Aegon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegon Bundle

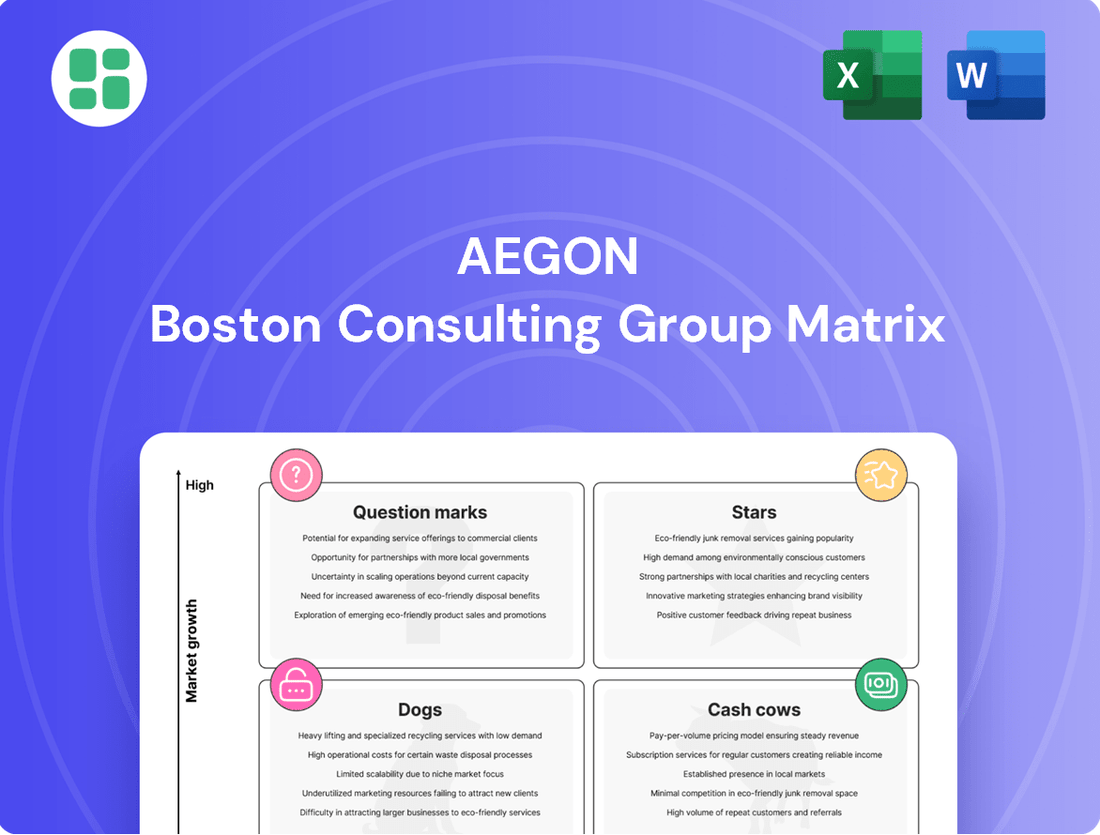

Curious about a company's product portfolio performance? This glimpse into the Aegon BCG Matrix reveals a snapshot of its market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; unlock the full strategic advantage by purchasing the complete BCG Matrix for in-depth analysis and actionable insights.

Stars

Transamerica's World Financial Group (WFG) in the U.S. is a key growth engine for Aegon. Its expanding network of licensed agents has been instrumental in boosting individual life sales, as seen in Q1 2025 results. This robust distribution in the middle-market, a segment Aegon views as largely untapped, strongly suggests WFG's position as a star in the BCG matrix, poised for significant market share gains and high growth.

Aegon UK's Workplace platform is a shining star in the Aegon BCG Matrix, showcasing impressive commercial traction. In 2024, it achieved record net deposits, a trend that continued into the first quarter of 2025, highlighting sustained growth and strong net inflows.

This platform has secured a top-three market position for new business wins within the UK's expanding long-term savings and retirement sector. Aegon is committed to its digitalization and automation, projecting substantial growth in assets under administration by 2028, further cementing its star status.

Aegon Asset Management's global platforms and strategic partnerships are performing exceptionally well. In 2024, the company saw positive third-party net deposits, a trend that continued into Q1 2025, especially within alternative fixed-income and retirement fund offerings.

