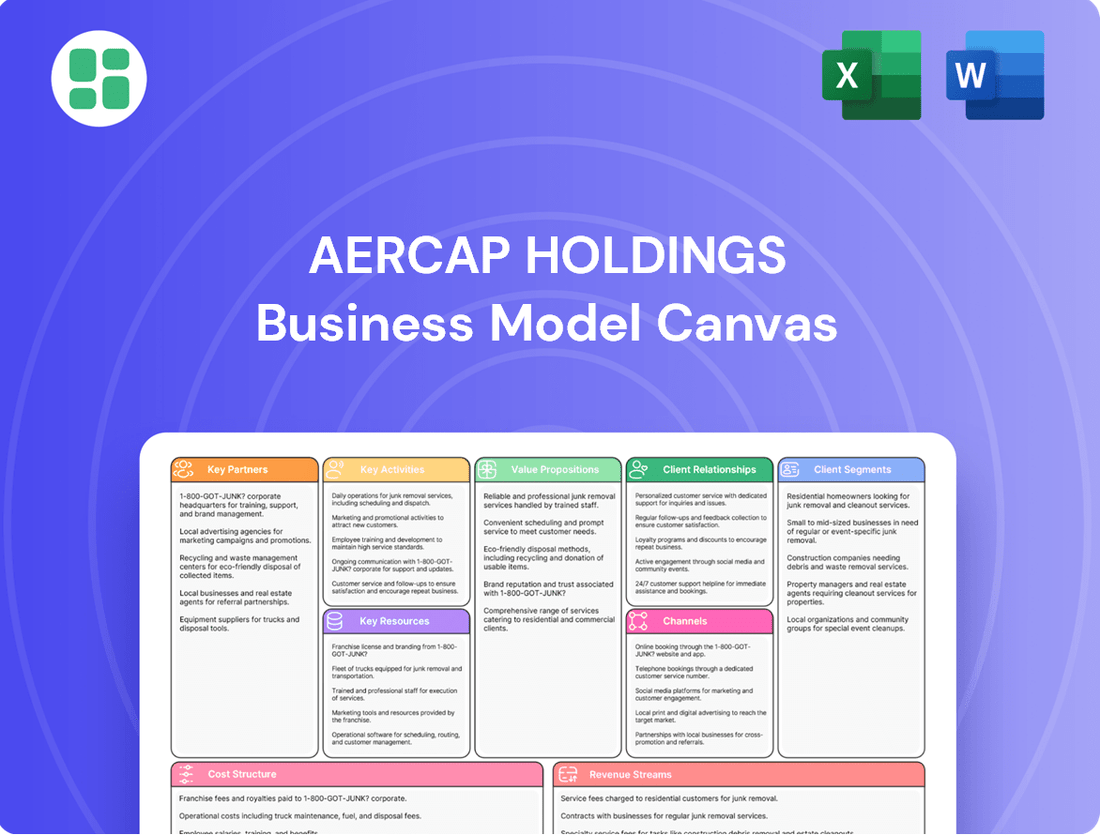

AerCap Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerCap Holdings Bundle

Unlock the strategic blueprint behind AerCap Holdings's dominant position in aircraft leasing. This comprehensive Business Model Canvas details their key partnerships, value propositions, and revenue streams, offering a clear view of their success. Discover how they manage their vast fleet and serve global airlines. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

AerCap Holdings cultivates essential alliances with leading aircraft manufacturers like Boeing and Airbus. These collaborations are vital for securing new, fuel-efficient aircraft directly from production, thereby maintaining a consistent flow of sought-after assets for their leasing operations. In 2024, AerCap's strategic fleet investments included substantial new engine orders.

AerCap's business model heavily relies on robust relationships with financial institutions, including banks and bondholders. These partnerships are crucial for securing the significant capital needed to acquire and manage its extensive aircraft fleet.

In 2024 alone, AerCap successfully arranged approximately US$17.5 billion in financing. This highlights the critical role these financial partners play in supporting AerCap's large-scale operations and growth initiatives.

AerCap's relationships with Maintenance, Repair, and Overhaul (MRO) providers are crucial for maintaining the airworthiness and value of its extensive aircraft portfolio. These collaborations ensure that the fleet adheres to stringent safety regulations and operational standards, which is vital for attracting and retaining lessees.

These partnerships are fundamental to the seamless operation and lifecycle management of AerCap's leased assets. By outsourcing complex technical work to specialized MROs, AerCap can focus on its core leasing business while ensuring its aircraft remain in optimal condition, thereby maximizing their economic life and leaseability.

A prime example of this strategic collaboration is AerCap's 2025 agreement with Caerdav, a UK-based MRO specialist. This partnership specifically targets the maintenance of narrowbody aircraft, underscoring AerCap's commitment to leveraging expert third-party services for critical technical upkeep.

Other Lessors and Asset Managers

AerCap actively participates in the secondary market, engaging with other lessors and asset managers for the acquisition and disposition of used aircraft and engines. This fosters crucial relationships for portfolio adjustments and strategic asset repositioning.

These partnerships offer AerCap enhanced flexibility in managing its extensive fleet, enabling timely rotation of assets to optimize returns and adapt to evolving market demands. For instance, in 2024, AerCap continued to execute its strategy of actively managing its portfolio through opportunistic sales and purchases.

Furthermore, AerCap extends its expertise by providing specialized services to external investors and owners of aircraft assets. This includes asset management, technical advisory, and remarketing services, leveraging AerCap's deep industry knowledge and global network.

Key aspects of these partnerships include:

- Facilitating secondary market transactions: Buying and selling of used aircraft and engines with peer lessors and asset managers.

