Aegon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegon Bundle

Aegon's competitive landscape is shaped by powerful forces, including the bargaining power of buyers and the threat of substitute products. Understanding these dynamics is crucial for any strategic decision-maker. The full Porter's Five Forces Analysis provides a comprehensive, data-driven framework to uncover Aegon's true competitive strengths and vulnerabilities.

Ready to move beyond the basics? Get a full strategic breakdown of Aegon’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Aegon's reliance on specialized technology and data providers for critical functions like policy administration and claims processing grants these suppliers considerable bargaining power. Vendors offering proprietary software or unique data sets, particularly those integral to Aegon's digital transformation efforts such as AI and machine learning tools, can command stronger terms due to the high costs and operational disruption associated with switching. For instance, the increasing integration of advanced analytics platforms, often developed by niche providers, underscores this dependency.

Reinsurance providers are critical suppliers for Aegon, offering essential risk mitigation for large-scale exposures. The concentration within the reinsurance market, or the scarcity of specific types of coverage, directly translates into increased bargaining power for these reinsurers. This can manifest as higher premiums or less favorable contract terms, squeezing Aegon's profitability and limiting its capacity to underwrite new business.

For instance, Aegon's Q1 2025 earnings call highlighted the impact of unfavorable mortality claims, a factor that could certainly influence the pricing and terms offered by reinsurers in upcoming renewals. If reinsurers perceive a sustained increase in such claims, they are likely to adjust their pricing upwards to compensate for the perceived higher risk, thereby strengthening their position in negotiations with Aegon.

The bargaining power of suppliers, particularly concerning talent and expert labor, significantly impacts Aegon. The availability of highly skilled professionals, such as actuaries, investment managers, and cybersecurity experts, is crucial for Aegon's operations and innovation. A tight labor market for these roles, or strong representation by professional bodies, can drive up compensation and limit Aegon's flexibility, effectively increasing supplier power.

Aegon's strategic move towards a hybrid work model, as highlighted in April 2024, directly addresses these labor market dynamics. By expanding its reach beyond traditional geographic constraints, Aegon aims to broaden its talent pool. This initiative is a proactive measure to mitigate the potential for increased labor costs and to ensure it can attract and retain the specialized expertise needed to maintain its competitive edge in the financial services industry.

Financial Market Data and Analytics

The bargaining power of suppliers for Aegon's financial market data and analytics is significant, particularly for providers of real-time, accurate information and advanced analytical tools. These suppliers, especially those with dominant market positions, can exert considerable influence over pricing and terms. The heightened market volatility anticipated in 2025, as highlighted in various asset management outlooks, further amplifies the demand for reliable data, strengthening supplier leverage.

Key factors contributing to supplier power include:

- Exclusive Data Feeds: Certain data providers hold exclusive rights to critical market information, limiting Aegon's alternatives.

- Proprietary Analytics: Advanced analytical platforms often involve proprietary algorithms and technology, creating high switching costs.

- Regulatory Compliance: Data providers often cater to stringent regulatory requirements, adding complexity and cost to data sourcing.

- Market Consolidation: The financial data industry has seen consolidation, leading to fewer, larger suppliers with increased market power.

Regulatory Compliance and Consulting Services

The financial services industry, including companies like Aegon, operates within a complex web of regulations, making specialized compliance and consulting services critical. These suppliers, possessing deep expertise in navigating these intricate rules, hold significant bargaining power. Their ability to ensure adherence to laws and avoid costly penalties makes their services indispensable to financial institutions.

For instance, in 2024, the global financial consulting market was valued at over $200 billion, with a substantial portion dedicated to regulatory compliance. This highlights the significant demand and reliance on these specialized firms. Their specialized knowledge allows them to command premium fees, as a single compliance misstep can result in millions in fines and reputational damage.

- Expertise is Key: Suppliers with niche knowledge in areas like anti-money laundering (AML) or data privacy regulations possess considerable leverage.

- Regulatory Shifts: Anticipated regulatory changes in 2025, such as evolving capital requirements or consumer protection laws, further amplify the power of consultants who can guide Aegon through these transitions.

