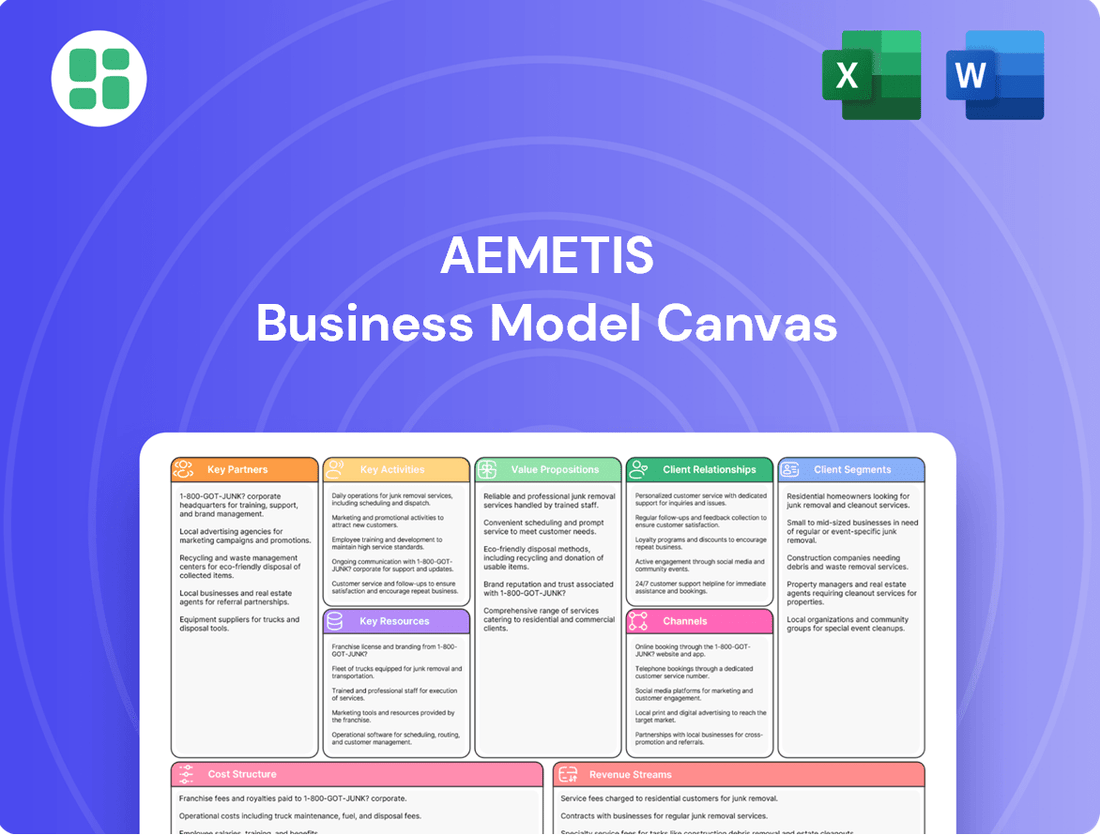

Aemetis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aemetis Bundle

Unlock the full strategic blueprint behind Aemetis's innovative business model. This comprehensive Business Model Canvas reveals how they leverage renewable fuels and biochemicals to create value and capture market share. Ideal for anyone seeking to understand their unique approach to sustainability and growth.

Dive deeper into Aemetis’s real-world strategy with the complete Business Model Canvas. From their customer segments to revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its significant opportunities lie.

See how the pieces fit together in Aemetis’s business model. This detailed, editable canvas highlights the company’s key partners, core activities, and cost structure. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Aemetis cultivates vital partnerships with agricultural waste producers and dairy farms, ensuring a steady and economical supply of raw materials for its biofuel operations. These relationships are fundamental to achieving the low carbon intensity of their biofuels and advancing a circular bioeconomy. For instance, Aemetis is actively growing its network of biogas digesters on dairy farms, aiming to have 26 operational or under construction by the close of 2025, with an additional 50 dairies already under contract.

Aemetis relies heavily on technology and engineering partners to build and improve its advanced biofuel facilities, such as those for sustainable aviation fuel and renewable diesel. These collaborations are crucial for implementing advanced processes like mechanical vapor recompression and carbon capture to boost efficiency and lower carbon footprints.

For example, Aemetis' biodiesel technology in India was provided by DeSmet-Ballestra, an Italian firm. This partnership highlights the importance of specialized engineering expertise in bringing complex biofuel production to life.

Long-term agreements with major airlines, fuel distributors, and government-owned oil marketing companies (OMCs) are critical for selling and distributing Aemetis' renewable fuels, such as sustainable aviation fuel (SAF), renewable diesel, ethanol, and biodiesel. These partnerships secure predictable demand and consistent revenue streams.

Aemetis has a substantial off-take agreement with a major airline for SAF, a deal valued at more than $1 billion. This agreement underscores the growing demand for sustainable aviation fuel and provides a significant revenue foundation for Aemetis.

Government Agencies and Regulators

Aemetis's strategic partnerships with government agencies and regulators are foundational to its operational success and growth. Collaborations with bodies such as the California Air Resources Board (CARB), the U.S. Department of Agriculture (USDA), and the Environmental Protection Agency (EPA) are essential for obtaining critical permits and approvals. These relationships also unlock vital financial incentives that bolster project economics.

These government partnerships are instrumental in securing revenue streams and ensuring regulatory compliance. For instance, Aemetis anticipates substantial revenue from California's Low Carbon Fuel Standard (LCFS) credits and the U.S. Renewable Fuel Standard (RFS) RINs. Furthermore, the Inflation Reduction Act (IRA) provides significant tax credits, such as the 45Z Clean Fuel Production Credit, which are crucial for the financial viability of its renewable fuel projects.

- CARB and LCFS: Partnerships with the California Air Resources Board are key to Aemetis's ability to generate revenue through Low Carbon Fuel Standard (LCFS) credits, a critical component of their business model.

- USDA Funding: The U.S. Department of Agriculture has provided funding to Aemetis, demonstrating direct financial support and validation from a key federal agency.

- EPA and RFS: Collaboration with the Environmental Protection Agency is necessary for compliance with the Renewable Fuel Standard (RFS) and the generation of RINs, another significant revenue driver.

- IRA Tax Credits: Aemetis is positioned to benefit from the Inflation Reduction Act, specifically anticipating substantial income from 45Z tax credits, underscoring the importance of federal legislative support.

Research and Development Collaborators

Aemetis actively partners with academic institutions and research organizations to ensure it remains a leader in renewable fuel innovation. These collaborations are crucial for exploring novel feedstocks and refining processes to further lower the carbon footprint of their products.