- Enhancing portfolio flexibility: Enabling strategic asset rotation and optimization of the fleet.

- Providing asset management services: Offering specialized services to third-party aircraft asset owners and investors.

- Accessing market intelligence: Gaining insights into asset values and market trends through collaborative dealings.

Insurance Providers

AerCap's partnerships with global insurance providers are fundamental to managing the substantial risks inherent in owning and leasing high-value aircraft. These collaborations serve as a crucial safeguard against unforeseen events and potential losses. For instance, in the second quarter of 2025, AerCap secured approximately $1 billion in payouts from war risks insurers for aircraft that were lost in Russia.

These relationships are not merely transactional; they represent a strategic alignment to ensure the financial stability and operational continuity of AerCap's extensive fleet. The ability to secure comprehensive insurance coverage for assets valued in the tens of billions of dollars is a testament to the strength and necessity of these key partnerships.

- Risk Mitigation: Insurance providers offer essential protection against catastrophic events, such as aircraft damage, loss, or liability, which could otherwise lead to significant financial setbacks.

- Asset Value Protection: By insuring its vast portfolio of aircraft, AerCap ensures the preservation of its core assets, which are central to its leasing business.

- Operational Resilience: Strong insurance ties enable AerCap to maintain operational resilience, allowing for swift recovery and replacement of assets in the event of an incident.

- Financial Stability: Payouts from insurers, like the $1 billion received in Q2 2025 for assets lost in Russia, directly contribute to AerCap's financial health and its capacity to continue investing in its fleet.

AerCap's key partnerships extend to aircraft lessors and financial institutions, crucial for fleet management and capital access. In 2024, AerCap arranged approximately US$17.5 billion in financing, demonstrating the vital role of financial partners in supporting its large-scale operations. These alliances also facilitate secondary market transactions, enhancing portfolio flexibility and asset repositioning.

What is included in the product

AerCap's business model focuses on leasing aircraft to airlines globally, generating revenue through lease payments and asset management, while leveraging its vast fleet and strong customer relationships.

This model details AerCap's key partners, activities, and resources, including its diverse aircraft portfolio and financing capabilities, to deliver value to its airline customers.

AerCap's Business Model Canvas offers a clear, structured approach to navigating the complexities of aircraft leasing, providing a vital framework for understanding and addressing industry pain points.

It simplifies the intricate world of aviation finance, offering a digestible overview that helps stakeholders pinpoint and resolve operational and strategic challenges.

Activities

AerCap's fundamental activity is the strategic acquisition of a wide array of commercial aircraft, engines, and helicopters. This encompasses both new aircraft sourced directly from manufacturers like Boeing and Airbus, and the procurement of pre-owned assets.

This proactive acquisition strategy is a cornerstone of their business. In 2024 alone, AerCap successfully completed 150 aircraft purchases, demonstrating significant capital deployment into expanding their fleet.

Complementing these acquisitions, the company also secured 496 new lease agreements in 2024, effectively placing these assets with customers and generating revenue. This dual focus on acquisition and leasing is key to their market position.

AerCap's core activity is the leasing of aviation assets, primarily aircraft, to airlines worldwide. This involves the crucial tasks of negotiating favorable lease agreements, overseeing contract management, and maximizing the operational uptime of its extensive fleet.

The company's focus on efficiency is evident in its performance metrics. For instance, AerCap reported a remarkable 99% fleet utilization rate in the first quarter of 2025, underscoring its ability to keep its assets actively generating revenue. Furthermore, a strong 97% lease extension rate in the second quarter of 2025 signals robust customer satisfaction and sustained demand for AerCap's services.

AerCap Holdings actively manages a vast portfolio of aircraft assets, offering extensive management services to investors and owners. This includes remarketing aircraft, meticulously monitoring maintenance schedules, ensuring adherence to contract terms, and overseeing the complex process of aircraft deliveries and redeliveries.

This diversified approach is a core strength, drawing upon AerCap's profound industry knowledge and extensive global network. For instance, as of December 31, 2023, AerCap’s fleet comprised 3,650 aircraft, with a significant portion managed on behalf of third parties, underscoring the scale and importance of these asset management activities.

Aircraft Sales and Trading

Beyond its core leasing operations, AerCap Holdings actively participates in the sale of commercial aircraft, engines, and helicopters. This strategic activity involves both owned and managed assets, facilitating efficient portfolio management and value realization. In 2024 alone, AerCap successfully completed 166 sale transactions, demonstrating a robust engagement in this key activity.

These sales are crucial for asset rotation, allowing AerCap to monetize its holdings and reinvest capital effectively. This dynamic approach to its portfolio significantly contributes to the company's overall financial performance and strategic flexibility.

- Aircraft Sales: AerCap sells commercial aircraft from its extensive portfolio.

- Engine and Helicopter Trading: The company also trades engines and helicopters.

- Asset Monetization: This activity is key to rotating and realizing value from assets.

- 2024 Performance: AerCap completed 166 sale transactions in 2024.

Financing and Capital Management

Financing and Capital Management is a core activity for AerCap, focusing on effectively managing its significant financial resources and securing optimal funding. This includes actively raising debt capital, meticulously managing exposure to interest rate fluctuations, and continuously refining its capital structure. The goal is to ensure robust financial support for its extensive operations and ongoing investments in new aircraft assets.

AerCap's strategy involves leveraging various debt instruments to fund its asset acquisitions and manage its balance sheet. This proactive approach to capital management is essential for maintaining financial flexibility and supporting its growth objectives in the competitive aviation leasing market. For instance, in the second quarter of 2025, the company successfully secured approximately $2.9 billion in financing.

- Debt Raising: Actively accessing diverse debt markets to secure necessary capital for fleet expansion and operations.

