritizing autonomous counter-drone systems, with the outlook for 2025 pointing to significant growth in this sector. This surge is driven by the escalating need to counter unauthorized drone activity, making the development of effective Counter-Unmanned Aircraft Systems (C-UAS) a critical technological focus.

These C-UAS technologies are designed to detect, identify, track, and neutralize drones, encompassing a range of solutions from electronic warfare to directed energy weapons. For instance, the U.S. Department of Defense alone has allocated billions of dollars towards C-UAS research and procurement, reflecting the urgency and scale of this technological advancement.

Miniaturization and improved battery technology are revolutionizing the aeronautics sector. Advances in lithium-ion batteries have dramatically boosted drone flight times and operational ranges; for instance, some military-grade drones now boast flight endurance exceeding 24 hours. Simultaneously, the shrinking size of sensors, cameras, and processing units allows for smaller, lighter, and more maneuverable aircraft.

Looking ahead, innovations like hydrogen fuel cells promise to further extend endurance, potentially enabling drones to stay airborne for days rather than hours. This technological leap is critical for applications ranging from long-range surveillance to complex aerial logistics and delivery services.

Integration of Advanced Sensors and Communication Systems

The integration of advanced sensors like LiDAR, infrared, and hyperspectral imaging is significantly expanding the capabilities and applications of Unmanned Aerial Vehicles (UAVs) across numerous industries. These technologies are proving invaluable in sectors such as construction for site surveying, environmental monitoring for tracking changes, and industrial inspections for assessing infrastructure integrity. For instance, the global drone services market, heavily reliant on such sensor technology, was valued at approximately USD 15.1 billion in 2023 and is projected to reach USD 46.8 billion by 2028, demonstrating robust growth driven by these technological advancements.

Furthermore, sophisticated GPS and advanced navigation algorithms are enabling drones to achieve remarkable levels of flight accuracy and autonomy. This precision is critical for tasks requiring detailed mapping, precise delivery, or complex aerial maneuvers. The increasing accuracy allows drones to operate reliably in challenging environments, reducing the need for manual intervention and enhancing operational efficiency. By 2025, the demand for highly automated drone operations, powered by these navigation systems, is expected to surge, particularly in logistics and public safety applications.

- LiDAR and hyperspectral imaging are enhancing UAVs' data collection capabilities for detailed environmental and structural analysis.

- Advanced navigation systems allow for centimeter-level accuracy in drone flight paths, crucial for precision tasks.

- The global drone services market, driven by sensor and navigation tech, saw significant growth, projected to expand considerably by 2028.

- These technological integrations are paving the way for greater autonomy and wider adoption of drones in critical industries.

Cybersecurity Threats and Data Integrity

The increasing digitization across the aerospace and defense sectors, driven by advancements in areas like AI and IoT, has significantly amplified the risk of sophisticated cyberattacks. Companies are consequently investing heavily in robust cybersecurity solutions to protect sensitive data and operational systems. For instance, the global cybersecurity market in the aerospace and defense sector was projected to reach approximately $25 billion by 2024, highlighting the critical focus on this area.

Maintaining the integrity of data and ensuring the security of communication networks are paramount, particularly for Unmanned Aircraft Systems (UAS) operations. This is especially true for military and homeland security applications where breaches could have severe national security implications. A 2023 report indicated that cyber threats against critical infrastructure, including aviation, are becoming more frequent and complex, with state-sponsored actors posing a significant risk.

- Increased Investment: Aerospace and defense firms are allocating a larger portion of their IT budgets to cybersecurity, with some reporting increases of 15-20% year-over-year leading into 2025.

- UAS Vulnerabilities: The interconnected nature of modern UAS makes them prime targets for data interception and manipulation, necessitating advanced encryption and authentication protocols.

- Regulatory Scrutiny: Government agencies are imposing stricter cybersecurity mandates on aviation and defense contractors, demanding higher standards for data protection and system resilience.

