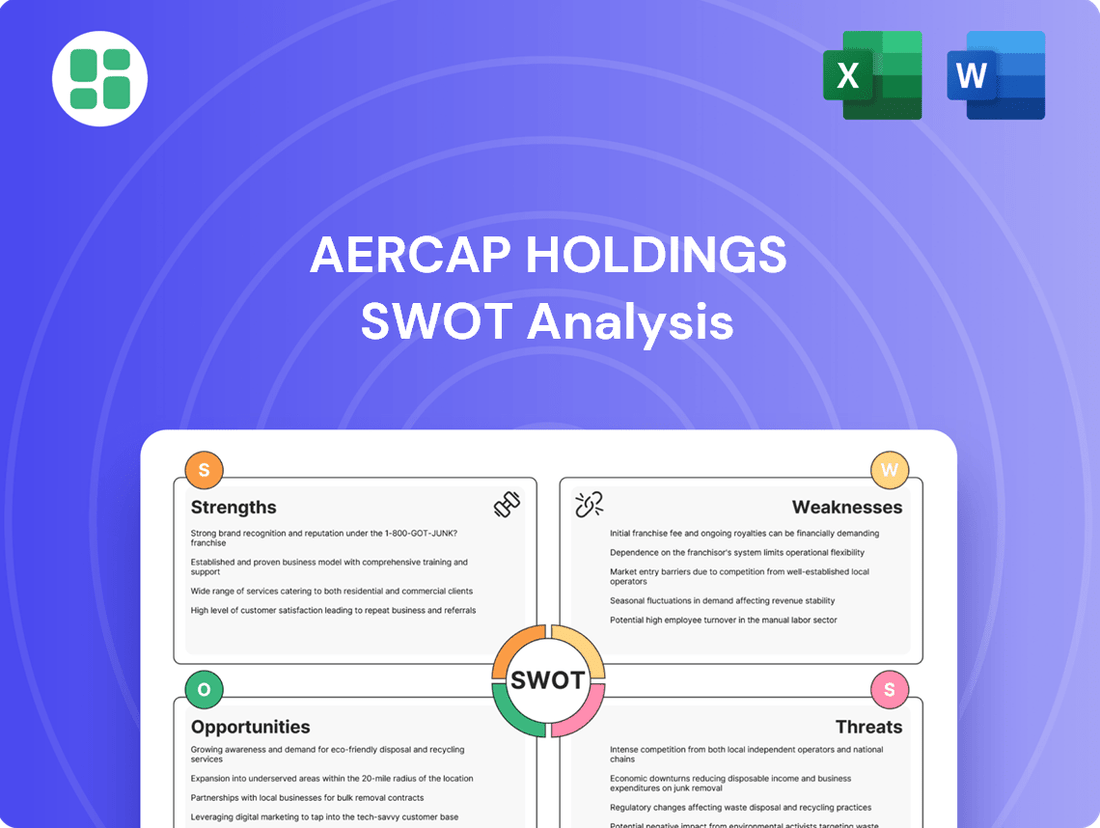

AerCap Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerCap Holdings Bundle

AerCap Holdings, a global leader in aircraft leasing, navigates a dynamic market with significant strengths in its vast portfolio and strong customer relationships. However, understanding the subtle threats from evolving regulations and the opportunities presented by emerging aviation trends is crucial for strategic advantage.

Want the full story behind AerCap's market position, its competitive advantages, and the potential headwinds it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

AerCap Holdings stands as the undisputed global leader in independent aircraft leasing, boasting a fleet of over 1,000 owned and managed aircraft as of early 2024. This immense scale provides significant competitive advantages, including preferential access to new aircraft orders and favorable financing terms. The company's market presence translates into substantial bargaining power with both aircraft manufacturers and airline customers.

AerCap Holdings possesses a remarkably diverse and modern fleet, a significant strength that underpins its market leadership. This extensive portfolio includes a vast number of commercial aircraft, engines, and helicopters, catering to a wide array of customer needs. As of the first quarter of 2024, AerCap’s fleet comprised 1,300 aircraft owned, managed, and on order, with a notable emphasis on next-generation, fuel-efficient models.

