Aemetis Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aemetis Bundle

Discover how Aemetis leverages its product innovation, strategic pricing, efficient distribution, and targeted promotions to capture market share. This analysis goes beyond the surface, offering a comprehensive look at their marketing engine.

Unlock the full potential of Aemetis's marketing strategy. Our detailed 4Ps analysis provides actionable insights into their product development, pricing architecture, channel management, and promotional campaigns, empowering you with a strategic advantage.

Ready to elevate your marketing understanding? Get instant access to our in-depth Aemetis 4Ps Marketing Mix Analysis, a professionally crafted resource perfect for business professionals, students, and consultants seeking to benchmark and strategize.

Product

Aemetis offers a diverse portfolio of advanced biofuels, encompassing ethanol, renewable natural gas (RNG), and renewable diesel (RD). These are engineered to substitute conventional petroleum fuels, thereby aiding in the decarbonization of transportation and various industrial applications.

The company's strategic emphasis lies in generating low and even negative carbon intensity fuels. This is achieved by utilizing sustainable feedstocks, a key differentiator in the evolving energy landscape.

For instance, Aemetis's renewable diesel production facility in Riverbank, California, is projected to produce approximately 40 million gallons of RD annually. This facility is expected to reduce greenhouse gas emissions by over 130,000 metric tons per year compared to petroleum diesel.

Aemetis's product strategy centers on transforming agricultural waste and other sustainable feedstocks into valuable renewable energy. This includes using dairy manure for Renewable Natural Gas (RNG) and waste oils, fats, and orchard waste wood for Sustainable Aviation Fuel (SAF) and renewable diesel.

This focus on sustainable feedstock utilization directly addresses environmental concerns by diverting waste from landfills and repurposing it. For instance, Aemetis's Keyes facility in California is designed to process approximately 20,000 tons of orchard waste annually, contributing to a circular economy.

By leveraging these waste streams, Aemetis not only produces cleaner fuels but also creates economic opportunities in rural areas. The company's commitment to these feedstocks underpins its market position in the growing renewable energy sector, aligning with increasing demand for environmentally responsible products.

Aemetis's decarbonization solutions directly address the critical need to reduce greenhouse gas (GHG) emissions and carbon intensity. Their innovative projects, such as advanced dairy digesters and biorefineries, are engineered to produce fuels with substantially lower carbon footprints, aiding clients in achieving their sustainability targets and adhering to stringent environmental mandates like the Low Carbon Fuel Standard (LCFS).

High-Quality Renewable s

Aemetis prioritizes high-quality renewable products, exemplified by its distilled biodiesel and refined glycerin from India, serving both domestic and European markets. This commitment ensures premium ingredients for various industrial applications.

In California, the company produces high-octane, low-emission ethanol, a key component in cleaner transportation fuels. Furthermore, Aemetis is aggressively scaling its renewable natural gas (RNG) output, capitalizing on the surging demand for sustainable energy solutions. For instance, by the end of 2023, Aemetis had plans to expand its RNG production capacity to approximately 4 million MMBtu per year, with a significant portion of this expansion targeting dairy farms in California.

- Premium Biodiesel & Glycerin: Aemetis' India facility manufactures high-quality distilled biodiesel and refined glycerin, meeting stringent customer specifications in India and Europe.

- Clean Transportation Fuel: The California operations focus on producing high-octane, low-emission ethanol, contributing to a reduction in vehicle emissions.

- Rapid RNG Expansion: Aemetis is significantly increasing its renewable natural gas production to meet the growing demand for sustainable energy, with a strategic focus on dairy digester projects.

- Market Demand Alignment: The company's product portfolio directly addresses the increasing global need for cleaner fuels and renewable energy sources.

Innovation and Technology

Aemetis is heavily focused on innovation and technology to drive its business forward. They are actively deploying advanced biorefinery technologies for the production of Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD). This commitment to cutting-edge tech is crucial for their competitive edge.

The company's investment in carbon capture and sequestration (CCS) and mechanical vapor recompression systems highlights their dedication to improving production efficiency and significantly reducing their carbon footprint. These technologies are not just about environmental responsibility; they are integral to Aemetis's long-term growth strategy.

