AerCap Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AerCap Holdings Bundle

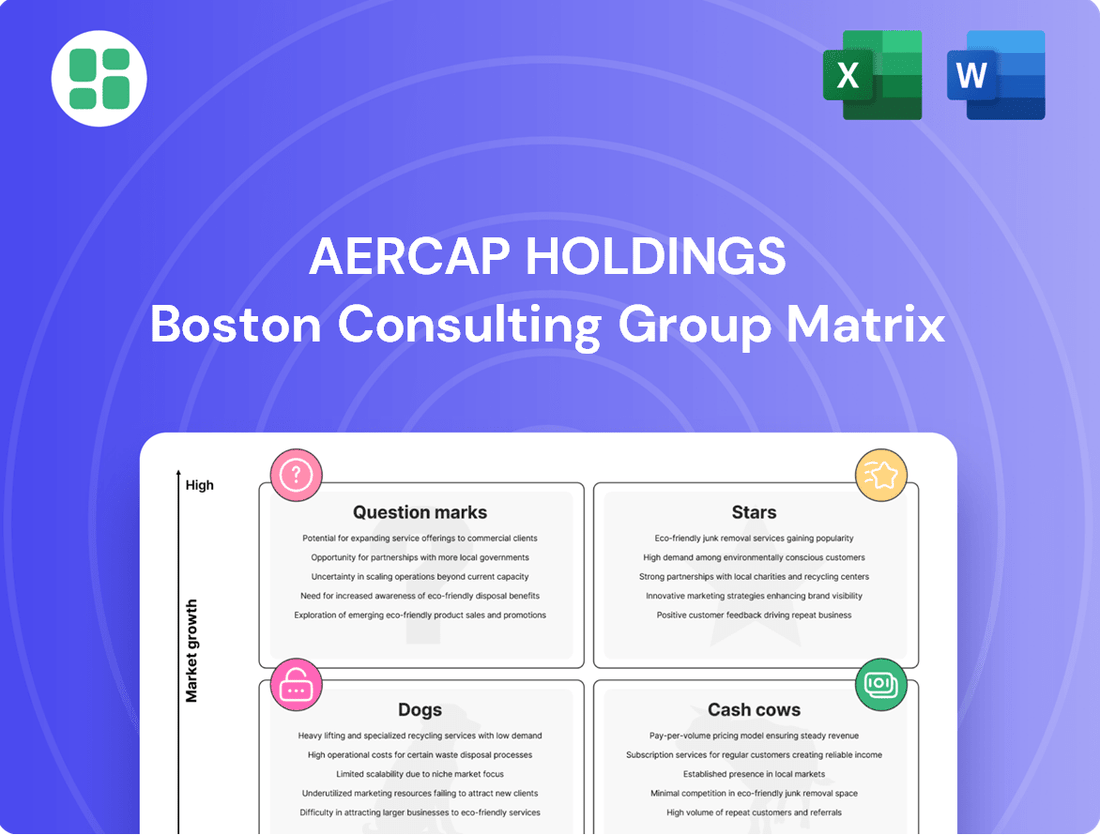

Curious about AerCap Holdings' strategic positioning? This preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks within their diverse aircraft leasing portfolio. Understand where their assets are generating the most value and where future growth might lie.

Unlock the full potential of this analysis by purchasing the complete AerCap Holdings BCG Matrix. Gain a comprehensive, quadrant-by-quadrant breakdown, complete with data-backed recommendations and a clear roadmap for optimizing their fleet and capital allocation. Don't miss out on the strategic insights that will drive informed decisions.

Stars

The A320neo and 737 MAX families are AerCap's Stars, reflecting substantial recent orders and deliveries driven by robust global demand for fuel-efficient narrowbodies. These aircraft are crucial for airlines modernizing fleets and meeting environmental goals, a segment where AerCap's leading lessor position is a significant advantage.

AerCap's investment in these next-generation narrowbodies, which are key to airline fleet renewal, positions them for continued growth in high-demand markets. As of the first quarter of 2024, AerCap's fleet included over 1,500 aircraft from these popular families, underscoring their importance to the company's portfolio.

AerCap Holdings has significantly invested in the latest generation widebody aircraft like the Airbus A350 and Boeing 787. These planes are vital for long-haul international routes and cargo, reflecting a growing demand as global travel rebounds and airlines prioritize fuel-efficient, long-range capabilities. AerCap's substantial presence in this premium segment, bolstered by the 2021 acquisition of GECAS, positions these aircraft as key drivers of future growth and profitability.

