AerCap Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerCap Holdings Bundle

Discover how political shifts, economic volatility, and technological advancements are profoundly impacting AerCap Holdings's strategic landscape. Our comprehensive PESTLE analysis provides the critical external intelligence you need to anticipate challenges and seize opportunities in the aviation leasing sector. Download the full version now to gain a decisive market advantage.

Political factors

Global political stability is a significant factor for AerCap, as disruptions in international relations directly affect air travel demand and operational costs. Geopolitical tensions, like the ongoing conflict in Ukraine, have already led to airspace closures and rerouting, increasing fuel consumption and flight times for airlines leasing aircraft from AerCap.

These conflicts also elevate insurance premiums and can impact aircraft recovery efforts if leases are terminated due to sanctions or operational challenges. For instance, the grounding of aircraft in Russia following the 2022 invasion resulted in significant write-downs for lessors, highlighting the financial exposure AerCap faces from such events.

Government aviation policies, including subsidies and taxes, directly shape AerCap's operating landscape. For instance, the International Air Transport Association (IATA) reported in late 2024 that government support packages for airlines globally reached an estimated $210 billion during the pandemic, with ongoing debates about the fairness and sustainability of such interventions. These policies can alter aircraft demand and the financial stability of AerCap's airline clients.

Bilateral air service agreements also play a crucial role, dictating which airlines can fly which routes and how often. Changes here, such as the expansion of open skies agreements in certain regions throughout 2024, can open new markets for aircraft leasing or increase competition on existing routes, impacting AerCap's portfolio performance.

International trade relations and the imposition of tariffs on commercial aircraft or engine parts can significantly increase acquisition and leasing costs for airlines and leasing companies like AerCap. For instance, ongoing trade disputes, such as those involving the US and China, have previously led to retaliatory tariffs on various goods, and the aviation sector is not immune to such pressures. These tariffs can directly inflate the price of new aircraft and essential components, impacting AerCap's overall operational expenses and the cost of fleet modernization for its lessees.

Such trade barriers can also restrict access to updated aircraft fleets, as airlines may find it more economically challenging to acquire the latest, most fuel-efficient models. This limitation can have a ripple effect on the global economy, potentially slowing down air travel growth and reducing demand for leasing services. In 2023, global trade growth was sluggish, and the International Monetary Fund projected only modest improvements for 2024 and 2025, underscoring the sensitivity of AerCap's business to these geopolitical and economic headwinds.

Sanctions and Export Controls

Sanctions and export controls can directly impact AerCap's operations by limiting its access to aircraft or preventing lease agreements with entities in sanctioned countries. For instance, the ongoing geopolitical tensions and associated sanctions have created significant challenges in managing aircraft assets located in Russia.

These restrictions create substantial risks for AerCap, potentially leading to asset impairment if aircraft cannot be repossessed or leased elsewhere. The company has previously highlighted the financial impact of such geopolitical events, underscoring the vulnerability of its global fleet to international policy changes.

- Asset Impairment Risk: Sanctions can prevent AerCap from repossessing aircraft, leading to potential write-downs on those assets.

- Lease Restrictions: Export controls may prohibit leasing aircraft to specific countries or entities, limiting revenue opportunities.

- Geopolitical Event Impact: Past events have demonstrated that AerCap's fleet value and operational flexibility can be significantly affected by international political actions.

Aviation Safety and Security Regulations

Aviation safety and security regulations are a significant political factor for AerCap. While these rules are vital for passenger well-being and industry integrity, they often translate into increased operational expenses for airlines. For instance, the International Civil Aviation Organization (ICAO) continually updates standards, impacting everything from pilot training to aircraft design, which can indirectly affect lease agreements as airlines manage these compliance costs.

The evolving landscape of aviation security, including stricter cybersecurity measures and enhanced physical security protocols, adds another layer of complexity. Airlines must invest in technology and training to meet these requirements, potentially impacting their ability to service lease payments. As of early 2024, the focus on data security for flight operations and passenger information is particularly intense, requiring substantial IT infrastructure upgrades.

- Increased Compliance Costs: Airlines face rising expenses to adhere to new safety mandates, such as enhanced aircraft maintenance record-keeping and the integration of new technologies.

- Cybersecurity Investments: Significant financial outlays are necessary for airlines to bolster their cybersecurity defenses against evolving threats to flight operations and passenger data.

