Aegon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegon Bundle

Gain a critical advantage by understanding the external forces shaping Aegon's path. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their strategy. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and unlock a deeper understanding of Aegon's market landscape.

Political factors

Aegon, operating in the highly regulated financial services sector, is significantly influenced by government regulations and policy changes across its global markets, especially in life insurance, pensions, and asset management. For instance, evolving solvency requirements, like those stemming from Solvency II directives, and new consumer protection legislation directly affect Aegon's capital needs and the design of its financial products.

The company's 2024 Integrated Annual Report and its 2025 Q1 trading update underscore a continuous focus on navigating these complex regulatory landscapes and managing capital effectively in diverse operating environments. These reports often detail specific impacts of regulatory adjustments on Aegon's financial performance and strategic planning.

Aegon's operations are deeply intertwined with the political stability of the nations it serves. Fluctuations in government policies, regulatory changes, and shifts in political leadership can directly impact its insurance and asset management businesses, affecting everything from capital requirements to product offerings.

Geopolitical risks, such as ongoing trade disputes and regional conflicts, present significant challenges. For instance, the lingering effects of the war in Ukraine and evolving trade dynamics with major economies like China, as highlighted in 2025 economic forecasts, can introduce considerable market volatility. This volatility directly impacts Aegon's investment portfolios and the overall economic climate in key operating regions like Europe, potentially hindering growth prospects.

Aegon's extensive global footprint necessitates a constant evaluation of political landscapes. The company must actively manage the risks associated with political instability in diverse markets. For example, heightened tensions in Eastern Europe and ongoing trade negotiations globally underscore the need for robust risk mitigation strategies to safeguard its financial performance and operational continuity.

Changes in taxation policies significantly influence Aegon's profitability and the appeal of its financial products. For instance, adjustments to capital gains tax or dividend tax rates can directly alter the net returns for investors using Aegon's investment platforms.

New or modified tax laws concerning insurance premiums or pension contributions can sway customer demand and, consequently, Aegon's revenue. In 2023, many countries continued to review their fiscal policies, with some nations considering adjustments to corporate tax rates, which could impact Aegon's overall tax burden.

Aegon's commitment to tax compliance is evident in its governance, including its Global Tax Policy, which outlines its approach to adhering to tax regulations across its global operations. This policy ensures the company navigates the complex and evolving tax landscapes in markets like the Netherlands, the United States, and the United Kingdom.

International Trade Agreements

International trade agreements significantly shape Aegon's global operations and market access. For instance, the European Union's single market facilitates seamless cross-border business for Aegon, while trade disputes or new tariffs, such as those impacting global supply chains in 2024, can introduce volatility and necessitate strategic adjustments to investment portfolios and operational footprints.

Changes in trade relationships, particularly between major economies like the US and China, directly influence global financial flows. These shifts can impact investment strategies for Aegon by altering risk perceptions and the attractiveness of different markets. In 2024, ongoing trade negotiations and the potential for new trade blocs continue to be a key consideration for international financial institutions.

Aegon's international joint ventures and partnerships, such as its collaboration in the Netherlands and Spain, underscore its reliance on stable international economic relations. The stability provided by agreements like the Comprehensive Economic and Trade Agreement (CETA) between Canada and the EU, which came into full effect in 2017 and continues to evolve, supports Aegon's ability to manage diverse international assets and client bases.

- Global Trade Dynamics: Trade policies directly affect Aegon's ability to operate and expand internationally, influencing cross-border financial flows.

- Tariff Impacts: Imposition of tariffs or changes in trade relationships can create market volatility, impacting Aegon's investment strategies.

- Partnership Reliance: Aegon's international joint ventures depend on stable economic relations, often facilitated by established trade agreements.

- EU Single Market: The EU's single market remains a crucial facilitator for Aegon's European operations, promoting seamless integration.

Government Intervention Measures

Government intervention measures, such as nationalization or industry-specific bailouts, represent a potential risk for financial services firms like Aegon. While outright nationalization is rare in developed markets, governments can implement policies that significantly impact operations, like capital requirements or dividend restrictions. Aegon's financial reports, including its 2024 disclosures, acknowledge the evolving regulatory landscape and the potential for unexpected government actions to influence its business environment.

The likelihood and form of government intervention can be influenced by macroeconomic stability and the health of the financial sector. For instance, during the 2008 financial crisis, many governments worldwide intervened to support financial institutions. More recently, in 2023 and early 2024, discussions around potential interventions in specific banking sectors, particularly in response to regional bank failures in the US, highlighted ongoing government preparedness and willingness to act to ensure systemic stability.

- Regulatory Scrutiny: Increased government oversight and potential for new regulations can impact Aegon's profitability and strategic flexibility.