These research alliances are key to Aemetis's long-term strategy, fostering the development of cutting-edge technologies and maintaining a competitive edge in the dynamic clean energy market. For instance, their work on cellulosic sugars derived from waste wood for ethanol-to-jet fuel production exemplifies this commitment to advanced research and development.

Key R&D collaborators contribute to Aemetis's ability to:

- Advance cellulosic ethanol technology: Leveraging academic expertise to optimize the conversion of waste wood into valuable sugars for biofuel production.

- Develop next-generation feedstocks: Investigating and validating new, sustainable sources for renewable fuel production.

- Reduce carbon intensity: Collaborating on process improvements that demonstrably lower greenhouse gas emissions across the product lifecycle.

- Drive market adoption: Working with research bodies to validate performance and environmental benefits, supporting wider acceptance of their fuels.

Aemetis's key partnerships are essential for its entire value chain, from securing sustainable feedstocks to ensuring market access for its renewable fuels. These collaborations are not just about supply and demand; they are integral to the company's mission of advancing a circular bioeconomy and achieving low carbon intensity targets.

The company's strategic alliances with agricultural waste producers and dairy farms are foundational, providing a consistent and cost-effective supply of raw materials. These partnerships are critical for the success of their biogas projects. By the end of 2025, Aemetis aims to have 26 biogas digesters operational or under construction, with contracts already in place for an additional 50 dairies.

Furthermore, Aemetis collaborates with technology providers and engineering firms to enhance its production facilities. These partnerships are vital for implementing advanced technologies that improve efficiency and reduce environmental impact. For example, DeSmet-Ballestra, an Italian firm, provided the biodiesel technology for Aemetis's Indian operations.

Securing long-term agreements with airlines, fuel distributors, and government-owned oil marketing companies is crucial for the sale and distribution of their renewable fuels, including sustainable aviation fuel (SAF) and renewable diesel. A notable example is a substantial off-take agreement with a major airline for SAF, valued at over $1 billion, which highlights the growing market demand and provides a stable revenue base.

Crucially, Aemetis partners with government agencies like the California Air Resources Board (CARB) and the U.S. Environmental Protection Agency (EPA) to navigate regulatory landscapes and access financial incentives. These partnerships are vital for generating revenue from programs like California's Low Carbon Fuel Standard (LCFS) credits and the U.S. Renewable Fuel Standard (RFS) RINs. The Inflation Reduction Act (IRA) also offers significant tax credits, such as the 45Z Clean Fuel Production Credit, which are instrumental for project economics.

| Partnership Type | Key Partners | Impact on Business Model | Example/Data Point |

|---|---|---|---|

| Feedstock Supply | Dairy Farms, Agricultural Waste Producers | Ensures low-cost, sustainable raw materials for biofuels. | Aiming for 26 biogas digesters operational/under construction by end of 2025; 50 additional dairies contracted. |

| Technology & Engineering | DeSmet-Ballestra, other specialized firms | Enables efficient and advanced biofuel production processes. | DeSmet-Ballestra provided biodiesel technology for Indian operations. |

| Off-take & Distribution | Major Airlines, Fuel Distributors, OMCs | Secures predictable demand and revenue streams for renewable fuels. | Over $1 billion SAF off-take agreement with a major airline. |

| Regulatory & Financial Incentives | CARB, USDA, EPA | Facilitates compliance, unlocks credits (LCFS, RINs), and tax benefits (IRA 45Z). | Anticipates substantial revenue from LCFS credits and 45Z tax credits. |

What is included in the product

Aemetis's Business Model Canvas outlines its strategy for producing renewable fuels and chemicals, focusing on customer segments like fuel distributors and industrial users, and leveraging its integrated production facilities as a key value proposition.

This model details Aemetis's operational framework, including key resources like proprietary technology and renewable feedstocks, and its revenue streams from fuel sales and by-product monetization.

Aemetis's Business Model Canvas offers a clear, structured approach to identifying and addressing key challenges in the renewable fuels sector, simplifying complex operations for stakeholders.

Activities

Biofuel Production Operations are the heart of Aemetis' business, involving the daily management of its diverse facilities. This includes running the California ethanol plant, the India biodiesel facility, and the growing network of dairy RNG digesters. These operations are focused on efficiently transforming agricultural waste and other sustainable materials into valuable renewable fuels.

A key highlight in 2024 was the significant expansion of Aemetis' India biodiesel plant. This facility successfully increased its annual production capacity to 80 million gallons per year. This expansion is a testament to the company's commitment to scaling up its renewable fuel output and meeting growing market demand.

Aemetis focuses on the development and construction of renewable fuel facilities. This includes building new plants, like their sustainable aviation fuel and renewable diesel facility in Riverbank, California, and adding more dairy digesters to their operations.

Key activities involve the intricate processes of engineering design, obtaining necessary permits, and securing the substantial financing required for these ambitious, large-scale projects.

Looking ahead, Aemetis has a clear growth strategy, with plans to construct an additional 10 dairy digester projects throughout 2025, further expanding their renewable energy infrastructure.

Securing a consistent and sustainable supply of agricultural waste, dairy manure, and other biomass is a fundamental ongoing activity for Aemetis. This involves building strong relationships and supply agreements with farmers and waste producers, meticulously managing the logistics of collection and transportation, and ensuring the quality and cost-effectiveness of these raw materials for their various production processes.

Aemetis actively sources orchard waste wood and a range of other agricultural byproducts, diversifying its feedstock portfolio. For instance, in 2024, the company continued to leverage its established network for dairy manure, a crucial component for its anaerobic digestion facilities, while also expanding its intake of orchard waste, contributing to a circular economy model.

Environmental Credit Generation and Monetization

Aemetis's core operations revolve around generating and selling environmental credits, a crucial revenue stream. This includes navigating the complexities of programs like the California Low Carbon Fuel Standard (LCFS) and federal Renewable Fuel Standard (RFS) D3 RINs. The company also aims to capitalize on incentives from the Inflation Reduction Act (IRA), specifically Section 45Z production tax credits, which began to be realized in 2024.

The company's engagement in 2024 with the California LCFS program, particularly through its Renewable Natural Gas (RNG) business, marks a significant step in its environmental credit monetization strategy. This activity is vital for the financial viability of its renewable energy projects, demonstrating a direct link between environmental impact and economic return.

- California LCFS Credits: Aemetis began generating and selling these credits in 2024 from its RNG operations.

- Federal RFS D3 RINs: The company actively participates in the market for these renewable identification numbers.

- IRA Section 45Z Credits: Aemetis is positioned to benefit from these production tax credits under the Inflation Reduction Act.

- Regulatory Navigation: Successfully generating and monetizing these credits requires a deep understanding of evolving environmental regulations.

