Aemetis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aemetis Bundle

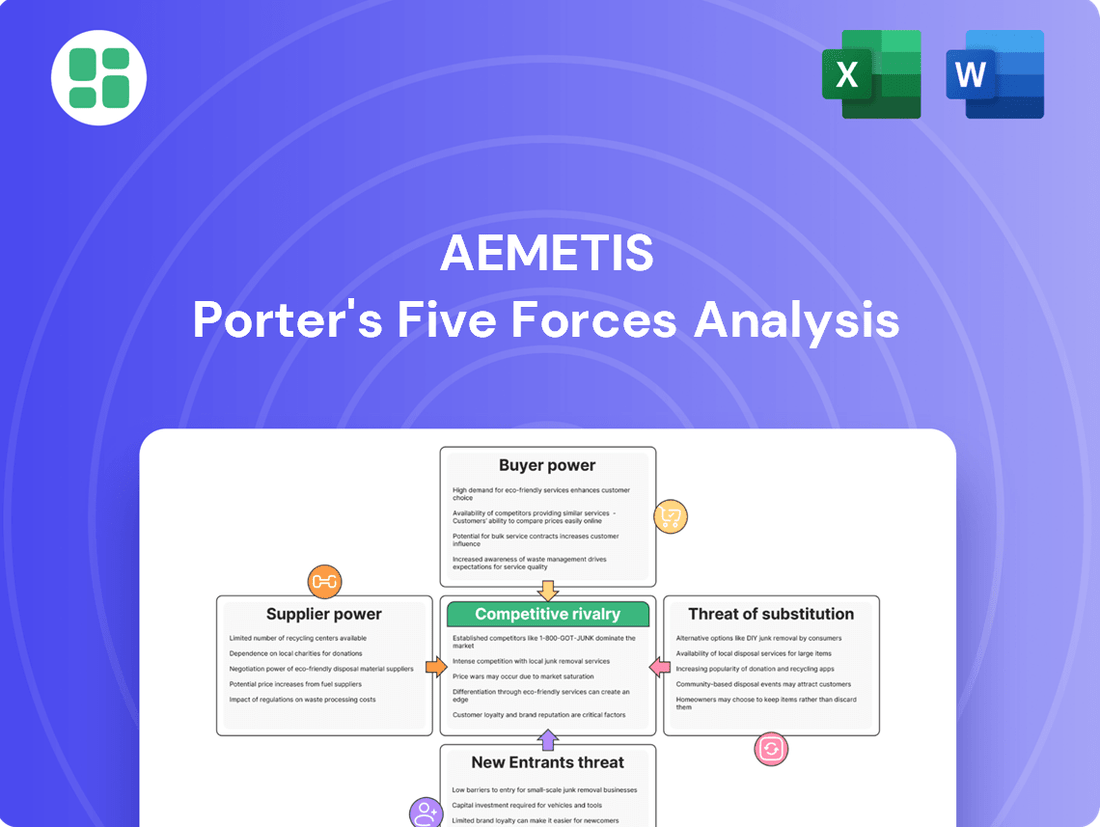

Aemetis faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers influencing its profitability. The threat of new entrants and substitutes also presents significant challenges, demanding strategic agility.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aemetis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aemetis's reliance on agricultural waste and sustainable feedstocks, such as dairy waste and orchard waste wood, positions its suppliers with significant bargaining power. The availability and price stability of these specialized inputs, including used cooking oil and animal fats, are subject to agricultural cycles, weather patterns, and competing industrial demands, all of which can escalate supplier leverage.

Recent market data from early 2024 highlights a considerable tightening in the supply of waste-based biofuel feedstocks, driving prices to multi-year highs. This upward price pressure directly impacts Aemetis's cost of goods sold, underscoring the substantial influence suppliers hold over the company's operational expenses.

The concentration of suppliers for specific agricultural wastes or advanced feedstocks can significantly influence their bargaining power over Aemetis. While general agricultural waste is abundant, niche or premium feedstocks may originate from a smaller pool of substantial suppliers.

Aemetis's strategic move to expand its dairy digester network is a clear indicator of its effort to gain more direct control over its renewable natural gas (RNG) feedstock. This expansion aims to diversify its supplier base by securing supply from a multitude of dairies, thereby mitigating the risks associated with reliance on a few key suppliers.