- Economic Stability Mandates: Governments may prioritize broader economic stability, leading to interventions that affect financial markets and company operations.

- Industry-Specific Support: While less common for established insurers, governments have historically provided bailouts or support to critical financial sectors during crises.

Political stability and government policies are paramount for Aegon, influencing everything from regulatory compliance to market access across its global operations. For instance, the company's 2024 Integrated Annual Report highlights the ongoing need to adapt to evolving solvency requirements and consumer protection laws in key markets like the Netherlands and the United States. These regulatory shifts directly impact capital management and product development strategies.

Geopolitical tensions, such as those affecting Eastern Europe and global trade dynamics, introduce significant market volatility. This volatility can affect Aegon's investment portfolios and overall economic climate in regions where it operates, as noted in 2025 economic outlooks. Consequently, Aegon must maintain robust risk mitigation strategies to navigate these uncertainties and ensure operational continuity.

Taxation policies are a critical factor affecting Aegon's profitability and the attractiveness of its financial products. Adjustments to capital gains or dividend taxes, as well as changes in taxes on insurance premiums or pension contributions, can influence customer demand and Aegon's revenue streams. For example, ongoing reviews of corporate tax rates in various nations, as observed in 2023, can impact the company's overall tax burden.

International trade agreements and global trade dynamics significantly shape Aegon's cross-border operations. The EU's single market, for example, facilitates seamless business integration for Aegon's European entities. Conversely, trade disputes or the imposition of tariffs, as seen in global supply chains during 2024, can create volatility and necessitate strategic adjustments to investment portfolios and operational footprints.

What is included in the product

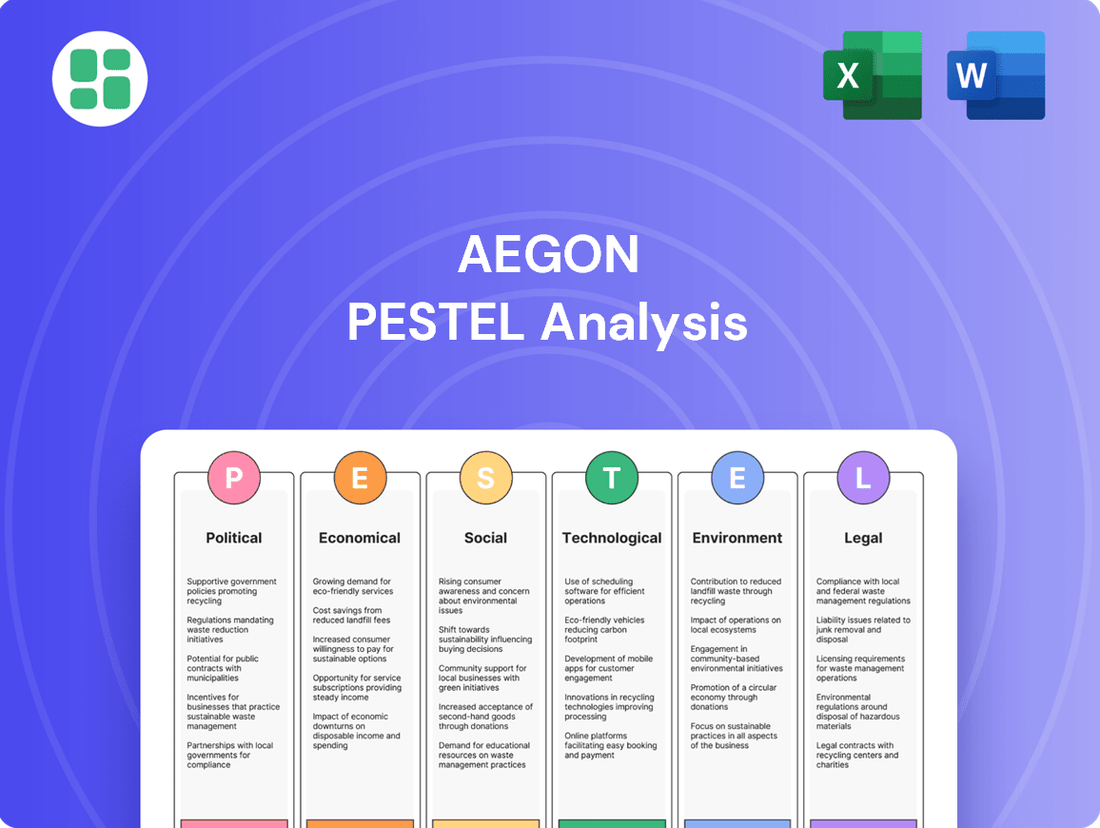

This Aegon PESTLE analysis examines the critical external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Aegon PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

Economic factors

Interest rate fluctuations are a significant economic factor for Aegon. Changes in rates directly impact the profitability of its life insurance and pension operations by altering investment returns and the cost of borrowing. For instance, a prolonged low-rate environment or sharp rate increases can affect how Aegon values its long-term obligations and the performance of its investment portfolio.