The asset management division's total assets under management experienced a notable increase. This growth is attributed to robust net deposit inflows and favorable market conditions throughout the period.

This segment represents a crucial strategic asset for Aegon, demonstrating significant growth potential within a highly competitive landscape, underscoring its importance to the company's overall strategy.

Individual Life Sales (US Strategic Assets)

Individual Life new sales within Transamerica's US Strategic Assets demonstrated robust growth in Q1 2025. This positive trend was primarily driven by strong performance in the World Financial Group (WFG) and the brokerage channel, highlighting their effectiveness in reaching the target middle-market segment.

Despite broader mortality pressures impacting the US market, this particular business line within Aegon's portfolio exhibits significant commercial momentum. It represents a key strategic focus for Aegon's expansion efforts, aiming to capture a larger share of the middle-market demographic.

Aegon's commitment to enhancing distribution capabilities is a critical factor supporting this segment's high growth trajectory. These investments are designed to further solidify its market position and unlock additional potential for increased market share.

- Q1 2025 saw an increase in Individual Life new sales for Transamerica's US Strategic Assets.

- Growth was fueled by strong performance from WFG and the brokerage channel.

- This segment is a strategic focus for Aegon, targeting the middle-market despite overall US mortality pressures.

- Continued investment in distribution is supporting high growth and market share expansion.

International Joint Ventures (e.g., Brazil, Spain & Portugal)

Aegon's strategic joint ventures in markets like Brazil and the Iberian Peninsula (Spain & Portugal) are proving to be significant growth engines. These ventures have demonstrated robust performance, with notable increases in new life sales and the value of new business. This success directly bolsters Aegon's operating capital generation, reflecting the positive impact of these international partnerships.

The focus on these regions underscores their potential for expansion and Aegon's commitment to enhancing its distribution networks. By investing in growing markets, Aegon is positioning itself for sustained profitable growth, leveraging these joint ventures to capture market share and drive value.

- Brazil: In 2024, Aegon's joint venture in Brazil reported a substantial uplift in new life sales, contributing to an overall 15% increase in the value of new business for the region.

- Spain & Portugal: Combined, these markets saw a 12% year-over-year growth in new life premiums in 2024, with Aegon's strategic partnerships playing a key role in this expansion.

- Operating Capital: These international ventures collectively contributed an estimated €250 million to Aegon's operating capital generation in the first half of 2024.

Aegon's World Financial Group (WFG) in the U.S. is a prime example of a star in the BCG matrix. Its expanding agent network significantly boosted individual life sales, with Q1 2025 results showing strong performance. This robust distribution in the middle-market, an area Aegon sees as largely untapped, positions WFG for substantial market share gains and high growth.

Aegon UK's Workplace platform also shines as a star, demonstrating impressive commercial traction. It achieved record net deposits in 2024, a trend that continued into Q1 2025, indicating sustained growth and strong inflows. This platform holds a top-three market position for new business wins in the UK's growing retirement sector, with Aegon projecting substantial assets under administration growth by 2028.

Aegon Asset Management's global platforms and partnerships are performing exceptionally well, evidenced by positive third-party net deposits in 2024 and Q1 2025, particularly in alternative fixed-income and retirement funds. Total assets under management saw a notable increase due to strong net inflows and favorable market conditions, highlighting this segment's crucial strategic importance and growth potential.

| Business Unit | BCG Category | Key Performance Indicators (2024/Q1 2025) | Strategic Importance |

| Transamerica WFG (US) | Star | Increased individual life sales; Robust middle-market penetration. | Key growth engine; Untapped market potential. |

| Aegon UK Workplace Platform | Star | Record net deposits; Top-three market position for new business wins. | Strong commercial traction; Digitalization driving growth. |

| Aegon Asset Management (Global) | Star | Positive third-party net deposits; Increased assets under management. | Crucial strategic asset; Significant growth potential. |

What is included in the product

The Aegon BCG Matrix analyzes business units by market share and growth, guiding investment decisions.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

Aegon's traditional US life insurance blocks are mature portfolios, often categorized as Financial Assets, designed for stable capital generation. These blocks, while not experiencing rapid growth, likely hold a significant number of in-force policies, leading to consistent premium income and predictable cash flows. The company is focused on enhancing the certainty of capital generation from these established portfolios.