For instance, Aemetis's Keyes facility, a key operational site, has been a focus for these technological upgrades. By integrating advanced systems, they aim to lower the carbon intensity of their fuels, a critical factor for market acceptance and regulatory compliance in the growing low-carbon fuel sector. This strategic technological deployment positions Aemetis to capitalize on the increasing demand for sustainable energy solutions.

Key technological advancements include:

- Advanced Biorefinery Technologies: Enabling efficient production of SAF and RD.

- Carbon Capture and Sequestration (CCS): Reducing overall emissions from operations.

- Mechanical Vapor Recompression (MVR): Enhancing energy efficiency in production processes.

Aemetis offers a portfolio of advanced biofuels, including ethanol, renewable natural gas (RNG), and renewable diesel (RD), designed to replace conventional petroleum fuels and reduce carbon intensity. Their product strategy focuses on utilizing sustainable feedstocks like dairy manure, waste oils, and orchard waste to create low-carbon fuels such as RNG, renewable diesel, and Sustainable Aviation Fuel (SAF).

The company's commitment to high-quality products is evident in its distilled biodiesel and refined glycerin from India, serving industrial needs. In California, Aemetis produces low-emission ethanol and is rapidly expanding its RNG production capacity, aiming for approximately 4 million MMBtu per year by the end of 2023, primarily from dairy farms. This aligns directly with market demand for cleaner energy solutions.

| Product Category | Key Feedstocks | California Production Focus | India Production Focus | Market Application |

| Renewable Diesel (RD) | Waste oils, fats, orchard waste | 40 million gallons/year (Riverbank facility) | Transportation | |

| Renewable Natural Gas (RNG) | Dairy manure | Expanding to 4 million MMBtu/year (targeting dairy farms) | Transportation, Grid Injection | |

