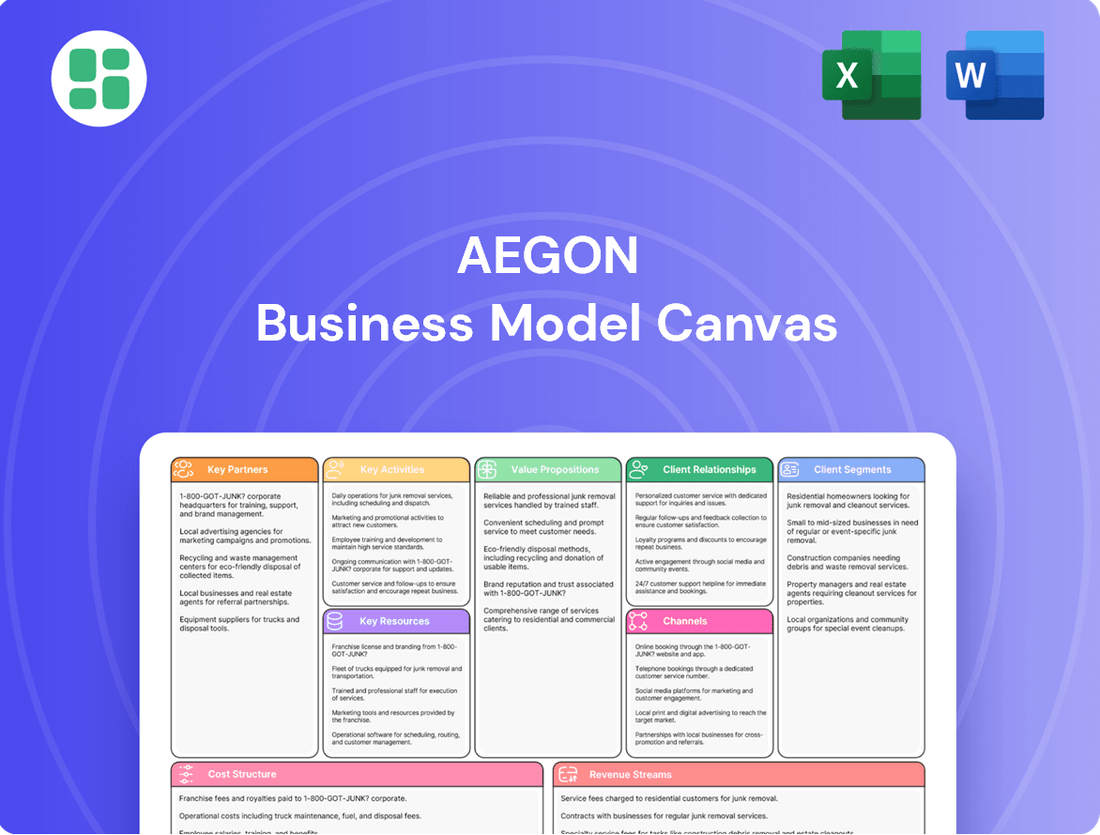

Aegon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aegon Bundle

Unlock the strategic blueprint behind Aegon's success with their comprehensive Business Model Canvas. This detailed analysis reveals how they effectively deliver value, manage key resources, and cultivate vital partnerships in the financial services sector. Discover the core components that drive their market position and revenue streams.

Ready to gain actionable insights into Aegon's operations? Our full Business Model Canvas provides a clear, section-by-section breakdown of their customer segments, value propositions, and cost structure. This professionally crafted document is your key to understanding their strategic advantages and potential for growth.

See how Aegon builds and sustains its business with our complete Business Model Canvas. This downloadable resource offers a deep dive into their revenue streams, key activities, and customer relationships, perfect for anyone looking to learn from a market leader. Get the full picture and accelerate your own strategic planning.

Partnerships

Aegon actively pursues strategic joint ventures, notably in markets such as Spain and Portugal, China, and Brazil. These collaborations are designed to merge Aegon's global insurance and asset management expertise with the deep local market knowledge and established networks of its partners.

These ventures are crucial for navigating complex regulatory environments and diverse economic conditions, thereby enabling effective market penetration. For instance, Aegon's joint venture in China, established in 2003, has been a significant driver of its growth in that dynamic market, allowing for shared risk and accelerated expansion.

By engaging in these strategic alliances, Aegon effectively broadens its global reach and strengthens its product distribution channels. This partnership model is particularly beneficial for entering or expanding within emerging economies where local understanding is paramount for success.

Aegon actively pursues asset management collaborations, notably in France and China, to bolster its investment management expertise and market penetration. These strategic alliances are instrumental in driving the growth of third-party net deposits within its Global Platforms and Strategic Partnerships segments, thereby increasing overall assets under management.

In 2024, Aegon's commitment to these partnerships continued to yield positive results, contributing to diversified revenue streams and strengthening its influence within the competitive asset management landscape. Such collaborations are vital for Aegon to expand its product offerings and access new client bases across different geographies.

Aegon leverages diverse distribution networks, including financial advisors and workplace platforms, to connect with a wide customer base. In the UK, a strategic focus on the top 500 financial adviser firms aims to boost gross flows, demonstrating a commitment to advisor relationships. The World Financial Group (WFG) in the US is a key partner, significantly contributing to the distribution of life insurance and annuity products.

Technology and Digital Solution Providers

Aegon actively collaborates with technology and digital solution providers to bolster its digital savings and retirement platforms. These partnerships are crucial for delivering a superior customer experience and optimizing service delivery. For instance, in 2024, Aegon continued its focus on digital transformation, investing significantly in upgrading its technological infrastructure to meet evolving customer expectations in the financial services sector.

These collaborations are vital for Aegon's competitive edge in the fast-paced digital financial environment. By leveraging the expertise of tech firms, Aegon can implement innovative solutions that streamline operations and enhance customer engagement. This strategic approach ensures Aegon remains at the forefront of digital innovation.

- Enhanced Customer Experience: Partnerships enable the integration of user-friendly interfaces and personalized digital tools.

