AerCap Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerCap Holdings Bundle

AerCap Holdings operates in a dynamic aviation leasing market where buyer power is significant due to the concentration of major airlines. The threat of new entrants, while moderated by high capital requirements, still poses a challenge, and the bargaining power of suppliers, particularly aircraft manufacturers, is substantial. Understanding these intricate competitive forces is crucial for navigating AerCap's strategic landscape.

The complete report reveals the real forces shaping AerCap Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The aircraft leasing sector, and by extension AerCap, faces a significant concentration of power with a near-duopoly of major aircraft manufacturers, namely Boeing and Airbus. This limited number of key players means AerCap has fewer choices when sourcing new aircraft, a situation that inherently strengthens the bargaining position of these manufacturers. In 2023, for instance, Boeing and Airbus continued to dominate global aircraft deliveries, with Airbus securing over 2,000 net orders and Boeing receiving over 1,000 net orders for new aircraft, underscoring their market control.

The bargaining power of suppliers for AerCap is significantly influenced by high switching costs. Shifting away from established relationships with manufacturers like Boeing and Airbus, or even altering the balance between them, presents considerable hurdles for AerCap.

These complexities include the need to reconfigure intricate supply chains, invest in retraining personnel for new aircraft types or systems, and potentially disrupt fleet commonality, which is crucial for operational efficiency and maintenance. This entrenchment of current suppliers strengthens their position in negotiations.

Aircraft manufacturers are currently experiencing significant order backlogs, with some reaching several years into the future. For instance, Boeing reported a backlog of over 5,600 aircraft as of the first quarter of 2024. This robust demand, coupled with persistent production challenges and supply chain disruptions, grants these suppliers considerable bargaining power.

These extended backlogs and limited production capacity mean that lessors like AerCap often find themselves competing for scarce production slots. This dynamic inherently shifts leverage towards the manufacturers, making it more difficult for AerCap to negotiate highly favorable terms on new aircraft orders.

Proprietary Technology and Certifications

Aircraft manufacturers hold significant bargaining power due to their proprietary technology and the complex certifications required for commercial aviation. This intellectual property, including advanced designs and manufacturing processes, acts as a substantial barrier to entry for potential new suppliers, effectively limiting competition and reinforcing the established players' control over the market for new aircraft.

AerCap, as a major aircraft lessor, is directly impacted by this. For instance, in 2023, the delivery slots for new, technologically advanced aircraft from major manufacturers like Boeing and Airbus remained highly sought after, with lead times extending for popular models. This scarcity and the proprietary nature of these aircraft designs mean lessors have limited options when sourcing new fleet additions, strengthening the manufacturers' position.

- Proprietary Designs: Manufacturers like Boeing and Airbus invest billions in research and development, creating unique aircraft architectures and aerodynamic efficiencies that cannot be easily replicated.

- Essential Certifications: Obtaining airworthiness certifications from bodies such as the FAA and EASA is a lengthy and expensive process, exclusive to the original equipment manufacturers.

- Limited Alternatives: The high cost and technical expertise required to develop and certify new aircraft designs mean few companies can compete, leaving lessors reliant on a small number of established manufacturers.

- Technological Edge: Innovations in fuel efficiency, materials science, and avionics further differentiate these aircraft, making them indispensable for airline operations and enhancing supplier leverage.

AerCap's Large Purchase Volumes

AerCap's substantial purchasing power significantly influences supplier negotiations. As the largest independent aircraft lessor globally, AerCap's sheer scale allows it to command better terms. For instance, in 2024, AerCap purchased 150 aircraft, demonstrating its immense order volumes.

This considerable buying power translates into tangible benefits for AerCap. It can leverage these large orders to negotiate more favorable pricing and secure preferential delivery schedules from aircraft manufacturers. These advantages help to partially offset the inherent power of concentrated suppliers in the aerospace industry.

- Leveraging Scale: AerCap's status as the world's largest independent aircraft lessor provides significant clout.

- 2024 Acquisitions: The company acquired 150 aircraft in 2024, highlighting its substantial order volumes.