AerCap is actively pursuing growth by leasing aircraft to rapidly expanding low-cost carriers (LCCs), especially those in emerging markets. These airlines are increasing their routes and aircraft orders, creating a strong demand for AerCap's modern fleet. For instance, in 2024, the LCC segment continued its robust expansion, with many carriers in Asia and Latin America placing significant aircraft orders, which AerCap is well-positioned to fulfill.

This strategic focus allows AerCap to capitalize on high-growth LCC segments, leveraging its extensive fleet and global reach. By partnering with these dynamic airlines, AerCap secures high utilization rates and long-term lease agreements, ensuring consistent revenue streams from its diverse aircraft portfolio. This approach directly contributes to AerCap's market share in a key growth area of the aviation industry.

Aircraft Portfolio Management Services for Third Parties

AerCap's aircraft portfolio management services for third parties represent a significant growth area, leveraging its position as the world's largest lessor. This segment caters to institutional investors and airlines seeking to optimize aviation assets without direct operational burdens. As of late 2024, AerCap continues to expand its market share in this specialized, high-value service, demonstrating its ability to generate new revenue streams by capitalizing on its core competencies in aircraft asset management.

- Market Growth: The demand for outsourced aircraft asset management is rising as more investors enter the aviation finance space.

- Expertise Leverage: AerCap utilizes its extensive experience and global network to provide these specialized services.

- Revenue Diversification: This segment offers a valuable avenue for AerCap to diversify its income beyond direct leasing activities.

- Clientele: Services are offered to a range of clients, including financial institutions, private equity firms, and other airlines.

Strategic Investments in New Aircraft Orders

AerCap Holdings consistently places substantial, forward-looking orders for new aircraft directly from manufacturers. This proactive approach anticipates future market demand and secures advantageous pricing, ensuring a continuous pipeline of high-demand assets.

By doing so, AerCap maintains its market leadership in the dynamic aircraft leasing industry. This strategy allows them to capture growth opportunities as new aircraft types become available and sought after by airlines worldwide.

- Strategic Aircraft Orders: AerCap's commitment to placing large orders for new aircraft from manufacturers like Boeing and Airbus is a cornerstone of its strategy. For example, in 2023, AerCap continued to manage a significant order book, reflecting its long-term view of the aviation market.

- Market Leadership and Growth: This proactive ordering ensures AerCap has access to the latest, most fuel-efficient aircraft, which are in high demand. This positions them to meet evolving airline needs and capitalize on market expansion.

- Securing Favorable Terms: Placing large, early orders often allows AerCap to negotiate better pricing and delivery slots, enhancing its competitive advantage and profitability.

- Future-Proofing the Fleet: By investing in next-generation aircraft, AerCap ensures its portfolio remains attractive and relevant to airlines looking to upgrade their fleets and reduce operating costs.

AerCap's Stars, representing their most promising and high-growth assets, are clearly the next-generation narrowbody aircraft like the A320neo and 737 MAX families. These aircraft are in high demand globally due to their fuel efficiency, making them critical for airlines modernizing their fleets and meeting environmental targets.

AerCap's significant investment in these aircraft families, with over 1,500 units from these popular types in their fleet as of Q1 2024, demonstrates their central role in the company's growth strategy. This focus on fuel-efficient narrowbodies positions AerCap to capitalize on ongoing airline demand for these essential aircraft.

The company's proactive approach to securing these future-ready assets through substantial forward orders from manufacturers further solidifies their Star status. This ensures AerCap maintains a competitive edge by having access to the latest technology and meeting the evolving needs of the global airline industry.

| Aircraft Family | Key Characteristics | AerCap's Position | Market Demand Driver |

|---|---|---|---|

| A320neo | Fuel efficiency, reduced emissions, modern cabin | Largest lessor of A320neo family aircraft | Airline fleet modernization, environmental regulations |

| 737 MAX | Improved range, fuel savings, passenger comfort | Significant lessor of 737 MAX family aircraft | Global demand for narrowbody capacity, cost-conscious operations |

What is included in the product

AerCap's BCG Matrix positions its aircraft leasing units, identifying Stars for growth, Cash Cows for stable returns, Question Marks for potential, and Dogs for divestment.