Aemetis faces potential supplier bargaining power due to significant switching costs. For instance, altering feedstock sources might necessitate costly retooling of production facilities and the negotiation of new supply agreements. This investment in specialized infrastructure, particularly for processing unique waste streams like dairy manure and orchard waste wood, can lock Aemetis into existing supplier relationships, thereby strengthening those suppliers' leverage.

Uniqueness of Feedstock

The uniqueness of Aemetis's chosen feedstocks significantly influences supplier bargaining power. If Aemetis relies on agricultural waste or sustainable materials with specific properties crucial for its low-carbon intensity products, suppliers of these niche materials can indeed demand premium pricing.

Aemetis's strategy to incorporate feedstocks contributing to negative carbon intensity, such as waste wood for Sustainable Aviation Fuel (SAF), further amplifies supplier leverage. The limited availability of alternative suppliers for such specialized, environmentally beneficial materials strengthens their negotiating position.

- Feedstock Specificity: Aemetis's focus on unique, low-carbon feedstocks like waste wood for SAF means fewer suppliers can meet these precise requirements.

- Environmental Benefits: Feedstocks that enable negative carbon intensity, a key differentiator for Aemetis, are inherently scarcer and held by suppliers with greater bargaining power.

- Market Demand for SAF: The growing global demand for SAF, projected to reach over 100 billion liters by 2050, increases the value and negotiating strength of suppliers of qualifying feedstocks.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into renewable fuels production, such as ethanol or renewable natural gas, could significantly boost their bargaining power. This would allow them to capture more of the value chain.

However, the substantial capital investment and specialized technological expertise needed for Aemetis's conversion processes, like those for renewable diesel, present a considerable hurdle for most agricultural waste suppliers. For instance, establishing a renewable natural gas facility can require hundreds of millions of dollars in upfront capital.

This high barrier to entry effectively diminishes the direct threat of forward integration by these suppliers, thereby moderating their potential to exert greater influence over Aemetis.

Aemetis's reliance on specialized, low-carbon feedstocks, such as dairy manure and orchard waste wood, grants suppliers significant bargaining power. The unique nature of these materials, coupled with increasing market demand for sustainable fuels, allows suppliers to command higher prices. This is evident in early 2024 data showing multi-year highs for waste-based biofuel feedstock prices, directly impacting Aemetis's cost of goods sold.

The limited number of suppliers capable of providing feedstocks that enable negative carbon intensity, a key differentiator for Aemetis, further amplifies their leverage. For example, the growing global demand for Sustainable Aviation Fuel (SAF), projected to exceed 100 billion liters by 2050, increases the negotiating strength of suppliers of qualifying feedstocks.

| Feedstock Type | Supplier Concentration | Impact on Aemetis | 2024 Price Trend |

|---|---|---|---|

| Dairy Manure | Moderate to High | High, due to specialized processing | Increasing |

| Orchard Waste Wood | Moderate | High, for SAF production | Multi-year Highs |

| Used Cooking Oil | Moderate | Moderate, subject to competing demands | Increasing |

What is included in the product

Aemetis' Porter's Five Forces Analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the renewable fuels and biochemicals industry.

Effortlessly visualize competitive pressures with a dynamic, interactive dashboard that highlights key Aemetis strategic advantages.

Customers Bargaining Power

Aemetis's customer base is concentrated, with significant reliance on government oil marketing companies (OMCs) in India for its biodiesel sales. These large-volume buyers possess substantial bargaining power, enabling them to negotiate favorable pricing and contract terms. For instance, Aemetis's 2023 financial reports indicated that a significant portion of its revenue was tied to these OMC contracts.

Similarly, its US operations serve the transportation sector with renewable natural gas and ethanol. The sheer volume these customers purchase gives them leverage. Delays in securing contracts with Indian OMCs, as seen in past reporting periods, directly impacted Aemetis's revenue streams, underscoring the substantial influence these major customers wield.

Customers considering Aemetis's renewable fuels have a range of alternatives, including traditional petroleum-based fuels. The competitive landscape also features other companies offering various renewable fuel options, each with its own pricing and performance characteristics. This availability directly impacts how much customers are willing to pay for Aemetis's offerings, as they can easily switch if prices are too high or performance is lacking.

For Aemetis, the bargaining power of customers is significantly influenced by switching costs. Generally, these costs are quite low, especially for products like renewable diesel that are chemically indistinguishable from traditional petroleum diesel. This ease of transition means customers can readily shift to competitors without incurring substantial expenses, thereby enhancing their leverage.

