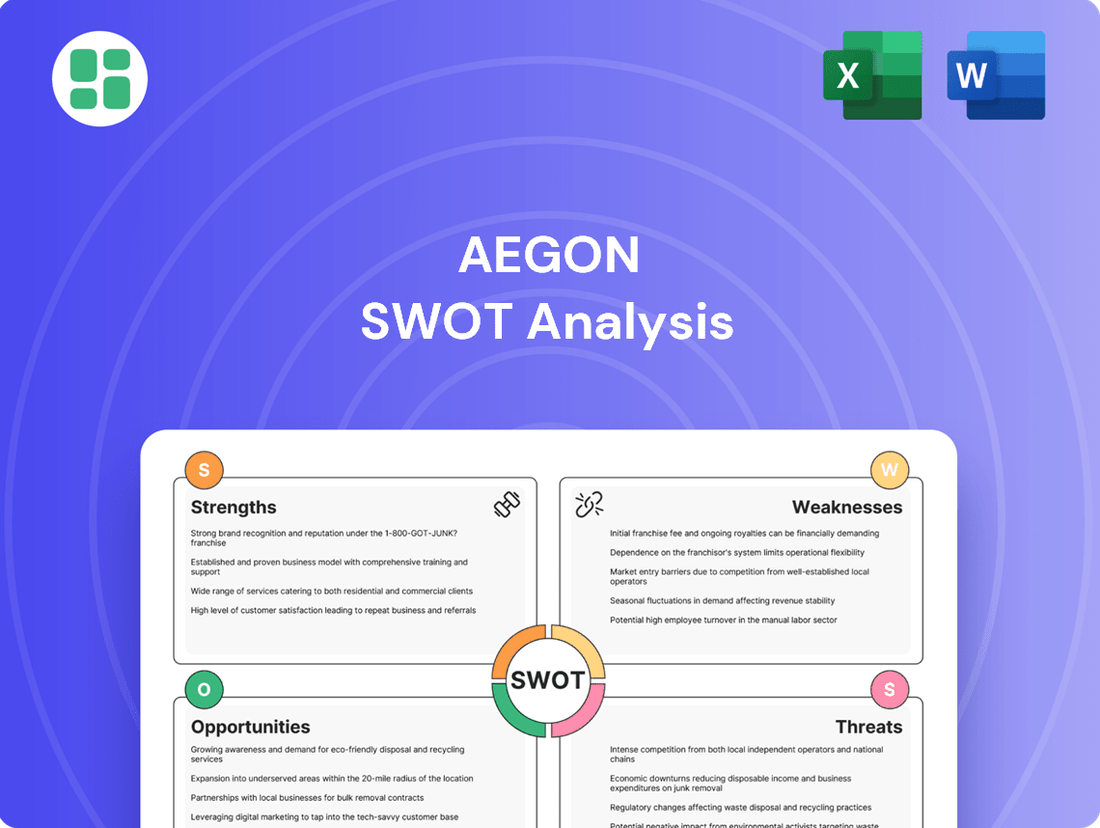

Aegon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegon Bundle

Aegon's strengths lie in its diversified business model and strong European presence, but its opportunities are tempered by evolving regulatory landscapes. Understanding these dynamics is crucial for navigating the competitive insurance and asset management sectors.

Want the full story behind Aegon’s competitive advantages, potential threats, and expansion avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Aegon's global diversification is a significant strength, with substantial operations in the Americas and Europe, complemented by strategic alliances in Asia. This wide reach across continents naturally spreads risk and income sources, preventing over-dependence on any single region.

The company's market position is reinforced by its solid financial performance in 2024. Aegon reported an increase in operating profit, reaching €1.2 billion in the first quarter of 2024, and a net profit of €677 million. This growth was notably strong in its US business and asset management divisions, underscoring its robust standing in key markets.