- High Switching Costs: The effort and risk involved in switching compliance providers, given the need for continuity and deep understanding of Aegon's operations, also contribute to supplier power.

- Limited Supplier Pool: The number of highly reputable and effective regulatory consulting firms is finite, creating a concentrated supplier base that can exert greater influence over pricing and terms.

Suppliers of specialized technology and data, particularly those integral to Aegon's digital transformation, wield significant bargaining power due to high switching costs and the critical nature of their offerings. Reinsurance providers also hold considerable sway, especially in concentrated markets or when specific coverage is scarce, impacting Aegon's profitability and underwriting capacity.

The availability of highly skilled labor, such as actuaries and cybersecurity experts, is another area where supplier power is evident, driven by tight labor markets and the need for specialized expertise. Furthermore, providers of financial market data and regulatory compliance services command premium fees due to their unique knowledge and the critical importance of accuracy and adherence to evolving regulations.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Aegon |

|---|---|---|

| Technology & Data Providers | Proprietary software, unique data sets, high switching costs | Increased costs for essential digital transformation tools, potential operational disruption |

| Reinsurance Providers | Market concentration, scarcity of specific coverage, claims experience | Higher premiums, less favorable contract terms, reduced underwriting capacity |

| Specialized Labor (e.g., Actuaries) | Tight labor market, demand for niche skills, professional representation | Higher compensation costs, challenges in talent acquisition and retention |

| Financial Data & Analytics | Exclusive data feeds, advanced proprietary analytics, market volatility | Premium pricing for real-time, accurate information, reliance on key providers |

| Regulatory Compliance Consultants | Niche expertise, evolving regulations, high switching costs, limited supplier pool | Premium fees for essential compliance guidance, risk of penalties for non-compliance |