The AerCap Holdings BCG Matrix provides a clear, visual overview of business unit performance, easing the pain of unclear strategic direction.

Cash Cows

AerCap's A320ceo and 737NG fleets are prime examples of cash cows. These aircraft, while not the latest models, are workhorses for airlines worldwide, offering proven reliability and cost-effectiveness. Their widespread adoption and continued demand ensure consistent revenue streams for AerCap.

The significant amortization of these aircraft means they generate substantial, stable cash flows with relatively low ongoing capital expenditure needs. This maturity in their lifecycle allows AerCap to reap the benefits of their initial investment, contributing significantly to the company's profitability.

With a substantial market share in the narrowbody segment, these aircraft represent a mature but highly profitable business. Their consistent returns underscore their status as a core component of AerCap's robust financial performance, particularly in 2024, where demand for these efficient, albeit older, aircraft remained strong.

AerCap's portfolio features a significant number of mature widebody aircraft, such as older Boeing 777s and Airbus A330s. These aircraft are typically secured by long-term leases with reputable airlines, ensuring consistent revenue streams.

While this segment represents a low-growth area, these aircraft boast high utilization rates and generate predictable, strong cash flows for AerCap. Their stable lease structures mean they contribute substantially to profitability without demanding significant new capital outlays.

As of the first quarter of 2024, AerCap reported that its fleet comprised 1,300 aircraft owned and managed, with a substantial portion of these being widebodies. The company's commitment to managing these mature assets effectively underscores their role as consistent cash generators within its diverse portfolio.

AerCap's Engine Leasing Portfolio is a significant Cash Cow. This segment boasts a vast and varied collection of aircraft engines, essential for airlines and frequently leased separately from the aircraft itself. The inherent necessity of engines and their complex maintenance needs translate into a steady, high-margin revenue stream for AerCap.

The engine leasing market is characterized by relative stability and modest growth, an environment where AerCap commands a robust market share. This strong position solidifies the portfolio's role as a reliable generator of consistent cash flow, underpinning its Cash Cow status within the BCG matrix.

Long-Term Lease Agreements with Established Flag Carriers

AerCap Holdings benefits significantly from its long-term lease agreements with established flag carriers. These partnerships are the bedrock of its predictable revenue, offering stability in a dynamic industry. The company's extensive network ensures high aircraft utilization, a key factor in its operational efficiency.

These agreements translate into a consistent cash flow, a hallmark of AerCap's 'Cash Cow' status within the BCG matrix. For instance, as of the first quarter of 2024, AerCap reported a strong lease portfolio, with a significant portion tied to these reliable airline customers. This stability allows for robust financial planning and reinvestment.

- Predictable Revenue Streams: Long-term leases with financially stable flag carriers provide a secure and consistent income, minimizing revenue volatility.

- High Aircraft Utilization: These established relationships ensure AerCap's aircraft are consistently leased and generating returns, maximizing asset value.

- Low Growth, High Reliability: While the market segment of flag carriers may exhibit lower growth, their inherent stability offers a low-risk, high-return profile for AerCap.

- Strong Financial Performance: As of Q1 2024, AerCap's lease portfolio demonstrates the success of these strategies, contributing to its overall financial strength and market position.

Sale-and-Leaseback Transactions for Existing Airline Fleets

AerCap Holdings frequently utilizes sale-and-leaseback transactions for existing airline fleets, a strategy that positions these assets as cash cows within its portfolio. By acquiring aircraft directly from airlines and then leasing them back, AerCap unlocks capital for carriers while securing high-quality, revenue-generating assets.

This approach capitalizes on AerCap's robust financial standing and deep market knowledge to acquire stable, valuable assets in a well-established market. For instance, in 2023, AerCap reported lease revenue of $7.7 billion, a significant portion of which is derived from such long-term lease agreements on in-service aircraft.

- Sale-and-Leaseback Strategy: AerCap purchases aircraft from airlines and leases them back, providing immediate liquidity to the airline.

- Asset Acquisition: This allows AerCap to acquire in-service, high-quality aircraft assets with existing lease agreements.

- Revenue Generation: These assets generate stable and predictable cash flow due to their immediate operational status and established lease contracts.

- Market Position: It reinforces AerCap's position in a mature market by securing high-value, in-demand assets.

AerCap's A320ceo and 737NG fleets are prime examples of cash cows. These aircraft, while not the latest models, are workhorses for airlines worldwide, offering proven reliability and cost-effectiveness. Their widespread adoption and continued demand ensure consistent revenue streams for AerCap.