This strategic focus on newer aircraft, such as the Airbus A320neo and Boeing 737 MAX families, directly addresses the growing airline demand for enhanced operational efficiency and reduced environmental impact. The company's substantial order book, featuring a high proportion of these advanced aircraft, positions AerCap favorably for long-term asset value appreciation and sustained relevance in an industry increasingly prioritizing sustainability.

AerCap consistently demonstrates robust financial performance, evidenced by strong net income and healthy cash flow from operating activities. For the first quarter of 2024, AerCap reported a net income of $730 million, showcasing continued profitability.

The company’s financial stability is underscored by its investment-grade credit ratings from all three major rating agencies, reflecting prudent capital management and operational resilience. This strong credit profile provides a solid foundation for its extensive operations and strategic growth initiatives.

AerCap maintains substantial liquidity, further bolstered by a healthy debt-to-equity ratio, which stood at 2.56 as of March 31, 2024. This financial strength enables the company to navigate market fluctuations and pursue attractive investment opportunities effectively.

Extensive Global Customer Base and Risk Management

AerCap Holdings boasts a formidable global customer base, serving hundreds of airlines across more than 80 countries. This extensive diversification significantly reduces concentration risk, as the company isn't overly reliant on any single airline or region. For instance, as of their Q1 2024 report, AerCap's portfolio was leased to 100+ customers.

The company’s robust risk management is further evidenced by its portfolio's characteristics. AerCap maintains long average lease terms, providing revenue visibility, and consistently achieves high committed utilization rates, often exceeding 99%. This disciplined approach ensures stable and predictable revenue streams, a key strength in the often-volatile aviation sector.

- Global Reach: Serves over 100 customers in more than 80 countries.

- Diversification: Mitigates risk by not depending on a few major clients.

- Portfolio Health: High committed utilization rates, often above 99%, demonstrate strong demand for its assets.

- Revenue Stability: Long average lease terms contribute to predictable income generation.

Proven Asset Management Expertise

AerCap Holdings boasts proven asset management expertise, a cornerstone of its success. The company has a strong history of strategically acquiring, leasing, and selling aviation assets, as demonstrated by its significant annual transaction volume. For instance, in 2023, AerCap completed over 300 aircraft transactions, highlighting its active market presence.

This operational prowess is driven by specialized teams dedicated to marketing, asset trading, and technical management. These experts ensure that AerCap's extensive fleet is not only efficiently deployed but also effectively monetized. Their deep understanding of the aviation market allows for agile responses to changing conditions, optimizing fleet utilization and overall asset value.

- Strategic Acquisition and Disposition: AerCap's consistent ability to identify and execute strategic deals in the aviation asset market.

- Fleet Monetization: Proven success in maximizing the value derived from its aircraft portfolio through leasing and sales.

- Market Adaptability: The company's capacity to navigate market fluctuations and leverage opportunities through expert asset management.

- Operational Efficiency: High volume of transactions and efficient management of a large, diverse fleet underscore its expertise.

AerCap's extensive global reach is a significant strength, with over 100 customers spread across more than 80 countries as of Q1 2024. This broad customer base ensures diversification, reducing reliance on any single airline or region. The company also boasts high fleet utilization, consistently exceeding 99% on committed aircraft, which translates into stable revenue streams.

The company's proven asset management expertise is evident in its active market participation, completing over 300 aircraft transactions in 2023. This includes strategic acquisitions and dispositions, demonstrating their ability to effectively monetize their vast aircraft portfolio and adapt to market dynamics.

| Metric | Value (as of Q1 2024) | Significance |

|---|---|---|

| Number of Customers | 100+ | Reduces concentration risk |

| Countries Served | 80+ | Global diversification |

| Committed Utilization Rate | >99% | Maximizes asset revenue |

| 2023 Aircraft Transactions | 300+ | Demonstrates active asset management |

What is included in the product

Delivers a strategic overview of AerCap Holdings’s internal and external business factors, highlighting its strong market position and fleet diversification while acknowledging potential economic downturns and competitive pressures.

