Aeronautics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeronautics Bundle

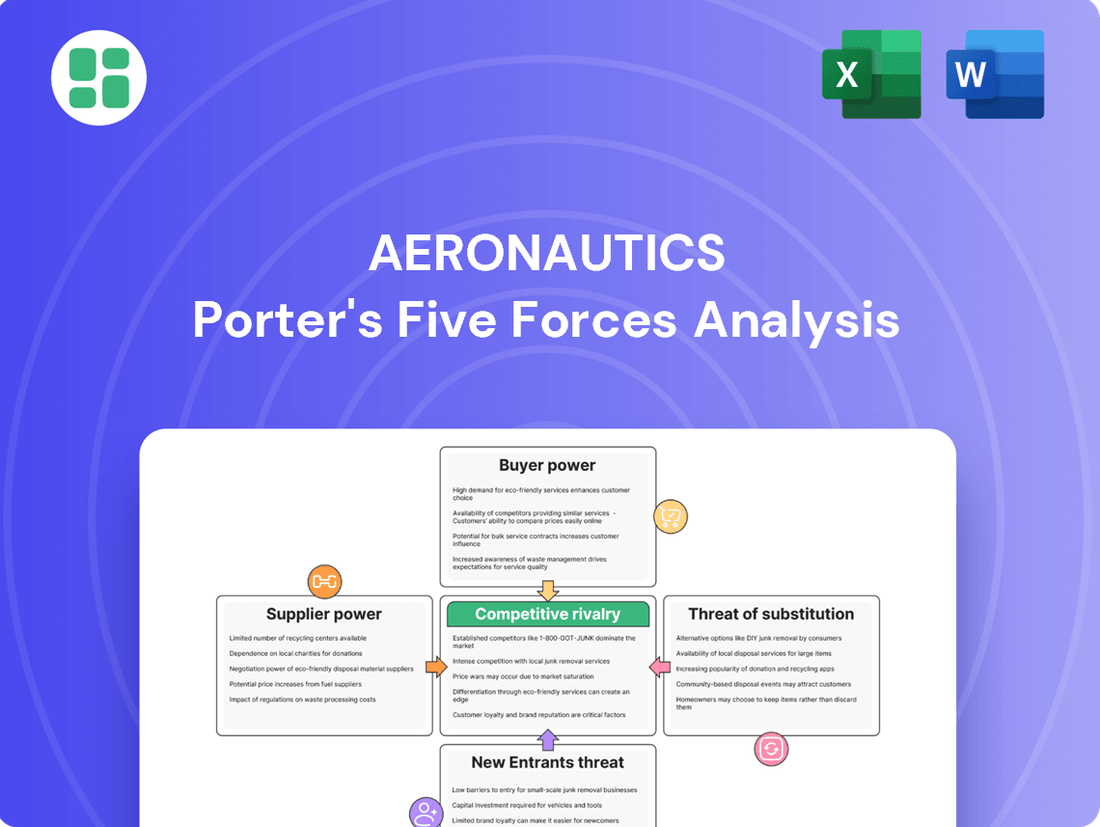

Aeronautics faces a dynamic competitive landscape, shaped by the bargaining power of its buyers and suppliers, the threat of new entrants, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategic planning and identifying opportunities.

The complete report reveals the real forces shaping Aeronautics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aeronautics Ltd. faces considerable supplier power due to its dependence on a select group of highly specialized providers for crucial elements such as advanced sensors, propulsion systems, and complex avionics. The proprietary nature of these components means that Aeronautics incurs substantial costs and faces significant integration and certification hurdles when attempting to switch suppliers, granting these specialized entities considerable leverage.

While raw materials like advanced composites for aircraft manufacturing might have several sourcing options, the bargaining power of suppliers in the Aeronautics sector is significantly influenced by specialized software providers. Companies developing critical flight control systems, artificial intelligence for autonomous flight, and advanced data processing solutions often operate in a concentrated market.

