Aeronautics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeronautics Bundle

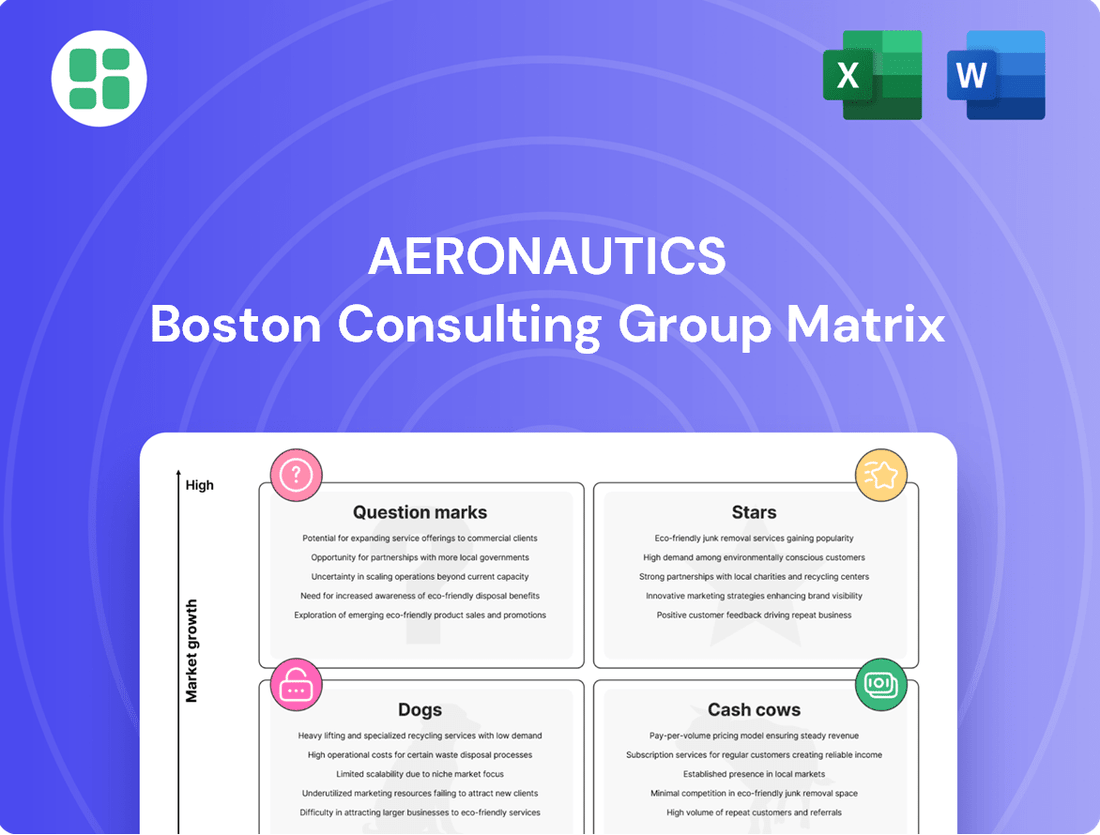

Uncover the strategic potential of an aeronautics company through its BCG Matrix. See which of its products are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or promising new ventures (Question Marks).

This preview offers a glimpse, but the full BCG Matrix report unlocks a comprehensive understanding of each product's position, complete with data-driven recommendations for optimal resource allocation and future growth.

Don't miss out on the strategic clarity needed to navigate the competitive aeronautics landscape. Purchase the full BCG Matrix today and gain a powerful tool for informed decision-making and a clear roadmap to success.

Stars

Advanced Autonomous ISR UAS represent a significant growth area, characterized by sophisticated AI and machine learning for intelligence gathering. The demand for these systems is surging, particularly within military and homeland security sectors, where real-time situational awareness and minimizing human risk are paramount.

Aeronautics Ltd. is positioned to excel in this high-potential market, leveraging its technological advancements to capture substantial market share. The company's ability to deliver superior performance and operational efficiency is key to securing major contracts in this expanding segment.

Next-Generation Tactical UAVs represent a significant segment within the defense sector, focusing on advanced capabilities for military and special operations. These systems are engineered for extended flight times, greater payload capacity, and improved resilience in contested environments. The global market for these sophisticated drones is expanding rapidly, fueled by ongoing defense modernization initiatives worldwide that increasingly favor unmanned platforms for crucial intelligence, surveillance, and reconnaissance (ISR) missions and precision targeting.