The significant amortization of these aircraft means they generate substantial, stable cash flows with relatively low ongoing capital expenditure needs. This maturity in their lifecycle allows AerCap to reap the benefits of their initial investment, contributing significantly to the company's profitability.

With a substantial market share in the narrowbody segment, these aircraft represent a mature but highly profitable business. Their consistent returns underscore their status as a core component of AerCap's robust financial performance, particularly in 2024, where demand for these efficient, albeit older, aircraft remained strong.

AerCap's portfolio features a significant number of mature widebody aircraft, such as older Boeing 777s and Airbus A330s. These aircraft are typically secured by long-term leases with reputable airlines, ensuring consistent revenue streams.

While this segment represents a low-growth area, these aircraft boast high utilization rates and generate predictable, strong cash flows for AerCap. Their stable lease structures mean they contribute substantially to profitability without demanding significant new capital outlays.

As of the first quarter of 2024, AerCap reported that its fleet comprised 1,300 aircraft owned and managed, with a substantial portion of these being widebodies. The company's commitment to managing these mature assets effectively underscores their role as consistent cash generators within its diverse portfolio.

AerCap's Engine Leasing Portfolio is a significant Cash Cow. This segment boasts a vast and varied collection of aircraft engines, essential for airlines and frequently leased separately from the aircraft itself. The inherent necessity of engines and their complex maintenance needs translate into a steady, high-margin revenue stream for AerCap.

The engine leasing market is characterized by relative stability and modest growth, an environment where AerCap commands a robust market share. This strong position solidifies the portfolio's role as a reliable generator of consistent cash flow, underpinning its Cash Cow status within the BCG matrix.

AerCap Holdings benefits significantly from its long-term lease agreements with established flag carriers. These partnerships are the bedrock of its predictable revenue, offering stability in a dynamic industry. The company's extensive network ensures high aircraft utilization, a key factor in its operational efficiency.

These agreements translate into a consistent cash flow, a hallmark of AerCap's 'Cash Cow' status within the BCG matrix. For instance, as of the first quarter of 2024, AerCap reported a strong lease portfolio, with a significant portion tied to these reliable airline customers. This stability allows for robust financial planning and reinvestment.

- Predictable Revenue Streams: Long-term leases with financially stable flag carriers provide a secure and consistent income, minimizing revenue volatility.

- High Aircraft Utilization: These established relationships ensure AerCap's aircraft are consistently leased and generating returns, maximizing asset value.

- Low Growth, High Reliability: While the market segment of flag carriers may exhibit lower growth, their inherent stability offers a low-risk, high-return profile for AerCap.

- Strong Financial Performance: As of Q1 2024, AerCap's lease portfolio demonstrates the success of these strategies, contributing to its overall financial strength and market position.

AerCap Holdings frequently utilizes sale-and-leaseback transactions for existing airline fleets, a strategy that positions these assets as cash cows within its portfolio. By acquiring aircraft directly from airlines and then leasing them back, AerCap unlocks capital for carriers while securing high-quality, revenue-generating assets.

This approach capitalizes on AerCap's robust financial standing and deep market knowledge to acquire stable, valuable assets in a well-established market. For instance, in 2023, AerCap reported lease revenue of $7.7 billion, a significant portion of which is derived from such long-term lease agreements on in-service aircraft.

- Sale-and-Leaseback Strategy: AerCap purchases aircraft from airlines and leases them back, providing immediate liquidity to the airline.

- Asset Acquisition: This allows AerCap to acquire in-service, high-quality aircraft assets with existing lease agreements.

- Revenue Generation: These assets generate stable and predictable cash flow due to their immediate operational status and established lease contracts.

- Market Position: It reinforces AerCap's position in a mature market by securing high-value, in-demand assets.

AerCap's mature aircraft portfolio, particularly narrow-body jets like the A320ceo and 737NG, are key cash cows. These aircraft, despite being older, remain highly sought after by airlines for their reliability and cost-effectiveness, ensuring consistent lease revenue for AerCap.

These assets benefit from significant amortization, leading to strong, stable cash flows with minimal new capital investment required. This maturity allows them to consistently contribute to AerCap's profitability, a trend that remained robust through 2024.

