Advanced Medical Solutions Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Medical Solutions Group Bundle

Advanced Medical Solutions Group's strengths lie in its innovative product pipeline and strong market presence, but it faces external threats from evolving regulations and competitive pressures. Understanding these dynamics is crucial for strategic planning.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Advanced Medical Solutions Group plc (AMS) truly shines with its diverse and innovative product range, covering both surgical and advanced wound care. This includes everything from tissue adhesives and sutures to internal fixation devices and specialized wound dressings like silver alginates and foams. This breadth means AMS isn't putting all its eggs in one basket, addressing a wide spectrum of patient needs.

The company's commitment to innovation is a significant strength, as demonstrated by products like the LIQUIFIX™ hernia fixation device. This forward-thinking approach helps AMS stand out in a competitive market, offering advanced solutions that cater to evolving clinical demands and patient outcomes.

Advanced Medical Solutions Group (AMS) showcased impressive financial momentum in 2024, achieving a substantial 43% revenue increase at constant currency, reaching £177.5 million. This growth was significantly fueled by the strategic acquisition and successful integration of Peters Surgical and Syntacoll, which bolstered its surgical division and expanded its global footprint.

The company's strong performance is further underscored by its projected H1 2025 revenue of £110 million, highlighting the effectiveness of its acquisition strategy and its ability to capitalize on new market opportunities.

Advanced Medical Solutions Group (AMS) has significantly boosted its global reach and direct sales capabilities through strategic acquisitions, notably Peters Surgical. This expansion now provides AMS with a robust direct selling presence in crucial international markets, allowing for more focused customer engagement and quicker market response.

The company's enhanced geographical footprint is further solidified by its R&D innovation hubs strategically located across the UK, Ireland, Germany, France, and Israel. With manufacturing operations spread across multiple countries, AMS ensures a diversified and resilient supply chain, facilitating efficient global distribution and market penetration.

This expanded network of R&D centers and manufacturing sites, coupled with a growing direct sales force, empowers AMS to better serve a wider customer base and adapt to regional market demands more effectively. For instance, in 2024, AMS reported that its direct sales channels contributed to a substantial portion of its revenue growth, underscoring the effectiveness of this strategy.

Commitment to Research and Development

Advanced Medical Solutions Group’s dedication to research and development is a significant strength. The company boosted its R&D investment to £12.9 million in 2024, underscoring its commitment to innovation. This focus is vital for creating novel tissue-healing technologies and enhancing current offerings, keeping AMS competitive and attuned to patient requirements. The successful launch of products like LIQUIFIX™ serves as tangible proof of their R&D prowess.

Successful Integration of Acquisitions and Synergies

Advanced Medical Solutions Group (AMS) demonstrated exceptional capability in integrating its major 2024 acquisitions, notably Peters Surgical and Syntacoll. This strategic move has already translated into robust performance metrics, with significant anticipated commercial and operational synergies bolstering the company's market position.

The successful assimilation of these entities has demonstrably expanded AMS's product portfolio and technical expertise. Furthermore, it has broadened the company's geographic footprint, increasing its overall scale and competitiveness within the vital tissue-healing market.

- 2024 Acquisitions: Peters Surgical and Syntacoll successfully integrated.

- Synergy Realization: Strong performance and anticipated commercial/operational benefits.

- Market Expansion: Enhanced product offerings, expertise, and geographic reach.

- Competitive Edge: Increased scale positions AMS as a larger, more formidable player.

Advanced Medical Solutions Group (AMS) possesses a diverse and innovative product portfolio spanning surgical and advanced wound care, addressing a wide range of patient needs. Their commitment to R&D is a key strength, evidenced by a £12.9 million investment in 2024 and successful product launches like LIQUIFIX™.

The company's strategic acquisitions in 2024, including Peters Surgical and Syntacoll, have significantly boosted revenue, with a 43% increase at constant currency to £177.5 million. These integrations have expanded AMS's global reach, direct sales capabilities, and overall market competitiveness.