| Ethanol | High-octane, low-emission | Transportation | ||

| Biodiesel & Glycerin | Distilled, Refined | Industrial, European markets |

What is included in the product

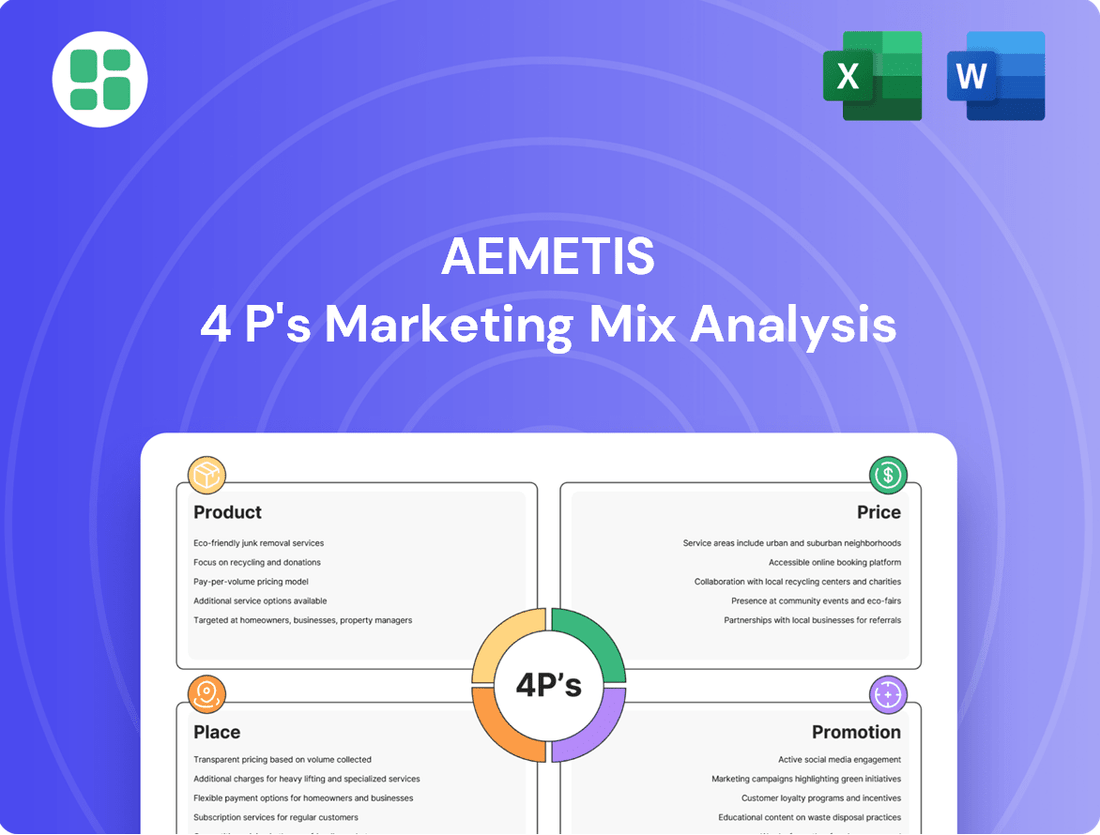

This analysis provides a comprehensive deep dive into Aemetis's Product, Price, Place, and Promotion strategies, offering a clear understanding of their marketing positioning.

It's designed for professionals seeking a grounded, data-driven overview of Aemetis's marketing mix, perfect for strategic planning and competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for decision-makers.

Provides a clear, structured overview of Aemetis's 4Ps, easing the burden of understanding their market approach.

Place

Aemetis strategically operates its production facilities, with a significant presence in California including its Keyes ethanol plant and the upcoming SAF/RD biorefinery in Riverbank. This geographic focus allows for efficient sourcing of agricultural feedstocks common in the region. The company also has a biodiesel plant in India, diversifying its operational footprint and market access.

These locations are not chosen by chance. They are situated to optimize access to renewable feedstocks, such as corn and waste oils, which are crucial for their advanced biofuels. Furthermore, proximity to key markets in California, a leader in renewable fuel mandates, and India, a growing energy market, ensures efficient distribution and sales.

Leveraging existing infrastructure is also a key consideration. The Keyes facility benefits from established ethanol production capabilities, while the Riverbank site is being developed to integrate SAF production with existing infrastructure, aiming for cost-effective scaling. This approach minimizes upfront capital expenditure and accelerates time-to-market for their sustainable aviation fuel and renewable diesel products.

Aemetis is building integrated supply chains to streamline operations and secure raw materials. For instance, its California biogas digester network processes dairy waste into renewable natural gas (RNG). This network, coupled with a pipeline system, ensures a steady flow of feedstock.

Further integration involves utilizing refined tallow from its India facility. This tallow is slated to become feedstock for Aemetis's sustainable aviation fuel (SAF) and renewable diesel (RD) plant in California. This strategic move optimizes logistics and guarantees a consistent supply for its biofuel production.

Aemetis focuses its sales strategy on directly serving industrial clients, a crucial aspect of its marketing mix. This approach involves supplying renewable fuels and biochemicals to sectors that require these products for their operations. For instance, the company is a key supplier of biodiesel to oil marketing companies in India, a market that has seen significant growth in renewable energy adoption.

The direct sales model enables Aemetis to forge strong relationships with its industrial customers, offering them customized solutions that meet specific operational needs. This is particularly relevant for products like Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD), where Aemetis is exploring opportunities with airlines and fuel blenders in the United States. Such direct engagement allows for the negotiation of long-term contracts, providing revenue stability and predictable demand for its renewable products.

Expanding Distribution Networks

Aemetis is strategically broadening its distribution channels to ensure its renewable natural gas (RNG) reaches a wider market. A key initiative involves expanding its biogas pipeline infrastructure in California, directly connecting its production facilities to the broader natural gas grid. This expansion is crucial for delivering RNG to a larger customer base within the transportation and energy sectors.

The company is also actively investigating the development of RNG dispensing stations. These stations would offer convenient access points for consumers looking to fuel their vehicles with sustainable alternatives. By increasing accessibility, Aemetis aims to capture greater market share and drive adoption of its RNG products.

This focus on distribution network enhancement is directly tied to Aemetis's growth strategy, aiming to capitalize on the increasing demand for low-carbon fuels. For instance, by mid-2024, the company was progressing with its Keyes RNG project, which is expected to produce approximately 2.2 million MMBtu of RNG annually once fully operational, highlighting the scale of distribution needed.

Key distribution expansion efforts include:

- Biogas pipeline expansion: Connecting production sites to existing natural gas infrastructure for broad market access.

- RNG dispensing stations: Developing retail locations for direct sale to transportation fuel users.

- Strategic partnerships: Collaborating with fuel distributors and energy companies to leverage existing networks.