This concentration means that a few key developers can wield considerable influence, particularly when their software becomes an industry standard or offers unique, indispensable functionalities that directly impact the performance and safety of aircraft. For instance, the market for certified flight control software is highly specialized, with only a handful of companies possessing the rigorous development and certification capabilities required.

The dependence of major aerospace manufacturers on these proprietary software solutions allows these suppliers to dictate terms, impacting pricing and development timelines. This is a crucial factor in the overall cost structure and innovation cycle within the Aeronautics industry, as demonstrated by the significant R&D investments required by software firms to maintain their competitive edge and regulatory compliance.

Intellectual property holders, particularly those controlling essential patents for Unmanned Aerial System (UAS) subsystems like secure communication or advanced targeting, wield significant bargaining power over aeronautics companies. This leverage can translate into substantial licensing fees or limitations on design choices, directly affecting a company's cost structure and the speed of its innovation. For instance, a critical patent on a next-generation sensor array could force an aeronautics firm to pay premium rates, impacting the overall profitability of a UAS program.

Dependency on Niche Technologies

The aerospace sector's reliance on specialized, cutting-edge components significantly bolsters supplier bargaining power. For instance, the development of advanced Unmanned Aerial Systems (UAS) often necessitates suppliers who are leaders in highly specific fields, such as miniaturized artificial intelligence processors or novel energy storage solutions. This dependence is amplified when these niche suppliers have constrained production capabilities or are simultaneously supplying multiple aerospace manufacturers, creating potential chokepoints in the supply chain.

This dynamic is evident in the market for advanced avionics and sensor technology. Companies specializing in these areas often hold patents or possess proprietary knowledge that is difficult for larger manufacturers to replicate. For example, in 2024, the lead times for certain high-performance radar components from specialized suppliers stretched to over 18 months, directly impacting production schedules for new aircraft models.

- Niche Technology Dependence: Aeronautics firms often require suppliers with unique expertise in areas like advanced composite materials or specialized propulsion systems.

- Limited Supplier Capacity: Suppliers focusing on these niche technologies may have limited production volumes, increasing their leverage.

- Competitor Supply: If a key supplier also serves direct competitors, it can create further pressure on pricing and delivery terms.

- Innovation Cycles: The fast pace of technological advancement in areas like AI and sensor technology means new, critical components are constantly emerging, reinforcing supplier power.

Geopolitical and Regulatory Influence

Geopolitical shifts and evolving regulatory landscapes significantly amplify the bargaining power of suppliers in the aeronautics sector. Global supply chains for defense-related technologies, crucial for many aeronautics firms, are frequently entangled with stringent export controls and the dynamics of international relations. For instance, in 2024, increased tensions in Eastern Europe led to heightened scrutiny and restrictions on the export of certain advanced materials and electronic components, directly impacting the sourcing capabilities of Western aerospace manufacturers.

Suppliers situated in countries with strategically vital defense industries or those benefiting from supportive government policies can wield considerable influence. This can translate into preferential pricing, limited availability, or outright refusal to supply, thereby constraining an aeronautics company's operational flexibility and cost management. The reliance on a concentrated few suppliers for specialized, high-value components, often originating from nations with robust state-backed aerospace programs, further solidifies their leverage.

- Export Controls: In 2024, the United States Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce strict export controls on advanced technologies, affecting the flow of critical components to international aeronautics markets.

- Strategic Importance: Countries with dominant positions in specific aerospace materials, such as titanium or advanced composites, can leverage this importance to negotiate more favorable terms with buyers.

- Geopolitical Risk Premium: Suppliers in politically stable regions may command higher prices due to reduced perceived risk, while those in volatile areas might face supply disruptions or increased compliance costs for buyers.

- Government Subsidies and Support: State-sponsored aerospace suppliers often benefit from lower capital costs and R&D funding, enabling them to offer competitive pricing or prioritize certain markets, thereby influencing global supply dynamics.