What is included in the product

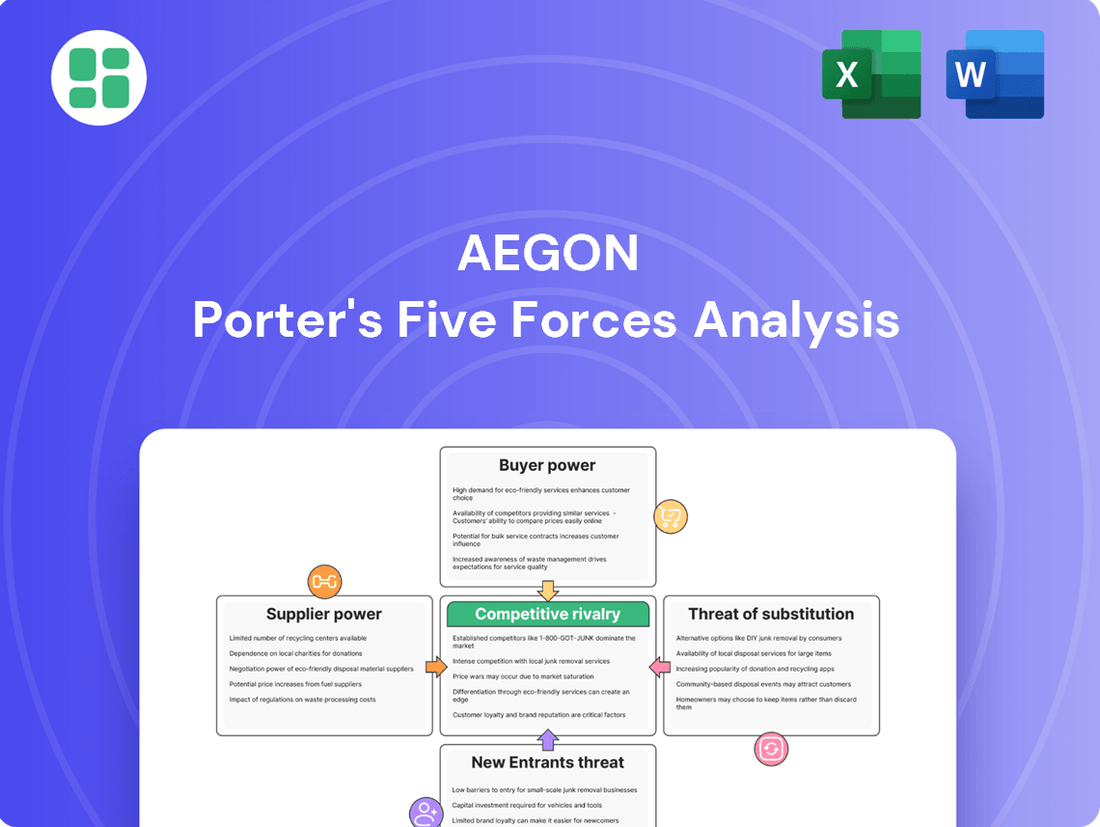

This analysis leverages Porter's Five Forces to dissect Aegon's competitive environment, examining industry rivalry, the threat of new entrants, buyer and supplier power, and the impact of substitutes.

Quickly identify and address competitive pressures with a visual representation of all five forces, enabling targeted strategic adjustments.

Customers Bargaining Power

For complex, long-term financial products like pensions and life insurance, customers often encounter substantial switching costs. These can include administrative fees, the risk of forfeiting accumulated benefits, and the sheer difficulty of transferring intricate policies. In 2024, Aegon's established presence in these markets means many customers are locked into existing arrangements, significantly diminishing their power to easily switch to rivals.

For standardized investment products, customers often exhibit high price sensitivity. This is because these offerings, unlike complex financial instruments, have lower switching costs. Customers can readily compare fees and expected returns across different providers for simpler accounts, which naturally amplifies their bargaining power.

The asset management sector, where Aegon is a significant player, has been experiencing persistent fee compression. This trend directly reflects the increased customer pressure on pricing, as clients become more discerning about the costs associated with their investments.

Information asymmetry, where Aegon holds more knowledge about its financial products than its customers, traditionally grants the company leverage. However, this dynamic is shifting. The increasing availability of online comparison tools and a growing emphasis on financial education are leveling the playing field.

By 2025, the insurance sector anticipates a more financially savvy consumer. For instance, a 2024 study indicated that over 60% of individuals surveyed actively used online resources to compare financial products before making a purchase, directly impacting Aegon's ability to dictate terms.

Large Institutional Clients

Aegon’s large institutional clients, like corporate pension plans and major investment funds, wield considerable bargaining power. Their sophisticated financial knowledge and significant investment volumes allow them to demand customized terms and pricing, which can put pressure on Aegon’s profit margins. For instance, the scale of assets managed for these clients means even small concessions can represent substantial financial impact.

These institutional clients are not passive participants; they actively negotiate, often leveraging their ability to shift assets to competitors if Aegon’s offerings are not sufficiently attractive. Aegon’s business segments, particularly its workplace platform and broader institutional client services, are direct interfaces where this power is most evident. In 2024, the continued focus on fee compression across the asset management industry underscores the ongoing pressure from these sophisticated buyers.

- Sophisticated Expertise: Institutional clients possess deep financial understanding, enabling them to scrutinize Aegon's proposals thoroughly.

- Substantial Purchasing Power: The sheer volume of assets managed by these clients grants them significant leverage in negotiations.

- Bespoke Terms: Clients can negotiate unique service agreements and fee structures tailored to their specific needs.

- Market Pressure: The competitive landscape for institutional asset management in 2024 highlights the client's ability to switch providers, intensifying bargaining power.

Digital Platforms and Direct-to-Consumer Models

The proliferation of digital platforms and direct-to-consumer (D2C) models significantly amplifies customer bargaining power. These channels grant consumers unprecedented access to information, enabling seamless product and price comparisons. For instance, in 2024, online comparison sites for financial products saw a 15% increase in user engagement, reflecting this trend.