Aegon's Q1 2025 trading update highlighted the sensitivity of its business to these shifts, specifically mentioning the impact of decreasing interest rates on variable annuities and the capital requirements for managing market risks. This underscores the critical need for Aegon to effectively manage its exposure to interest rate volatility.

Inflation and economic growth are critical considerations for Aegon. Elevated inflation, as seen in many economies through 2024, directly impacts consumer purchasing power and savings, potentially dampening demand for financial products. For instance, persistent inflation can erode the real returns on investments, making it harder for Aegon's customers to meet their long-term financial goals.

The pace of economic growth also plays a significant role. Subdued growth in key markets throughout 2024 and into 2025 could lead to reduced new business volumes for Aegon, as individuals and businesses may be less inclined to invest or purchase new insurance policies. Aegon's strategic planning, as outlined in its 2024 reports, actively considers these regional economic divergences.

Aegon, as a global insurer and asset manager, faces significant exposure to currency exchange rate volatility. Fluctuations in exchange rates directly impact the translation of its foreign currency-denominated assets and liabilities into its reporting currency, affecting reported earnings and capital values. For instance, in 2023, Aegon's financial statements often highlighted the impact of currency movements, with specific gains or losses attributed to these shifts, underscoring the sensitivity of its international operations to foreign exchange markets.

Consumer Spending and Saving Habits

Consumer spending and saving habits are fundamental to Aegon's business, influencing demand for its life insurance, pensions, and investment products. Economic volatility and fluctuating consumer confidence directly impact disposable income allocation, affecting net deposits and overall product sales.

Looking ahead to 2025, European consumers are generally in a stable financial position. However, persistent economic and political uncertainties are prompting a noticeable trend towards increased savings.

- Increased Savings Trend: In 2024, a significant portion of European households reported an increase in their savings, driven by caution regarding future economic stability.

- Impact on Investment Products: Higher savings rates can translate to greater inflows into investment and pension products, benefiting Aegon's asset management divisions.

- Disposable Income Allocation: Shifts in consumer sentiment, influenced by inflation and geopolitical events, will continue to shape how disposable income is divided between immediate consumption and long-term savings.

Global Financial Market Stability

Global financial market stability is a critical concern for Aegon. Disruptions can significantly impact asset values and investment opportunities. For instance, the MSCI World Index experienced volatility in early 2024, reflecting ongoing geopolitical uncertainties and inflation concerns, which directly affect Aegon's investment portfolios across equities and debt.

Aegon's financial reports consistently highlight the sensitivity of its assets under management and capital ratios to market fluctuations. In 2024, continued interest rate hikes by major central banks, while aimed at curbing inflation, also increased the risk of bond market volatility and potential credit defaults, impacting Aegon's fixed-income holdings.

- Market Volatility: Equity markets, like the S&P 500, saw fluctuations in 2024, influenced by economic data and policy shifts, posing risks to Aegon's equity investments.

- Interest Rate Sensitivity: Rising interest rates in 2024, with the US Federal Reserve maintaining a hawkish stance, directly affect the valuation of Aegon's bond portfolios and its overall profitability.

- Credit Risk: Increased economic uncertainty in 2024 raised concerns about credit quality, potentially leading to higher default rates for corporate bonds held by Aegon.

- Real Estate Market Performance: Mixed performance in global real estate markets in 2024, with some regions showing resilience and others facing headwinds, impacts Aegon's real estate investment strategies.

Economic factors significantly shape Aegon's operational landscape. Interest rate shifts, inflation, and economic growth directly influence profitability and customer demand for financial products. Currency volatility impacts international earnings, while consumer spending habits dictate product sales. Global financial market stability is paramount, as asset values and investment opportunities are directly tied to market performance.

| Economic Factor | Impact on Aegon | 2024/2025 Relevance |

|---|---|---|

| Interest Rates | Affects investment returns and cost of borrowing. | Continued sensitivity to central bank policies, with potential for rate stabilization or further shifts impacting Aegon's portfolio valuations. |

| Inflation | Impacts consumer purchasing power and real investment returns. | Persistent inflation in some regions in 2024 continued to challenge real returns, influencing customer savings behavior into 2025. |

| Economic Growth | Influences new business volumes and investment appetite. | Regional growth divergences in 2024 and projected for 2025 mean varying demand for Aegon's products across its markets. |

| Currency Exchange Rates | Translates foreign earnings and impacts capital values. | Ongoing volatility in major currency pairs in 2024 necessitates careful hedging and risk management for Aegon's global operations. |

| Consumer Savings Habits | Drives demand for savings and investment products. | A trend towards increased savings in Europe observed in 2024, driven by economic uncertainty, is expected to continue into 2025, potentially boosting asset management inflows. |

Full Version Awaits

Aegon PESTLE Analysis

The Aegon PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Aegon's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering detailed insights into Political, Economic, Social, Technological, Legal, and Environmental factors impacting Aegon.