Technological advancements are rapidly reshaping the aeronautics landscape, with AI and advanced sensors driving innovation in autonomous systems and data analysis. The increasing sophistication of navigation systems enables unprecedented flight accuracy, crucial for complex operations. These technological leaps are fostering greater autonomy and expanding drone applications across vital sectors.

| Technology Area | 2024/2025 Outlook | Impact on Aeronautics |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Continued integration into autonomous flight, predictive maintenance, and real-time decision support. | Enhanced operational efficiency, reduced human error, and improved safety. The global AI in aerospace market is projected to exceed $25 billion by 2028. |

| Advanced Sensors (LiDAR, Hyperspectral) | Wider adoption for detailed surveying, environmental monitoring, and infrastructure inspection. | Expanded capabilities for Unmanned Aerial Vehicles (UAVs) in diverse industrial applications. The drone services market is projected to reach $46.8 billion by 2028. |

| Miniaturization & Battery Technology | Development of lighter, more efficient components and extended flight endurance solutions (e.g., hydrogen fuel cells). | Smaller, more maneuverable aircraft with significantly longer operational ranges, enabling new use cases in logistics and surveillance. Military drones now boast endurance exceeding 24 hours. |

| Cybersecurity | Increased investment in robust solutions to protect sensitive data and operational systems against sophisticated threats. | Ensuring the integrity of data and communication networks, particularly critical for UAS operations. The aerospace and defense cybersecurity market was projected to reach $25 billion by 2024. |

Legal factors

The legal landscape for aeronautics is rapidly changing, particularly concerning drones. The FAA Reauthorization Act of 2024 is a significant development, paving the way for Beyond Visual Line of Sight (BVLOS) operations to commence for commercial and public use in 2025. This regulatory shift promises to unlock substantial new opportunities in areas like package delivery and infrastructure inspection.

However, these advancements come with increased compliance burdens. Operators will need to navigate new requirements for obtaining specific permits and certificates to conduct BVLOS flights, adding a layer of complexity to operations planning and execution.

Data privacy laws are increasingly shaping the operational landscape for aeronautics, particularly concerning surveillance activities. For instance, Australia's Privacy and Other Legislation Amendment Act 2024, effective December 2024, allows individuals to sue for serious privacy invasions. This legislative shift mandates a robust privacy-by-design framework for drone operators involved in data collection and surveillance.

Export control regulations, such as China's updated rules for unmanned aerial vehicles (UAVs) effective July 2024, and ongoing U.S. export controls on space-related technologies, exert considerable influence on the international aerospace market. These regulations dictate the permissible transfer of advanced technologies to specific nations, thereby shaping global trade dynamics and market access for aerospace companies.

The global aerospace industry, valued at approximately $900 billion in 2023, is particularly sensitive to these legal frameworks. For instance, U.S. export controls on dual-use technologies, including those applicable to satellite components and launch services, directly impact the ability of American firms to compete in international markets and collaborate with foreign partners, potentially limiting market expansion opportunities.

Intellectual Property Rights and Patent Protection

The fast-paced advancements in Unmanned Aircraft Systems (UAS) technology, including autonomous navigation and advanced sensor integration, demand strong intellectual property (IP) strategies. Protecting novel designs, proprietary software algorithms, and unique operational capabilities is crucial for maintaining a competitive edge in the aerospace sector.

Companies operating in the aeronautics industry must diligently analyze existing patent landscapes to avoid infringement issues and to identify opportunities for their own patent filings. This proactive approach safeguards investments in research and development and secures market exclusivity for innovative UAS solutions. For instance, in 2024, the global patent applications related to drone technology saw a significant uptick, reflecting the intense innovation race.

- Patent Filings: The number of patent applications for drone-related technologies globally is projected to continue its upward trend through 2025, driven by advancements in AI, cybersecurity, and payload capabilities.

- IP Litigation: Increased patent filings inevitably lead to a higher potential for IP litigation, making robust legal counsel and infringement monitoring essential for UAS developers.

- Trade Secrets: Beyond patents, safeguarding critical manufacturing processes and proprietary data through trade secret protection remains a vital legal strategy for many aeronautics firms.

Product Liability and Safety Standards

Product liability and safety standards are increasingly stringent in the aeronautics sector. For instance, the Federal Aviation Administration (FAA) mandated that all drones operating in U.S. airspace must broadcast a Remote ID by September 16, 2023, a move designed to enhance accountability and safety. This regulation requires manufacturers to equip drones with broadcast capabilities, impacting design and production costs.