Offers a clear, actionable framework for identifying and mitigating AerCap's strategic challenges and capitalizing on its market advantages.

Weaknesses

The aircraft leasing industry is inherently capital intensive, demanding massive upfront investments for acquiring new aircraft and engines. This means AerCap must consistently raise substantial financing, which can place a strain on its financial resources, even with its strong access to capital markets.

For instance, in the first quarter of 2024, AerCap reported total assets of $84.7 billion, a significant portion of which is comprised of aircraft and engines. The ongoing need for large-scale funding to maintain and expand its fleet is a fundamental characteristic of its business model.

AerCap's financial well-being is intrinsically tied to the economic health of its airline clients. When airlines struggle, AerCap can face lease defaults or requests for rent adjustments, impacting its revenue streams. For instance, during the COVID-19 pandemic, many airlines faced severe financial distress, leading to significant disruptions in lease payments for aircraft lessors.

The company's profitability and how effectively it uses its aircraft assets are directly influenced by the financial stability and operational success of its worldwide airline customer base. Economic slowdowns, geopolitical instability, or financial difficulties experienced by individual airlines can result in lease defaults, the need for renegotiations, or the early return of leased aircraft, as seen with the impact of the pandemic on global travel demand.

This reliance on the aviation sector means AerCap is exposed to systemic risks inherent in the broader industry. A downturn affecting multiple airlines simultaneously, such as the widespread grounding of fleets experienced in 2020, directly translates into increased risk for AerCap's portfolio, potentially leading to lower asset values and reduced lease income.

As a company heavily reliant on debt financing, AerCap Holdings is inherently sensitive to shifts in global interest rates. A sustained increase in rates, for instance, could directly elevate its cost of borrowing, potentially impacting profitability. For example, if AerCap’s weighted average cost of debt were to increase by 1% due to rising rates, it could translate to hundreds of millions in additional annual interest expense, depending on its debt structure.

Dependency on Aircraft Manufacturers

AerCap's significant reliance on a limited number of aircraft manufacturers, primarily Boeing and Airbus, presents a notable weakness. Any disruptions in their production schedules, such as the ongoing challenges faced by Boeing in 2024 with its 737 MAX program, directly impact AerCap's fleet acquisition and modernization strategies. These delays can hinder AerCap's ability to capitalize on market demand for newer, more fuel-efficient aircraft, potentially affecting lease revenue and fleet renewal timelines.

Supply chain issues affecting these manufacturers, as seen throughout the aerospace industry in recent years, can exacerbate these delivery delays. For instance, shortages in critical components can extend production lead times, meaning AerCap might not receive the aircraft it has ordered as anticipated. This can lead to a gap in its fleet, impacting its competitive positioning and ability to meet airline customer needs promptly.

- Production Delays: Boeing's 2024 delivery targets for the 737 MAX have been subject to revisions, impacting fleet expansion plans for lessors.

- Supply Chain Vulnerability: The broader aerospace supply chain, experiencing bottlenecks in 2024, can further compound delivery uncertainties for new aircraft.

- Fleet Modernization Impact: Delays in new aircraft deliveries can slow down AerCap's fleet renewal process, potentially leading to higher maintenance costs for older aircraft.

Geopolitical Risks and Asset Impairments

AerCap's extensive global footprint means it's inherently vulnerable to geopolitical tensions. Trade wars, sanctions, and regional conflicts can disrupt operations and impact asset values. For instance, the ongoing situation in Eastern Europe has underscored the potential for asset seizures, leading to significant insurance claims and write-offs. In 2023, AerCap continued to manage the fallout from the Russia-Ukraine conflict, which involved the write-off of assets previously leased to Russian airlines.