- Regulatory Uncertainty: Shifting or newly introduced regulations can create unpredictability, influencing airlines' long-term financial planning and their capacity to manage lease obligations.

Government stability and policy continuity are paramount for AerCap. Unstable political environments can disrupt air travel, impact lease agreements, and affect asset values. For example, the 2024 re-election of governments in several key aviation markets could signal policy stability, but emerging geopolitical flashpoints, such as increased tensions in the South China Sea, present ongoing risks to global air connectivity and AerCap's operational reach.

Trade relations and potential tariffs on aircraft components or finished aircraft directly influence AerCap's acquisition costs and the competitiveness of its fleet. As of late 2024, ongoing trade negotiations between major economic blocs continue to create uncertainty, with the potential for new tariffs impacting the cost of new aircraft deliveries, a critical factor for fleet renewal and expansion strategies.

International sanctions and export controls pose significant risks, as demonstrated by the challenges in managing aircraft assets in regions subject to such measures. The global regulatory environment for aviation, including evolving safety and security standards from bodies like ICAO, also adds complexity and potential cost burdens for airlines, indirectly affecting their leasing capacity and AerCap's financial performance.

What is included in the product

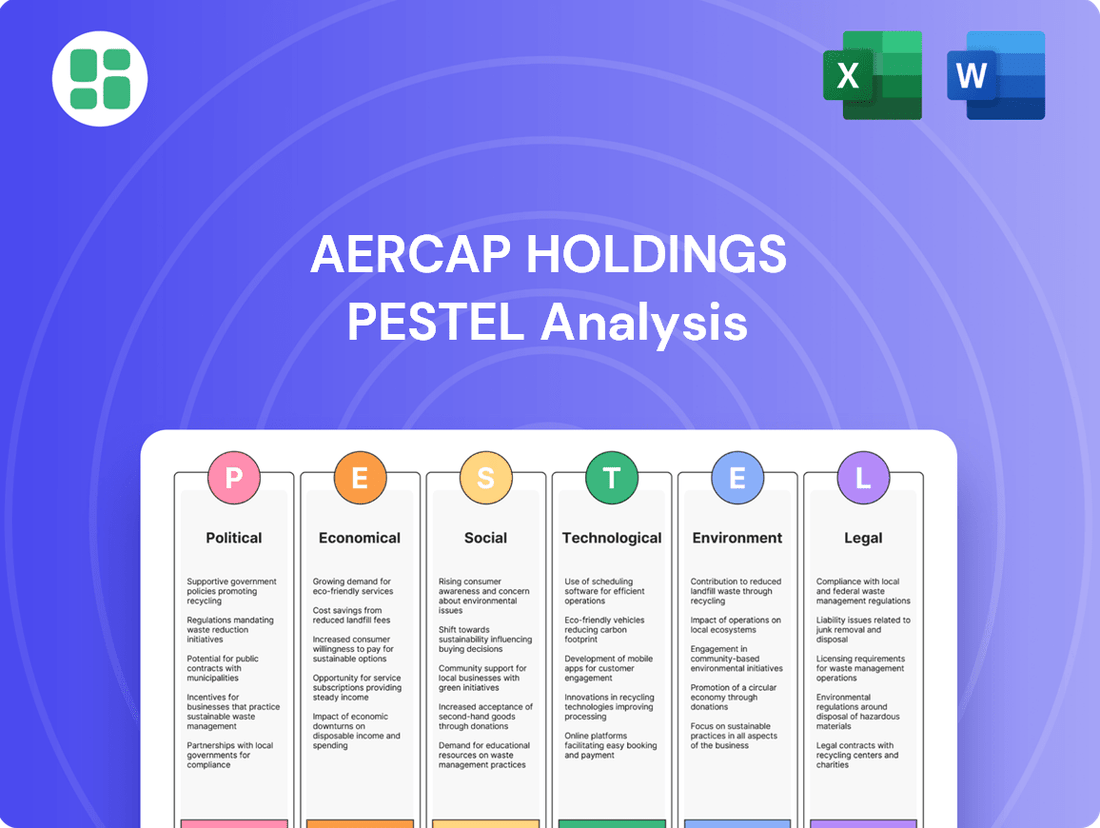

This PESTLE analysis of AerCap Holdings examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, identifying key drivers that shape AerCap's opportunities and challenges in the global aviation leasing market.

A concise PESTLE analysis for AerCap Holdings, highlighting key external factors impacting the aviation leasing industry, serves as a pain point reliever by offering clear insights for strategic decision-making.