AMS has a robust global operational and R&D footprint, with innovation hubs across Europe and diversified manufacturing sites ensuring supply chain resilience. This allows for effective market penetration and adaptation to regional demands, with direct sales channels proving instrumental in their 2024 growth.

| Metric | 2024 Value | Significance |

|---|---|---|

| Revenue Growth (Constant Currency) | 43% | Demonstrates strong market traction and successful acquisition integration. |

| R&D Investment | £12.9 million | Highlights commitment to innovation and future product development. |

| Key Acquisitions | Peters Surgical, Syntacoll | Expanded product portfolio, global reach, and direct sales capabilities. |

What is included in the product

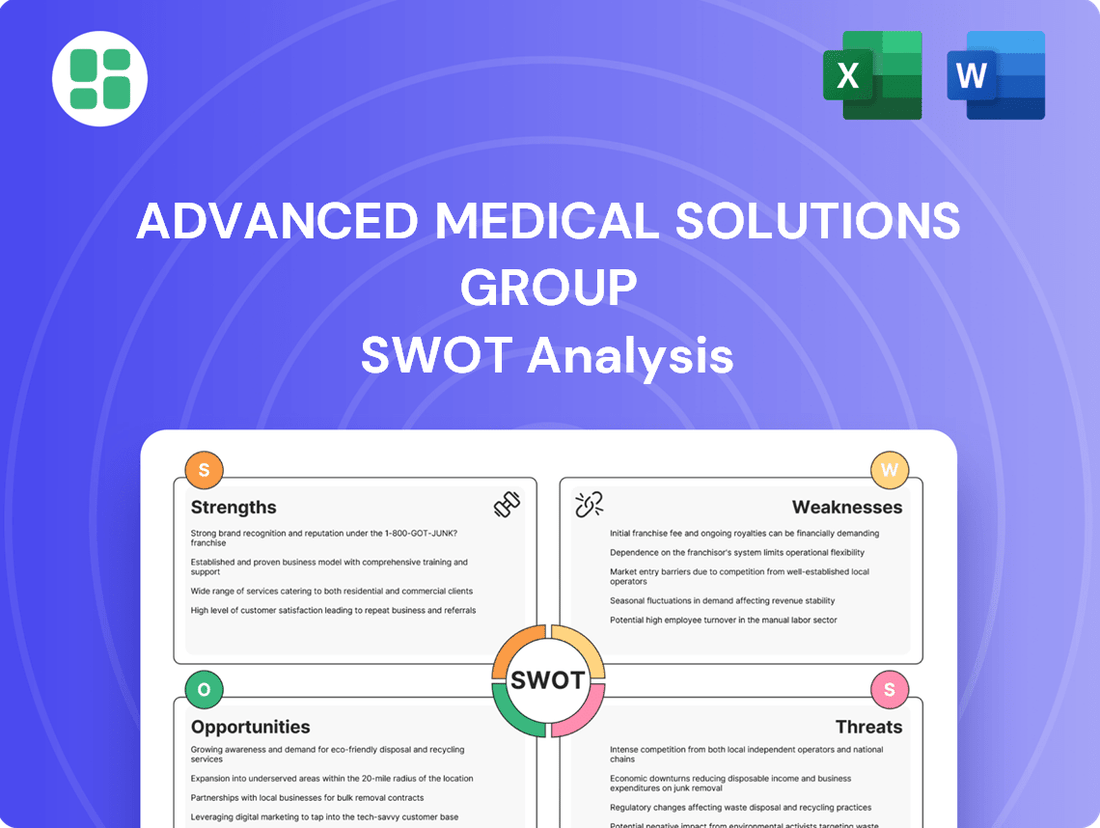

This SWOT analysis provides a comprehensive overview of Advanced Medical Solutions Group's internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats that shape its strategic landscape.

Offers a clear, actionable framework to identify and leverage Advanced Medical Solutions Group's competitive advantages, mitigating potential market threats.

Weaknesses

Advanced Medical Solutions Group (AMS) experienced a significant 54% decrease in reported profit before tax, falling to £9.8 million in 2024. This decline was largely driven by substantial acquisition and integration costs stemming from their strategic moves to acquire Peters Surgical and Syntacoll. While adjusted profit before tax showed an increase, the reported figures highlight the immediate financial impact of these expansion efforts.

Advanced Medical Solutions Group's (AMS) financial standing has notably shifted due to recent acquisitions. Following the acquisition of Peters Surgical, AMS transitioned from a net cash position of £60.2 million in 2023 to a net debt of £55.8 million by the close of 2024.

This move into a net debt position, though anticipated with significant corporate transactions, highlights an increase in financial leverage. Consequently, AMS may face higher interest expenses, potentially impacting its profitability and overall financial maneuverability in the near term.

The Woundcare division encountered significant headwinds in 2024, largely attributed to evolving market conditions. Despite these challenges, Advanced Medical Solutions Group initiated strategic maneuvers aimed at bolstering profitability in 2025, with early indications suggesting a positive trajectory.

However, the very necessity of these restructuring efforts underscores the segment's inherent vulnerability to market fluctuations. This ongoing need for active management highlights a persistent weakness within the Woundcare business, demanding continuous adaptation to maintain competitive standing.