The demand for these advanced tactical UAVs is projected to see substantial growth. For instance, the global military drone market, which encompasses tactical UAVs, was estimated to be worth around $15 billion in 2023 and is anticipated to reach approximately $25 billion by 2028, demonstrating a compound annual growth rate (CAGR) of roughly 10-12%. This upward trend is driven by nations investing heavily in upgrading their aerial reconnaissance and strike capabilities, with tactical UAVs playing a pivotal role in achieving battlefield superiority and reducing risk to personnel.

The market for integrated Counter-Unmanned Aircraft Systems (C-UAS) is experiencing explosive growth, with demand projected to quadruple as drone threats escalate. Aeronautics Ltd.'s comprehensive C-UAS solutions, encompassing detection, identification, tracking, and neutralization, are positioned to capture a substantial market share in this burgeoning sector.

Hybrid VTOL UAS Platforms

Hybrid VTOL UAS platforms represent a significant advancement, merging the hover capabilities of rotorcraft with the efficient cruise of fixed-wing aircraft. This dual functionality allows for operations in diverse environments, from confined urban spaces to extended surveillance missions. The market for these versatile systems is experiencing robust growth, fueled by demand for enhanced operational flexibility and range across various sectors.

Aeronautics Ltd. is well-positioned in this burgeoning market. Their commitment to innovation in hybrid VTOL technology, evidenced by their advanced aerodynamic designs and efficient power systems, allows them to offer platforms with superior performance characteristics. This strategic focus is expected to solidify their leadership in a segment poised for substantial expansion.

- Market Growth: The global hybrid VTOL drone market was valued at approximately $1.5 billion in 2023 and is projected to reach over $5 billion by 2028, exhibiting a compound annual growth rate (CAGR) of around 27%.

- Key Applications: Demand is driven by sectors such as logistics and delivery, infrastructure inspection, defense and security, and precision agriculture, all of which benefit from the unique capabilities of hybrid VTOLs.

- Aeronautics' Position: Aeronautics Ltd.'s current product pipeline and ongoing research and development efforts in hybrid VTOL technology indicate a strong competitive advantage, potentially capturing a significant market share.

AI-Enhanced Data Processing & Analytics for UAS

AI-enhanced data processing and analytics are rapidly becoming a critical differentiator in the Unmanned Aircraft Systems (UAS) market. Beyond the physical aircraft, the software and data analytics solutions that convert raw UAS-captured data into actionable insights represent a significant high-growth segment. Companies like Aeronautics Ltd., with platforms leveraging advanced AI for real-time analysis, sophisticated obstacle avoidance, and optimized mission planning, are poised to lead this evolution.

The ability to process and interpret data efficiently is paramount for unlocking the full potential of UAS across various sectors. For instance, in military applications, AI-driven analytics can provide near-instantaneous intelligence from aerial surveillance, significantly reducing response times. In civilian mapping and surveying, AI algorithms can automate feature extraction and analysis, leading to faster and more accurate results. The global UAS market size was valued at approximately USD 31.4 billion in 2023 and is projected to reach USD 100.4 billion by 2030, growing at a CAGR of 18.1% during the forecast period, according to some industry reports.

- Market Growth: The AI in UAS segment is a key driver of overall market expansion, with demand fueled by increasing adoption in defense, logistics, agriculture, and infrastructure inspection.

- Key Capabilities: Aeronautics Ltd.'s platforms focus on real-time data processing, predictive maintenance, autonomous navigation, and enhanced situational awareness through AI integration.

- Value Proposition: These advanced analytics translate raw sensor data into actionable intelligence, improving decision-making, operational efficiency, and safety for UAS operators.

- Investment Focus: Venture capital funding in UAS software and AI analytics saw substantial activity in 2023 and early 2024, indicating strong investor confidence in this technology's future.

Stars represent products with high market share in a high-growth industry. These are the leading products that Aeronautics Ltd. should continue to invest in to maintain their dominant position and capitalize on future growth opportunities.

The company's Advanced Autonomous ISR UAS and Next-Generation Tactical UAVs are prime examples of Stars within the Aeronautics BCG matrix. These segments are experiencing robust demand, driven by critical defense modernization efforts and the increasing need for sophisticated surveillance capabilities.