Sociological factors

Demographic shifts are profoundly reshaping the financial services landscape. In many developed nations, populations are aging, leading to increased demand for retirement income and long-term care solutions. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.5 billion globally, a significant jump from current figures.

Conversely, some regions are experiencing declining birth rates, which can impact the size of the future workforce and the demand for certain insurance products like child education plans. Aegon's strategic emphasis on retirement solutions, particularly in markets like the United Kingdom, directly addresses the needs of an aging demographic, aiming to provide financial security and support for individuals navigating their later years.

Consumers increasingly favor digital interactions for financial services, seeking personalized advice and prioritizing investments aligned with environmental and social values. This shift demands Aegon refine its product suite and how it reaches customers.

Aegon's strategic pivot in the UK, focusing on a digital-first savings and retirement platform, directly addresses these evolving consumer expectations. The company is actively investing in technology to enhance user experience and offer tailored solutions.

There's a noticeable surge in individuals actively seeking financial planning, driven by a desire for long-term security. This growing awareness directly fuels demand for Aegon's life insurance and retirement solutions. For instance, by late 2024, a significant percentage of adults in developed economies were reportedly engaging in some form of financial planning, a trend expected to continue into 2025.

Educational campaigns emphasizing retirement readiness and the protective benefits of insurance are proving effective. These initiatives resonate with consumers, encouraging them to invest in their financial futures, which in turn bolsters Aegon's product uptake. Market data from early 2025 indicates a sustained increase in participation in retirement savings plans across key Aegon markets.

Aegon's core mission—to empower individuals to achieve financial well-being—is perfectly aligned with this societal shift. As more people prioritize securing their financial future, Aegon is well-positioned to meet this evolving need, reinforcing its relevance and market position.

Workforce Trends and Talent Retention

Workforce trends are significantly reshaping the financial services landscape, with a growing demand for flexible work arrangements. This shift, coupled with intense competition for skilled talent, directly influences Aegon's operational efficiency and capacity for innovation. Attracting and retaining a diverse workforce is therefore paramount for sustained success.

Aegon's commitment to inclusion and diversity is highlighted as a critical societal issue in its Integrated Annual Report 2024. This focus is essential for building a resilient and adaptable workforce capable of navigating evolving market demands.

- Demand for Flexibility: Employees increasingly seek hybrid or remote work options, impacting traditional office-centric models.

- Talent Scarcity: The financial sector faces a shortage of specialized skills, particularly in areas like data analytics and digital transformation.

- Diversity Imperative: A diverse workforce fosters innovation and better reflects the customer base, a key strategic priority for Aegon.

Social Responsibility and Ethical Investing Trends

Societal expectations are increasingly pushing financial firms like Aegon to prioritize social responsibility and offer investment options that align with ethical, or ESG (Environmental, Social, and Governance), principles. This growing demand from consumers and stakeholders for transparency and positive impact is reshaping the investment landscape. For instance, a 2024 survey indicated that over 70% of investors consider ESG factors when making investment decisions.

Aegon is proactively responding to these trends by embedding ESG considerations into its investment analysis processes and establishing ambitious net-zero targets. This commitment to sustainable and responsible investment practices is a key component of their corporate strategy, as detailed in their latest sustainability reports. These reports often highlight specific initiatives, such as the reduction of carbon emissions in their investment portfolios or the promotion of diversity and inclusion within their operations.

- Growing Investor Demand: By 2025, the global sustainable investment market is projected to exceed $50 trillion, underscoring the significant shift towards ESG-focused portfolios.

- Aegon's ESG Integration: Aegon has committed to achieving net-zero emissions across its investment portfolio by 2050, with interim targets for 2030.

- Consumer Expectations: Research from 2024 shows that 65% of millennials and Gen Z investors prioritize ESG factors, influencing product development and marketing strategies for financial institutions.

- Reporting Transparency: Aegon's annual reports detail their progress on ESG metrics, including governance structures and social impact initiatives, providing stakeholders with verifiable data.

Societal shifts are driving a greater emphasis on financial literacy and well-being, with individuals increasingly seeking guidance to navigate complex financial landscapes. This heightened awareness fuels demand for accessible financial planning tools and educational resources, directly benefiting companies like Aegon that offer such services. By 2025, a notable portion of the population across developed economies is actively engaging in financial planning, a trend expected to persist.

