Aemetis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aemetis Bundle

Navigate the complex external forces shaping Aemetis's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now for a deeper understanding.

Political factors

Government policies, particularly the Inflation Reduction Act (IRA), are crucial for Aemetis. The IRA's Section 45Z production tax credits and transferable investment tax credits directly boost the financial attractiveness of producing low-carbon fuels like renewable natural gas and sustainable aviation fuel.

These incentives are a key driver for Aemetis's project development. The company's ability to leverage these credits significantly impacts its financial outlook and operational expansion plans for its renewable fuel facilities.

Real-world impact is evident in Aemetis's Q1 2025 results, where they reported $19 million from tax credit sales. They anticipate further revenue from these credits later in 2025, especially under the Section 45Z provisions, underscoring their importance to the company's revenue stream.

California's Low Carbon Fuel Standard (LCFS) is a key policy influencing the market for low-carbon fuels. Amendments set to take effect July 1, 2025, mandate a 30% carbon intensity reduction by 2030 and a 90% reduction by 2045.

These ambitious targets are designed to significantly boost demand for sustainable fuels, directly benefiting companies like Aemetis that produce them. The policy's focus on feedstock sustainability certifications also shapes operational requirements and market access for Aemetis.

International trade policies and agreements, especially those influencing biofuel markets in India, directly affect Aemetis's worldwide business. These policies can create opportunities or challenges for the company's expansion and profitability.

Aemetis experienced a notable impact from trade dynamics, as delays in securing new government biodiesel contracts in India led to a revenue shortfall in Q1 2025. This demonstrates how sensitive their financial performance is to shifts in international trade arrangements.

However, there are positive developments, with the India Biodiesel segment securing new letters of intent totaling $31 million in April 2025. This signals a positive turn and a resumption of supply, suggesting that trade relationships are stabilizing.

Regulatory Support for Advanced Biofuels

Government support for advanced biofuels, such as sustainable aviation fuel (SAF) and renewable diesel, is a key political factor for Aemetis's expansion. The U.S. Clean Fuel Production Credit (CFPC), commencing January 1, 2025, provides incentives for producing low-carbon transportation fuels, directly impacting Aemetis's domestic production capabilities.

This new credit replaces the prior blenders tax credit, with its structure tied to a fuel's carbon intensity. The policy's aim to boost domestic production and decrease reliance on imported fuels is a significant tailwind for Aemetis's U.S.-based ventures.

- CFPC Incentive: The CFPC offers a tax credit of up to $1.75 per gallon for SAF and renewable diesel, depending on carbon intensity, starting in 2025.

- Domestic Production Focus: The credit is designed to encourage the build-out of U.S. biofuel production facilities, aligning with Aemetis's strategic investments.

- Carbon Intensity Metric: Production pathways must meet specific lifecycle greenhouse gas emission reduction thresholds to qualify for the credit, driving innovation in low-carbon fuel technology.

Political Stability and Energy Independence Initiatives

The ongoing emphasis on energy independence and national energy security provides a supportive political climate for domestic renewable fuel producers like Aemetis. Policies aimed at reducing reliance on foreign energy sources can directly benefit companies involved in biofuel production.

A key development is the potential for year-round E15 ethanol sales. For example, a directive for the EPA to consider this, as was anticipated for January 2025, would significantly broaden market access for ethanol, boosting demand and creating more favorable conditions for Aemetis in the US market.

- Government Support for Biofuels: Political mandates and incentives for renewable fuels, such as blending targets and tax credits, directly impact market demand.

- Energy Independence Policies: Initiatives to reduce dependence on imported oil can lead to increased support for domestic production of biofuels.

- Regulatory Changes: EPA decisions on fuel standards, like E15 availability, have a direct impact on market access and sales volumes for ethanol producers.

Government policies, particularly the Inflation Reduction Act (IRA) and the U.S. Clean Fuel Production Credit (CFPC), are foundational to Aemetis's financial performance and expansion. The IRA's tax credits, like Section 45Z, directly enhance the profitability of producing low-carbon fuels, a core business for Aemetis. The CFPC, effective January 1, 2025, offers up to $1.75 per gallon for sustainable aviation fuel and renewable diesel, incentivizing domestic production. California's Low Carbon Fuel Standard (LCFS) is also critical, with its 2025 amendments pushing for significant carbon intensity reductions, thereby increasing demand for Aemetis's products. International trade policies, especially concerning India's biodiesel market, also play a significant role, as demonstrated by recent contract developments impacting revenue. The broader political emphasis on energy independence further supports domestic renewable fuel producers like Aemetis.