This enhanced transparency and ease of comparison directly challenge traditional intermediaries. Customers can now bypass them, engaging directly with providers, which often leads to more competitive pricing and tailored offerings. Aegon's strategic focus on improving digital channels and customer experiences is a direct response to this evolving landscape, aiming to retain and attract customers in this more empowered environment.

- Increased Information Access: Customers can easily research and compare financial products from various providers online.

- Direct Engagement: Digital platforms allow customers to interact directly with companies, bypassing traditional sales channels.

- Price Transparency: Online tools facilitate easy comparison of pricing and fees, driving down costs for consumers.

- Shift in Power Dynamics: The ease of switching and access to alternatives strengthens the customer's position in negotiations.

Customers' bargaining power is influenced by switching costs, price sensitivity, and information access. While complex products like pensions have high switching costs, simpler investments are more susceptible to price competition. In 2024, Aegon faces increased customer power due to readily available online comparison tools and a growing demand for transparent pricing, especially in the asset management sector where fee compression is evident.

Large institutional clients, with their financial expertise and substantial assets, exert significant leverage, often negotiating bespoke terms. The rise of digital platforms further empowers individual consumers by increasing transparency and facilitating direct engagement with providers, leading to more competitive pricing. A 2024 study showed over 60% of consumers used online resources for financial product comparisons, highlighting this shift.

| Factor | Impact on Aegon | 2024 Data/Trend |

|---|---|---|

| Switching Costs (Complex Products) | Lowers customer power | High for pensions/life insurance |

| Price Sensitivity (Simple Products) | Increases customer power | High for standardized investments |

| Information Access | Increases customer power | 60%+ consumers use online comparison tools |

| Institutional Client Leverage | Increases customer power | Significant negotiation on fees and terms |

Full Version Awaits

Aegon Porter's Five Forces Analysis

This preview showcases the complete Aegon Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the insurance industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You're looking at the final, ready-to-use document, guaranteeing instant access to this valuable strategic tool the moment your transaction is complete.

Rivalry Among Competitors

The global financial services sector, a vast arena including life insurance, pensions, and asset management, is characterized by significant fragmentation. This means there are many companies, both big and small, domestic and international, all competing for customers. For instance, in 2024, the global insurance market alone was valued at trillions of dollars, with a substantial number of players contributing to this figure.

This intense competition naturally fuels rivalry. Companies are constantly striving to capture a larger piece of the market, whether it's by offering better products, more competitive pricing, or superior customer service. Aegon, operating across various financial segments and regions, encounters a broad spectrum of competitors, from established global giants to agile local specialists, all vying for the same customer base.

While some insurance and investment offerings boast unique features, many fundamental products can become quite similar over time. This similarity naturally drives intense competition based on price. Think about basic savings plans or term life insurance; when the core benefits are alike, companies often find themselves battling on who offers the lowest cost or fees.

This trend is clearly visible in the asset management industry, which has experienced significant fee compression in recent years. For example, average global equity fund fees dropped to approximately 0.47% in 2023, down from higher levels previously, illustrating the pressure to compete on price.

In mature markets, the life insurance and pension sectors often experience sluggish growth. This forces companies to battle fiercely for a limited pool of customers, turning market share gains into a zero-sum game and intensifying rivalry. For instance, the global life insurance market in advanced economies is projected for only modest expansion through 2025, underscoring this competitive pressure.

High Fixed Costs and Exit Barriers

The financial services sector, including companies like Aegon, is characterized by significant fixed costs. These are often tied to maintaining robust IT systems, adhering to stringent regulatory frameworks, and building expansive distribution channels. For instance, in 2024, the global financial services industry continued to invest heavily in digital transformation, with cybersecurity alone representing a substantial ongoing expense for major players.

Furthermore, high exit barriers are a defining feature of this industry. These can include the long-term nature of insurance contracts and the intricate processes involved in ceasing operations, which effectively lock companies into the market. This means firms may continue to compete fiercely, even when market conditions are unfavorable, to avoid the costs and complexities of exiting.

Aegon's own global footprint and its long-standing commitments to policyholders underscore these industry dynamics. The company's diverse product portfolio and international presence necessitate substantial ongoing investment, making it challenging to scale back operations quickly.