This analysis helps alleviate pain points by providing a structured framework to understand political, economic, social, technological, environmental, and legal influences, enabling proactive risk management and opportunity identification.

Economic factors

Global economic growth is a crucial driver for the aviation industry, directly impacting airline profitability and, consequently, the demand for aircraft leasing. A robust global economy generally translates to increased travel and cargo demand, boosting airline revenues. For 2025, projections indicate a continued expansion of the global economy, with the IMF forecasting a 3.2% growth rate, which should bolster airline financial health.

Improved airline profitability, a direct result of a healthier global economy, fuels demand for new and used aircraft. When airlines are making more money, they are more likely to invest in fleet expansion or modernization, creating opportunities for lessors like AerCap. This positive cycle is expected to continue into 2025, with many airlines reporting stronger financial performance in late 2024.

Fluctuations in global interest rates directly influence AerCap's cost of borrowing and its capacity to finance new aircraft purchases. For instance, the US Federal Reserve's benchmark interest rate, which impacts borrowing costs across the economy, saw several increases throughout 2023 and into early 2024, with projections suggesting continued stability or gradual adjustments. This environment can elevate AerCap's funding expenses.

Higher interest rates can translate to increased funding costs for aircraft lessors like AerCap. This directly affects their ability to offer competitive lease rates to airlines. If AerCap's cost of capital rises, they may need to pass some of that expense on through higher lease payments, potentially impacting their market position against competitors with lower funding costs.

Volatile jet fuel prices remain a significant operational cost for airlines, directly impacting their profitability and capacity to fulfill lease obligations to lessors like AerCap. For instance, in early 2024, jet fuel prices fluctuated, with Brent crude oil averaging around $80 per barrel, a key benchmark impacting jet fuel costs.

While projections for 2025 suggest a potential benefit from stabilizing or lower oil prices, airlines are still contending with persistent high non-fuel operating expenses. These include rising maintenance costs, driven by an aging global aircraft fleet, and increasing labor expenses, which continue to squeeze airline margins and affect their financial health.

Supply Chain Disruptions and Aircraft Deliveries

Lingering supply chain issues continue to affect aircraft manufacturers like Boeing and Airbus, leading to significant delays in new aircraft deliveries. This directly impacts AerCap's ability to acquire modern, fuel-efficient aircraft, potentially keeping older planes in service longer. For instance, by the end of 2023, Boeing reported a backlog of over 5,600 aircraft, with ongoing production challenges affecting delivery schedules.

These delivery delays can force airlines to extend the operational life of their existing fleets. This often translates to higher maintenance expenditures for airlines, which in turn can influence their leasing decisions and potentially impact AerCap's fleet modernization strategies. The extended use of older aircraft also raises questions about their long-term residual values.

- Extended Aircraft Lifespans: Delays mean airlines may operate older aircraft for longer periods, increasing maintenance needs.

- Fleet Modernization Challenges: AerCap's plans to introduce newer, more efficient models into its portfolio are hindered by manufacturer delivery schedules.

- Impact on Maintenance Costs: Older aircraft typically incur higher maintenance costs, affecting airline profitability and leasing demand.

- Boeing's 2023 Backlog: Over 5,600 aircraft were on order, highlighting the scale of production challenges affecting new deliveries.

Currency Fluctuations and Exchange Rates

AerCap, as a global aircraft leasing powerhouse, is significantly exposed to currency fluctuations. With a vast portfolio of aircraft leased to airlines worldwide and assets denominated in various currencies, shifts in exchange rates directly affect its financial performance.

For instance, if the US Dollar strengthens against other major currencies like the Euro or Japanese Yen, it can reduce the reported value of lease revenues earned in those foreign currencies when translated back into USD. Conversely, a weaker USD can boost reported earnings. This dynamic impacts AerCap's profitability and the overall valuation of its international asset base.

- Impact on Lease Revenues: Fluctuations can alter the USD equivalent of lease payments received in foreign currencies.

- Operational Costs: Expenses incurred in different currencies, such as maintenance or administrative costs, are also affected.

- Asset Valuation: The market value of AerCap's aircraft portfolio, often assessed in USD, can be influenced by prevailing exchange rates.

- Hedging Strategies: AerCap actively employs hedging strategies to mitigate the risks associated with currency volatility, aiming to stabilize its financial results.