- Interest Rate Risk Management: Employing strategies to mitigate the impact of changing interest rates on financing costs.

- Capital Structure Optimization: Continuously evaluating and adjusting the mix of debt and equity to maintain a healthy and efficient financial profile.

- Funding for Investments: Ensuring adequate and cost-effective financing is available to support the acquisition of new aircraft.

AerCap's key activities revolve around acquiring, leasing, managing, and selling aviation assets. This includes sourcing new and used aircraft, engines, and helicopters, and then placing them with airlines globally through various lease agreements. The company also actively manages a portfolio of aircraft on behalf of third parties, providing comprehensive asset management services.

Furthermore, AerCap engages in the strategic sale of its aviation assets to optimize its portfolio and realize value, demonstrating a dynamic approach to fleet management. Crucially, robust financing and capital management activities underpin these operations, ensuring the company can fund its substantial asset base and growth initiatives.

| Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Aircraft Acquisition | Purchasing new and pre-owned aircraft, engines, and helicopters. | 150 aircraft purchases completed in 2024. |

| Aircraft Leasing | Leasing aircraft to airlines worldwide, managing contracts and utilization. | 496 new lease agreements secured in 2024; 99% fleet utilization (Q1 2025). |

| Asset Management | Managing aircraft portfolios for third parties, including remarketing and maintenance oversight. | Managed a significant portion of its 3,650 aircraft fleet (as of Dec 31, 2023) for third parties. |

| Aircraft Sales | Selling owned and managed aviation assets to optimize the portfolio. | 166 sale transactions completed in 2024. |

| Financing & Capital Management | Securing debt capital and managing financial structure to support operations. | Secured approximately $2.9 billion in financing (Q2 2025). |

Full Document Unlocks After Purchase

Business Model Canvas

The AerCap Holdings Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you'll get a fully realized, detailed analysis of AerCap's business strategy, presented precisely as you see it now. No placeholders or altered content; you're getting the complete, ready-to-use Business Model Canvas for AerCap.

Resources

AerCap's most critical resource is its extensive and varied collection of aviation assets. This includes commercial aircraft, engines, and helicopters, forming the backbone of their leasing operations.

As of the close of 2024, AerCap managed a substantial fleet of 3,525 assets. This figure encompasses aircraft that are owned, managed, and those still on order, showcasing the sheer scale of their holdings.

Further highlighting the modernity and efficiency of their fleet, the average age of AerCap's owned aircraft stood at a remarkably young 7.4 years by the end of 2024. This youthful fleet contributes to operational efficiency and market appeal.

AerCap's access to substantial financial capital, encompassing both equity and global debt markets, is a cornerstone of its business model. This financial muscle allows the company to purchase high-value aircraft and maintain robust liquidity, essential for its operations.

As of June 30, 2025, AerCap demonstrated its financial strength with total assets valued at $73.6 billion. Furthermore, the company maintained a healthy liquidity position, standing at approximately $22 billion, underscoring its capacity to fund new acquisitions and manage ongoing financial commitments.

AerCap's extensive global network, featuring offices in vital aviation centers like Dublin, Shannon, Miami, Singapore, and Dubai, underpins its worldwide operations. This strategically placed infrastructure is crucial for delivering exceptional customer service and managing its vast aircraft portfolio effectively.

This robust operational infrastructure allows AerCap to maintain close relationships with airlines across the globe, facilitating efficient aircraft leasing, sales, and technical support. As of the first quarter of 2024, AerCap managed a fleet of 1,570 aircraft, highlighting the scale and complexity its network must support.

Industry Expertise and Talent

AerCap Holdings leverages its profound industry expertise and a highly skilled workforce as a cornerstone of its business model. This deep bench of talent spans critical areas such as aviation finance, technical asset management, legal counsel, and marketing.

This human capital is instrumental in AerCap's ability to identify lucrative opportunities, navigate intricate global transactions, and consistently maintain its competitive advantage in the dynamic aviation leasing market. For instance, as of the first quarter of 2024, AerCap reported a significant portfolio of over 3,000 aircraft, a testament to the team's capacity for managing large-scale operations.

- Aviation Finance Acumen: Expertise in structuring complex aircraft financing deals, including sale-leasebacks and debt financing, is crucial for portfolio growth and profitability.

- Technical Asset Management: Skilled teams ensure aircraft are maintained to the highest standards, optimizing residual values and managing lifecycle costs.

- Legal and Contractual Proficiency: Navigating international regulations and drafting robust lease agreements are vital for mitigating risk and ensuring smooth operations.

- Market Intelligence and Marketing: Understanding global demand trends and effectively marketing aircraft to airlines worldwide drives lease placements and customer satisfaction.

Strong Brand Reputation and Relationships

AerCap's strong brand reputation as the world's largest independent aircraft leasing company is a cornerstone of its business model. This established trust and recognition are critical for attracting and retaining airline customers globally.

The company cultivates long-standing relationships with roughly 300 customers worldwide. These deep connections, built over years of reliable service and partnership, are vital for securing new lease agreements and facilitating lease extensions, directly contributing to revenue stability and growth.

- Global Leader: AerCap's position as the largest independent aircraft lessor provides significant market influence and bargaining power.

- Customer Network: Approximately 300 airline customers form a diverse and robust client base.

- Relationship Capital: Long-term partnerships foster loyalty and create opportunities for repeat business and expansion.

- Trust and Reliability: A proven track record of dependability underpins AerCap's ability to secure favorable lease terms.

AerCap's most critical resources are its vast and modern aircraft fleet, substantial financial capital, a global operational network, and deep industry expertise. These elements collectively enable the company to maintain its leadership position in aircraft leasing.