The company’s exposure to these volatile markets necessitates robust risk management. While AerCap has actively worked to mitigate its presence in high-risk regions, the potential for unforeseen geopolitical events to affect its portfolio remains a persistent challenge. This can lead to unexpected asset impairments, impacting financial performance and requiring strategic adjustments to fleet deployment and leasing strategies.

- Geopolitical Vulnerability: AerCap's global operations expose it to risks from international conflicts and trade disputes.

- Asset Seizure Risk: Events like the Russia-Ukraine conflict highlight the danger of asset confiscation, leading to financial losses.

- Mitigation Efforts: AerCap has taken steps to reduce exposure to volatile markets, but these risks persist.

- Impact on Financials: Geopolitical events can trigger asset impairments and necessitate substantial insurance claims or write-offs.

AerCap's substantial debt burden, while enabling fleet expansion, makes it highly susceptible to interest rate fluctuations. A rise in borrowing costs directly impacts its profitability, as seen in potential increases to its cost of debt. For example, a hypothetical 1% increase in its average debt cost could translate to hundreds of millions in additional annual interest expenses, depending on its debt structure and total borrowings.

The company's dependence on a few key aircraft manufacturers, primarily Boeing and Airbus, poses a significant risk. Production delays or supply chain disruptions affecting these manufacturers, such as the challenges Boeing faced with its 737 MAX program in 2024, can impede AerCap's ability to acquire new aircraft and modernize its fleet. This can lead to missed market opportunities and affect its competitive edge.

AerCap's global operations expose it to considerable geopolitical risks. Conflicts, trade wars, and sanctions can disrupt operations and lead to asset write-offs, as demonstrated by the company's experience with assets leased to Russian airlines following the 2022 conflict. Managing these volatile market exposures requires constant vigilance and strategic adjustments.

| Weakness | Description | Impact |

| Interest Rate Sensitivity | High reliance on debt financing makes AerCap vulnerable to rising interest rates, increasing borrowing costs. | Reduces profitability and potentially impacts financial flexibility. |

| Manufacturer Dependence | Reliance on Boeing and Airbus for new aircraft deliveries. | Production delays and supply chain issues can hinder fleet expansion and modernization, impacting revenue potential. |

| Geopolitical Exposure | Global operations are subject to risks from international conflicts and trade disputes. | Can lead to asset seizures, write-offs, and operational disruptions, affecting financial performance. |

Full Version Awaits

AerCap Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual SWOT analysis file for AerCap Holdings, detailing its Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into AerCap's strategic positioning.

Opportunities

The ongoing rebound and anticipated expansion of global air travel, both for passengers and cargo, represent a substantial opportunity for AerCap. This trend directly fuels the need for airlines to grow their fleets, thereby increasing demand for leased aircraft.

With air passenger traffic projected to reach 4.7 billion by the end of 2024, according to IATA, and cargo volumes also showing resilience, AerCap is well-positioned to capitalize on this demand. The company's extensive portfolio of modern aircraft supports airlines in meeting these growing traffic needs.

Emerging markets are particularly noteworthy, with regions like Asia-Pacific expected to lead aviation growth in the coming years. This expansion necessitates significant fleet investments by airlines in these areas, a requirement that aircraft lessors like AerCap are ideally suited to fulfill.

Airlines globally are prioritizing fleet modernization, aiming for better fuel efficiency and lower operating expenses. This push directly benefits AerCap, as it holds a significant portfolio of newer, more fuel-efficient aircraft and a robust order book for advanced models. For instance, the demand for narrow-body aircraft, which are typically more fuel-efficient, has remained strong, with AerCap having a substantial number of these in its fleet.

The shift towards modern fleets is also driven by increasingly stringent environmental regulations. Airlines are looking for aircraft that emit less CO2, and leasing offers a capital-efficient solution for this transition. AerCap's ability to provide these modern aircraft supports airlines in meeting their sustainability goals while managing their financial resources effectively.