Research, Development, and Carbon Intensity Reduction

Aemetis actively invests in research and development, focusing on enhancing current production methods and pioneering new technologies for advanced biofuels, particularly cellulosic ethanol-to-jet fuel. This commitment extends to significantly lowering the carbon intensity of their offerings. For instance, their Riverbank, California plant is undergoing upgrades, including the installation of a solar microgrid, which is expected to reduce grid electricity consumption by approximately 60% and lower the plant's overall carbon footprint.

The company's strategic goal is to achieve below-zero carbon intensity fuels. This ambitious target is pursued through ongoing innovation and the implementation of energy-efficient technologies. Mechanical vapor recompression, a key technology being deployed, aims to recover and reuse heat within their ethanol production process, thereby reducing energy consumption and associated emissions. In 2024, Aemetis continued to advance these initiatives, aiming to solidify its position as a leader in sustainable aviation fuel (SAF) production.

- R&D Focus: Development of cellulosic ethanol-to-jet fuel and process optimization.

- Carbon Intensity Reduction: Implementation of solar microgrids and mechanical vapor recompression.

- 2024 Initiatives: Continued upgrades at the Riverbank plant to enhance sustainability.

- Target: Achieving below-zero carbon intensity for all products.

Key activities for Aemetis center on operating and expanding its renewable fuel production facilities, including ethanol, biodiesel, and dairy RNG digesters. This involves the efficient processing of agricultural waste and manure into valuable fuels. A significant 2024 achievement was boosting the India biodiesel plant’s capacity to 80 million gallons annually, demonstrating a commitment to scaling up production.

The company also focuses on developing and constructing new renewable fuel plants, such as the sustainable aviation fuel facility in Riverbank, California. This entails meticulous engineering design, securing permits, and arranging substantial project financing. Aemetis plans to add ten more dairy digesters by the end of 2025, further broadening its renewable energy infrastructure.

Aemetis's core strategy involves generating and selling environmental credits, a vital revenue stream. This includes navigating programs like the California Low Carbon Fuel Standard and federal Renewable Fuel Standard. The company also anticipates benefits from Inflation Reduction Act Section 45Z production tax credits, which started to be realized in 2024. Their engagement with the California LCFS program in 2024, particularly through their RNG business, is crucial for the financial success of their renewable energy projects.

Research and development are also key activities, with Aemetis investing in improving current production methods and developing new technologies for advanced biofuels, especially cellulosic ethanol-to-jet fuel. Their goal is to achieve below-zero carbon intensity fuels through innovation and energy-efficient technologies like mechanical vapor recompression. In 2024, upgrades at the Riverbank plant, including a solar microgrid, aimed to cut grid electricity use by about 60% and reduce the plant's carbon footprint.

| Key Activity | Description | 2024 Highlights/Data |

|---|---|---|

| Biofuel Production | Operating ethanol, biodiesel, and RNG facilities | India biodiesel capacity increased to 80 million gallons/year. |

| Facility Development | Engineering, permitting, and financing new plants | Progress on Riverbank SAF/renewable diesel facility; 10 new dairy digesters planned for 2025. |

| Feedstock Sourcing | Securing agricultural waste and dairy manure | Continued use of dairy manure; expanded intake of orchard waste. |

| Environmental Credits | Generating and selling LCFS, RINs, and IRA tax credits | Active generation and sale of California LCFS credits from RNG; positioning for IRA 45Z credits. |

| Research & Development | Improving production and developing advanced biofuels | Focus on cellulosic ethanol-to-jet fuel; Riverbank plant upgrades including solar microgrid. |

What You See Is What You Get

Business Model Canvas

The Aemetis Business Model Canvas preview you see is the actual document you will receive upon purchase, offering a transparent look at the comprehensive plan. This isn't a sample or mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Aemetis's production facilities are the backbone of its operations, featuring a 65 million gallon per year ethanol plant in California and an 80 million gallon per year biodiesel plant in India. These established assets are crucial for current revenue generation and operational expertise.

The company is actively expanding its infrastructure with a growing network of dairy digesters and biogas pipelines, demonstrating a commitment to renewable energy sources. This expansion is key to their feedstock acquisition and distributed energy generation strategy.

Further solidifying its future, Aemetis is developing a significant 90 million gallon per year Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) plant in Riverbank, California. This new facility is poised to be a major player in the low-carbon fuel market.

Aemetis leverages proprietary processes and intellectual property crucial for its biofuel operations. These technologies are central to its ability to produce low and negative carbon intensity fuels from a variety of feedstocks.

The company holds patents and trade secrets related to its advanced biofuel production methods, including those for carbon capture and the reduction of carbon intensity. This intellectual property forms a significant competitive moat, allowing Aemetis to differentiate its offerings in the market.

Specifically, Aemetis's proprietary biodiesel production process, which utilizes waste and byproducts, directly contributes to enhanced profitability. This efficient conversion of waste streams into valuable fuels underscores the economic importance of its technological assets.

Access to a consistent and scalable supply of agricultural waste, dairy manure, and other renewable biomass is a fundamental resource for Aemetis. This ensures the continuous operation of their biorefineries.

Long-term supply agreements and strategic relationships with farmers and waste generators are key to securing this critical input. These partnerships provide Aemetis with reliable access to the necessary raw materials.

Aemetis has established agreements with 50 dairies specifically for biogas development, highlighting their commitment to building a robust and geographically diverse feedstock base.

Skilled Workforce and Management Team

Aemetis relies heavily on its skilled workforce and experienced management team. This includes engineers, scientists, and operations personnel with deep knowledge in renewable fuels and project development. Their collective expertise is crucial for driving innovation and ensuring efficient operations across the company's various projects.

The management team's proficiency in navigating complex regulatory environments and securing necessary permits is a significant asset. This capability is vital for the successful execution of Aemetis' ambitious growth plans in the renewable energy sector.

Aemetis has recently strengthened its leadership by appointing a new CEO to oversee its biodiesel operations in India. This strategic move underscores the company's commitment to enhancing its management capabilities in key growth regions.

- Experienced Personnel: A robust team of engineers, scientists, and operations staff with specialized knowledge in renewable fuels and project execution.

- Management Expertise: A leadership team possessing significant experience in project development, financial management, and regulatory compliance within the renewable energy industry.

- Innovation and Efficiency: The team's expertise directly contributes to Aemetis' ability to innovate and maintain high operational efficiency.

- Strategic Leadership: Recent appointment of a new CEO for the Indian biodiesel unit highlights a focus on strengthening management in key operational areas.

Financial Capital and Access to Funding

Aemetis requires substantial financial capital for its ambitious projects, including building and expanding facilities, alongside covering daily operational costs. This funding primarily comes from equity investments and various forms of debt financing.

Access to funding is critical, with the company leveraging instruments like USDA loan guarantees to secure necessary capital. Furthermore, Aemetis actively monetizes government incentives, such as tax credits, to bolster its financial resources.

- Equity Investments: Essential for initial project funding and expansion.