Compliance with these evolving safety standards and obtaining necessary certifications is not merely a regulatory hurdle but a critical aspect of risk management for manufacturers and operators. Failure to adhere can lead to significant financial penalties and reputational damage.

- FAA Remote ID Mandate: All drones must broadcast identification and location information, increasing operator accountability.

- Increased Scrutiny: Regulators are placing greater emphasis on the safety features and performance of aeronautical products.

- Liability Mitigation: Adherence to safety standards and proper certification is essential to minimize product liability exposure in case of incidents.

Legal frameworks are pivotal, with the FAA Reauthorization Act of 2024 enabling Beyond Visual Line of Sight (BVLOS) operations from 2025, opening new commercial avenues. However, this necessitates stringent compliance and permitting for operators. Data privacy laws, like Australia's 2024 amendment, impose liability for privacy invasions, requiring robust data protection by design for drone surveillance. Export controls, such as China's July 2024 UAV rules, significantly influence global technology transfer and market access for aerospace firms.

Environmental factors

Noise pollution from Unmanned Aircraft Systems (UAS) operations is a significant environmental concern, particularly for drone deliveries in urban areas. While advancements in propulsion technology are ongoing, the auditory impact of these aircraft is a key consideration for widespread adoption.

Studies in 2024 continue to assess the decibel levels of various drone models, with some commercial delivery drones registering noise levels comparable to or exceeding those of conventional traffic in residential zones. For instance, research from institutions like the National Academies of Sciences, Engineering, and Medicine has highlighted that the frequency and pattern of drone noise can be perceived as more intrusive than steady-state noise sources.

The energy and materials used to build drones, from their components to their assembly, create a substantial environmental footprint. This includes not only the electricity powering factories but also the extraction and processing of raw materials. For instance, the production of lithium-ion batteries, common in drones, involves mining operations that can lead to habitat disruption and water pollution.

Life Cycle Assessments (LCAs) are vital for understanding the full environmental cost of drones. These studies examine impacts from raw material extraction, manufacturing, use, and end-of-life disposal. An LCA might reveal that while a drone's operational energy use is low, the embodied energy in its manufacturing, particularly for advanced composite materials, significantly contributes to its overall carbon footprint.

In 2024, the global drone market is projected to reach over $40 billion, with continued growth expected. As production scales up, so does the potential environmental strain. For example, a 2023 study by the European Aviation Safety Agency (EASA) highlighted that the manufacturing phase of a medium-sized commercial drone accounts for roughly 60% of its total lifecycle greenhouse gas emissions, underscoring the importance of sustainable manufacturing practices.

Drones, with their complex construction of plastics, metals, batteries, and intricate electronic circuits, present significant end-of-life disposal challenges. The environmental footprint associated with these components, particularly batteries and electronic waste, necessitates robust waste management strategies.

Effective recycling programs are crucial for mitigating the environmental impact of discarded drones. For instance, the global e-waste recycling market, which includes components found in drones, was valued at approximately $50 billion in 2023 and is projected to grow substantially, highlighting the increasing need for specialized recycling solutions for unmanned aerial vehicles.

Environmental Impact Assessments for Drone Usage Areas

While drones can reduce the environmental footprint of logistics by cutting down on traditional vehicle emissions, their actual impact is nuanced. Factors such as the distance traveled, the density of the areas they operate in, and the emissions generated throughout their lifecycle, from manufacturing to disposal, are critical. For instance, a 2024 study by the International Air Transport Association (IATA) highlighted that while electric drones have zero tailpipe emissions, the energy source for charging them remains a significant consideration.

To ensure responsible and sustainable integration of drones, comprehensive environmental impact assessments (EIAs) are essential. These assessments help identify potential risks and outline mitigation strategies. For example, in 2025, the European Union's Aviation Safety Agency (EASA) is expected to release updated guidelines for drone operations in urban environments, with a strong emphasis on noise pollution and potential impacts on local wildlife habitats.