This low switching cost directly impacts customer loyalty, giving them more power in negotiations. For instance, a fleet operator can switch from Aemetis's renewable diesel to another supplier's product with minimal disruption. However, regulatory frameworks, such as California's Low Carbon Fuel Standard (LCFS), create a counterbalancing effect by incentivizing the adoption of low-carbon fuels, which can somewhat anchor customer demand for Aemetis's offerings.

Customer Price Sensitivity

Customers in the transportation and energy sectors, where Aemetis operates, are typically very sensitive to price. This is largely because fuels are treated as commodities, and these industries often contend with narrow operating profit margins, making cost a primary consideration.

Aemetis can mitigate some of this price sensitivity by offering low-carbon intensity products. These products can generate valuable regulatory credits, such as Low Carbon Fuel Standard (LCFS) credits in California and Renewable Identification Numbers (RINs) under the Renewable Fuel Standard. These credits add an extra layer of value for customers, making the overall offering more attractive beyond just the base fuel price.

The impact of government policies and support is a crucial factor in how customers perceive the value of Aemetis's products. For instance, the LCFS program in California, which aims to reduce the carbon intensity of transportation fuels, directly influences the economics for Aemetis and its customers. In 2023, LCFS credit prices fluctuated, with some periods seeing prices above $100 per metric ton, demonstrating the significant financial impact of these policies on the market for low-carbon fuels.

- Customer Price Sensitivity: High in transportation and energy sectors due to commodity nature of fuels and tight margins.

- Value Proposition Enhancement: Low-carbon intensity products generate regulatory credits (LCFS, RINs), offsetting price sensitivity.

- Policy Impact: Government support, like California's LCFS, significantly influences customer value perception and Aemetis's competitive advantage.

- Market Data: LCFS credit prices in 2023 saw periods exceeding $100 per metric ton, highlighting policy's economic significance.

Threat of Backward Integration by Customers

The threat of customers integrating backward into renewable fuel production for companies like Aemetis is generally low. This is primarily due to the substantial barriers to entry, including the need for specialized infrastructure and significant capital investment, which most transportation or fuel distribution companies do not possess.

Developing and operating complex biofuel production facilities requires a high degree of technical expertise and a considerable financial commitment. For instance, Aemetis's advanced ethanol and biodiesel plants involve sophisticated processes and adherence to stringent environmental regulations, making them difficult for typical customers to replicate.

This lack of readily available expertise and resources significantly limits the customers' ability to exert leverage through backward integration. Consequently, their direct bargaining power in this regard is diminished, as they are unlikely to undertake such a complex and costly endeavor.

- High Capital Requirements: Building renewable fuel plants can cost hundreds of millions of dollars, a prohibitive sum for most end-users.

- Technical Expertise Gap: Operating advanced biofuel facilities demands specialized knowledge in chemical engineering, process management, and regulatory compliance.

- Regulatory Hurdles: Navigating the complex web of permits and compliance for fuel production is a significant barrier for non-industry players.

- Limited Economies of Scale: Individual customers attempting backward integration would likely struggle to achieve the economies of scale that established producers like Aemetis benefit from.

Aemetis faces considerable customer bargaining power, particularly from large-volume buyers like Indian Oil Marketing Companies (OMCs) and US transportation sector entities. These customers' ability to negotiate favorable pricing and terms is amplified by the commodity nature of fuels and their own tight profit margins, making price a critical factor. The availability of alternatives, including traditional petroleum fuels and other renewable options, further empowers these customers.

Switching costs for Aemetis's renewable fuels are generally low, especially for products like renewable diesel that are chemically similar to petroleum diesel. This ease of substitution allows customers to shift suppliers without significant disruption, enhancing their leverage in negotiations. However, regulatory incentives like California's Low Carbon Fuel Standard (LCFS) can somewhat mitigate this by increasing the value proposition of low-carbon fuels, as seen with LCFS credit prices exceeding $100 per metric ton at times in 2023.