Consumer preferences are leaning towards digital-first engagement, personalized advice, and investments that reflect ethical and social values. This necessitates that Aegon enhances its digital platforms and product offerings to align with these evolving expectations. The company's strategic focus on digital transformation and customer-centric solutions addresses this critical societal trend.

The growing importance of social responsibility and ethical investing, often termed ESG (Environmental, Social, and Governance), is profoundly influencing consumer choices. By 2025, a significant majority of investors are expected to consider ESG factors in their decisions, creating a strong market for sustainable financial products. Aegon's commitment to integrating ESG principles into its investment strategies and operations positions it favorably to meet this demand.

| Societal Factor | Trend Description | Impact on Aegon | Supporting Data (2024/2025) |

|---|---|---|---|

| Financial Literacy & Well-being | Increased demand for financial planning and education. | Drives demand for Aegon's advisory and retirement solutions. | By late 2024, a significant percentage of adults in developed economies engaged in financial planning. |

| Digital Engagement & Personalization | Preference for digital interactions and tailored financial advice. | Requires Aegon to enhance digital platforms and personalize customer experiences. | Consumers increasingly favor digital channels for financial services. |

| ESG & Ethical Investing | Growing investor preference for socially responsible investments. | Creates market opportunities for Aegon's sustainable investment products. | Over 70% of investors consider ESG factors in 2024; global sustainable market projected to exceed $50 trillion by 2025. |

Technological factors

Aegon's commitment to digitalization and automation is a cornerstone of its strategy to boost operational efficiency and lower costs. By streamlining processes and adopting digital platforms for customer engagement, the company aims to deliver a superior customer experience. This focus is evident in Aegon's transformation of its UK operations into a digital-first savings and retirement platform.

In 2024, Aegon continued to invest heavily in digital transformation, with a significant portion of its IT budget allocated to automation initiatives. For instance, the company reported a 15% reduction in processing times for new policy applications in its Dutch business following the implementation of automated workflows in early 2024. This drive for efficiency is critical as Aegon navigates an increasingly competitive landscape.

Aegon's increasing digital footprint exposes it to a growing landscape of cybersecurity threats, demanding robust measures to safeguard sensitive customer information. A significant data breach could result in substantial financial penalties, severe reputational harm, and stringent legal repercussions.

The company explicitly acknowledges computer system failures and data privacy breaches as key operational risks in its annual reporting, underscoring the critical nature of these technological challenges.

Aegon's strategic embrace of emerging technologies like AI, blockchain, and big data analytics is pivotal for its future. These advancements enable more sophisticated data analysis, leading to hyper-personalized product offerings and significantly improved fraud detection capabilities. For instance, AI-powered analytics can process vast customer datasets to identify unmet needs, a trend reflected in the global AI market projected to reach $1.8 trillion by 2030, according to some estimates.

The integration of these technologies is not just about efficiency; it's about cultivating a distinct competitive advantage. Aegon's ongoing digital transformation efforts are heavily focused on leveraging these tools to streamline operations, enhance customer experience, and innovate in product development. The company's investment in digital capabilities is crucial in a landscape where data-driven insights are paramount for success.

Fintech Innovation and Competition

The financial technology (Fintech) sector is rapidly evolving, presenting both opportunities and challenges for established players like Aegon. New Fintech startups are consistently introducing innovative business models and digital-first solutions, forcing traditional financial institutions to adapt or risk losing market share. This competitive pressure necessitates a continuous drive for innovation within Aegon, whether through strategic partnerships with Fintechs or the development of proprietary technological capabilities.

Aegon's strategic outlook for 2025, as highlighted in its 'Enterprise Tech Ecosystem Series' profile, underscores a commitment to leveraging technology. This focus suggests an active pursuit of digital transformation and collaborations to enhance its service offerings and maintain relevance in a market increasingly shaped by technological advancements. For instance, the global Fintech market size was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of this disruptive force.

Key technological factors influencing Aegon's competitive landscape include:

- Increased Competition: Fintechs are unbundling traditional financial services, offering specialized and often more user-friendly alternatives in areas like payments, lending, and wealth management.

- Demand for Digital Experiences: Customers now expect seamless, intuitive digital interactions, pushing companies like Aegon to invest heavily in user experience and mobile accessibility.

- Innovation in AI and Blockchain: Emerging technologies like artificial intelligence for personalized advice and blockchain for secure transactions are creating new efficiencies and product possibilities.

Online Distribution Channels and Customer Engagement

Leveraging online distribution channels and advanced customer engagement platforms is crucial for insurers like Aegon to broaden their reach and foster customer loyalty. This involves robust mobile applications, intuitive online portals, and sophisticated digital advisory tools. For instance, Aegon has been actively investing in enhancing its digital customer experience and streamlining online adviser journeys, reflecting a strong commitment to digital transformation in its distribution strategies.

