Aemetis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aemetis Bundle

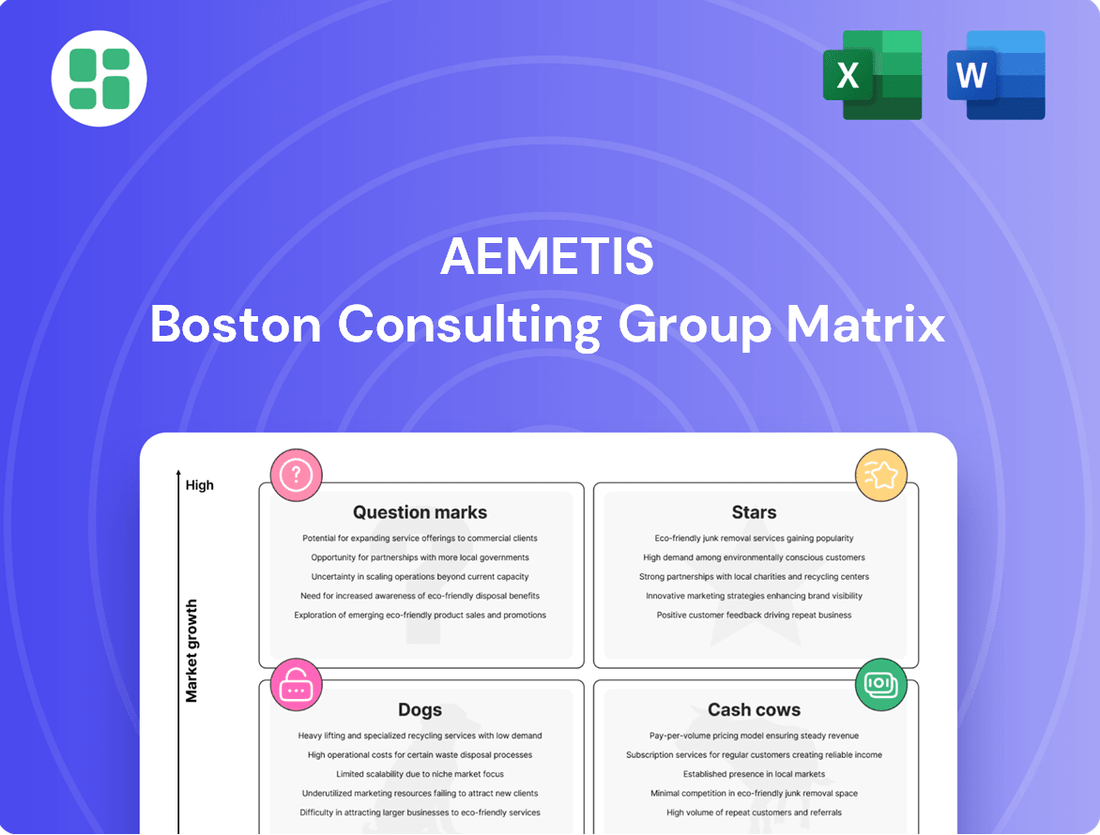

Curious about Aemetis's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but to truly grasp their strategic positioning, you need the full picture. Discover which products are driving growth, which are stable earners, and which require careful consideration.

Unlock the complete Aemetis BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments. Purchase the full report for actionable strategies.

Stars

Aemetis's Renewable Natural Gas (RNG) production is a star performer, demonstrating exceptional growth. The company saw annual revenues surge by 139% in 2024, followed by an impressive 140% year-over-year increase in Q1 2025, highlighting its rapid expansion in a critical decarbonization sector.

This robust expansion is fueled by Aemetis's strategic commissioning of new dairy digester facilities, significantly boosting its RNG production capacity. The company's aggressive build-out is directly addressing the surging demand for clean energy solutions, driven by global decarbonization mandates and supportive governmental policies.

Aemetis is aggressively expanding its renewable natural gas (RNG) production capacity. The company plans to increase output from 550,000 MMBtu per year in 2025 to a substantial 1 million MMBtu annually by the end of 2026.

This rapid growth is fueled by the construction of 10 new dairy digester projects planned for 2025, alongside the expansion of its biogas pipeline network. Such a significant scaling effort underscores Aemetis's strategy to capture a dominant position in the burgeoning RNG market.

The global Renewable Natural Gas (RNG) market is experiencing robust growth, with projections indicating compound annual growth rates (CAGRs) between 8.1% and over 40% in various analyses leading up to 2030. This expansion is fueled by escalating renewable energy mandates and a surge in waste-to-energy projects worldwide.