The threat of backward integration by customers is minimal for Aemetis. The substantial capital investment, specialized technical expertise, and complex regulatory compliance required to establish biofuel production facilities act as significant barriers to entry for most end-users.

| Factor | Aemetis's Situation | Impact on Bargaining Power |

| Customer Concentration | High reliance on large OMCs in India and major US transportation clients. | Increases bargaining power due to volume and negotiation leverage. |

| Availability of Alternatives | Presence of traditional petroleum fuels and competing renewable fuel providers. | Empowers customers to switch based on price and performance. |

| Switching Costs | Generally low, especially for chemically similar renewable diesel. | Enhances customer ability to change suppliers, increasing leverage. |

| Price Sensitivity | High due to fuels being commodities and tight margins in target industries. | Customers prioritize cost, pressuring Aemetis on pricing. |

| Backward Integration Threat | Low due to high capital, technical, and regulatory barriers. | Limits customer leverage through self-production. |

Preview Before You Purchase

Aemetis Porter's Five Forces Analysis

This preview showcases the complete Aemetis Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within its industry. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, ensuring no surprises. This comprehensive analysis is ready for your immediate use, providing actionable insights into Aemetis's strategic positioning.

Rivalry Among Competitors

The renewable fuels and biochemicals sector is experiencing robust growth, drawing in a wide array of companies. This includes established energy giants venturing into renewables alongside nimble, specialized biofuel producers. The sheer number and varied nature of these players create a dynamic and often intense competitive environment.

While Aemetis strategically targets specific segments such as dairy-derived renewable natural gas (RNG) and advanced biofuels derived from waste streams, its competitive arena is much broader. The market encompasses traditional ethanol and biodiesel producers, as well as the rapidly expanding segments of renewable diesel and sustainable aviation fuel (SAF). This diversity of offerings and market approaches significantly heightens the overall rivalry.

The renewable energy sector, particularly renewable diesel and biofuels, is booming. Projections indicate the global renewable energy market will expand at a compound annual growth rate of 17.23% between 2025 and 2034. This rapid expansion, while seemingly reducing competition by creating more opportunities, actually intensifies rivalry. Many companies are investing heavily and scaling up operations, including Aemetis itself, leading to fierce competition for market share and essential feedstocks.

Aemetis distinguishes its offerings by concentrating on low and negative carbon intensity fuels derived from sustainable sources, such as agricultural waste. This strategic focus, bolstered by supportive policies like the Low Carbon Fuel Standard (LCFS) and Inflation Reduction Act (IRA) tax credits, helps to lessen direct price-based competition.

While Aemetis benefits from its early mover advantage in this niche, the competitive landscape is dynamic. As more companies invest in and develop similar low-carbon fuel technologies, the distinctiveness of Aemetis's products may diminish over time, potentially intensifying rivalry in the future.

Exit Barriers

The renewable fuels sector, including companies like Aemetis, faces considerable exit barriers due to the substantial capital investment required for specialized production facilities and infrastructure. This high upfront cost makes it difficult and expensive for firms to leave the market, even when facing financial challenges. Consequently, companies may continue operating at reduced capacity or with lower profitability, contributing to ongoing competitive pressure.

Aemetis, for instance, has made significant capital expenditures to establish its renewable fuel production capabilities. For example, the company's Keyes facility, a key asset in its portfolio, involves substantial investment in infrastructure for producing advanced biofuels. These investments create a strong incentive to remain in the market rather than abandon the sunk costs, intensifying rivalry among existing players.

- High Capital Investment: Significant upfront costs for specialized renewable fuel production plants and related infrastructure.

- Sunk Costs: Investments in facilities and technology are largely irrecoverable if a company exits the market.

- Industry Specificity: Assets are often designed for specific biofuel production, limiting their use or resale value elsewhere.

- Aemetis Example: Substantial capital deployed by Aemetis in its facilities, such as the Keyes plant, exemplifies these high exit barriers.

Cost Structure and Capacity Utilization

Aemetis faces intense competitive rivalry, largely driven by the significant fixed costs inherent in its large-scale biorefineries and extensive digester networks. These substantial upfront investments mean that achieving high capacity utilization is not just beneficial, but absolutely critical for the company to reach profitability.

Companies that can operate more efficiently or secure cheaper feedstocks are positioned to gain a significant competitive edge. This often translates into intense price pressures within the industry, as players vie for market share. For instance, in the renewable fuels sector, feedstock costs can represent a major portion of a company's overall expenses.

- High Fixed Costs: Biorefineries and digester networks require substantial capital investment.

- Capacity Utilization is Key: Profitability hinges on operating plants at or near full capacity.

- Efficiency and Feedstock Costs: Operational efficiency and access to low-cost raw materials are major competitive differentiators.