Global Market Reach

Aemetis strategically leverages its dual operational footprint in the United States and India to achieve a significant global market reach. This international presence allows the company to cater to diverse customer bases and capitalize on regional market dynamics.

The Aemetis India plant is a key hub, supplying customers not only within India but also across Europe. Meanwhile, its California operations are strategically positioned to serve the robust U.S. market, with a particular advantage derived from California's progressive low carbon fuel standards.

- India Operations: Serves domestic Indian market and exports to European customers.

- California Operations: Focuses on the U.S. market, benefiting from California's LCFS.

- Market Diversification: Global reach mitigates reliance on any single market.

- Strategic Advantage: California's LCFS provides a competitive edge for U.S. sales.

Aemetis's distribution strategy focuses on expanding access to its renewable natural gas (RNG) through pipeline integration and the development of dispensing stations. By mid-2024, the Keyes RNG project was advancing, targeting an annual output of approximately 2.2 million MMBtu of RNG, underscoring the need for robust distribution channels to serve a growing market for low-carbon fuels.

Full Version Awaits

Aemetis 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Aemetis 4P's Marketing Mix Analysis is fully complete and ready for immediate use.

Promotion

Aemetis prioritizes robust investor relations, consistently updating stakeholders through press releases, quarterly earnings calls, and detailed investor presentations. These channels are vital for disseminating information on financial performance, strategic achievements, and forward-looking growth initiatives.

For instance, during their Q1 2024 earnings call, Aemetis reported a significant increase in revenue, driven by strong demand for their renewable fuels. The company also detailed progress on its dairy RNG projects, aiming for a substantial increase in operational capacity by late 2024.

This transparent communication strategy aims to cultivate trust and attract a broad range of investors, from individual shareholders to institutional portfolio managers, by clearly outlining the company's value proposition and financial trajectory.

Aemetis actively promotes its dedication to sustainability and ESG principles, a key element of its marketing. The company consistently highlights the low and often negative carbon intensity of its renewable fuels, underscoring its contribution to decarbonization efforts.

This focus on utilizing agricultural waste as feedstock directly appeals to investors and stakeholders prioritizing environmental responsibility. For instance, Aemetis's Keyes facility in California achieved a negative carbon intensity of -22.36 for its dairy-derived renewable natural gas (RNG) in 2023, a significant data point for ESG-focused analysis.

Aemetis's leadership, including CEO Andy Smith, actively participates in key industry events. For instance, in 2024, executives presented at the International Fuel Ethanol Workshop & Expo, a premier gathering for the biofuel industry, and engaged in discussions with policymakers at the Renewable Fuels Association's annual meeting. This consistent presence elevates Aemetis's standing as a thought leader.

By sharing insights on renewable fuels and biochemicals, Aemetis influences policy and perception. Their participation in forums like the 2025 Advanced Biofuels Summit directly contributes to shaping the narrative around sustainable energy solutions, reinforcing their commitment to the clean energy sector's expansion.

Strategic Partnerships and Collaborations

Aemetis actively cultivates strategic partnerships to drive market adoption and secure future revenue. For instance, their agreements with airlines for Sustainable Aviation Fuel (SAF) offtake are vital for demonstrating market demand and ensuring a consistent customer base. These collaborations are foundational to validating the commercial feasibility and scalability of their innovative technologies.

Furthermore, Aemetis's collaborations with dairy farms for Renewable Natural Gas (RNG) projects highlight a commitment to building a robust supply chain and expanding their operational footprint. These alliances are not just about securing raw materials; they are instrumental in penetrating new markets and establishing long-term, predictable revenue streams.

The company's approach to partnerships is a key element in its marketing strategy, directly impacting its ability to grow and achieve its ambitious sustainability goals.

- Airline offtake agreements: Aemetis has secured agreements with major airlines, such as the one with Delta Air Lines for SAF, demonstrating a clear market demand and commitment from key industry players.

- Dairy farm collaborations: Partnerships with numerous dairy farms across California are essential for sourcing the necessary feedstock for their RNG production facilities, ensuring a consistent and sustainable supply.

- Market penetration: These strategic alliances are critical for Aemetis to gain a foothold in competitive markets and establish its brand as a leader in low-carbon fuels and renewable energy.