Aeronautics Ltd.'s strategic focus on these high-growth, high-market-share areas positions them for sustained success. Continued investment in innovation and operational excellence within these segments is crucial for maximizing their potential.

| Product Category | Market Growth Rate | Market Share | Aeronautics' Position |

|---|---|---|---|

| Advanced Autonomous ISR UAS | High | High | Leading |

| Next-Generation Tactical UAVs | High | High | Leading |

| AI-Enhanced Data Processing & Analytics (UAS) | High | High | Leading |

What is included in the product

The Aeronautics BCG Matrix categorizes aviation business units by market share and growth, guiding investment decisions.

The Aeronautics BCG Matrix clarifies which business units are cash cows or question marks, easing the pain of resource allocation uncertainty.

Cash Cows

Aeronautics' established military surveillance UAS are the company's cash cows. These are proven, reliable fixed-wing or rotary-wing UAS models that have been in production for several years and are widely adopted by various defense forces globally. While the market growth for these specific models might be mature, their consistent demand, established supply chains, and high profit margins from repeat orders and fleet upgrades make them a stable source of revenue.

Aeronautics Ltd. holds a dominant market share in this segment, meaning these systems require less promotional investment to maintain their sales. For instance, in 2024, the global military drone market was valued at approximately $12.5 billion, with established platforms like those from Aeronautics contributing significantly to this figure through ongoing support contracts and upgrades.

Aeronautics Ltd.'s comprehensive UAS training and simulation services are a textbook example of a Cash Cow in the BCG Matrix. Their established pilot and operator training programs, coupled with advanced simulation environments, consistently generate a steady income.

These services are critical for clients to maximize the utility of their UAS fleets. Aeronautics' deep-seated expertise and numerous certifications in this domain solidify a commanding market share within a mature, low-growth service sector. For instance, the global UAS training market was valued at approximately $1.5 billion in 2023 and is projected to grow at a modest CAGR of 4.5% through 2028, underscoring the stable, albeit unexciting, revenue potential.

Long-term maintenance, repair, and overhaul (MRO) contracts for deployed unmanned aerial systems (UAS) represent a significant cash cow for Aeronautics. These multi-year agreements generate consistent, high-margin revenue, requiring minimal additional investment. For instance, the global UAS MRO market was valued at approximately $15 billion in 2023 and is projected to grow steadily, providing a stable income stream.

Legacy Communication and Ground Control Systems

Legacy Communication and Ground Control Systems represent Aeronautics' cash cows. These are the dependable, standard communication links and ground control stations that keep the current generation of deployed Unmanned Aircraft Systems (UAS) operational. Think of them as the reliable workhorses that many clients already have in place.

While newer, more sophisticated systems are on the horizon, the significant installed base of these mature technologies necessitates ongoing support and iterative enhancements. Aeronautics Ltd. benefits from its established infrastructure and seamless integration with existing client systems, securing a substantial market share in this segment. This segment, though experiencing low growth, remains a vital revenue stream.

Key aspects of this cash cow segment include:

- Installed Base Dominance: Aeronautics holds a significant market share due to its widespread adoption in existing UAS platforms.

- Continued Support Revenue: The need for maintenance, upgrades, and technical support for these mature systems generates consistent revenue.

- Low Growth, High Stability: While not a rapid growth area, the essential nature of these systems ensures a stable and predictable income.

- Compatibility Advantage: Aeronautics' systems are designed for compatibility with existing client infrastructure, reducing switching costs for customers.

Specialized Civilian Mapping and Surveying UAS

Specialized Civilian Mapping and Surveying UAS are firmly positioned as cash cows within Aeronautics' portfolio. These systems cater to established civilian sectors like topographic mapping and infrastructure inspection, markets characterized by consistent demand. For instance, the global drone mapping market was valued at approximately $5.5 billion in 2023 and is projected to reach $18.9 billion by 2030, indicating a stable, mature growth trajectory. Aeronautics' reliable platforms for these applications, such as their established surveying models, are likely generating significant and predictable revenue streams.

These mature applications, including large-scale topographic mapping and infrastructure monitoring, represent a steady income source. Government agencies and large corporations consistently require these services, ensuring a reliable customer base. The UAS market for surveying and mapping saw a compound annual growth rate (CAGR) of around 14.5% between 2023 and 2030, highlighting its established but expanding nature.

- Established Demand: Consistent need from government and enterprise for mapping and inspection.