- Price Pressures: Superior efficiency and feedstock access can lead to pricing advantages, impacting rivals.

Aemetis's ongoing efforts to reduce energy costs and enhance operational efficiency across its various plants are therefore paramount. These initiatives directly impact their ability to compete on price and maintain healthy margins in a challenging market landscape.

The competitive rivalry for Aemetis is intense, fueled by a growing market and significant capital investments. Companies are vying for market share and essential feedstocks, with efficiency and feedstock costs acting as key differentiators.

The renewable fuels sector is experiencing rapid growth, projected to expand significantly. This expansion attracts numerous players, from energy giants to specialized biofuel producers, all competing for a slice of the market. Aemetis's focus on low-carbon fuels, while a strategic advantage, operates within this broader, highly competitive landscape.

| Metric | Value | Source | Year |

|---|---|---|---|

| Global Renewable Energy Market CAGR | 17.23% | Market Research Report | 2025-2034 |

| Aemetis Keyes Facility Investment | Significant Capital Expenditure | Company Filings | Ongoing |

| Feedstock Cost as % of Expenses | Major Portion | Industry Analysis | 2024 |

SSubstitutes Threaten

Traditional petroleum fuels like diesel, gasoline, and jet fuel are significant substitutes for Aemetis's renewable products. Despite the push for sustainability, these conventional fuels often maintain a cost advantage and wider availability, presenting a substantial challenge to Aemetis, particularly in markets lacking robust regulatory support or high carbon pricing mechanisms. For instance, in 2024, the price volatility of crude oil directly impacts the competitiveness of biofuels, with lower oil prices making petroleum fuels a more attractive option for many consumers and businesses.

While Aemetis is active in ethanol, renewable natural gas, and renewable diesel, the threat of substitutes is significant. Other companies are developing and producing alternative biofuels from diverse feedstocks and through innovative processes. For instance, advanced biofuels derived from non-food sources and e-fuels synthesized using renewable electricity and captured carbon represent growing competitive forces.

The market for sustainable fuels is rapidly expanding and technologically diverse. Many companies are exploring various pathways, including bio-based chemicals that can serve similar energy or industrial needs. This broad landscape of innovation means that Aemetis faces competition not just from direct ethanol or diesel alternatives but also from a wider array of bio-based and synthetic fuel solutions.

Electric vehicles (EVs) and hydrogen fuel cell vehicles represent significant long-term substitutes for traditional liquid fuels in transportation. As of early 2024, EV adoption continues to grow, with global sales projected to reach over 13 million units in 2024, a substantial increase from previous years. This trend could eventually dampen demand for advanced biofuels, particularly in light-duty vehicle segments.

However, the threat from these substitutes is currently mitigated for specific sectors. For instance, in heavy-duty transport and aviation, where energy density and refueling times are critical, liquid fuels like Sustainable Aviation Fuel (SAF) remain essential for decarbonization efforts. Aemetis, a player in the advanced biofuels market, is focusing on SAF production, recognizing this ongoing demand.

Efficiency Improvements and Conservation

Improvements in fuel efficiency and conservation efforts represent a significant threat of substitution for companies like Aemetis. As vehicles and industrial processes become more efficient, less fuel is required to achieve the same output. This directly reduces the demand for the very products Aemetis produces, potentially impacting sales volumes. For instance, the average fuel economy for new passenger cars sold in the U.S. reached approximately 26.0 miles per gallon in 2023, a steady increase over the years.

While efficiency gains can curb fuel demand, overall energy consumption is still growing in certain sectors. The burgeoning demand from data centers, for example, is a counteracting force. These facilities require substantial amounts of energy, which could offset some of the reductions seen in transportation and other industries. In 2024, global data center energy consumption was projected to reach around 200 terawatt-hours, a figure that continues to climb.

This dynamic creates a complex landscape for Aemetis. The threat of substitution through efficiency is real, but it's partially mitigated by the increasing energy needs of emerging technologies. Understanding these competing trends is crucial for strategic planning.

- Reduced Fuel Demand: Advances in vehicle and industrial efficiency directly lower the need for traditional and alternative fuels.

- Energy Conservation: Broader societal and corporate efforts to conserve energy further decrease overall fuel consumption.

- Sectoral Growth: Rising energy demands from sectors like data centers can partially offset efficiency-driven reductions.

- Impact on Sales: These substitution effects can lead to lower sales volumes for fuel producers if not adequately managed.