- Revenue stream security: By locking in offtake agreements and securing feedstock supply through partnerships, Aemetis enhances the predictability and stability of its future revenue generation.

Government and Policy Advocacy

Aemetis actively engages with government and policy makers to champion renewable fuel initiatives. This includes advocating for programs like the California Low Carbon Fuel Standard (LCFS), which provides a financial incentive for low-carbon intensity fuels. For instance, in 2024, the LCFS credit price has seen fluctuations, impacting the economics of renewable fuel production.

Furthermore, Aemetis leverages federal tax credits, such as Section 45Z, to enhance the profitability of its sustainable products. These credits are crucial for making low-carbon fuels competitive with traditional fossil fuels. The Inflation Reduction Act of 2022 significantly expanded and extended many of these crucial tax incentives through 2032, creating a more stable and attractive market.

This proactive government relations strategy is essential for Aemetis, as it directly influences the regulatory landscape and market demand for its offerings. A favorable policy environment, supported by these incentives, is a cornerstone for the company's growth and the successful commercialization of its advanced biofuels and renewable chemicals.

Key aspects of Aemetis's government and policy advocacy include:

- Advocacy for LCFS: Supporting and promoting policies like the California LCFS that create market demand and value for low-carbon fuels.

- Leveraging Federal Tax Credits: Utilizing incentives such as Section 45Z to improve the economic viability of renewable fuel production, with extensions through 2032 under the IRA.

- Shaping Favorable Regulations: Working to establish and maintain a regulatory framework that encourages investment and growth in the renewable fuels sector.

- Building Stakeholder Relationships: Engaging with policymakers, industry associations, and other stakeholders to advance the company's strategic objectives.

Aemetis's promotional efforts center on highlighting its ESG credentials and thought leadership within the renewable fuels sector. The company actively communicates its low-carbon intensity achievements, such as the -22.36 CI score for its dairy RNG in 2023, to attract environmentally conscious investors.

Executives regularly present at key industry events, like the 2024 International Fuel Ethanol Workshop & Expo, positioning Aemetis as an innovator and influencer in sustainable energy solutions.

These promotional activities aim to build brand recognition and demonstrate Aemetis's commitment to decarbonization, resonating with a growing segment of the investment community focused on sustainability.

Price

Aemetis employs value-based pricing for its biofuels, directly linking cost to the significant environmental benefits and regulatory compliance advantages offered. This strategy recognizes that customers are willing to pay more for low carbon intensity fuels, especially those that help them meet sustainability goals and navigate environmental regulations.

A key component of this value proposition is the inclusion of Low Carbon Fuel Standard (LCFS) credits. For instance, in California, LCFS credits have traded in a range, with prices reaching over $100 per metric ton of CO2 equivalent in late 2023 and early 2024, allowing Aemetis to capture a premium over traditional fossil fuels.

Aemetis strategically integrates carbon credits, like California's Low Carbon Fuel Standard (LCFS) credits and the federal Section 45Z Production Tax Credits, directly into its pricing and profitability models for renewable natural gas and ethanol. These credits are not just an add-on; they fundamentally shape the economic viability of its products.

The company's ability to generate and sell these transferable tax credits provides a significant and reliable source of cash flow. For instance, in the first quarter of 2024, Aemetis reported generating $19.7 million in LCFS credits, demonstrating the substantial financial impact of this strategy.

Aemetis is strategically securing long-term offtake agreements, a critical component of its marketing strategy. These agreements are crucial for ensuring consistent demand for its products, particularly its sustainable aviation fuel (SAF) and biodiesel.

Major airlines are key partners for SAF offtake, providing a stable customer base. Similarly, oil marketing companies are entering into agreements for biodiesel, demonstrating broad market acceptance. For instance, Aemetis announced a significant expansion of its renewable jet fuel production capacity in 2024, underscoring the growing demand and the importance of these secured offtake commitments.

These agreements often feature cost-plus pricing or fixed pricing structures for extended durations, typically five to ten years. This provides Aemetis with exceptional revenue predictability and financial stability, mitigating market volatility and allowing for more confident long-term planning and investment.

Market-Competitive Pricing

Aemetis navigates the dynamic renewable fuel landscape by balancing environmental advantages with the realities of competitive fuel markets. Its pricing reflects a keen awareness of external pressures, including competitor pricing and the fluctuating demand for sustainable energy solutions. The company strives to offer products that are not only environmentally sound but also economically attractive to a broad customer base.