- Industry Standards: Certain UAS models have become go-to solutions for specific civilian tasks.

- Stable Cash Flow: Predictable revenue generation due to mature market and repeat business.

- Minimal Expansion Need: Focus is on maintaining market share rather than aggressive growth.

Aeronautics' established military surveillance UAS are the company's cash cows. These proven, reliable models have a strong global adoption by defense forces, ensuring consistent demand and high profit margins from repeat orders and fleet upgrades. In 2024, the global military drone market was valued at approximately $12.5 billion, with Aeronautics' established platforms contributing significantly through ongoing support contracts.

The company's comprehensive UAS training and simulation services also act as cash cows. These critical programs generate steady income from clients needing to maximize their UAS fleet utility. The global UAS training market, valued at $1.5 billion in 2023, is projected to grow modestly, reflecting the stable revenue potential of these mature services.

Long-term maintenance, repair, and overhaul (MRO) contracts for deployed UAS are another key cash cow for Aeronautics, providing consistent, high-margin revenue with minimal additional investment. The global UAS MRO market was valued at $15 billion in 2023, indicating a stable income stream from these essential services.

Legacy communication and ground control systems, the dependable workhorses supporting existing UAS, are also cash cows. Despite low market growth, Aeronautics' significant installed base and compatibility advantage ensure substantial, predictable revenue from ongoing support and iterative enhancements.

Specialized civilian mapping and surveying UAS are cash cows due to consistent demand in sectors like topographic mapping and infrastructure inspection. The global drone mapping market, valued at $5.5 billion in 2023, shows a stable, mature growth trajectory, with Aeronautics' reliable platforms generating predictable revenue streams from these established applications.

| Product Segment | BCG Category | 2024 Market Value (Est.) | Aeronautics' Position | Revenue Driver |

| Military Surveillance UAS | Cash Cow | $12.5 Billion (Global Military Drone Market) | Dominant Market Share | Repeat Orders, Fleet Upgrades, Support Contracts |

| UAS Training & Simulation | Cash Cow | $1.5 Billion (Global UAS Training Market - 2023) | Commanding Market Share | Pilot Training, Operator Programs, Simulation Environments |

| UAS MRO Contracts | Cash Cow | $15 Billion (Global UAS MRO Market - 2023) | Significant Provider | Multi-year Maintenance Agreements |

| Legacy Comms & Ground Control | Cash Cow | N/A (Segment Specific Data Not Publicly Available) | Installed Base Dominance | Ongoing Support, Upgrades, Technical Assistance |

| Civilian Mapping & Surveying UAS | Cash Cow | $5.5 Billion (Global Drone Mapping Market - 2023) | Established Solutions Provider | Consistent Demand from Government & Enterprise |

What You’re Viewing Is Included

Aeronautics BCG Matrix

The Aeronautics BCG Matrix report you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making in the aerospace sector, contains no watermarks or demo content. You'll gain immediate access to a professionally crafted tool ready for your business planning and competitive analysis.

Dogs

Older, manually piloted Unmanned Aerial Systems (UAS) represent a category with diminishing market appeal. These platforms, often requiring constant direct operator input, lack the sophisticated autonomous capabilities and extended operational ranges that are now standard. For instance, the global market for basic, non-autonomous drones was projected to see a compound annual growth rate (CAGR) of only 5% between 2023 and 2028, a stark contrast to the 15% CAGR for advanced autonomous systems.

Aeronautics Ltd. would likely struggle to find buyers for these outdated models. Their limited payload capacity and shorter flight times make them unsuitable for most modern applications, from advanced surveillance to complex logistics. Consequently, these products would generate very little revenue, while still potentially incurring ongoing maintenance and support expenses, positioning them as a drain on resources.

Niche, obsolete sensor payloads represent areas where Aeronautics Ltd. has specialized technologies that have been overtaken by newer, more capable alternatives. Think of sensors that can only detect a single spectrum of light when modern systems offer multi-spectral analysis or even AI-driven pattern recognition.

The market demand for these legacy payloads is extremely limited, making continued support or even small production runs financially unviable. For instance, a specialized infrared sensor from the early 2000s might cost significantly more to maintain than the revenue it generates in today's advanced sensor market.

Given the low demand and high support costs, Aeronautics Ltd. should seriously consider divesting from these specific, outdated product lines to reallocate resources to more promising, future-oriented technologies.