The bargaining power of suppliers in the aeronautics sector is substantial, driven by the specialized nature of components and limited supplier options. For example, in 2024, the lead times for certain high-performance radar components from specialized suppliers extended beyond 18 months, directly impacting aircraft production schedules.

This reliance on niche technology, such as advanced AI processors or novel energy storage, grants suppliers significant leverage, especially when their production capacity is constrained or they also supply competitors. Intellectual property, particularly patents for critical Unmanned Aerial System (UAS) subsystems, allows these entities to dictate terms through licensing fees or design limitations, affecting cost structures and innovation speed.

Geopolitical factors further amplify supplier power, with export controls and government support for national aerospace industries influencing component availability and pricing. For instance, in 2024, increased geopolitical tensions led to stricter export controls on advanced materials and electronics, impacting Western aerospace manufacturers' sourcing capabilities.

| Supplier Characteristic | Impact on Aeronautics Firms | 2024 Data/Example |

|---|---|---|

| Specialized Component Dependence | High leverage for suppliers of critical parts like avionics and propulsion systems. | 18+ month lead times for certain radar components. |

| Proprietary Technology & IP | Suppliers can command premium pricing and dictate terms due to unique software or patents. | Licensing fees for essential UAS subsystem patents. |

| Limited Production Capacity | Creates supply chain chokepoints and strengthens supplier negotiating position. | Niche suppliers often have constrained output. |

| Geopolitical Factors & Export Controls | Restricts sourcing options and increases compliance costs. | Stricter US export controls on advanced technologies in 2024. |

What is included in the product

A comprehensive Porter's Five Forces analysis for Aeronautics, dissecting the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential of substitute products to reveal the industry's profitability and Aeronautics' strategic positioning.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Governments and military entities represent substantial customers for the aeronautics sector, wielding considerable bargaining power due to their large-volume purchasing capacity. These entities often engage in competitive bidding processes, defining precise technical requirements and lengthy contractual terms that allow them to negotiate favorable pricing and demand extensive after-sales support. For instance, in 2023, the United States Department of Defense remained a primary client, awarding billions in contracts for aircraft and related services, underscoring the significant leverage these governmental bodies possess in shaping industry economics.

Homeland security agencies, much like their military counterparts, represent significant purchasers of Unmanned Aircraft Systems (UAS). These organizations utilize UAS for critical functions such as surveillance, border patrol, and various law enforcement operations. Their substantial procurement needs mean they can influence pricing and demand specific customizations, often benefiting from competitive bidding processes with multiple UAS providers vying for their business.

The market for high-end, specialized Unmanned Aerial Systems (UAS) can be relatively concentrated, meaning Aeronautics might serve a smaller number of large, powerful customers. This concentration grants individual customers more influence over contract terms, pricing, and post-sale support. For instance, a significant portion of Aeronautics' revenue could be tied to a few key defense or commercial contracts, making customer retention paramount.

Demand for Integrated Solutions

Customers in the Unmanned Aircraft Systems (UAS) market are increasingly looking for more than just the aircraft itself. They want complete, integrated solutions that bundle everything from initial training and ongoing maintenance to sophisticated data analytics services. This trend significantly boosts customer bargaining power.

Because customers are demanding these end-to-end packages, they can now more effectively shop around. They can compare vendors not just on the UAS platform but on their ability to deliver comprehensive support and long-term commitments. This forces providers to offer more value and potentially lower prices to secure these integrated deals.

- Demand for Integrated Solutions: UAS customers are shifting from purchasing standalone drones to seeking comprehensive service packages.

- Increased Vendor Evaluation Criteria: This demand broadens how customers assess suppliers, focusing on end-to-end capabilities and support.

- Shifting Power Dynamic: Customers gain leverage by being able to dictate terms for integrated offerings, influencing pricing and service levels.