Reliance on Successful Integration for Future Growth

Advanced Medical Solutions Group (AMS) faces a significant hurdle as a substantial portion of its projected growth and profitability relies heavily on the successful integration of its recent acquisitions. For instance, the company's 2025 financial targets are closely tied to realizing operational synergies and revenue streams from these new entities.

Any setbacks or prolonged delays in fully integrating these acquired businesses could directly impede the expected benefits, potentially impacting AMS's financial performance through 2027. This reliance creates a vulnerability, as integration challenges can easily derail strategic objectives.

- Acquisition Integration Risk: AMS's future growth is contingent on successfully merging recent acquisitions, a process that historically presents challenges.

- Synergy Realization: The company anticipates significant revenue and cost synergies from these deals, but their actualization is not guaranteed.

- Financial Outlook Impact: Delays in integration could negatively affect AMS's financial projections for 2025-2027, potentially leading to missed revenue targets.

Potential for Diluted Earnings per Share

Advanced Medical Solutions Group (AMS) faced a notable challenge in 2024 concerning its earnings per share (EPS). While adjusted diluted EPS saw an increase, the reported diluted EPS experienced a significant decline. This discrepancy points to potential headwinds from strategic activities, such as acquisitions, which may have led to a dilution of earnings for existing shareholders, possibly through increased share counts or associated integration costs.

Specifically, the reported diluted EPS for AMS in 2024 fell by 15% to £0.052 compared to £0.061 in 2023. This contrasts with an increase in adjusted diluted EPS, which rose by 7% to £0.085. The divergence highlights how factors beyond core operational improvements can impact shareholder value on a per-share basis.

- Diluted EPS Decline: Reported diluted EPS decreased by 15% in 2024.

- Adjusted EPS Growth: Adjusted diluted EPS increased by 7% in the same period.

- Acquisition Impact: Potential dilution from acquisitions and associated financial activities is a key concern.

- Shareholder Value: The divergence raises questions about the immediate impact of strategic moves on per-share shareholder returns.

Advanced Medical Solutions Group's (AMS) increased debt following acquisitions presents a financial vulnerability. The shift from a net cash position of £60.2 million in 2023 to a net debt of £55.8 million in 2024 means higher interest expenses, potentially impacting near-term profitability and financial flexibility.

The company's reliance on successful integration of Peters Surgical and Syntacoll for its 2025 financial targets creates a significant risk. Any integration delays could derail expected synergies and negatively affect performance through 2027.

Furthermore, AMS experienced a 15% drop in reported diluted EPS to £0.052 in 2024, contrasting with a 7% rise in adjusted diluted EPS. This divergence suggests that strategic activities, including acquisitions, may be diluting per-share earnings for shareholders.

| Metric | 2023 | 2024 | Change |

| Net Cash/(Debt) | £60.2m | -£55.8m | Net Debt Increase |

| Reported Diluted EPS | £0.061 | £0.052 | -15% |

| Adjusted Diluted EPS | £0.080 (approx.) | £0.085 | +7% |

What You See Is What You Get

Advanced Medical Solutions Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Advanced Medical Solutions Group, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth report.

Opportunities

Advanced Medical Solutions Group (AMS) is well-positioned to capitalize on the synergies arising from its recent acquisitions of Peters Surgical and Syntacoll. This integration offers a significant opportunity to boost commercial and operational performance by cross-selling an expanded product range. For instance, the combined entity can now offer a more comprehensive suite of surgical solutions to existing clients, potentially increasing average revenue per customer.

The enhanced direct selling capabilities resulting from these acquisitions present a clear path to accelerating sales growth and improving overall profitability. By leveraging a larger and more experienced sales force, AMS can penetrate new markets and deepen relationships with healthcare providers. This strategic advantage is crucial in the competitive medical device sector, where direct market access often translates to quicker adoption and better market share.

Innovation synergies are also a key opportunity. The combined R&D expertise and intellectual property from Peters Surgical and Syntacoll can accelerate the development of next-generation medical technologies. This could lead to the introduction of novel products that address unmet clinical needs, further solidifying AMS's market leadership and driving long-term value creation.

Advanced Medical Solutions Group sees substantial opportunity in expanding its surgical and wound care segments. The continued robust performance of LiquiBand in the US, coupled with the recent full market introduction of LIQUIFIX™ in the same region, signals strong potential for increased penetration within the surgical market.

Furthermore, targeted strategic efforts within the Woundcare division are designed to enhance profitability and strengthen its market position. These initiatives are projected to drive sustained growth and improved margins in this crucial business area, offering a clear pathway for future expansion.