Global economic expansion is a key driver for AerCap, with the IMF projecting 3.2% growth for 2025, which should support airline demand for aircraft leasing and improve airline profitability. Stronger airline finances in late 2024 indicate a positive outlook for fleet acquisition and modernization, benefiting lessors.

Interest rate hikes, like those seen in early 2024, increase AerCap's borrowing costs, potentially leading to higher lease rates for airlines. This directly impacts AerCap's competitiveness and the affordability of aircraft for its customers.

Persistent supply chain issues, exemplified by Boeing's over 5,600 aircraft backlog at the end of 2023, lead to delivery delays. This forces airlines to extend the use of older aircraft, increasing maintenance costs and potentially affecting AerCap's fleet modernization strategies and asset valuations.

Currency fluctuations, such as a strengthening US Dollar, can reduce the reported value of AerCap's foreign-denominated lease revenues, impacting overall profitability and asset valuation. Hedging strategies are crucial for mitigating these risks.

Preview the Actual Deliverable

AerCap Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AerCap Holdings covers political, economic, social, technological, legal, and environmental factors impacting the aviation leasing industry. Understand the external forces shaping AerCap's strategic landscape.

Sociological factors

Global air travel demand is experiencing a significant rebound, with passenger traffic projected to surpass pre-pandemic levels by 2025. This recovery is largely fueled by a strong resurgence in leisure travel, as consumers prioritize experiences. For instance, the International Air Transport Association (IATA) forecasts that global air passenger traffic will reach 4.7 billion in 2024, a notable increase from previous years.

Evolving passenger preferences are also reshaping the market. While business travel is gradually recovering, the sustained growth in leisure demand means airlines are adapting their fleet strategies to cater to these trends. This shift influences the types of aircraft in demand, potentially favoring more fuel-efficient and versatile models.

The robust passenger traffic growth expected in 2025 directly translates to an increased need for aircraft, a positive development for aircraft leasing companies like AerCap. As airlines expand their operations to meet this demand, the leasing market is poised to benefit from higher utilization rates and new lease agreements.

Public awareness of aviation's environmental footprint is growing, with a significant portion of travelers now considering sustainability in their choices. Surveys in 2024 indicate that over 60% of frequent flyers are more likely to choose airlines with demonstrable green initiatives. This societal shift directly pressures lessors like AerCap to manage fleets that align with environmental expectations, potentially affecting the demand for older, less fuel-efficient aircraft in their portfolio.

A significant challenge facing the aviation industry, and by extension lessors like AerCap, is the persistent shortage of skilled aviation professionals. This scarcity spans critical roles such as pilots, aircraft maintenance technicians, and air traffic controllers, directly impacting airline operational efficiency.

These labor deficits are driving up wage demands, as airlines compete for a limited pool of qualified personnel. For example, the FAA projected a need for over 620,000 aviation jobs in the US alone between 2023 and 2042, highlighting the scale of the challenge. This trend can escalate leasing costs and create operational disruptions for airlines, potentially affecting their financial health and their capacity to meet lease obligations.

Urbanization and Connectivity Needs

The persistent global trend toward urbanization significantly fuels the demand for air travel. As more people move to cities, the need for efficient and rapid transportation between these hubs, and to connect less developed areas to urban centers, grows. This demographic shift directly translates into increased demand for air connectivity, a core service provided by airlines.

This escalating need for connectivity isn't just about passenger travel; it also encompasses cargo movement, essential for supplying urban populations and supporting globalized supply chains. AerCap, as a leading aircraft lessor, benefits from this as airlines require more aircraft to serve these expanding routes and handle increased passenger and cargo volumes. For instance, the International Air Transport Association (IATA) projected global passenger traffic to reach 4.7 billion in 2024, a substantial increase from pre-pandemic levels, underscoring the recovery and growth in this sector driven by urbanization.

- Urban Population Growth: The UN estimates that by 2050, 68% of the world's population will reside in urban areas, up from 56% in 2021.

- Increased Air Travel Demand: IATA data indicates a strong rebound in air travel, with passenger traffic expected to surpass 2019 levels in 2024.

- Cargo Importance: Air cargo is vital for global trade, with estimates suggesting it will carry over 35% of world trade by value in 2025.

- Aircraft Leasing Role: Airlines often rely on leasing to manage fleet expansion and modernization, directly benefiting from increased demand driven by urbanization.