What is included in the product

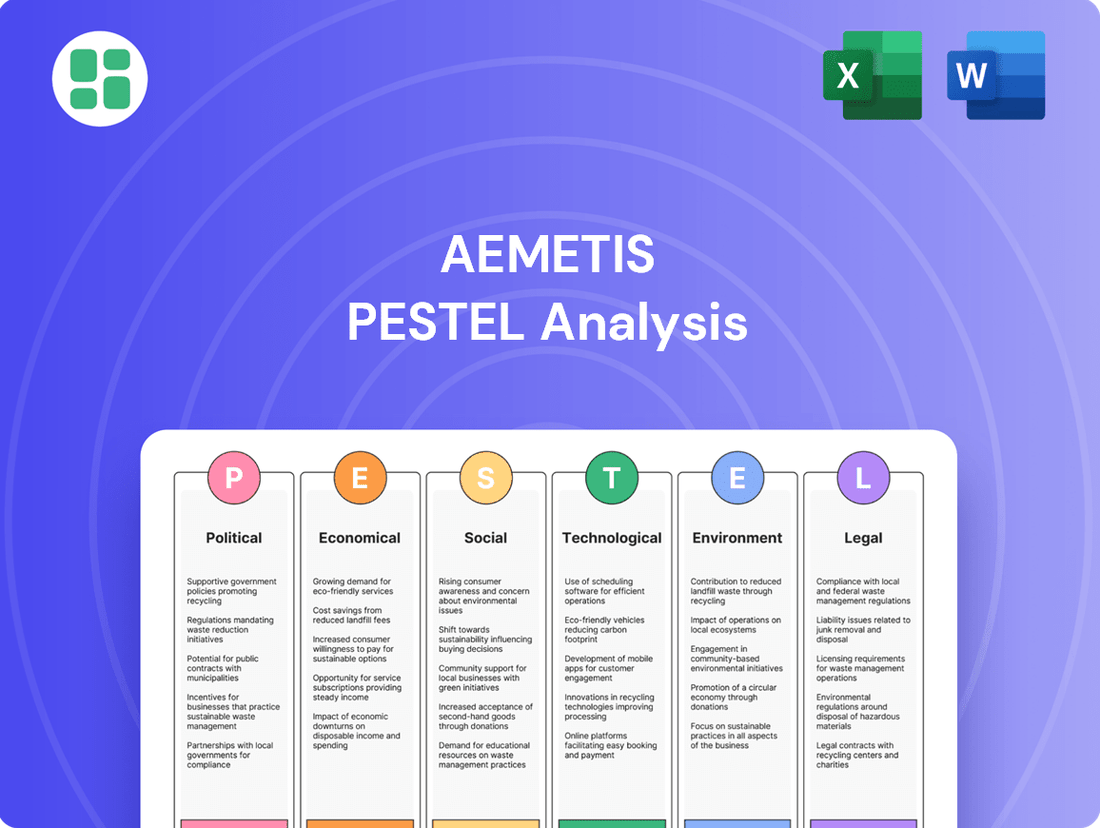

The Aemetis PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

This comprehensive review equips stakeholders with actionable insights into the external forces shaping Aemetis's industry and market landscape.

Aemetis' PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of information overload for efficient strategic decision-making.

Economic factors

The cost and availability of agricultural waste, like dairy manure, and other sustainable feedstocks are critical economic considerations for Aemetis. These inputs are the lifeblood for their renewable natural gas and biofuel production. For instance, the price of corn, a key feedstock for ethanol, saw significant fluctuations in 2024, with average prices ranging from $4.50 to $5.00 per bushel, impacting Aemetis's input costs.

Volatility in these commodity markets directly translates to Aemetis's production expenses and ultimately, their profit margins. A surge in feedstock prices can squeeze margins, while stable or declining prices offer an opportunity for improved profitability. The company's ability to secure reliable and cost-effective feedstock sources is therefore paramount to its economic success.

The market demand and pricing for Aemetis's key products like ethanol, renewable natural gas (RNG), and renewable diesel directly impact its financial performance. The growing emphasis on sustainable fuels is a significant driver for these products.