Public Policy and Regulatory Environment

Government policies play a crucial role in shaping the threat of substitutes for companies like Aemetis. Regulations such as carbon taxes and mandates for renewable fuels, like the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standard (LCFS), directly impact the cost-competitiveness of alternative energy sources compared to traditional petroleum products. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides significant tax credits for renewable energy projects, including advanced biofuels, which directly bolsters the attractiveness of Aemetis' offerings.

The strength and stability of these policies are paramount. Robust government support for low-carbon fuels effectively reduces the threat posed by conventional fossil fuels by making alternatives more economically viable. Conversely, any weakening or uncertainty in these policy frameworks can increase the threat of substitutes, as it may diminish the cost advantage of renewable options. This dynamic means that shifts in public policy can rapidly alter the competitive landscape for companies operating in the renewable energy sector.

- Government policies like carbon taxes and fuel mandates directly influence the cost-competitiveness of renewable fuels versus traditional petroleum.

- The Inflation Reduction Act (IRA) tax credits are a significant driver for companies like Aemetis, enhancing the viability of their renewable energy solutions.

- Strong, consistent policies favoring low-carbon fuels diminish the threat of conventional alternatives.

- Policy changes or uncertainties can significantly alter the competitive threat from substitutes.

The threat of substitutes for Aemetis's renewable fuels is multifaceted, encompassing both traditional petroleum products and emerging alternative energy sources. While conventional fuels like diesel and gasoline may offer cost advantages, their long-term viability is challenged by sustainability mandates and the growing adoption of electric and hydrogen technologies. As of early 2024, global EV sales are projected to exceed 13 million units, signaling a significant shift in the transportation sector.

However, for specific applications like heavy-duty transport and aviation, advanced biofuels, including Sustainable Aviation Fuel (SAF) which Aemetis produces, remain critical. Efficiency improvements in vehicles and industrial processes also reduce overall fuel demand, a trend exemplified by the steady increase in average vehicle fuel economy. Despite this, the escalating energy needs of sectors such as data centers, projected to consume around 200 terawatt-hours in 2024, present a counterbalancing demand.

| Substitute Type | Key Characteristics | Impact on Aemetis | 2024 Data/Projections |

| Traditional Petroleum Fuels | Cost-competitiveness, availability | Direct competition, price sensitivity | Crude oil price volatility directly affects competitiveness. |

| Electric Vehicles (EVs) | Zero tailpipe emissions, growing adoption | Long-term threat to liquid fuel demand in light-duty transport | Global EV sales projected over 13 million units in 2024. |

| Hydrogen Fuel Cell Vehicles | Zero emissions, potential for green production | Future competitor, particularly in heavy transport | Continued investment and development in hydrogen infrastructure. |

| Advanced Biofuels (from other companies) | Diverse feedstocks, innovative processes | Competition within the renewable fuel market | Growth in non-food feedstock utilization and e-fuels. |

| Fuel Efficiency & Conservation | Reduced energy consumption per unit | Lower overall demand for all fuels | Average new passenger car fuel economy ~26.0 mpg in 2023 (US). |

Entrants Threaten

Building and running major renewable fuel plants, like those for renewable diesel or sustainable aviation fuel (SAF), demands significant upfront capital for land, machinery, and essential infrastructure. For instance, Aemetis's own initiatives, such as its Keyes, California renewable natural gas facility, involve substantial capital outlays, with the company securing significant funding, including USDA grants, to support these ventures.

These high financial hurdles act as a formidable barrier, deterring many potential new competitors from entering the market. The sheer scale of investment needed to establish a competitive presence in the renewable fuels sector, particularly for advanced biofuels, means that only well-capitalized entities can realistically consider entering, thus limiting the threat of new entrants.

The renewable fuels sector is a minefield of regulations, demanding intricate permits, thorough environmental impact studies, and adherence to numerous standards like the Low Carbon Fuel Standard and Renewable Fuel Standard. Successfully navigating this complex web is both time-consuming and costly, acting as a substantial deterrent for potential new players. Aemetis itself has secured the crucial air permits for its sustainable aviation fuel and renewable diesel facility, underscoring the significant barriers these regulatory requirements present.

New companies entering the renewable fuels market face significant hurdles in securing consistent access to sustainable feedstocks. For instance, obtaining reliable supplies of agricultural waste, dairy manure, or waste wood is paramount, and building the necessary logistics to collect these materials from potentially scattered sources is a considerable challenge. Aemetis, however, has proactively addressed this by establishing strong relationships with dairies and gaining access to orchard waste wood, giving it a distinct advantage.