- Debt Financing: Including USDA loan guarantees to support capital expenditures.

- Government Incentives: Monetizing tax credits and other programs to enhance cash flow.

- Q1 2025 ITC Sale: Aemetis realized $19.4 million from the sale of investment tax credits in the first quarter of 2025, demonstrating the value of these incentives.

Aemetis's key resources include its operational production facilities, such as the California ethanol plant and the India biodiesel plant, which are vital for current revenue. The company is also building out a network of dairy digesters and biogas pipelines to support its renewable energy initiatives. Furthermore, a significant new Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) plant is under development, poised to tap into a growing market.

Proprietary processes and intellectual property, including patents and trade secrets for low-carbon fuel production and carbon capture, form a critical competitive advantage for Aemetis. These technologies enable efficient conversion of waste streams into biofuels and are central to the company's ability to achieve negative carbon intensity ratings.

Access to a consistent supply of renewable biomass, secured through long-term agreements with farmers and waste generators, is a fundamental resource. The company has established relationships with 50 dairies for biogas development, ensuring a reliable feedstock base for its operations.

Aemetis's skilled workforce, comprising experienced engineers, scientists, and operations personnel, is a key asset. The management team's expertise in project development, financial management, and navigating regulatory landscapes is crucial for executing the company's growth strategy. The recent appointment of a new CEO for its Indian biodiesel operations highlights a focus on strengthening leadership in key regions.

Substantial financial capital, sourced through equity investments, debt financing, and government incentives like USDA loan guarantees, is essential for Aemetis's expansion. The company effectively monetizes tax credits, as demonstrated by realizing $19.4 million from the sale of investment tax credits in Q1 2025, which bolsters its financial resources.

| Resource Category | Specific Assets/Capabilities | Significance |

|---|---|---|

| Production Facilities | 65 MGY Ethanol Plant (CA) | Current revenue generation, operational expertise |

| 80 MGY Biodiesel Plant (India) | Current revenue generation, operational expertise | |

| Infrastructure Expansion | Dairy Digesters & Biogas Pipelines | Feedstock acquisition, distributed energy generation |

| New Development | 90 MGY SAF/RD Plant (Riverbank, CA) | Entry into growing low-carbon fuel market |

| Intellectual Property | Proprietary Biofuel Processes | Production of low/negative carbon intensity fuels |

| Patents & Trade Secrets (Carbon Capture, CI Reduction) | Competitive moat, market differentiation | |

| Feedstock Access | Agricultural Waste, Dairy Manure, Biomass | Ensures continuous biorefinery operation |

| Long-term Supply Agreements (50 Dairies for Biogas) | Reliable raw material access, diverse feedstock base | |

| Human Capital | Engineers, Scientists, Operations Staff | Innovation, operational efficiency |

| Experienced Management Team | Project development, financial management, regulatory navigation | |

| Financial Resources | Equity Investments, Debt Financing (USDA Loan Guarantees) | Capital for expansion and operations |

| Government Incentives (Tax Credits, ITC Sale of $19.4M in Q1 2025) | Enhances cash flow, supports capital expenditures |

Value Propositions

Aemetis offers a powerful value proposition centered on decarbonization and greenhouse gas (GHG) emission reduction. They provide advanced biofuels and renewable products that demonstrably lower carbon intensity compared to conventional fossil fuels, directly addressing the critical global imperative to combat climate change. This resonates strongly with environmentally conscious consumers and increasingly stringent regulatory frameworks worldwide.

Their commitment is underscored by the design of their Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) plant, which is engineered to produce fuels with a below-zero carbon intensity. This remarkable achievement signifies a net removal of carbon from the atmosphere throughout the fuel's lifecycle, offering a significant advantage in the transition to a low-carbon economy.

Aemetis offers energy solutions from agricultural waste and renewable resources, fostering energy independence and a circular bioeconomy. This directly addresses industries aiming to reduce reliance on petroleum and improve their environmental performance.

The company's core activity involves transforming dairy farm waste gas into renewable natural gas. In 2024, Aemetis reported significant progress in its renewable natural gas (RNG) projects, with several dairies in California actively supplying methane for conversion, contributing to a cleaner energy supply chain.

Aemetis’ offerings directly address the growing need for businesses to comply with strict environmental rules. For instance, their products enable customers to meet California's Low Carbon Fuel Standard (LCFS) and federal Renewable Fuel Standard (RFS) requirements, offering a clear route to compliance and financial incentives from credit markets.

The company's success in obtaining CARB approval for LCFS pathways for its dairy digester projects is a significant advantage. This approval unlocks substantial credit generation, further enhancing the value proposition for customers seeking to navigate and benefit from environmental regulations.

Cost-Effective Renewable Fuels (long-term)

Aemetis is committed to delivering cost-competitive renewable fuels over the long term. While the initial capital outlay for these advanced facilities is substantial, the company leverages efficient production methods and the use of readily available, low-cost feedstocks. Furthermore, the revenue generated from environmental credits, such as Renewable Identification Numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits, significantly enhances the economic viability of their offerings.

This strategy provides tangible long-term economic advantages for customers. By choosing Aemetis' renewable fuels, clients can achieve greater stability in their fuel expenses, effectively hedging against the unpredictable price swings inherent in the fossil fuel market. This predictability is a key component of their value proposition for businesses aiming for cost certainty.

The company's financial strategy is centered on achieving robust positive cash flow. Aemetis is actively pursuing debt financing with lower interest rates, which is crucial for managing the overall cost of capital and improving profitability. For instance, in the first quarter of 2024, Aemetis reported a significant increase in revenue, driven by their renewable fuel segment, demonstrating progress towards these financial goals.

- Cost-Competitiveness: Achieved through efficient production, low-cost feedstocks, and environmental credit monetization.

- Customer Benefits: Long-term fuel cost stabilization and reduced exposure to fossil fuel price volatility.

- Financial Focus: Emphasis on generating positive cash flow and securing lower-interest debt financing.

- Market Performance: Q1 2024 revenue growth highlights the increasing demand and economic viability of their renewable fuel products.

Diversified Portfolio of Renewable Products

Aemetis offers a robust suite of renewable products, encompassing ethanol, renewable natural gas, renewable diesel, and sustainable aviation fuel (SAF). This broad product mix allows the company to serve diverse markets within the transportation and industrial sectors, enhancing its market penetration and offering adaptable sustainable solutions.

The company's production capabilities are flexible, enabling the creation of either pure renewable diesel or a blend that includes up to 50% SAF. This adaptability is crucial for meeting evolving customer demands and regulatory requirements in the burgeoning sustainable fuels market.

- Ethanol: A foundational renewable fuel.

- Renewable Natural Gas (RNG): Capturing methane for energy.

- Renewable Diesel (RD): A cleaner-burning alternative fuel.