- Negotiating Advantage: Large purchase volumes enable AerCap to negotiate better pricing and delivery slots.

- Mitigating Supplier Power: This leverage helps to counter the bargaining power of aircraft manufacturers.

The bargaining power of aircraft manufacturers like Boeing and Airbus remains substantial for AerCap due to the industry's concentrated nature and high barriers to entry. Despite AerCap's significant purchasing power, demonstrated by its 2024 acquisition of 150 aircraft, the limited number of major suppliers and their proprietary technology grants them considerable leverage.

These manufacturers benefit from proprietary designs and essential certifications, making it difficult for new entrants to compete, thereby reinforcing their market control. Furthermore, substantial order backlogs, such as Boeing's over 5,600 aircraft backlog in early 2024, coupled with production challenges, limit AerCap's ability to negotiate favorable terms on scarce production slots.

| Supplier | 2023 Net Orders | 2024 Q1 Backlog (Approx.) | Impact on AerCap |

|---|---|---|---|

| Airbus | 2,000+ | N/A (Extensive) | Limited delivery options, strong pricing power |

| Boeing | 1,000+ | 5,600+ | Competition for slots, extended lead times |

What is included in the product

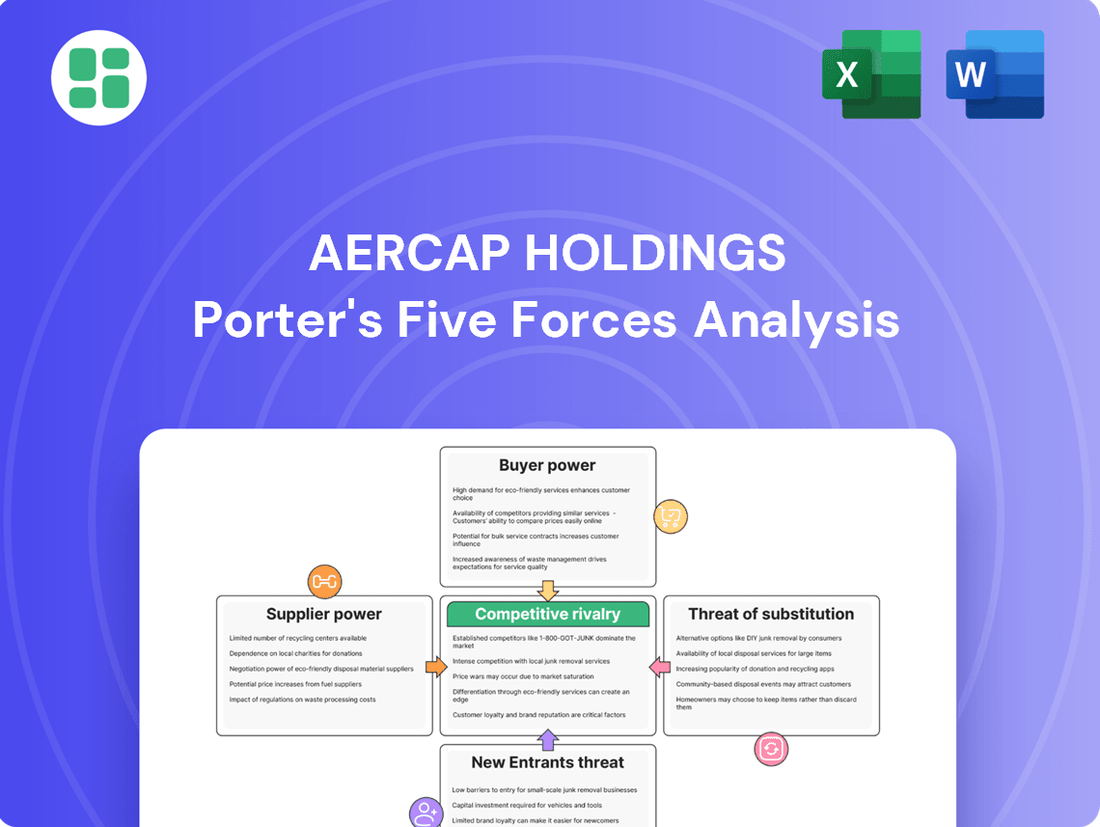

Tailored exclusively for AerCap Holdings, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Instantly identify and address competitive threats by visually mapping AerCap's Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