- Streamlined Service Delivery: Collaboration with tech providers helps automate processes and improve efficiency in service provision.

- Digital Transformation: Investments in technology upgrades, often facilitated by these partnerships, are key to Aegon's ongoing digital evolution.

- Competitive Advantage: Staying ahead in the digital landscape requires continuous innovation, driven by strong relationships with technology solution providers.

Regulatory Bodies and Industry Associations

Aegon actively cultivates relationships with key regulatory bodies such as De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM). These engagements are crucial for ensuring ongoing compliance with financial regulations and for staying abreast of evolving legal frameworks. For instance, in 2024, Aegon's participation in the UK's pension adequacy reviews highlights its commitment to addressing significant societal financial challenges.

Participation in industry associations and forums allows Aegon to contribute to shaping industry standards and best practices. This collaborative approach is vital for addressing complex issues like climate change and promoting inclusion and diversity within the financial sector. By actively engaging in these discussions, Aegon aims to influence policy and ensure a more robust and equitable financial landscape for all stakeholders.

These strategic partnerships with regulators and industry groups are instrumental in navigating the intricate legal and operational environments of the financial services industry. By fostering strong relationships, Aegon not only mitigates regulatory risks but also gains opportunities to proactively influence the direction of industry policies and contribute to positive societal outcomes.

- Regulatory Engagement: Maintaining direct communication with bodies like DNB and AFM ensures adherence to the latest financial regulations.

- Industry Influence: Active participation in UK pension adequacy reviews demonstrates Aegon's role in addressing critical societal financial issues.

- Policy Shaping: Collaborating with industry associations helps Aegon influence standards related to climate change and diversity initiatives.

- Risk Mitigation: Strong regulatory relationships are key to navigating complex legal landscapes and minimizing compliance-related risks.

Aegon's key partnerships are multifaceted, encompassing joint ventures for market entry, collaborations with technology providers for digital enhancement, and strategic alliances with distribution networks. These relationships are vital for expanding its global footprint, improving customer experience, and driving growth in asset management.

In 2024, Aegon continued to leverage these partnerships, particularly focusing on enhancing its digital capabilities and strengthening its presence in key markets. The World Financial Group (WFG) in the US remains a significant contributor to life insurance and annuity distribution, while collaborations in France and China bolster its asset management segment.

These alliances are crucial for navigating regulatory landscapes and accessing new client bases, directly contributing to diversified revenue streams and a stronger competitive position in the financial services sector.

| Partner Type | Key Examples | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Joint Ventures | Spain, Portugal, China, Brazil | Market penetration, local expertise, risk sharing | Continued growth in dynamic markets |

| Asset Management Collaborations | France, China | Investment expertise, market access | Driving third-party net deposits |

| Distribution Networks | World Financial Group (US), Financial Advisors (UK) | Product distribution, customer reach | Boosting gross flows, expanding product reach |

| Technology Providers | Digital savings & retirement platforms | Customer experience, operational efficiency | Upgrading infrastructure, digital transformation |

What is included in the product

A detailed breakdown of Aegon's operations, outlining its key customer segments, value propositions, and revenue streams.

This model provides a strategic overview of Aegon's approach to customer relationships, key activities, and cost structure.

The Aegon Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of business strategy, allowing for rapid identification of inefficiencies and areas for improvement.

It streamlines the process of understanding complex business operations, thereby reducing the frustration and time spent on deciphering intricate strategies.

Activities

Aegon's primary function revolves around underwriting a diverse range of insurance products, encompassing both life and non-life categories, and diligently managing the inherent risks. This entails a thorough assessment of mortality and morbidity risks, the strategic establishment of premium rates, and the maintenance of robust capital reserves to ensure financial stability.

In 2024, Aegon continued to emphasize proactive risk management strategies. These efforts are vital for preserving a strong capital position and mitigating fluctuations in capital ratios, a key focus for the company's financial health and operational resilience.

Aegon's core activities heavily involve managing investment funds and individual client portfolios. This isn't just for their own insurance operations but also for a broad range of external customers. They focus on smart asset allocation and providing expert investment advice across different types of investments, including bonds and mixed-asset funds.

The growth of assets under management is a crucial metric for Aegon. For instance, as of the first quarter of 2024, Aegon's total assets under management stood at €389 billion. This figure directly impacts the company's revenue and overall financial health, as higher assets under management generally translate to more fee income.

Aegon's core activity involves the continuous development of a diverse range of financial products. This encompasses life insurance, comprehensive pension and retirement solutions, and various investment products designed to meet the dynamic needs of its global customer base.

The company actively pursues innovation by launching new digital products and enhancing existing platforms. In 2024, Aegon continued its focus on digital transformation, aiming to streamline customer experiences and introduce more accessible financial tools. This commitment to innovation is crucial for maintaining a competitive edge and expanding its product portfolio in response to evolving market demands.

Customer Service and Relationship Management

Aegon's customer service and relationship management are central to its operations. This involves actively engaging with customers, offering robust support, and ensuring a positive experience across all touchpoints. For instance, in 2024, Aegon continued to invest in digital tools to streamline customer interactions and improve response times, aiming to boost overall user satisfaction.

The company prioritizes building and maintaining strong client relationships, recognizing their importance for long-term retention and loyalty. This includes proactive communication, personalized service, and efficiently addressing any customer inquiries or concerns through multiple channels, whether online, via phone, or through financial advisors.

Key activities in this area include:

- Digital Platform Enhancement: Continuously improving online portals and mobile apps to provide seamless self-service options and easy access to information.

- Personalized Engagement: Tailoring communication and offerings based on individual customer needs and preferences, fostering a deeper connection.

- Multi-Channel Support: Ensuring consistent and high-quality service across all communication channels to meet customers wherever they are.

- Proactive Issue Resolution: Addressing potential customer issues before they escalate, demonstrating a commitment to customer well-being.

Digital Transformation and Platform Enhancement

Aegon is heavily invested in transforming its business through digital innovation, particularly focusing on enhancing its savings and retirement platforms. This strategic pivot involves ongoing capital allocation towards technology modernization to create more intuitive and accessible customer experiences. For instance, in 2024, Aegon continued to prioritize digital investments, aiming to streamline service delivery and boost operational efficiency across its core offerings.