- Sustainable Aviation Fuel (SAF): Targeting the aviation industry's decarbonization efforts.

- Glycerin: A co-product with industrial applications.

In 2024, Aemetis continued to expand its SAF production capacity, with a target to produce 90 million gallons of SAF per year from its California facilities. This strategic diversification positions Aemetis to capitalize on the growing demand for low-carbon fuels across multiple industries.

Aemetis provides a clear pathway for businesses to meet stringent environmental regulations like California's LCFS and the federal RFS. Their CARB approval for dairy digester LCFS pathways unlocks significant credit generation, offering a tangible financial benefit to clients navigating environmental compliance.

The company's value proposition includes offering cost-competitive renewable fuels, supported by efficient production and low-cost feedstocks. Monetizing environmental credits, such as RINs and LCFS credits, further enhances economic viability, providing customers with greater stability in fuel expenses and hedging against fossil fuel market volatility.

Aemetis focuses on generating positive cash flow, evidenced by their Q1 2024 revenue growth in the renewable fuel segment. Their strategy includes securing lower-interest debt financing to manage capital costs and improve profitability, demonstrating a commitment to financial sustainability.

Aemetis offers a diverse portfolio of renewable products, including ethanol, RNG, renewable diesel, and SAF, catering to various market needs. Their flexible production capabilities allow for the creation of blends, such as up to 50% SAF with renewable diesel, meeting evolving customer demands and regulatory requirements.

| Product | Description | 2024 Capacity Target | Key Value Proposition |

| Renewable Natural Gas (RNG) | Methane captured from dairy waste | Expanding | Decarbonization, circular economy, meeting LCFS credits |

| Sustainable Aviation Fuel (SAF) | Low-carbon fuel for aviation | 90 million gallons/year | Significant GHG reduction, meeting aviation mandates |

| Renewable Diesel (RD) | Cleaner-burning alternative fuel | Expanding | Lower carbon intensity, compliance with fuel standards |

| Ethanol | Renewable fuel | Established | Market presence, blending component |

Customer Relationships

Aemetis cultivates direct relationships with significant customers, including airlines, fuel distributors, and government bodies, often securing these through multi-year supply contracts. These agreements offer a bedrock of stability and foresight for all involved, nurturing robust, enduring collaborations.

The company boasts long-term off-take agreements with major airlines, such as those with JetBlue Airways, demonstrating a commitment to sustained business partnerships. For instance, Aemetis has a significant agreement to supply renewable jet fuel to JetBlue, underscoring the value of these direct, long-term customer relationships.

Aemetis offers dedicated technical support, particularly for industrial clients and those with unique blending needs. This involves collaborating to create bespoke fuel solutions aligned with operational demands and environmental targets, fostering trust and seamless product integration. For instance, in 2024, Aemetis continued to emphasize its commitment to quality, ensuring its distilled biodiesel and refined glycerin meet stringent industry standards.

Aemetis actively partners with its customers to enhance their sustainability reporting. By providing detailed data and insights into the environmental advantages of its renewable fuels, Aemetis empowers clients, especially airlines and transportation firms, to showcase their dedication to decarbonization and meet their specific environmental objectives.

Investor Relations and Stakeholder Engagement

Aemetis actively cultivates relationships with its investors and financial stakeholders, recognizing their vital role in capital acquisition and market confidence. This involves consistent delivery of transparent financial reports, operational progress updates, and strategic outlooks.

The company prioritizes clear communication, evidenced by its regular conference calls designed to thoroughly review financial results and address stakeholder inquiries. This proactive engagement is fundamental to maintaining trust and support.

- Investor Communication: Aemetis provides quarterly earnings calls and annual investor meetings to share financial performance and strategic direction.

- Transparency: The company emphasizes detailed financial reporting, ensuring stakeholders have access to comprehensive operational and financial data.

- Capital Access: Strong investor relations are critical for Aemetis to secure the necessary funding for its growth initiatives, such as expanding its renewable fuel production capacity.

- Market Confidence: Consistent and open communication helps build and maintain investor confidence, which can positively impact the company's stock valuation and access to capital markets.

Government and Policy Advocacy

Building strong ties with policymakers and actively participating in advocacy are crucial for Aemetis. This ensures a supportive regulatory landscape and sustained incentives for renewable fuels, which in turn bolsters the long-term competitiveness of their products for customers.

Aemetis keeps a close watch on federal policy developments and provides timely updates. For instance, in 2024, the company continued to advocate for policies that support the growth of sustainable aviation fuel (SAF) and renewable diesel, recognizing their importance for market expansion.

- Policy Engagement: Aemetis actively engages with government bodies to promote favorable regulations for renewable fuels.

- Incentive Advocacy: The company advocates for the continuation and enhancement of tax credits and other incentives vital for renewable fuel projects.

- Market Development: Policy advocacy directly contributes to creating a more robust and predictable market for Aemetis' renewable fuel products.

- Information Dissemination: Aemetis provides stakeholders with updates on key federal policies impacting the renewable energy sector.

Aemetis focuses on building enduring relationships with key customers, including major airlines and fuel distributors, often solidified through multi-year supply agreements. This strategy ensures predictable revenue streams and fosters deep collaboration. For example, Aemetis's 2024 agreements with airlines highlight the value placed on these long-term partnerships, aiming to provide a stable supply of renewable fuels.

The company also provides dedicated technical support, working closely with industrial clients to develop customized fuel solutions that meet specific operational and environmental needs. This collaborative approach enhances product integration and builds significant customer trust. Aemetis's commitment to quality, as seen in its 2024 production standards for biodiesel and glycerin, underpins these relationships.

Aemetis actively supports customers in their sustainability reporting by providing data on the environmental benefits of its renewable fuels. This empowers clients, particularly in the transportation sector, to demonstrate their decarbonization efforts and achieve their environmental targets. The company’s investor relations are equally vital, with regular financial reporting and investor calls in 2024 reinforcing transparency and market confidence to support capital access for expansion.

Furthermore, Aemetis engages with policymakers to shape a supportive regulatory environment for renewable fuels. Its advocacy in 2024 for policies like those supporting sustainable aviation fuel (SAF) is critical for market growth and the long-term competitiveness of its offerings.

| Customer Segment | Relationship Type | Key Engagement Strategy | Example (2024 Focus) |

|---|---|---|---|

| Airlines & Fuel Distributors | Direct, Long-Term Supply Agreements | Multi-year contracts, technical support, sustainability data sharing | Continued supply agreements with major airlines, emphasizing renewable jet fuel delivery |

| Industrial Clients | Partnership, Custom Solutions | Bespoke fuel development, operational integration support | Ensuring distilled biodiesel and refined glycerin meet stringent industry standards |

| Investors & Financial Stakeholders | Transparent Communication, Trust Building | Quarterly earnings calls, detailed financial reporting, strategic updates | Maintaining open communication to secure capital for capacity expansion |

| Policymakers & Government Bodies | Advocacy, Regulatory Engagement | Promoting favorable policies, advocating for incentives | Continued advocacy for SAF and renewable diesel market growth |

Channels

Aemetis utilizes a direct sales force to connect with major clients like airlines and trucking companies, ensuring customized solutions and strong relationships. This internal team handles negotiations and manages ongoing supply agreements, fostering direct communication.