AerCap's diverse global customer base, encompassing everything from major international airlines to smaller regional carriers, presents a nuanced picture of customer bargaining power. This broad reach, with over 300 airline customers as of the end of 2023, means that while AerCap mitigates single-customer risk, the leverage of individual customers can vary significantly. Larger, financially robust airlines often command greater negotiating power due to their volume and importance to AerCap's overall leasing business.

For many airlines, leasing aircraft from AerCap is a strategic choice to conserve cash and maintain fleet adaptability, sidestepping the burdens of outright ownership. This core benefit of leasing, enabling airlines to utilize contemporary aircraft without substantial initial investment, can temper their desire for aggressive price negotiations, given the high perceived value of the service.

The bargaining power of customers, in this case, airlines, is influenced by the availability of multiple lessors. While AerCap is the largest aircraft lessor globally, the market does feature other significant players. This competitive landscape allows airlines to compare offerings and negotiate terms, creating some pressure on lease rates.

For instance, in 2024, the aircraft leasing market, despite AerCap's dominant position with a fleet of over 1,000 aircraft, still includes substantial competitors like Avolon and SMBC Aviation Capital. This means airlines aren't entirely reliant on a single provider. However, current market dynamics, characterized by tight aircraft supply and strong airline demand, generally favor lessors, mitigating some of the airlines' bargaining power.

Long-Term Lease Commitments

Long-term lease commitments significantly curb the bargaining power of customers in the aircraft leasing industry. Aircraft lease agreements are typically long-term contracts, often spanning several years, locking airlines into specific terms and reducing their ability to negotiate favorable changes in the short to medium term. This provides AerCap with stable revenue streams and greater predictability.

For instance, AerCap's fleet utilization rates are consistently high, reflecting the commitment of airlines to these long-term agreements. In the first quarter of 2024, AerCap reported a fleet utilization rate of 99.1%, underscoring the stickiness of these long-term leases.

- Reduced Flexibility: Airlines are bound by the terms of their multi-year lease agreements, limiting their ability to switch lessors or renegotiate terms mid-contract.

- Revenue Stability: These long-term commitments ensure predictable and consistent revenue for AerCap, as airlines are obligated to make payments over extended periods.

- Limited Price Negotiation: Once a lease is signed, the airline's leverage to demand lower lease rates diminishes considerably for the duration of the contract.

- Strategic Lock-in: Airlines often align their fleet plans with these long-term leases, making it strategically difficult and costly to exit or alter these arrangements.

Airline Financial Health and Industry Cycles

The bargaining power of customers in the airline sector is significantly influenced by the industry's inherent cyclicality. Airline financial health is often a rollercoaster, highly susceptible to economic slumps, volatile fuel costs, and unpredictable geopolitical situations. For instance, while projections suggest a rebound in airline profitability by 2025, ongoing supply chain disruptions and other economic pressures mean that airlines may still face situations where customers hold considerable sway.

This fluctuating market dynamic directly impacts customer bargaining power. When airlines are struggling financially or facing capacity constraints due to external factors, customers can leverage these conditions to negotiate better fares or terms. Conversely, during periods of strong demand and stable operating environments, airlines may find themselves in a stronger position to resist customer pressure.

- Airline Profitability Trends: Despite expected improvements in 2025, the industry has historically experienced significant volatility. For example, IATA reported a net profit of $23.3 billion for the global airline industry in 2023, a substantial increase from $7.6 billion in 2022, but this can be quickly eroded by external shocks.

- Customer Sensitivity to Price: Air travel demand, particularly for leisure, remains price-sensitive. A significant portion of travelers will switch airlines or adjust travel plans based on fare differences, amplifying customer bargaining power when options are plentiful.

- Impact of Capacity: When airlines operate with high load factors and limited available seats, customer bargaining power diminishes. However, overcapacity or fleet groundings, as seen during certain periods of the pandemic, can shift power back to the customer.