The company's commitment to digital transformation is evident in its continuous efforts to upgrade its technological infrastructure. These enhancements are designed to not only improve the user experience but also to create a more agile and responsive service model. This focus on platform improvement is a key driver for Aegon's pursuit of future growth and greater operational effectiveness.

- Digital Savings and Retirement Focus: Aegon is prioritizing the development and enhancement of its digital platforms for savings and retirement products.

- Continuous Technology Investment: The company consistently allocates resources to upgrade its technological capabilities, ensuring platforms remain current and competitive.

- Streamlined Service Delivery: Investments aim to simplify customer interactions and improve the overall efficiency of service provision.

- Growth and Efficiency Objectives: This digital transformation strategy is directly linked to Aegon's goals of achieving sustainable future growth and optimizing operational performance.

Aegon's key activities center on underwriting insurance, managing investments, and developing financial products. They also focus on digital innovation and robust customer relationship management.

In 2024, Aegon continued to invest in digital platforms for savings and retirement, aiming for streamlined service and operational efficiency. This digital push supports their growth objectives.

The company actively manages investment funds and client portfolios, emphasizing smart asset allocation. As of Q1 2024, Aegon's assets under management reached €389 billion, a key indicator of its scale and revenue generation potential.

Aegon's commitment to innovation is evident in launching new digital products and enhancing existing platforms to meet evolving market needs and improve customer experience.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Insurance Underwriting | Assessing and managing life and non-life insurance risks. | Proactive risk management to preserve capital position. |

| Investment Management | Managing investment funds and client portfolios. | Focus on asset allocation and investment advice. |

| Product Development | Creating diverse financial products, including savings and retirement solutions. | Continuous development of digital products and platforms. |

| Digital Transformation | Enhancing online portals and mobile apps, investing in technology. | Prioritizing digital investments for service delivery and efficiency. |

| Customer Relationship Management | Engaging customers, offering support, and ensuring positive experiences. | Investing in digital tools to streamline interactions and improve satisfaction. |

Full Version Awaits

Business Model Canvas

The Aegon Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full usability from the moment of acquisition. You can confidently assess the quality and completeness of the Business Model Canvas based on this direct representation.

Resources

Aegon possesses significant financial capital, including substantial cash reserves at the holding company level, which is a critical resource for its operations. This financial strength, coupled with robust capital ratios across its various business units, allows Aegon to confidently underwrite insurance policies, manage investment portfolios, and effectively absorb unexpected financial downturns.

For instance, as of the first quarter of 2024, Aegon reported a Solvency II ratio of 221%, demonstrating a strong buffer above regulatory requirements. This healthy capital position is not just about resilience; it’s fundamental for meeting stringent regulatory demands and ensuring overall financial stability in a dynamic market environment.

Aegon's investment management expertise is a critical resource, built on deep knowledge across diverse asset classes and market cycles. This intellectual capital underpins their ability to manage substantial assets for both Aegon's own businesses and external clients, driving significant revenue streams.

This specialized knowledge is the bedrock of Aegon's asset management division. As of the first quarter of 2024, Aegon Asset Management reported €353 billion in assets under management, showcasing the scale and impact of their investment acumen.

Aegon's proprietary technology platforms are the backbone of its operations, facilitating everything from intricate insurance administration to seamless asset management and direct customer engagement. These systems are not static; they are continuously updated and enhanced, reflecting significant ongoing investments aimed at boosting operational efficiency and enriching the customer journey with cutting-edge digital solutions.

In 2024, Aegon continued to prioritize these technological assets, recognizing their pivotal role in scaling its business and maintaining a sharp competitive edge in the evolving financial services landscape. These investments are designed to ensure Aegon can adapt quickly to market changes and deliver innovative digital products that meet customer needs.

Global Distribution Networks and Brands

Aegon's extensive global distribution networks are a cornerstone of its business model. This includes fully owned operations in key markets like the United States through Transamerica, and significant presence in the United Kingdom. These established channels are crucial for reaching a broad customer base across multiple continents.

Complementing these distribution capabilities is Aegon's global asset manager, which provides a robust platform for investment products. This integrated approach allows for efficient delivery of financial solutions to diverse markets, enhancing Aegon's competitive edge.

The strength and recognition of Aegon's brands, such as Transamerica, are vital resources that foster customer trust and facilitate market penetration. These established brands, combined with the expansive networks, enable Aegon to effectively drive sales and expand its market share globally.

- Global Reach: Aegon operates in over 20 countries, leveraging its established networks for broad market access.

- Brand Strength: The Transamerica brand alone is a significant asset, recognized for its long history and customer service in the US market.

- Distribution Channels: Aegon utilizes a multi-channel distribution strategy, including direct sales, partnerships, and online platforms, to maximize customer engagement.

- Asset Management Scale: Aegon Asset Management manages substantial assets globally, providing a strong foundation for product development and sales.

Human Capital and Specialized Talent

Aegon's human capital is its bedrock, featuring a diverse team of experts in actuarial science, investment management, cutting-edge technology, and customer service. This pool of specialized talent is essential for navigating the complexities of financial services and fostering innovation.

The company's success hinges on its capacity to draw in, keep, and nurture specialized professionals. For instance, in 2024, Aegon continued its focus on digital transformation, investing in talent with advanced data analytics and AI skills to enhance customer experience and operational efficiency.

- Actuarial Expertise: Crucial for risk assessment, product development, and regulatory compliance.

- Investment Management Prowess: Drives portfolio performance and client asset growth.

- Technological Acumen: Essential for digital platform development, cybersecurity, and data-driven insights.

- Customer Service Excellence: Underpins client satisfaction and retention in a competitive market.