- Significant fixed costs in financial services are driven by technology infrastructure and regulatory compliance.

- High exit barriers, such as long-term policy obligations, keep firms competing even in tough times.

- Aegon's global operations and long-term commitments illustrate these industry-wide high fixed costs and exit barriers.

Technological Innovation and Digital Transformation

Technological innovation, particularly in areas like artificial intelligence, big data analytics, and automation, is fundamentally reshaping the insurance and financial services landscape. This rapid digital transformation intensifies competitive rivalry as companies race to develop and implement cutting-edge solutions. Those that lag in adopting these new technologies face a significant risk of losing market share to more agile competitors.

Aegon's strategic focus on digital transformation, including substantial investments in AI and data capabilities, is a direct acknowledgment of this intense competitive pressure. For instance, Aegon's 2024 digital transformation initiatives aim to enhance customer experience and operational efficiency, reflecting a broader industry trend where technological prowess is a key differentiator. This competitive dynamic forces companies to continuously innovate to attract and retain customers in an increasingly digital-first market.

- AI Adoption: By 2024, over 60% of financial services firms were expected to have integrated AI into at least one core business process, driving efficiency and personalized customer offerings.

- Data Analytics Investment: Companies are channeling significant resources into big data capabilities, with global spending on data analytics in financial services projected to reach billions by 2025.

- Customer Experience Focus: Digital transformation efforts are heavily geared towards improving customer journeys, with personalized digital platforms becoming a primary competitive battleground.

- Automation in Operations: The adoption of robotic process automation (RPA) and other automation technologies is accelerating, aiming to reduce operational costs and speed up service delivery.

Competitive rivalry within the financial services sector, where Aegon operates, is exceptionally high due to market fragmentation and product similarity. Many companies, from global institutions to local players, vie for customers, often competing on price for standardized offerings. This pressure is evident in the declining fees within asset management, with average global equity fund fees around 0.47% in 2023.

Mature markets exacerbate this rivalry, as sluggish growth forces companies to fight for market share, making it a zero-sum game. Aegon's global presence and long-term commitments, like those in life insurance, contribute to significant fixed costs and high exit barriers, compelling firms to remain competitive even in challenging conditions. The industry's substantial investment in technology, with over 60% of financial services firms expected to use AI in core processes by 2024, further intensifies this competition.

| Metric | 2023/2024 Data Point | Implication for Rivalry |

|---|---|---|

| Average Global Equity Fund Fees | ~0.47% (2023) | Intensified price competition, particularly in asset management. |

| AI Adoption in Financial Services | >60% of firms integrating AI (expected by 2024) | Companies leveraging AI gain a competitive edge in efficiency and customer service. |

| Global Life Insurance Market Growth (Advanced Economies) | Modest expansion projected through 2025 | Forces intense competition for limited customer pools in mature markets. |

SSubstitutes Threaten

Self-insurance and personal savings present a substantial threat to traditional insurance and pension providers. Individuals and businesses with sufficient financial resources may choose to forgo insurance policies and pension plans, instead opting to manage their own risk and future financial needs through direct investments in assets like real estate, stocks, and bonds. This approach offers a sense of control and can potentially lead to cost savings, particularly for those with a high net worth or a clear understanding of their specific risk exposures.

Government social security and public pension schemes represent a significant threat of substitutes for private retirement products. In many developed nations, these state-provided benefits offer a baseline level of retirement income, reducing the perceived need for individual savings vehicles like private pensions and annuities. For instance, in 2024, the US Social Security system paid benefits to over 66 million Americans, demonstrating its widespread reach and impact on individual retirement planning.

The mandatory nature and perceived reliability of public pension systems can further diminish demand for private alternatives. When citizens are assured of a government-backed income stream in retirement, their propensity to invest in private plans may decrease. This is particularly true in countries with comprehensive welfare states where these programs are seen as a fundamental right and a secure fallback.