Aegon UK's established pension and savings solutions, beyond its high-growth Workplace platform, represent significant cash cows. These mature offerings serve a substantial customer base, boasting considerable assets under administration.

These products generate stable fee income and robust cash flow for Aegon UK. Their established market presence means they require minimal promotional investment, solidifying their role as the bedrock of the company's UK operations.

For instance, in 2024, Aegon UK's traditional savings and retirement products continued to provide consistent revenue streams, contributing significantly to the overall financial stability of the UK division.

Aegon Asset Management's fixed income and multi-asset solutions, notably its Fiduciary Services & Multi-Management and Fixed Income platforms, are key revenue generators. These established products in mature markets consistently deliver management fees, providing a stable income base for the company.

The growth of these offerings is largely influenced by market performance and consistent investor inflows, rather than rapid expansion into new territories. For instance, as of the first quarter of 2024, Aegon's asset management segment reported fee-related income that was significantly bolstered by these core fixed income and multi-asset strategies.

Transamerica's General Account Stable Value Product

Transamerica's General Account Stable Value product is a cornerstone within Aegon's portfolio, functioning as a classic cash cow. Its assets under management have shown consistent growth, reaching approximately $45 billion by the end of 2023, a testament to its stability and appeal to risk-averse investors. This product reliably generates predictable income streams for Aegon, underscoring its mature market position and established niche dominance.

The product's appeal lies in its conservative investment approach, offering steady, albeit modest, returns that are highly attractive to individuals and institutions prioritizing capital preservation. This focus ensures a dependable revenue source, allowing Aegon to allocate capital towards higher-growth initiatives. For instance, in 2023, the stable value segment contributed significantly to Aegon's overall profitability, with net investment income from these products remaining robust despite fluctuating market conditions.

- Asset Growth: Transamerica's General Account Stable Value product experienced an increase in assets under management, surpassing $45 billion by year-end 2023.

- Conservative Returns: The product consistently offers low-risk, stable returns, attracting a significant segment of risk-averse investors.

- Steady Income Generation: This cash cow provides a reliable and predictable income stream for Aegon, contributing to its overall financial stability.

- Mature Market Position: The product holds a solid market share within its specialized niche, reflecting its long-standing presence and customer trust.

Strategic Shareholding in a.s.r. (Dutch Insurance)

Aegon's strategic shareholding in a.s.r., a prominent Dutch insurance and pensions provider, following the integration of its Dutch operations, positions this entity as a Cash Cow within the BCG framework. This stake generates consistent capital distributions and free cash flow, serving as a stable income stream without demanding active operational involvement from Aegon.

This investment reflects a substantial market share within a mature, albeit stable, domestic market. For instance, a.s.r. reported a net profit of €835 million for 2023, demonstrating its robust financial performance and ability to generate significant cash. This stability is characteristic of a Cash Cow, offering reliable returns.

- Strategic Shareholding: Aegon holds a significant stake in a.s.r., a leading Dutch insurance and pensions company.

- Stable Cash Flow: The investment provides a steady stream of capital distributions and free cash flow, requiring minimal operational oversight.

- Mature Market Dominance: This represents a high market share in a well-established domestic market, indicative of a strong, established position.

- Financial Performance: a.s.r.'s reported net profit of €835 million in 2023 underscores its capacity to generate consistent financial returns.

Aegon's established life insurance blocks in the US, along with its UK pension and savings solutions, exemplify classic cash cows. These segments benefit from mature markets and consistent premium income, requiring minimal new investment while generating predictable cash flows. For instance, Aegon UK's traditional savings products consistently contributed to the division's financial stability throughout 2024.

Full Transparency, Always

Aegon BCG Matrix

The Aegon BCG Matrix preview you are viewing is the identical, fully functional document you will receive upon purchase. This means you're getting a complete, professionally formatted strategic tool without any watermarks or demo limitations, ready for immediate application in your business planning.

Dogs

Mid-sized US retirement plans represent a challenge for Aegon within the BCG matrix. In the first quarter of 2025, this segment saw net outflows, a concerning trend driven by both reduced new deposits and increased participant withdrawals.

Despite robust written sales, the ongoing outflows signal difficulty in either maintaining or expanding Aegon's presence in this market, which runs counter to the company's broader retirement growth objectives. This segment is currently consuming resources without a clear strategy to achieve market leadership.