Advanced Medical Solutions Group's commitment to ongoing research and development, particularly in identifying unmet clinical needs, presents a significant opportunity to launch novel tissue-healing technologies. This strategic focus on innovation is poised to strengthen their product pipeline and enhance market differentiation.

Furthermore, the anticipated reduction in Medical Device Regulation (MDR) expenditures in 2025 will free up capital, allowing for a more concentrated investment in product innovation. This strategic shift is expected to accelerate the development of next-generation solutions, further solidifying AMS's position in the market.

Global Market Penetration and Geographic Expansion

Advanced Medical Solutions Group (AMS) has a significant opportunity to deepen its penetration in existing European and Asian markets, while also aggressively expanding into new geographies. The company's established global manufacturing capabilities and direct sales networks provide a strong foundation to capitalize on the escalating worldwide demand for innovative medical technologies. For instance, the global medical device market was valued at approximately $495.8 billion in 2023 and is projected to reach $767.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.4% during this period. This presents a substantial runway for AMS to increase its market share.

Key aspects of this opportunity include:

- Targeting Emerging Markets: Focusing on regions with rapidly growing healthcare infrastructure and increasing disposable incomes, such as parts of Southeast Asia and Latin America, can unlock new revenue streams. The healthcare spending in emerging markets is expected to outpace developed economies in the coming years.

- Leveraging Product Portfolio: AMS can strategically introduce its existing advanced wound care and hemostatic solutions to markets where such technologies are currently under-penetrated, offering superior patient outcomes and potentially reducing healthcare costs.

- Strategic Partnerships: Forming alliances with local distributors or healthcare providers in new territories can accelerate market entry and build brand recognition, mitigating the complexities of direct market establishment.

- Regulatory Navigation: Proactively addressing and streamlining regulatory approval processes in target expansion countries will be crucial for timely product launches and market access.

Strategic Partnerships and Collaborations

Advanced Medical Solutions Group's (AMS) established leadership in tissue-healing technologies, coupled with its end-to-end capabilities in design, development, and manufacturing, creates significant opportunities for strategic partnerships. These alliances can unlock new markets and accelerate innovation.

Collaborations with other healthcare providers, research institutions, and distribution networks are key. For instance, AMS reported a revenue of £147.7 million for the year ended December 31, 2023, indicating a solid foundation for such ventures. These partnerships can lead to shared development of novel technologies, expanding AMS's product pipeline and market reach.

- Accelerated Market Access: Partnering with established distributors can provide immediate entry into new geographical regions or therapeutic areas.

- Co-Development of Technologies: Collaborating with research institutions can leverage external expertise to speed up the development of next-generation wound care solutions.

- Enhanced Market Presence: Strategic alliances can bolster AMS's brand recognition and competitive positioning within the global medical device market.

Advanced Medical Solutions Group (AMS) is well-positioned to capitalize on synergies from recent acquisitions, enhancing its product portfolio and direct selling capabilities. The company can leverage combined R&D to accelerate innovation in tissue-healing technologies, addressing unmet clinical needs and strengthening its market leadership. Furthermore, anticipated reductions in Medical Device Regulation (MDR) expenditures in 2025 will free up capital for reinvestment in product development.

AMS has a significant opportunity to expand its global reach, particularly in emerging markets with growing healthcare sectors. The company's established manufacturing and sales networks provide a strong base to tap into the escalating worldwide demand for medical technologies. Strategic partnerships with local entities can further accelerate market entry and brand recognition.

| Opportunity | Description | Supporting Data/Rationale |

| Acquisition Synergies | Cross-selling expanded product range, boosting commercial and operational performance. | Integration of Peters Surgical and Syntacoll enhances direct selling capabilities, accelerating sales growth. |

| Innovation Acceleration | Leveraging combined R&D expertise to develop next-generation medical technologies. | Focus on unmet clinical needs to launch novel tissue-healing technologies, strengthening product pipeline. |

| Market Expansion | Deepening penetration in existing markets and expanding into new geographies. | Global medical device market projected to reach $767.1 billion by 2030 (6.4% CAGR). |

| Strategic Partnerships | Forming alliances to unlock new markets and accelerate innovation. | AMS reported £147.7 million revenue in 2023, providing a solid foundation for collaborations. |

Threats

The medical device market is incredibly crowded, with both long-standing companies and newer ones frequently launching innovative products. Advanced Medical Solutions Group (AMS) feels this pressure across its surgical and wound care divisions. This constant competition can squeeze market share and affect how much AMS can charge for its products.