AerCap's extensive customer base, comprising over 300 airlines globally as of late 2023, means individual airline bargaining power varies. Larger, financially stable airlines often leverage their volume to negotiate better terms with AerCap, the world's largest aircraft lessor.

While leasing offers airlines flexibility and avoids large capital outlays, the competitive landscape with other major lessors like Avolon and SMBC Aviation Capital means airlines can compare offers, applying some pressure on lease rates, even with AerCap's dominant fleet of over 1,000 aircraft in 2024.

Long-term lease agreements, typical in the industry, significantly reduce customer bargaining power by locking airlines into specific terms for several years, ensuring AerCap's revenue stability. For instance, AerCap maintained a high fleet utilization rate of 99.1% in Q1 2024, demonstrating the commitment of airlines to these long-term contracts.

The cyclical nature of the airline industry, marked by fluctuating profitability and external shocks, can shift bargaining power. While the industry saw a net profit of $23.3 billion in 2023 according to IATA, economic downturns can empower price-sensitive customers to negotiate more favorable terms.

| Factor | Impact on AerCap Customer Bargaining Power | Supporting Data (as of latest available) |

|---|---|---|

| Customer Concentration | Moderate to High for large airlines; Low for smaller airlines | Over 300 airline customers (end of 2023) |

| Availability of Alternatives | Moderate pressure due to competition | Major competitors include Avolon, SMBC Aviation Capital |

| Lease Commitment Length | Low leverage due to long-term contracts | 99.1% fleet utilization (Q1 2024) |

| Airline Industry Cyclicality | Varies with airline financial health and market conditions | Global airline net profit: $23.3 billion (2023) vs $7.6 billion (2022) |

Same Document Delivered

AerCap Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for AerCap Holdings, detailing the competitive landscape and strategic positioning within the aircraft leasing industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, providing actionable insights for stakeholders.

Rivalry Among Competitors

The aircraft leasing sector is inherently capital-intensive, demanding substantial investments to build and manage fleets. For instance, a new wide-body aircraft can cost upwards of $300 million. This significant financial barrier naturally restricts the number of companies that can operate at scale, but within this group of major lessors, rivalry is fierce.

Existing large lessors like AerCap, Avolon, and SMBC Aviation Capital are locked in a constant battle for market share. This competition extends to securing prime aircraft assets and placing them with airlines under favorable lease terms, especially for newer, more fuel-efficient models. As of early 2024, the global aircraft order backlog remained substantial, indicating continued demand but also intense competition for available delivery slots and attractive lease agreements.

AerCap Holdings, despite its leading position, faces significant competition from other major independent aircraft lessors. Companies like Avolon Aerospace, SMBC Aviation Capital, and Air Lease Corporation are substantial players, actively vying for the same airline clients and valuable aircraft portfolios. This intense rivalry ensures a dynamic market where pricing and lease terms are constantly influenced by the presence of these well-established competitors.

Competition among aircraft lessors, including AerCap, frequently centers on lease rates and the overall terms offered to airlines. This rivalry extends to crucial aspects like maintenance responsibilities, the timing of aircraft deliveries, and flexibility in contract clauses. For instance, in 2024, the market saw lessors actively competing to secure airline placements, particularly for newer, in-demand aircraft models, which naturally influences pricing and deal structures.

This intense competition can indeed put pressure on profit margins, especially for less differentiated aircraft types where airlines have more choices. However, recent market dynamics, driven by a robust recovery in air travel demand and supply chain constraints impacting new aircraft production, have led to an improvement in lease rates. Reports from industry analysts in late 2023 and early 2024 indicated that average lease rates for popular narrow-body aircraft had seen a notable uptick compared to the pandemic-affected years, reflecting a healthier supply-demand balance.