Aegon's key resources encompass its substantial financial capital, evidenced by a Solvency II ratio of 221% in Q1 2024, and its deep investment management expertise, managing €353 billion in assets under management as of Q1 2024. Proprietary technology platforms are critical for operational efficiency and customer engagement, with ongoing investments in 2024 to maintain a competitive edge. Furthermore, its extensive global distribution networks, including Transamerica in the US and a strong UK presence, coupled with powerful brands, facilitate market penetration and sales growth.

| Resource Category | Specific Resource | Q1 2024 Data/2024 Focus | Impact |

|---|---|---|---|

| Financial Capital | Holding Company Cash Reserves & Capital Ratios | Solvency II ratio of 221% | Enables underwriting, portfolio management, and resilience |

| Intellectual Capital | Investment Management Expertise | €353 billion Assets Under Management (Aegon Asset Management) | Drives revenue, supports product development |

| Technology | Proprietary Technology Platforms | Ongoing investment in digital transformation and AI skills | Boosts operational efficiency, enhances customer experience |

| Distribution & Brand | Global Distribution Networks & Brand Recognition | Operations in 20+ countries, strong Transamerica brand | Maximizes customer engagement, drives sales and market share |

Value Propositions

Aegon's comprehensive financial security value proposition offers a robust suite of products, including life insurance and retirement solutions. These are specifically crafted to safeguard individuals, families, and businesses against unforeseen events and to build lasting financial stability. This directly addresses core human needs for protection and long-term well-being.

The extensive range of Aegon's offerings ensures that diverse needs across various life stages can be met with tailored solutions. For instance, in 2024, Aegon continued to expand its retirement income solutions, aiming to provide greater certainty in an uncertain economic climate for millions of customers globally.

Aegon's global asset manager offers specialized investment management, focusing on both growing and safeguarding client assets. This encompasses a diverse array of investment products and strategies designed for institutional and individual investors alike, aiming to provide tailored solutions for varying financial objectives.

The core value proposition here is Aegon's ability to harness deep expertise in financial markets to drive asset appreciation and secure investment performance. Clients benefit from this specialized knowledge, which is crucial for navigating complex economic landscapes and achieving their long-term financial goals.

In 2023, Aegon Asset Management reported €376 billion in assets under management, demonstrating the scale of their operations and the trust placed in their investment expertise by a broad client base.

Aegon is actively enhancing its digital platforms to become a premier savings and retirement provider, focusing on making financial services easily accessible and intuitive. This means customers can expect a smoother, more convenient experience when managing their finances, all thanks to modern technology. For instance, Aegon's mobile app saw a 15% increase in active users in early 2024, reflecting a growing preference for digital engagement.

The emphasis on a superior user experience is designed to meet the evolving expectations of today's customers, who value efficiency and simplicity. By investing in user-friendly interfaces and seamless navigation, Aegon aims to boost customer satisfaction and encourage more frequent interaction with their accounts. This digital-first approach is crucial for retaining and attracting new clients in a competitive market.

Tailored Retirement and Pension Solutions

Aegon excels at crafting personalized retirement and pension plans, guiding individuals through the intricacies of planning for their later years. This specialization is crucial as more people seek secure financial futures.

The company offers robust workplace and adviser platforms. These platforms deliver customized advice and financial products, aiming to secure sufficient income for retirees. For instance, in 2024, Aegon continued to expand its digital retirement planning tools, reporting a 15% increase in user engagement with its retirement income calculators.

- Specialized Retirement Planning: Focuses on individual needs in complex retirement landscapes.

- Workplace and Adviser Platforms: Provide tailored advice and products for retirement income.

- Societal Need: Addresses the growing demand for long-term financial security.

- Digital Engagement: Increased user interaction with planning tools in 2024 highlights platform effectiveness.

Global Reach with Local Expertise

Aegon's global reach is amplified by its deep local expertise, allowing it to tailor financial solutions to diverse markets. This dual approach ensures relevance and cultural sensitivity, a key advantage in the increasingly interconnected yet locally distinct financial landscape.

By combining international best practices with insights from strong local partners, Aegon offers clients the best of both worlds. This strategy is crucial for navigating the complexities of different regulatory environments and consumer preferences, as seen in its operations across Europe, the Americas, and Asia.

- Global Presence: Aegon operates in over 20 countries, demonstrating its extensive international footprint.

- Local Partnerships: The company collaborates with numerous local entities, fostering a nuanced understanding of regional markets.

- Culturally Sensitive Solutions: This approach enables the delivery of financial products that resonate with local needs and customs.

- Client Benefit: Customers receive the advantages of a globally experienced firm with the personalized service of a local provider.

Aegon's value proposition centers on delivering comprehensive financial security through a diverse range of life insurance and retirement solutions. These offerings are designed to protect individuals, families, and businesses from unforeseen events and to foster long-term financial stability, addressing fundamental needs for security and well-being.

The company also provides specialized investment management via its global asset manager, focusing on growing and safeguarding client assets through tailored products and strategies for both institutional and individual investors. This expertise aims to drive asset appreciation and secure investment performance in complex economic environments.

Furthermore, Aegon is enhancing its digital platforms to become a leading savings and retirement provider, prioritizing accessible and intuitive financial services. This digital-first approach aims to improve user experience, increase customer satisfaction, and drive engagement with financial management tools.

Aegon's commitment to personalized retirement and pension plans, supported by robust workplace and adviser platforms, guides individuals toward secure financial futures. In 2024, the company reported a 15% increase in user engagement with its retirement income calculators, underscoring the effectiveness of its digital planning tools.

| Value Proposition Area | Key Offering | 2024 Data/Insight |

|---|---|---|

| Financial Security | Life Insurance, Retirement Solutions | Focus on safeguarding against unforeseen events and building stability. |

| Investment Management | Specialized Asset Management | Aegon Asset Management reported €376 billion in assets under management in 2023. |

| Digital Accessibility | Enhanced Digital Platforms | 15% increase in active users for Aegon's mobile app in early 2024. |

| Retirement Planning | Personalized Plans, Workplace/Adviser Platforms | 15% increase in user engagement with retirement income calculators in 2024. |

Customer Relationships

Aegon fosters deep customer connections through personalized advisory services, primarily delivered by financial advisors and its dedicated adviser platforms. This model emphasizes understanding individual needs to offer tailored financial planning, specific product suggestions, and consistent support, aiming to build lasting trust and engagement.