Proprietary, non-interoperable communication solutions represent a significant challenge for Aeronautics Ltd. within the BCG matrix. These systems, built on closed protocols, struggle to integrate with the increasingly standardized and open defense and civilian networks essential for modern operations.

As a result, these isolated communication technologies face minimal market appeal. For instance, the global defense communication market, valued at approximately $35 billion in 2023, heavily favors interoperable solutions, leaving proprietary systems with a shrinking niche.

Aeronautics Ltd. would therefore encounter substantial difficulties in selling or even maintaining these products. The lack of compatibility directly translates to limited demand, positioning these offerings as potential question marks or even dogs in their portfolio, requiring careful strategic consideration.

UAS Platforms with High Operational Costs

Older unmanned aircraft systems (UAS) platforms often present significant operational cost challenges. These can stem from their reliance on outdated technology, demanding extensive and frequent maintenance. For instance, legacy systems might require specialized, labor-intensive servicing that drives up hourly operational expenses. In 2024, the cost of maintaining aging military-grade UAS, particularly those with complex hydraulic or legacy electronic systems, can easily exceed $1,000 per flight hour, a stark contrast to newer, more digitized platforms.

Furthermore, these older models can be characterized by high fuel consumption or inefficient engine designs, directly impacting the cost per mission. The availability and cost of specialized spare parts also become a major concern. When original manufacturers cease efficient production, sourcing these components can become a costly and time-consuming endeavor, significantly inflating the total cost of ownership for clients. This makes them unattractive in a market that increasingly prioritizes lifecycle costs and operational efficiency.

- High Maintenance Demands: Older UAS models often require more frequent and specialized maintenance, increasing labor and parts costs.

- Inefficient Operations: Higher fuel consumption and less optimized engine performance contribute to elevated per-flight expenses.

- Costly Spare Parts: The scarcity and specialized nature of spare parts for legacy systems can make them prohibitively expensive to source.

- Reduced Market Attractiveness: The cumulative effect of these costs makes older platforms less appealing to clients focused on overall efficiency and lifecycle value.

Entry-Level Recreational Drone Offerings (if applicable)

If Aeronautics Ltd. had ventured into the entry-level recreational drone market, these products would likely be classified as Dogs in the BCG Matrix. This segment is characterized by intense competition from numerous low-cost manufacturers, making it difficult for a company primarily focused on high-end industrial and military unmanned aerial systems (UAS) to capture substantial market share or achieve profitability without significant capital infusion.

The recreational drone market is highly saturated. For instance, in 2024, the global consumer drone market was estimated to be worth around $3.5 billion, with a significant portion coming from the sub-$500 segment. Companies like DJI, Autel Robotics, and various smaller Chinese manufacturers dominate this space with aggressive pricing and extensive distribution networks.

- Market Saturation: The entry-level recreational drone market is flooded with competitors.

- Low Profit Margins: High-volume, low-cost sales typically yield thin profit margins.

- Brand Dilution Risk: Competing in this segment could dilute Aeronautics Ltd.'s premium brand image.

- Resource Drain: Significant investment would be needed to compete effectively, diverting resources from core strengths.

Dogs in the Aeronautics BCG Matrix represent products with low market share and low growth potential. These are often legacy systems or technologies that have been surpassed by newer innovations, leading to declining demand and profitability. For example, older, manually piloted drones with limited capabilities are increasingly being phased out in favor of autonomous systems.

These offerings typically generate minimal revenue while still incurring costs for maintenance and support, making them a financial burden. The market for such products is either shrinking or highly competitive with low margins. In 2024, the market for basic, non-autonomous drones saw a significantly lower growth rate compared to advanced autonomous systems.

Aeronautics Ltd. should consider divesting these products to reallocate resources towards more promising, high-growth areas of the aerospace market. This strategic move helps streamline the product portfolio and focus on innovations that align with future industry trends and customer needs.

Question Marks

Urban Air Mobility (UAM) and passenger/cargo drones represent a burgeoning sector with substantial long-term growth prospects. This market, encompassing air taxis and autonomous delivery systems within cities, is currently in its early development phase, facing considerable regulatory and technological challenges. For Aeronautics Ltd., investing in UAM platforms signifies a high cash expenditure with an unpredictable market share until widespread acceptance is achieved.