Furthermore, AerCap's engine leasing segment and long-term leases with flag carriers exemplify cash cow characteristics. The consistent demand for engines and the stability of major airline clients provide predictable, high-margin revenue streams.

Sale-and-leaseback transactions also bolster this category, allowing AerCap to acquire operational, revenue-generating assets with established contracts, reinforcing their role as dependable cash generators.

| Asset Type | BCG Category | Key Characteristics | 2024 Relevance |

| A320ceo & 737NG Fleets | Cash Cow | Proven reliability, cost-effectiveness, high demand | Continued strong demand, stable revenue |

| Mature Widebody Aircraft (e.g., 777, A330) | Cash Cow | Long-term leases, high utilization, predictable cash flow | Consistent profitability, low capital expenditure |

| Engine Leasing Portfolio | Cash Cow | Essential for airlines, complex maintenance, steady revenue | Robust market share, high-margin income |

| Sale-and-Leaseback Assets | Cash Cow | In-service, high-quality assets, established leases | Secure revenue, reinforces market position |

What You See Is What You Get

AerCap Holdings BCG Matrix

The AerCap Holdings BCG Matrix preview you're examining is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete strategic analysis ready for your immediate use. You can confidently download this document knowing it's the final, professionally crafted output designed to provide clear insights into AerCap's portfolio. This ensures you get exactly what you need for informed decision-making and strategic planning without any unexpected surprises.

Dogs

AerCap's extensive portfolio, while largely featuring state-of-the-art aircraft, does include a segment of aging regional jets and older turboprops. These older models face challenges in a market increasingly favoring fuel-efficient and environmentally compliant aircraft, leading to reduced leasing demand and potentially slower sales cycles.

As of the first quarter of 2024, AerCap reported a fleet of 3,657 aircraft owned, including 1,129 regional aircraft. While specific data on the age breakdown of the turboprop and older regional jet segments isn't always granularly disclosed, the general industry trend indicates a declining appetite for these less efficient types, impacting their residual values and lease rates.

These older assets represent a category that AerCap actively manages for divestment. The strategy here is to exit these positions opportunistically, freeing up capital that can be redeployed into newer, more in-demand aircraft types, thereby optimizing the overall fleet efficiency and return on investment.

Certain very old or niche aircraft types, like the Boeing 757 or Airbus A300, often fall into the dog category within AerCap's portfolio. These aircraft have typically exceeded their most economically viable years, facing higher maintenance expenditures and limited re-leasing prospects due to evolving technology and environmental regulations. For instance, as of early 2024, the demand for older, less fuel-efficient wide-body aircraft has diminished significantly, impacting their residual values.

These specific aircraft types generate minimal cash flow for AerCap, often requiring substantial investment in upkeep without a strong return. Their market share in terms of future leasing demand is also quite low, making them less attractive to airlines. AerCap's strategy is to minimize its exposure to these assets, aiming for timely divestments to free up capital for more profitable ventures.

AerCap Holdings, like any large leasing company, may hold smaller portfolios of aircraft or related assets that don't perfectly fit its primary strategy. These could be older aircraft types with declining demand or assets in less strategic geographic regions. Such holdings, if they show limited growth potential and low market share within AerCap's overall business, could be categorized as dogs in a BCG matrix analysis.

The company's approach to these non-core assets is typically proactive divestment. For instance, in 2023, AerCap continued its strategy of managing its portfolio by selling off older, less fuel-efficient aircraft. This allows AerCap to focus its resources and capital on newer, more in-demand models, thereby enhancing overall fleet efficiency and profitability.

Aircraft Grounded Long-Term Due to Technical or Regulatory Issues

Aircraft grounded long-term for technical or regulatory reasons can be considered 'dogs' in AerCap's portfolio. These assets tie up capital through maintenance and storage costs without generating any income, effectively representing a low market share. For instance, in 2024, AerCap managed a diverse fleet, and while specific numbers of long-term grounded aircraft are proprietary, the company's operational reports consistently highlight the financial impact of such situations.

AerCap's strategy involves proactive measures to minimize the duration and impact of these grounded aircraft. This includes robust technical management to address issues promptly and aggressive remarketing efforts to find new lessees or buyers. The company's success hinges on efficiently moving aircraft through their lifecycle, minimizing the time they spend in a non-revenue-generating state.

- Extended grounding drains financial resources due to ongoing maintenance and storage expenses.

- These grounded aircraft possess low 'effective' market share as they are not generating revenue.