Key considerations for drone environmental impact assessments include:

- Energy Consumption and Source: Evaluating the electricity demand for drone charging and the carbon intensity of the local power grid.

- Noise Pollution: Assessing the acoustic impact on residential areas and sensitive ecosystems, especially with increased flight volumes.

- Lifecycle Emissions: Analyzing emissions from manufacturing, battery production, maintenance, and end-of-life disposal of drones.

- Habitat Disruption: Understanding potential impacts on bird populations and other wildlife, particularly for drones operating at lower altitudes.

Sustainable Manufacturing Practices and Material Sourcing

Sustainable manufacturing practices and eco-friendly material sourcing are increasingly critical in the aeronautics sector, mirroring trends seen in industries like agricultural drones. These drones have already shown substantial environmental advantages, such as an estimated 20-30% reduction in water usage and a similar decrease in pesticide application compared to traditional methods, alongside lower carbon emissions. This success underscores the growing demand for greener manufacturing processes and materials throughout the aerospace supply chain.

The push for sustainability in aeronautics is driven by both regulatory pressures and market demand for environmentally responsible products. Companies are exploring bio-based composites, recycled aluminum, and advanced manufacturing techniques like additive manufacturing (3D printing) to minimize waste and energy consumption. For instance, by 2025, the global aerospace market for sustainable aviation fuel is projected to reach $1.9 billion, indicating a significant shift towards environmentally conscious operations and materials.

- Reduced Environmental Impact: Sustainable practices in aeronautics can lead to significant reductions in water, pesticide, and carbon emissions, similar to the agricultural drone sector's achievements.

- Material Innovation: The industry is actively researching and adopting eco-friendly materials, including bio-composites and recycled metals, to lessen its environmental footprint.

- Market Demand: Growing consumer and regulatory pressure is accelerating the adoption of sustainable manufacturing and material sourcing throughout the aerospace industry.

- Investment in Green Technologies: Significant financial investments are being channeled into sustainable aviation fuel and other green technologies, signaling a strong commitment to environmental responsibility by 2025.

The environmental considerations for aeronautics are multifaceted, extending from the noise generated by aircraft to the materials used in their construction and eventual disposal. As the drone market rapidly expands, projected to exceed $40 billion in 2024, understanding these impacts becomes crucial for sustainable growth.

Noise pollution from drones, particularly in urban settings, is a growing concern, with some commercial models emitting noise levels comparable to urban traffic. Simultaneously, the manufacturing process for drones, including battery production, contributes significantly to their lifecycle environmental footprint, with manufacturing phases accounting for approximately 60% of greenhouse gas emissions for some models as of 2023.

The end-of-life disposal of drones, laden with plastics, metals, and electronics, presents a substantial waste management challenge. Effective recycling programs are vital, especially given the global e-waste recycling market, valued around $50 billion in 2023, is growing, indicating a need for specialized drone component recycling solutions.

Sustainable practices are increasingly important, with a projected $1.9 billion market for sustainable aviation fuel by 2025. Innovations in bio-based composites and recycled materials are also being explored to reduce the industry's environmental impact, mirroring the success of agricultural drones which have demonstrated 20-30% reductions in water and pesticide usage.

| Environmental Factor | 2023/2024 Data Point | 2025 Projection/Trend |

|---|---|---|

| Global Drone Market Value | Over $40 billion (2024) | Continued significant growth |

| Drone Manufacturing Emissions Share | ~60% of lifecycle GHG emissions (2023 study) | Focus on reduction through sustainable practices |

| E-waste Recycling Market Value | ~$50 billion (2023) | Increasing demand for specialized recycling |

| Sustainable Aviation Fuel Market | Projected $1.9 billion (2025) | |

| Agricultural Drone Benefits | 20-30% reduction in water/pesticide use | Inspiration for broader aerospace sustainability |

PESTLE Analysis Data Sources

Our Aeronautics PESTLE Analysis is meticulously crafted using data from official aviation authorities, international regulatory bodies, and leading aerospace industry publications. This ensures comprehensive coverage of political stability, economic forecasts, technological advancements, environmental regulations, and socio-cultural impacts relevant to the sector.