The Renewable Natural Gas market, especially in North America, is poised for substantial expansion, bolstered by supportive renewable fuel policies. Aemetis's own performance reflects this trend, with its RNG segment experiencing a remarkable 140% revenue surge in the first quarter of 2025.

Access to investment capital and favorable financing are critical for Aemetis's capital-intensive operations, particularly for its sustainable aviation fuel (SAF), renewable natural gas (RNG), and carbon sequestration projects. The company's ability to secure funding directly impacts its capacity for expansion and the implementation of carbon reduction strategies.

Aemetis has demonstrated strong access to capital, notably securing $200 million in EB-5 program investment approved by USCIS in March 2024. This significant influx of funding is earmarked for its key growth initiatives, underscoring the importance of such capital for advancing its project pipeline.

Inflation and Interest Rate Impacts

Inflation and rising interest rates directly affect Aemetis's financial health. Higher inflation can increase the cost of raw materials and operational expenses, while elevated interest rates make borrowing more expensive. For instance, Aemetis reported a notable increase in its interest expense in the first quarter of 2025 compared to the same period in 2024, underscoring the sensitivity of its debt servicing costs to market conditions.

These macroeconomic factors are crucial for managing profitability and securing financing for ongoing and future projects. The company's ability to navigate these challenges by effectively managing its debt and operational costs will be key to its sustained growth and financial stability in the coming periods.

- Increased Borrowing Costs: Aemetis's interest expense rose in Q1 2025, reflecting higher interest rate environments and their impact on debt servicing.

- Operational Cost Pressures: Inflationary pressures can lead to higher costs for raw materials and general operating expenditures.

- Project Financing Sensitivity: The cost of capital, influenced by interest rates, directly impacts the feasibility and financing of new renewable energy projects.

- Profitability Management: Efficiently managing interest expenses and operational costs is vital for maintaining and improving profit margins.

Competition from Other Energy Sources

Aemetis operates in a dynamic energy market where competition is fierce. Traditional fossil fuels remain a significant benchmark, and the company must also contend with a growing array of renewable energy alternatives, each with its own cost structures and technological advancements.

The ultimate competitiveness of Aemetis's products hinges on a few key elements: their carbon intensity, the efficiency of their production costs, and the availability and value of government incentives when measured against other energy sources. For instance, the shift from the Blenders Tax Credit to the Clean Fuel Production Credit (CFPC) in the US, while generally favorable for producers of low-carbon fuels, introduces new layers of complexity that could reshape market dynamics and Aemetis's market position.

- Fossil Fuel Price Volatility: Fluctuations in crude oil and natural gas prices directly impact the cost-competitiveness of Aemetis's renewable fuels.

- Renewable Energy Landscape: Competition includes established biofuels like corn ethanol and emerging technologies such as green hydrogen and advanced battery storage.

- Incentive Structures: The effectiveness of government programs like the CFPC in leveling the playing field against subsidized fossil fuels is crucial.

- Carbon Intensity Benchmarking: Aemetis's ability to demonstrate lower carbon intensity than competitors is a key differentiator in securing market share.

The economic landscape for Aemetis is shaped by feedstock costs, product demand, and capital availability. Fluctuations in agricultural commodity prices directly impact production expenses, as seen with corn prices ranging from $4.50 to $5.00 per bushel in 2024. The demand for renewable fuels, particularly RNG, is robust, with Aemetis reporting a 140% revenue increase in its RNG segment in Q1 2025, highlighting market growth. Securing investment capital is crucial for expansion, with Aemetis obtaining $200 million in EB-5 investment in March 2024 to fund key growth initiatives.

Inflation and rising interest rates pose significant economic challenges. Increased inflation can escalate operating costs, while higher interest rates elevate borrowing expenses, as evidenced by Aemetis's Q1 2025 interest expense increase compared to Q1 2024. Effectively managing these financial pressures is vital for maintaining profitability and ensuring the financial viability of its capital-intensive projects.