Technology and Expertise

Developing and scaling advanced biofuel technologies, like those Aemetis employs to convert waste into fuels, demands significant scientific and engineering expertise. This specialized knowledge is a substantial barrier for potential new entrants. Aemetis's established operational experience in optimizing these complex conversion processes creates a distinct competitive advantage that is not easily replicated.

The technological know-how and the practical, hands-on experience in running these advanced biofuel facilities are difficult for newcomers to acquire and master quickly. This creates a high hurdle for new companies looking to enter the market. For instance, Aemetis reported a significant increase in its renewable natural gas production capacity in 2024, showcasing their operational maturity.

- Specialized Expertise: Advanced biofuel technology development requires deep scientific and engineering talent, a resource not readily available to all.

- Operational Experience: Aemetis's proven track record in operating and optimizing waste-to-fuel processes provides a critical edge.

- High Barrier to Entry: The combination of technological sophistication and operational know-how makes it challenging and time-consuming for new competitors to establish themselves.

Economies of Scale and Experience Curve

Existing players in the advanced biofuels and renewable chemicals sector, such as Aemetis, leverage significant economies of scale. This scale advantage translates into lower per-unit costs for production, raw material procurement, and distribution networks. For instance, Aemetis's integrated biorefinery model allows for more efficient operations compared to a new entrant operating at a smaller capacity.

Newcomers to the industry face a considerable cost disadvantage as they must build their operations from the ground up, often without the established supplier relationships or optimized logistics that incumbents enjoy. Until a new entrant achieves comparable production volumes, their per-unit costs will likely remain higher, making it challenging to compete on price.

Furthermore, the experience curve plays a crucial role. Companies like Aemetis have years of operational experience, leading to refined processes, improved efficiency, and a deeper understanding of market dynamics. This accumulated knowledge allows them to optimize production yields and minimize waste, further widening the cost gap and creating a barrier for potential new entrants.

- Economies of Scale: Aemetis benefits from cost efficiencies in large-scale production and procurement, a hurdle for smaller new entrants.

- Experience Curve: Years of operational refinement allow Aemetis to achieve higher efficiency and lower costs than nascent competitors.

- Cost Disadvantage: New entrants must overcome initial higher per-unit costs due to smaller scale and lack of established operational expertise.

The renewable fuels industry presents substantial barriers to new entrants due to the immense capital required for plant construction and infrastructure development. For example, building a modern biorefinery can easily cost hundreds of millions of dollars, a figure that immediately filters out smaller players. This high initial investment is a significant deterrent, ensuring that only well-funded organizations can even consider entering the market.

Navigating the complex regulatory landscape is another major hurdle, involving numerous permits and environmental compliance standards. Successfully obtaining these approvals is a lengthy and costly process. For instance, securing the necessary air permits for facilities like Aemetis's sustainable aviation fuel and renewable diesel plant is a critical but challenging step.

Access to reliable and sustainable feedstocks, such as agricultural waste or dairy manure, is essential and requires robust logistics. Furthermore, the specialized scientific and engineering expertise needed to operate advanced biofuel technologies creates a steep learning curve for newcomers. Aemetis's operational experience in optimizing these processes, evidenced by their 2024 increase in renewable natural gas production capacity, provides a distinct competitive advantage.

| Barrier Type | Description | Example/Impact on New Entrants |

|---|---|---|

| Capital Investment | High upfront costs for plant construction and infrastructure. | Requires hundreds of millions of dollars, limiting entry to well-capitalized firms. |

| Regulatory Compliance | Complex permitting and environmental standards. | Time-consuming and expensive to obtain approvals; Aemetis secured key air permits. |

| Feedstock Access & Logistics | Securing consistent supply of sustainable raw materials. | Requires building extensive collection and transportation networks. |

| Technological Expertise | Specialized knowledge in advanced biofuel conversion processes. | Steep learning curve; Aemetis's operational maturity in 2024 demonstrates this advantage. |

Porter's Five Forces Analysis Data Sources

Our Aemetis Porter's Five Forces analysis leverages a comprehensive blend of data, including the company's SEC filings, investor presentations, and industry-specific market research reports from firms like IBISWorld. This ensures a robust understanding of competitive dynamics within the renewable fuels sector.