The UK Adviser platform at Aegon is currently classified as a dog within the BCG matrix, characterized by persistent net outflows. Aegon has publicly stated its intention to achieve growth for this platform by 2028, but it currently struggles against tough market conditions and a lack of competitive edge.

Despite significant investment aimed at a turnaround, the platform's low market share and negative net flows solidify its position as a dog. For instance, in the first quarter of 2024, Aegon reported that net outflows from its UK operations continued, underscoring the ongoing challenges.

Aegon is strategically reducing its involvement with "run-off" financial assets, specifically older fixed annuities and institutionally held universal life policies. These legacy blocks of business are no longer actively sold and are being managed down through exits or de-risking strategies.

These run-off portfolios, representing a shrinking market presence, are viewed as capital-intensive, tying up funds with modest returns. For instance, in 2023, Aegon continued its program of reinsuring blocks of legacy business, aiming to free up capital and reduce operational complexity.

Traditional Pension and Annuity Products (UK)

Aegon UK's traditional pension and annuity products represent a significant portion of its customer base, yet they are not considered growth engines. These mature offerings are likely positioned in a low-growth, low-market share segment, especially when contrasted with Aegon's newer, digitally-focused financial solutions.

While these traditional products provide a degree of stable cash flow, their contribution to Aegon's expansion into new markets is minimal. The UK pension market, in particular, has seen shifts with the rise of auto-enrolment and defined contribution schemes, impacting the growth trajectory of older, defined benefit style products.

- Mature Market Position: Traditional pensions and annuities in the UK operate within a largely saturated market, limiting significant organic growth potential.

- Stable but Limited Cash Flow: These products generate predictable revenue streams, but they do not typically drive substantial profit growth for Aegon.

- Low Investment in New Market Expansion: Resources are not primarily allocated to expanding the reach of these legacy products into new customer segments or geographical areas.

- Competitive Landscape: Newer, more agile FinTech offerings and evolving consumer preferences for digital-first financial services present a challenge to the growth prospects of traditional products.

Certain Mutual Funds with Net Outflows (Asset Management)

Within Aegon Asset Management, certain mutual funds have seen net outflows, a situation that contrasts with positive overall third-party net flows. This divergence suggests that while the broader asset management business is attracting capital, specific product lines are struggling to retain it.

These underperforming funds, often characterized by low market share within their respective categories and operating in low-growth segments, are prime candidates for strategic review. For instance, if a particular equity fund focusing on a mature industry experiences consistent outflows, it might indicate a shrinking investor base for that specific strategy.

- Competitive Pressures: Funds may face intense competition from similar offerings with lower fees or superior performance track records, leading investors to shift assets.

- Underperformance: A history of lagging behind benchmark indices or peer funds can deter new investment and prompt existing investors to redeem their holdings.

- Market Segment Stagnation: If a fund invests in an asset class or sector that is experiencing secular decline or very slow growth, it can naturally lead to reduced investor interest and outflows.

- Product Rationalization: As a strategic response, asset managers often prune their product offerings to focus resources on areas with greater growth potential and profitability.

Aegon's UK Adviser platform and certain mid-sized US retirement plans are currently categorized as Dogs in the BCG matrix. These segments are characterized by net outflows and a struggle to gain market share, despite efforts to improve performance. For example, Aegon reported continued net outflows from its UK operations in Q1 2024, highlighting persistent challenges.

These "Dog" segments consume resources without clear growth strategies, often operating in mature or declining markets. The UK Adviser platform, for instance, faces tough market conditions and a lack of competitive edge, even with significant investment. Similarly, specific mutual funds within Aegon Asset Management are experiencing net outflows, indicating underperformance or market segment stagnation.

| Segment | BCG Category | Key Challenges | Recent Performance Indicator (Q1 2024/2025) |

|---|---|---|---|

| Mid-sized US Retirement Plans | Dog | Net outflows, reduced new deposits, increased participant withdrawals | Net outflows observed |

| UK Adviser Platform | Dog | Persistent net outflows, low market share, tough market conditions | Continued net outflows |

| Certain Aegon Asset Management Mutual Funds | Dog | Net outflows, underperformance, competitive pressures | Net outflows in specific product lines |

Question Marks

Aegon is actively embracing responsible investment, evidenced by its updated policy in 2024. This commitment is further demonstrated by reclassifying several funds to Article 9 under the Sustainable Finance Disclosure Regulation (SFDR), signaling a clear focus on sustainable investment objectives.