The company actively engages with Oil Marketing Companies (OMCs) in India through this direct sales channel. In 2024, Aemetis reported progress on its India Renewable Jet and Diesel projects, highlighting the importance of these direct customer relationships for securing offtake agreements.

Aemetis leverages its established fuel distribution channels and collaborates with fuel blenders to efficiently deliver its renewable fuels, including ethanol, biodiesel, and renewable natural gas (RNG), to a wide customer base. This integration into existing supply chains ensures broad market access for its products.

The company specifically markets its RNG for transportation applications, capitalizing on the growing demand for cleaner fuel alternatives in the logistics sector. In 2023, Aemetis reported significant progress in its RNG production, with its California dairy digester projects contributing to its expanding renewable fuels portfolio.

Industry conferences and trade shows are crucial channels for Aemetis to demonstrate its innovative renewable energy technologies and products. These events, like the recent 2024 International Fuel Ethanol Workshop & Expo, provide a platform to highlight the company's commitment to sustainability and reach a broad audience of potential customers and strategic partners.

Participation in these key industry gatherings serves as a vital tool for market education and business development. Aemetis leadership, including its CEO, actively engages at these forums, sharing insights and advancing the company's mission. For instance, Aemetis announced in early 2024 its plans to present at the upcoming Fuels & Energy Conference, underscoring the importance of these events for strategic outreach.

Online Presence and Investor Portals

Aemetis utilizes its corporate website and dedicated investor relations portals as key channels for transparent communication. These platforms are central to disseminating crucial company updates, including financial results, operational news, detailed product information, and comprehensive sustainability reports. This direct approach ensures investors, media, and the public have consistent access to vital information.

The company's online presence is designed to facilitate easy access to all essential investor materials. This includes a library of past and upcoming conference call recordings and presentations, allowing stakeholders to stay informed about Aemetis' strategic direction and performance. As of early 2024, Aemetis has actively engaged with investors through these digital channels, highlighting progress in its renewable fuel projects.

- Corporate Website: Primary hub for company news, product details, and sustainability efforts.

- Investor Relations Portal: Dedicated section for financial reports, SEC filings, and shareholder information.

- Conference Calls & Presentations: Accessible archives of past calls and upcoming event schedules.

- Public Dissemination: Ensures broad reach to investors, media, and the general public.

Regulatory Credit Markets

The sale of environmental credits, such as Low Carbon Fuel Standard (LCFS) credits, Renewable Identification Numbers (RINs), and 45Z tax credits, represents a vital channel for Aemetis to monetize the environmental benefits of its advanced biofuels. These regulatory markets are fundamental to the company's revenue generation strategy.

Aemetis actively participates in these markets, with a particular focus on selling LCFS credits generated by its California operations and D3 RINs for its cellulosic ethanol. For instance, in the first quarter of 2024, Aemetis reported significant revenue from these credits, underscoring their importance to its financial performance. The company's ability to generate and sell these credits directly impacts its profitability and cash flow.

- LCFS Credits: Aemetis sells these in California, with prices fluctuating based on supply and demand dynamics within the state's program.

- RINs: The company generates and sells D3 RINs for its advanced biofuels, which are traded on national markets.

- 45Z Tax Credits: These credits, introduced under the Inflation Reduction Act, provide a further avenue for monetizing low-carbon fuel production, offering a significant financial incentive.

- Market Monetization: These regulatory credit markets serve as the primary mechanism for Aemetis to convert the environmental attributes of its products into tangible financial returns.

Aemetis employs a multi-faceted channel strategy to reach its diverse customer base and monetize its renewable fuel products. Direct sales to major clients like airlines and trucking companies are key, complemented by partnerships with Oil Marketing Companies in India. The company also leverages existing fuel distribution networks and collaborates with fuel blenders for broader market access.

Furthermore, Aemetis actively participates in environmental credit markets, selling LCFS credits, RINs, and benefiting from 45Z tax credits to enhance revenue. Industry conferences and its corporate website serve as crucial platforms for marketing, investor relations, and disseminating company information.

| Channel | Description | Key Activities/Products | 2024/2023 Data Point | Impact |

| Direct Sales | Engaging major clients directly. | Airlines, trucking companies; customized solutions, supply agreements. | Progress on India Renewable Jet and Diesel projects (2024). | Secures offtake, builds strong customer relationships. |

| OMC Partnerships | Collaborating with fuel distributors in India. | Securing agreements for renewable fuels. | Progress on India Renewable Jet and Diesel projects (2024). | Expands market reach in India. |

| Distribution & Blending | Utilizing existing fuel infrastructure. | Ethanol, biodiesel, RNG delivery. | Reported progress in RNG production (2023). | Ensures efficient product delivery. |

| Environmental Credits | Monetizing environmental benefits. | LCFS credits, RINs, 45Z tax credits. | Significant revenue from credits in Q1 2024. | Drives profitability and cash flow. |

| Industry Events | Showcasing technology and products. | Demonstrating renewable energy innovations. | Plans to present at Fuels & Energy Conference (early 2024). | Market education and business development. |

| Corporate Website/IR | Online communication and information dissemination. | Company news, financial reports, product details. | Active investor engagement via digital channels (early 2024). | Transparent communication with stakeholders. |

Customer Segments

Airlines and cargo carriers are a primary customer segment for Aemetis' Sustainable Aviation Fuel (SAF). These companies are actively looking to lower their environmental impact and comply with increasingly stringent sustainability regulations. Aemetis has secured an off-take agreement with a major airline, demonstrating direct market demand for their SAF products.

Trucking companies, logistics providers, and other heavy-duty transportation fleets represent a key customer segment for Aemetis. These businesses are actively seeking renewable diesel and renewable natural gas to lower their carbon footprint and meet increasingly stringent emissions standards. For instance, by 2024, many regions are expected to see stricter regulations on greenhouse gas emissions from transportation, driving demand for sustainable fuels.

These fleet operators prioritize fuel performance, ensuring it meets the rigorous demands of heavy-duty engines, alongside the environmental benefits. Aemetis's strategy to produce renewable natural gas (RNG) aims to directly substitute imported diesel, offering a cleaner alternative that can reduce operational costs and enhance sustainability credentials. The U.S. Environmental Protection Agency (EPA) has been steadily increasing the Renewable Fuel Standard (RFS) mandates, creating a favorable market for renewable fuels like RNG and renewable diesel.