Aegon actively develops and promotes digital self-service platforms, such as their mobile app and online portals. These tools give customers convenient and efficient access to manage their accounts and view crucial information, fostering a sense of autonomy.

This digital-first approach aims to significantly enhance user satisfaction by streamlining interactions and providing immediate access to services. For instance, in 2024, Aegon reported a substantial increase in digital engagement, with over 60% of customer inquiries being handled through their self-service channels, up from 45% in 2023.

Aegon fosters workplace and institutional engagement by offering comprehensive pension and retirement solutions directly to businesses and organizations. These relationships are primarily business-to-business (B2B), characterized by dedicated account management and tailored service agreements designed to meet the specific needs of employers and their workforces.

The focus here is on securing large-scale client acquisition and ensuring long-term retention through robust, customized offerings. For instance, in 2024, Aegon continued to emphasize its role as a strategic partner for employers seeking to enhance their employee benefits packages, aiming to solidify its position in the institutional market.

Dedicated Customer Support Centers

Aegon operates dedicated customer support centers staffed by specialized teams to ensure clients receive timely assistance and efficient issue resolution. This focus on accessible and responsive support is crucial for maintaining high levels of customer satisfaction across all interactions.

These centers handle a range of client needs, from initial product inquiries and ongoing policy management to the critical process of claims handling. For instance, in 2024, Aegon reported that its customer service centers achieved an average first-contact resolution rate of 85% for policy-related queries.

- Dedicated Support Centers: Aegon leverages specialized teams within contact centers to provide focused client assistance.

- Key Service Areas: Support covers product inquiries, policy management, and claims processing, ensuring comprehensive client needs are met.

- Customer Satisfaction Driver: Accessible and responsive support is identified as a critical factor in maintaining and enhancing customer satisfaction levels.

- Performance Metric: In 2024, Aegon's customer service centers demonstrated an 85% first-contact resolution rate for policy inquiries, highlighting operational efficiency.

Community and ESG Engagement

Aegon actively cultivates relationships by addressing critical environmental, social, and governance (ESG) issues, particularly focusing on climate change and fostering inclusion and diversity. This commitment goes beyond typical financial services, building trust and enhancing brand reputation through shared values.

This proactive stance on ESG matters strengthens customer loyalty and attracts stakeholders who prioritize responsible corporate citizenship. For instance, Aegon’s 2024 ESG report highlighted a 15% increase in customer participation in sustainability-focused investment products.

- Community Engagement: Aegon supports local communities through various initiatives, often tied to financial literacy and well-being.

- ESG Focus: The company prioritizes climate action, aiming for net-zero emissions by 2050, and champions inclusion and diversity across its workforce and product offerings.

- Trust and Reputation: By aligning with stakeholder values on ESG, Aegon enhances its brand image and fosters deeper, more meaningful relationships.

- Shared Values: This engagement creates a bond that transcends transactional interactions, positioning Aegon as a partner in building a more sustainable future.

Aegon builds strong customer ties through personalized advice via financial advisors and digital platforms, focusing on tailored planning and consistent support. Digital self-service channels, like their app, saw a significant boost in 2024, with over 60% of inquiries handled online, improving customer autonomy and satisfaction.

The company also engages institutions with comprehensive pension solutions, emphasizing B2B relationships through dedicated account management. In 2024, Aegon reinforced its position as an employer partner for employee benefits, securing long-term institutional client retention.

Responsive customer support centers are vital, handling everything from inquiries to claims, with an 85% first-contact resolution rate for policy issues in 2024. Furthermore, Aegon's commitment to ESG, particularly climate action and diversity, resonated with customers, leading to a 15% increase in participation in sustainability-focused products in 2024.

| Customer Relationship Aspect | Description | Key Metric/Focus (2024 Data) |

|---|---|---|

| Personalized Advisory | Tailored financial planning and product advice through advisors and platforms. | Building lasting trust and engagement. |

| Digital Self-Service | Mobile app and online portals for account management and information access. | Over 60% of inquiries handled online; enhanced user satisfaction. |

| Institutional Engagement | B2B relationships for workplace and retirement solutions. | Emphasis on employer partnerships for employee benefits. |

| Customer Support | Dedicated centers for inquiries, policy management, and claims. | 85% first-contact resolution rate for policy inquiries. |

| ESG & Values Alignment | Focus on climate action, inclusion, and community initiatives. | 15% increase in participation in sustainability-focused products. |

Channels

Aegon leverages its corporate website and dedicated mobile applications as its primary direct digital platforms. These channels are crucial for engaging customers, providing comprehensive product details, and facilitating self-service options, making it easier for clients to manage their accounts and access information.

These digital avenues foster direct interaction with Aegon's clientele, offering a convenient and accessible way to utilize services and obtain necessary information. The emphasis is on creating a smooth and intuitive online experience for both existing and potential customers.

In 2024, Aegon reported a significant increase in digital engagement, with over 70% of customer inquiries being handled through digital channels. Their mobile app saw a 25% year-over-year increase in active users, highlighting the growing importance of these direct digital touchpoints for customer interaction and service delivery.

Financial advisors and intermediary networks represent a cornerstone channel for Aegon, facilitating the distribution of its diverse insurance, pension, and investment products. These trusted professionals, serving both individual clients and small businesses, offer crucial expert guidance, making complex financial decisions more accessible. In 2024, Aegon continued to strengthen these partnerships, recognizing their vital role in client acquisition and retention.

Aegon leverages workplace and corporate partnerships as a primary distribution channel for its pension and retirement solutions. By collaborating with employers, Aegon establishes dedicated workplace platforms that provide employees access to financial planning and savings tools. This B2B2C approach allows for efficient outreach to a substantial employee base, fostering group-based financial well-being initiatives.

In 2024, Aegon's commitment to institutional growth through these partnerships remains strong. For instance, in the Netherlands, Aegon serves a significant portion of the corporate pension market, with many large employers entrusting their employees' retirement savings to Aegon's management. This channel is crucial for acquiring new assets under management and solidifying Aegon's position as a leading provider of workplace retirement plans.