Aemetis competes in a dynamic energy market influenced by fossil fuel prices and evolving renewable energy technologies. Its product competitiveness relies on carbon intensity, production efficiency, and government incentives. The transition to the Clean Fuel Production Credit (CFPC) in the US introduces new market dynamics that Aemetis must navigate to maintain its market position.

| Economic Factor | 2024/2025 Data Point | Impact on Aemetis |

|---|---|---|

| Corn Prices (2024 Avg.) | $4.50 - $5.00 per bushel | Influences feedstock costs for ethanol production. |

| RNG Revenue Growth (Q1 2025) | 140% increase | Demonstrates strong market demand and Aemetis's performance in the RNG sector. |

| EB-5 Investment Secured (March 2024) | $200 million | Provides essential capital for growth initiatives and project expansion. |

| Interest Expense (Q1 2025 vs. Q1 2024) | Notable increase | Reflects the impact of higher interest rates on debt servicing costs. |

Full Version Awaits

Aemetis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aemetis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Aemetis's business landscape.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This trend is a major driver for the renewable fuels market, as both individuals and businesses seek to reduce their carbon footprint. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions.

This growing societal demand for cleaner alternatives is pushing industries, especially transportation, to adopt more sustainable energy sources. As a result, there's mounting pressure on sectors historically reliant on fossil fuels to transition towards greener options, creating a fertile ground for companies like Aemetis that offer advanced biofuels.

Public opinion on biofuels significantly impacts their growth. For instance, surveys in 2024 indicated that while many consumers support renewable energy, a substantial portion expressed concerns about the environmental footprint of certain biofuel production methods, especially those tied to land use changes. This sentiment directly affects how governments craft policies and how readily consumers embrace biofuel-derived products.

The ongoing debate around food versus fuel remains a critical factor. In 2025, several reports highlighted that the sourcing of feedstocks, particularly corn and soy, continues to be scrutinized for its potential impact on food prices and availability. Companies like Aemetis must navigate these perceptions by emphasizing sustainable sourcing and transparent production processes to maintain public trust and policy favorability.

Aemetis's operations, especially its dairy digester projects and biorefinery facilities in California and India, are significant drivers of local employment. These facilities create jobs across various sectors, including agriculture, construction, and manufacturing, directly benefiting rural economies. For instance, the company's expansion plans in California are projected to create hundreds of new jobs, bolstering community development.

Shifting Workforce Skills and Training

The global shift towards a green energy economy is fundamentally altering the skills landscape, demanding specialized expertise in areas like renewable fuel production, biochemical engineering, and environmental management. Aemetis, deeply involved in this transition, must proactively address these evolving skill requirements.

To capitalize on growth opportunities, Aemetis needs to adapt by potentially investing in robust training and development programs. This investment can upskill its current workforce and also benefit local communities, fostering a pipeline of talent essential for the company's expansion in the bioenergy sector.

- Growing Demand for Green Skills: Reports indicate a significant increase in job postings requiring skills in renewable energy, with a projected 50% rise in demand for green energy technicians by 2030 in some regions.

- Aemetis's Training Investment: The company's commitment to developing its workforce is crucial for operational efficiency and innovation in areas like advanced biofuels and dairy RNG production.

- Community Skill Development: Initiatives to train local populations in renewable energy technologies can create a sustainable talent pool, supporting both Aemetis's operational needs and regional economic development.

Corporate Social Responsibility (CSR) Expectations

Stakeholders are increasingly demanding that companies actively engage in corporate social responsibility (CSR), with a particular emphasis on clear environmental practices and meaningful community involvement. Aemetis's core business model, which centers on repurposing agricultural waste and driving decarbonization in the transportation sector, directly addresses these evolving expectations. This alignment is crucial for bolstering its brand image and appealing to investors who prioritize sustainability.

For instance, Aemetis's commitment to producing renewable fuels from waste streams directly contributes to a circular economy, a key aspect of modern CSR. In 2024, the demand for sustainable aviation fuel (SAF), a primary product for Aemetis, continued its upward trajectory, with projections indicating significant growth through 2025 and beyond as regulatory mandates and corporate sustainability goals intensify. This positions Aemetis favorably within the socially conscious investment landscape.

- Growing Demand for Sustainable Products: Consumers and businesses are actively seeking environmentally friendly alternatives, driving market growth for companies like Aemetis.

- Investor Scrutiny on ESG: Environmental, Social, and Governance (ESG) factors are paramount for many investors, with companies demonstrating strong CSR performance often attracting more capital.

- Regulatory Tailwinds: Government policies and incentives aimed at reducing carbon emissions further support Aemetis's business model and its CSR initiatives.