Portfolio Diversification and Asset Management

Competitors in the aircraft leasing sector actively strive to construct diverse portfolios encompassing various aircraft types, age profiles, and geographic customer bases. This strategy is crucial for mitigating inherent risks and attracting a wider spectrum of airline clients. For instance, as of the first quarter of 2024, AerCap Holdings reported a diverse fleet, with approximately 3,600 aircraft owned, managed, or on order, serving over 200 customers in 80 countries, underscoring the industry's focus on broad diversification.

The efficiency with which lessors can manage, remarket, and ultimately sell their aircraft assets serves as a significant competitive advantage, directly influencing a lessor's standing in the market. This capability impacts profitability and the ability to capitalize on asset value fluctuations. In 2023, AerCap successfully managed a significant number of aircraft sales and lease placements, demonstrating robust asset management capabilities that are vital for maintaining a competitive edge.

- Fleet Diversification: Lessors compete on the breadth of their aircraft portfolios, balancing narrow-body, wide-body, and regional jets across different age ranges.

- Geographic Reach: A global customer base is essential, allowing lessors to tap into diverse airline markets and reduce reliance on any single region.

- Remarketing and Sales Prowess: The ability to efficiently remarket existing leases and strategically sell aircraft assets is a key differentiator, impacting financial performance.

- Asset Management Efficiency: Streamlined operations for aircraft maintenance, transitions, and end-of-lease management contribute to a lessor's competitive positioning.

Industry Consolidation Trends

The aircraft leasing sector has experienced substantial consolidation, a prime example being AerCap's acquisition of GECAS. This strategic move, valued at approximately $30 billion, significantly reshaped the competitive landscape.

This trend indicates a maturing market where intense rivalry is being met by larger entities striving for economies of scale. By absorbing competitors, dominant players aim to solidify their market share and potentially reduce the number of direct rivals in the long run.

- AerCap's acquisition of GECAS in 2021 created the world's largest aircraft leasing company.

- This consolidation aims to achieve greater operational efficiencies and purchasing power.

- The trend suggests a move towards an oligopolistic market structure in aircraft leasing.

- Further consolidation could lead to fewer, but larger, leasing entities dominating the industry.

AerCap operates in a highly competitive environment, facing off against other major lessors like Avolon and SMBC Aviation Capital. This rivalry is evident in their pursuit of airline clients and desirable aircraft, particularly newer, fuel-efficient models. The intense competition influences lease rates and contract terms, as lessors vie for market share and favorable placements.

The market dynamics in 2024 show a strong demand for aircraft, yet the significant order backlogs at manufacturers mean competition for available delivery slots remains fierce. Lessors like AerCap differentiate themselves through fleet diversification, global reach, and efficient asset management, including remarketing and sales capabilities. For instance, AerCap's extensive portfolio of approximately 3,600 aircraft serving over 200 customers in 80 countries highlights this strategic focus on breadth and reach.

| Key Competitors | Fleet Size (Approximate) | Market Focus |

| AerCap Holdings | ~3,600 (owned, managed, on order) | Global, diverse fleet |

| Avolon Aerospace | ~900+ | Global, modern fleet |

| SMBC Aviation Capital | ~700+ | Global, focus on narrow-body and wide-body |

| Air Lease Corporation (ALC) | ~400+ | Global, focus on new technology aircraft |

SSubstitutes Threaten

The primary substitute for aircraft leasing is an airline directly purchasing aircraft from manufacturers. This option allows airlines to own their assets outright, avoiding ongoing lease payments and gaining complete control. However, it demands substantial upfront capital. For instance, a new Boeing 737 MAX 8 can cost upwards of $120 million, representing a significant investment.

Airlines might opt to extend the service life of their current aircraft instead of leasing or buying new ones. This choice is influenced by maintenance expenses, the fuel efficiency gap between older and newer planes, and regulatory mandates. For instance, in 2024, the ongoing challenges with Original Equipment Manufacturer (OEM) aircraft delivery schedules could further incentivize airlines to maximize the utilization of their existing fleets, thereby delaying new lease commitments.

While AerCap's primary focus is large commercial aircraft, the threat of substitutes for air travel, particularly for shorter distances, exists. High-speed rail networks, like the Eurostar or China's extensive high-speed rail system, offer competitive travel times and can divert passengers from regional flights. For instance, by 2024, China's high-speed rail network is expected to exceed 150,000 kilometers, connecting major cities and offering a viable alternative to short-haul aviation.