Customers increasingly bypass traditional asset managers and investment-linked insurance by directly purchasing stocks, bonds, and exchange-traded funds (ETFs) through user-friendly online brokerage platforms. This shift is fueled by reduced transaction costs and greater control, especially evident as retail trading volume in the US saw significant spikes in recent years, with platforms like Robinhood reporting millions of active users.

The threat of these direct investment channels is substantial for companies relying on managed assets. For instance, the global asset management industry, valued in the trillions, faces pressure as fee compression becomes more pronounced due to the accessibility of low-cost index funds and direct trading options. In 2024, many asset managers are actively adapting by offering more competitive fee structures and enhancing digital client experiences to retain market share against these substitutes.

Alternative Risk Transfer Mechanisms

Alternative risk transfer (ART) mechanisms present a significant threat to traditional insurance. These include options like captive insurance companies, risk retention groups, and the securitization of risks through instruments such as catastrophe bonds. For instance, the global market for insurance-linked securities (ILS), a key ART component, saw significant growth in recent years, with new issuances reaching an estimated $15 billion in the first half of 2024, demonstrating a clear alternative for risk financing.

These ART solutions offer businesses greater flexibility and can potentially lead to cost savings compared to conventional insurance. This flexibility allows companies to tailor risk management strategies to their specific needs, thereby diverting demand away from standard insurance products. For example, many large corporations now utilize captives to underwrite their own risks, particularly for property and casualty lines, reducing their reliance on the commercial insurance market.

- Captive Insurance: Businesses forming their own insurance subsidiaries to cover specific risks.

- Risk Retention Groups: Groups of similar businesses pooling resources to insure each other, often for liability.

- Securitization of Risk: Transferring risk to capital markets via financial instruments like catastrophe bonds.

- Market Growth: The ILS market, a prime example of ART, continues to expand, indicating a growing preference for these alternatives.

Emerging Fintech Solutions for Financial Planning

The threat of substitutes is significantly amplified by emerging fintech solutions. Robo-advisors, budgeting apps, and other digital platforms offer individuals accessible and often more affordable alternatives for financial planning, investment, and retirement management. These innovations bypass traditional financial institutions, providing a direct challenge.

These fintech alternatives frequently operate with lower overheads, translating into reduced fees for consumers. For instance, many robo-advisors charge annual management fees in the range of 0.25% to 0.50%, a stark contrast to the 1% or higher often seen with traditional human advisors. This cost-effectiveness makes them a compelling substitute for a growing segment of the market.

- Robo-advisors provide automated, algorithm-driven investment management.

- Budgeting apps like Mint or YNAB offer tools for tracking expenses and managing cash flow.

- Digital investment platforms allow for fractional share investing and easy portfolio diversification.

- Peer-to-peer lending platforms present an alternative to traditional banking for borrowing and lending.

The threat of substitutes for Aegon's core insurance and pension products is multifaceted. Self-insurance and direct investment in markets, facilitated by user-friendly fintech platforms, offer individuals greater control and potential cost savings, diverting significant capital from traditional channels. Government social security programs also act as a powerful substitute, providing a baseline retirement income that can reduce the perceived necessity of private pension plans. For instance, in 2024, the US Social Security system continues to be a primary income source for millions of retirees.

Alternative risk transfer (ART) mechanisms, such as captive insurance and insurance-linked securities (ILS), provide businesses with tailored risk management solutions that bypass conventional insurance markets. The ILS market alone saw substantial growth, with new issuances estimated at $15 billion in the first half of 2024, highlighting the increasing adoption of these ART strategies. This trend directly challenges traditional insurers by offering more flexible and potentially cost-effective ways to manage risk.

The rise of fintech solutions, including robo-advisors and digital budgeting tools, presents a significant challenge by offering lower-cost, accessible alternatives for financial planning and investment management. These platforms often charge fees as low as 0.25% to 0.50%, making them highly competitive against traditional financial advisory services. This shift empowers consumers to manage their finances more directly, reducing reliance on established institutions.