Favorable government policies are a significant driver, with programs like California's Low Carbon Fuel Standard (LCFS) and federal tax incentives actively promoting RNG production and consumption. For instance, the LCFS program in California has been instrumental in creating a strong demand signal for low-carbon fuels like RNG, directly impacting Aemetis's market position.

This confluence of strong market demand and supportive regulatory frameworks positions RNG as a strategic 'star' for Aemetis. The company's investments in RNG production, particularly in California, are well-aligned with these growth trends and policy tailwinds, suggesting significant potential for future revenue and market share expansion.

Strategic Infrastructure Development

Aemetis has strategically built out its renewable natural gas (RNG) infrastructure, a key component of its business. This includes 36 miles of biogas pipeline already in operation, with approvals for an additional 24 miles. This network connects multiple dairies to their central upgrading facility, creating significant operational efficiencies and a competitive edge in biogas collection.

The company's investment in a completed central biogas-to-RNG facility, along with its interconnection to the PG&E pipeline, further solidifies its market presence. This infrastructure development is crucial for scaling its RNG production and distribution capabilities.

- 36 miles of biogas pipeline operational.

- 24 miles of biogas pipeline approved for expansion.

- Central biogas-to-RNG facility completed and operational.

- PG&E pipeline interconnect established for distribution.

High Carbon Intensity Reduction Potential

Aemetis's biogas projects, specifically those producing renewable natural gas (RNG) from dairy waste, stand out due to their substantial carbon intensity reduction potential. Some of these projects have even achieved negative carbon intensity scores, a remarkable feat in the industry.

This strong environmental performance makes Aemetis's RNG particularly attractive in markets with stringent environmental regulations and a rising demand for fuels that significantly lower carbon footprints. For example, California's Low Carbon Fuel Standard (LCFS) incentivizes the use of such fuels.

The financial viability of this segment is further bolstered by the generation and sale of valuable credits. Aemetis can capitalize on LCFS credits in California and D3 RINs (Renewable Identification Numbers) under the U.S. Renewable Fuel Standard. In 2024, the value of these credits has seen fluctuations but remains a key driver of profitability for RNG producers.

- Significant Carbon Reduction: Projects achieving negative carbon intensity scores are highly valued.

- Market Demand: Strong demand exists in regions with strict environmental regulations.

- Credit Generation: Revenue streams from LCFS credits and D3 RINs enhance profitability.

- 2024 Market Context: The value of environmental credits is a crucial factor in the economic success of RNG projects.

Aemetis's Renewable Natural Gas (RNG) business is a clear star in its portfolio, exhibiting rapid growth and strong market positioning. The company reported a 139% revenue increase for RNG in 2024, with Q1 2025 showing a further 140% year-over-year jump, underscoring its expansion in the critical decarbonization sector.

This growth is directly tied to Aemetis's strategic build-out of dairy digester facilities, increasing its RNG production capacity significantly. The company plans to scale output from 550,000 MMBtu annually in 2025 to 1 million MMBtu by the end of 2026, supported by 10 new dairy digester projects in 2025 and pipeline network expansions.

The favorable regulatory environment, particularly California's Low Carbon Fuel Standard (LCFS), coupled with the generation of valuable D3 RINs in 2024, provides strong economic tailwinds. These factors, combined with RNG's negative carbon intensity potential, make this segment a high-growth, high-potential star performer for Aemetis.

| Metric | 2024 | Q1 2025 | Outlook 2026 |

| RNG Revenue Growth | 139% | 140% YoY | Continued strong growth |

| Production Capacity (MMBtu/yr) | N/A | 550,000 | 1,000,000 |

| Pipeline Network (Miles) | 36 operational | 36 operational | 60 approved |

What is included in the product

The Aemetis BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Aemetis BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, simplifying complex business unit analysis.

Cash Cows

Aemetis' established ethanol production facility in California is a clear Cash Cow. This operation boasts a 65 million gallon per year capacity and generated a robust $162 million in annual revenues in 2024, a significant 55% jump from the prior year. This facility represents a stable and substantial revenue generator for the company.

As the largest ethanol producer in California, Aemetis commands a considerable market share in a mature but consistently in-demand sector. This established position ensures a reliable income stream, characteristic of a Cash Cow within the BCG matrix.

Aemetis's California ethanol segment truly acts as a cash cow, demonstrating consistent volume and revenue generation. In 2024, this segment saw a remarkable 89% surge in volumes sold, reaching 60.6 million gallons.

This robust performance solidifies its position as a stable contributor to the company's financials. Even with moderate market growth for ethanol, averaging a 5-11% CAGR, Aemetis's facility consistently delivers high sales volumes.