- Enhanced Brand Reputation: Proactive CSR efforts, such as Aemetis's focus on waste reduction and clean energy, build trust and loyalty among customers and the wider community.

Societal expectations are increasingly centered on environmental stewardship, with a growing segment of the population actively seeking out and supporting businesses committed to sustainability. This shift directly benefits companies like Aemetis, whose core operations involve producing renewable fuels and reducing waste. For example, by 2025, consumer preference for products with a low carbon footprint is expected to be a dominant purchasing driver across many sectors.

Technological factors

Continuous innovation in biochemical conversion processes is vital for Aemetis to boost efficiency and output from its varied feedstocks. For instance, advancements in enzymatic hydrolysis and microbial fermentation are making the conversion of biomass and waste into advanced biofuels more effective, directly enhancing Aemetis's production capacity.

Aemetis is heavily investing in research and development to unlock new, efficient methods for using diverse sustainable feedstocks. This includes agricultural waste, dairy manure, and even wood waste from forests and orchards, broadening their operational base.

The company is actively growing its network of dairy digesters, a core part of its feedstock strategy. Furthermore, Aemetis is exploring the potential of utilizing sugars derived from waste wood, significantly boosting its feedstock flexibility and reducing dependence on any single input source.

Aemetis is investing in carbon capture and utilization (CCU) technologies, specifically focusing on carbon capture and sequestration (CCS) projects. These initiatives are crucial for their goal of producing negative carbon intensity fuels by capturing CO2 from their operations and storing it underground. This aligns with the broader global push for decarbonization, with Aemetis targeting substantial CO2 sequestration capacity in their plans.

Scalability of Production Processes and Facility Upgrades

Aemetis's ability to scale production and integrate new technologies is crucial for its expansion. For instance, the company is upgrading its Keyes ethanol plant with a solar microgrid and mechanical vapor recompression (MVR) systems. These upgrades are designed to boost energy efficiency and increase production capacity, directly impacting its ability to meet growing market demand.

These facility upgrades are key technological factors enabling Aemetis to grow. The MVR system, for example, is expected to significantly reduce the plant's energy consumption, making its operations more cost-effective and scalable. This focus on technological enhancement supports Aemetis's strategic goals for increased output and improved environmental performance.

- Solar Microgrid at Keyes: Aemetis is implementing a 14 MW solar microgrid at its Keyes facility, aiming to reduce reliance on grid electricity and lower operational costs.

- MVR System Development: The company is developing a Mechanical Vapor Recompression (MVR) system to improve energy efficiency in its ethanol production process.

- Capacity Expansion: These technological investments are geared towards enabling significant expansion of Aemetis's renewable fuel production capacity.

Research and Development into New Renewable Products

Aemetis is actively investing in research and development for novel renewable products, aiming to diversify its offerings and tap into emerging markets. This strategic focus on innovation, particularly in areas like sustainable aviation fuel (SAF) and renewable hydrogen, is designed to create new avenues for revenue growth.

The company's development of a SAF and renewable diesel biorefinery in California exemplifies this commitment. This project signifies Aemetis's dedication to expanding its product portfolio beyond its established ethanol and biogas operations, positioning it to capitalize on the growing demand for cleaner fuel alternatives. For instance, the global SAF market was valued at approximately $2.8 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial growth potential that Aemetis aims to capture.

- Ongoing R&D into SAF and renewable hydrogen: Aims to unlock new market opportunities and revenue streams for Aemetis.

- California Biorefinery Project: Demonstrates Aemetis's strategic expansion into advanced biofuels like SAF and renewable diesel.

- Market Growth Potential: The SAF market is expected to grow significantly, offering a strong incentive for Aemetis's product development initiatives.

Aemetis is actively integrating advanced technologies to enhance its biofuel production. The company's commitment to innovation is evident in its development of a solar microgrid and mechanical vapor recompression (MVR) systems at its Keyes facility, aiming to boost energy efficiency and production capacity. These technological advancements are critical for scaling operations and reducing costs in the competitive renewable fuels market.