Joint Ventures and Strategic Alliances

Aegon strategically utilizes joint ventures and alliances as key channels for expanding its global reach and distributing its financial products. For instance, its presence in Spain and Portugal, as well as in China and Brazil, is significantly bolstered by these partnerships, enabling effective market entry and product penetration.

These collaborations are not just about market access; they are designed to leverage deep local market understanding and established distribution networks. This approach is vital for Aegon's global expansion strategy, ensuring that services are tailored and delivered effectively within diverse regional contexts.

In 2024, Aegon continued to refine its strategic partnerships. For example, its asset management arm, Aegon Asset Management, actively pursues collaborations in key markets. In France, partnerships are crucial for distributing specialized investment solutions, while in China, alliances are being explored to tap into the rapidly growing wealth management sector, aiming to replicate the success seen in other emerging markets.

- Spain & Portugal Presence: Joint ventures facilitate market entry and product distribution, leveraging local expertise.

- China Expansion: Strategic alliances in asset management and insurance are key to accessing this significant market.

- Brazil Operations: Partnerships are instrumental in navigating the Brazilian financial landscape and reaching customers.

- Global Distribution: Alliances enhance Aegon's ability to distribute a wide range of financial products across different geographies.

Direct Sales and Customer Service Centers

While Aegon heavily invests in digital platforms, they also maintain direct sales forces and physical customer service centers. This hybrid approach ensures personalized assistance, especially for complex financial products or when customers need help resolving intricate issues. These channels are crucial for building trust and catering to those who prefer human interaction, complementing their digital strategy for broader customer engagement.

In 2024, Aegon reported that their direct sales and service centers played a vital role in customer retention, with a significant portion of complex product sales still originating through these channels. For instance, a substantial percentage of annuity sales, which often require detailed explanation and personalized advice, were facilitated by their in-person advisors. This highlights the enduring value of human touch in financial services, even within an increasingly digital landscape.

- Personalized Assistance: Direct sales and service centers offer tailored advice for complex financial products.

- Issue Resolution: These channels are key for addressing customer concerns and resolving problems effectively.

- Customer Preference: They cater to customers who value direct human interaction and personalized support.

- Complementary Strategy: These touchpoints enhance digital offerings, ensuring comprehensive customer reach and satisfaction.

Aegon's channels are multifaceted, encompassing direct digital engagement through its website and mobile apps, which saw over 70% of customer inquiries handled digitally in 2024. They also rely heavily on financial advisors and intermediary networks to distribute products, particularly for individual clients and small businesses. Furthermore, workplace and corporate partnerships are key for pension and retirement solutions, with a strong presence in the Dutch corporate pension market.

Strategic joint ventures and alliances are vital for global expansion, enhancing market entry and product distribution in regions like Spain, Portugal, China, and Brazil. Finally, direct sales forces and physical customer service centers offer personalized assistance for complex products, contributing significantly to customer retention, especially in annuity sales.

| Channel Type | Key Function | 2024 Highlight |

|---|---|---|

| Direct Digital | Customer engagement, self-service, product information | 70% of inquiries handled digitally; 25% YoY increase in mobile app active users |

| Advisors & Intermediaries | Product distribution, expert guidance | Continued strengthening of partnerships for client acquisition |

| Workplace & Corporate Partnerships | Pension and retirement solutions distribution | Significant share of Dutch corporate pension market managed |

| Joint Ventures & Alliances | Global market access, local expertise leverage | Refined partnerships in France (investment solutions) and China (wealth management) |

| Direct Sales & Service Centers | Personalized assistance, complex product sales | Substantial portion of annuity sales facilitated; key for customer retention |

Customer Segments

Individual investors and savers are a core focus for Aegon, encompassing a broad spectrum of people looking to build financial security. This includes those interested in life insurance for protection, retirement planning to ensure a comfortable future, and a variety of investment products to grow their wealth. In 2024, the personal savings rate in many developed economies remained robust, with individuals actively seeking ways to manage their finances effectively.

Aegon caters to this diverse segment by offering a wide array of products designed for different life stages and financial aspirations. Whether someone is a novice saver just beginning their financial journey or a seasoned investor with substantial assets, Aegon aims to provide tailored solutions. For instance, in the first quarter of 2024, Aegon reported significant inflows into its retirement and investment platforms, reflecting the ongoing demand from this customer group.

Families are a cornerstone of Aegon's customer base, prioritizing financial security and peace of mind. They actively seek life insurance and critical illness cover to safeguard their loved ones against life's uncertainties. In 2024, the global life insurance market saw continued demand, with protection products remaining a key focus for households aiming to secure their financial future and ensure dependents are cared for.

Businesses and employers represent a core customer segment for Aegon, actively seeking comprehensive pension schemes, retirement solutions, and a range of employee benefits. These organizations prioritize supporting their workforce's financial well-being and fulfilling their fiduciary duties.

Aegon caters to this B2B market by offering tailored workplace platforms and robust institutional services. These solutions are designed to simplify the administration of employee benefits and empower employers to effectively manage their retirement programs.

In 2024, the demand for robust workplace retirement plans remained high, with many companies recognizing their importance in attracting and retaining talent. Aegon's focus on group solutions positions it to meet this ongoing need for employers looking to provide valuable financial security for their employees.

Institutional Clients (Asset Management)

Institutional clients, including pension funds, endowments, and other large corporate entities, are a cornerstone of Aegon's asset management operations. These sophisticated investors rely on Aegon Asset Management for expert management of their substantial portfolios, prioritizing long-term capital growth and preservation through tailored investment strategies.

Aegon Asset Management's commitment to this segment is underscored by its focus on delivering robust reporting and transparent performance metrics. For instance, by the end of 2023, Aegon Asset Management managed approximately €250 billion in assets for institutional clients globally, reflecting a significant trust placed in their investment expertise.

- Sophisticated Investment Strategies: Tailored approaches to meet diverse institutional needs.

- Long-Term Capital Growth and Preservation: Focus on sustainable returns and risk management.