These digital initiatives are supported by significant market trends. In 2024, the global digital insurance market was valued at over $70 billion and is projected to grow substantially. Aegon's focus on these channels aligns with customer preferences, as a significant portion of insurance purchases and inquiries are increasingly handled online.

Key aspects of Aegon's technological approach include:

- Enhanced Mobile Applications: Providing seamless policy management and claims processing via mobile devices.

- Online Advisory Tools: Offering digital platforms for financial planning and product selection, making advice more accessible.

- Personalized Customer Journeys: Utilizing data analytics to tailor digital interactions and product offerings to individual customer needs.

- Digital Adviser Support: Equipping financial advisors with advanced digital tools to improve client engagement and service efficiency.

Technological advancements are reshaping Aegon's operational landscape, driving efficiency and customer engagement. The company's strategic investments in digitalization and automation, particularly evident in its UK operations, aim to streamline processes and enhance user experience. By early 2024, Aegon reported a 15% reduction in policy application processing times in its Dutch business due to automated workflows, highlighting tangible efficiency gains.

Emerging technologies like AI and big data analytics are central to Aegon's future, enabling hyper-personalized offerings and improved fraud detection. The global AI market's projected growth to $1.8 trillion by 2030 underscores the significance of these investments. Furthermore, the rapidly evolving Fintech sector, with its market valued at approximately $2.4 trillion in 2023, presents both competitive pressures and opportunities for innovation through partnerships or proprietary development.

Aegon's digital distribution strategy focuses on leveraging online channels and advanced customer engagement platforms, including mobile applications and digital advisory tools. This aligns with the growing trend of online insurance purchases, as the global digital insurance market exceeded $70 billion in 2024. Key aspects of this approach include enhanced mobile applications for policy management, online tools for financial planning, and personalized customer journeys driven by data analytics.

Legal factors

Strict data protection regulations, like the EU's GDPR and similar global laws, create significant compliance challenges for Aegon. These rules govern how personal data is collected, stored, and processed, with non-compliance risking substantial fines and reputational harm. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. Aegon's internal governance and risk assessments actively address these data privacy and security obligations to mitigate these risks.

Consumer protection laws are crucial for financial services companies like Aegon, shaping everything from product design to how they communicate with customers. These regulations, like the EU's General Data Protection Regulation (GDPR) which came into full effect in 2018 and continues to influence data handling, ensure fair practices and transparency. For instance, stricter rules around product disclosures and complaint resolution mechanisms, often updated in response to market events, directly impact Aegon's operational procedures and customer service strategies.

Aegon operates under a complex web of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations globally. These rules mandate rigorous customer due diligence, transaction monitoring, and suspicious activity reporting to combat financial crime. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize enhanced due diligence for high-risk jurisdictions, impacting Aegon's international operations.

Failure to comply with these evolving AML/CTF frameworks can result in substantial financial penalties and significant reputational harm. In 2023, fines for AML breaches across the financial sector globally exceeded billions of dollars, underscoring the critical importance of robust compliance programs for companies like Aegon.

Solvency and Capital Adequacy Requirements

Regulatory mandates like Solvency II in Europe are crucial, setting minimum capital levels Aegon must maintain to absorb potential losses and ensure its ability to meet policyholder obligations. These rules directly influence the company's financial maneuverability and how it approaches its investment portfolio. For instance, Aegon's Q1 2025 Solvency and Financial Condition Report (SFCR) highlighted a strong solvency position, with its Solvency II ratio standing at 220% as of March 31, 2025. This figure demonstrates robust capital buffers well above the regulatory minimums, providing Aegon with significant financial flexibility.

Changes in these solvency and capital adequacy frameworks can significantly reshape Aegon's operational strategies and investment decisions. Stricter requirements might necessitate holding more capital, potentially limiting risk-taking or impacting dividend payouts. Conversely, a more favorable regulatory environment could unlock capital for growth initiatives or share buybacks. Aegon's ongoing monitoring and adaptation to evolving regulatory landscapes are therefore paramount for sustained financial health and strategic execution.

Key solvency metrics reported by Aegon in its Q1 2025 updates underscore its commitment to regulatory compliance and financial resilience. These reports, including the SFCR, provide transparency on capital levels and risk management practices.

- Solvency II Ratio: Aegon reported a Solvency II ratio of 220% as of March 31, 2025.

- Capital Buffers: This ratio indicates substantial capital reserves exceeding regulatory requirements.

- Regulatory Impact: Changes in solvency regulations directly affect Aegon's capital management and investment strategy.

- Financial Flexibility: Strong solvency positions enhance Aegon's capacity for strategic investments and shareholder returns.