Further technological focus includes investments in carbon capture and sequestration (CCS) to produce negative carbon intensity fuels, a key differentiator in the market. Aemetis is also exploring novel products like sustainable aviation fuel (SAF) and renewable hydrogen, tapping into rapidly growing markets. The global SAF market, valued at approximately $2.8 billion in 2023, is projected for substantial growth, presenting significant opportunities for Aemetis's strategic product development.

| Technological Factor | Description | Impact on Aemetis | Relevant Data/Initiative |

| Biochemical Conversion Efficiency | Improving processes for converting biomass and waste into biofuels. | Increases production output and feedstock utilization. | Advancements in enzymatic hydrolysis and microbial fermentation. |

| Carbon Capture & Sequestration (CCS) | Capturing CO2 from operations for underground storage. | Enables production of negative carbon intensity fuels. | Targeting substantial CO2 sequestration capacity. |

| Energy Efficiency Upgrades | Implementing technologies to reduce energy consumption. | Lowers operational costs and improves scalability. | 14 MW solar microgrid and MVR system at Keyes facility. |

| New Product Development | Researching and developing advanced biofuels and chemicals. | Diversifies revenue streams and taps into emerging markets. | Focus on SAF and renewable hydrogen; California biorefinery project. |

Legal factors

Aemetis must navigate a complex web of environmental regulations, including strict air and water quality standards, to operate and grow. Securing necessary permits is a crucial step, especially for projects like biogas pipelines and new biorefineries. For instance, their California projects, such as the Keyes facility, require thorough environmental impact assessments under the California Environmental Quality Act (CEQA).

Federal and state fuel standards, like the U.S. Renewable Fuel Standard (RFS) and California's Low Carbon Fuel Standard (LCFS), are crucial legal drivers for Aemetis, mandating the integration of biofuels into the fuel mix. For instance, the RFS program aims to reduce reliance on foreign oil and improve air quality by requiring a certain volume of renewable fuels to be blended into gasoline and diesel each year. California’s LCFS, which began in 2011, sets a declining carbon intensity standard for transportation fuels, incentivizing the use of lower-carbon alternatives.

Aemetis must continually adapt to evolving regulations. Recent updates, such as potential increases in the RFS blending targets for 2024 and beyond, or stricter carbon intensity thresholds under the LCFS, directly impact Aemetis's operational strategies and investment decisions. For example, the EPA's proposed 2024 RFS volumes in late 2023 suggested a slight increase in the total renewable diesel mandate to 7.5 billion gallons, a key product for Aemetis.

Compliance with these mandates, including any new feedstock sustainability requirements that may be introduced, is non-negotiable. Failure to meet these standards can result in significant penalties. Aemetis's ability to meet or exceed these legal obligations is a direct determinant of its market access and financial performance within the biofuel sector.

Land use and zoning regulations directly influence Aemetis's capacity to establish and grow its production sites and essential infrastructure, including dairy digesters and biogas pipelines. These laws dictate where such facilities can be located and what types of operations are permissible, impacting expansion strategies and project feasibility.

Securing the required approvals from local governing bodies is a critical step for Aemetis. For instance, obtaining permits from entities like the Stanislaus County Board of Supervisors for projects such as pipeline extensions is fundamental to moving forward with development and ensuring compliance with regional planning objectives.

Intellectual Property Rights

Intellectual Property Rights are crucial for Aemetis, particularly its patented microbes and proprietary processes, which form the bedrock of its competitive edge in the renewable fuels and biochemicals sector. These legal protections are essential for safeguarding its innovative technologies and sustaining its market leadership.

The company's reliance on IP is underscored by its ongoing efforts to secure and enforce these rights. For instance, Aemetis has actively pursued patent protection for its novel microbial strains and fermentation processes, which are key to its advanced biofuel production. As of early 2024, Aemetis held a significant portfolio of patents and patent applications globally, covering various aspects of its technology, ensuring exclusivity and a barrier to entry for competitors.

- Patented Technologies: Aemetis's core business relies on patented microbial strains and biochemical processes.

- Market Exclusivity: IP rights grant Aemetis exclusive rights to utilize its innovations, preventing competitors from replicating its technology.

- Competitive Advantage: Protecting its intellectual property is vital for maintaining Aemetis's position in the rapidly evolving renewable fuels market.

- Investment Protection: Legal frameworks for IP allow Aemetis to protect its substantial investments in research and development.

International Compliance and Trade Laws

Aemetis's operations, particularly in India, are heavily influenced by international compliance and trade laws. Navigating these regulations is crucial for smooth business operations and contract acquisition. For instance, the company experienced delays in securing contracts from government-owned Oil Marketing Companies in India during Q1 2025, underscoring the complexities of these legal frameworks.