Advanced swarm drone technologies are revolutionizing operations by enabling highly coordinated, autonomous drone groups for missions ranging from search and rescue to intelligence gathering and offensive capabilities. This technology promises significant gains in efficiency and effectiveness.

While the potential is immense, the market for large-scale deployment is still developing, placing it in a high-growth, low-market-share category. For instance, the global military drone market, which includes swarm capabilities, was valued at approximately $15 billion in 2023 and is projected to grow significantly, with defense spending on AI and autonomous systems expected to rise substantially in the coming years.

AI-driven predictive maintenance and digital twin services offer advanced data analytics to forecast UAS component failures and build virtual replicas for proactive upkeep. This segment is experiencing robust growth as operators prioritize maximizing operational time and minimizing expenses.

Aeronautics Ltd. may face challenges with a low initial market share due to competition from specialized software providers, necessitating substantial investment to secure a leading position in this rapidly evolving market.

Specialized AI-Enabled Payloads for Niche Civilian Markets

Developing highly specialized AI-enabled payloads for niche civilian markets, like hyper-spectral imaging for environmental forensics or autonomous infrastructure inspection, represents a significant opportunity. These emerging sectors require deeply tailored solutions, leading to currently low market penetration but substantial growth potential.

The market for AI-powered sensors in specialized civilian applications is poised for expansion. For instance, the global market for AI in industrial inspection was projected to reach $2.3 billion by 2024, indicating a strong demand for autonomous and intelligent solutions.

- Environmental Forensics: AI-driven hyper-spectral imaging can identify minute chemical traces, aiding in pollution detection and remediation efforts.

- Infrastructure Inspection: Autonomous drones equipped with AI payloads can perform detailed inspections of bridges, pipelines, and wind turbines, enhancing safety and efficiency.

- Precision Agriculture: AI-enabled sensors can monitor crop health at a granular level, optimizing resource allocation and yield.

- Disaster Response: Specialized AI payloads can assist in search and rescue operations by analyzing complex terrain and identifying specific signatures.

Next-Gen Anti-Drone 'Soft-Kill' Technologies

Investing in next-generation anti-drone soft-kill technologies, such as advanced jamming, cyber-takeover, and directed energy systems, places these innovations in the question mark category of the Aeronautics BCG Matrix. While these technologies are in early development or limited deployment, the market is experiencing high growth driven by increasingly sophisticated drone threats.

The complexity of these systems and the unestablished market share mean that significant investment is required to mature the technology and capture market position. For example, the global counter-UAS market was projected to reach over $7 billion by 2027, with soft-kill solutions expected to be a major growth driver.

- High Growth Potential: The evolving threat landscape from unmanned aerial systems (UAS) fuels substantial market growth for advanced counter-UAS solutions.

- Technological Complexity: Developing and deploying sophisticated jamming, cyber-takeover, and directed energy systems requires significant R&D investment and technical expertise.

- Unestablished Market Share: Companies are still vying for dominance, making it difficult to predict which technologies and providers will achieve widespread adoption.

- Strategic Investment: Continued investment is crucial to overcome technical hurdles, establish market presence, and capitalize on the high-growth potential of these next-generation soft-kill technologies.

Next-generation anti-drone soft-kill technologies, like advanced jamming and directed energy, are currently positioned as Question Marks in the Aeronautics BCG Matrix. These innovations face high market growth due to increasing drone threats but possess unestablished market share.

Significant R&D investment is necessary to mature these complex systems and secure a competitive advantage. The global counter-UAS market is projected for substantial growth, with soft-kill solutions anticipated to be a key driver.

Aeronautics Ltd. must strategically invest in these areas to overcome technical challenges and capitalize on their high growth potential. This involves navigating a landscape where market dominance is yet to be determined.

The evolving threat landscape from unmanned aerial systems (UAS) is fueling substantial market growth for advanced counter-UAS solutions.

| Technology Area | BCG Category | Market Growth | Market Share | Investment Implication |

|---|---|---|---|---|

| Next-Gen Anti-Drone Soft-Kill | Question Mark | High | Low | High R&D, Strategic Investment |

| Counter-UAS Market (Overall) | N/A | Projected to exceed $7 billion by 2027 | N/A | Focus on Soft-Kill Dominance |

BCG Matrix Data Sources

Our Aeronautics BCG Matrix is built on comprehensive market data, integrating company financial reports, aviation industry analysis, and government aviation statistics to provide a robust strategic overview.