Aegon boasts a comprehensive product portfolio, specializing in life insurance, pensions, and asset management. This breadth allows them to serve a wide range of customer needs, from long-term savings to protection. The company's diverse offerings enable it to adapt to changing market demands and customer preferences.

The company's asset management arm experienced a positive turnaround in 2024, achieving significant net deposits. This growth indicates a strong market reception for their investment products and strategies. Such a diversified approach across insurance, retirement, and investments positions Aegon favorably in the financial services landscape.

Aegon demonstrated robust financial performance in the latter half of 2024, achieving a net profit of EUR 741 million. This was accompanied by a significant 14% rise in its operating result, highlighting operational efficiency and growth.

The company successfully met its revised full-year guidance for operating capital generation, reaching EUR 1.2 billion in 2024. Furthermore, Aegon consistently maintained its capital ratios well above the necessary operating thresholds, indicating a strong and stable capital base.

This solid financial footing is further evidenced by Aegon's disciplined capital management strategies. These include the execution of share buyback programs and a commitment to increasing dividends, reinforcing investor confidence and the company's overall financial resilience.

Commitment to Digital Transformation

Aegon is making significant strides in its digital transformation, aiming to create more engaging customer experiences and boost operational efficiency. The company is actively integrating advanced technologies such as artificial intelligence and machine learning. These tools are being used to better understand customer behaviors, streamline internal processes, and ultimately deliver superior service.

This commitment to digitalization is a core part of Aegon's strategy for future growth. For instance, Aegon UK is targeted to become a premier digital savings and retirement platform by 2028. This strategic push is designed to enhance customer engagement and solidify Aegon's market position in the digital age.

- Enhanced Customer Experience: Leveraging AI and machine learning to personalize interactions and improve service delivery.

- Operational Efficiency: Streamlining processes through digital tools to reduce costs and increase speed.

- Strategic Growth Driver: Aiming to transform Aegon UK into a leading digital savings and retirement platform by 2028.

Focus on Sustainability and Responsible Investment

Aegon’s dedication to sustainability and responsible investment is a significant strength, aligning with global trends and investor preferences. The company is committed to international sustainability standards and has established ambitious net-zero targets for its investment portfolios. This includes a strategic focus on reducing carbon intensity and channeling investments into climate change mitigation and adaptation activities.

Aegon has already achieved a key milestone by meeting its 2025 target of investing USD 2.5 billion in climate-focused initiatives. This proactive approach to Environmental, Social, and Governance (ESG) factors not only meets growing investor demand for sustainable finance but also bolsters Aegon's corporate reputation and competitive positioning in the market.

- Commitment to International Standards: Aegon adheres to recognized international sustainability frameworks.

- Net-Zero Targets: Ambitious goals are set for investment portfolios to achieve net-zero emissions.

- Climate Investment Milestone: Achieved USD 2.5 billion investment in climate change mitigation and adaptation, ahead of its 2025 target.

- Enhanced Reputation: Strong ESG focus appeals to a growing segment of socially conscious investors.

Aegon's diversified geographic presence, particularly strong in the Americas and Europe with growing Asian partnerships, mitigates regional economic risks and broadens revenue streams. This global footprint is a key advantage in navigating varied market conditions.

The company's financial health is robust, as evidenced by its strong performance throughout 2024. Aegon reported a net profit of €741 million in the second half of 2024, with operating results up 14%. Furthermore, the company successfully achieved its revised full-year operating capital generation guidance of €1.2 billion for 2024, maintaining capital ratios well above regulatory requirements.

Aegon's comprehensive product suite, spanning life insurance, pensions, and asset management, caters to a wide array of customer needs, enhancing its market resilience and adaptability. This broad offering positions the company effectively across different segments of the financial services industry.