These delays emphasize the need for Aemetis to meticulously understand and comply with both Indian domestic trade regulations and international trade agreements. Such adherence is not just about legal obligation but also a strategic imperative for timely project execution and revenue generation. The company's ability to manage these legal factors directly impacts its project timelines and financial performance.

- Adherence to Indian Trade Laws: Aemetis must comply with all national trade regulations, import/export controls, and local business licensing requirements in India.

- International Trade Agreements: Compliance with global trade pacts and sanctions is essential, especially when sourcing materials or selling products across borders.

- Government Procurement Processes: Understanding and navigating the specific procurement procedures of Indian government entities, like Oil Marketing Companies, is critical for contract awards.

- Contractual Compliance: Ensuring all agreements, from supply chain to offtake, meet the legal standards of all involved jurisdictions prevents disputes and operational disruptions.

Aemetis's ability to secure permits and comply with environmental regulations, such as CEQA in California, is fundamental to its operational expansion. The company's success is directly tied to its adherence to federal and state fuel standards like the RFS and LCFS, which incentivize biofuel adoption. For instance, the EPA's proposed 2024 RFS volumes indicated a target of 7.5 billion gallons for renewable diesel, a key market for Aemetis.

Land use and zoning laws significantly impact Aemetis's ability to site new facilities and infrastructure, requiring local approvals like those from Stanislaus County. Furthermore, Aemetis's core competitive advantage is protected by its intellectual property, including patented microbes and processes, with a global portfolio of patents as of early 2024. Navigating international trade laws and government procurement processes in markets like India is also critical, as evidenced by contract delays experienced in early 2025 with Indian Oil Marketing Companies.

Environmental factors

Aemetis's commitment to using agricultural waste and other sustainable feedstocks is central to its operations, but it requires diligent oversight to prevent adverse effects on land use and biodiversity. The company's model depends on sourcing materials that don't compete with food production or lead to habitat destruction.

California's Low Carbon Fuel Standard (LCFS) amendments, effective in 2024, are particularly relevant. These amendments establish crucial guardrails against indirect land-use change (ILUC) and mandate third-party sustainability certifications for feedstocks. This means Aemetis must demonstrate that its sourcing practices do not contribute to deforestation or reduce land available for food crops, a key factor in its environmental compliance and market access.

Aemetis is deeply committed to lowering greenhouse gas (GHG) emissions by creating fuels with low and even negative carbon intensity. This focus is central to their environmental strategy.

Their initiatives, such as utilizing dairy digesters to capture methane and implementing carbon capture and sequestration technologies, are designed for substantial GHG reductions. For instance, their Keyes, California facility aims to reduce emissions by approximately 100,000 metric tons of CO2 equivalent annually, supporting broader climate objectives.

The company's efforts are directly aligned with global climate goals, positioning them as a key player in the transition to a lower-carbon economy. Their projects are expected to contribute to significant environmental improvements, reflecting a strong commitment to sustainability.

Aemetis’s core business actively tackles waste management by transforming agricultural byproducts into renewable fuels and chemicals. This approach directly addresses the environmental challenge of agricultural waste disposal, turning a potential liability into a valuable resource. For instance, their advanced biofuel facilities are designed to process significant volumes of waste, contributing to a circular economy model.

The company's strategy emphasizes the efficient utilization of all byproducts generated during the conversion process. This not only minimizes environmental impact by reducing landfill waste but also opens up opportunities for creating additional revenue streams from these secondary products. In 2023, Aemetis reported progress in developing markets for their co-products, such as high-protein animal feed, further enhancing their waste-to-value proposition.

Water Usage and Wastewater Treatment

Water is absolutely essential for industrial operations, and for companies like Aemetis involved in biofuel production, it's a critical input. Managing how much water is used and how wastewater is treated is paramount to keeping environmental impacts low. This is particularly true in areas facing water scarcity where their plants might be located.

Aemetis's commitment to sustainability means they are focused on efficient water management. For instance, in 2024, the company continued to invest in technologies aimed at reducing water consumption and improving the quality of discharged water. Strict adherence to wastewater treatment standards is not just a regulatory requirement but a core part of their environmental stewardship, especially as global water stress intensifies.