Budgetary Constraints and Political Factors

Government and military budgets, crucial for the aeronautics sector, are inherently volatile due to shifting political priorities and macroeconomic trends. For instance, a global economic slowdown in 2024 could lead to significant defense budget reallocations, directly impacting demand for aircraft and related services. This volatility amplifies the bargaining power of these large institutional customers.

When faced with reduced funding, government and military entities often respond by delaying new procurements, negotiating steeper price reductions, or demanding more accommodating payment schedules. This forces aeronautics companies to demonstrate greater flexibility and cost-effectiveness in their proposals to secure contracts.

- Budgetary Constraints: Fluctuations in government spending directly impact order volumes and pricing power for aeronautics firms.

- Political Influence: Changes in political administrations can lead to rapid shifts in defense and aerospace priorities, affecting customer demand.

- Economic Sensitivity: Broader economic downturns often trigger austerity measures, compelling customers to seek concessions from suppliers.

- Negotiating Leverage: Customers facing budget pressures can leverage their purchasing power to secure more favorable contract terms.

The bargaining power of customers in the aeronautics sector is significantly influenced by the concentration of buyers. A few large government entities, such as defense departments, often represent the majority of sales for major aircraft manufacturers. These large-volume buyers can negotiate favorable terms due to their substantial purchasing power and the critical nature of their needs, as seen in 2023 defense spending figures. For example, the United States' defense budget allocated hundreds of billions of dollars, with a significant portion directed towards aerospace and aviation procurement, giving these agencies considerable leverage.

| Customer Type | Influence Factor | Example Data (2023/2024) |

|---|---|---|

| Government/Military | High Volume Purchases, Budget Control | US Defense Budget: ~$886 billion (FY2024) |

| Commercial Airlines | Fleet Size, Order Consolidation | Global airline capital expenditures projected to reach hundreds of billions annually. |

| UAS Agencies | Specialized Needs, Contract Bidding | Increased government investment in drone technology for security applications. |

Full Version Awaits

Aeronautics Porter's Five Forces Analysis

This preview shows the exact Aeronautics Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the industry. You'll gain immediate access to this fully formatted and professionally written document, ready for immediate use in your strategic planning. No surprises, no placeholders—just the complete analysis you need to understand the landscape.

Rivalry Among Competitors

The global Unmanned Aircraft Systems (UAS) market is characterized by fierce competition among numerous established players, ranging from major defense contractors to niche drone manufacturers. This intense rivalry is particularly evident in high-value sectors like military and security, where securing contracts hinges on a company's reputation and demonstrated performance.

Companies are actively competing for a finite number of significant contracts, driving innovation and aggressive market strategies. For instance, in 2023, the global defense market, which heavily influences UAS procurement, saw significant investment, with major players like Lockheed Martin and Northrop Grumman reporting substantial revenues, indicating the scale of competition for these lucrative deals.

The pace of technological innovation in Unmanned Aircraft Systems (UAS) is a major driver of competitive rivalry in the aeronautics sector. Companies are locked in a race to develop more advanced capabilities, such as extended flight times, enhanced autonomous navigation, and novel sensor integration. This relentless pursuit of innovation means that firms must consistently invest heavily in research and development to avoid falling behind. For example, in 2024, the global UAS market saw significant investment in AI-driven autonomy, with companies like Skydio showcasing advancements in obstacle avoidance that could reshape commercial drone operations.

In the aeronautics sector, companies often differentiate themselves by focusing on specific unmanned aircraft system (UAS) applications or platform types. For instance, some manufacturers concentrate on tactical UAS for close-range surveillance, while others develop high-altitude, long-endurance (HALE) platforms for extensive aerial coverage. This specialization intensifies rivalry within these distinct market segments, as firms compete to offer unique features and superior performance tailored to particular customer requirements.