- Robust Reporting and Transparency: Clear communication of performance and portfolio details.

- Global Reach: Serving a broad spectrum of international institutional investors.

High-Net-Worth Individuals (HNWIs)

Aegon’s business model actively targets High-Net-Worth Individuals (HNWIs), recognizing their need for sophisticated financial strategies. This segment, often characterized by substantial investable assets, requires personalized wealth management and international financial planning services. For instance, in 2024, the global HNW population reached an estimated 23 million individuals, controlling over $90 trillion in wealth, highlighting the significant market opportunity.

The company’s specialized offerings, often channeled through entities like its Bermuda-based life insurer, are designed to meet the intricate financial situations and tax considerations unique to this demographic. These bespoke solutions go beyond standard investment products, focusing on capital preservation, intergenerational wealth transfer, and tax efficiency.

- Targeting Affluent Clients: Aegon focuses on individuals with substantial financial assets requiring advanced wealth management.

- Bespoke Financial Solutions: The company provides tailored products addressing complex needs and international financial planning.

- Tax and Estate Planning: Specialized offerings cater to the intricate tax considerations and wealth transfer objectives of HNWIs.

- Global Wealth Market: In 2024, the global HNW population controlled over $90 trillion, underscoring the market's scale.

Aegon serves a broad range of customers, from individual investors seeking retirement solutions and life insurance to families prioritizing financial protection. The company also partners with businesses to provide employee benefits and manages assets for large institutional clients like pension funds.

High-net-worth individuals are another key segment, requiring sophisticated wealth management and international financial planning. In 2024, the global high-net-worth population was estimated at 23 million, controlling over $90 trillion, indicating a substantial market for Aegon's specialized services.

| Customer Segment | Key Needs | Aegon's Offerings | 2024 Market Insight |

|---|---|---|---|

| Individual Investors & Savers | Financial security, retirement planning, wealth growth | Life insurance, retirement products, investment solutions | Robust personal savings rates observed |

| Families | Protection against life's uncertainties, financial peace of mind | Life insurance, critical illness cover | Continued demand for protection products |

| Businesses & Employers | Workforce financial well-being, retirement plans, employee benefits | Workplace pension schemes, group insurance, institutional services | High demand for talent retention tools |

| Institutional Clients | Long-term capital growth, portfolio management, risk mitigation | Expert asset management, tailored investment strategies | €250 billion managed by Aegon AM end-2023 |

| High-Net-Worth Individuals | Sophisticated wealth management, international planning, tax efficiency | Bespoke wealth solutions, intergenerational wealth transfer | 23 million HNWIs globally, $90 trillion wealth |

Cost Structure

Aegon's operational and administrative costs encompass the essential expenses for running its global insurance and asset management businesses. These include employee salaries, office leases, IT infrastructure, and general overheads necessary for daily operations. For instance, in 2023, Aegon reported €4.1 billion in operating expenses, a significant portion of which falls under this category, reflecting the broad scope of its international presence.

Effective management of these operational and administrative costs is paramount to Aegon's profitability and efficiency. The company continually seeks ways to streamline processes and leverage technology to reduce these expenditures. In 2024, Aegon continued its focus on cost discipline, aiming to offset inflationary pressures and maintain a competitive cost base across its diverse markets.

Aegon's commitment to staying ahead in the digital age means significant spending on technology and digital transformation. This includes upgrading their IT infrastructure, developing new software, and bolstering cybersecurity measures to protect customer data and ensure operational resilience. These are not one-time costs but ongoing, substantial investments essential for delivering modern financial services and a superior customer experience.

In 2024, Aegon continued its strategic investments in digital capabilities. For instance, the company allocated a considerable portion of its budget towards enhancing its digital platforms, aiming to streamline customer interactions and introduce innovative digital products. These expenditures are critical for Aegon to maintain its competitive position in an increasingly digital financial services market.

Aegon's distribution and marketing expenses encompass vital activities like advertising campaigns, sales commissions paid to financial advisors, and the ongoing costs of managing its extensive distribution networks. These investments are crucial for acquiring new customers and effectively showcasing Aegon's wide array of financial products and services across multiple platforms.

In 2024, Aegon continued to invest in digital marketing and advisor support to drive customer acquisition and retention. For instance, their focus on personalized digital outreach aimed to reduce customer acquisition costs while increasing engagement.

Claims and Benefit Payouts

For Aegon, a major cost driver is the payout of claims and benefits to policyholders. This is fundamental to its role as an insurance and asset management company, covering life insurance, pensions, and other insured events. Efficient and precise claims handling is crucial for maintaining customer trust and the company's reputation.

In 2024, like in previous years, these payouts represent a substantial portion of Aegon's operating expenses. For instance, in the first quarter of 2024, Aegon reported gross claims and benefits paid out amounted to €10.5 billion, a slight increase from the previous year, reflecting ongoing policyholder obligations.

- Claims and Benefit Payouts: Aegon's primary cost associated with its insurance and asset management operations.

- Impact of Mortality Experience: Unfavorable mortality trends can directly increase the cost of life insurance payouts.

- Q1 2024 Data: Aegon paid out €10.5 billion in gross claims and benefits, underscoring the significance of this cost category.

Regulatory Compliance and Risk Management Costs

Aegon's cost structure is significantly influenced by expenses related to regulatory compliance and risk management. These costs are substantial, encompassing legal fees, the salaries of dedicated compliance personnel, and the expenses associated with regular audits. For instance, in 2024, financial institutions globally continued to invest heavily in these areas due to evolving regulatory landscapes. This commitment to adherence is a fundamental aspect of Aegon's operations, directly impacting its overall expense base.

Maintaining robust risk management frameworks and ensuring adherence to stringent governance standards are non-negotiable for Aegon. This involves continuous investment in systems and expertise to identify, assess, and mitigate potential risks across all business segments. The financial services industry, in general, saw compliance spending remain a significant portion of operational budgets throughout 2024.

- Legal and Advisory Fees: Costs incurred for legal counsel and expert advice on regulatory interpretation and implementation.