Cross-Border Regulatory Harmonization or Divergence

The varying or converging financial regulations across nations present both hurdles and advantages for Aegon's international business. Successfully managing diverse legal environments demands substantial investment and can affect how smoothly cross-border operations run. For instance, in 2024, the European Union continued its efforts to harmonize digital finance regulations, which could streamline operations for Aegon's European subsidiaries, while simultaneously differing data privacy laws, like GDPR versus US state-specific regulations, still create complexity.

Aegon's extensive global asset management footprint and its strategic joint ventures mean it must stay acutely informed about these international legal structures. The company's presence in over 20 countries means it must constantly adapt to a patchwork of rules. For example, differing capital requirements for insurance companies in markets like the Netherlands versus those in the United States can significantly impact Aegon's capital allocation strategies and the overall efficiency of its global financial management.

- Regulatory Divergence Impact: Varying capital adequacy rules and consumer protection laws across jurisdictions can increase compliance costs and operational complexity for Aegon's multinational operations.

- Harmonization Opportunities: Progress in areas like international accounting standards (IFRS) or cross-border data flow agreements can reduce administrative burdens and facilitate more integrated global business practices.

- Asset Management Challenges: Different licensing requirements and investment restrictions in countries where Aegon manages assets necessitate tailored legal and operational approaches, impacting scalability.

- Joint Venture Considerations: Legal frameworks governing partnerships and mergers in different regions, such as antitrust regulations or foreign investment controls, directly influence Aegon's ability to form and manage its joint ventures effectively.

Aegon's operations are significantly shaped by evolving financial regulations, including those concerning capital adequacy and consumer protection. For instance, the company's Solvency II ratio stood at a robust 220% as of March 31, 2025, demonstrating strong capital buffers well above minimum requirements and providing financial flexibility. These legal frameworks directly influence Aegon's capital management and investment strategies, impacting its capacity for growth initiatives and shareholder returns.

| Regulatory Area | Impact on Aegon | 2024/2025 Data Point |

| Solvency II | Ensures capital adequacy, influences investment strategy | Solvency II Ratio: 220% (as of March 31, 2025) |

| Data Protection (e.g., GDPR) | Compliance with data handling, risk of fines | Fines can reach up to 4% of global turnover |

| AML/CTF | Mandates due diligence and reporting to combat financial crime | FATF emphasized enhanced due diligence in 2024 |

| Consumer Protection | Shapes product design, communication, and complaint resolution | Stricter rules on product disclosures and complaint mechanisms |

Environmental factors

Climate change poses significant risks and opportunities for Aegon. Physical risks, such as extreme weather events impacting property and casualty insurance portfolios, are a growing concern. Transition risks, driven by evolving climate policies and market shifts towards a low-carbon economy, could affect investment valuations and business models. For instance, a significant portion of the global economy is now subject to net-zero targets, influencing investment strategies and asset management.

Aegon views climate change as a pivotal environmental factor, integrating it into its strategic planning and operational frameworks. The company is actively engaged in identifying and managing climate-related risks across its diverse business lines, from life insurance to asset management.

The company is capitalizing on opportunities presented by the transition to a sustainable economy. This includes expanding its offerings in green investments and developing innovative climate-resilient insurance products. Aegon has committed to increasing its investments in activities that support climate change mitigation and adaptation, aligning its portfolio with sustainability goals and seeking to generate long-term value from these initiatives.

ESG investing pressure is significantly shaping Aegon's landscape. Investors, regulators, and the public are increasingly demanding that companies like Aegon integrate environmental, social, and governance factors into their investment strategies and day-to-day operations. This trend directly influences how Aegon develops its products and makes investment decisions, pushing for more sustainable and responsible practices across the board.

Aegon demonstrates its commitment to this shift through active participation in key initiatives. For instance, its membership in the Net-Zero Asset Owner Alliance underscores a dedication to incorporating ESG issues into its investment analysis and decision-making. This alliance aims to transition investment portfolios towards net-zero greenhouse gas emissions by 2050, a goal that requires substantial integration of environmental considerations into financial planning and execution.

Governments and financial regulators worldwide are intensifying their focus on sustainable finance, implementing new policies and demanding greater transparency regarding environmental impact and investment strategies. This regulatory push directly influences how companies like Aegon integrate sustainability into their operations and reporting.

Aegon's commitment to this evolving landscape is evident in its Integrated Annual Report 2024, which outlines its sustainability framework and performance metrics. For instance, the report details Aegon's progress in aligning its investment portfolio with climate goals, a key area of regulatory scrutiny.

Physical Risks from Extreme Weather Events

Extreme weather events pose significant physical risks to Aegon's operations and investments. Floods, wildfires, and other climate-related disasters can directly impact property and casualty insurance claims, a segment Aegon is less exposed to but still indirectly affected through broader economic disruption. For instance, the increasing frequency and intensity of such events globally, as noted by the World Meteorological Organization, can lead to substantial asset depreciation within Aegon's diverse investment portfolio, even though its core business is life and pensions.