However, for long-haul and intercontinental journeys, air travel remains largely without direct substitutes. The speed and reach of commercial aviation are unmatched by any other mode of transport for these routes. Projections from bodies like the International Air Transport Association (IATA) continue to forecast robust growth in global air passenger traffic, underscoring the enduring demand for air travel, especially for international routes where substitutes are practically non-existent.

Technological Advancements in Communication

Technological advancements in communication present a subtle but evolving threat to AerCap's business. While not an immediate substitute for air travel, the increasing sophistication of virtual reality and teleconferencing tools could gradually decrease the necessity for some business travel in the long term. This trend, if it accelerates significantly, might lead to a reduction in overall demand for air cargo and passenger services, impacting fleet utilization and lease rates.

Consider the growth in remote work adoption. By early 2024, a significant portion of the global workforce continued to operate remotely, a shift that began during the pandemic. This sustained change means fewer employees are commuting or traveling for business meetings, directly affecting airlines' revenue streams. For instance, if virtual meetings become more immersive and cost-effective, companies might further curtail travel budgets.

The long-term implications are worth noting. While current technologies don't fully replicate the experience of in-person interaction, continuous innovation in areas like holographic communication could eventually offer a more compelling alternative for certain business activities. This remains a speculative threat, but AerCap, like other lessors, must monitor these technological trajectories for their potential impact on future air travel demand.

Key considerations regarding this threat include:

- Virtual Reality and Teleconferencing: Enhanced realism and accessibility could reduce business travel frequency.

- Remote Work Trends: Persistent adoption of remote work models limits the need for business-related flights.

- Long-Term Technological Evolution: Future communication innovations might offer more viable alternatives to physical travel.

- Impact on Demand: A sustained shift away from business travel could affect AerCap's fleet utilization and lease revenues.

Government Policies and Subsidies

Government policies can influence the threat of substitutes for aircraft leasing. For instance, subsidies or incentives encouraging airlines to purchase aircraft outright instead of leasing could make direct ownership a more attractive alternative. Changes in tax laws affecting leasing arrangements might also shift the balance. However, the international scope of the aviation industry means that broad, consistent policy changes across many jurisdictions are improbable, limiting the potential for such shifts to fundamentally undermine the leasing market's value proposition.

In 2024, the aviation sector continued to navigate evolving regulatory landscapes. While specific subsidy programs can vary by region, the underlying economic advantages of leasing, such as capital preservation and fleet flexibility, generally remain compelling for airlines. For example, many airlines prioritize lease agreements to manage upfront capital expenditure, a strategy that remains viable even with fluctuating government incentives.

- Government Policies: Subsidies or tax incentives favoring aircraft ownership over leasing represent a direct threat.

- Impact on Leasing: Such policies could increase the attractiveness of purchasing, thereby reducing demand for leases.

- Global Aviation Dynamics: The international nature of aviation makes it unlikely for uniform, impactful policy shifts to occur globally, thus moderating this threat.

- 2024 Context: While specific incentives exist, the fundamental benefits of leasing continue to support its market position.

The most direct substitute for leasing is airlines buying aircraft outright, a move requiring significant capital. For example, a new narrow-body jet can cost over $100 million, a substantial barrier. Another substitute involves airlines extending the lifespan of their existing fleets, a strategy potentially boosted in 2024 by ongoing OEM delivery delays, making older planes more attractive than new leases.

Entrants Threaten

Extremely high capital requirements present a formidable barrier to entry in the aircraft leasing sector. Acquiring a competitive fleet necessitates billions of dollars, as even a single narrow-body aircraft can cost upwards of $100 million, with wide-bodies easily exceeding $300 million. This immense financial hurdle effectively deters most potential new entrants, safeguarding established players like AerCap.

New entrants face a substantial hurdle in acquiring the specialized expertise crucial for aviation leasing. This includes deep knowledge of aircraft finance, technical management, and navigating complex global regulations. For instance, understanding the intricacies of aircraft lease agreements and remarketing strategies requires years of hands-on experience and a dedicated team, a significant barrier for newcomers.