Price Competition and Contract Wins

The aerospace industry, particularly in the Unmanned Aerial Systems (UAS) sector, sees intense price competition, especially for high-value military and large-scale civilian contracts. Companies frequently engage in aggressive bidding to secure these lucrative deals, which are vital for maintaining revenue streams and market share.

This fierce bidding can sometimes result in reduced profit margins for the winning companies. For instance, in 2024, major defense contractors often submitted bids that were significantly lower than initial estimates to secure multi-billion dollar drone procurement contracts. The pressure to win these large tenders means that cost efficiency and competitive pricing are paramount for survival and growth in this market.

- Aggressive Bidding: Companies often undercut competitors to win large UAS contracts, impacting profitability.

- Contract Value: The high financial stakes of military and civilian UAS deals intensify price wars.

- Market Share: Winning major tenders is critical for sustaining revenue and establishing a strong market presence in 2024.

- Margin Pressure: The drive for contract wins can lead to lower profit margins, forcing companies to optimize operations.

Aftermarket Services and Support

Competition in the aerospace sector significantly intensifies beyond the initial aircraft sale, extending into the crucial realm of aftermarket services and support. This includes vital offerings such as maintenance, repair, overhaul (MRO), software upgrades, and specialized pilot and technician training.

Companies that excel in delivering dependable, efficient, and economically viable long-term support solutions cultivate a distinct competitive edge. This focus on robust after-sales service not only builds strong customer loyalty but also establishes predictable and recurring revenue streams, a critical factor in the industry's financial health.

For instance, in 2024, major aerospace manufacturers like Boeing and Airbus reported substantial portions of their revenue derived from aftermarket services. Boeing's Defense, Space & Security segment, which heavily relies on support contracts, saw its revenue influenced by these ongoing service agreements. Similarly, the global aerospace MRO market was projected to reach over $100 billion in 2024, highlighting the immense value and competitive battleground of these services.

- Aftermarket services are a key battleground for competitive advantage.

- Reliable and cost-effective long-term support fosters customer loyalty.

- Recurring revenue from aftermarket services is crucial for financial stability.

- The global aerospace MRO market is a multi-billion dollar industry in 2024.

Competitive rivalry in aeronautics, particularly for Unmanned Aircraft Systems (UAS), is intense due to a crowded market and high stakes. Companies vie for significant contracts, driving innovation and aggressive pricing strategies. This rivalry extends beyond initial sales to aftermarket services, where reliable support builds loyalty and recurring revenue.

| Company | 2023 UAS Revenue (Est.) | Key UAS Segment | Competitive Strategy |

|---|---|---|---|

| Lockheed Martin | $10.5 Billion (Defense) | Military, ISR | Technological Superiority, Large Contracts |

| Northrop Grumman | $9.8 Billion (Defense) | Military, Surveillance | Advanced Capabilities, Integrated Systems |

| General Atomics Aeronautical Systems | $3.2 Billion (UAS Focus) | Military, ISR | Platform Specialization, Cost-Effectiveness |

| Skydio | $150 Million (Commercial/Public Safety) | Commercial, Public Safety | AI-Driven Autonomy, Ease of Use |

SSubstitutes Threaten

Manned aircraft and helicopters represent a significant threat of substitutes for Unmanned Aircraft Systems (UAS), particularly in specialized military and security applications. For missions demanding immediate human judgment and adaptability in rapidly evolving scenarios, such as close air support or complex reconnaissance, manned platforms retain a distinct advantage. Despite the growing capabilities and cost-effectiveness of UAS, the inherent value of human intuition and on-the-spot decision-making in high-stakes situations ensures that manned aviation remains a viable alternative.

While UAS have seen substantial growth, with the global military UAS market projected to reach over $15 billion by 2024, manned aircraft continue to dominate certain operational theaters. For instance, in 2023, global defense spending on manned aircraft programs remained robust, indicating continued investment in these traditional platforms. The ability of manned platforms to handle dynamic threats and complex tactical environments, where the speed of human decision-making is paramount, limits the complete substitution by UAS in these critical roles.