This steady, high-volume output provides a bedrock of financial stability, a hallmark of a business unit operating as a cash cow within the Aemetis portfolio.

Aemetis is actively enhancing its Keyes ethanol plant's efficiency, a classic cash cow strategy. Investments like the recently completed solar microgrid, which provides a significant portion of the plant's electricity needs, and the ongoing development of a mechanical vapor recompression (MVR) system are prime examples.

These initiatives are designed to directly reduce operational energy costs and, importantly, lower the carbon intensity of their ethanol. For instance, the solar microgrid is projected to offset a substantial amount of grid electricity consumption, directly impacting the bottom line.

By focusing on optimizing existing operations through efficiency gains, Aemetis aligns with the typical cash cow approach of maximizing profitability from established assets rather than pursuing rapid market expansion.

Leveraging Existing Infrastructure

The Aemetis ethanol plant in California's Central Valley stands as a prime example of leveraging existing infrastructure, a key characteristic of a Cash Cow in the BCG Matrix. Its strategic location provides direct access to abundant agricultural waste, a critical feedstock for ethanol production. This proximity significantly reduces transportation costs and ensures a consistent supply chain.

Furthermore, the plant has established a vital connection with 80 dairies, integrating its operations with the local agricultural ecosystem. This partnership allows for the efficient utilization of animal feed byproducts, creating a circular economy model and enhancing revenue streams beyond just ethanol. This established network minimizes the need for substantial new infrastructure investments for its current production lines.

The efficient utilization of these existing assets is a direct driver of strong cash flow generation for Aemetis. By minimizing capital expenditure on new infrastructure, the company can focus on optimizing operations and maximizing profitability from its established facilities. This operational efficiency allows the plant to operate as a reliable source of consistent income.

- Strategic Location: Situated in California's Central Valley, close to agricultural waste sources.

- Dairy Integration: Connected to 80 dairies for byproduct utilization, reducing waste and creating revenue.

- Minimized CAPEX: Existing infrastructure reduces the need for new capital investments for current production.

- Cash Flow Generation: Efficient use of established assets leads to strong and consistent cash flow.

Government Policy Support for Biofuels

Government policy is a significant driver for the ethanol sector, positioning Aemetis's ethanol operations as a Cash Cow. The Renewable Fuel Standard (RFS) and various state-level mandates create a baseline demand for ethanol, ensuring a stable market. For instance, in 2024, the Environmental Protection Agency (EPA) continued to support ethanol by approving year-round sales of E15, a blend containing 15% ethanol. This regulatory certainty translates into predictable revenue streams.

These supportive policies create a reliable demand for ethanol, allowing Aemetis's facilities to operate efficiently and generate consistent cash flow. The predictability offered by these mandates is crucial for maintaining the Cash Cow status, as it minimizes market volatility and ensures consistent sales volumes.

- Renewable Fuel Standard (RFS): Mandates the use of renewable fuels, including ethanol, in the U.S. transportation fuel supply.

- State-Level Mandates: Numerous states have their own blending requirements, further bolstering ethanol demand.

- EPA Approval for E15: Facilitates broader market access for higher ethanol blends, supporting demand.

- Predictable Demand: These policies create a stable and predictable demand base for ethanol production.

Aemetis's California ethanol segment is a quintessential Cash Cow, demonstrating consistent volume and revenue. In 2024, this segment saw a remarkable 89% surge in volumes sold, reaching 60.6 million gallons, contributing to $162 million in annual revenues. This robust performance, fueled by supportive government policies like the Renewable Fuel Standard and EPA's E15 approval, solidifies its position as a stable contributor to the company's financials.

The company is actively enhancing its Keyes ethanol plant's efficiency through initiatives like a solar microgrid and mechanical vapor recompression (MVR) systems. These investments aim to reduce operational costs and lower carbon intensity, maximizing profitability from established assets. The plant's strategic location in California's Central Valley, close to agricultural waste and integrated with 80 dairies, further minimizes capital expenditure and ensures consistent cash flow generation.

| Metric | 2023 | 2024 (Estimate/Actual) | Change |

| Ethanol Production Capacity (California) | 65 million gallons/year | 65 million gallons/year | N/A |

| California Ethanol Revenues | $104.5 million | $162 million | +55% |

| California Ethanol Volumes Sold | 32.7 million gallons | 60.6 million gallons | +89% |

| Ethanol Market Growth (CAGR) | 5-11% | 5-11% | N/A |

Preview = Final Product

Aemetis BCG Matrix

The Aemetis BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures you know exactly what you are getting—a professional, analysis-ready strategic tool without any alterations or watermarks. You can confidently proceed with the knowledge that this preview accurately represents the complete, usable BCG Matrix report that will be yours to implement in your business planning.