Established relationships with manufacturers like Boeing and Airbus are crucial. AerCap, for instance, has cultivated decades-long partnerships, securing preferential access to new aircraft orders and favorable pricing. A new entrant would face significant hurdles in replicating these deep-seated connections, making it difficult to procure modern aircraft on competitive terms.

Furthermore, AerCap's extensive network of airline clients, built on trust and consistent service, presents another barrier. Airlines often prefer to work with established lessors with proven track records and strong financial backing. Breaking into this established customer base requires considerable time and resources, as new entrants would need to demonstrate reliability and offer compelling value propositions to win over these key relationships.

Regulatory and Legal Complexities

The global aircraft leasing industry is heavily regulated, presenting a significant hurdle for potential new entrants. Navigating a complex web of international aviation rules, diverse tax regimes across different countries, and sophisticated legal processes for aircraft registration, financing, and repossession demands specialized expertise and substantial resources. For instance, the International Civil Aviation Organization (ICAO) sets global standards, but national implementation varies considerably, adding layers of complexity.

These regulatory and legal complexities act as a powerful deterrent to new players. Establishing the necessary legal and compliance infrastructure to operate on a global scale, as AerCap does, is a costly and time-consuming endeavor. This high barrier to entry effectively limits the number of new companies that can realistically challenge established lessors.

- Global Regulatory Landscape: Compliance with diverse international and national aviation laws is essential.

- Taxation and Financing: Understanding and adhering to varying tax laws and complex financing regulations across jurisdictions is critical.

- Legal Frameworks: Expertise in aircraft registration, financing agreements, and repossession laws is paramount.

- Barrier to Entry: These combined complexities create a substantial barrier for new companies entering the aircraft leasing market.

Economies of Scale and Scope

Economies of scale are a significant barrier for new entrants in the aircraft leasing market. Large lessors like AerCap leverage their immense size to negotiate favorable terms for fleet acquisition, often securing substantial discounts from manufacturers due to bulk orders. In 2023, AerCap, with a fleet of over 3,000 aircraft, demonstrated this advantage, placing significant orders that position them favorably against smaller competitors.

These scale advantages extend to financing. Larger players can access capital markets more efficiently and at lower interest rates than newer, smaller firms. This cost of capital differential makes it exceedingly difficult for new entrants to match the pricing power of established giants like AerCap, who benefit from a lower weighted average cost of debt.

- Fleet Size Advantage: AerCap's portfolio of over 3,000 aircraft in 2023 provides unparalleled purchasing power.

- Financing Costs: Lower borrowing costs for large lessors translate to more competitive lease rates.

- Operational Efficiencies: Bulk purchasing of maintenance, parts, and services further reduces overhead for established players.

- Manufacturer Relationships: Strong, long-standing relationships with Boeing and Airbus allow for preferential treatment and pricing.

The threat of new entrants in the aircraft leasing market is low, primarily due to the immense capital requirements and established relationships. A new player would need billions to acquire a competitive fleet, with narrow-body aircraft costing over $100 million and wide-bodies exceeding $300 million. Furthermore, securing favorable terms from manufacturers like Boeing and Airbus, as AerCap does through its decades-long partnerships, is a significant barrier that newcomers cannot easily replicate.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Acquiring aircraft requires substantial investment, with single aircraft costing tens to hundreds of millions of dollars. | Extremely High Barrier |

| Manufacturer Relationships | Established lessors like AerCap have long-standing, preferential access to new aircraft orders and pricing. | High Barrier |

| Expertise & Experience | Deep knowledge of aircraft finance, technical management, and global regulations is crucial and takes years to develop. | High Barrier |

| Economies of Scale | Large lessors benefit from bulk purchasing power and lower financing costs, making it difficult for smaller players to compete on price. | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AerCap Holdings leverages data from AerCap's annual reports and SEC filings, alongside industry-specific market research from firms like FlightGlobal and Aviation Week.