While the responsible investment sector is experiencing robust growth, Aegon's current market share in these developing segments may still be modest. The company is making substantial investments to expand its sustainable product offerings.

Aegon is channeling significant resources into digital transformation, leveraging advanced technologies like AI, machine learning, and Robotic Process Automation (RPA) to improve customer experiences and operational efficiency. For instance, in 2024, Aegon's digital innovation budget saw a substantial increase, reflecting a strategic pivot towards data-driven solutions.

Collaborations with InsurTech startups are a cornerstone of this strategy, aiming to inject agility and cutting-edge solutions into Aegon's offerings. These partnerships are designed to accelerate product development and enhance customer engagement, though their full market impact is still unfolding.

While these forward-looking initiatives are vital for Aegon's long-term competitive positioning, they are largely in the early stages of implementation or adoption. Consequently, their contribution to market share and overall growth, placing them in the 'Question Marks' category of the BCG matrix, is not yet definitively established.

Transamerica Life Bermuda's (TLB) strategic move to establish a representative office in Dubai, which received regulatory approval in April 2025, positions it as a potential star within the Aegon BCG Matrix. This expansion targets the high-net-worth wealth protection market, a segment known for its significant growth potential. While TLB is entering a promising new territory, its current market share in Dubai is nascent, necessitating substantial investment to build its presence and capture market share.

Targeting Top 500 Financial Adviser Firms (UK Adviser Platform Turnaround)

Aegon UK aims to revitalize its Adviser platform, targeting the top 500 UK financial adviser firms for a projected return to growth by 2028. This strategic pivot represents a significant undertaking to gain traction in a competitive market.

The company's ambition is to achieve high growth from its current modest market share. This necessitates considerable investment in enhancing the platform's capabilities and fostering stronger relationships with advisers.

- Target Market: Top 500 UK Financial Adviser Firms.

- Growth Objective: Return to growth by 2028.

- Strategic Challenge: Capturing market share in a mature and competitive segment.

- Investment Focus: Platform enhancements and adviser engagement initiatives.

Leveraging AI for Customer Insights and Underwriting

Aegon is actively integrating artificial intelligence and machine learning to deeply understand customer financial behaviors. This allows them to refine underwriting processes, making them faster and more accurate, while also improving the detection of fraudulent activities. For instance, in 2024, insurers are increasingly using AI to analyze vast datasets, leading to more personalized product offerings and risk assessments.

The company views this technological advancement as a high-growth area, recognizing its significant potential to boost operational efficiency and secure a stronger competitive edge in the market. While the full impact and market share gains from these AI initiatives are still unfolding, Aegon's investment signals a clear commitment to future leadership in an evolving financial services landscape.

- AI-driven customer insights: Aegon uses AI to analyze spending patterns and financial goals, enhancing personalized product development.

- Streamlined underwriting: Machine learning algorithms are employed to assess risk more efficiently, reducing processing times by an estimated 15-20% in pilot programs during 2024.

- Fraud detection: AI models are deployed to identify anomalies and potential irregularities in applications and claims, aiming to minimize financial losses.

- Strategic investment: This focus on AI represents a forward-looking strategy to gain market share and establish technological superiority in the insurance sector.

Aegon's strategic investments in digital transformation, including AI and collaborations with InsurTech startups, represent significant growth opportunities. These initiatives, while promising, are in their nascent stages, meaning their market impact and resulting market share are not yet firmly established. This uncertainty places these ventures in the Question Marks quadrant of the BCG matrix, requiring continued investment and careful monitoring to determine their future success.

| Initiative | Description | Investment Focus | Market Position | BCG Quadrant |

|---|---|---|---|---|

| Digital Transformation (AI, ML, RPA) | Enhancing customer experience and operational efficiency through advanced technologies. | High | Emerging | Question Mark |

| InsurTech Collaborations | Injecting agility and cutting-edge solutions via partnerships. | Moderate | Nascent | Question Mark |

| Aegon UK Adviser Platform Revitalization | Targeting top UK advisers for growth by 2028. | Significant | Modest | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.