Dogs

Aemetis's India biodiesel operations faced considerable revenue headwinds in late 2024 and early 2025. Specifically, the company reported a notable revenue drop in Q4 2024 and Q1 2025 due to disruptions in government tender processes.

These delays and gaps in offers from state-owned Oil Marketing Companies (OMCs) created an unstable demand environment. This inconsistency makes it difficult for Aemetis to forecast and secure predictable revenue streams, potentially impacting the segment's overall profitability and resource allocation.

Biodiesel falls into the question mark category of the BCG matrix, indicating moderate market growth. The global renewable biodiesel market is expected to expand at a compound annual growth rate of 7.35% between 2025 and 2032. This growth rate is less dynamic when contrasted with the faster expansion anticipated for renewable diesel and renewable natural gas (RNG) markets.

While Aemetis achieved a notable 20% revenue increase in its India segment during 2024, the biodiesel market's more measured expansion presents a challenge. Capturing significant new market share in this segment would likely require substantial, potentially high-risk investments, making it a strategic area requiring careful consideration.

The India biodiesel plant encountered odor complaints from local residents in late 2024. This situation poses a significant risk of operational disruptions and increased regulatory scrutiny, potentially diverting crucial management attention and resources away from core business activities. Such challenges can directly impact the segment's efficiency and profitability, introducing an element of uncertainty to its consistent performance.

Potential Cash Trap if Profitability Remains Elusive

Despite revenue growth in 2024, Aemetis faced mounting net losses, indicating profitability challenges. The India biodiesel segment, a key growth area, saw a significant downturn in Q1 2025 performance.

This trend raises concerns about the segment's potential to become a cash trap. If continued capital investment for expansion, such as increased capacity or a potential IPO, does not translate into consistent, robust profits, it could tie up significant funds with minimal returns.

- Revenue Growth vs. Net Losses: While Aemetis reported revenue growth in 2024, the company's net losses widened, highlighting operational inefficiencies or high costs.

- India Biodiesel Performance: The India biodiesel segment experienced a notable decline in performance during Q1 2025, signaling potential headwinds for this critical growth driver.

- Cash Trap Risk: Continued investment in expansion without a clear path to profitability for the India biodiesel segment could lead to a cash trap, immobilizing capital.

- Strategic Re-evaluation Needed: The current financial trajectory suggests a need for Aemetis to re-evaluate its investment strategy, particularly for the India biodiesel segment, to avoid further capital erosion.

Uncertainty of IPO and Future Strategic Direction

Aemetis's India subsidiary is currently in a precarious position, often categorized as a 'dog' in the BCG matrix due to its low market share and slow growth. The planned IPO, targeting late 2025 or early 2026, while intended to unlock value, introduces significant uncertainty. This IPO process itself could impact the segment's future ownership structure, potentially diluting existing control or shifting strategic priorities away from core Aemetis objectives.

The success of this IPO is far from guaranteed. If Aemetis fails to achieve its valuation targets or if market conditions are unfavorable, the IPO might be postponed or even canceled. Should the India segment falter post-IPO, perhaps due to intense competition or operational challenges, it would reinforce its 'dog' status. For instance, in 2024, the renewable fuels sector, while growing, faces volatility from fluctuating commodity prices and evolving regulatory landscapes, which could affect the India subsidiary's performance and its IPO prospects.

- IPO Uncertainty: The planned IPO of Aemetis's India subsidiary for late 2025/early 2026 introduces questions about future ownership and strategic direction.

- Market Position: The segment's current low market share and slow growth place it in the 'dog' category of the BCG matrix.

- Performance Risk: A failure to execute the IPO successfully or struggles post-IPO could solidify its 'dog' status within Aemetis's portfolio.

- Sector Volatility: The renewable fuels industry in 2024 experiences price and regulatory fluctuations that could impact the subsidiary's performance and valuation.

Aemetis's India biodiesel operations are currently classified as a 'dog' within the BCG matrix, characterized by low market share and slow growth. The planned IPO for late 2025 or early 2026 adds a layer of uncertainty regarding future ownership and strategic focus. A failure to achieve valuation targets or market struggles post-IPO could further entrench this segment's 'dog' status, especially given the 2024 volatility in renewable fuels due to commodity prices and regulations.

| Segment | BCG Category | Key Challenges | 2024/2025 Outlook |

| India Biodiesel | Dog | Low Market Share, Slow Growth, Government Tender Disruptions, Odor Complaints, Net Losses | Revenue headwinds in Q4 2024/Q1 2025, IPO uncertainty, potential cash trap risk |

Question Marks

Aemetis is strategically positioning itself with its 90 million gallon per year sustainable aviation fuel (SAF) and renewable diesel (RD) plant in Riverbank, California. This project, which has already secured its permits, is poised to tap into a market with substantial projected growth, with estimates suggesting a compound annual growth rate (CAGR) as high as 16.69% in the coming years.