In 2024, the aviation industry continued to see a strong demand for fuel-efficient aircraft, a trend that is expected to persist. AerCap's strategic positioning with a large number of young, fuel-efficient aircraft in its portfolio, including popular models like the Airbus A320neo family and Boeing 737 MAX, allows it to capitalize on this ongoing fleet upgrade cycle.

Persistent production delays at major aircraft manufacturers like Boeing and Airbus are significantly constraining the delivery of new aircraft to airlines. For instance, Boeing's 737 MAX deliveries faced further setbacks in early 2024 due to quality control issues, impacting airline fleet planning.

This scarcity of new planes directly fuels demand for existing aircraft, making aircraft leasing a highly attractive and rapid solution for airlines needing to expand capacity quickly. AerCap, with its extensive portfolio, is well-positioned to capitalize on this trend.

AerCap's substantial existing fleet allows it to effectively meet this immediate demand, potentially enabling the company to negotiate more favorable lease rates and terms. This situation presents a clear opportunity for AerCap to enhance its market position and profitability.

Potential for Industry Consolidation and M&A

The current economic climate, marked by airline financial pressures and persistent supply chain issues, is likely to spur further consolidation within the airline sector. This trend could result in the emergence of larger, more financially robust airline customers for lessors like AerCap. For instance, as of early 2025, several smaller carriers have already signaled potential merger talks or sought government aid, indicating a heightened risk of industry contraction.

Opportunities for mergers and acquisitions (M&A) also extend to the aircraft leasing industry itself. As the dominant player with significant capital and operational scale, AerCap is well-positioned to acquire smaller leasing companies. Such strategic moves could allow AerCap to further optimize its fleet composition, gain access to new markets, and enhance its overall competitive standing.

Key opportunities stemming from consolidation include:

- Acquisition of distressed leasing portfolios: Smaller lessors struggling with capital access or fleet modernization might become acquisition targets.

- Enhanced bargaining power with manufacturers: A larger AerCap could secure more favorable terms for new aircraft orders, potentially leveraging its 2024 order book exceeding 200 aircraft.

- Synergies and cost efficiencies: Integrating acquired entities can lead to operational cost savings and improved asset management.

- Expansion into niche markets: Acquiring specialized lessors could broaden AerCap's service offerings and geographic reach.

Expansion into Non-Commercial Aircraft Leasing

AerCap can tap into a growing niche market for aircraft modified for specialized missions, including medical evacuation, homeland security, and defense applications. This expansion offers a pathway to diversify revenue beyond traditional commercial aviation.

These specialized leasing arrangements frequently involve sovereign guarantees and extended contract durations. This can translate into more predictable and stable income streams for AerCap, mitigating some of the cyclicality inherent in the commercial airline industry.

For instance, the global defense and aerospace market is projected to reach $1.1 trillion by 2030, with specialized aircraft playing an increasingly vital role. AerCap's existing expertise in aircraft management and financing positions it well to capture opportunities in this segment.

- Diversification: Entry into non-commercial leasing provides a buffer against commercial aviation downturns.

- Stable Revenue: Longer contract terms and sovereign backing offer predictable cash flows.

- Market Growth: The demand for specialized aircraft for government and security purposes is on the rise.

- Leveraging Expertise: AerCap's established leasing infrastructure can be adapted for these new markets.

The sustained rebound in global air travel, with passenger traffic projected to hit 4.7 billion in 2024, creates a robust demand for aircraft leasing. This growth, particularly in emerging markets like Asia-Pacific, necessitates fleet expansion by airlines, directly benefiting lessors like AerCap. The company's extensive portfolio of modern, fuel-efficient aircraft, including popular narrow-body models, aligns perfectly with airlines' needs for capacity and sustainability.

Persistent production delays from major manufacturers like Boeing and Airbus, leading to a scarcity of new aircraft deliveries in 2024 and early 2025, further amplify the demand for existing leased aircraft. This supply-demand imbalance allows AerCap to potentially negotiate more favorable lease terms and rates, enhancing its market position and profitability. The company's substantial existing fleet is key to meeting this immediate demand.