- AerCap's proactive technical management aims to resolve issues swiftly, shortening grounding periods.

- Remarketing strategies are crucial for redeploying grounded assets to generate income.

Legacy Assets with Limited Re-Lease Potential in Declining Markets

Legacy aircraft assets tied to declining market segments or facing structural challenges, such as those reliant on phased-out routes or in regions with severe economic downturns, can be categorized as dogs within AerCap's portfolio. These aircraft may experience difficulty securing new lessees, resulting in extended periods of inactivity and diminished financial returns. For example, older wide-body aircraft models that are less fuel-efficient might struggle to attract airlines operating on routes experiencing reduced demand or shifting to newer, more economical planes.

AerCap's strategy for these dog assets involves a focused approach on remarketing efforts or an eventual, planned phase-out. This proactive management aims to mitigate further financial strain and optimize the overall fleet composition. The company actively monitors market trends and fleet demand to make informed decisions regarding the future of these less productive assets.

- Aircraft Type Example: Older generation Boeing 747-400s or Airbus A340-300s, which are being retired by many airlines due to fuel inefficiency and higher maintenance costs.

- Market Challenge: Declining demand for long-haul, four-engine aircraft in favor of more fuel-efficient twin-engine wide-bodies.

- Financial Impact: Increased idle times and lower lease rates for these aircraft compared to newer models, impacting AerCap's overall return on assets.

- Strategic Response: Prioritizing sale or part-out strategies for these assets to free up capital and reduce carrying costs.

AerCap's 'dogs' are typically older aircraft models with declining market demand and higher operating costs, such as certain regional jets and older wide-body planes. These assets generate minimal cash flow and often require significant maintenance without strong returns, leading to reduced leasing prospects.

As of Q1 2024, AerCap managed a fleet of 3,657 aircraft, including 1,129 regional aircraft. While specific age breakdowns are proprietary, industry trends show a reduced appetite for less fuel-efficient models, impacting their residual values and lease rates. The company actively manages these assets for divestment to redeploy capital into newer aircraft.

Aircraft types like the Boeing 757 or Airbus A300, which have passed their most economical years, represent 'dogs' due to high maintenance and limited re-leasing potential. By early 2024, demand for older, less fuel-efficient wide-bodies had significantly decreased, affecting their market value.

AerCap's strategy for these underperforming assets is proactive divestment, aiming to exit positions opportunistically. For example, in 2023, the company continued selling older, less efficient aircraft to optimize its fleet and enhance profitability.

| Asset Category | Market Share/Demand | Cash Flow Generation | AerCap Strategy |

| Older Regional Jets/Turboprops | Low and declining | Minimal | Divestment, capital redeployment |

| Older Wide-body Aircraft (e.g., 747-400, A340-300) | Very low, facing competition from fuel-efficient twin-jets | Low, impacted by higher maintenance and idle times | Sale or part-out, reduce carrying costs |

| Long-Term Grounded Aircraft | Zero (non-revenue generating) | Negative (due to maintenance/storage costs) | Proactive technical management, aggressive remarketing |

Question Marks

AerCap is actively investigating opportunities in the emerging sustainable aviation sector, including leasing electric or hydrogen aircraft and related infrastructure for sustainable aviation fuels. This represents a high-growth, albeit speculative, market with substantial future potential.

While AerCap's current direct leasing market share in these nascent technologies is minimal, reflecting the market's early stage of development, the company is positioned to capitalize on future growth. Significant capital outlay would be necessary for AerCap to establish a dominant presence in this evolving landscape.

Expanding into regional cargo conversion programs presents a compelling opportunity for AerCap, tapping into a growing niche within the air cargo sector. While AerCap has historically concentrated on passenger aircraft, this specialized market, particularly for specific regional jet conversions, offers significant growth potential. For instance, the global air cargo market saw a notable rebound in 2024, with demand increasing, signaling a favorable environment for such expansions.

Despite the growth prospects, AerCap's initial market share in this highly specialized regional cargo conversion segment would likely be modest when compared to established players who are solely focused on cargo operations or maintenance, repair, and overhaul (MRO) services. This necessitates a strategic approach to investment, focusing on building expertise and capacity in these targeted conversion programs to effectively compete and scale.

AerCap's strategy involves targeting rapidly expanding aviation markets in emerging economies, which often present a double-edged sword: immense growth potential coupled with fierce existing competition. For instance, by the end of 2024, many of these emerging markets are projected to see fleet growth exceeding 10% year-over-year, a significant draw for lessors.