Aegon actively manages its exposure to climate risk, as detailed in its annual reports. This management involves assessing the potential financial impact of physical climate hazards on its assets and liabilities.

- Impact on Investments: Physical risks can devalue assets held in Aegon's investment portfolio, such as real estate or infrastructure, due to damage or reduced economic viability from extreme weather.

- Insurance Claims: While Aegon's primary focus is life and pensions, any property and casualty exposure or reinsurance relationships can lead to increased claims payouts following severe weather events.

- Economic Disruption: Broader economic instability caused by widespread natural disasters can negatively affect investment returns and the overall financial health of policyholders, indirectly impacting Aegon.

- Climate Risk Management: Aegon's commitment to managing climate risk includes scenario analysis and stress testing to understand potential financial losses from physical climate impacts.

Reputational Risks related to Environmental Impact

Aegon faces significant reputational risks if its environmental impact is perceived negatively. Stakeholder scrutiny, from customers to regulators, can quickly erode trust and damage brand perception if the company is seen as lagging in sustainability efforts. For instance, in 2024, a significant portion of investors indicated that a company's environmental, social, and governance (ESG) performance directly influences their investment decisions, with 65% stating they would divest from companies with poor environmental records.

The financial services sector, including insurance and asset management, is particularly vulnerable to these reputational risks. Negative publicity surrounding investments in fossil fuels or inadequate climate risk management can lead to customer attrition and difficulty attracting new business. Aegon's commitment to reducing its carbon footprint, as evidenced by its 2023 target to achieve net-zero emissions in its own operations by 2030, directly addresses these concerns.

- Reputational Damage: Negative public perception regarding environmental practices can lead to customer boycotts and a decline in brand loyalty.

- Investor Confidence: A poor environmental record can deter ESG-focused investors, potentially impacting Aegon's access to capital and its stock valuation. In 2024, ESG funds saw continued inflows, highlighting the growing importance of sustainability for capital allocation.

- Regulatory Scrutiny: Increased focus on climate-related disclosures and environmental regulations means that inadequate performance can invite greater regulatory oversight and potential penalties.

- Talent Acquisition: A strong sustainability record is becoming crucial for attracting and retaining top talent, as employees increasingly seek to work for environmentally responsible organizations.

Environmental regulations are increasingly shaping Aegon's operations, pushing for greater transparency and sustainable practices. Stricter climate disclosure requirements, for example, are becoming standard, with many jurisdictions mandating reporting aligned with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). By 2024, a significant number of global companies, including those in financial services, were enhancing their climate risk reporting to meet these evolving expectations.

Aegon actively engages with these regulatory shifts, integrating sustainability into its core business strategy. The company's commitment to net-zero emissions, as outlined in its 2024 sustainability reports, reflects an adaptation to this regulatory environment. This proactive approach aims to mitigate compliance risks and capitalize on opportunities in the green economy.

The growing emphasis on sustainable finance by governments and regulators worldwide directly influences Aegon's investment decisions and product development. Policies promoting green bonds and sustainable investments are creating new avenues for growth, while also demanding robust risk management frameworks for climate-related financial exposures. For instance, European Union regulations like the Sustainable Finance Disclosure Regulation (SFDR) are already impacting how financial products are categorized and marketed.

Aegon's strategic response to environmental factors, particularly climate change, is detailed in its annual reports. The company's progress in aligning its investment portfolio with climate goals, such as increasing investments in renewable energy and sustainable infrastructure, demonstrates its adaptation to both regulatory pressures and market opportunities. For example, Aegon's 2024 Integrated Report highlighted a notable increase in its sustainable investment portfolio.

| Environmental Factor | Impact on Aegon | Aegon's Response/Data (2024/2025 Focus) |

|---|---|---|

| Climate Change (Physical Risks) | Increased insurance claims, asset depreciation | Scenario analysis for physical risks; focus on resilience in investment portfolios. |

| Climate Change (Transition Risks) | Impact on investment valuations, shift to low-carbon economy | Commitment to net-zero emissions in operations by 2030; increased green investments. |

| ESG Investing Pressure | Demand for sustainable practices, investor divestment risk | Membership in Net-Zero Asset Owner Alliance; 65% of investors consider ESG performance in 2024. |

| Regulatory Scrutiny (Sustainable Finance) | New policies, disclosure requirements, compliance risk | Enhanced climate risk reporting (TCFD aligned); SFDR compliance in relevant markets. |

PESTLE Analysis Data Sources

Our Aegon PESTLE analysis is meticulously constructed using a diverse array of data sources, including reports from international financial institutions, government regulatory bodies, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Aegon.