As of the close of 2024, AerCap managed a fleet of 3,525 assets, with owned aircraft averaging a young 7.4 years old. By June 30, 2025, the company's total assets were valued at $73.6 billion, supported by approximately $22 billion in liquidity.

The company's global presence, with offices in key aviation hubs, ensures efficient management and customer support. This infrastructure, combined with a skilled workforce possessing expertise in aviation finance, asset management, and legal matters, underpins AerCap's operational success and competitive edge.

AerCap's strong brand reputation and extensive network of around 300 airline customers are vital intangible assets, fostering trust and driving repeat business.

Value Propositions

AerCap provides airlines with the crucial ability to adapt their fleet size and composition without tying up substantial capital. This means carriers can scale up during periods of high demand or downsize during downturns without the immediate financial strain of purchasing new aircraft. For instance, in 2024, airlines are increasingly focused on fleet modernization to improve fuel efficiency and passenger experience, a goal made more attainable through leasing rather than outright purchase.

This leasing model allows airlines to maintain a strong balance sheet by avoiding large debt obligations associated with aircraft ownership. By converting a significant capital expenditure into predictable operating lease payments, airlines can better manage their cash flow and allocate resources to other critical areas like route development or customer service. This financial agility is paramount in the volatile aviation industry.

The flexibility offered by AerCap effectively shifts the burden of aircraft ownership from the airline to the lessor. This strategic advantage enables airlines to respond swiftly to changing market conditions and passenger preferences, ensuring their fleet remains modern and competitive. In 2023, the global aviation leasing market facilitated the financing of over half of the world's aircraft fleet, highlighting the widespread adoption of this flexible capital expenditure model.

AerCap empowers airlines by offering access to a diverse and modern fleet, featuring a wide array of in-demand aircraft types. This includes the latest generation of fuel-efficient models, crucial for economic operations and meeting environmental goals.

By providing these advanced aircraft, AerCap helps lessees avoid the significant upfront costs and long lead times associated with direct aircraft purchases. This strategic advantage allows airlines to maintain a competitive edge and adapt quickly to market demands.

In 2024, AerCap's commitment to fuel efficiency is evident in its portfolio, which consistently prioritizes newer technology aircraft. This focus directly supports airline customers in reducing their operational expenses and achieving sustainability targets.

AerCap provides airlines with comprehensive fleet management services, extending far beyond simple aircraft leasing. This includes vital technical oversight, proactive maintenance scheduling, and seamless management of aircraft transitions at the end of lease agreements.

These integrated services significantly alleviate the operational burdens airlines face, freeing up their resources and management attention to concentrate on their primary mission: safe and efficient flight operations.

For instance, in 2024, AerCap managed a diverse portfolio of over 3,600 aircraft, demonstrating its capacity to handle complex logistical and technical requirements for a global customer base.

Risk Mitigation and Asset Management Expertise

AerCap's value proposition for airlines centers on its deep expertise in risk mitigation and asset management. By leasing aircraft from AerCap, airlines effectively transfer the risks of fleet obsolescence, unpredictable residual values, and volatile market shifts to AerCap. This allows airlines to maintain a modern fleet without the capital burden and associated risks of ownership.

AerCap's proven ability to manage these complex risks provides significant stability for its airline customers. A prime example of this expertise in action was their successful navigation of insurance claims following asset losses, demonstrating a robust framework for asset protection and recovery. This capability ensures greater predictability and financial security for their lessees.

The company's proactive approach to asset lifecycle management is a core component of this value. For instance, in 2024, AerCap continued its strategy of placing younger, more fuel-efficient aircraft with customers, directly addressing the risk of obsolescence and reducing operational costs for airlines. Their extensive portfolio management also allows them to absorb market fluctuations more effectively than individual airlines might.

- Fleet Modernization: Airlines reduce the risk of owning aging aircraft by leasing newer, more fuel-efficient models from AerCap.

- Residual Value Protection: AerCap assumes the risk associated with the future value of aircraft, shielding airlines from market depreciation.

- Market Fluctuation Management: AerCap's diversified portfolio and global reach help absorb the impact of economic downturns and demand shifts.

- Operational Stability: Expertise in areas like insurance recoveries for lost assets provides a safety net, ensuring continuity for airline operations.

Tailored and Flexible Leasing Structures

AerCap excels by offering leasing structures precisely tailored to each airline's unique financial and operational requirements. This includes a range of options like operating leases and sale-and-leaseback agreements, ensuring maximum flexibility for their diverse clientele.

This adaptability is crucial in the dynamic aviation market. For instance, in 2024, AerCap continued to facilitate complex transactions, demonstrating their capacity to structure deals that align with evolving airline strategies and market conditions, thereby supporting fleet modernization and capital management.

- Customized Operating Leases

- Sale-and-Leaseback Arrangements

- Flexible Term and Payment Structures

- Tailored Fleet Solutions

AerCap provides airlines with unparalleled access to a diverse, modern, and fuel-efficient fleet, enabling them to meet evolving passenger demands and environmental standards. This access is crucial for airlines aiming to optimize operational costs and enhance their passenger experience. For example, in 2024, the increasing focus on sustainability means airlines are actively seeking newer generation aircraft, which AerCap readily supplies.

By offering flexible leasing structures, AerCap allows airlines to avoid the substantial capital outlay and long-term commitment of aircraft ownership. This financial agility is critical in the often-unpredictable aviation sector, allowing carriers to maintain strong balance sheets and redirect capital to other strategic initiatives.

AerCap's comprehensive fleet management services, including technical oversight and maintenance, significantly reduce the operational burden on airlines. This allows carriers to focus on their core competencies of safe and efficient flight operations, supported by AerCap's expertise in managing a vast global portfolio, which in 2024 comprised over 3,600 aircraft.