Satellite imagery presents a significant threat of substitution for certain Unmanned Aerial System (UAS) applications in aeronautics. Satellites excel at broad-area intelligence gathering, mapping, and environmental monitoring, directly competing with UAS for wide-area surveillance tasks. For instance, the global satellite imagery market was valued at approximately $5.1 billion in 2023 and is projected to grow substantially, indicating increasing adoption and capability.

While satellite technology offers a comprehensive overview, its effectiveness as a substitute is nuanced. Enhancements in satellite resolution and revisit rates are making them increasingly viable alternatives for specific data collection needs, potentially reducing the demand for aerial platforms. However, satellites generally lack the high-resolution, real-time, close-up observational capabilities that drones can provide, limiting their substitutability for tasks requiring immediate, detailed ground-level data.

Ground-based surveillance systems present a significant threat of substitution for Unmanned Aircraft Systems (UAS) in specific applications, particularly for homeland security and civilian monitoring. These terrestrial solutions, including advanced sensor networks and high-resolution cameras, can provide continuous oversight in fixed or localized areas without the complexities of aerial deployment. For instance, in 2024, the global market for physical security systems, which encompasses many ground-based solutions, was valued at over $120 billion, demonstrating the substantial investment in these alternatives.

While ground-based systems excel at persistent monitoring, their inherent limitations in mobility and line-of-sight compared to UAS restrict their scope. However, advancements in networked sensors and AI-powered analytics are increasingly mitigating these drawbacks, allowing for broader coverage and more sophisticated threat detection, thereby intensifying the substitution threat.

Alternative Intelligence Gathering Methods

The threat of substitutes for Unmanned Aerial Systems (UAS) in intelligence gathering is significant, as alternative methods can often fulfill similar needs. Human intelligence (HUMINT), signal intelligence (SIGINT), and open-source intelligence (OSINT) are well-established disciplines that provide valuable data, potentially reducing reliance on drones for certain reconnaissance missions.

While UAS excel at providing real-time visual and sensor data, a robust intelligence framework frequently incorporates a blend of sources. For instance, in 2024, the global OSINT market was projected to reach over $110 billion, demonstrating the substantial investment and capability in non-UAS data collection. This integration means that for many intelligence requirements, the unique advantages of UAS might not be indispensable, thereby increasing the threat of substitution.

Consider these key substitutes:

- Human Intelligence (HUMINT): Agents on the ground can gather nuanced information, build relationships, and access data not detectable by sensors, offering a qualitative depth that complements or sometimes replaces drone-based observation.

- Signal Intelligence (SIGINT): Intercepting and analyzing electronic communications, radar signals, and other transmissions provides critical insights into adversary activities and capabilities, often without direct visual or physical presence.

- Open-Source Intelligence (OSINT): Publicly available information from the internet, social media, news outlets, and satellite imagery (not necessarily from UAS) offers vast datasets that can be analyzed for intelligence purposes. In 2023, OSINT tools and platforms saw increased adoption across government and private sectors, highlighting their growing effectiveness.

- Traditional Reconnaissance Platforms: Manned aircraft, satellites, and ground-based sensors continue to offer sophisticated intelligence-gathering capabilities that can overlap with or substitute for UAS functions, especially in scenarios where platform endurance or payload capacity is paramount.

Emerging Technologies and Counter-UAS Systems

The increasing sophistication of counter-unmanned aerial systems (C-UAS) presents a significant threat of substitution for drone operations. As C-UAS technology advances to detect, track, and neutralize drones, the perceived value and operational effectiveness of UAS in contested airspace could be significantly reduced. For instance, by mid-2024, several nations have deployed advanced C-UAS systems capable of identifying and disabling drones at considerable ranges, making drone deployment riskier and less reliable for certain missions.