Health and Safety Concerns

Public health crises, such as the COVID-19 pandemic, have a profound impact on AerCap Holdings by significantly altering air travel demand and necessitating the implementation of stringent health and safety protocols. While the most acute phase of the pandemic has passed, the lingering possibility of future health concerns continues to shape consumer travel behavior and operational strategies within the aviation industry.

The lingering effects of past pandemics mean that passenger confidence remains a critical variable. For instance, during the height of COVID-19, international air passenger traffic plummeted by an estimated 60% in 2020 compared to 2019, according to IATA data. This highlights the direct correlation between public health perceptions and travel volumes, directly affecting lease rates and aircraft utilization for lessors like AerCap.

- Passenger Confidence: Ongoing vigilance regarding health and safety measures is crucial for rebuilding and maintaining passenger trust.

- Operational Adaptations: Airlines and lessors must remain agile in adapting to evolving health and safety regulations and passenger expectations.

- Demand Volatility: The potential for future health scares introduces an element of unpredictability into long-term demand forecasts for air travel.

Societal attitudes towards travel and sustainability are increasingly influencing the aviation sector. Growing environmental consciousness means a greater demand for fuel-efficient aircraft, impacting fleet choices for airlines and, consequently, lessors like AerCap. For example, surveys from 2024 indicated that over 60% of frequent flyers consider an airline's environmental initiatives when booking.

The aviation industry also faces a persistent shortage of skilled professionals, including pilots and mechanics. This labor deficit, projected by the FAA to require over 620,000 aviation jobs in the US alone between 2023 and 2042, can lead to increased operational costs for airlines due to rising wages, potentially affecting their ability to meet lease obligations.

Urbanization continues to be a significant driver of air travel demand, as more people move to cities, increasing the need for connectivity. The UN projects that by 2050, 68% of the global population will live in urban areas, up from 56% in 2021, directly boosting passenger and cargo traffic, which benefits aircraft lessors.

| Sociological Factor | Impact on AerCap | Supporting Data (2024/2025) |

|---|---|---|

| Environmental Awareness | Increased demand for fuel-efficient aircraft, potential for faster fleet turnover. | 60%+ of frequent flyers consider sustainability (2024 surveys). |

| Labor Shortages | Potential for higher airline operating costs, impacting lease affordability and airline financial health. | US aviation sector needs 620,000+ jobs (2023-2042 projection). |

| Urbanization Trends | Sustained growth in passenger and cargo demand, driving aircraft leasing needs. | 68% global urban population by 2050 (UN projection); IATA forecasts 4.7 billion passengers in 2024. |

Technological factors

Technological advancements are reshaping the aviation landscape, with new generations of aircraft boasting significantly improved fuel efficiency and lower emissions. This trend is a major factor for lessors like AerCap. For instance, the Boeing 737 MAX and Airbus A320neo families offer substantial fuel savings compared to older models, with the A320neo family reportedly achieving a 15% reduction in fuel burn.

AerCap directly benefits as airlines increasingly prioritize these fuel-efficient aircraft to cut operational expenses and comply with stricter environmental regulations. This demand influences AerCap's fleet renewal strategies, pushing for leases of newer, more sustainable aircraft to remain competitive and attractive to lessees aiming to meet their own environmental, social, and governance (ESG) goals.

Progress in Sustainable Aviation Fuels (SAF) is a significant technological shift for aviation's decarbonization efforts. By 2023, global SAF production reached approximately 7 million gallons, a substantial increase from previous years, signaling growing momentum.

AerCap's portfolio strategy must adapt to SAF mandates and technological advancements, as these will influence the long-term value and demand for its leased aircraft fleet. The increasing focus on SAF is projected to drive demand for newer, more fuel-efficient aircraft capable of operating with higher SAF blends.

The aviation industry is rapidly embracing digitalization in aircraft maintenance. This includes the widespread adoption of digital maintenance records, moving away from paper-based systems, which streamlines data access and reduces errors. By 2024, a significant portion of airlines are expected to have fully digitized their maintenance operations, leading to improved turnaround times and compliance.

Predictive maintenance, powered by AI and machine learning, is a key technological factor. Sensors on aircraft collect vast amounts of data, enabling early detection of potential issues. For instance, companies are investing heavily in AI platforms that analyze engine performance data to predict component failures, potentially saving millions in unscheduled downtime and costly repairs. AerCap, as a lessor, benefits from this through enhanced asset visibility and reduced operational risks.