AerCap's core value proposition lies in its ability to mitigate risks associated with aircraft ownership, such as obsolescence and residual value fluctuations. By leasing from AerCap, airlines transfer these financial and operational risks, gaining stability and predictability. This is exemplified by AerCap's proactive management of aircraft lifecycles, ensuring customers are consistently placed in newer, more efficient assets.

| Value Proposition | Description | 2024 Impact/Example |

|---|---|---|

| Fleet Access & Modernization | Provides airlines with a diverse, modern, and fuel-efficient aircraft fleet. | Enables airlines to meet passenger demand and environmental goals with newer aircraft. |

| Financial Flexibility | Offers leasing solutions that avoid large capital expenditures and debt. | Allows airlines to maintain strong balance sheets and improve cash flow management. |

| Operational Support | Delivers comprehensive fleet management, technical oversight, and maintenance. | Reduces airline operational burdens, allowing focus on core flight operations. |

| Risk Mitigation | Assumes risks of obsolescence, residual values, and market fluctuations. | Provides airlines with greater financial stability and predictability. |

Customer Relationships

AerCap cultivates long-term strategic partnerships with its airline clients, characterized by multi-year lease agreements that solidify trust and provide deep insights into evolving fleet requirements. This focus on enduring relationships is a cornerstone of their business model, ensuring stability and mutual growth.

This strategy is demonstrably effective, as evidenced by AerCap's impressive 97% lease extension rate reported in the second quarter of 2025. This high renewal rate underscores the value airlines place on AerCap's reliable service and tailored fleet solutions, reinforcing the strength of these long-term collaborations.

AerCap Holdings offers dedicated account management, ensuring each airline client has a direct point of contact for personalized service. This approach allows for proactive problem-solving and the development of customized solutions tailored to specific lease agreements and operational needs.

AerCap provides extensive technical and operational support, a key element in their customer relationships. This includes aiding lessees with crucial aircraft maintenance, managing complex configuration changes, and ensuring seamless aircraft transitions between lessees.

This hands-on support is vital for their clients, directly contributing to maintaining high levels of aircraft readiness and overall operational efficiency. For instance, in 2023, AerCap managed a fleet of over 3,600 aircraft, underscoring the scale of their operational support capabilities.

Advisory Services and Market Insights

AerCap leverages its deep market understanding and significant industry influence to offer valuable advisory services to airlines. These services focus on crucial areas like fleet strategy and navigating evolving market trends, empowering clients to make well-informed decisions regarding their aircraft portfolios.

This advisory role is a key differentiator, providing a significant value-add beyond simple aircraft leasing. For instance, in 2024, AerCap continued to be a central player in discussions around fleet modernization and the impact of new technology on airline operations, providing insights that directly informed customer strategies.

- Fleet Strategy Guidance: AerCap assists airlines in optimizing their aircraft fleets for efficiency, cost-effectiveness, and market demand alignment.

- Market Trend Analysis: Providing up-to-date insights on global aviation markets, including passenger demand, fuel prices, and regulatory changes.

- Portfolio Optimization: Advising on aircraft acquisitions, disposals, and lease structures to enhance financial performance.

- Technological Advancements: Sharing expertise on the adoption and integration of new aircraft technologies and sustainable aviation solutions.

Direct Engagement and Responsiveness

AerCap prioritizes direct engagement with its worldwide clientele, ensuring prompt attention to both immediate and future requirements. This approach, bolstered by a network of regional offices, facilitates swift issue resolution and fosters robust customer satisfaction.

Their customer relationship strategy is built on proactive communication and a deep understanding of client needs.

- Dedicated Account Management: Each client is assigned dedicated professionals who understand their specific operational and financial objectives.

- Global Support Network: With offices strategically located across key aviation hubs, AerCap offers localized support and rapid response times.

- Client Feedback Integration: Customer input is actively sought and integrated into service improvements and product development.

- Proactive Problem Solving: AerCap aims to anticipate and address potential issues before they impact client operations, exemplified by their swift response to fleet management challenges.

AerCap's customer relationships are built on a foundation of proactive engagement and tailored support, fostering long-term partnerships with airlines globally.

This is achieved through dedicated account management, a global support network, and a commitment to integrating client feedback for continuous service enhancement.

Their approach emphasizes anticipating needs and providing solutions, as seen in their extensive operational support which managed over 3,600 aircraft in 2023.

AerCap also acts as a strategic advisor, guiding airlines on fleet strategy and market trends, a role that became even more critical in 2024 as the industry navigated technological advancements and sustainability initiatives.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Partnership Focus | Cultivating long-term, strategic relationships with airlines. | 97% lease extension rate (Q2 2025). |

| Dedicated Support | Providing personalized service through account management. | Direct point of contact for tailored solutions. |

| Operational Assistance | Offering technical and operational support for aircraft. | Managed over 3,600 aircraft in 2023. |

| Advisory Services | Guiding airlines on fleet strategy and market trends. | Central player in fleet modernization discussions (2024). |

Channels

AerCap leverages its dedicated, globally dispersed sales and marketing teams to forge direct relationships with airlines and other aviation clients. These professionals are instrumental in pinpointing emerging leasing prospects and overseeing the complete sales journey, from initial discussions and complex negotiations to the finalization of lease agreements.

In 2024, AerCap's proactive sales efforts were evident in its continued expansion of its fleet and customer base. The company reported a significant number of new lease agreements signed, demonstrating the effectiveness of its direct engagement strategy in securing long-term partnerships and driving revenue growth within the competitive aviation leasing market.