Considering the operational footprint of Aemetis, particularly in regions like California which has experienced significant drought conditions, water usage and wastewater treatment are key environmental considerations. Their facilities must meet stringent discharge permits, often requiring advanced treatment processes to ensure compliance with local and federal regulations. The company's long-term strategy includes optimizing these processes to minimize their water footprint.

Key aspects of Aemetis's water management strategy include:

- Water Conservation Initiatives: Implementing technologies and practices to reduce overall water intake in production processes.

- Wastewater Treatment Excellence: Ensuring all discharged water meets or exceeds regulatory standards through advanced treatment systems.

- Regulatory Compliance: Maintaining strict adherence to all local, state, and federal environmental regulations governing water usage and discharge.

- Regional Water Scarcity Awareness: Strategically managing water resources in consideration of the specific water stress levels of the regions where their facilities operate.

Climate Change Risks and Operational Resilience

Climate change presents significant challenges, including unpredictable weather patterns that can impact the availability of crucial feedstocks for Aemetis's operations, potentially affecting supply chains and production costs. Furthermore, an intensifying regulatory landscape driven by climate concerns could impose stricter environmental standards and carbon pricing mechanisms.

Aemetis is actively bolstering its operational resilience by pursuing a strategy of feedstock diversification, aiming to reduce reliance on any single source. This approach, coupled with the development of advanced, low-carbon technologies, is designed to mitigate the adverse effects of environmental shifts and capitalize on the growing demand for sustainable solutions in a climate-conscious global market.

For instance, Aemetis's renewable natural gas (RNG) projects, which utilize agricultural waste, demonstrate a commitment to feedstock flexibility. In 2024, the company announced plans to expand its RNG production capacity, targeting a significant increase in output by 2025, thereby enhancing its ability to navigate feedstock volatility. This strategic focus positions Aemetis to benefit from policy incentives supporting decarbonization efforts.

- Feedstock Diversification: Aemetis is expanding its use of various waste streams for RNG production, reducing reliance on single sources.

- Low-Carbon Technology Development: Investment in advanced technologies aims to improve efficiency and reduce the carbon footprint of its operations.

- Regulatory Adaptation: Proactive development of sustainable practices helps Aemetis comply with and potentially benefit from evolving environmental regulations.

- Market Positioning: The company's focus on renewable fuels aligns with global decarbonization trends, creating a competitive advantage.

Aemetis's environmental strategy centers on reducing greenhouse gas emissions and managing waste effectively. Their renewable fuel projects, like those utilizing dairy digesters for methane capture, are designed to significantly cut carbon intensity. For example, their Keyes facility aims for an annual reduction of approximately 100,000 metric tons of CO2 equivalent.

The company's focus on transforming agricultural byproducts into renewable fuels directly addresses waste management challenges, promoting a circular economy model. In 2023, Aemetis reported progress in developing markets for co-products such as high-protein animal feed, enhancing their waste-to-value proposition.

Water management is critical, especially in water-scarce regions. Aemetis invests in technologies to reduce water consumption and improve wastewater quality, adhering to strict discharge standards. By 2024, they continued to focus on efficient water use and regulatory compliance, acknowledging the increasing global water stress.

Climate change impacts feedstock availability and regulatory landscapes. Aemetis mitigates these by diversifying feedstocks and investing in low-carbon technologies, aiming to enhance operational resilience and capitalize on decarbonization trends. Their RNG production capacity expansion, targeting significant increases by 2025, supports this strategy.

| Environmental Focus Area | Key Initiatives/Strategies | Impact/Data Point (2023-2025) |

|---|---|---|

| GHG Emission Reduction | Renewable Natural Gas (RNG) production, Methane capture from dairy digesters | Keyes facility targeting ~100,000 metric tons CO2e annual reduction. |

| Waste Management | Processing agricultural byproducts into fuels and chemicals | Development of markets for co-products like animal feed (reported in 2023). |

| Water Management | Water conservation technologies, Wastewater treatment | Continued investment in water efficiency and compliance with discharge standards (ongoing in 2024). |

| Climate Resilience | Feedstock diversification, Low-carbon technology development | RNG capacity expansion targeting significant output increase by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aemetis is built on a robust foundation of data from official government agencies, industry-specific regulatory bodies, and leading market research firms. We incorporate insights from energy sector reports, environmental policy updates, and economic forecasts to ensure comprehensive and accurate assessments.