Furthermore, alternative technologies are emerging that can perform tasks currently handled by drones. Advanced robotics, including autonomous ground vehicles and sophisticated sensor platforms, offer parallel solutions for surveillance, logistics, and reconnaissance. The development and deployment of these ground-based or alternative aerial systems could divert demand from UAS, particularly in scenarios where drone vulnerability to C-UAS is high.

- Advanced C-UAS systems are increasingly capable of detecting and neutralizing drones, impacting their operational viability.

- Emerging technologies like autonomous ground vehicles offer alternative solutions for tasks traditionally performed by drones.

- Increased risk and reduced reliability of drone operations in contested environments due to C-UAS advancements could drive adoption of substitutes.

The threat of substitutes for aeronautics is multifaceted, encompassing alternatives that can fulfill similar functions, albeit with different capabilities and cost structures. These substitutes can range from other forms of transportation to entirely different technological approaches for achieving specific objectives.

For instance, high-speed rail networks offer a compelling substitute for short to medium-haul air travel, particularly in densely populated regions. In 2023, several European countries saw significant investments in high-speed rail expansion, aiming to capture a larger share of intercity passenger traffic. This trend is driven by factors like environmental concerns and the convenience of city-center to city-center travel, which airlines often cannot match.

Autonomous ground vehicles and advanced logistics systems also pose a threat to traditional cargo aviation. As autonomous trucking technology matures, it presents a more cost-effective and potentially faster alternative for overland freight movement, directly competing with air cargo for certain goods. The global autonomous trucking market is expected to see substantial growth, with projections indicating it could reach tens of billions of dollars by the late 2020s.

Furthermore, advancements in drone technology itself create substitutes within the aerial domain. Larger, more capable cargo drones could eventually replace some fixed-wing aircraft operations for last-mile delivery and specialized transport, especially in less accessible areas. The regulatory landscape for these larger drones is evolving, with significant developments anticipated by 2025.

| Substitute Category | Specific Examples | Key Advantages | Potential Impact on Aeronautics |

|---|---|---|---|

| Ground Transportation | High-Speed Rail | Cost-effectiveness for medium distances, reduced environmental impact, city-center access | Reduces demand for short-haul passenger flights |

| Ground Transportation | Autonomous Trucking | Lower operational costs, potential for 24/7 operation, direct door-to-door delivery | Challenges air cargo for overland freight |

| Other Aerial Systems | Advanced Cargo Drones | Accessibility to remote areas, lower operational overhead for specific payloads | Disrupts niche cargo aviation markets |

Entrants Threaten

Entering the Unmanned Aerial Systems (UAS) manufacturing market, particularly for advanced military and security applications, demands substantial capital. This includes significant outlays for research and development, state-of-the-art manufacturing plants, and rigorous testing facilities.

The sheer financial commitment required to develop competitive UAS products acts as a formidable barrier. For instance, companies like Northrop Grumman and Lockheed Martin invest billions annually in aerospace and defense R&D, with UAS being a growing segment. This high upfront investment effectively deters many potential new players from entering the market.

The aerospace and defense sectors are notoriously complex due to rigorous regulatory frameworks. Obtaining certifications for airworthiness, safety standards, and operational protocols is a lengthy and expensive undertaking. For instance, the Federal Aviation Administration (FAA) certification process for new aircraft can take years and cost hundreds of millions of dollars, effectively deterring many potential new players.

The development and production of sophisticated unmanned aerial systems (UAS) require a deep bench of specialized talent across engineering, aerospace, software development, and systems integration. New entrants face significant challenges in acquiring and retaining these highly skilled professionals, as competition for such expertise is fierce and compensation demands are high. For instance, a 2024 report indicated that the average salary for aerospace engineers in the US reached over $120,000, a figure that can be prohibitive for startups.