Emerging Propulsion Technologies (Electric, Hydrogen)

The aviation industry is on the cusp of a significant technological transformation with the ongoing development of electric and hydrogen propulsion systems. While these innovations are still in their early stages for large commercial aircraft, they hold the potential to fundamentally alter fleet composition and leasing strategies in the coming years, especially for shorter routes.

Companies like Eviation are making strides, with their Alice electric aircraft completing its first flight in 2022 and targeting commercial operations by 2027. Similarly, Airbus has outlined ambitious plans for a zero-emission hydrogen-powered aircraft, aiming for a 2035 entry into service. These advancements signal a long-term shift away from traditional jet fuel, impacting aircraft design and operational economics.

The implications for lessors like AerCap are substantial. As these new technologies mature, there will be a growing demand for leasing agreements tailored to electric and hydrogen aircraft. This could lead to new financing models and a gradual phasing out of older, less efficient aircraft, creating both challenges and opportunities for fleet management and asset value assessment.

- Electric Aircraft Development: Eviation's Alice completed its first flight in 2022, with commercial operations targeted for 2027.

- Hydrogen Aircraft Ambitions: Airbus aims to introduce a hydrogen-powered aircraft by 2035.

- Leasing Model Evolution: New leasing structures will be required for these emerging technologies.

- Fleet Modernization: Expect a gradual transition away from conventional aircraft as new propulsion systems become viable.

Cybersecurity in Aviation Systems

The aviation industry's growing dependence on interconnected digital systems, from flight planning to in-flight entertainment, makes robust cybersecurity paramount. This technological shift, while enhancing efficiency, also broadens the attack surface for cyber threats. For instance, the International Air Transport Association (IATA) has highlighted cybersecurity as a top priority, with incidents potentially disrupting operations and compromising sensitive passenger information.

Protecting aircraft systems, ground operations, and passenger data from sophisticated cyberattacks is a significant and evolving technological challenge. This necessitates substantial ongoing investment in advanced security solutions and strict adherence to evolving regulatory frameworks. By 2024, the global aviation cybersecurity market was projected to reach billions, underscoring the scale of this technological imperative.

Key technological considerations for cybersecurity in aviation include:

- Securing connected aircraft systems: Protecting avionics, communication, and navigation systems from unauthorized access and manipulation.

- Data protection: Implementing strong measures to safeguard passenger personal information and operational data.

- Threat detection and response: Developing and deploying advanced tools to identify and neutralize cyber threats in real-time.

- Regulatory compliance: Adhering to international standards and guidelines set by bodies like ICAO and EASA for aviation cybersecurity.

The aviation sector is rapidly adopting advanced technologies like AI for predictive maintenance, aiming to reduce downtime and operational costs. By 2024, the global aviation cybersecurity market was projected to reach billions, reflecting the critical need for digital security. New aircraft designs are prioritizing fuel efficiency, with the Airbus A320neo family offering a 15% fuel burn reduction, directly impacting lessor asset value and airline demand.

Legal factors

International aviation treaties, like the Cape Town Convention, are fundamental for AerCap's global business. These agreements, which have seen widespread ratification by over 70 countries as of early 2024, offer crucial legal protections for aircraft lessors. They streamline asset registration and, importantly, facilitate repossession of aircraft in cases of default, providing essential legal certainty for AerCap's cross-border leasing activities.

Antitrust and competition laws are crucial for AerCap, the world's largest aircraft leasing company. Regulatory bodies globally, including the European Commission and the U.S. Department of Justice, closely monitor mergers and acquisitions to prevent market monopolization and ensure fair competition within the aviation leasing sector. For instance, AerCap's 2021 acquisition of GECAS, a deal valued at approximately $24 billion, underwent extensive review by multiple antitrust authorities.

Bankruptcy laws in key jurisdictions, such as the United States' Chapter 11 and European Union member states' insolvency frameworks, directly influence AerCap's ability to repossess aircraft from struggling airlines. These legal structures can create significant hurdles and delays in asset recovery, impacting AerCap's financial performance and risk management strategies. For instance, the US Bankruptcy Code's Section 1110 provides specific protections for aircraft lessors, allowing for repossession if lease payments are not cured within a set timeframe, a crucial factor for lessors operating in that market.