AerCap actively participates in major international aviation conferences and trade shows, such as the Paris Air Show and Farnborough Airshow, to display its extensive aircraft portfolio. These events are crucial for connecting with current and prospective airline customers, fostering relationships, and generating new business opportunities.

These gatherings are not just about showcasing; they are vital for market intelligence. By attending, AerCap gains firsthand insights into emerging trends, technological advancements, and the competitive landscape, which informs strategic decisions. In 2024, industry events continue to be a primary avenue for deal origination and client engagement.

AerCap's global office network, with key locations in Dublin, Miami, Singapore, and Dubai, acts as a crucial touchpoint for its worldwide clientele. This widespread presence ensures proximity to customers, fostering robust relationships and enabling efficient service delivery.

As of the first quarter of 2024, AerCap operated offices in over 20 locations, strategically positioned in major aviation markets. This extensive network supports its business model by facilitating direct engagement with airlines, crucial for lease negotiations and ongoing asset management.

Online Presence and Investor Relations Portal

AerCap's official website and dedicated investor relations portal serve as crucial digital conduits for transparent communication. These platforms are instrumental in distributing vital information, ranging from quarterly financial results to detailed fleet statistics and comprehensive corporate responsibility reports, ensuring a wide array of stakeholders remain informed.

- Website Accessibility: AerCap's investor relations site provides easy access to SEC filings, earnings call webcasts, and presentations, fostering direct engagement with the financial community.

- Information Dissemination: Key data points, such as fleet utilization rates and aircraft delivery schedules, are regularly updated, offering real-time insights into operational performance. For instance, as of Q1 2024, AerCap reported a strong aircraft utilization rate of 99.0%.

- Stakeholder Reach: These digital channels effectively reach individual investors, financial analysts, and institutional shareholders, broadening the company's visibility and accessibility in the global market.

- Transparency and Reporting: Corporate governance information and sustainability initiatives are also prominently featured, reinforcing AerCap's commitment to responsible business practices.

Established Industry Relationships and Referrals

AerCap Holdings leverages its established industry relationships and strong reputation to drive significant referral business and secure repeat customers. As the world's largest independent aircraft leasing company, this network is a cornerstone of its customer acquisition strategy.

These deep-seated connections, cultivated over years, translate into a consistent flow of new leasing opportunities and a high degree of customer loyalty. For instance, in 2024, AerCap continued to benefit from its strong relationships with major airlines, which often lead to pre-emptive lease extensions and new aircraft placements.

- Customer Retention: AerCap's strong relationships contribute to a high aircraft utilization rate, minimizing idle assets.

- Lead Generation: Referrals from satisfied clients and industry partners consistently feed AerCap's sales pipeline.

- Market Influence: Its leading position amplifies the impact of these relationships, attracting new clients seeking a reliable lessor.

AerCap's channels are multifaceted, blending direct sales engagement with strategic participation in industry events and a robust digital presence. This combination ensures broad market reach and deep client relationships.

The company's global office network and dedicated sales teams facilitate close proximity to airlines, enabling efficient negotiation and service delivery. In 2024, AerCap's presence in over 20 locations underscored its commitment to direct customer interaction.

Digital platforms, including its website and investor relations portal, provide transparent communication and access to key performance data, such as a 99.0% aircraft utilization rate reported in Q1 2024. These channels are vital for informing a diverse stakeholder base.

Leveraging established industry relationships and a strong reputation, AerCap consistently benefits from referral business and repeat customers, a trend that continued to drive new leasing opportunities throughout 2024.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales Teams | Airline relationship management, lease negotiation | Secured numerous new lease agreements, expanding fleet and customer base. |

| Industry Events | Aircraft portfolio display, networking, market intelligence gathering | Continued to be a primary avenue for deal origination and client engagement. |

| Digital Presence (Website/Investor Portal) | Information dissemination, financial reporting, stakeholder communication | Facilitated broad reach to investors and analysts; reported 99.0% aircraft utilization (Q1 2024). |

| Industry Relationships/Referrals | Customer retention, lead generation, market influence | Drove consistent flow of new leasing opportunities and repeat business. |

Customer Segments

Global Full-Service Airlines represent a core customer segment for AerCap, encompassing major international and domestic carriers. These airlines depend on AerCap for large, diverse fleets to manage extensive route networks and accommodate varied passenger needs. AerCap's global reach is evident in its service to approximately 300 customers worldwide, highlighting the significant role these large airlines play in its business.

Low-Cost Carriers (LCCs) are a significant customer segment for AerCap, drawn to leasing for its ability to rapidly expand fleets with modern, fuel-efficient aircraft. This strategy allows LCCs to avoid substantial upfront capital outlays, a critical factor for maintaining their competitive low-fare models. For example, in 2024, many LCCs continued to prioritize fleet modernization, directly benefiting lessors like AerCap by driving demand for newer generation aircraft.

Air cargo operators, a vital segment for AerCap, include companies focused on e-commerce and express delivery. These businesses rely on AerCap's specialized freighter aircraft and engine leasing to meet the growing demand for rapid global shipping. AerCap Cargo, a key part of this business, manages a fleet exceeding 120 aircraft.

Regional Airlines

Regional airlines, often operating smaller aircraft like jets and turboprops, rely heavily on leasing to align their fleet with fluctuating regional travel demands and specialized operational needs. This approach provides crucial flexibility.

For instance, AerCap's portfolio includes a significant number of regional aircraft, catering to these specific market segments. In 2024, the demand for regional capacity remained robust, driven by the need for point-to-point connectivity in less-trafficked markets.

- Fleet Flexibility: Leasing allows regional carriers to scale their operations up or down without the large capital outlay of purchasing aircraft, adapting to seasonal or economic shifts.