The company's strategic digital transformation, including the use of AI and machine learning, is set to improve customer engagement and operational efficiency. Aegon UK's target to become a leading digital savings and retirement platform by 2028 highlights this forward-looking approach.

| Metric | 2024 (H2) | 2024 (FY) |

|---|---|---|

| Net Profit | €741 million | (Not specified for FY) |

| Operating Result Growth | 14% | (Not specified for FY) |

| Operating Capital Generation | (Not specified for H2) | €1.2 billion |

What is included in the product

Delivers a strategic overview of Aegon’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Aegon has faced headwinds with outflows in key areas, notably its US Retirement Plans segment. This indicates a struggle to retain assets within this crucial business line, impacting overall stability.

The UK market also presents a mixed picture. While the Workplace platform attracted strong net deposits, the Adviser platform experienced significant outflows, highlighting a need for targeted strategies to stem customer departures and improve retention.

Furthermore, lower new life sales in specific international markets, such as China, represent another area of concern. This suggests challenges in expanding market share and generating new business in these regions.

Aegon's financial performance is closely tied to market swings. For instance, a significant drop in equity markets, as seen in periods of economic uncertainty, can directly reduce the value of its investment portfolios, impacting profitability and capital reserves.

Interest rate changes also pose a challenge. The company noted in its 2024 outlook that lower interest rates in China have already put pressure on new life sales, demonstrating a direct link between macroeconomic factors and business performance.

The asset management sector is incredibly competitive, with giants like BlackRock and Vanguard, known as mega-indexers, exerting significant pressure. This intense rivalry, coupled with a widespread shift from actively managed funds to lower-cost passive investing, is driving down management fees across the board.

While Aegon's asset management arm has seen a resurgence in growth, the industry's ongoing trend of declining fee levels, alongside increasing operational and distribution costs, poses a persistent threat. These combined pressures could potentially squeeze Aegon's profit margins and hinder its long-term organic growth prospects.

Reliance on Joint Ventures and Partnerships

Aegon's strategy heavily involves creating value through strategic shareholdings and joint ventures, especially in dynamic emerging markets such as Spain, Portugal, China, and Brazil. This approach allows for market entry and expansion where direct operations might be more challenging.

However, this reliance on partnerships introduces a significant weakness: dependence on the performance and stability of these local collaborators. Fluctuations in their operational success or financial health can directly impact Aegon's overall results.

Furthermore, these ventures tie Aegon's fortunes to the economic and political stability of the specific countries involved. For instance, in 2023, emerging markets faced headwinds from inflation and geopolitical tensions, which could have indirectly affected the performance of Aegon's joint ventures in regions like Latin America.

- Dependence on Partner Performance: Aegon's financial outcomes are intertwined with the operational success and financial stability of its joint venture partners.

- Exposure to Market Instability: Reliance on emerging markets means vulnerability to regional political and economic fluctuations.

- Limited Control: Joint ventures can limit Aegon's direct control over strategic decisions and operational execution within those entities.

Exposure to Restructuring Charges and Impairments

Aegon's financial performance can be negatively impacted by restructuring charges and impairments. For instance, the second half of 2024 saw Aegon's net profit partially reduced by these factors, particularly within its US operations. These charges are often a consequence of ongoing efforts to transform and streamline the business, which, while beneficial for future growth, can lead to significant one-time expenses that weigh on current earnings.

These business transformation initiatives, though crucial for long-term sustainability and competitiveness, frequently involve substantial upfront costs. Such expenditures can create a temporary financial strain, necessitating careful financial planning and management to mitigate their impact on short-term profitability. For example, the company might incur costs related to severance packages, asset write-downs, or system integration during these periods.

- Restructuring Charges: These are costs associated with significant organizational changes, such as layoffs, facility closures, or business divestitures.

- Impairments: This refers to the reduction in the carrying value of an asset when its recoverable amount is less than its book value, often due to adverse market conditions or operational issues.

- Impact on Profitability: Both restructuring charges and impairments directly reduce a company's net income, potentially affecting investor sentiment and dividend payouts in the short term.