Established Brand Reputation and Customer Relationships

Established brand reputations and deep customer relationships pose a significant barrier for new entrants in the aeronautics sector. Companies like Aeronautics Ltd. have cultivated trust over years, often decades, through consistent performance and reliability, particularly with government and military clients. This history is invaluable in a market where the stakes are incredibly high, and trust is not easily earned.

Newcomers find it exceptionally challenging to replicate the credibility that incumbents possess. Demonstrating the required level of reliability and security, crucial for defense contracts and large-scale aviation projects, takes substantial time and a proven track record. For instance, a new entrant might struggle to secure initial contracts without the established certifications and past performance data that existing players readily provide, hindering their ability to gain a foothold.

- Brand Loyalty: Long-standing relationships mean clients are less likely to switch to unproven alternatives, even if offered at a lower cost.

- Trust and Security: In aeronautics, trust is paramount. New entrants must overcome skepticism regarding their security protocols and operational integrity.

- Switching Costs: For major clients, the cost and complexity of switching suppliers, including re-tooling and retraining, are substantial deterrents.

- Incumbent Advantage: Aeronautics Ltd. likely benefits from existing contracts and supply chains, making it difficult for new entrants to compete on price or delivery speed initially.

Proprietary Technology and Intellectual Property

The Unmanned Aerial Systems (UAS) sector is heavily guarded by intellectual property, encompassing patents for innovative designs, sophisticated control systems, and advanced payload technologies. New players must navigate this landscape, either by creating truly novel solutions or by incurring substantial costs for licensing existing patents, thereby creating a barrier to entry.

For instance, in 2024, the global UAS market saw continued investment in R&D, with companies actively filing patents to protect their advancements in areas like AI-driven navigation and multi-sensor integration. This robust IP portfolio makes it difficult for newcomers to establish a competitive advantage without significant upfront investment or a breakthrough innovation that circumvents existing protections.

- Significant IP Landscape: The UAS market is rich with patents covering design, control, and payload technologies, presenting a formidable hurdle for new entrants.

- Innovation vs. Infringement: New companies must either develop groundbreaking technology or face high licensing fees to avoid infringing on established intellectual property.

- Cost of Entry: The need for substantial investment in R&D to create unique solutions or to secure IP licenses significantly raises the barrier to entry in the UAS market.

The threat of new entrants into the aeronautics sector, particularly in advanced UAS manufacturing, is significantly mitigated by substantial capital requirements. Developing cutting-edge technology, establishing robust manufacturing capabilities, and meeting stringent regulatory standards demand billions of dollars in upfront investment, effectively deterring most new players.

The sector's complexity, coupled with extensive intellectual property protection and the need for highly specialized talent, further erects formidable barriers. Newcomers must navigate a landscape rich with patents and compete for scarce expertise, often requiring years to build the credibility and track record that established firms possess.

High switching costs for major clients and the deep-seated trust incumbents have cultivated with government and military entities also present significant challenges. These factors combine to create a market where entry is exceptionally difficult and requires more than just a competitive product; it demands proven reliability and established relationships.

| Barrier Type | Description | Example Data (2024 Estimates) |

|---|---|---|

| Capital Requirements | High R&D, manufacturing, and testing outlays. | UAS R&D spending by major defense contractors often exceeds $1 billion annually. |

| Regulatory Hurdles | Lengthy and costly certification processes. | FAA certification for new aircraft can cost hundreds of millions of dollars and take several years. |

| Talent Acquisition | Competition for specialized aerospace engineers and software developers. | Average US aerospace engineer salary: ~$120,000+ in 2024. |

| Intellectual Property | Navigating a landscape of patents for designs and technologies. | Companies actively file numerous patents annually to protect UAS innovations. |

| Brand Reputation & Trust | Cultivating long-term relationships and proven reliability. | Defense contracts often require decades-long performance history. |

Porter's Five Forces Analysis Data Sources

Our Aeronautics Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, aerospace manufacturer financial statements, and regulatory body publications to comprehensively assess competitive pressures.