Entering these arenas means AerCap might initially struggle to capture substantial market share against established local players or other global lessors already entrenched. Success hinges on cultivating strong local partnerships and developing customized leasing solutions that resonate with regional demands, a crucial step to transform these challenging markets into future growth engines.

Digital Transformation Initiatives for Asset Management Services

AerCap is likely investing in advanced digital platforms and data analytics to enhance its aircraft asset management services. This could involve offering new, value-added services that go beyond its core aircraft leasing business, tapping into the growing aviation technology sector. While this represents a high-growth area, AerCap's current market share in providing these digital solutions as distinct, standalone products might be relatively low when compared to specialized technology firms. However, successful development and implementation could transform these initiatives into significant new revenue streams for the company.

These digital transformation initiatives are crucial for maintaining a competitive edge in the evolving aviation landscape. By leveraging data analytics, AerCap can optimize fleet management, predict maintenance needs, and improve operational efficiency for its clients. This strategic focus aligns with industry trends, where technology plays an increasingly vital role in asset management. For instance, the global aviation analytics market size was valued at USD 2.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for such services.

- Digital Platform Investment: AerCap is enhancing its digital infrastructure to support advanced data analytics and client-facing portals.

- Value-Added Services: Exploring new revenue streams by offering specialized digital solutions beyond traditional aircraft leasing.

- Market Position: Potentially a low market share in standalone digital products compared to tech specialists, but with high growth potential.

- Revenue Generation: Successful digital initiatives could create substantial new income sources, diversifying AerCap's business model.

Targeted Growth in Helicopter Leasing Segment

AerCap's helicopter leasing division, while smaller than its significant fixed-wing aircraft portfolio, presents a dynamic area for potential growth. The global helicopter market, especially in sectors like offshore oil and gas support and emergency medical services (EMS), has demonstrated robust expansion. For example, the global helicopter market was valued at approximately USD 28.5 billion in 2023 and is projected to reach USD 37.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 3.9%.

If AerCap is strategically investing in and expanding its presence within these high-growth helicopter niches, where its market share is still establishing itself, this segment could be classified as a question mark on the BCG matrix. This classification suggests a need for continued, potentially significant, investment to capture market share and capitalize on emerging opportunities before they mature.

- Market Focus: AerCap's helicopter division concentrates on specialized segments like offshore energy and EMS, which are experiencing strong demand.

- Growth Potential: These specialized helicopter markets are projected for continued growth, offering AerCap opportunities to expand its footprint.

- Investment Strategy: The question mark classification implies AerCap is actively investing in these developing helicopter niches to build market share.

- Strategic Consideration: Continued evaluation is needed to determine if these investments will yield a strong market position or require further capital allocation.

AerCap's foray into electric and hydrogen aircraft leasing, along with sustainable aviation fuel infrastructure, represents a high-potential but currently nascent market. While AerCap's market share in these areas is minimal as of 2024, the company is strategically positioning itself for future growth in this evolving sector.

Expanding into regional cargo conversion programs taps into a growing niche. The global air cargo market showed a rebound in 2024, with increasing demand, making this a favorable expansion area. However, AerCap's initial market share in this specialized segment is expected to be modest compared to dedicated cargo operators.

AerCap's helicopter leasing division, particularly in high-demand sectors like offshore oil and gas support and emergency medical services, shows strong growth potential. The global helicopter market was valued at approximately USD 28.5 billion in 2023, with projections indicating continued expansion. AerCap's investment in these developing niches positions them as question marks, requiring ongoing capital to build market share.

| Category | AerCap's Position | Market Growth | Strategic Consideration |

| Sustainable Aviation (Electric/Hydrogen) | Low Market Share, High Potential | Nascent, High Growth | Significant investment needed for market capture. |

| Regional Cargo Conversions | Modest Initial Share, Growing Niche | Rebounding Air Cargo Market (2024) | Requires specialized expertise to compete. |

| Helicopter Leasing (Specialized Niches) | Establishing Presence, High Potential | Robust Growth (USD 28.5B in 2023) | Continued investment required to build share. |

BCG Matrix Data Sources

Our AerCap BCG Matrix is built on comprehensive financial disclosures, industry growth forecasts, and aircraft market intelligence to provide accurate strategic insights.