- Strategic Necessity: Despite the short-term financial burden, these actions are often vital for improving efficiency, adapting to market changes, and ensuring long-term viability.

Aegon faces challenges with asset retention, particularly in its US Retirement Plans segment, indicating a need to strengthen its offerings and customer engagement. The company also navigates a bifurcated UK market, with success on its Workplace platform contrasted by outflows from its Adviser platform, suggesting a need for targeted retention strategies.

Same Document Delivered

Aegon SWOT Analysis

This is the actual Aegon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You are getting a direct look at the comprehensive report that will be yours after completing your transaction.

The preview below is taken directly from the full Aegon SWOT report you'll get. Purchase unlocks the entire in-depth version, providing you with all the strategic insights.

This is a real excerpt from the complete Aegon SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

Aegon's strategic shift to transform its UK operations into a premier digital savings and retirement platform is a key opportunity. The company aims for positive combined net flows of approximately £5 billion annually by 2028, a testament to this digital focus.

This digital transformation allows Aegon to tap into the expanding online savings and retirement market. By enhancing digital customer experiences, Aegon is well-positioned to attract and retain a greater share of this growing segment.

Aegon can significantly boost its operations by embracing Artificial Intelligence (AI) and Machine Learning (ML). These technologies can streamline complex processes like underwriting, leading to faster decisions and reduced costs. For instance, in 2024, many insurers reported efficiency gains of up to 20% in underwriting by implementing AI-powered tools.

Furthermore, AI and ML provide a powerful avenue for Aegon to achieve deeper customer insights. This allows for more personalized product development and marketing strategies, enhancing customer satisfaction and retention. By analyzing vast datasets, Aegon can better predict customer needs and tailor offerings, a key differentiator in the competitive financial services landscape.

Improving claims outcomes is another critical opportunity. AI can assist in fraud detection and automate claims processing, leading to quicker payouts and a better experience for policyholders. In 2025, early adopters of AI in claims management are seeing a reduction in processing times by as much as 30% and a decrease in fraudulent claims by 15%.

Aegon's US operations, particularly in individual life and through World Financial Group (WFG), have demonstrated robust growth. WFG, for instance, saw a notable increase in its licensed agents, contributing to a stronger sales network.

This expansion in key strategic segments presents a significant opportunity. By continuing to invest in and nurture these areas, Aegon can capitalize on their proven success to drive future revenue streams and enhance the value of new business written.

Furthermore, Aegon's strategic focus on emerging markets like Brazil and Spain & Portugal offers additional avenues for growth. These dynamic regions provide fertile ground for expanding market share and diversifying revenue sources, leveraging the company's established presence.

Demand for Sustainable and ESG-focused Investment Products

The global shift towards sustainability is creating a significant opportunity for financial institutions like Aegon. Investors are increasingly prioritizing environmental, social, and governance (ESG) factors in their decisions. This trend is backed by substantial market growth; for instance, assets in sustainable funds globally reached an estimated $3.7 trillion by the end of 2023, with projections indicating continued expansion through 2025.

Aegon's established commitment to sustainability, including its net-zero ambitions, directly aligns with this burgeoning investor interest. This positions the company favorably to capture a larger share of this growing market. The demand for ESG-focused products is not just a niche trend but a mainstream movement, with many institutional investors now mandating ESG integration. For example, in 2024, a significant percentage of pension funds reported incorporating ESG criteria into at least half of their investment portfolios.

- Growing Investor Demand: Global sustainable investment assets are projected to exceed $50 trillion by 2025, presenting a vast market for ESG-aligned products.

- Regulatory Tailwinds: Increasing government regulations and reporting requirements worldwide are further incentivizing the development and adoption of sustainable investment strategies.

- Product Innovation: Aegon can leverage its sustainability focus to develop innovative ESG-centric investment products, attracting a new wave of environmentally and socially conscious capital.