The company's pricing strategy aims to capture market share by being competitive, even as it leverages the value proposition of its renewable products. This approach ensures that Aemetis remains a viable option for consumers seeking greener alternatives without compromising on cost-effectiveness. For instance, in 2024, the renewable diesel market saw significant growth, with prices influenced by crude oil benchmarks and government mandates, areas Aemetis actively monitors.

- Competitive Positioning: Aemetis prices its renewable fuels to align with or undercut conventional fuel prices where feasible, considering the total cost of ownership for customers.

- Market Demand Influence: Pricing is adjusted based on current and projected demand for renewable fuels, influenced by factors like seasonal driving patterns and industrial activity.

- Incentive Integration: While environmental incentives bolster profitability, pricing decisions ensure that the base product remains competitive even without these subsidies.

- Value Perception: Aemetis aims to price its products to reflect the premium associated with sustainability and reduced carbon intensity, appealing to environmentally conscious buyers.

Cost-Efficiency and Production Scalability

Aemetis is actively driving down production costs by implementing efficiency upgrades and transitioning to electrification. For instance, the company's focus on utilizing lower-cost sustainable feedstocks, such as agricultural waste, directly impacts its cost structure. In 2024, Aemetis reported that its renewable natural gas (RNG) production costs were significantly reduced through these initiatives, contributing to a more competitive market position.

The company's strategy emphasizes project scalability to unlock economies of scale, which is crucial for maintaining competitive pricing and enhancing profit margins. Expanding its dairy digester networks, a key growth area, allows Aemetis to process larger volumes of feedstock more efficiently. This expansion is projected to lead to a substantial decrease in per-unit production costs as capacity increases, further bolstering profitability.

- Cost Reduction Initiatives: Aemetis focuses on efficiency upgrades, electrification, and leveraging lower-cost sustainable feedstocks to decrease production expenses.

- Scalability Benefits: Expanding operations, such as dairy digester networks, enables economies of scale, leading to competitive pricing.

- Profitability Enhancement: Achieved economies of scale directly translate into improved profit margins for Aemetis's products.

- Feedstock Optimization: The strategic use of abundant and lower-cost sustainable feedstocks is a cornerstone of their cost-efficiency strategy.

Aemetis's pricing strategy for its renewable fuels is multifaceted, aiming to balance environmental value with market competitiveness. The company leverages its ability to generate significant carbon credits, such as California's LCFS, which directly enhance profitability and allow for premium pricing. For example, in Q1 2024, Aemetis generated $19.7 million in LCFS credits, demonstrating their financial impact.

These credits are integrated into the core pricing model, ensuring that Aemetis captures the economic benefits of its low-carbon products. While aiming for competitive pricing against conventional fuels, Aemetis also prices to reflect the premium associated with sustainability and reduced carbon intensity, appealing to environmentally conscious buyers.

The company's pricing is also influenced by long-term offtake agreements with major airlines and oil marketing companies, often featuring cost-plus or fixed structures for 5-10 years. This provides revenue predictability, as seen with the expansion of renewable jet fuel capacity in 2024 driven by secured commitments. Despite this, Aemetis monitors market demand and competitor pricing to remain viable.

Furthermore, Aemetis actively works to reduce production costs through efficiency upgrades, electrification, and the use of lower-cost feedstocks like agricultural waste. This focus on cost reduction, exemplified by reduced RNG production costs in 2024, supports their ability to offer competitive pricing while enhancing profit margins through economies of scale.

| Metric | Value | Period | Notes |

| LCFS Credit Generation | $19.7 million | Q1 2024 | Key revenue driver, impacting pricing premium |

| LCFS Credit Prices | > $100 per metric ton CO2e | Late 2023 - Early 2024 | Supports premium pricing over fossil fuels |

| Offtake Agreement Duration | 5-10 years | Ongoing | Ensures revenue predictability and stability |

| Renewable Fuel Market Growth | Significant | 2024 | Influenced by crude oil benchmarks and mandates |

4P's Marketing Mix Analysis Data Sources

Our Aemetis 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including SEC filings and investor presentations, alongside industry-specific market research and competitive intelligence reports. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.