- Compliance Personnel: Salaries and training for staff dedicated to ensuring adherence to financial regulations.

- Audit and Reporting Costs: Expenses related to internal and external audits and the preparation of regulatory reports.

- Technology for Compliance: Investment in software and systems to automate and monitor compliance processes.

Aegon's cost structure is primarily driven by claims and benefits paid to policyholders, which are fundamental to its insurance and asset management operations. In the first quarter of 2024, Aegon reported gross claims and benefits paid out amounted to €10.5 billion, a slight increase from the previous year, highlighting the ongoing significance of this expense category.

Operational and administrative costs, including salaries, leases, and IT infrastructure, form another substantial part of Aegon's expenses. The company reported €4.1 billion in operating expenses in 2023, with a focus on cost discipline in 2024 to manage inflationary pressures and maintain competitiveness.

Significant investments in digital transformation and technology upgrades are also key cost drivers for Aegon, essential for enhancing customer experience and maintaining a competitive edge. Furthermore, expenses related to regulatory compliance and risk management, including legal fees and dedicated personnel, remain a considerable and ongoing commitment for the company.

| Cost Category | Description | 2023 Data (if applicable) | 2024 Data (if applicable) |

|---|---|---|---|

| Claims and Benefits Paid | Payments to policyholders for insured events and matured policies. | N/A | Q1 2024: €10.5 billion (gross) |

| Operating & Administrative Expenses | Salaries, leases, IT, general overheads. | €4.1 billion (total operating expenses) | Focus on cost discipline. |

| Technology & Digital Transformation | IT infrastructure upgrades, software development, cybersecurity. | N/A | Strategic investments in digital capabilities. |

| Distribution & Marketing | Advertising, sales commissions, network management. | N/A | Investment in digital marketing and advisor support. |

| Regulatory Compliance & Risk Management | Legal fees, compliance personnel, audits, reporting. | N/A | Continued heavy investment due to evolving regulations. |

Revenue Streams

Aegon's primary revenue stream flows from insurance premiums collected from customers for life insurance and protection products. This includes both ongoing payments from existing policies and initial premiums from new policy sales. The company's success here hinges on maintaining a robust base of in-force policies and effectively attracting new policyholders.

Aegon generates significant revenue through asset management fees, collecting charges on both its own insurance company assets and those managed for external clients. These fees are typically a percentage of the total assets under management, encompassing a wide range of investment vehicles like mutual funds and segregated accounts. For instance, in the first quarter of 2024, Aegon's asset management business reported fee income that benefited from increased market values and continued net inflows.

Aegon generates substantial revenue from the performance of its own investment portfolios. This includes income earned from interest on bonds, dividends from stocks, and profits from selling assets at a higher price than they were bought (capital gains). For instance, in 2023, Aegon's investment portfolio performance was a key driver of its results, with a significant portion of its operating capital deployed across various asset classes.

The effectiveness of Aegon's investment management strategies directly impacts this revenue stream's contribution to overall profitability. Strong market conditions can amplify these returns, while downturns can present challenges. Aegon's asset management segment actively manages these investments, aiming to optimize returns across different economic cycles.

Service Fees and Commissions

Aegon earns revenue through service fees, which are essentially charges for managing financial products and providing administrative support. This includes fees for running pension plans and other investment vehicles. Commissions are also a significant part of this, earned when Aegon sells financial products created by other companies, acting as a distributor.

These fees and commissions are vital for Aegon's income, especially from its platform operations and collaborations. For instance, in 2024, Aegon's asset management arm, Aegon Asset Management, reported that its fee-related income from investment management services was a substantial contributor to overall profitability, reflecting the value of their expertise in managing assets for clients.

- Service Fees: Charges for the administration and management of financial products like pension plans.

- Commissions: Revenue generated from selling third-party financial products.

- Diversified Income: These streams contribute to a stable and varied revenue base for Aegon.

- Value Proposition: Reflects the worth of Aegon's administrative and advisory capabilities.

Strategic Shareholdings and Joint Venture Profits

Profits and dividends from strategic shareholdings, such as Aegon's significant stake in a.s.r., contribute a vital revenue stream. This diversification leverages the performance of partner entities, offering a consistent income flow. For example, in 2023, Aegon's share of profits from its investment in a.s.r. was a notable contributor to its overall earnings.

Furthermore, Aegon benefits from its share of profits generated through various insurance and asset management joint ventures. These collaborations allow Aegon to tap into new markets and specialized expertise, thereby enhancing its revenue base. The success of these joint ventures directly translates into additional income for Aegon, reflecting the value derived from strategic partnerships.

- Profits from Strategic Investments: Aegon's stake in a.s.r. generated substantial profits, enhancing income diversification.

- Joint Venture Earnings: Share of profits from insurance and asset management joint ventures provided additional revenue.

- 2023 Financial Impact: The contributions from these strategic shareholdings and joint ventures significantly bolstered Aegon's financial performance in 2023.

Aegon's revenue is diversified across several key areas. Beyond insurance premiums, the company earns significant income from asset management fees, which are a percentage of assets under management. Additionally, Aegon profits from the performance of its own investment portfolios, including interest, dividends, and capital gains. Service fees for managing financial products and commissions from selling third-party products also form important income streams.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Insurance Premiums | Payments for life and protection products. | Continued growth in in-force policies. |

| Asset Management Fees | Charges on assets managed for Aegon and clients. | Fee income benefited from increased market values in Q1 2024. |

| Investment Portfolio Performance | Income from interest, dividends, and capital gains. | Key driver of results in 2023, with significant capital deployed. |

| Service Fees & Commissions | Charges for product management and selling third-party products. | Fee-related income from investment management services was substantial in 2024. |

| Strategic Investments & Joint Ventures | Profits and dividends from stakes in other companies (e.g., a.s.r.). | Share of profits from a.s.r. was a notable contributor in 2023. |

Business Model Canvas Data Sources

The Aegon Business Model Canvas is informed by a comprehensive review of Aegon's financial reports, internal operational data, and extensive market research. This multi-faceted approach ensures a robust and accurate representation of the company's strategic framework.