- Enhanced Brand Reputation: Demonstrating a strong commitment to ESG principles can bolster Aegon's brand image and attract both retail and institutional investors seeking responsible financial partners.

Strategic Capital Reallocation and Shareholder Returns

Aegon's strategic capital reallocation from financial assets to growth areas like strategic assets, partnerships, and its global asset manager offers a significant opportunity. This shift is designed to fuel expansion and improve profitability.

The company's commitment to enhancing shareholder returns through increased dividends and share buybacks is a key element of this strategy. For instance, Aegon targeted a capital return of approximately €1.1 billion to shareholders in 2023, demonstrating a clear focus on value enhancement.

This capital deployment aims to optimize the business portfolio for higher returns:

- Focus on Growth: Shifting capital towards strategic assets and partnerships can unlock new revenue streams and market share.

- Asset Manager Synergies: Investing in its global asset manager can lead to improved operational efficiency and cross-selling opportunities.

- Shareholder Value: Increased dividends and buybacks directly reward investors and can signal confidence in future performance.

- Portfolio Optimization: The reallocation process is expected to create a more robust and higher-returning business mix.

Aegon's digital transformation of its UK operations into a leading savings and retirement platform presents a significant growth avenue, targeting £5 billion in annual net flows by 2028.

Leveraging AI and ML can streamline underwriting, improve claims processing efficiency by up to 30% (as seen in early 2025 adopters), and provide deeper customer insights for personalized offerings.

The company's strong performance in US individual life and through World Financial Group (WFG) offers a solid base for further expansion, capitalizing on established sales networks.

Emerging markets like Brazil and Spain & Portugal, coupled with a global surge in sustainable investing (estimated at $3.7 trillion by end-2023, with continued growth through 2025), provide substantial opportunities for market share expansion and ESG-focused product development.

| Opportunity Area | Key Metric/Data Point | Impact |

|---|---|---|

| Digital Transformation (UK) | Targeting £5 billion annual net flows by 2028 | Increased market share in digital savings and retirement |

| AI/ML Implementation | Up to 30% reduction in claims processing time (early 2025) | Enhanced efficiency, cost reduction, improved customer experience |

| US Growth (WFG) | Growing licensed agent network | Strengthened sales capabilities, increased new business value |

| Emerging Markets & ESG | Global sustainable investment assets projected to exceed $50 trillion by 2025 | New revenue streams, enhanced brand reputation, capital attraction |

Threats

The financial services sector faces increasing regulatory pressure, with potential shifts in corporate tax rates and pension rules posing a significant threat. For instance, upcoming changes to capital frameworks, like the move to Bermuda's system in 2028, could demand substantial operational and financial adaptations, thereby raising compliance expenses and potentially affecting Aegon's bottom line.

Global economic uncertainties, including persistent high inflation and the specter of recession in major economies, present a significant threat to Aegon. These conditions can dampen consumer spending on insurance and investment products, directly impacting revenue streams.

Geopolitical tensions, such as ongoing conflicts and trade disputes, further exacerbate these economic headwinds. For instance, the IMF projected global growth to slow to 2.7% in 2024, a stark contrast to the 3.4% seen in 2023, highlighting a challenging operating environment.

Political instability or the imposition of trade tariffs in key markets where Aegon operates could disrupt market access and negatively affect the performance of its extensive investment portfolio, potentially leading to reduced asset values and returns.

The insurance, pensions, and asset management industries are intensely competitive, featuring established companies alongside innovative fintech startups. This landscape presents a significant threat to Aegon, as new entrants and evolving market dynamics can disrupt traditional business models.

Increased competition, particularly from US asset managers increasing their European presence or the growing influence of large index fund providers, poses a risk of fee compression. This trend can hinder Aegon's ability to achieve organic growth and protect its existing market share.