Consolidation within the airline industry, driven by economic pressures and supply chain issues, is expected to create larger, more financially stable airline customers. Furthermore, AerCap, as a dominant player, is strategically positioned to pursue mergers and acquisitions within the leasing sector itself, acquiring distressed portfolios and achieving significant operational synergies and cost efficiencies. This could also lead to expanded market reach and a strengthened competitive stance.

AerCap can also capitalize on the growing niche market for aircraft modified for specialized missions, such as defense, security, and medical evacuation. These arrangements often involve sovereign guarantees and longer contract durations, offering AerCap more predictable and stable revenue streams, thereby diversifying its income away from the cyclical commercial aviation market. The global defense and aerospace market's projected growth further supports this opportunity.

| Opportunity Area | Key Driver | AerCap's Advantage | 2024/2025 Data Point |

|---|---|---|---|

| Rebounding Air Travel Demand | Passenger traffic expected to reach 4.7 billion in 2024 (IATA) | Extensive portfolio of modern aircraft | Strong demand for narrow-body aircraft |

| Aircraft Scarcity due to Production Delays | Manufacturer delivery constraints | Ability to meet immediate airline needs | Boeing 737 MAX delivery setbacks in early 2024 |

| Industry Consolidation | Airline financial pressures | Potential to acquire smaller lessors, gain scale | Indications of merger talks by smaller carriers as of early 2025 |

| Niche Markets (Defense, Security) | Growth in specialized aviation needs | Diversification of revenue, stable income streams | Global defense market projected to reach $1.1 trillion by 2030 |

Threats

A global economic downturn poses a significant threat to AerCap. A slowdown could curb consumer spending on travel and reduce the volume of goods shipped, directly impacting airline demand for leases. For instance, if major economies like the US or Eurozone experience a contraction in GDP, as some forecasts suggest for parts of 2024, airlines might scale back operations, leading to fewer aircraft being leased.

This reduced demand and potential financial strain on airlines could translate into higher default rates on existing leases or a need for renegotiations, impacting AerCap's revenue streams. If airlines struggle to meet their lease payments, AerCap could face increased financial risk, potentially affecting its profitability and asset valuations. The International Monetary Fund's (IMF) projections often highlight downside risks to global growth, which directly correlates with the health of the aviation sector and, by extension, AerCap's business.

Geopolitical instability, exemplified by ongoing conflicts and the potential for escalating trade disputes, presents a substantial threat to AerCap. These tensions can directly impact air travel demand and disrupt global supply chains, affecting aircraft delivery schedules and maintenance operations. For instance, the International Air Transport Association (IATA) has cautioned that geopolitical risks could temper the pace of aviation industry recovery in 2024 and 2025.

The imposition of tariffs or other trade barriers could increase the cost of aircraft manufacturing and spare parts, thereby impacting AerCap's operational expenses and lease rates. Furthermore, such disputes can lead to unpredictable shifts in economic growth, directly influencing airline profitability and their capacity to lease new aircraft. The volatility in oil prices, often exacerbated by geopolitical events, also adds another layer of cost pressure for airlines, potentially delaying fleet modernization plans.

AerCap, despite its leading position, navigates a highly competitive aircraft leasing market. It contends with other major global lessors and a growing number of specialized and regional players, all vying for airline contracts.

This intense rivalry directly impacts AerCap's ability to command favorable lease rates and maintain robust profit margins. Aggressive pricing strategies from competitors can make securing new business at optimal terms a significant challenge.

For instance, the market saw lease rate increases of approximately 5-10% for new narrow-body aircraft in early 2024, a figure that could be pressured by intense competition, especially for less in-demand models or during periods of oversupply.