- Specialized Aircraft: Many regional routes require aircraft with specific performance characteristics, and leasing provides access to a diverse range of suitable models.

- Cost Management: Lease agreements often include maintenance and support services, helping smaller airlines manage operational costs more predictably.

- Market Responsiveness: The ability to quickly adjust fleet size through leasing enables regional airlines to capitalize on emerging route opportunities or respond to competitive pressures.

Aircraft Owners and Financial Investors

Aircraft owners and financial investors represent a crucial customer segment for lessors like AerCap. These entities, ranging from airlines that own parts of their fleet to dedicated investment funds, are looking for efficient ways to manage their aviation assets or generate returns from them. They often engage with lessors for sale-and-leaseback transactions, where they sell their aircraft to the lessor and then lease them back, freeing up capital while maintaining operational continuity. In 2024, the aviation leasing market continued to see strong demand for these services as airlines focused on fleet modernization and capital efficiency.

This segment values the expertise and financial stability of a lessor. They seek partners who can offer competitive lease rates, flexible terms, and reliable asset management. For financial investors, the appeal lies in the predictable cash flows generated by aircraft leases and the tangible nature of the underlying asset. AerCap's extensive portfolio and strong track record make it an attractive partner for these sophisticated investors.

- Aircraft Owners: Airlines and other entities that possess owned aircraft and seek to optimize their balance sheets through sale-and-leaseback agreements.

- Financial Investors: Investment funds, private equity firms, and high-net-worth individuals looking to gain exposure to the aviation asset class through leasing structures.

- Asset Monetization: A primary driver for this segment is the ability to convert owned aircraft into liquidity without disrupting operations.

- Risk Mitigation: Investors also seek to offload the risks associated with aircraft ownership, such as residual value depreciation and maintenance, to the lessor.

AerCap serves a diverse array of customer segments within the aviation industry. These include global full-service airlines, low-cost carriers (LCCs), and air cargo operators, each with distinct fleet needs and operational strategies. The company also caters to regional airlines requiring specialized aircraft and flexible leasing solutions, as well as aircraft owners and financial investors seeking to manage or invest in aviation assets.

| Customer Segment | Key Needs | AerCap's Role |

|---|---|---|

| Global Full-Service Airlines | Large, diverse fleets for extensive networks | Provides fleet solutions and global reach (approx. 300 customers) |

| Low-Cost Carriers (LCCs) | Fleet expansion with modern, fuel-efficient aircraft | Enables rapid fleet growth and capital efficiency, driving demand for newer aircraft in 2024 |

| Air Cargo Operators | Specialized freighter aircraft and engine leasing | Supports e-commerce and express delivery growth with a fleet exceeding 120 aircraft |

| Regional Airlines | Flexible fleet to match fluctuating demand and specialized needs | Offers access to diverse regional aircraft, supporting point-to-point connectivity (robust demand in 2024) |

| Aircraft Owners & Financial Investors | Asset management, liquidity, and investment returns | Facilitates sale-and-leasebacks, offering predictable cash flows and risk mitigation (strong demand in 2024) |

Cost Structure

The largest expense for AerCap is acquiring aircraft, engines, and helicopters. This is a massive capital outlay. They then have to manage the debt taken on to pay for these assets.

In the second quarter of 2025, AerCap's average cost of debt stood at 4.1%. This interest expense is a significant ongoing cost that directly impacts profitability.

AerCap's cost structure significantly includes expenses for maintaining, repairing, and overhauling its extensive leased aircraft fleet. This covers both the direct costs of these activities and the administrative overhead involved in managing maintenance reserves.

For instance, AerCap reported leasing expenses of $95 million in the second quarter of 2025, a figure that encompasses a substantial portion of these upkeep and refurbishment costs, crucial for ensuring fleet airworthiness and value retention.

Operating and administrative expenses are the backbone of AerCap's global operations, encompassing everything from employee compensation and benefits to the costs of maintaining office spaces worldwide. These essential overheads also include crucial services like legal counsel and other administrative necessities that keep the company running smoothly.

For the second quarter of 2025, AerCap reported selling, general, and administrative expenses totaling $171 million. This figure reflects the significant investment required to manage a complex, international leasing business with a vast fleet and diverse customer base.

Insurance Costs

AerCap's insurance costs are substantial, reflecting the immense value and global operational scope of its aircraft fleet. These premiums cover comprehensive protection, including hull insurance for physical damage, liability insurance for passenger and third-party claims, and war risk insurance against geopolitical threats. For instance, in 2023, AerCap reported total insurance expenses of $535.7 million, a notable increase from $486.8 million in 2022, underscoring the significant impact of these necessary expenditures on its overall cost structure.

The sheer scale of AerCap's asset portfolio, comprising thousands of aircraft, necessitates robust and costly insurance policies. These policies are critical for mitigating financial risks associated with asset damage, operational disruptions, and potential legal liabilities. The upward trend in insurance premiums, as seen between 2022 and 2023, highlights the dynamic nature of this cost component, influenced by factors such as global economic conditions, geopolitical events, and the aviation industry's overall risk profile.

- Hull Insurance: Covers physical damage to aircraft, essential given the high per-unit cost of modern airliners.

- Liability Insurance: Protects against claims arising from passenger injuries, third-party damages, and operational incidents.

- War Risk Insurance: Provides coverage for losses incurred due to acts of war, terrorism, or hijacking in volatile regions.

- 2023 Insurance Expenses: AerCap incurred $535.7 million in insurance costs, demonstrating the significant financial commitment required to safeguard its extensive fleet.