Fuel blenders and distributors, including gasoline stations and industrial fuel suppliers, are key customers for Aemetis’ renewable fuels like ethanol and biodiesel. These companies require a reliable and consistent supply chain, competitive pricing that allows them to maintain healthy margins, and the assurance that Aemetis can meet fluctuating market demands for renewable fuel content.

Aemetis specifically targets Oil Marketing Companies (OMCs) in India for its biodiesel sales. This strategic focus allows Aemetis to tap into a significant market where renewable fuel adoption is a growing priority, aligning with India's energy diversification goals.

Industrial and Chemical Manufacturers

Industrial and chemical manufacturers are key customers for Aemetis, particularly those requiring high-quality biochemicals. These businesses are increasingly focused on sustainable sourcing, making Aemetis's byproducts attractive. For instance, refined glycerin, a byproduct of their biodiesel operations, finds significant demand in these sectors.

Aemetis actively serves these markets, with substantial refined glycerin sales to customers in India and Europe. This demonstrates a direct engagement with industries that rely on these sustainable chemical components for their manufacturing processes.

- Key Industries: Pharmaceutical, cosmetic, and food industries are primary consumers of refined glycerin.

- Value Proposition: Customers prioritize the purity and verifiable sustainable origins of biochemical feedstocks.

- Market Reach: Aemetis's exports of refined glycerin to India and Europe highlight its role in the global supply chain for these essential chemicals.

- Growth Driver: The growing global demand for bio-based chemicals, projected to reach hundreds of billions of dollars by 2030, underscores the importance of this customer segment.

Government and Public Sector Entities

Government and public sector entities are key customers, often procuring renewable fuels to meet their own fleet requirements or to bolster local decarbonization efforts. For instance, in 2024, many municipalities and state governments are actively seeking sustainable fuel alternatives to reduce their carbon footprint and comply with emissions regulations.

Policy support, including mandates and incentives, significantly influences demand from this segment. Aemetis' operations directly support governmental objectives related to enhancing energy independence and achieving ambitious greenhouse gas reduction targets, making them a strategic partner.

- Fleet Modernization: Government fleets, from local transit buses to federal vehicles, are increasingly transitioning to renewable fuels.

- Decarbonization Mandates: Public sector entities are often bound by regulations requiring them to reduce emissions by specific percentages, driving demand for biofuels.

- Energy Security: Supporting domestic renewable fuel production aligns with national goals for energy independence and reduced reliance on foreign oil.

- Economic Development: Government agencies may also prioritize purchasing from companies that contribute to regional economic growth through job creation and local investment.

Aemetis's customer base is diverse, spanning transportation, industrial, and governmental sectors, all seeking sustainable fuel and chemical solutions. Airlines and cargo carriers are major clients for Sustainable Aviation Fuel (SAF), driven by emission reduction goals and regulations. Trucking and logistics companies are adopting renewable diesel and renewable natural gas to meet 2024 emissions standards. Fuel blenders, distributors, and Oil Marketing Companies in India are key for ethanol and biodiesel, valuing reliability and competitive pricing. Industrial and chemical manufacturers, including pharmaceutical and cosmetic sectors, purchase refined glycerin, prioritizing purity and sustainable origins.

| Customer Segment | Primary Products | Key Drivers | Aemetis Engagement |

| Airlines & Cargo Carriers | Sustainable Aviation Fuel (SAF) | Emission Reduction, Regulatory Compliance | Off-take agreements secured |

| Trucking & Logistics Fleets | Renewable Diesel, Renewable Natural Gas (RNG) | Emissions Standards, Carbon Footprint Reduction | Meeting 2024 regulations |

| Fuel Blenders & Distributors | Ethanol, Biodiesel | Supply Chain Reliability, Pricing, Market Demand | Serving fuel content requirements |

| Oil Marketing Companies (India) | Biodiesel | Energy Diversification, Renewable Fuel Adoption | Targeted sales strategy |

| Industrial & Chemical Manufacturers | Refined Glycerin, Biochemicals | Sustainable Sourcing, Purity | Exports to India and Europe |

| Government & Public Sector | Renewable Fuels | Fleet Decarbonization, Energy Independence | Supporting policy objectives |

Cost Structure

Aemetis' most significant expenses are tied to obtaining the raw materials for its operations, such as agricultural waste and dairy manure. These feedstocks are the foundation of their production, making their acquisition a critical cost driver.

Changes in how much feedstock is available and what it costs directly affects the company's cost of goods sold. For instance, in 2024, the cost of goods sold saw an increase that closely mirrored the growth in revenue, highlighting the direct link between feedstock expenses and overall sales performance.

Production and operating expenses are a significant component of Aemetis' cost structure, encompassing the day-to-day running of its ethanol, biodiesel, and renewable natural gas (RNG) facilities. These costs include essential inputs like energy consumption, primarily electricity and natural gas, alongside labor, ongoing maintenance, and general facility overheads.

Aemetis is actively implementing strategies to mitigate these operational costs, notably through investments in solar microgrids and mechanical vapor recompression technology. These initiatives are designed to significantly reduce the company's reliance on external energy sources and improve overall energy efficiency, thereby lowering a key expense category.

Developing new dairy digesters, a sustainable aviation fuel (SAF) and renewable diesel (RD) plant, and carbon capture facilities necessitates substantial capital investment. These upfront expenditures are crucial for increasing production capacity and lowering the carbon footprint of operations.

Aemetis allocated $20.3 million in capital expenditures during 2024 specifically for carbon intensity reduction initiatives and biogas expansion projects. This investment underscores a commitment to building out the infrastructure required for future growth and environmental performance.

Research and Development Costs

Aemetis consistently invests in research and development to drive innovation and enhance its product offerings. These ongoing expenses are crucial for developing cutting-edge technologies and refining existing processes to further reduce the carbon intensity of their biofuels and biochemicals. This commitment to advanced technologies is a core component of their strategy.

The company allocates significant resources towards pilot projects and process optimization. These initiatives are designed to test and scale new technologies, ensuring they are efficient and economically viable. This hands-on approach to R&D allows Aemetis to stay ahead in a rapidly evolving market.

For the fiscal year ending December 31, 2023, Aemetis reported Research and Development expenses of $10.2 million. This figure highlights their dedication to advancing their technological capabilities and maintaining a competitive edge in the sustainable fuels and chemicals sector.

Key areas of Aemetis' R&D focus include:

- Development of advanced cellulosic ethanol technologies.

- Improvement of existing biofuel production processes for greater efficiency.

- Exploration of new biochemicals derived from renewable feedstocks.

- Reducing the overall carbon footprint of their manufacturing operations.