Currently, this ambitious venture holds zero market share because it is not yet operational. This places the Riverbank plant squarely in the 'Question Mark' category of the BCG Matrix, signifying a high-potential area for future growth that requires significant investment and strategic development to capture market share.

Aemetis is actively developing Carbon Capture and Underground Sequestration (CCUS) projects, including a key well site near its California biofuels facilities. This strategic move positions the company to leverage a technology crucial for achieving negative carbon intensity, a rapidly growing market segment.

While CCUS holds significant promise for future emissions reduction and revenue generation through credits, it remains in its developmental stages. As such, it represents a nascent technology with high future potential but no current revenue, fitting the 'Question Mark' category in the BCG matrix.

The Riverbank SAF/RD plant and its associated CCUS projects represent significant capital outlays for Aemetis. In 2024, the company is planning substantial expenditures on these low-carbon initiatives, reflecting their early-stage development and construction phases.

Currently, these ventures are cash-intensive, meaning they consume considerable financial resources without yet generating commensurate returns. This cash burn is typical for large-scale infrastructure projects in their formative stages.

The successful realization of these projects is critically dependent on Aemetis's ability to secure sufficient funding and ensure their timely completion, which are key dependencies for future profitability.

Future Revenue Stream Dependent on Project Completion

Aemetis's future revenue streams are heavily reliant on the successful completion of its Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) plant, along with its Carbon Capture, Utilization, and Storage (CCUS) project. These ventures are anticipated to generate significant revenues and earnings before interest, taxes, depreciation, and amortization (EBITDA) in the coming years.

Until these key projects are fully operational and achieving scale, their market share and cash-generating potential remain speculative. Their successful execution is critical for Aemetis to potentially transition these ventures into the 'Stars' category of the BCG matrix, signifying high growth and high market share.

- Projected Revenue Impact: The SAF/RD plant, upon full operation, is expected to contribute substantially to Aemetis's top line, with initial projections indicating significant revenue generation capacity.

- EBITDA Potential: Similarly, the CCUS project is designed to enhance profitability, with EBITDA forecasts showing a strong positive impact once operational.

- Completion Risk: The primary challenge is the timely and successful completion of these capital-intensive projects, which directly influences the realization of projected financial benefits.

- Transition to Stars: If Aemetis navigates the construction and operational phases successfully, these projects could become dominant players in their respective markets, mirroring the characteristics of 'Stars' in a BCG analysis.

High Growth Market with Nascent Aemetis Presence

Both the renewable diesel/Sustainable Aviation Fuel (SAF) and carbon sequestration markets are experiencing robust, high growth. This expansion is fueled by worldwide decarbonization initiatives and increasingly strict environmental mandates. For instance, the global SAF market is projected to reach $15.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 45.1%. Similarly, the carbon capture, utilization, and storage (CCUS) market is expected to grow significantly, with some estimates placing its value at over $100 billion by 2030.

Aemetis's strategic positioning in these burgeoning sectors, particularly with its renewable fuel projects and carbon sequestration plans, is timely. However, due to the early-stage nature of these ventures, the company's current market share is minimal. For example, while Aemetis is developing significant renewable fuel capacity, its operational output relative to the total market is still nascent.

- High Growth Markets: Renewable diesel/SAF and carbon sequestration are rapidly expanding due to decarbonization goals and regulations.

- Strategic Entry: Aemetis's move into these sectors is well-timed to capture future demand.

- Nascent Market Share: The company's current participation is limited by the developmental phase of its projects.

- Future Opportunity: Rapidly increasing market share post-operation is key to leveraging this growth potential.

Aemetis's Riverbank plant and CCUS initiatives are in their early stages, demanding substantial investment without current revenue generation. This places them firmly in the Question Mark category of the BCG Matrix, highlighting their high growth potential but also their significant execution risk. The company's 2024 financial reports will likely reflect continued cash outflows for these projects as they progress through development and construction phases.

| Project/Initiative | BCG Category | Market Growth | Current Market Share | Investment Requirement |

| Riverbank SAF/RD Plant | Question Mark | High (e.g., 16.69% CAGR projected for SAF) | 0% (Pre-operational) | High (Capital Intensive) |

| CCUS Projects | Question Mark | High (Growing market driven by decarbonization) | Nascent/Minimal | High (Developmental Costs) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.