Staying ahead requires significant and ongoing investment in research and development. For instance, in 2023, the global medical device market was valued at approximately $560 billion, with projections indicating continued growth, meaning R&D spending is crucial for survival and expansion.

The healthcare sector faces significant regulatory hurdles, exemplified by the European Union's Medical Device Regulation (MDR). Advanced Medical Solutions Group must navigate these evolving requirements, as delays in obtaining approvals, such as for their advanced wound care products, could significantly impact market entry and revenue streams. For instance, the MDR implementation has led to extended timelines for device certification across the industry.

Global supply chains are still a weak point, easily shaken by international tensions, trade barriers, and unpredictable material prices. For Advanced Medical Solutions Group (AMS), operating across different countries means potential headaches with keeping supplies flowing, higher shipping expenses, and the possibility of new taxes impacting their ability to produce and make money. For instance, the ongoing conflicts in Eastern Europe have led to a significant rise in shipping costs, with some routes seeing increases of over 50% in 2024.

Integration Risks of Acquisitions

The integration of significant acquisitions, such as the Peters Surgical deal, presents ongoing challenges for Advanced Medical Solutions Group. While progress has been noted, potential cultural clashes between the two entities, operational inefficiencies during the merging process, and the risk of not realizing projected synergies remain key concerns. These integration hurdles could divert critical management focus and strain financial resources, potentially impacting overall performance.

Specifically, the successful assimilation of Peters Surgical is crucial. For example, if synergy targets, estimated to contribute £15 million to operating profit by 2026, are not met due to integration issues, it could lead to a shortfall in expected returns. Management's ability to navigate these complexities will be vital.

- Cultural Misalignment: Differences in corporate culture can hinder collaboration and slow down the realization of combined efficiencies.

- Operational Inefficiencies: Merging IT systems, supply chains, and administrative functions can lead to temporary disruptions and increased costs.

- Synergy Realization Failure: Overestimating cost savings or revenue enhancements from the acquisition can result in a failure to achieve the anticipated financial benefits.

Economic Downturns and Healthcare Spending Constraints

Economic downturns pose a significant threat to Advanced Medical Solutions Group (AMS). Global or regional recessions often trigger reduced healthcare spending by both government bodies and private insurance providers. This directly impacts the demand for medical devices and wound care products, potentially squeezing AMS's revenue streams.

These spending constraints can exert considerable pressure on pricing strategies, forcing AMS to reconsider its product pricing to remain competitive. Consequently, this could lead to lower sales volumes and a dampening effect on the company's overall revenue growth and profitability, especially in the 2024-2025 period where economic uncertainties remain.

- Reduced Demand: Economic slowdowns can decrease patient visits and elective procedures, directly impacting AMS's sales volumes.

- Pricing Pressure: Healthcare providers facing budget cuts may negotiate harder on prices, affecting AMS's profit margins.

- Delayed Investment: Hospitals and clinics might postpone capital expenditures on new medical technologies, including those offered by AMS.

- Impact on R&D: Reduced profitability could force AMS to scale back investment in research and development, hindering future innovation.

Intensifying competition within the medical device sector, particularly from agile innovators, presents a significant threat to Advanced Medical Solutions Group (AMS). The rapid pace of technological advancement means that established products can quickly become outdated, necessitating continuous and substantial investment in research and development to maintain market relevance.

Navigating complex and evolving regulatory landscapes, such as the EU's Medical Device Regulation (MDR), poses a considerable challenge. Delays in product approvals or compliance issues can hinder market access and revenue generation, impacting AMS's ability to capitalize on new opportunities. For instance, the MDR has already extended approval timelines for many medical devices.

Global economic uncertainties and potential downturns can significantly affect healthcare spending, leading to reduced demand for AMS's products and increased pricing pressure. This economic volatility, particularly evident in 2024, could impact sales volumes and profit margins, making financial forecasting more challenging.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point (2024-2025 Focus) |

|---|---|---|---|

| Competition | New product launches, market saturation | Loss of market share, pricing erosion | Global medical device market expected to reach over $600 billion by 2024, with intense innovation. |

| Regulatory | MDR compliance, changing standards | Delayed market entry, increased compliance costs | Extended approval timelines for new devices under MDR are a common industry concern. |

| Economic | Recessions, reduced healthcare budgets | Lower demand, pricing pressure, reduced R&D investment | Inflationary pressures in 2024 are impacting healthcare provider budgets globally. |

SWOT Analysis Data Sources

This SWOT analysis for Advanced Medical Solutions Group is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thoroughly informed strategic assessment.