Regulatory Compliance and Environmental Management

Aemetis incurs significant costs related to environmental compliance and regulatory adherence. These expenses cover obtaining and maintaining permits, implementing environmental management systems, and addressing operational impacts like odor control and waste treatment. For instance, securing and sustaining Low Carbon Fuel Standard (LCFS) pathway approvals represents a crucial, ongoing cost. In 2024, Aemetis continued its efforts to manage local community concerns regarding odors at its India operations, necessitating investments in mitigation strategies and community engagement.

Key cost drivers within this category include:

- Environmental Permit Fees: Costs associated with applying for, renewing, and maintaining various environmental permits required for plant operations.

- LCFS Pathway Compliance: Expenses tied to the rigorous process of developing, submitting, and maintaining LCFS pathway applications, which are critical for revenue generation.

- Odor Control and Mitigation: Investments in technologies and operational practices to minimize and manage odors, particularly relevant for the India facility and addressing local complaints.

- Waste Management and Treatment: Costs for the safe and compliant disposal or treatment of waste generated during the production processes.

Aemetis' cost structure is heavily influenced by feedstock acquisition, with agricultural waste and dairy manure being primary expenses. Production and operational costs, including energy, labor, and maintenance, are also significant. The company is investing in solar microgrids and vapor recompression to lower energy expenses.

Substantial capital expenditures are directed towards developing new facilities like SAF and RNG plants, as well as carbon capture technology. In 2024, $20.3 million was allocated to carbon intensity reduction and biogas expansion. Research and development, totaling $10.2 million in 2023, focuses on advanced technologies and process optimization.

Environmental compliance, including LCFS pathway approvals and odor mitigation, represents another key cost area. Aemetis incurred costs in 2024 to address community concerns regarding odors at its India operations, demonstrating the ongoing investment in regulatory adherence and community relations.

| Cost Category | Key Components | 2023 Data (USD) | 2024 Initiatives |

|---|---|---|---|

| Feedstock Acquisition | Agricultural waste, dairy manure | N/A (Directly impacts COGS) | Focus on securing reliable supply |

| Production & Operations | Energy, labor, maintenance | N/A (Directly impacts COGS) | Solar microgrids, vapor recompression |

| Capital Expenditures | New plants, carbon capture | N/A (Specific project costs) | $20.3M for carbon intensity/biogas expansion |

| Research & Development | Process optimization, new tech | $10.2M | Continued investment in advanced technologies |

| Environmental Compliance | Permits, LCFS, odor control | N/A (Specific compliance costs) | Odor mitigation at India operations |

Revenue Streams

Aemetis generates substantial revenue through the sale of renewable ethanol, primarily supplying fuel blenders for use in gasoline. This segment is a cornerstone of the company's financial performance.

In 2024, Aemetis saw a remarkable surge in its California ethanol annual revenues, which climbed by 55% to reach $162 million. This growth underscores the increasing demand and Aemetis's strong position in the renewable fuels market.

Aemetis generates significant revenue by selling Renewable Natural Gas (RNG) produced from dairy farm waste, primarily targeting the transportation sector. This revenue stream is experiencing robust growth, fueled by Aemetis's expanding production capabilities.

The company reported a remarkable 140% year-over-year increase in RNG segment revenue during the first quarter of 2025, highlighting its strong market traction and increasing output.

Aemetis generates significant revenue from selling biodiesel produced at its Indian facility. These sales are primarily to oil marketing companies and other industrial customers within India. In 2024, these annual revenues saw a robust increase of 20%, reaching $93 million, demonstrating strong market demand and Aemetis's growing market share.

Alongside biodiesel, Aemetis also capitalizes on the sale of refined glycerin, a valuable co-product of the biodiesel manufacturing process. This diversified revenue stream enhances the overall profitability of their operations, as glycerin is a sought-after ingredient in various industries, including pharmaceuticals, cosmetics, and food production.

Sales of Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD)

The sale of Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) represents a primary revenue stream for Aemetis. The company anticipates substantial growth from future production and sales of these biofuels, primarily targeting major airlines and transportation companies. Aemetis has secured off-take agreements, providing a foundational demand for its SAF output.

Key aspects of this revenue stream include:

- Anticipated Revenue Growth: Future production and sales of SAF and RD from the Riverbank plant are expected to be a significant growth driver.

- Target Markets: The focus is on major airlines and transportation companies, sectors with increasing demand for sustainable alternatives.

- Off-take Agreements: Aemetis has secured off-take agreements for SAF, ensuring a baseline level of demand and revenue certainty.

- Market Demand: The growing global mandate for decarbonization in aviation and transportation fuels this revenue stream.

Environmental Credit Sales (LCFS, RINs, Tax Credits)

Aemetis generates substantial revenue from selling environmental credits, a vital part of its business model. These credits, such as California's Low Carbon Fuel Standard (LCFS) credits and federal Renewable Fuel Standard (RFS) D3 RINs, directly boost the profitability of their renewable fuel production. The company also benefits from federal incentives like the Inflation Reduction Act's Section 45Z production tax credits.

The financial impact of these credits is significant. For instance, Aemetis reported receiving $19.4 million in the first quarter of 2025 specifically from the sale of investment tax credits. This highlights how these environmental programs are a core financial driver for the company.

- California Low Carbon Fuel Standard (LCFS) Credits: Crucial for renewable fuel profitability.

- Federal Renewable Fuel Standard (RFS) D3 RINs: Another key revenue source from renewable fuel sales.

- Inflation Reduction Act (IRA) Section 45Z Tax Credits: Provides production incentives for renewable fuels.

- Q1 2025 Investment Tax Credit Sales: Aemetis realized $19.4 million from these sales, demonstrating immediate financial benefit.

Aemetis's revenue streams are diverse, encompassing renewable fuels, environmental credits, and co-products. The company's strategic focus on sustainable alternatives positions it to capitalize on growing market demand and regulatory support.

In 2024, Aemetis achieved significant revenue growth across its segments. Renewable ethanol sales reached $162 million, a 55% increase year-over-year. Biodiesel revenue grew 20% to $93 million. The company also generated substantial income from environmental credits, with $19.4 million from investment tax credit sales in Q1 2025 alone.

| Revenue Stream | 2024 Revenue | Year-over-Year Growth | Key Drivers |

| Renewable Ethanol | $162 million | 55% | Fuel blending demand |

| Biodiesel | $93 million | 20% | Industrial and oil marketing company sales |

| Renewable Natural Gas (RNG) | (Not specified for 2024) | 140% (Q1 2025 YoY) | Dairy waste conversion, transportation sector |

| Environmental Credits | (Not specified for 2024) | (Not specified for 2024) | LCFS, RFS RINs, IRA Section 45Z |

Business Model Canvas Data Sources

The Aemetis Business Model Canvas is built upon a foundation of Aemetis's financial disclosures, public company filings, and detailed market research reports. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.