Depreciation and Impairment Charges

Depreciation and impairment charges represent significant non-cash expenses for AerCap, reflecting the systematic allocation of the cost of its vast aircraft fleet over their operational lives. In 2023, AerCap reported depreciation and amortization expenses of $2.7 billion, a crucial element in understanding the true cost of maintaining its assets.

These charges are vital for accurately valuing AerCap's fleet and future earning potential. They account for the wear and tear on aircraft, as well as any potential write-downs if an asset's market value falls below its recorded book value. For instance, if economic conditions or technological advancements reduce the demand for a particular aircraft type, AerCap might incur an impairment charge.

- Depreciation: This is the systematic expensing of an aircraft's cost over its estimated useful life.

- Impairment: This occurs when an aircraft's carrying amount exceeds its recoverable amount, leading to a write-down.

- Impact on Profitability: While non-cash, these charges directly reduce reported net income, affecting key financial ratios.

- 2023 Data: AerCap's depreciation and amortization expenses were $2.7 billion in 2023, highlighting the scale of these cost components.

AerCap's cost structure is heavily influenced by the initial acquisition of aircraft and the subsequent management of associated debt, with an average cost of debt at 4.1% in Q2 2025. Significant ongoing expenses include fleet maintenance, repair, and overhaul, with leasing expenses totaling $95 million in Q2 2025. Operating and administrative costs, including selling, general, and administrative expenses of $171 million in Q2 2025, are also substantial.

| Cost Component | Q2 2025 (Estimated) | 2023 Actual |

|---|---|---|

| Interest Expense (on debt) | N/A (4.1% average cost of debt) | N/A |

| Leasing Expenses (Maintenance Reserves) | $95 million | N/A |

| Selling, General & Administrative Expenses | $171 million | N/A |

| Insurance Expenses | N/A | $535.7 million |

| Depreciation & Amortization | N/A | $2.7 billion |

Revenue Streams

Lease rentals represent AerCap's core and most dependable income source, generated from airlines paying to use their aircraft, engines, and helicopters. This fundamental income stream is crucial for their operational stability.

In the second quarter of 2025, these basic lease rents amounted to a substantial $1.653 billion, underscoring the significant contribution of this revenue stream to AerCap's overall financial performance and demonstrating the consistent demand for their leased assets.

AerCap Holdings generates revenue through the strategic sale of aviation assets, including aircraft, engines, and helicopters, from its extensive owned and managed portfolio. These transactions are crucial for asset rotation and unlocking capital.

In the second quarter of 2025, AerCap reported a net gain of $57 million from the sale of assets, demonstrating the financial impact of this revenue stream.

Maintenance rents and other receipts represent a crucial revenue stream for AerCap, encompassing payments from lessees for maintenance reserves and end-of-lease adjustments. This category also includes various other contractual receipts that contribute to the company's overall income.

For the second quarter of 2025, AerCap reported that maintenance rents and other receipts generated $115 million. This figure highlights the significance of these ancillary payments in supporting the company's financial performance beyond base lease payments.

Asset Management Fees

AerCap generates revenue by offering aircraft asset management services to external aircraft owners and investors. This allows them to capitalize on their extensive knowledge and experience in handling aviation assets for other parties.

This revenue stream diversifies AerCap's income beyond its owned fleet. For example, in 2023, AerCap managed a significant portfolio of aircraft for third parties, demonstrating the scale and potential of this business segment.

- Leveraging Expertise: AerCap's core competency in aircraft leasing and management is extended to clients who may not have the in-house capabilities.

- Third-Party Portfolio Growth: The company actively seeks to grow its third-party asset management business, aiming to increase the volume of assets under management.

- Fee-Based Income: Revenue is generated through management fees, typically a percentage of the assets managed or based on performance metrics.

Other Income

AerCap's Other Income stream captures various financial inflows beyond its core aircraft leasing operations. This includes earnings from investments and reimbursements from insurance settlements.

For the second quarter of 2025, AerCap reported Other Income of $62 million. A significant portion of this figure was attributed to a substantial insurance payment totaling $1 billion, stemming from the Ukraine conflict.

- Interest Income: Earnings generated from AerCap's cash reserves and short-term investments.

- Insurance Recoveries: Funds received from insurance claims related to aircraft damage, loss, or other covered events.

- Other Miscellaneous Income: Various other financial gains not classified under core leasing or investment activities.

- Impact of Ukraine Conflict: The $1 billion insurance payment in Q2 2025 significantly boosted this category due to events related to the Ukraine conflict.

AerCap's revenue streams are diverse, ranging from core lease rentals to asset sales and management services.

In the second quarter of 2025, lease rentals were the dominant source, bringing in $1.653 billion, while asset sales contributed $57 million in net gains.

Ancillary income from maintenance rents and other receipts added $115 million in Q2 2025, showcasing the importance of these additional payments.

The company also leverages its expertise by managing third-party aircraft portfolios, diversifying its income beyond its owned fleet.

| Revenue Stream | Q2 2025 (USD Millions) | Notes |

|---|---|---|

| Lease Rentals | 1,653 | Core income from aircraft, engine, and helicopter leases. |

| Net Gain on Sale of Assets | 57 | Revenue from selling owned and managed aviation assets. |

| Maintenance Rents and Other Receipts | 115 | Payments for maintenance reserves and end-of-lease adjustments. |

| Other Income | 62 | Includes investment earnings and insurance settlements, notably a $1 billion insurance payment related to the Ukraine conflict. |

Business Model Canvas Data Sources

The AerCap Holdings Business Model Canvas is informed by comprehensive financial disclosures, extensive market research reports, and internal operational data. These sources provide a robust foundation for understanding AerCap's customer segments, value propositions, and revenue streams.