Cybersecurity Risks and Technological Disruptions

Aegon's heavy reliance on digital platforms and sophisticated technologies makes it a prime target for cybersecurity threats and potential system failures. A significant data breach in 2024 could expose sensitive customer information, leading to substantial fines and a severe blow to its reputation. For instance, the financial services sector experienced a 72% increase in cyberattacks in the first half of 2024 compared to the same period in 2023, according to industry reports.

Furthermore, the pace of technological change presents a challenge; failing to adapt quickly to innovations like advanced AI in customer service or blockchain for secure transactions could put Aegon at a competitive disadvantage. By the end of 2025, it's projected that over 60% of financial institutions will have integrated AI into their core operations, a trend Aegon must keep pace with to avoid falling behind.

- Cybersecurity Vulnerabilities: Aegon's digital infrastructure is susceptible to data breaches, ransomware, and other cyberattacks, potentially impacting millions of customers.

- Technological Obsolescence: Failure to invest in and adopt emerging technologies could render Aegon's current systems outdated and inefficient.

- Operational Disruption: System failures or cyber incidents can halt critical business operations, leading to significant financial losses and customer dissatisfaction.

- Reputational Damage: A major security lapse or technological failure can erode customer trust and severely damage Aegon's brand image in the competitive insurance and asset management markets.

Adverse Mortality and Claims Experience

Unexpected adverse mortality experience, such as the noted US experience in Q1 2025, can directly impact Aegon's life insurance segment profitability. Catastrophic events also pose a significant risk, potentially leading to a surge in claims that could strain financial resources and negatively affect underwriting results.

While Aegon actively manages risk, large-scale unforeseen claims, like those potentially arising from a widespread health crisis or natural disaster, can challenge the company's ability to absorb losses. For instance, a sudden spike in mortality rates exceeding actuarial assumptions could lead to substantial payouts, impacting earnings and capital reserves.

- Adverse Mortality Impact: The Q1 2025 US mortality experience highlights the sensitivity of life insurance profitability to unexpected claims.

- Catastrophic Event Risk: Large-scale events can trigger significant claim volumes, testing financial resilience.

- Underwriting Strain: Unforeseen mortality trends can negatively impact underwriting results and profitability.

The increasing regulatory landscape, including potential shifts in tax and pension rules, presents a significant hurdle. For example, the move to Bermuda's system by 2028 will require substantial operational adjustments, increasing compliance costs.

Global economic instability, marked by persistent inflation and recessionary fears, dampens consumer demand for Aegon's products. The IMF's projected slowdown in global growth to 2.7% for 2024 underscores this challenging environment.

Intense competition from established players and agile fintech firms, coupled with US asset managers expanding in Europe, threatens fee compression and market share. This competitive pressure can hinder Aegon's organic growth prospects.

Cybersecurity threats remain a critical concern, with a 72% rise in financial sector cyberattacks in H1 2024. A data breach could lead to severe financial penalties and reputational damage.

| Threat Category | Specific Risk | Impact on Aegon | Supporting Data/Example |

|---|---|---|---|

| Regulatory Changes | Shifting capital frameworks (e.g., Bermuda system by 2028) | Increased compliance costs, potential financial adaptation needs | Bermuda system implementation by 2028 |

| Economic Uncertainty | High inflation, recessionary pressures | Reduced consumer spending on financial products, lower revenue | IMF projects 2.7% global growth in 2024 (down from 3.4% in 2023) |

| Competition | Fintech disruption, increased US asset manager presence in Europe | Fee compression, loss of market share, hindered organic growth | Growing influence of large index fund providers |

| Cybersecurity | Data breaches, ransomware attacks | Financial penalties, reputational damage, operational disruption | 72% increase in financial sector cyberattacks (H1 2024 vs. H1 2023) |

SWOT Analysis Data Sources

This Aegon SWOT analysis is built upon a robust foundation of data, including Aegon's official financial statements, comprehensive market research reports, and insights from industry experts and analysts to provide a well-rounded perspective.