Environmental Regulations and Compliance Mandates

Environmental regulations are becoming a significant legal factor for AerCap. New rules like CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) and the EU Emissions Trading System (EU ETS) directly impact airlines and, by extension, lessors. AerCap needs to ensure its aircraft portfolio can meet these evolving carbon emission standards, which could affect aircraft values and the terms of lease agreements.

Furthermore, mandates for Sustainable Aviation Fuel (SAF) usage are increasing. By 2024, for example, the EU's ReFuelEU Aviation initiative requires airlines to blend increasing percentages of SAF into their jet fuel. This legal pressure means AerCap must consider the operational and economic implications of SAF adoption when managing its fleet, potentially influencing which aircraft are more desirable for lessees.

- CORSIA Implementation: International Civil Aviation Organization (ICAO) member states are implementing CORSIA, aiming to cap net CO2 emissions from international aviation from 2024 onwards.

- EU ETS Expansion: The EU ETS now includes aviation, requiring airlines to purchase allowances for their emissions, a cost that can be passed on or absorbed.

- SAF Mandates: Countries and regions are setting SAF blending targets, creating a legal framework for increased SAF adoption in the coming years.

- Fleet Compliance: AerCap's ability to lease aircraft that are more fuel-efficient or compatible with SAF will be crucial for maintaining asset value and marketability.

Data Protection and Privacy Laws

The aviation industry, increasingly reliant on digital platforms, faces significant scrutiny under data protection and privacy regulations such as the EU's General Data Protection Regulation (GDPR). AerCap, like its airline clients, must navigate these complex legal frameworks to safeguard sensitive passenger and operational data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Ensuring robust data security measures is paramount for AerCap to maintain trust with its customers and avoid legal repercussions. This involves implementing stringent protocols for data collection, storage, processing, and transfer, aligning with global best practices. The company's commitment to data privacy directly impacts its ability to operate and lease aircraft in various jurisdictions.

- GDPR Fines: Penalties can be up to 4% of global annual revenue or €20 million.

- Data Lifecycle Management: Compliance covers data from collection to deletion.

- Cross-Border Data Flows: Navigating international data transfer regulations is crucial.

AerCap's operations are heavily influenced by international aviation law, particularly treaties like the Cape Town Convention, which provides legal protections for lessors and facilitates aircraft repossession in over 70 countries as of early 2024. Antitrust regulations, enforced by bodies like the European Commission, scrutinize large deals, such as AerCap's $24 billion GECAS acquisition in 2021, to ensure fair market competition.

Insolvency laws, including the US Chapter 11 and EU frameworks, impact AerCap's ability to recover assets from airlines in distress, though specific protections like Section 1110 of the US Bankruptcy Code offer some recourse. Data protection laws, notably GDPR with potential fines up to 4% of global annual revenue or €20 million, necessitate robust data security for AerCap and its clients.

| Legal Factor | Impact on AerCap | Key Regulations/Examples |

|---|---|---|

| International Treaties | Facilitates global operations, asset registration, and repossession. | Cape Town Convention (ratified by over 70 countries as of early 2024). |

| Antitrust & Competition | Requires regulatory approval for mergers and acquisitions, impacting market consolidation. | AerCap's 2021 GECAS acquisition ($24 billion) underwent extensive review. |

| Bankruptcy & Insolvency | Affects aircraft recovery from defaulting airlines; specific protections exist. | US Bankruptcy Code Section 1110 provides lessor protections. |

| Data Protection & Privacy | Mandates stringent data security and privacy compliance for customer data. | GDPR (penalties up to 4% of global annual revenue or €20 million). |

Environmental factors

The aviation sector faces increasing pressure to meet ambitious climate goals, with a global commitment to achieve net-zero carbon emissions by 2050. This significant environmental imperative is reshaping airline strategies and their purchasing decisions.

Consequently, airlines are actively seeking newer, more fuel-efficient aircraft from lessors like AerCap. For instance, in 2023, AerCap delivered 113 new aircraft, with a significant portion being fuel-efficient models, reflecting this market shift towards sustainability.

Regulations mandating Sustainable Aviation Fuel (SAF) adoption, like the EU's ReFuelEU Aviation initiative, are reshaping airline operational costs and fleet planning. These mandates, aiming for a significant SAF blend by 2030, directly influence the long-term value and marketability of AerCap's aircraft portfolio, pushing for more fuel-efficient models.

The increasing adoption and production of SAF, projected to reach 10% of global jet fuel demand by 2030 according to some industry forecasts, presents both challenges and opportunities for lessors. AerCap must strategically align its fleet acquisitions and leasing agreements with the evolving SAF landscape to maintain portfolio attractiveness and mitigate risks associated with older, less efficient aircraft.