Persistent Supply Chain Issues and Production Delays

The aviation sector continues to face significant headwinds from persistent supply chain disruptions and labor shortages impacting both aircraft and engine manufacturers. These ongoing challenges directly translate into delayed deliveries of new aircraft, a critical factor for AerCap's fleet modernization strategy. This inability to acquire the latest models can hinder AerCap's capacity to meet evolving customer demand for more fuel-efficient and technologically advanced aircraft. Furthermore, these delays contribute to an aging global fleet, potentially escalating maintenance expenditures across the industry.

These production delays have a tangible impact on AerCap's operational efficiency and future growth prospects. For instance, Boeing's 737 MAX production, a key aircraft type for many lessors, has experienced ongoing setbacks. As of early 2024, delivery targets for the 737 MAX have been adjusted multiple times due to manufacturing quality issues and supply chain constraints. Similarly, engine manufacturers like GE Aerospace and Pratt & Whitney have also reported production challenges, affecting the availability of new powerplants. This scarcity of new aircraft and engines can lead to extended lease terms on older, less efficient aircraft, increasing the operational costs for AerCap's lessees and potentially impacting lease rates.

- Delayed Deliveries: Continued supply chain bottlenecks mean AerCap may not receive new aircraft as scheduled, impacting fleet expansion and refresh plans.

- Increased Maintenance Costs: An aging global fleet, a consequence of delivery delays, can lead to higher maintenance, repair, and overhaul (MRO) expenses for lessees, potentially affecting lease renewals.

- Limited Fleet Modernization: Inability to secure new, fuel-efficient aircraft limits AerCap's ability to offer the latest technology to customers, potentially impacting competitiveness.

- Impact on Lease Rates: Scarcity of new aircraft could theoretically support higher lease rates on existing assets, but the overall economic uncertainty and operational challenges may temper this effect.

Rising Operating Costs for Airlines

Airlines are grappling with significant increases in operating costs. Labor shortages are pushing salaries higher, while maintenance expenses continue to climb. The volatility of jet fuel prices also adds a substantial layer of unpredictability to airline budgets. For instance, in late 2024, jet fuel prices saw a notable uptick, impacting carriers globally.

These rising expenses directly affect airline profitability, potentially limiting their ability to absorb higher lease rates from lessors like AerCap. This squeeze on margins could also hinder their capacity to meet existing lease obligations, creating a direct risk to AerCap's revenue streams and overall financial stability.

- Labor Cost Pressures: Ongoing staff shortages in 2024 and into 2025 have led to increased wage demands across the aviation sector.

- Escalating Maintenance Expenses: The cost of aircraft parts and specialized labor for maintenance has been on an upward trend.

- Fuel Price Volatility: Fluctuations in global oil markets continue to present a significant and often unmanageable cost factor for airlines.

Intensifying competition within the aircraft leasing sector presents a persistent threat to AerCap's market dominance and profitability. The presence of numerous global and specialized lessors creates pressure on lease rates, potentially impacting AerCap's ability to secure new contracts at optimal terms, especially as new aircraft deliveries continue to face delays into 2025.

The ongoing supply chain disruptions affecting aircraft and engine manufacturers pose a significant risk to AerCap's fleet modernization efforts. Delays in new aircraft deliveries, such as those impacting Boeing's 737 MAX program into 2024-2025, limit AerCap's capacity to offer the latest, fuel-efficient models, potentially affecting its competitiveness and increasing reliance on older, less efficient aircraft.

Rising operating costs for airlines, driven by labor shortages and increasing maintenance expenses, directly threaten AerCap's revenue streams. These financial pressures on lessees could lead to higher default rates or a need for lease renegotiations, as seen with the continued upward trend in aviation labor costs and parts pricing throughout 2024.

Geopolitical instability and potential trade disputes remain a substantial threat, capable of disrupting air travel demand and impacting global supply chains. Such tensions can temper aviation industry recovery, as noted by IATA for 2024-2025, and increase operational costs for airlines, indirectly affecting their leasing capacity and AerCap's financial performance.

SWOT Analysis Data Sources

This AerCap Holdings SWOT analysis is built upon a foundation of reliable data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust and insightful assessment.