Entrants Threaten

The financial services sector, including insurance, faces formidable regulatory hurdles. For instance, Solvency II regulations in Europe mandate substantial capital reserves for insurers, with compliance costs often running into millions of euros. These stringent requirements, alongside the need for extensive licensing and ongoing compliance procedures, create a high barrier to entry, making it difficult and costly for new players to establish themselves.

Brand loyalty in financial services is a significant barrier for new entrants. Customers often stick with established providers for life insurance and pensions, valuing trust and stability built over years. For instance, in 2024, major insurers continued to leverage their long-standing reputations, making it difficult for newcomers to attract customers without substantial investment in building credibility.

Economies of scale significantly deter new entrants in the insurance sector, as established players like Aegon leverage vast operational efficiencies. For instance, a large insurer can spread the high fixed costs of technology for policy administration and claims processing across a much larger customer base, leading to lower per-unit costs. This cost advantage makes it difficult for newcomers to compete on price without immense upfront capital. Aegon's established distribution channels, such as its World Financial Group, further solidify this barrier, as building a comparable network requires substantial time and investment.

Access to Proprietary Data and Analytics

Existing financial institutions possess extensive proprietary data, including historical customer behavior, sophisticated risk models, and detailed investment performance records. This data is invaluable for accurate underwriting, precise pricing, and innovative product development, giving incumbents a significant edge.

New entrants typically lack this deep well of proprietary information, creating a substantial barrier to entry. Without comparable data, they struggle to effectively assess risks and create products that can compete on price or features with established players.

For instance, in 2024, companies like Aegon are leveraging artificial intelligence and machine learning to extract granular insights from their vast datasets, further enhancing their ability to understand customer needs and market dynamics. This technological advantage, built upon years of data accumulation, makes it exceptionally difficult for newcomers to catch up.

- Data Advantage: Incumbents hold decades of customer and performance data, crucial for risk assessment.

- AI/ML Integration: Firms like Aegon use AI in 2024 to gain deeper insights from this data.

- Barrier to Entry: New entrants face significant challenges due to the lack of comparable historical data.

- Competitive Disadvantage: Without proprietary data, new players struggle with accurate pricing and product design.

Technological Infrastructure and Cybersecurity Investments

Developing and maintaining secure, advanced technological infrastructure is a significant hurdle for financial services firms, especially with the persistent threat of cyberattacks. The substantial expense and intricate nature of creating and safeguarding these systems effectively deter new market entrants.

Aegon's commitment to this area is evident in its continuous and substantial investments. For instance, in 2024, Aegon continued to prioritize cybersecurity enhancements and digital transformation initiatives, allocating significant capital to fortify its platforms against evolving cyber threats and to maintain a competitive technological edge.

- High Capital Expenditure: Building and securing state-of-the-art IT systems requires immense upfront investment, a barrier new competitors often cannot overcome.

- Cybersecurity Sophistication: The constant need for advanced cybersecurity measures, including threat detection and data protection, adds ongoing operational costs and complexity.

- Regulatory Compliance: Adhering to stringent data privacy and security regulations necessitates further investment in technology and expertise, increasing the barrier to entry.

The threat of new entrants for Aegon is moderate, primarily due to significant regulatory requirements and the substantial capital needed to operate within the financial services sector. These factors, combined with established brand loyalty and economies of scale enjoyed by incumbents, make it challenging for new players to gain a foothold.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Hurdles | Strict regulations like Solvency II require significant capital reserves and licensing. | High cost and complexity to comply, deterring new entrants. |

| Brand Loyalty & Trust | Customers prefer established, reputable financial institutions. | New entrants struggle to attract customers without proven track records. |

| Economies of Scale | Large insurers benefit from lower per-unit costs due to high fixed cost absorption. | Newcomers find it difficult to compete on price without massive upfront investment. |

| Proprietary Data & Technology | Incumbents possess vast historical data and advanced AI/ML capabilities. | New entrants lack crucial data for accurate risk assessment and product development. |

Porter's Five Forces Analysis Data Sources

Our Aegon Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from Aegon's annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and reputable financial news outlets to provide a comprehensive view of the competitive landscape.