Global aviation is facing increasingly stringent noise pollution regulations, impacting both new aircraft development and ongoing airport operations. These evolving standards are a significant driver for airlines and lessors like AerCap to invest in more modern, quieter aircraft technologies.

For instance, the European Union's Stage V noise emission standards for new aircraft, which came into full effect in 2020, have pushed manufacturers to prioritize quieter engine designs. This trend is expected to continue, influencing AerCap's fleet acquisition strategies as older, noisier aircraft become less desirable and potentially face operational restrictions.

Waste Management and Circular Economy Initiatives

The aviation industry is increasingly focusing on responsible waste management and adopting circular economy principles. This growing emphasis could translate into new regulations governing how aircraft are managed throughout their lifecycle, including their eventual recycling and disposal. For AerCap, this means potential shifts in maintenance strategies and how they handle the end-of-life phase of their leased aircraft.

These evolving environmental considerations are significant. For instance, the European Union's Circular Economy Action Plan, updated in 2020, aims to make sustainable products the norm, which will inevitably influence sectors like aviation. By 2025, the EU expects to see progress in areas like eco-design and waste reduction across various industries.

Consider these potential impacts on AerCap:

- Regulatory Compliance: AerCap will need to ensure its operations align with emerging waste management and recycling regulations for aircraft, potentially impacting asset remarketing and disposal costs.

- Maintenance and Operations: Aircraft maintenance practices may need to adapt to incorporate more sustainable material sourcing and end-of-life component management, possibly increasing operational complexity.

- Asset Value: The emphasis on circularity could influence the residual value of aircraft, as airlines and lessors prioritize assets that are easier to maintain, repair, and eventually disassemble for parts or recycling.

- Innovation Opportunities: This trend also presents opportunities for AerCap to partner with specialized companies in aircraft dismantling and recycling, creating new revenue streams or cost efficiencies.

Biodiversity and Ecosystem Impact

AerCap, like the broader aviation sector, faces increasing attention regarding its environmental footprint beyond direct emissions. This includes the significant land required for airports and the potential disruption to local ecosystems and biodiversity from infrastructure expansion. As environmental consciousness grows, future regulations may broaden their scope to encompass these wider ecological impacts, influencing AerCap's long-term strategies for fleet development and operational site planning.

The pressure to mitigate these broader impacts is mounting. For instance, airport development projects often involve land conversion, which can fragment habitats and threaten species. While specific data for AerCap's direct impact on biodiversity is not publicly detailed, the industry's reliance on extensive land for operations means this is a material consideration.

- Land Use: Airports, essential for aviation operations, consume vast tracts of land, potentially impacting local biodiversity and natural habitats.

- Ecosystem Services: Expansion or development of airport infrastructure can disrupt vital ecosystem services such as water filtration and carbon sequestration.

- Regulatory Scrutiny: Governments and international bodies are increasingly examining the indirect environmental consequences of industries, which could translate into stricter land-use and biodiversity protection policies for aviation.

- Industry Trends: Airlines and lessors like AerCap are beginning to integrate sustainability into their core business models, recognizing that long-term viability is linked to addressing a wider range of environmental concerns.

The aviation industry's environmental focus intensifies, with a strong push towards net-zero emissions by 2050. This drives demand for fuel-efficient aircraft, with AerCap delivering 113 new planes in 2023, many of them eco-friendly models.

Mandates for Sustainable Aviation Fuel (SAF) are also reshaping the market. By 2030, SAF is expected to meet 10% of global jet fuel demand, influencing aircraft values and AerCap's fleet strategy.

Stricter noise regulations, such as the EU's Stage V standards implemented in 2020, favor quieter aircraft. This trend will likely impact the desirability and operational viability of older, noisier models within AerCap's portfolio.

The growing emphasis on circular economy principles may lead to new regulations for aircraft lifecycle management, including recycling. AerCap could see shifts in maintenance and end-of-life asset handling, with potential opportunities in aircraft dismantling and recycling partnerships.

PESTLE Analysis Data Sources

Our PESTLE analysis for AerCap Holdings is built upon a robust foundation of data from leading aviation industry associations, financial market reports, and regulatory bodies. We incorporate insights from global economic indicators, environmental policy updates, and technological advancements impacting the aerospace sector.